Are Property Valuations A Hidden Culprit In Rising Property Prices?

April 15, 2022

An often overlooked, but important, element of home loan financing is the valuation. For anyone buying a resale private property, the valuation can impact the initial cash outlay, the stamp duty, and which bank gets chosen. But is the hunt for high valuations having an unintended side effect on the Singapore property market? Here’s what you should know:

What’s the valuation and why does it matter?

When purchasing a resale property, the maximum home loan is based on a valuation by a licensed appraiser. The bank will base the available loan amount on the valuation. For example:

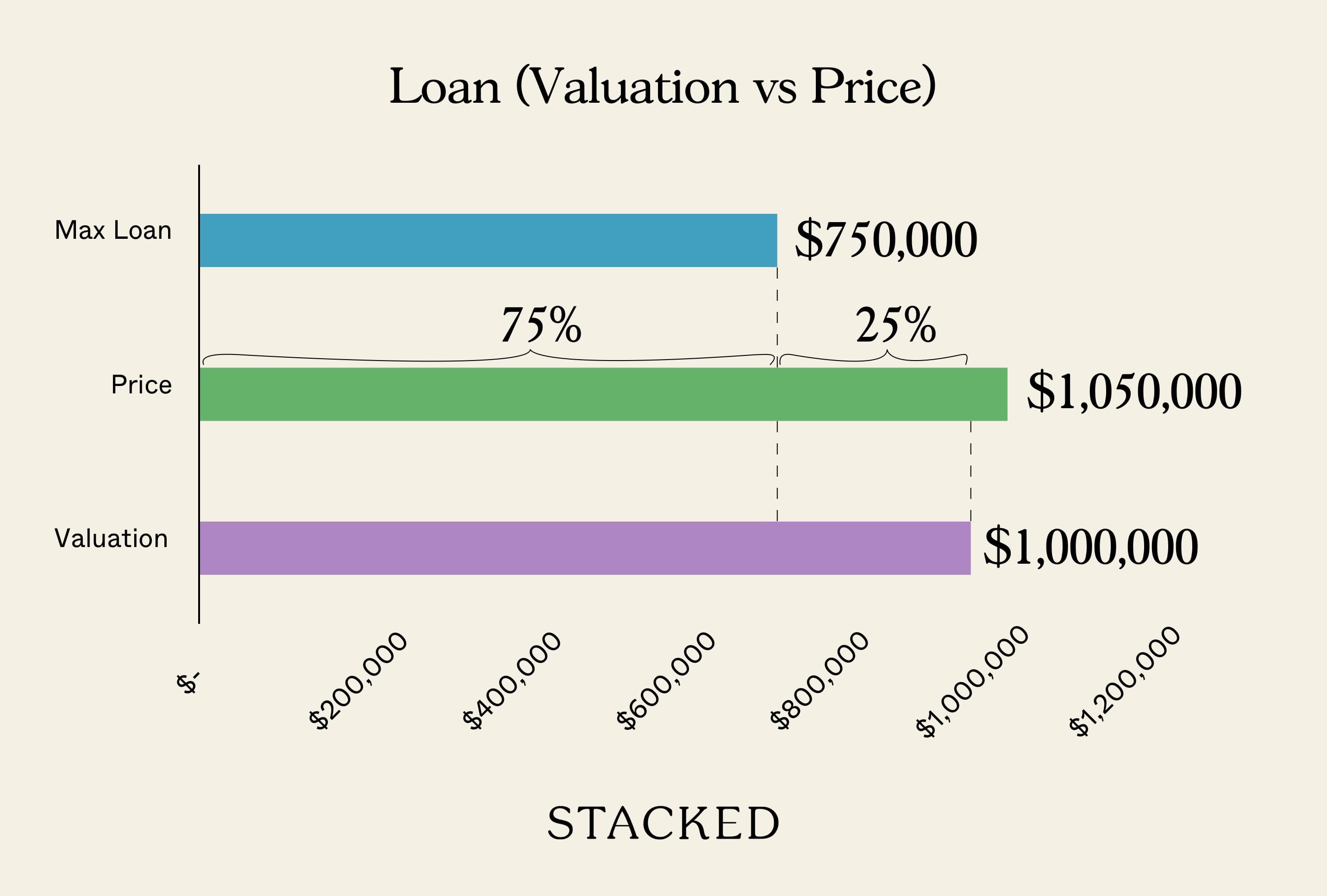

A property is valued by an appraiser at $1,000,000. The bank is allowed to loan up to 75 per cent of the appraised value, so the maximum home loan amount is $750,000.

It’s quite common, however, that the appraiser’s valuation does not match the seller’s price. In these cases, the bank will use the lower of the valuation or price. So, if a property is appraised at $1,000,000, but the seller has a price of $1,050,000, then the maximum loan amount is still only $750,000.

This applies to all resale properties (for properties bought directly from the developer, the valuation is considered to be the same as the sale price).

This can prompt home buyers to seek higher valuations

As the loan amount is based on the lower of price or valuation, any amount above valuation has to be paid in cash. This increases the initial cash outlay for a buyer; and for some investors, it can impact Cash-on-Cash valuation.

This is the main reason that many buyers want a higher valuation on the property. In the current market, different banks will accept different valuations (not all appraisers will agree on the same exact value).

The problem is that the valuation then becomes a bit arbitrary; and the borrower has a strong inclination to push up the recorded values.

One mortgage broker, who declined to be named, said the practice is routine:

“Some of the more experienced ones (borrowers – ed.) will just straight away call and say ‘I want the highest valuation’. So rather than just look for the best package, we are basically looking for the bank that is okay to lend more.

Sometimes the bank they use, the rate is actually on the high side; but they are okay to go ahead because why? Higher valuation accepted. That’s all.”

He noted that it can feel like a win-win proposition for all parties involved:

- The borrower gets a lower cash outlay

- The mortgage banker can meet their sales quota, which is quite tough if your bank has one of the higher rates

- The mortgage broker gets their referral fee from the banker

- The seller gets to close the deal at the price (or closer to the price) they want

As such, most of the parties involved are on the side of the borrower who wants a bigger loan. And because it seems like an “everybody wins” scenario, few people are inclined to question it.

What are the unintended consequences?

- Contributing to rising property prices

- Getting a worse loan package

- Questions about the arbitrariness of valuations

1. Contributing to rising property prices

When the highest valuation is constantly sought, this ultimately results in property prices being pushed up. This happens for two reasons:

The first is that sellers are well catered to, even if their asking price is well above the actual valuation. Buyers – and indirectly the system of lenders – bend over backward to try and stretch financing, so that their higher prices can be met.

More from Stacked

6 Things To Prepare If You’re Buying A Home In 2021

One of the worst feelings is to have finally found your dream home, and then being forced to walk away…

The second is that recorded values and transactions ultimately climb, and the numbers imply prices are rising. This has a knock-on effect on surrounding properties: when multiple units near yours get higher valuations, your property valuation tends to go up as well.

On an emotional level, buyers who see “hard data” that property values are rising fast are compelled to buy – often at prices justified by rising valuations.

Property Market Commentary5 Property Types That May Be Most Affected By The New Cooling Measures

by Ryan J. Ong2. Paying unnecessary interest

While a higher valuation can mean paying less cash now, borrowers should consider if being saddled with a worse loan package is worth it.

This isn’t just about paying a higher interest rate (although that’s part of the concern). It could be that the bank accepting a higher valuation is using an internal board rate, allowing them to alter the interest rate at will; or the package may come with various constraints, such as long lock-in periods, that make it difficult to refinance when rates dip.

It’s not always worth accepting these conditions, plus higher interest, just to stretch your loan amount. We suggest you take the mortgage broker’s advice here, as each situation is different.

(Note: Sometimes you can get lucky, and the bank accepting a higher valuation also happens to be the cheapest or the best – but don’t count on it).

3. Questions about the arbitrariness of valuations

All licensed appraisers have a degree in real estate from NUS, or an accepted equivalent; and they all need to have at least two years of experience. But the practice of pushing up valuations does raise some questions.

If, for example, a bank can be persuaded with enough negotiation to just accept a figure that’s $30,000 higher, are the numbers more arbitrary than we think?

We’re aware of the whole “an art as well as a science” argument when it comes to property valuation – but perhaps more clarity is needed as to what actually happens behind the scenes. It’s not clear when a bank will or won’t accept a higher valuation, and why.

The main worry is that a bank’s mortgage department – whose key performance indicator is usually the number of home loans they sell – is highly incentivised to accept higher valuations.

For buyers who don’t want to deal with these issues, we suggest initiating a deal only when you’ve got around 30 per cent of the required capital ready to go. This will ensure you don’t end up forced into a bad deal, to stretch your financing.

Another way around valuation issues is to buy a new launch property; but that’s assuming you can wait for construction, and can bear with higher prices.

For more on the situation as it unfolds, follow us on Stacked. We’ll also provide you with the latest insights on the Singapore private property market, and in-depth reviews of new and resale properties.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How do property valuations affect the amount I can borrow for a resale home?

Why do some buyers want higher property valuations during the purchase process?

Can pushing for higher property valuations contribute to rising property prices?

Are there risks or downsides to trying to get a higher property valuation?

How might the valuation process be influenced by banks or appraisers?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Property Market Commentary Why Early Buyers In New Housing Estates May See Less Upside In 2026

Latest Posts

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

0 Comments