6 Slow Selling New Launches That Became Profitable Later (More Than 90% Made Money)

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

A common marketing tactic in real estate is to slap “selling fast” on new launch websites. We tend to assume that what starts well will also end well – so any property that’s selling out quickly must, by conventional thinking of “wisdom of the crowd”, will also end up being a top performer in the resale market. In practice, that doesn’t always pan out.

Sometimes, even if condos had a slow start (which could be due to various reasons), they can still pick up the pace later on. In general, people like to see condos selling well before taking the plunge themselves. If it only sells 10% of its units at launch, the typical thinking is that it must have something wrong with it, right? Well, that’s not always true.

In this list, the following condos all saw slow sales at launch, but have since done much better than most would have expected.

How we picked the condos on this list

The following condos sold less than 30 per cent of their total units within the first six months (considered slow by industry norms). However, based on resale transactions up to May 2022, these projects have seen profits in at least 90 per cent or more of all transactions.

| Project | How Many Sold In 6 Months? | First Sale Year | Tnx (Gains) | Average Gain | Tnx (Loss) | Average Loss | Tnx (Breakeven) | Total Tnx | Proportion Winners |

| EIGHT RIVERSUITES | 39.6% | 2012 | 256 | $110,394 | 15 | -$150,761 | 2 | 273 | 94% |

| BARTLEY RESIDENCES | 43.9% | 2012 | 202 | $112,969 | 20 | -$57,406 | 0 | 222 | 91% |

| SIMS URBAN OASIS | 25.9% | 2015 | 181 | $128,461 | 1 | -$140,000 | 0 | 182 | 99% |

| COMMONWEALTH TOWERS | 38.1% | 2014 | 139 | $152,243 | 5 | -$14,580 | 0 | 144 | 97% |

| THE PANORAMA | 27.2% | 2014 | 138 | $239,235 | 0 | $ – | 0 | 138 | 100% |

| RIVERBANK @ FERNVALE | 39.6% | 2014 | 121 | $132,834 | 1 | -$11,000 | 0 | 122 | 99% |

| THE TRILINQ | 14.4% | 2013 | 103 | $190,715 | 11 | -$85,347 | 0 | 114 | 90% |

| THE SANTORINI | 21.9% | 2014 | 89 | $86,211 | 8 | -$21,283 | 0 | 97 | 92% |

| PRINCIPAL GARDEN | 30.8% | 2015 | 85 | $214,348 | 1 | -$36,000 | 0 | 86 | 99% |

| SYMPHONY SUITES | 21.1% | 2015 | 80 | $85,923 | 2 | -$80,500 | 0 | 82 | 98% |

| VUE 8 RESIDENCE | 29.4% | 2013 | 71 | $184,703 | 4 | -$38,555 | 0 | 75 | 95% |

| THE SKYWOODS | 14.3% | 2013 | 66 | $133,709 | 4 | -$18,950 | 1 | 71 | 93% |

| LAKEVILLE | 36.6% | 2014 | 64 | $161,159 | 3 | -$25,588 | 0 | 67 | 96% |

| QUEENS PEAK | 47.6% | 2016 | 57 | $152,721 | 0 | $ – | 3 | 60 | 95% |

| STARS OF KOVAN | 44.8% | 2016 | 47 | $170,182 | 0 | $ – | 1 | 48 | 98% |

| THE VENUE RESIDENCES | 18.4% | 2013 | 39 | $125,173 | 3 | -$53,250 | 0 | 42 | 93% |

| THOMSON IMPRESSIONS | 45.5% | 2015 | 39 | $174,988 | 2 | -$56,000 | 0 | 41 | 95% |

| HIGHLINE RESIDENCES | 27.2% | 2014 | 33 | $234,133 | 3 | -$61,633 | 0 | 36 | 92% |

| TRE RESIDENCES | 20.8% | 2014 | 30 | $125,136 | 0 | $ – | 0 | 30 | 100% |

| WATERFRONT @ FABER | 43.3% | 2014 | 23 | $209,150 | 0 | $ – | 0 | 23 | 100% |

| HALLMARK RESIDENCES | 6.7% | 2013 | 11 | $188,680 | 0 | $ – | 0 | 11 | 100% |

All data is based on caveats lodged with URA, but note that transactions not lodged with URA are not reflected.

1. Sims Urban Oasis

Location: 2 Sims Drive (District 14)

Developer:

TOP: 2017

Lease: 99-years

Number of units: 1,024

Initial launch sales: 26% sold in the first six months

Percentage of profitable resale transactions: 99% (181 gains, one loss)

Average gain: $128,461

To be fair, Sims Urban Oasis was launched in phases so it’s not as if it could totally sell out in one go. But even with its phase of 200 units, it only sold over 100 units of those – not exactly very stellar results. The biggest issue at that time was the slow and subdued market (it was on its way down to the bottom of 2017).

There were also two other factors that could have contributed to the slower sales:

First, it’s a mega-development with over 1,000 units; and the high unit count is coupled with a heavily built-up area. There is not much greenery or open space in the surroundings, and it was thought family buyers wouldn’t appreciate that.

Second, there was some concern that it’s within a 10-minute walk of the Geylang vice area. In actuality, Sims Urban Oasis is far enough that this isn’t an issue – but property buyers are always a bit cautious of the Geylang area. Vice aside, some buyers also find the area a bit run-down and crowded.

Sims Urban Oasis has since boomed, however, thanks to Paya Lebar’s transformation. This condo is a six-minute walk from Aljunied MRT, and from there it’s just one stop to Paya Lebar Quarter (PLQ). This is an area loaded with malls and Grade A offices, making Sims Urban Oasis of renewed interest to landlords.

As some residents can also attest, Sims Urban Oasis is in great proximity to several foodie areas, many of which are open till late (our red-light area is possibly even more famous for its food).

That said, Sims Urban Oasis still lives up to its namesake: it’s a condo for urbanites, who don’t mind being surrounded by concrete. It’s convenient, newer, and better priced than many Paya Lebar area counterparts; but at the cost of less green space.

2. The Panorama

Location: 8 Ang Mo Kio Avenue 2 (District 20)

Developer: Pinehill Investments Pte. Ltd. (Wheelock Properties)

TOP: 2017

Lease: 99-years

Number of units: 698

Initial launch sales: 27% sold in the first six months

Percentage of profitable resale transactions: 100% (138 gains, no losses)

Average gain: $239,235

Sales of The Panorama were so slow, that Wheelock Properties took a $110 million hit on the project for 2013. The main reason was a softening of the property market at the time. MAS had announced new cooling measures in January 2013, as well as Total Debt Servicing Ratio (TDSR) restrictions.

The Panorama was especially affected by this, as the perception was that it would be pricey (high-end condos tend to bear the brunt of cooling measures first). Wheelock Properties has a reputation as a high-end, luxury developer; and this was coupled with their high bid for the plot: $550 million for the Ang Mo Kio GLS plot.

Sales of The Panorama only picked up when the price dropped from a median of $1,343 psf, to an astounding $1,200 psf.

This likely accounts for the high number of profitable transactions today.

Even back then, a new, high-end condo below $1,300 psf would have been a steal – so the original buyers had a windfall.

Location-wise, The Panorama’s main highlight is proximity to the venerable CHIJ St. Nicholas Girls’ School, which is only a five-minute walk. It’s also within a 6-minute walk to Mayflower MRT, on the Thomson-East Coast Line.

3. The Trilinq

Location: 28 Jalan Lempeng (District 5)

Developer: Clementi Development Pte. Ltd.

TOP: 2017

Lease: 99-years

Number of units: 755

More from Stacked

A Buyer’s Case Study With Stacked: Fourth Avenue Residences

Project Case Study: Fourth Avenue Residences

Initial launch sales: 14% sold in the first six months

Percentage of profitable resale transactions: 90% (103 gains, 11 losses)

Average gain: $190,715

The slow initial sales at The Trilinq can be summed up in one phrase: void strata space. We’ve explained before how this is a potential money-waster, but to summarise: units have a high floor-to-ceiling ratio, and this vertical space counts toward what you buy.

Some of the Triliinq units have huge amounts of void space – there are living rooms where the floor-to-ceiling height is an impressive six metres. Perhaps this paid off for buyers in the long run, however, as resale gains have been solid. We have to admit the tall ceilings create quite the impression, and are rare outside of penthouse units.

That said, it apparently was part of the developer’s plan to sell slower over the course of the 3-year construction period, instead of trying to sell out in a month.

The other factor to consider is the ABSD deadline. Trilinq was one of the condos that were in danger of missing the five-year deadline (the estimated ABSD payout plus interest would have been $50.9 million). Towards the end of sales in 2017, the average price dropped to around $1,200 – $1,300 psf (as compared to the $1,505 psf average during launch). Hence, it goes some way to explain the high resale gains in some transactions today.

4. The Santorini

Location: 23 Tampines Street 86 (District 18)

Developer: MCC Land (Singapore) Pte. Ltd.

TOP: 2017

Lease: 99-years

Number of units: 597

Initial launch sales: 22% sold in the first six months

Percentage of profitable resale transactions: 92% (89 gains, eight losses)

Average gain: $86,211

The Santorini, like The Panorama, suffered from the introduction of TDSR curbs near launch. There was demand for this property; but the bulk of units sold, during Santorini’s launch weekend, were mainly its smaller one and two-bedders.

This was likely due to the lower quantum, which was essential for new buyers seeking to meet TDSR limits (the smallest one-bedder units were only around $500,000 at launch). The larger units, however, proved challenging to move over the next two years.

It was thought at that point that the market was beginning to get saturated with too much supply of mass-market projects, and that there was quite a lot of new supply in the area as well.

The Santorini also had to contend with an ongoing problem: this condo has no MRT station within walking distance, and it’s primarily for those who drive.

Nonetheless, resale gains have been strong thanks to ongoing developments in the Tampines area. The Santorini is less than a 10-minute drive to Tampines Central, which is a major retail cluster that also has a lot of Grade A office space. At current prices of around $1,240+ psf, this is a viable alternative to pricier and older condos closer to the centre of Tampines.

5. Principal Garden

Location: 93 Prince Charles Crescent (District 3)

Developer: Secure Venture Development (Alexandra) Pte. Ltd.

TOP: 2018

Lease: 99-years

Number of units: 663

Initial launch sales: 31% sold in the first six months

Percentage of profitable resale transactions: 99% (85 gains, one loss)

Average gain: $214,348

Principal Garden seems angled mainly toward investors: around 70 per cent of the unit are smaller one and two-bedders, while the project also features dual-key units. The trouble is, the shoebox craze had peaked in 2011/12; and by the time of Principal Garden’s launch in 2015, we were bombarded with news media about how shoebox units had oversaturated the market; and investors began to worry about resale prospects. There was also lots of nearby competition from Ascentia Sky, Echelon, and Alex Residences.

Principal Garden had news media that boasted brisk sales; but bear in mind that these numbers were for phased launches (e.g., the developer only put out 200 units on launch weekend). This is a common tactic used when developers are less confident, as it helps to create the impression of fast sales. As you can see from the numbers above, the take-up rate for the first six months was low.

Nonetheless, Principal Garden has done well over the years. This could be down to numerous factors such as the gentrification of Tiong Bahru (Redhill MRT is about a 10-minute walk from this project, and it’s one stop from Tiong Bahru MRT).

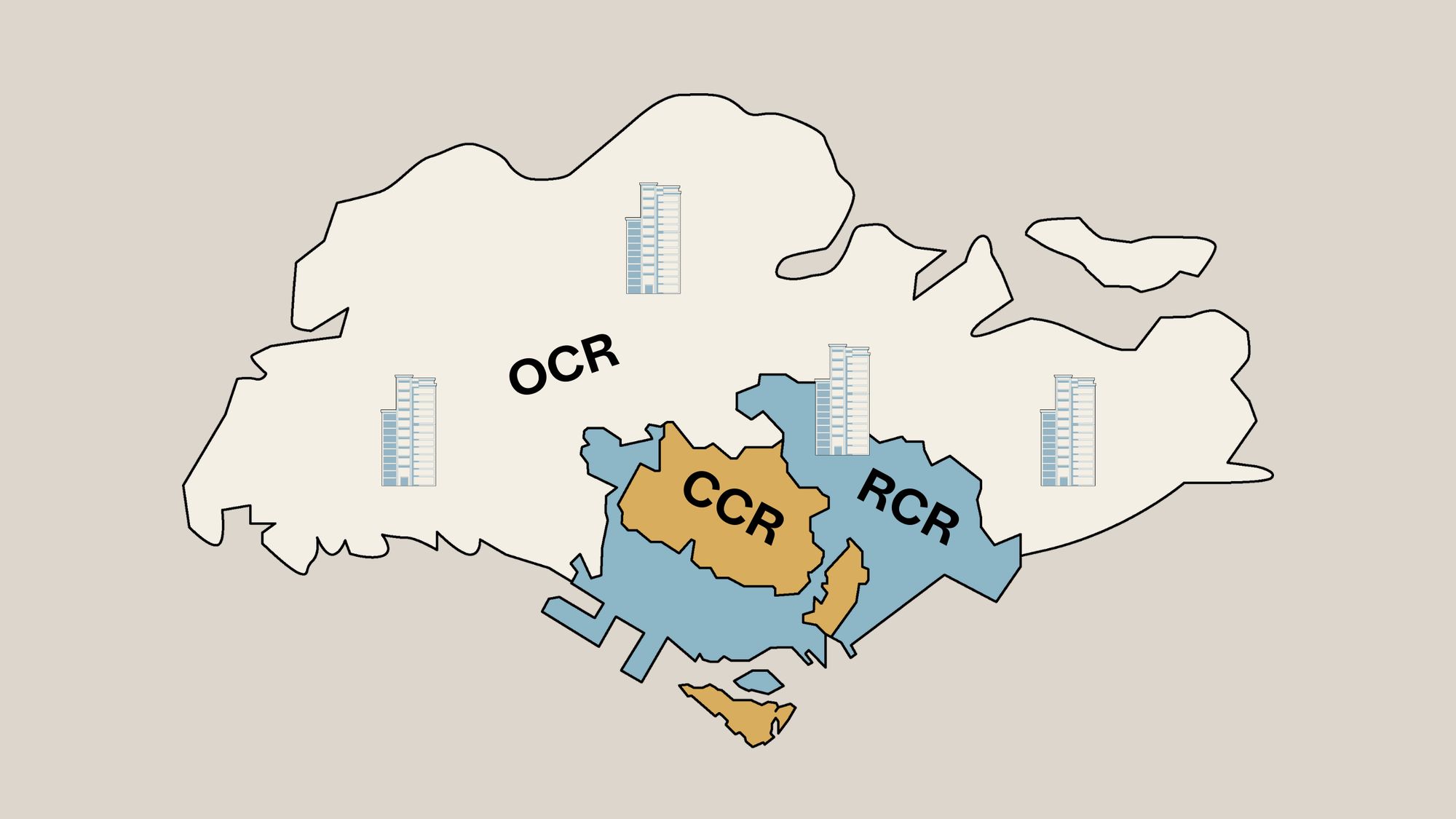

Perhaps another reason is the 80:20 approach used by the developer, where 80 per cent of the plot is landscaped greenery. Such generous allocations are a rare find these days, especially in the urbanised RCR. Sometimes, what you see in renders isn’t quite enough, and seeing it in real-life can make all the difference.

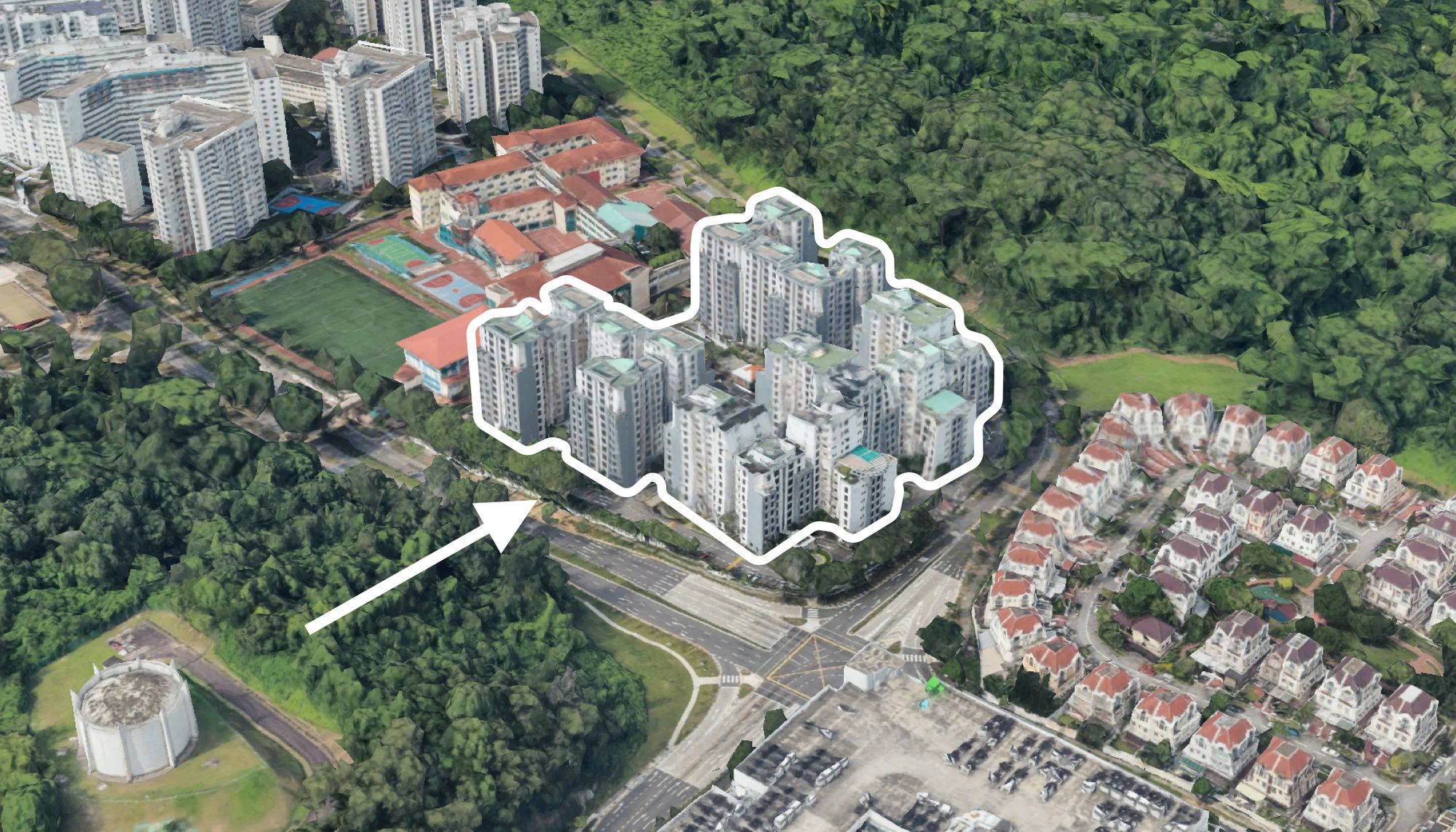

6. The Skywoods

Location: 11 Dairy Farm Heights (District 23)

Developer: Bukit Timah Green Development Pte. Ltd.

TOP: 2016

Lease: 99-years

Number of units: 420

Initial launch sales: 14% sold in the first six months

Percentage of profitable resale transactions: 93% (66 gains, four losses)

Average gain: $133,709

The main gripe from buyers, at the time of The Skywoods launch, was the leasehold status. The Skywoods’ closest neighbours at the time included condos like Dairy Farm Estate and Hazel Park, which were freehold condos selling at significantly less.

This was compounded by the launch date. The introduction of TDSR, close to The Skywoods’ launch, meant some buyers found that they couldn’t meet the requirements to buy The Skywoods. This made it tough for the sales team to shift units, until prices were lowered in 2015.

(We have more details on the pricing changes for The Skywoods in this earlier article.)

Since those days, however, it’s been smooth sailing for The Skywoods. Improvements in the area, such as the opening of Hillview MRT nearby and Rail Line developments, have helped to boost the price. You can find out more about The Skywoods today in this article.

There are other condos that fared poorly at launch, but have since performed well

It just goes to show, that launch-day sales aren’t always a good indicator of what’s to come (even though sometimes it does take some price discounts). For more in-depth reviews on new and resale properties alike, follow us on Stacked. We’ll keep you up to date with the latest happenings in the Singapore private property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Investment Insights

Property Investment Insights Why This 24-Year-Old Condo Outperformed Its Newer Neighbours In Singapore

Property Investment Insights How A 625-Unit Heartland Condo Launched In 2006 Became One Of 2025’s Top Performers

Property Investment Insights Does Buying A One-Bedroom Condo Still Make Sense As An Investment In 2026

Property Investment Insights This 21-Year-Old Condo Didn’t Sell Out Initially, Yet Became A Top Performer

Latest Posts

Singapore Property News This 4-Room HDB Just Crossed $1.3M — Outside the Usual Prime Hotspots

On The Market Here Are 5 Rare Newly-Renovated HDB Flats Near MRT Stations You Can Still Buy In 2026

Singapore Property News More BTO Flats Are Coming In 2026 And Why This Could Change The HDB Market

Editor's Pick We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Property Market Commentary Why This Once-Ulu Town In Singapore Is Going To Change (In A Big Way)

Editor's Pick This HDB Just Crossed $1.3M For The First Time — In An Unexpected Area

Singapore Property News “I Never Thought I’d Be Sued by a Tenant.” What Long-Time Landlords in Singapore Miss

Editor's Pick I Lived In Bayshore When It Was ‘Ulu’. Here’s How Much It Has Changed

Editor's Pick HDB Resale Prices Finally Slowed in 2025 — Will It Continue in 2026?

Singapore Property News Breaking News: District 23 Condo Sells Out In Under Two Years At $2,120 Psf Average

On The Market Here Are The Cheapest 3-Bedroom Condos in Central Singapore You Can Still Buy From $1.15M

Property Market Commentary Why The Singapore Property Market Will Be Different In 2026 — And It’s Not Just About Prices

Editor's Pick 2025 Year-End Review Of The Singapore Property Market: What The Numbers Reveal

Editor's Pick How The HDB Resale Market Performed In 2025, And What It Means For 2026 Prices

Editor's Pick 4 Key Trends Reshaping Singapore’s New Launch Condo Market In 2026

Do a 6 fast selling new launch but become unprofitable 😀