Can Singaporeans Really Afford Their Properties During Covid-19?

December 8, 2020

Last year, MAS issued cautions as new launches grew, side-lining resale units. Then the re-issue of Options To Purchase (OTPs) came to an end, ostensibly because it could contribute to “property fever”. As of yesterday, MAS has directly advised prudence in buying property (as well as taking on more debt in other forms).

This leads to an old question, especially one regarding those who live in private properties: how affordable are our homes in Singapore, and are we over-leveraged? It’s an especially important question right now, with private property and resale flat prices rising amid a pandemic.

Here’s the scene right now:

Why the worry about Singaporeans being unable to afford their homes?

- Growing unsecured-credit defaults over the past year

- Slight uptick in the number of non-performing loans for homes

- Mortgagee sales were already on the rise last year

- Rising unemployment figures

- A softening rental market

1. Growing unsecured-credit defaults over the past year

According to the Straits Times, the credit card charge-off rate (the rate at which banks write off credit card debts, versus rollover balances) is up from 5.9 per cent in Q3 last year, to 9.1 per cent in Q3 of 2020.

MAS sees the charge-off rate as a sort of bellwether for mortgages. Most people, upon encountering financial difficulties, will stop paying for their credit cards or personal loans first. This could be the prelude to being unable to service more important loans, such as their mortgage.

(Although it should be noted that many Singaporeans have a more significant buffer in keeping their home loan serviced, in the form of their CPF monies).

2. Slight uptick in the number of non-performing loans for homes

The number of non-performing home loans rose very slightly, up 0.1 per cent. This measures the percentage of borrowers who are in arrears, with regard to their mortgage.

At present, it’s still below one per cent; but any rise in this percentage has to be addressed quickly. The last Global Financial Crisis started with non-performing home loans after all.

3. Mortgagee sales were already on the rise last year

It’s not widely realised that mortgagee sales (when a bank forecloses on a home and auctions it) were already on the rise for three straight years, before 2020. In fact, mortgagee sales for residential listings rose from just 18 in 2014, to 99 in 2019. This isn’t likely to rise or spike in 2020.

Most of these happened in the luxury property market, in areas like Orchard or Sentosa Cove; so while it’s not a reflection of the typical real estate market, it is a warning sign for the higher-end property segment.

That said, mortgagee sales are not expected to rise this year; this is thanks to home loan deferments, and auctions not taking place. The market also seems to be ignoring the rise in mortgagee sales over the past few years. In fact, Covid-19 seems to have fuelled the luxury market even further.

Regardless, the growing number of mortgagee sales shouldn’t be ignored, especially by investors willing to take on such large loans right now.

Property Market CommentaryBuying At A Property Auction During Covid-19: Here’s All You Need To Know

by Ryan J. Ong4. Rising unemployment figures

In October, it was reported that Singapore’s jobless rate had reached 3.6 per cent the month before. Most Singaporeans have CPF savings to tide them over for a while, and there are home loan deferments in place; so for now we haven’t seen any big impact.

It remains a worry, however, that some Singaporeans will still be jobless when the home loan deferments end. Even if these retrenched Singaporeans find new jobs, there’s a risk that lower income levels make them less able to service their loans.

5. A softening rental market

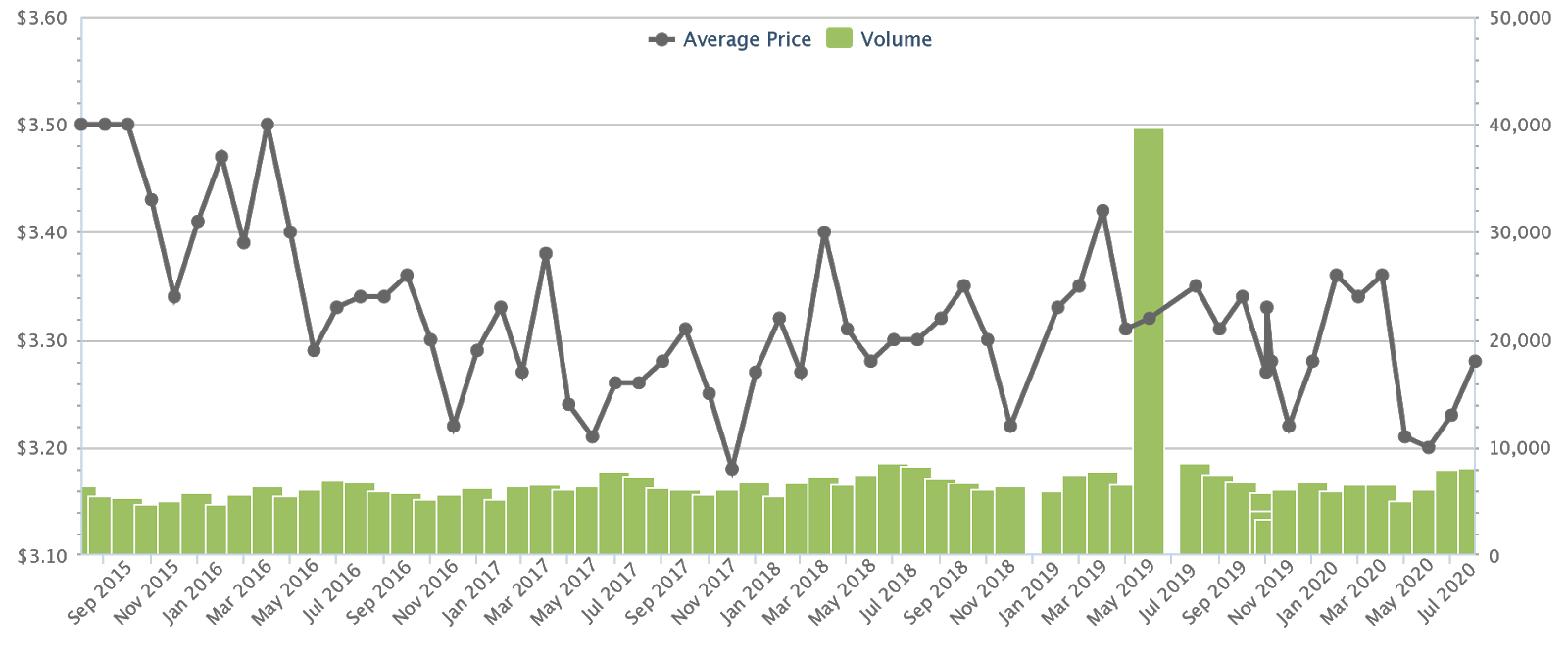

This is what the Singapore rental market has been like, from August 2015 to August 2020 (data beyond August 2020 is not yet available):

According to Square Foot Research, rental rates across Singapore have fallen from $3.50 psf to $3.28 psf; this is a 6.28 per cent decrease. This is likely to continue or to worsen, if the Covid-19 situation sees slashed housing allowances, and fewer expatriates in the country (some existing tenants may even be forced to go home, as a part of cost-cutting measures).

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1,600 New BTO Flats Are Coming To These Areas For The First Time In Over 40 Years

While most BTO-hopefuls are likely gearing up for the launch of this month’s Build-To-Order (BTO) sales exercise, let’s not lose…

A weak rental market raises the possibility of home loan defaults – this occurs if the property owner is dependent on rental income, and cannot bear the full mortgage if there’s a vacancy.

But how much housing debt do most Singaporeans take on?

Not much, thanks to a series of pre-emptive loan curbs.

At present, home loans are capped 75 per cent of price or value – whichever is lower – for private properties (the cap is 90 per cent for HDB loans). The maximum loan quantum is further reduced, in the event of loan tenures extending past retirement age, outstanding home loans, etc.

Besides that, two other measures restrict how much we can borrow. These are the Mortgage Servicing Ratio (MSR) and Total Debt Servicing Ratio (TDSR), implemented in 2013.

(In fact, the MSR is partially blamed for starting the downfall of HDB resale flat prices, which began to decline shortly after).

We have a longer explanation of these income caps in a previous article. But suffice to say that lending is tightly controlled, especially for the property market.

However, two additional factors are often overlooked

The income restrictions are even tighter than they seem. This is because the interest rate, when determining your MSR or TDSR, are calculated at 3.5 per cent; much higher than the HDB loan rate of 2.6 per cent, or bank rate of 1.3 per cent.

This gets even tighter for those on variable income, such as PHV drivers, sales people working on commissions, etc. In these instances, a further haircut of 30 per cent is applied to your assessed income as well.

So if you’re earning $4,000 a month on variable income, you’d count as only earning $2,800. This would reduce your maximum monthly loan repayments to $1,680 a month.

These hefty restrictions ensure that many Singaporeans can keep the home loan serviced, even if their income dips.

One of the biggest fears however, remains the Sellers Stamp Duty (SSD)

The SSD imposes a tax of 12 per cent on property sale proceeds, if the unit is sold within a year of purchase. This is subsequently eight per cent in the second year, and four per cent in the third year.

This is a serious concern for home buyers in volatile times. Property assets already lack liquidity; “sell and downgrade” is easier said than done. Adding SSD compounds the potential financial loss. Aversion to paying the SSD may also cause some imprudent decisions, such as borrowing to hold on to a property longer, and incurring more debt.

That said, one could also argue that SSD is useful as a deterrent, to prevent rash purchases in this downturn.

Overall, we think most Singaporeans are in a good place when it comes to affordability; and the surge in resale flat transactions might be a reflection of prudence.

As we mentioned in a previous article, some home buyers may be putting off buying private properties even if they can afford them, and opting for larger or prime area resale flats; these would still be cheaper.

It’s also possible that we’re seeing homeowners take pre-emptive steps, such as right-sizing from a condo to a resale flat, in expectation of harder times ahead.

Finally, given the interventionist nature of our government in real estate, we wouldn’t be surprised at possible new measures when home loan deferments end this year. If unpaid mortgages start to mount, but Singaporeans keep buying properties, we might even see tighter loan curbs.

Illustrations by: Xiu Ying

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are Singaporeans currently able to afford their homes during the pandemic?

How has the COVID-19 pandemic affected Singapore's property market and affordability?

What risks do Singaporeans face when taking on property loans during COVID-19?

Have mortgagee sales increased in Singapore during COVID-19?

What government measures are in place to ensure property affordability in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments