7 Useful Tips I’ve Learned Being An International Property Marketer: How To Start Investing In Overseas Property

June 13, 2022

I clearly remember the first time I felt invigorated to become a landlord and it was when I came across Robert Kiyosaki’s book, “Rich Dad Poor Dad”. This was a long time back when I was still a student (sidenote: yes, I’m aware that the general consensus deems him fluffy and repetitive but it is undeniable that he has kickstarted my own journey).

ZILLOW flipping flops. Is real estate BOOM about to BUST? Followers of Rich Dad know I do not “Flip Houses.” I prefer properties that CASH FLOW forever and pay zero taxes. Taxes and risk flipping too high. Be careful. Zillow’s flop may be 2008 again. Be aware. End may be near.

— therealkiyosaki (@theRealKiyosaki) November 2, 2021

For those who are unfamiliar, he is a real estate mogul that firmly believes in making your money work harder for you through investing in key assets and businesses. To him, becoming a landlord is one core way to bring in constant revenue, while preserving value and hedging using good debt.

He categorizes debt to be either “good debt” or “bad debt”, where good debts are the ones that profit you in the long run, whereas bad debts just make you financially crippled. Mortgages for your rental properties (not homes) are thus, a good debt.

And no, this piece isn’t going to be the one to inspire you to ‘take a leap of faith’ and become a landlord, but to remind those that already believe in real estate as a way to preserve and grow wealth to start on their journey again.

From my past experience as an international property marketer, I realised that the dream of owning a property in different parts of the world does not have to just be a daydream. After all, I’ve spoken to so many people that have already made it their reality.

For those looking to invest overseas, here are 7 useful tips that I’ve learned through my journey in my previous career as an international property marketer.

Tip 1: Educate Yourself & Don’t Skimp on Your Research

Needless to say, the more you know, the better a decision you can make. Most seasoned investors do at least an hour of research (on anything under the sun really) daily, so I can imagine that novices would need to do much more to catch up.

Here are some basic considerations I’d never forget:

- Determining Your Market

Determining your market is probably a no-brainer but those who tried know how tough that decision is. Most of the investors I’ve previously spoken to usually started off with somewhere familiar to Singapore like Thailand, Malaysia, or Vietnam.

This makes sense because site visits are much more convenient, you’d probably find more relatable materials and the place is more familiar. It’s just a little less daunting compared to more unfamiliar spaces.

Some examples that you can consider are DD Property for Thailand listings and PropertyGuru for Malaysia listings to get a gist of the different properties and their prices. You could also use it to see how the prices change as per the location so you’d know you’re paying fair value for your property.

- Governance & its Effects

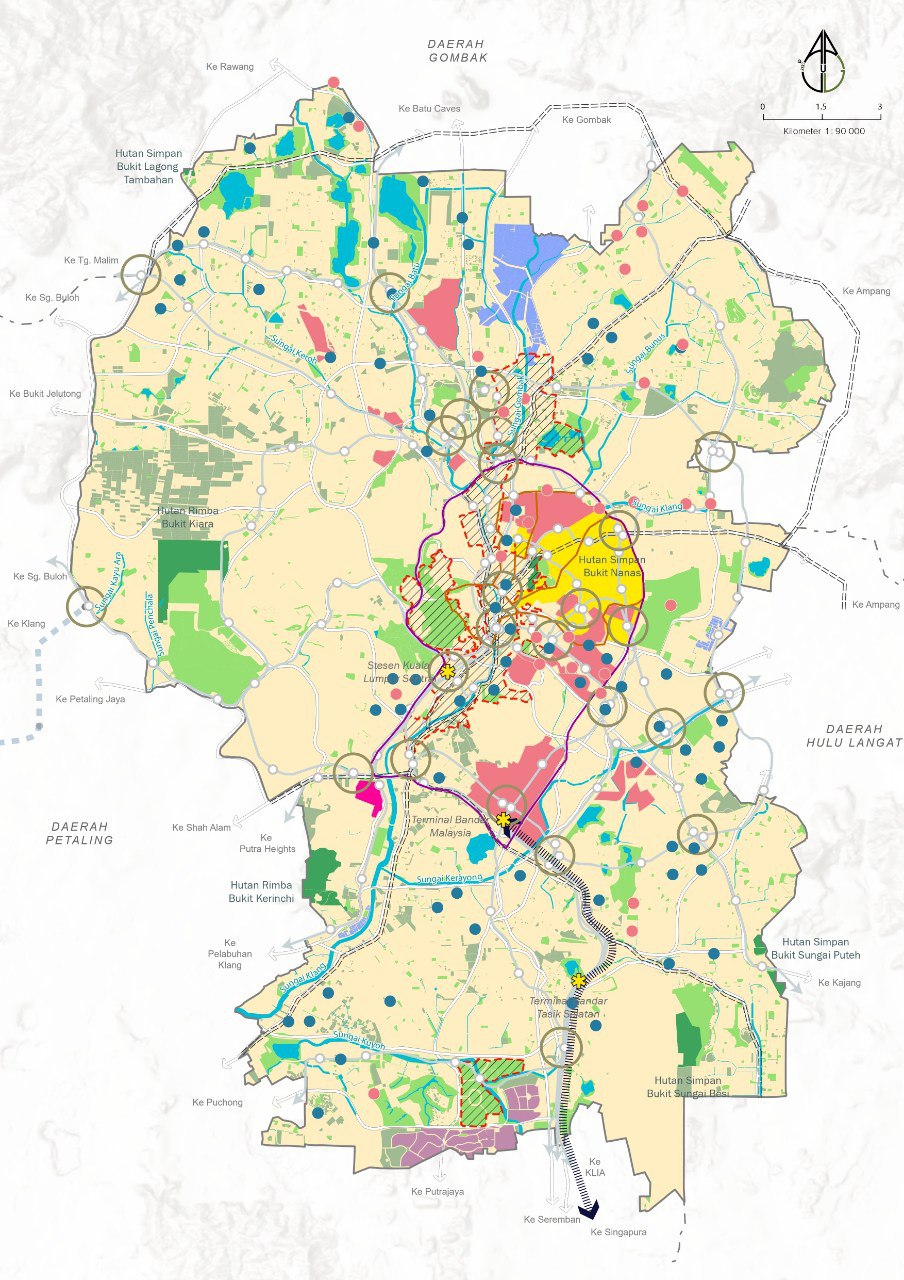

Just like in Singapore, a big bulk of your real estate’s performance depends on the government (think Singapore’s Master Plan and our cooling measures). Not only do the taxes and business environment affect the property market, but any upgrading works will also affect your assets too.

And if the government has no intention to upgrade the area or implement any regulations on the market, tough luck on expecting any capital upswing.

In short, make sure that the political party of that country is on the ball with their strategies to upgrade the city. You can look through news or government official pages to see the goals and timeline that they have proposed – it can give you a good gauge. One example is the VSIP program in Vietnam which has attracted many locals and foreigners to its many cities.

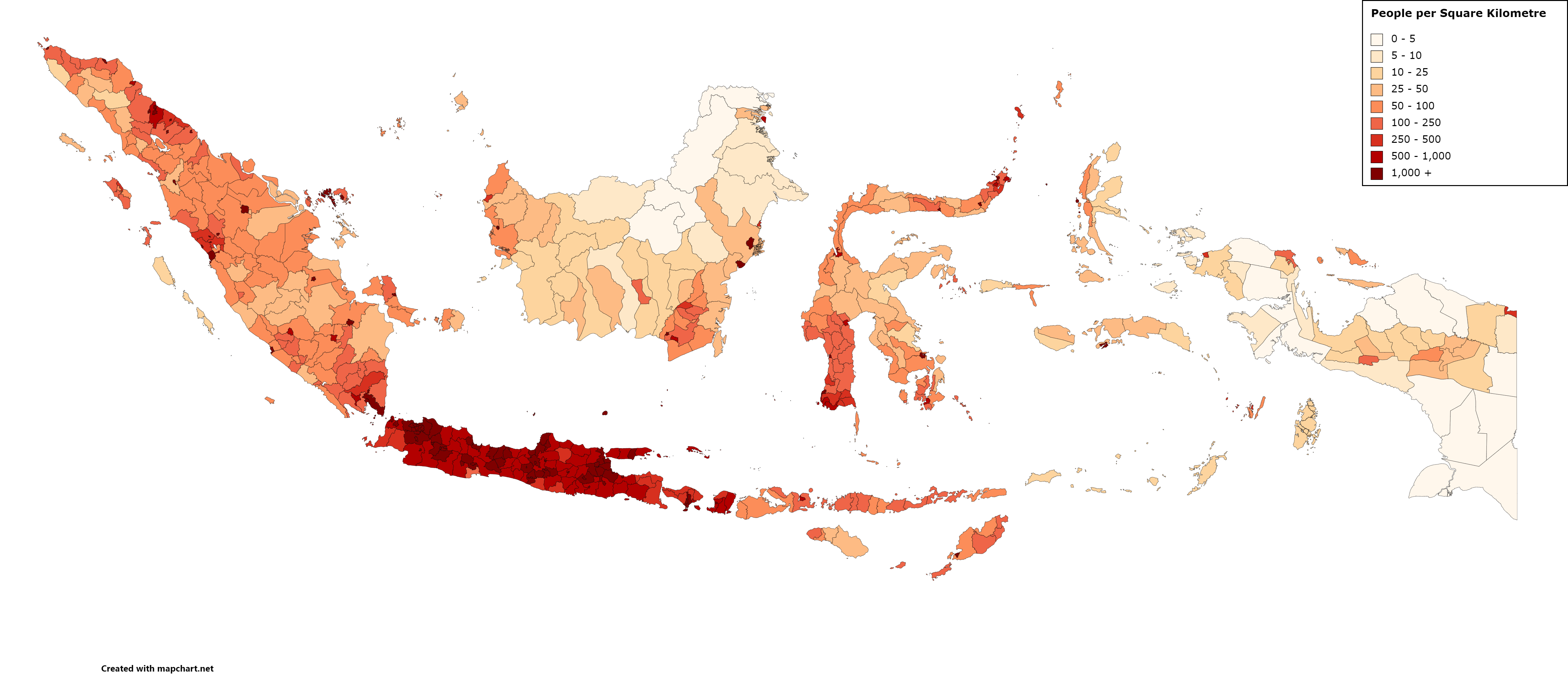

- Demographic Research

After shortlisting your ideal location, it’s great to determine the general demographics of the area. What do people require of the place? Where do they like to live? What is the difference in property prices in the various neighbourhoods? How about crime rates or amenities?

Let’s put it this way, if the bulk of the population is young office workers that are mainly single, it won’t make sense for you to purchase a 5 room unit (unless you’re renting out to 5 different people, which then makes you have to manage 5 tenants just for 1 key). Instead, a studio apartment would make more sense. Matching the amenities around your selected neighbourhood with the general demand would also be a good way to see if your unit is desirable.

- Having a Feel of the Numbers

This was mentioned fleetingly previously a few times but having a concrete idea of the different prices psf in each neighbourhood will be important in filtering which postal codes you can consider. You’d also know if you’re looking at an undervalued or overvalued property – which is really important when it comes to flipping real estate (if that’s your cup of tea).

- Reviewing the Master Plan of the City

The Master Plan gives a really clear idea of the zoning and land uses of the area, which is also important in determining the shape of the urban environment of the city. This will have the greatest impact as you’d want to invest in a growth area, not one that will be stagnant. After all, investing overseas has its risk, and you’d certainly want there to be a good upside to counter that.

Tip 2: Arguably the Hardest Part, Finding Equity

There are no rules in the game of finding equity, yet most of us can agree that ticking off this step from the list is really tough. After all, the downpayment is most of the time, at least 20% of the purchase price. One seasoned investor shared with me his experience when he was acquiring his first investment property at the tender age of 27.

Back then, he was strapped for cash but really wanted to try a hand at investing in real estate, and he eventually chose the UK. As he couldn’t afford a place on his own, he decided to fund the investment by finding other investors that shared the same sentiments as him. He did the heavy duty by researching all the information on the property, shared his strategy, and managed to make two strangers invest in that unit together with him.

His advice has stuck with me for the longest time and what’s more, we have the advantage of new services being offered to us. We can now leverage our crypto assets to ‘refinance it’ using services like Milo or invest in fractional real estate which is an easy way to diversify your portfolio with local companies like Real Vantage.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Ultimate New Launch Cheat Sheet 2020 (Land Price, PSF PPR, Take Up Rate)

If you are in the market for a new launch condo in Singapore you really could not have chosen a…

Tip 3: Stick to a Budget That You Can Really Afford

This is one major pitfall that many newbies might fall into – failing to have enough liquid funds to afford the cost of acquiring, maintaining, and selling the property. And one fool-proof way to get around this issue is to set a budget for your property while considering the downpayment required, recurring costs applicable, and factor in any unexpected costs.

You’d need to consider your Total Debt Servicing Ratio (TDSR) and loan-to-value (LTV), the monthly salary you rake in, and set aside some buffer funds to weather rainy days (if any). And once you have a good idea of your budget, stick to it strictly.

This budget will include all the taxes, miscellaneous fees, renovation costs, and purchase price of the property, and having a breakdown of all these numbers will give a much clearer idea of the requirements each property has. In terms of recurring costs, I like to make sure that I have 2 to 4 months worth of rental income set aside just as a safety net.

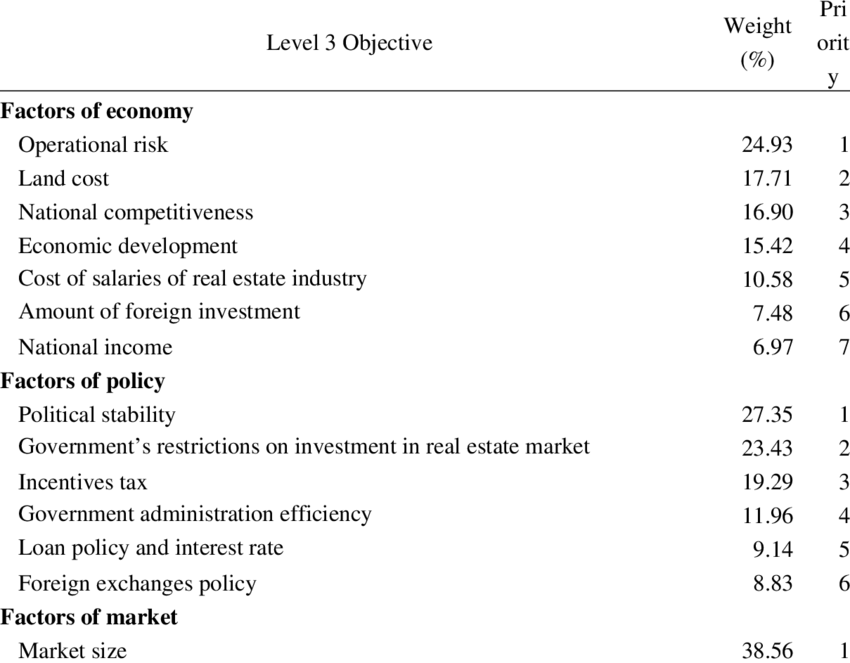

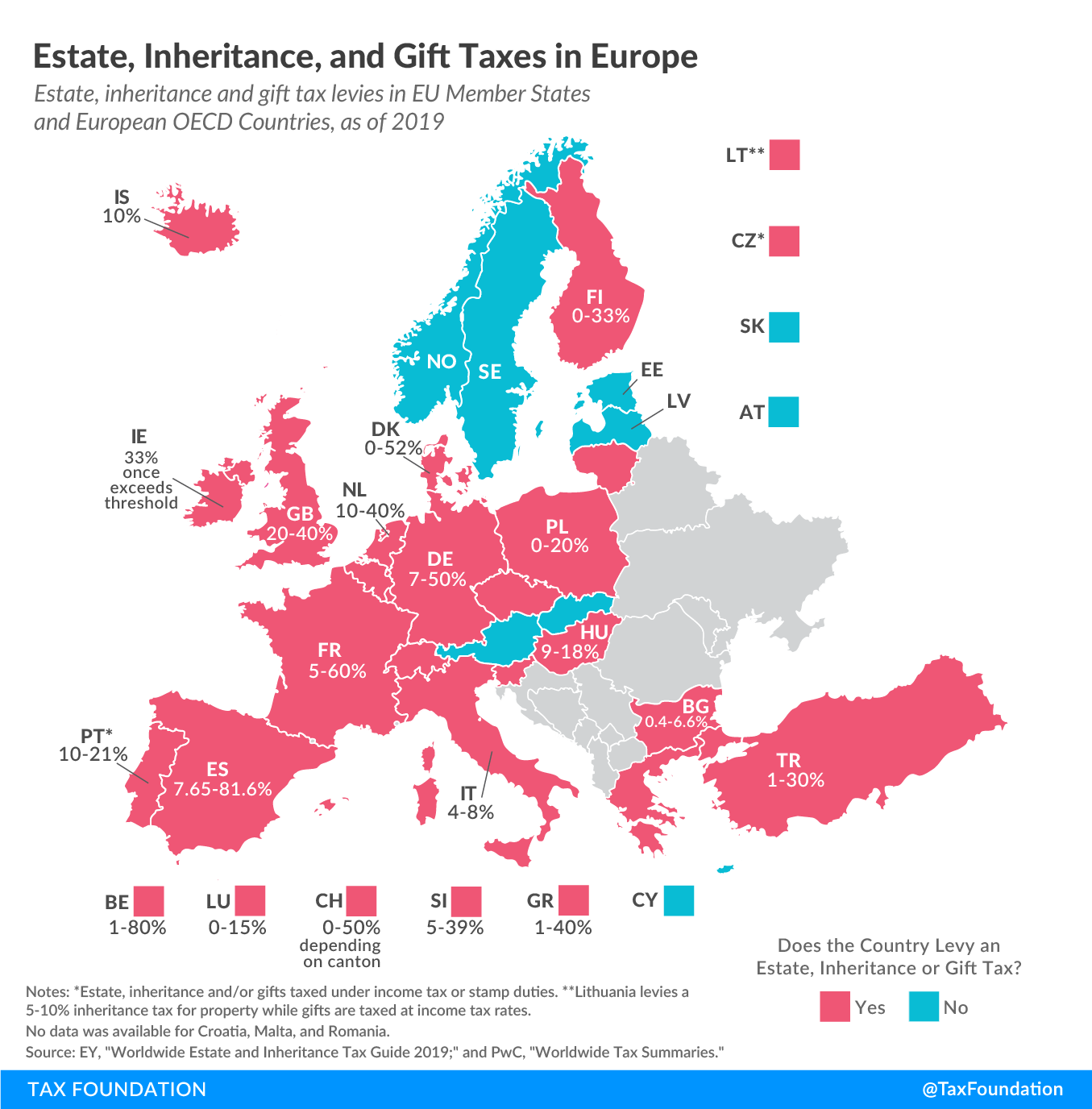

Tip 4: Be Smart with Legal Implications and Taxes

Depending on the city, timeline and the existing portfolio one has, the strategy would probably differ for most. Countries have their own way of handling ownership and you’d want to be aware of all the taxes and legal requirements.

For example, it might make more sense for a family of 4 to buy their first investment property under someone’s name to save up on inheritance tax when it comes to UK properties, whereas another example is understanding the fact that only a limited pool of people can buy a resale Australian property.

I’d highly recommend speaking to a professional solicitor which can give great insights and share personalised strategies.

Tip 5: The Internet is Your Best Friend, Research for Deals Daily

There isn’t a quick way to become awesome in assessing real estate deals – the only way is to do it constantly. Find deals online to assess and compare them with each other daily so as to have an understanding of the pros, cons, and potential of the deals in the long run.

You can study the neighbourhoods and rank them into 3 categories to understand what you’re dealing with better:

- Cat A: Great neighbourhoods with mainly homeowners that put in the effort to maintain their homes and outlook. This typically means that the property would probably not do too well as a rental.

- Cat B: Neighbourhoods with a mixture of renters and homeowners, which makes it easier to rent it out.

- Cat C: Neighbourhoods that are mainly rental properties that might not have great upkeep. There’ll probably be high turnover rates and possible difficulties in exiting the market in the future.

There’re many different types of categories that you can come up with. And once you’re familiar with how to analyse deals, it’ll be much clearer for you to analyse any investment deals in the future.

Tip 6: Find a Reliable Agent & Do Your Due Diligence

No matter how much research you do on a country, city, or neighbourhood, a good agent would be the best person to turn to when it comes to advise as they are always scouting on the ground. They are much more familiar with the city and its dynamics, along with its taxes and legal complications. In the event that travelling to the site is tough, an agent can also do a home inspection in your best interest so you’d know the unit’s condition and know what you’re getting yourself into. In countries where there are a lot of overseas investors, most agents would probably be able to do a job managing the property as well.

However, the caveat here is finding an agent that you can trust. Therefore, it’s your job to do thorough due diligence and cross-reference it to whatever your agent is telling you. Once you find someone that services you well, stick with him or her and you can go a long way.

You can join communities online, approach a property agency or consult with private companies to find a reliable agent. For a more unconventional approach, I like to scour local forums or Reddit to look for locals that may have organically recommended an agent – and reach out manually to ask for a referral. You’d find that if their agent has really done a good job for them, these people would usually be grateful enough to be enthusiastic about recommending their agent.

Tip 7: Learn how to do Your Cashflows and Valuation

It could be complicated at first when analyzing the numbers, but trust me, it gets easier the more you do it (which is why it’s recommended to analyse a deal every day). And once the opportunity of a great deal falls onto your lap, you’ll be confident enough to know that it’s worth pursuing.

Some important analyses to make are:

- Return on Investment (ROI)

- Net Operating Income (NOI)

- Gross Rental Yield

- Internal Rate of Return (IRR)

- Operating Expense Ratio (OER)

- Occupancy Rates

- Sensitivity Analysis

- Cashflow Analysis

You’d also have to have an ideal capitalization rate (cap rate) and understand your risk tolerance.

Check out on YouTube, read up on books, or attend courses that will guide you through these!

P.S: Different types of properties would have different considerations! So always keep in mind what numbers matter when you’re evaluating a property.

Bonus Tip (also a no-brainer): Listen to What Those Who Have Already Succeeded Have to Say

This is truly a no-brainer – follow the footsteps of those that have already paved a path. Be it developing a niche in a certain field of property (e.g. tourism), having a mentor, or analysing 5 deals a day, the journey has been a path well travelled.

Read up on what real estate moguls have to say, study their path to success, and imitate it.

Here are a few that have great insight that are worth a follow:

Final Thoughts

Since I started this piece off with Robert Kiyosaki, I shall end with one of my favorite quotes from George S. Clason: “A man’s wealth is not in the coins that he carries in his purse, but in the income he builds”.

I’m not going to lie: real estate is a challenging business. Skills, connections, luck, and timing are all part and parcel as well. I will continue writing about international property, so feel free to let me know in the comments if there are any topics that you are interested to know!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What should I consider when choosing a country for overseas property investment?

How can I find funding or partners for overseas property investments?

What are some key legal and tax considerations for buying property abroad?

How important is research and daily deal analysis in international property investing?

Why is it recommended to work with a reliable real estate agent when investing overseas?

What financial metrics should I learn to evaluate overseas property deals effectively?

Cheryl Teo

Cheryl has been writing about international property investments for the past two years since she has graduated from NUS with a bachelors in Real Estate. As an avid investor herself, she mainly invests in cryptocurrency and stocks, with goals to include real estate, virtual and physical, into her portfolio in the future. Her aim as a writer at Stacked is to guide readers when it comes to real estate investments through her insights.Need help with a property decision?

Speak to our team →Read next from Overseas Property Investing

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Overseas Property Investing What Under $200K Buys In Malaysia Today — From Freehold Apartments to Beachfront Suites

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments