The Allure Of Integrated Developments: Are They Worth The Price Premium?

June 13, 2023

Singaporeans love convenience. And nothing shows this better than the sales trend of new launch integrated developments, which have been flying off the shelves:

| Integrated Development | % Sales at launch |

| The Reserve Residences | 71% |

| Lentor Modern | 84% |

| Canninghill Piers | 77% |

| Midtown Modern | 61% |

| Pasir Ris 8 | 85% |

Because what could be better than having a proper shopping mall, a bus interchange, an MRT station, or maybe even the public library right downstairs?

However, because of those traits, it’s worth noting that integrated condo developments are a rarity in each estate. As a result, these sought-after properties command a significant price premium compared to standalone private residential developments.

The question then arises: Are integrated developments truly worth their price premium? In this analysis, we delve deeper into the appeal and value proposition of these integrated complexes:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What’s an integrated development?

An integrated development is a project that combined residential housing with a commercial component (this can be a mall, offices, or others). Unlike a mixed-use development, which sounds similar, an integrated development also tends to include three other things:

- It’s directly connected to public transport, such as with direct access to the MRT via the mall.

- There’s often some kind of civic institution embedded within the project. This is most commonly the neighbourhood library, but can also include things like clinics, senior day care, and others.

- An integrated development has full condo facilities, unlike some mixed-use developments that are on top of malls but lack pools, gyms, and so forth

The tenants of the commercial space, in an integrated development, also tend to be better managed compared to those of a mixed-use condo (e.g., the developer may go out of the way to ensure a proper supermarket, a better mix of food choices, and so on). If anything, the success of these spaces will typically be dependent on how well-curated the mall is.

What’s the typical premium for an integrated development?

A common saying, which you’ll hear from many a realtor, is that integrated developments can cost around 20 to 25 per cent more. When we looked closer at these developments, however, it’s clear the premium gap is usually much higher:

Premium gap at launch

| Projects | District | Avg New Sale $PSF | First Sale Date | 6 Months Before | Resale PSF 6 months Before 1st Sale | $PSF Premium Gap |

| BEDOK RESIDENCES | 16 | $1,338 | 1/12/11 | 4/6/11 | $933 | 43.4% |

| COMPASS HEIGHTS | 19 | $485 | 3/2/01 | 7/8/00 | $507 | -4.2% |

| DUO RESIDENCES | 7 | $2,030 | 14/11/13 | 18/5/13 | $1,249 | 62.5% |

| HILLION RESIDENCES | 23 | $1,411 | 26/3/13 | 27/9/12 | $888 | 58.9% |

| MARINA ONE RESIDENCES | 1 | $2,369 | 21/10/14 | 24/4/14 | $2,032 | 16.6% |

| MIDTOWN BAY | 7 | $3,007 | 5/10/19 | 8/4/19 | $2,597 | 15.8% |

| MIDTOWN MODERN | 7 | $2,798 | 19/3/21 | 20/9/20 | $1,701 | 64.5% |

| NORTH PARK RESIDENCES | 27 | $1,344 | 13/4/15 | 15/10/14 | $809 | 66.2% |

| PARK PLACE RESIDENCES AT PLQ | 14 | $1,896 | 24/3/17 | 25/9/16 | $1,060 | 78.8% |

| PASIR RIS 8 | 18 | $1,635 | 23/7/21 | 24/1/21 | $987 | 65.7% |

| SENGKANG GRAND RESIDENCES | 19 | $1,735 | 1/11/19 | 5/5/19 | $1,086 | 59.8% |

| THE CENTRIS | 22 | $502 | 20/1/06 | 24/7/05 | $305 | 64.5% |

| THE ORCHARD RESIDENCES | 9 | $3,341 | 22/3/07 | 23/9/06 | $1,110 | 200.9% |

| THE POIZ RESIDENCES | 13 | $1,427 | 28/11/15 | 1/6/15 | $1,183 | 20.6% |

| THE WOODLEIGH RESIDENCES | 13 | $2,010 | 10/11/18 | 14/5/18 | $1,418 | 41.7% |

| WALLICH RESIDENCE | 2 | $3,310 | 16/12/13 | 19/6/13 | $1,475 | 124.4% |

| WATERTOWN | 19 | $1,216 | 26/1/12 | 30/7/11 | $900 | 35.1% |

Premium gap for new launches across districts

| District | $PSF Premium Gap |

| 1 | 112.6% |

| 2 | 82.2% |

| 3 | 34.2% |

| 4 | 82.0% |

| 5 | 37.5% |

| 7 | 46.3% |

| 8 | 37.7% |

| 9 | 50.6% |

| 10 | 28.2% |

| 11 | 27.5% |

| 12 | 17.8% |

| 13 | 25.7% |

| 14 | 37.2% |

| 15 | 27.0% |

| 16 | 28.2% |

| 17 | 10.3% |

| 18 | 27.4% |

| 19 | 26.3% |

| 20 | 39.4% |

| 21 | 32.3% |

| 22 | 48.6% |

| 23 | 37.7% |

| 25 | 12.8% |

| 26 | 30.0% |

| 27 | 33.1% |

| 28 | 47.2% |

Integrated premium gap relative to their district’s premium gap

| Projects | District | $PSF Premium Gap | $PSF District Premium Gap | $PSF Integrated Gap |

| MARINA ONE RESIDENCES | 1 | 16.6% | 112.6% | -96.0% |

| COMPASS HEIGHTS | 19 | -4.2% | 26.3% | -30.5% |

| MIDTOWN BAY | 7 | 15.8% | 46.3% | -30.5% |

| THE POIZ RESIDENCES | 13 | 20.6% | 25.7% | -5.1% |

| WATERTOWN | 19 | 35.1% | 26.3% | 8.8% |

| BEDOK RESIDENCES | 16 | 43.4% | 28.2% | 15.2% |

| THE CENTRIS | 22 | 64.5% | 48.6% | 15.9% |

| THE WOODLEIGH RESIDENCES | 13 | 41.7% | 25.7% | 16.0% |

| DUO RESIDENCES | 7 | 62.5% | 46.3% | 16.2% |

| MIDTOWN MODERN | 7 | 64.5% | 46.3% | 18.2% |

| HILLION RESIDENCES | 23 | 58.9% | 37.7% | 21.2% |

| NORTH PARK RESIDENCES | 27 | 66.2% | 33.1% | 33.1% |

| SENGKANG GRAND RESIDENCES | 19 | 59.8% | 26.3% | 33.5% |

| PASIR RIS 8 | 18 | 65.7% | 27.4% | 38.3% |

| PARK PLACE RESIDENCES AT PLQ | 14 | 78.8% | 37.2% | 41.6% |

| WALLICH RESIDENCE | 2 | 124.4% | 82.2% | 42.2% |

| THE ORCHARD RESIDENCES | 9 | 200.9% | 50.6% | 150.3% |

13 of the 17 projects showed a premium higher than the typical new launch premium for their district. This is not entirely surprising, as even the land costs tend to be much higher for integrated projects (just by virtue of being so close to the MRT station, as well as near the hub of the neighbourhood).

More from Stacked

When Should You Consider Using A Home Equity Loan? Here Are 6 Reasons To Do So

You’ve seen the ads, or maybe had it suggested by a mortgage banker or two: take out a home equity…

Is it worth paying so much for an integrated development?

We looked at the performance of new launch integrated developments with transactions occurring after 14th January 2011. This prevents the data from being distorted by the effect of the Sellers Stamp Duty (SSD), which didn’t exist prior to this date. We also took into account those who sold before the development obtained their TOP, so developments like Midtown Bay are inside

| Integrated Developments | Proportions of gains |

| MIDTOWN BAY | 50% |

| MARINA ONE RESIDENCES | 59% |

| WALLICH RESIDENCE | 60% |

| THE WOODLEIGH RESIDENCES | 67% |

| DUO RESIDENCES | 79% |

| WATERTOWN | 90% |

| HILLION RESIDENCES | 92% |

| BEDOK RESIDENCES | 95% |

| PARK PLACE RESIDENCES AT PLQ | 95% |

| NORTH PARK RESIDENCES | 97% |

| MIDTOWN MODERN | 100% |

| SENGKANG GRAND RESIDENCES | 100% |

| THE POIZ RESIDENCES | 100% |

In the table above, you can see that developments such as Midtown Modern, Sengkang Grand Residences, and The Poiz Residences rewarded every single new launch buyer with a profitable transaction as far as the data is available. On the flip side, Midtown Bay and Marina One Residences saw a low portion of winners so far.

However, it’s safe to say that the majority of integrated development can be counted on for gains. Eight of 13 projects managed to see gains in 80 per cent of transactions, with Duo Residences coming close at 79 per cent.

But we can’t just look at integrated developments in isolation. How do these proportions of gains compare to non-integrated developments?

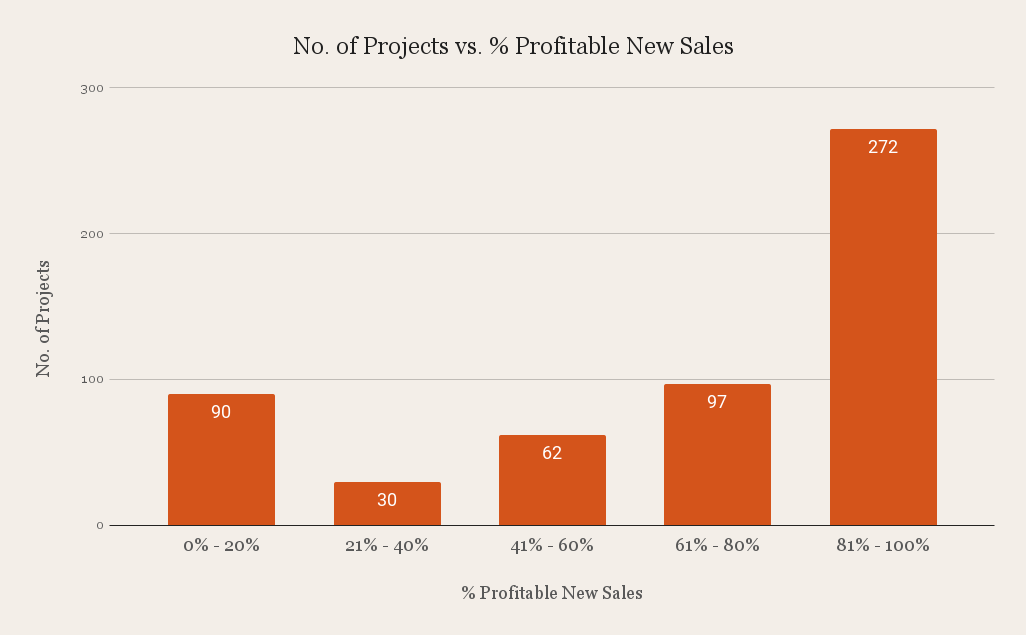

If we look at all 542 projects that had new sales after 14 Jan 2011, you’ll find that the majority have at least 4 in 5 transactions being profitable (excluding costs):

For new-to-resale transactions and sub-sales, the same pattern holds: around four out of five transactions were profitable, among 272 projects.

In other words, having a good proportion of new launch buyers winning is not unique to integrated development projects only. Ordinary new launches have also been shown to have rewarded buyers most of the time.

But this is just part of our original question. We wanted to know if the gains are enough to justify the premiums as well.

Comparison by percentage gains

| Project | Gain | Loss | Average | Integrated Premium Gap |

| BEDOK RESIDENCES | 12.1% | -2.2% | 11.4% | 15.2% |

| DUO RESIDENCES | 13.4% | -8.7% | 8.7% | 16.2% |

| HILLION RESIDENCES | 12.4% | -4.0% | 11.1% | 21.2% |

| MARINA ONE RESIDENCES | 6.8% | -6.4% | 1.4% | -96.0% |

| MIDTOWN BAY | 2.9% | -5.0% | -1.1% | -30.5% |

| MIDTOWN MODERN | 7.6% | 7.6% | 18.2% | |

| NORTH PARK RESIDENCES | 19.6% | -2.5% | 19.1% | 33.1% |

| PARK PLACE RESIDENCES AT PLQ | 13.7% | -1.2% | 13.0% | 41.6% |

| SENGKANG GRAND RESIDENCES | 6.2% | 6.2% | 33.5% | |

| THE POIZ RESIDENCES | 20.9% | 20.9% | -5.1% | |

| THE WOODLEIGH RESIDENCES | 8.3% | -2.4% | 4.8% | 16.0% |

| WALLICH RESIDENCE | 7.7% | -5.8% | 2.3% | 42.2% |

| WATERTOWN | 18.3% | -5.9% | 15.9% | 8.8% |

| Average | 16.6% | -5.7% | 14.78% |

| Projects | Gain | Loss | Average |

| Non-Integrated | 15.0% | -7.0% | 12.1% |

Here, we show the percentage gain and loss for integrated development transactions and compare them to every other non-integrated development (for new sale units).

We can see that in general, integrated developments experienced slightly higher gains when profitable (16.6% vs 15.0%).

Even if there’s a losing transaction, integrated developments tend to lose less than regular counterparts (-5.7% vs -7.0%).

This suggests that, despite the initial premium placed on integrated developments, there is still good room for profit.

This is true even if the premium for being integrated is higher than the typical premium for being a new launch.

North Park Residences, for example, had a premium gap of 33 per cent, but managed a gain of 19.6 per cent, and kept its losses to just -2.5 per cent.

Watertown had a much lower premium gap of 8.7 per cent, but the percentage gain was largely similar, and percentage losses were much greater at -5.9 per cent.

There are some exceptions, such as Midtown Bay and Marina One Residences; but this is due to the lack of new launches in the area, which may be distorting the overall picture (and it’s still early days for Midtown Bay, but also because there’s a cheaper alternative in Midtown Modern).

Profitability still boils down to the project in question

As we can see, the performance of integrated developments can vary widely from each other. In addition, we have to consider that the number of integrated developments is very small, compared to the number of regular condos; this also limits our ability to predict performance.

The only general conclusion we can draw is that, overall, you can make at least as much from an integrated development as you could from a typical new launch condo (at least in the context of the past 12 months).

But integrated developments are better rental assets, right?

Actually, most realtors will tell you integrated developments have high rentability, not that they have a higher rental yield. The two are not the same (rentability just means it’s easy to find a tenant, not that the yield is particularly high).

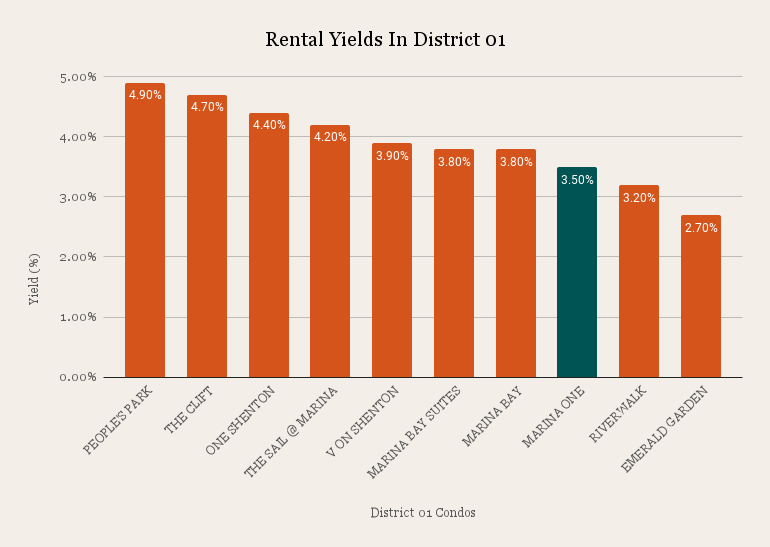

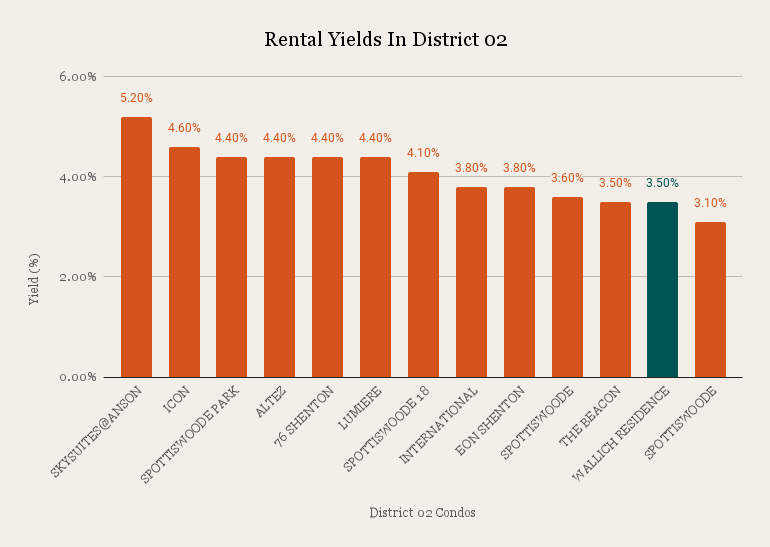

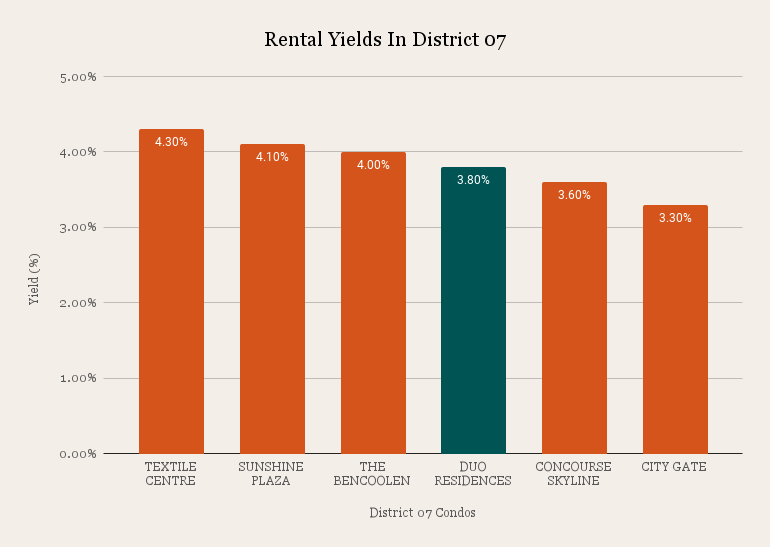

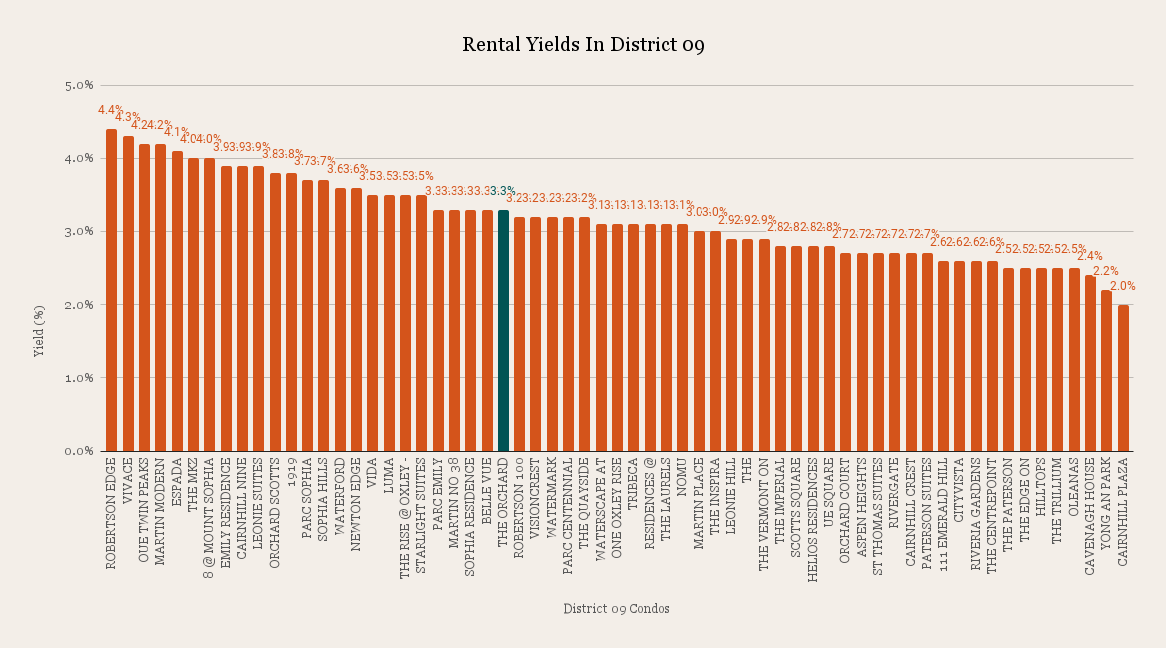

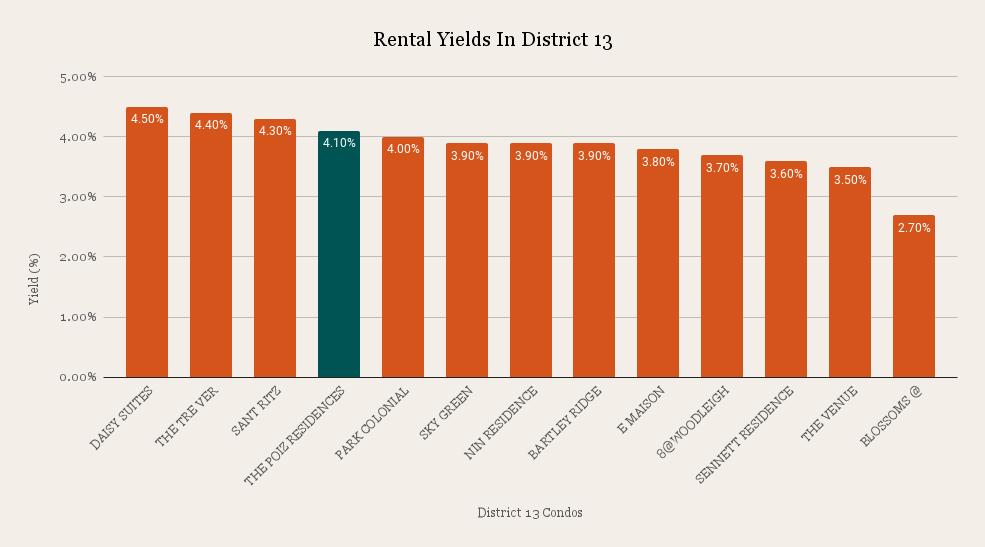

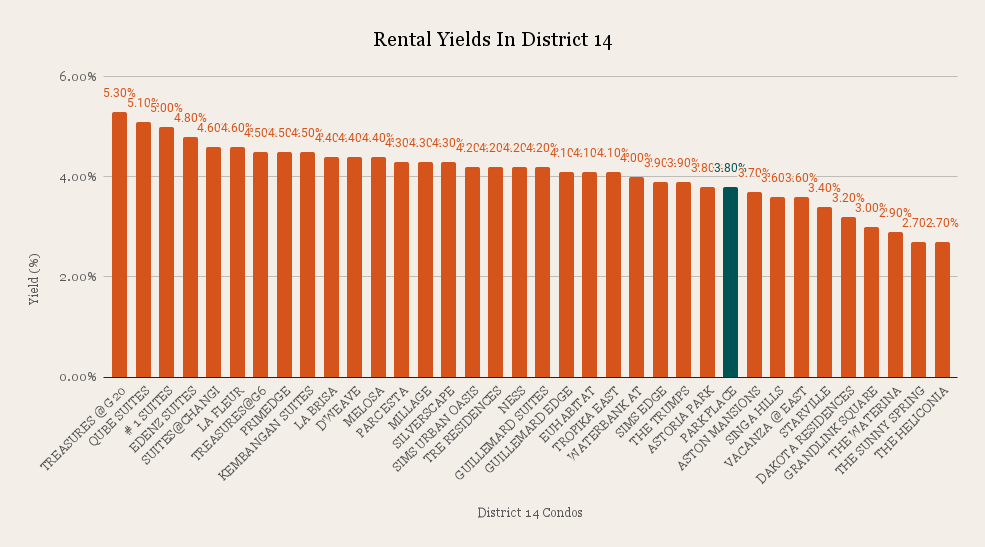

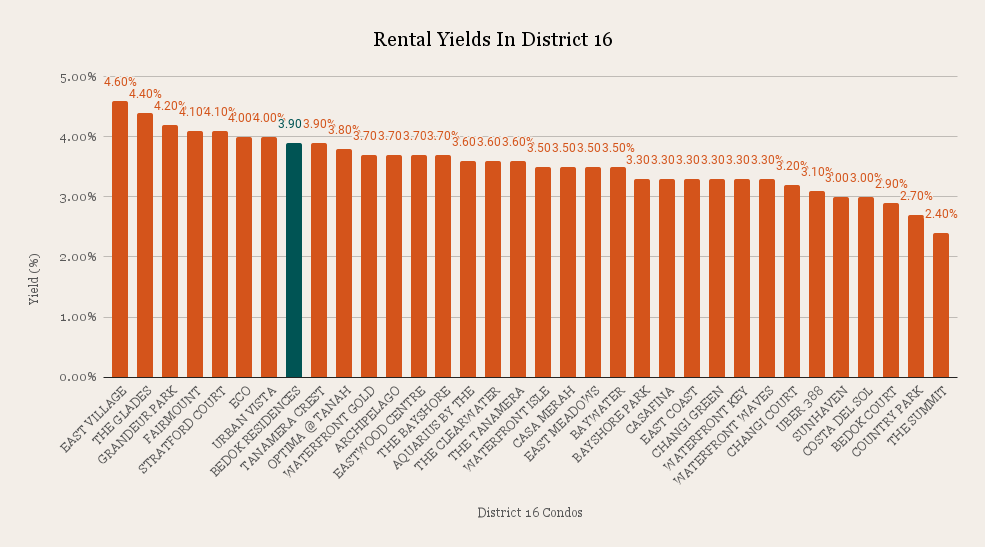

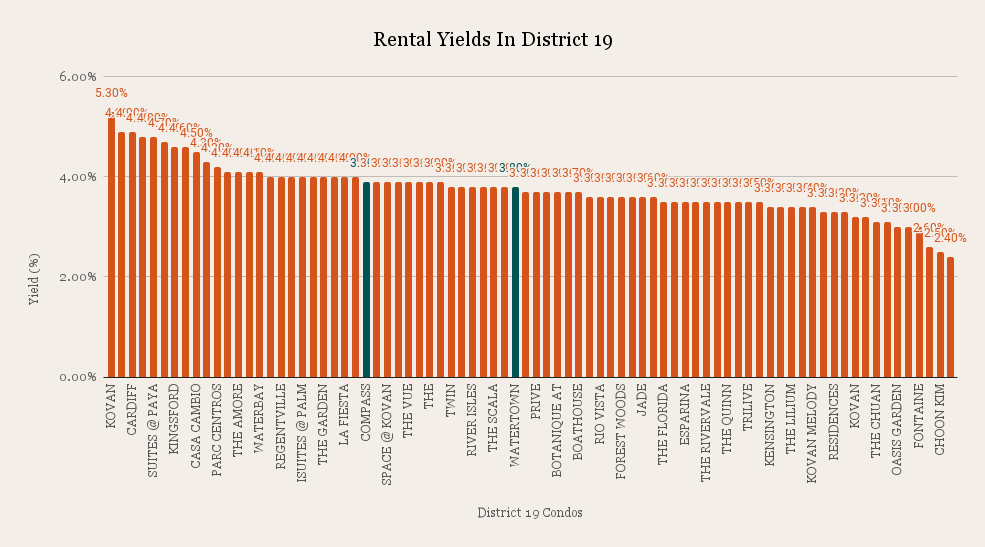

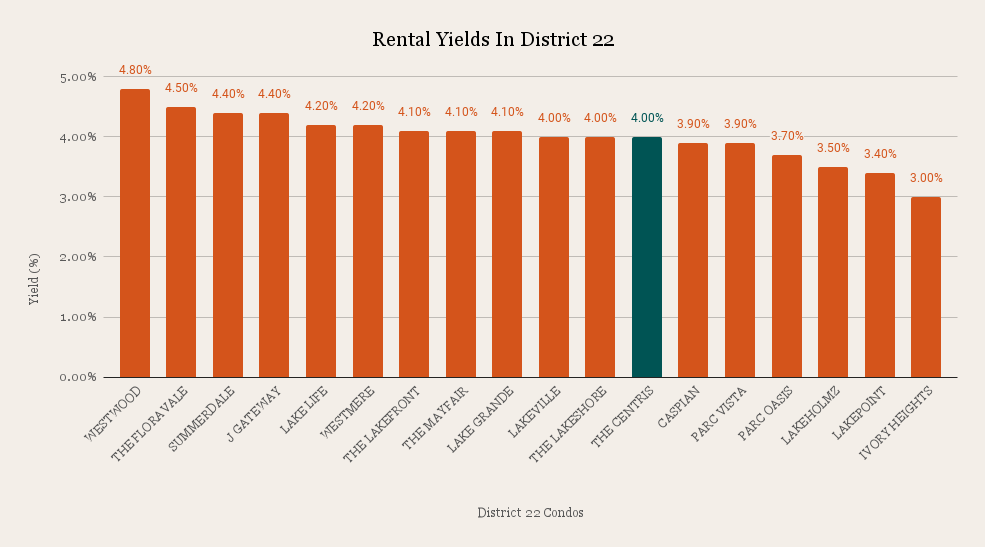

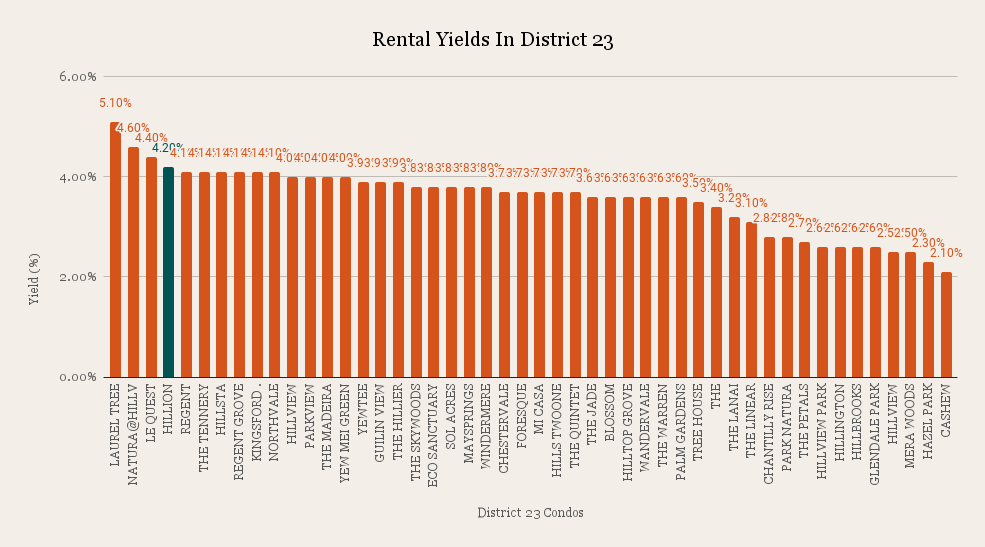

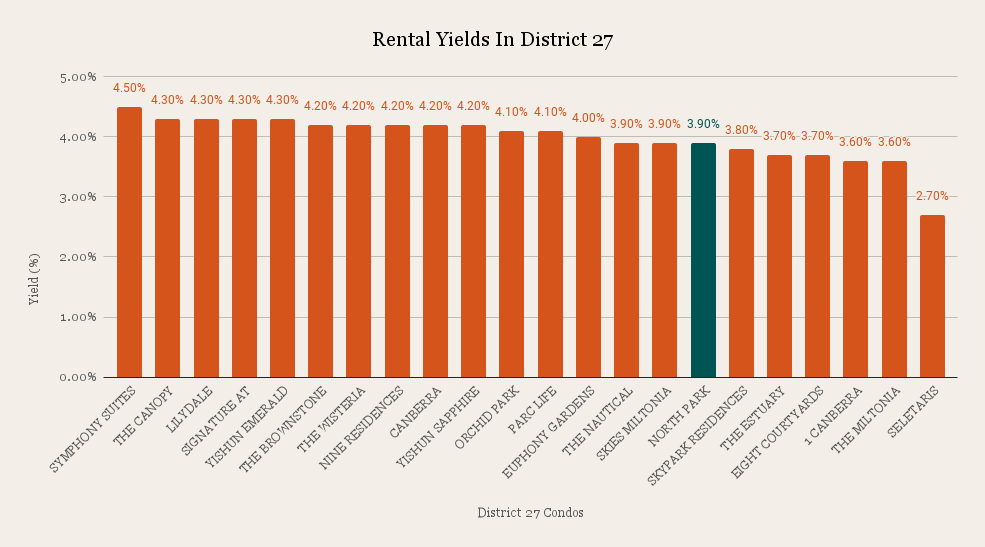

Here’s the reason for it: when we looked at 12 of the integrated developments, and compared rental yields to condos in the same district, there was no clear pattern that they were better:

Highlighted in green are the integrated development’s position in terms of yield from left to right (highest to slowest yields).

Hillion Residences and The Poiz top their district for rental yields, but Wallich Residence and Marina One Residences are at the bottom of their district. So there isn’t any strong conclusion here about yield, and it’s really more project and location dependent.

And as is always the case, yield is more about the price you paid: the more expensive the unit, the lower the yield is going to be (gross yield = annual income/unit cost). This could explain Compass Heights: as an older leasehold development, the overall price will be lower; but the rental income can be maintained due to its convenient nature.

On the flip side, luxury projects like Wallich Residence will always seem to have depressed yields, as these high-end properties are so pricey, to begin with.

So an integrated development may not necessarily get you a higher rental yield. However, few people would disagree that it’s much easier to find a tenant when your condo is directly connected to the MRT.

As with everything, it’s hard to draw a blanket statement regarding integrated developments completely – it will be dependent on the project in question. From the data shown, although they come with a price premium, their scarcity, curated amenities, and direct access to public transport contribute to their appeal, which can be seen even in the resale market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are integrated developments worth the higher price compared to regular condos?

What makes an integrated development different from a mixed-use development?

Do integrated developments have better rental yields than other condos?

How much more do integrated developments typically cost at launch?

Is investing in an integrated development a safe way to make profits?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

0 Comments