Are Luxury Or Mass-market Condos Better Investments In Singapore?

October 28, 2020

There are two conflicting theories we often hear in the Singapore private property market. The first is that luxury condos, such as those in prime areas, are better investments: they’re scarce, in high demand, and see better appreciation.

On the other hand, some investors swear by fringe region or “mass-market” condos. Their reasoning: the high premium on luxury units means there’s little room for further gains; and luxury properties – like expensive handbags or sports cars – are indulgences, not investments.

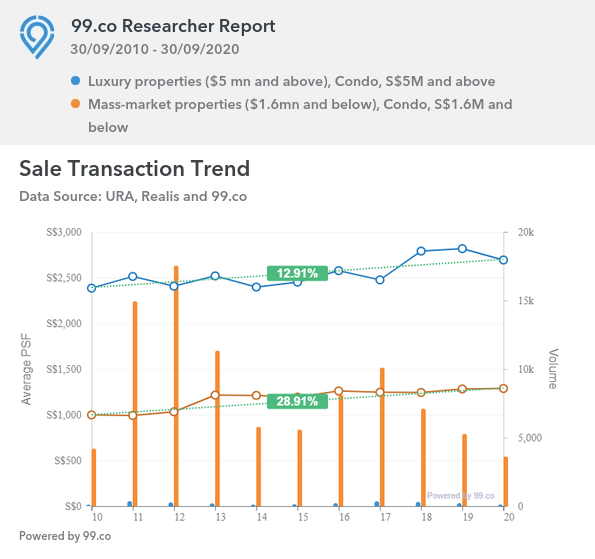

To shed some light on the argument, we’ve picked some of the top performing luxury and mass-market condos, and compared their gains and rental yields. Here’s a snapshot of the two over the past decade:

Why make this comparison?

Some may wonder why we’d make this comparison, given that the luxury market and mass-market condos are seen as two separate worlds. That’s generally true, but this comparison is important for two types of buyers:

The first group are those of you who are in a position to buy a luxury property, but are wondering if you should pick a more mass-market condo instead. This will hopefully give you some idea of the difference it can make to your finances, should you opt for a cheaper property.

The second group are pure investors. You can probably buy two mass-market properties for the price of one luxury condo-unit; even taking into account the Additional Buyers Stamp Duty (ABSD). As such, you may be wondering if it’s worth sinking all your eggs into one luxurious basket, or going for a cheaper, more diverse mix of properties.

This article aims to provide a snapshot of the current situation, over the past decade.

How we picked the units for comparison

For luxury properties, we picked the top condos with a quantum of $5 million or higher; we don’t follow developers’ definitions of “luxury” as the term is loosely used (there are condos below $1.4 million that have been marketed as luxury).

For mass-market properties, we picked the top condos with a quantum of no more than $1.6 million.

We observed the price changes over a 10-year period, from September 2010 to September 2020. We picked only developments with five or more transactions, during this period.

Note that the data provided, especially for luxury condos, is not perfect (we explain more on this below). It is only the nearest approximation we can find:

Top yields for mass-market condos

| Development | Lowest rent (PSF) | Median rent (PSF) | Highest rent (PSF) | Rental volume | Est. gross yield* |

| Legenda at Joo Chiat | $0.60 | $2.90 | $5.20 | 79 | 4.2% |

| Melville Park | $0.50 | $2.50 | $3.60 | 2,674 | 4.1% |

| West Bay Condominium | $1.80 | $2.90 | $4.70 | 750 | 4.1% |

| Simsville | $1.70 | $2.90 | $4.50 | 1,107 | 4% |

| The Mayfair | $0.70 | $2.90 | $5.40 | 869 | 4% |

*Gross rental yield does not account for costs such as maintenance fees, mortgage interest rates, utility bills, etc.

Top yields for luxury condos

| Development | Lowest rent (PSF) | Median rent (PSF) | Highest rent (PSF) | Rental volume | Est. gross yield* |

| Gallop Green | $3.60 | $4.80 | $5.90 | 102 | 3.1% |

| The Ladyhill | $3.60 | $5.60 | $8.60 | 90 | 3% |

| Lotus at Pasir Panjang | $2.50 | $3.30 | $3.90 | 24 | 2.9% |

| The Nassim | $4.90 | $6.50 | $7.70 | 34 | 2.5% |

| Sage | $4.90 | $6.10 | $7.60 | 85 | 2.3% |

*Gross rental yield does not account for costs such as maintenance fees, mortgage interest rates, utility bills, etc.

Luxury condos have lower yields due to their high quantum

Gross rental yield is (annual rental income / divided by total cost). As such, luxury condos won’t come close to matching their mass-market counterparts.

At four per cent or higher, the top mass-market properties show rental yields approaching that of commercial properties.

Rental MarketRental Yield Singapore: Top 10 condos with the highest rental yield

by Stanley GohAs a point of reference, the typical yield for non-landed residential units is two to three per cent, while the yield for commercial properties – or some of the smallest compact units – are around three to five per cent.

Luxury Developments:

| Development | Average price (PSF) between 2009 – 2010 | Average price (PSF) at present | Sales volume | Average gains |

| Four Seasons Park | $2,244.78 | $2,734.60 | 14 | 22% |

| Wing On Life Garden | $1,451.43 | $1,726 | 10 | 19% |

| The Claymore | $2,578.57 | $3,007 | 12 | 17% |

| Madison Residences | $1,670.29 | $1,926 | 43 | 15% |

| Hilltops | $2,676.00 | $3,073.64 | 12 | 15% |

Mass-Market Developments:

| Development | Average price (PSF) between 2009 – 2010 | Average price (PSF) at present | Sales volume | Average gains |

| Euro-Asia Park | $688.08 | $1,284.25 | 20 | 87% |

| Hillview Heights | $729.26 | $1,270.00 | 41 | 74% |

| Glendale Park | $729.93 | $1,246.40 | 32 | 71% |

| Ivory Heights | $525.95 | $897.47 | 36 | 71% |

| The Sunny Spring | $685.50 | $1,113.71 | 57 | 62% |

In terms of top performers for gains, it’s evident that mass-market condos come out far ahead. The lower initial prices provide better room for appreciation; and these returns haven’t even factored in their higher rental yields.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

We Make $280k Per Year And Are In Our 40s. Can We Afford To Decouple And Buy A Second Property?

Hi Stacked Home,

But how does the picture look if we compare the wider market, rather than just the top five?

We more or less see the same results – mass-market condos show better appreciation across the board:

Luxury properties priced at $5 million or above saw a 12.9 per cent appreciation over the last decade; for these properties, average price PSF has risen from $2,384 to $2,692.

Their mass-market counterparts, priced at $1.6 million or lower, saw a much higher percentage gain of 28.9 per cent. Their prices have moved from $998 psf, to $1,287 psf.

Why do luxury properties seem to be doing so poorly?

- There is greater opacity regarding luxury properties

- High quantum properties are just harder to sell in general

- Ultra-high net worth owners behave differently

- Cooling measures

- Indulgence, not investment

1. There is greater opacity regarding luxury properties

Buyers and sellers of luxury properties can behave very differently.

For example, many luxury property buyers are able to conclude the deal immediately, without having to secure an Option to Purchase, or lodge caveats URA. There may be many profitable transactions of this sort, which just don’t appear in the data.

Even when the data is available, luxury developments see much lower transaction volumes. As such, even one losing transaction can greatly pull down the overall numbers, and give an impression of poorer gains (conversely, a single profitable sale may give an inflated view of appreciation rates).

If you’re serious about investing in luxury property, focus more on the transaction histories of specific units, and less on the whole development. For specifics on any one property, do drop us a message on Facebook.

2. High quantum properties are just harder to sell in general

There are some exceptions but for the most part, the pool of prospective buyers shrinks as the quantum increases. It’s hard to get a good price out of, say, a $5 million condo even if it’s on Orchard Road; there are few buyers able to afford it, and those buyers know you have few options.

The longer time taken to sell luxury properties may also frustrate some sellers, who may take lower prices to have it over with after several months (see below). A luxury property is a lot of capital to keep locked up, once you decide you no longer need it.

3. Ultra-high net worth owners behave differently

Regular homeowners, or smaller investors, can’t afford to shrug off eight-digit losses. The owners of luxury properties can. Many aren’t concerned about investment, but are merely indulging in a home they can afford.

The most recent example of this was James Dyson incurring an $11.8 million loss on his penthouse.

Also, those who aren’t interested in returns may not bother to sell at the best price. They might willingly surrender an extra two or three per cent gain, just to get the transaction over and done with. This causes the development’s numbers to reflect lower gains.

4. Cooling measures

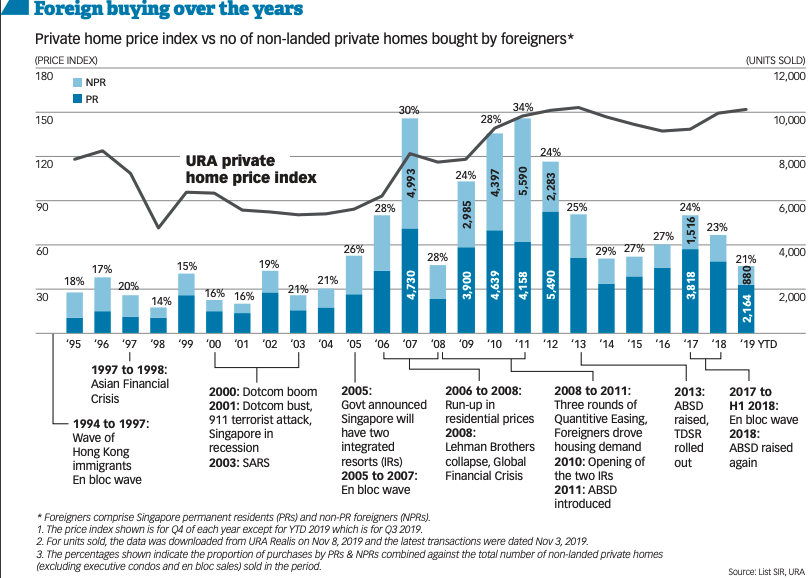

Foreign buyers are a major demographic, when it comes to luxury properties. In 2019, for instance, buyers from mainland China drive these properties to an 11-year high.

However, cooling measures seem to be mounting rather than easing. The ABSD, for instance, is now set at 20 per cent for foreigners; it was originally 15 per cent in 2011.

While the ultra-high net worth buyers may not care (see point 2), other foreign investors may think twice before accepting the hefty tax. The situation on Sentosa Cove is a good example of the effect ABSD is having.

Those foreign investors can, after all, buy in other markets like Australia.

5. Indulgence, not investment

With luxury goods, such as fine wine, art, and fast cars, the “investment” part is often up for debate. The same goes with luxury properties.

There may be little financial practicality to paying $2,889 per month in maintenance fees, for instance; and it’s questionable how much a $73 million+ penthouse could appreciate anyway.

As such, luxury properties may not perform as well as mass-market properties, for the simple reason that they’re more indulgences than they are investments.

What’s likely to happen to luxury property in the near to mid-term?

In terms of rental, the luxury market is likely to bear the initial brunt of the Covid-19 downturn. If companies begin to cut costs, it often means replacing expatriate workers with locals, or significant reductions in housing allowance.

This could cause an exodus of tenants toward the city fringe, into areas such as Beach Road, Paya Lebar, or Thomson.

In terms of gains, however, things are less predictable. Singapore real estate has long been seen as a safe haven; there’s a chance wealthy buyers may still choose luxury properties over more volatile assets, ABSD or no.

Follow us on Stacked, and we’ll keep you updated as the situation unfolds. We also provide in-depth reviews of Singapore’s top property offerings.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are luxury condos in Singapore good investments compared to mass-market condos?

What are the main differences between investing in luxury and mass-market condos in Singapore?

Why do luxury properties in Singapore seem to perform worse than mass-market ones?

How have mass-market condos in Singapore performed over the past decade?

Should I consider buying a luxury condo or a mass-market condo in Singapore for better investment returns?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

0 Comments