An Overview Of The Jurong Property Market In 2024: HDB Price Trends And Key Developments

August 14, 2024

As of 2024, Jurong is, broadly speaking, the jewel of west-end locations; in particular Jurong East. Jurong’s days of being a swampy industrial area are being left behind, and we’ve heard assertions that Jurong East can beat city fringe locations like Toa Payoh or Braddell for convenience. For those who are interested in making the move to Jurong, here’s an overview of how home prices have moved, as well as some of the key highlights of late:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Facts about Jurong

- District 22

- Jurong East and Jurong West are regarded as separate HDB towns, but the Jurong Lake District is not a separate town; it’s a special planning zone that forms an overlap between the two.

- In general, Jurong East is intended to be the more urbanised half: it is planned as Singapore’s “second CBD” and has offices, malls, and other commercial elements. Jurong West is intended to have a more serene suburban vibe.

- Jurong has a population of about 350,800, with a density of about 12,660 people per square kilometre. However, a lot of the population is concentrated in Jurong West: there are around 262,700 residents in Jurong West, compared to just 88,100 in Jurong East.

- The reason Jurong is so big is that way back in 1963 when we were still a part of Malaysia, Jurong was intended to be a processing centre for all the rubber, tin, palm oil, etc. across the Federation. Jurong was the biggest industrial estate in the whole of Southeast Asia at the time, at 3,900 hectares.

- Jurong used to house the tallest HDB blocks in Singapore, long before the days of Pinnacle @ Duxton. The 12 to 16-storey “diamond blocks” at Yung Kuang Road were the tallest back in the 1970’s, and are considered to be an iconic landmark; but they are vacant today.

Primary Schools In Jurong East

- Fuhua Primary School

- Jurong Primary School

- Princess Elizabeth Primary School

- Yuhua Primary School

Primary Schools In Jurong West:

- Boon Lay Garden Primary School

- Corporation Primary School

- Frontier Primary School

- Jurong West Primary School

- Lakeside Primary School

- Rulang Primary School

- West Grove Primary School

- Westwood Primary School

- Xingnan Primary School

Secondary Schools In Jurong East:

- Crest Secondary School

- Jurongville Secondary School

- Yuhua Secondary School

Secondary Schools In Jurong West:

- Boon Lay Secondary School

- Commonwealth Secondary School

- Fuhua Secondary School

- Hua Yi Secondary School

- Jurong Secondary School

- Jurong West Secondary School

- Juying Secondary School

- River Valley High School

- Westwood Secondary School

- Yuan Ching Secondary School

Other Educational institutes In Jurong

- Nanyang Technological University

- Jurong Pioneer Junior College

- ITE College West

- Canadian International School, Lakeside Campus

- Yuvabharathi International School

Malls in Jurong

- Westgate

- JEM (Jurong East Mall)

- IMM (International Merchandising Mart)

- Jurong East MRT Station’s Shopping Concourse

- J’Den (still under construction, this is a mixed-use project with a mall component managed by CapitaLand)

Note that Junction 8 mall – while technically in Bishan – is for all practical purposes a neighbourhood mall for Jurong West residents also.

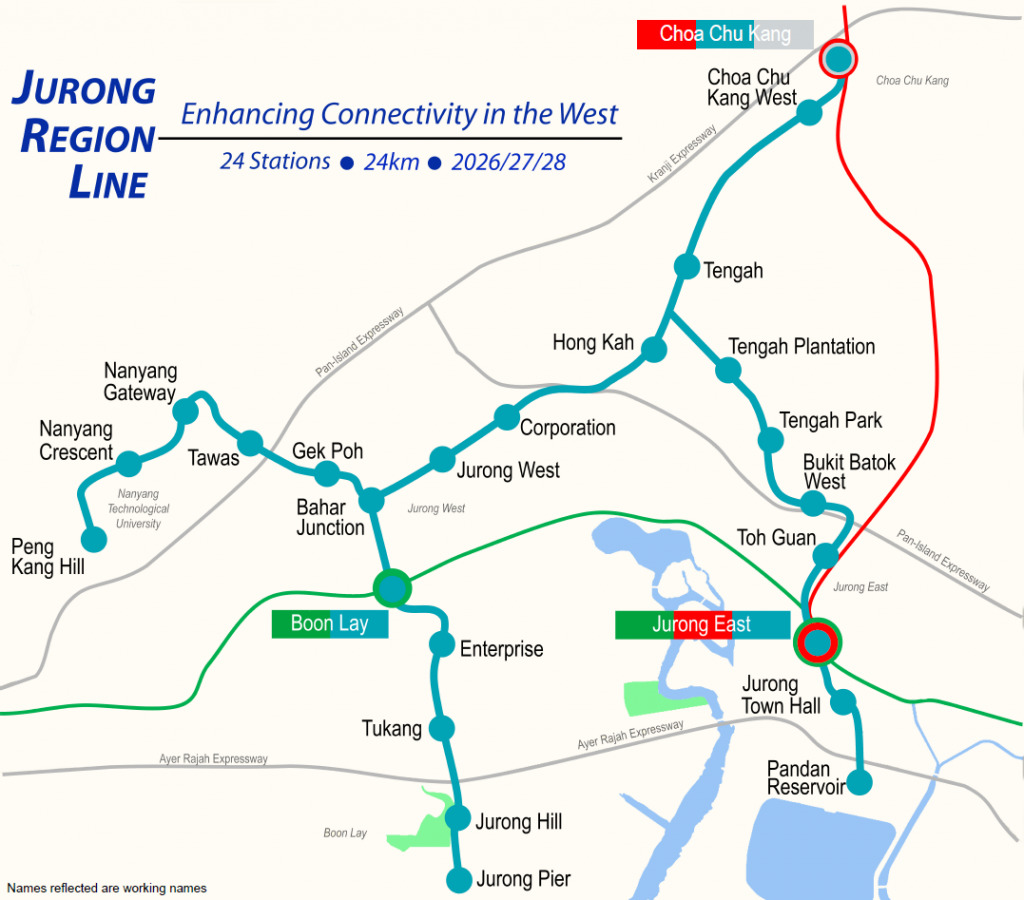

MRT Stations In Jurong:

Jurong East:

- Jurong East MRT Station (EW24/NS1)

Jurong West:

- Jurong West MRT Station (JS6)

- Boon Lay MRT Station (EW27)

- Pioneer MRT Station (EW28)

- Joo Koon MRT Station (EW29)

There are also several MRT stations on the upcoming Jurong Line (JRL), so we will see more in future.

A look at HDB prices in Jurong

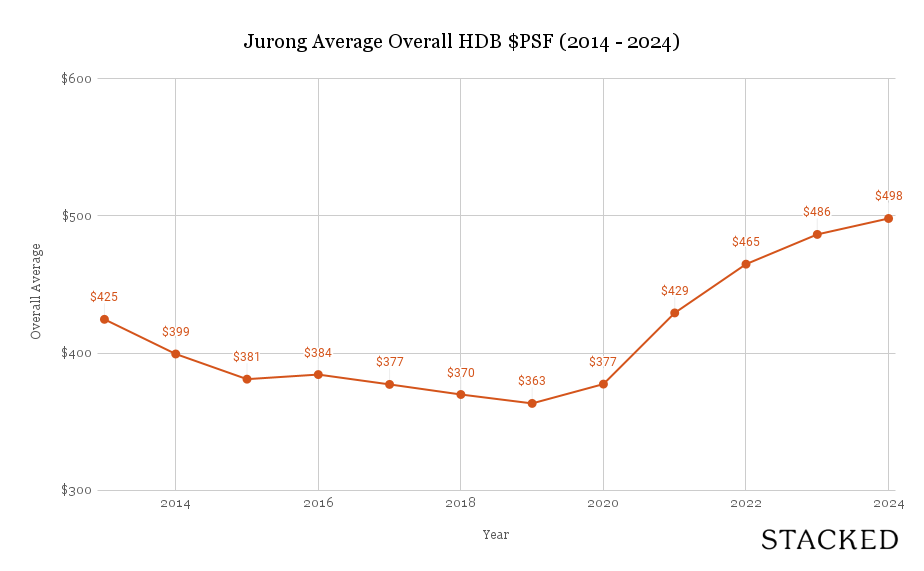

Here’s a look at how HDB prices have moved in Jurong as a whole (this includes both Jurong East and Jurong West)

| Year | 3 ROOM | 4 ROOM | 5 ROOM | EXECUTIVE | Overall Average |

| 2013 | $452 | $416 | $414 | $409 | $425 |

| 2014 | $423 | $390 | $387 | $399 | $399 |

| 2015 | $397 | $373 | $374 | $391 | $381 |

| 2016 | $393 | $375 | $386 | $392 | $384 |

| 2017 | $374 | $371 | $380 | $397 | $377 |

| 2018 | $365 | $362 | $371 | $392 | $370 |

| 2019 | $354 | $357 | $366 | $375 | $363 |

| 2020 | $379 | $373 | $372 | $390 | $377 |

| 2021 | $440 | $426 | $417 | $439 | $429 |

| 2022 | $473 | $464 | $456 | $458 | $465 |

| 2023 | $489 | $479 | $479 | $500 | $486 |

| 2024 | $509 | $489 | $481 | $504 | $498 |

| Overall Average | $418 | $405 | $404 | $418 | $411 |

| Gains | 12.6% | 17.5% | 16.2% | 23.1% | 17.3% |

More from Stacked

Sell your home: 5 actionable tips to take for a first-time home seller

"Sell your home Singapore" will probably be a trending search term on Google next year, as home prices are set…

| Year | 3 ROOM | 4 ROOM | 5 ROOM | EXECUTIVE | Overall Average |

| 2013 | $335,128 | $437,994 | $519,172 | $612,631 | $453,341 |

| 2014 | $313,417 | $408,409 | $485,722 | $594,540 | $419,082 |

| 2015 | $295,263 | $391,973 | $467,705 | $588,838 | $409,673 |

| 2016 | $290,512 | $394,601 | $482,228 | $593,303 | $412,630 |

| 2017 | $282,016 | $388,024 | $479,453 | $599,873 | $402,938 |

| 2018 | $270,115 | $377,319 | $468,795 | $594,618 | $399,478 |

| 2019 | $262,113 | $372,054 | $464,662 | $577,472 | $392,891 |

| 2020 | $281,192 | $386,771 | $469,797 | $595,789 | $414,368 |

| 2021 | $324,661 | $440,141 | $527,692 | $670,326 | $466,945 |

| 2022 | $352,646 | $479,686 | $577,284 | $701,127 | $496,537 |

| 2023 | $363,377 | $496,669 | $608,200 | $771,520 | $512,399 |

| 2024 | $376,174 | $508,638 | $610,363 | $761,811 | $517,463 |

| Overall Average | $310,800 | $421,804 | $510,114 | $636,517 | $440,128 |

| Gains From 2013 | 12.2% | 16.1% | 17.6% | 24.4% | 14.1% |

Note that the declining prices up to 2018 are not specific to Jurong, you’d see that in most HDB towns. It’s due to home prices being at a peak in 2013, causing HDB to impose the Mortgage Servicing Ratio (MSR) and ceasing to provide Cash Over Valuation (COV) data. This sent overall HDB prices downward, and they stabilised just before the pandemic. In the aftermath of Covid though, resale prices shot back up.

As such, Jurong’s HDB flat prices have reversed their decline, rising even higher than in 2013. At the market low in 2019, the average 4-room flat in Jurong cost just $372,000. Over 5 years, it has risen to $509,000.

The largest executive flats saw the best performance, with average price psf rising by 23.1 per cent since 2013. 4-room and 5-room flats saw almost similar performance in Jurong, with 5-room flats beating our 4-room by barely noticeably 0.7 per cent. Jurong’s 3-room flats performed significantly worse than their larger counterparts, but have still ended up 12.6 per cent higher than 2013.

Top and bottom performing projects in Jurong

| Project | Tenure | Completion Year | $ Gain/Loss | % Gain/Loss | Vol of Buy/Sel Tnx |

| WESTWOOD RESIDENCES | 99 yrs from 14/04/2014 | 2017 | $405,395 | 49% | 113 |

| LAKE LIFE | 99 yrs from 30/10/2013 | 2016 | $390,253 | 39% | 109 |

| IVORY HEIGHTS | 100 yrs from 01/02/1986 | 1993 | $436,907 | 35% | 12 |

| LAKESIDE TOWER | 99 yrs from 01/11/1975 | 1981 | $332,629 | 34% | 3 |

| THE FLORAVALE | 99 yrs from 16/12/1997 | 2000 | $220,531 | 26% | 26 |

| PARC VISTA | 99 yrs from 01/03/1995 | 1997 | $227,380 | 23% | 19 |

| LAKE GRANDE | 99 yrs from 09/06/2015 | 2019 | $217,377 | 22% | 98 |

| SUMMERDALE | 99 yrs from 22/09/1997 | 2000 | $192,086 | 21% | 14 |

| LAKEPOINT CONDOMINIUM | 99 yrs from 01/10/1983 | 1983 | $220,361 | 20% | 8 |

| J GATEWAY | 99 yrs from 28/08/2012 | 2016 | $189,420 | 18% | 186 |

| PARC OASIS | 99 yrs from 01/12/1991 | 1994 | $175,096 | 18% | 30 |

| LAKEVILLE | 99 yrs from 30/04/2013 | 2017 | $225,638 | 18% | 133 |

| THE CENTRIS | 99 yrs from 21/06/2006 | 2009 | $208,375 | 17% | 29 |

| CASPIAN | 99 yrs from 17/03/2008 | 2012 | $213,028 | 17% | 33 |

| LAKEHOLMZ | 99 yrs from 29/10/2001 | 2005 | $206,625 | 16% | 8 |

| THE LAKEFRONT RESIDENCES | 99 yrs from 03/08/2010 | 2014 | $148,852 | 13% | 27 |

| THE LAKESHORE | 99 yrs from 22/11/2002 | 2008 | $130,435 | 12% | 36 |

| THE MAYFAIR | 99 yrs from 04/12/1996 | 2000 | $101,130 | 10% | 23 |

| WESTMERE | 99 yrs from 26/06/1996 | 1999 | -$53,250 | -5% | 4 |

Top and bottom performing rental assets in Jurong

| Project | Tenure | Rental Yield |

| WESTWOOD RESIDENCES | 99 YEARS LEASEHOLD | 4.50% |

| THE FLORAVALE | 99 YRS FROM 1997 | 4.30% |

| SUMMERDALE | 99 YRS FROM 1997 | 4.30% |

| J GATEWAY | 99 YRS FROM 2012 | 4.20% |

| WESTMERE | 99 YRS FROM 1996 | 4.20% |

| LAKE GRANDE | 99 YRS FROM 2015 | 4.20% |

| LAKEVILLE | 99 YRS FROM 2013 | 4.10% |

| THE MAYFAIR | 99 YRS FROM 1996 | 4.10% |

| LAKE LIFE | 99 YRS FROM 2013 | 4.00% |

| PARC VISTA | 99 YRS FROM 1995 | 3.90% |

| THE CENTRIS | 99 YRS FROM 2006 | 3.90% |

| THE LAKEFRONT RESIDENCES | 99 YRS FROM 2010 | 3.90% |

| LAKEPOINT CONDOMINIUM | 99 YRS FROM 1983 | 3.90% |

| THE LAKESHORE | 99 YRS FROM 2002 | 3.80% |

| CASPIAN | 99 YRS FROM 2008 | 3.80% |

| PARC OASIS | 99 YRS FROM 1991 | 3.80% |

| LAKEHOLMZ | 99 YRS FROM 2001 | 3.60% |

| IVORY HEIGHTS | 100 YRS FROM 1986 | 3.40% |

Westwood Residences is one of the most notable resale condos in Jurong right now. It has a combination of a high rental yield and high resale gains, and this has been consistent throughout a high transaction volume. A possible reason for this is the upcoming Gek Poh MRT station on the Jurong Region Line, which will be within walking distance of Westwood.

Key drivers to look for:

The two most immediate factors to drive property value are train lines. The Jurong Region Line (JRL) will link up with the EWL at Jurong East MRT, and the NSL at Bukit Batok MRT, which provides a route to the CBD and Orchard, among other areas. We expect that some condos, such as Westwood as described above, are already factoring the upcoming stations into their pricing.

The on-again, off-again High Speed Rail (HSR) could provide a significant boost to Jurong area properties. But given the long and fickle history of this project, it’s not something we’d pin too much hope on. It’s nice if it happens, but Jurong has other things going for it even if it doesn’t.

The further development of Jurong Lake District, which has recently seen two new launches (Sora and Jurong Lake Residences), is one to watch. The lake district is one of the most heavily photographed scenic areas in Singapore; and its landscaped gardens and bridges are inimitable. This has the potential to be a future Bukit Timah, for home buyers who love the greenery – and it will have the added advantage of proximity to Singapore’s “second CBD.”

For those who are impatient for excellent amenities right now, however, Jurong East is a retail powerhouse; and new launches like J’Den will add some much-needed housing stock to the area.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How have HDB flat prices in Jurong changed over the past decade?

What are the main differences between Jurong East and Jurong West?

Which are some of the top-performing residential projects in Jurong?

What factors are expected to influence property values in Jurong in the near future?

Are there good educational options in Jurong for families?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

1 Comments

Hi, is this paragraph a typo error?

“Note that Junction 8 mall – while technically in Bishan – is for all practical purposes a neighbourhood mall for Jurong West residents also. “