Are Shoebox Units A Good Retirement Option? Here Are The Pros And Cons

February 6, 2021

To most Singaporeans, the term “shoebox unit” or “compact unit” is synonymous with property investment. Indeed, renting out a one-bedder is how many landlords get started on their property portfolio. What’s less commonly known, however, is that shoebox units also appeal to retirees, or couples whose children have moved out.

Not everyone wants to settle for a smaller resale flat when they retire; and some may even move into the one-bedder they used to rent out. There are pros and cons to this, but it’s useful to recognise that shoebox units can do more than just generate rental income:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

First, how much does it cost to right-size to a shoebox unit?

For the purposes of this discussion, we will define a shoebox unit as being condo or apartment properties, of 500 sq.ft. (in actuality the units may be a bit bigger or smaller, but this is the typical size of a one-bedder).

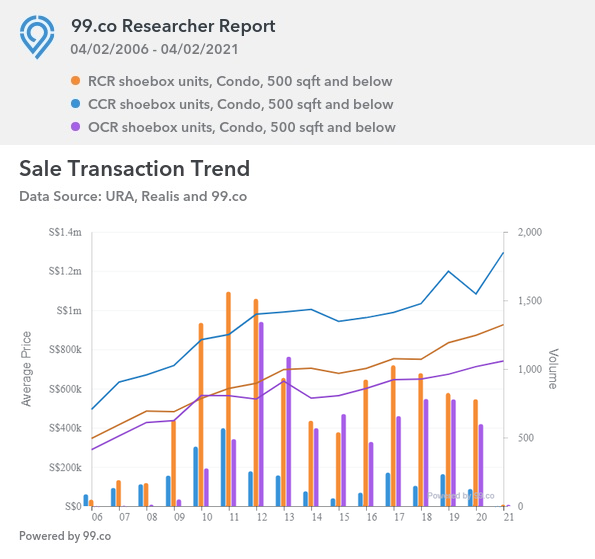

We examined the prices of shoebox units in the Core Central Region (CCR), Rest of Central Region (RCR), and Outside of Central Region (OCR) for the past year:

As of 2020, shoebox units in the CCR had an average quantum of $1,083,076, with an average price of $2,384 psf.

Units in the RCR had an average quantum of $926,209, with an average price of $1,938 psf.

Units in the OCR averaged $712,125, with an average price of $1,538 psf.

The price of the average condo, at the time of writing, is about $1.6 million, while the price of the average 5-room flat is about $540,000.

As such, someone downsizing from a larger condo unit will probably be able to cover the entire cost of the shoebox unit with the sale proceeds – even if they choose to buy in the prime districts. They’ll even have a substantial amount left to pad the retirement fund afterward.

Moving to a shoebox from an HDB unit is more challenging, especially if you’re older and financing isn’t available.

Why consider a shoebox unit, instead of just downgrading to a flat?

- Due to the low quantum, some retirees can afford to keep two properties

- Access to condo facilities, and the possibility of integrated developments

- It’s possible to get a freehold unit

- No HDB restrictions

- Maintaining the option of Cash-Out Refinancing

1. Due to the low quantum, some retirees can afford to keep two properties

If you right-size into a flat, you’ll have to lose your existing property; you can’t buy an HDB flat while holding on to your previous home. You can, however, do this with a shoebox unit: this gives you the opportunity to live in the shoebox unit, while renting out your old home for income.

The objection that most readers will raise here is the Additional Buyers Stamp Duty (ABSD). It’s true that, if you buy a shoebox on top of your existing property, it will incur an ABSD of 12 per cent (or 15 per cent if you’re a Permanent Resident).

However, shoebox units have a low quantum, making this less of a stretch. For example, 12 per cent ABSD on a $712,125 shoebox unit is just $85,455. Do bear in mind that stamp duties can be paid through CPF.

For older Singaporeans with accumulated savings, it may be viable to own a shoebox as a second property, and live in it.

2. Access to condo facilities, and the possibility of integrated developments

We don’t have to explain too much here, right? Condos have pools, gyms, BBQ pits, etc. That said, it’s the more active retirees who will really derive the most benefit from condo facilities. Otherwise, the main benefit is just privacy.

Besides the common facilities, retirees can pick shoebox units in integrated developments; examples are DUO Residences, The Woodleigh Residences, and Midtown Bay. These can provide restaurants, supermarkets, banking facilities, train stations, etc. Some of them even include civic amenities, such as the neighbourhood library.

This may be appealing to older Singaporeans who don’t want to travel out too much. Despite the age of places like Golden Mile Complex and People’s Park Complex, for instance, many of the elderly residents there wouldn’t even consider leaving; their favourite shops, food places, etc, are all right downstairs.

3. It’s possible to get a freehold unit

Some retirees are interested in legacy planning, which includes leaving a property to their children. This may exclude HDB flats, which are on 99-year leases; and flats may not be inheritable anyway. If the children already own private property, they’ll just have to sell the flat right after the will leaves it to them. They could, however, retain both their private property and the shoebox unit willed to them.

While freehold units come at a premium – typically around 20 per cent more than leasehold counterparts – the lower quantum of shoebox units might make up for it.

Property Investment InsightsFreehold vs Leasehold: 3 Tests To Determine Which Is Better (Part 2)

by Sean Goh4. No HDB restrictions

Retirees who already live in condos may find HDB restrictions chafing. An example is if they keep certain dog breeds, which HDB doesn’t allow.

They may also dislike the lack of voice in how the estate is run: HDB has its town councils and listens to feedback, but individual owners don’t have as much control as they would over a condo MCST.

In our experience, the density of HDB flats can also be off-putting, to people used to condos. For example, there may just be one other neighbour on the same floor of a condo unit; but in an HDB block there are whole rows of flats on each level, and some retirees find there’s too much noise and too little privacy.

5. Maintaining the option of Cash-Out Refinancing

Cash-Out Refinancing allows you to take out a loan against the equity of your home, at low interest rates. For example, you may be able to borrow up to 80 per cent of the appreciated value of your home, at rates as low as one per cent.

(This is dependent on various eligibility conditions, such as still having an income; for more details, contact us directly. This isn’t possible for everyone).

This option doesn’t exist for HDB flats, only for private properties.

For retirees looking to benefit their children, note that beneficiaries could potentially take out such a loan on the shoebox property, after they inherit it. For a shoebox unit valued at $712,125, that’s a loan of up to $569,700, at an interest rate of just around one per cent.

Quite the head start for your children or grandchildren, who would retain (and be able to rent out) the shoebox even after taking such a loan.

That said, right-sizing into a shoebox unit isn’t always appropriate

There are some important aspects to consider, such as:

- Maintenance fees

- Unjustifiable costs of common facilities

- Disruptions from en-bloc sales

1. Maintenance fees

This is often what kills the deal, for retirees considering a shoebox unit. Condo maintenance fees are around $70 to $80 per share value; and can be even higher for CCR properties. For many shoebox units*, retirees would still be forking out around $200+ per month; even for a one-bedder.

Bear in mind that maintenance fees continue throughout, and retirees will be paying them well into their twilight years. So don’t be lured in by the low quantum alone; maintenance is also part of the cost.

*Some old developments are an exception; People’s Park Complex has maintenance fees as low as $100 per month for some units.

2. Unjustifiable costs of common facilities

Speaking of maintenance fees, the cost of a shoebox unit is seldom justified if retirees have no use for the facilities. It might be better for them to save the funds for travel, healthcare, etc., as opposed to paying for pools and gyms that they’re not going to use.

3. Disruptions from en-bloc sales

In theory, HDB flats can also fall under SERS or VERS, and prompt retiree residents to move. In practice, collective sales are far less likely in an HDB development than a private one.

Many condos don’t make it past their 40th year without an en-bloc sale eventually happening. For retirees who move into older developments, it may sometimes necessitate moving yet again if an en-bloc happens. This can be hugely disruptive for seniors, especially if they don’t qualify for bridging loans, and need to find a new home before they’ve received the sale proceeds from an en-bloc.

We know of at least one retiree who right-sized into a one-bedder, and then the development went en-bloc in his second year. Not only did he have to move again, he had to pay eight per cent Sellers Stamp Duty (SSD), and lost out on the $70,000 of renovations he had done to his one-bedder.

While we don’t think most people will be so unlucky, it’s good to remember it can happen. Avoid right-sizing into a development that’s in the process of an en-bloc sale, or that came close recently.

That said, for now, many of the older developments that you see around that are prime for en-bloc don’t usually have shoebox units as they primarily start from 2 bedders and up – so this concern isn’t as widespread as you might think.

Don’t focus on just flats when right-sizing, shoebox units may turn out to be the better choice for some

Besides retirees, shoebox units may also be right for couples without children, or for lifelong singles; they can be used as more than just rental units for single expatriates. You do need to plan the costs carefully though; however low the quantum, they’re still a pricier alternative than flats.

To find one-bedders in the best developments, check-out our reviews on Stacked. We also provide an analysis of location, facilities, and specific unit layouts, so you can see if a condo’s compact units are right for you.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

0 Comments