5 Reasons Why OCR Condos Are Dominating The Property Market In 2021

September 2, 2021

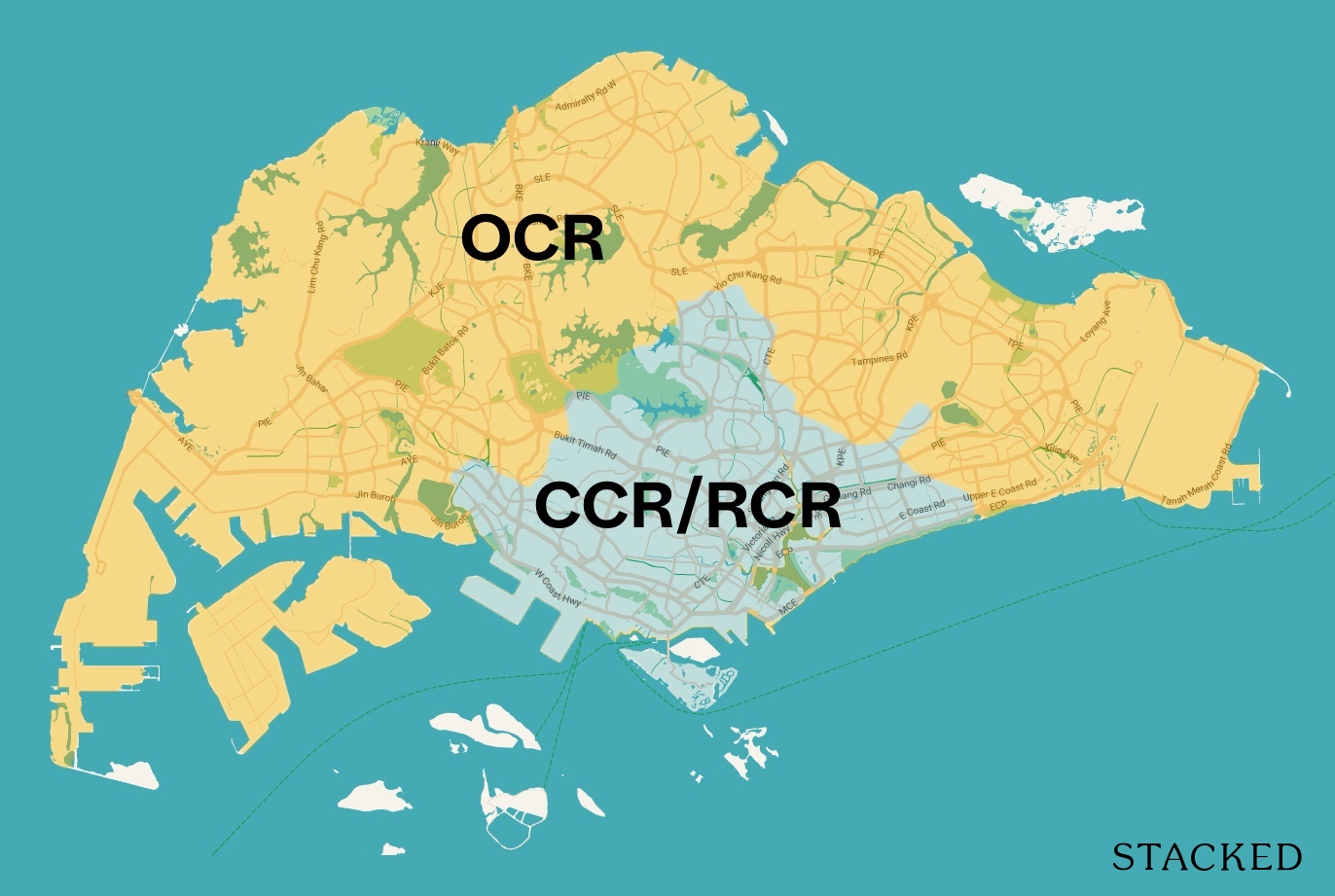

By now, property prices and transactions have been rising non-stop (barring Covid-19 measures) since January. As there’s been a general uptick in almost every market segment, it’s tempting to think that an owner-investor can “do no wrong” right now – that every new launch will see higher prices at the end of the phase, and that every resale condo is going to become a windfall. In reality, the pick-up has not been even across every sector; and 2021 is shaping up to be a golden year for the Outside of Central Region (OCR) specifically:

What’s happening in the OCR?

As of 2021, resale condo volumes are estimated to rise a further 22.5 per cent from the month prior. This makes for roughly 1,817 resale condo transactions, an increase of over 62 per cent from the same time last year (and an 83 per cent over the five-year average for July).

What’s worth noting about this spike, however, is that close to 60 per cent of the transactions occurred in the OCR.

In addition, resale condos in the OCR have outpaced the other regions by a notable margin.

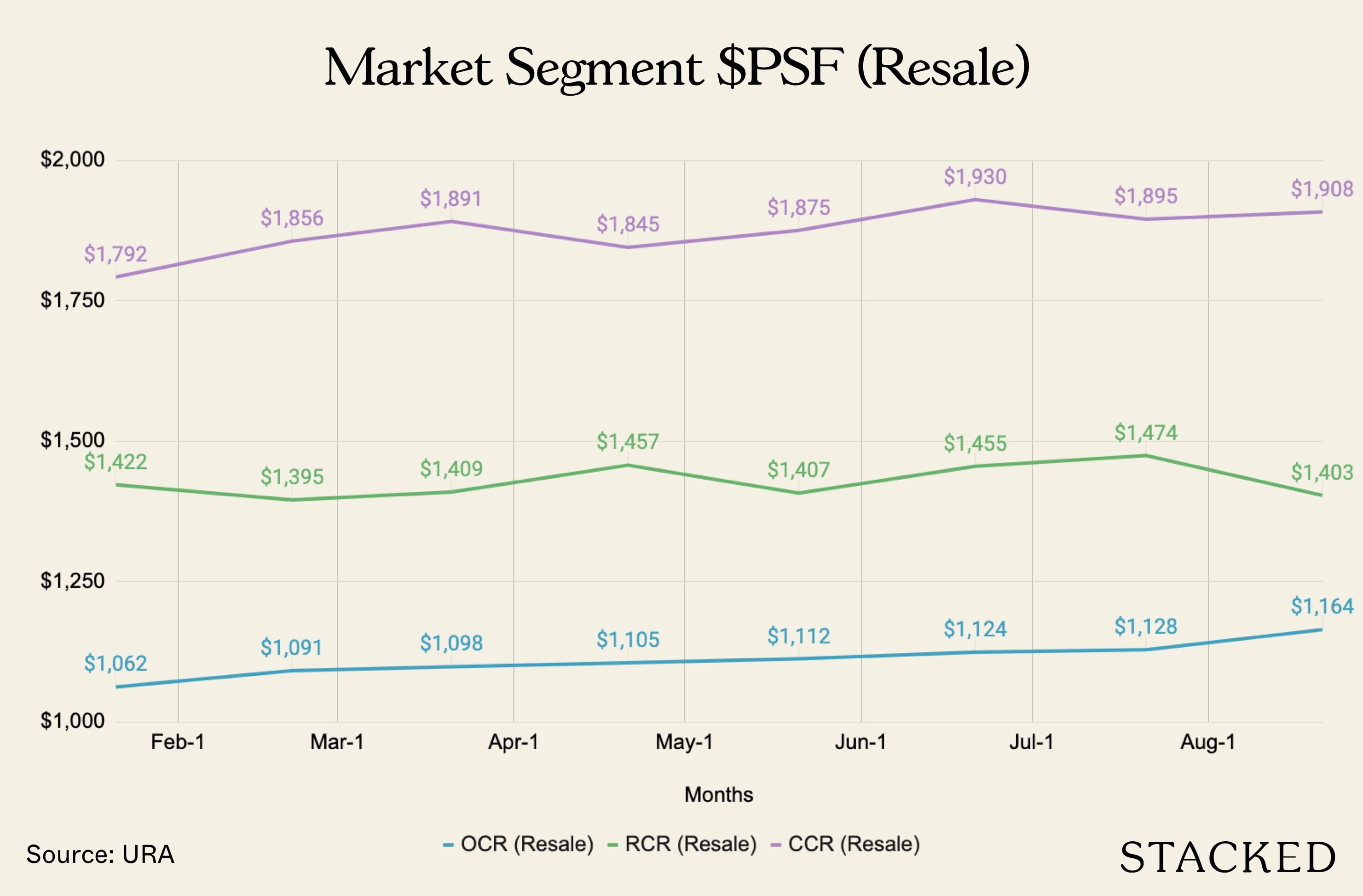

When we checked prices to date, we saw that median resale prices in the OCR stood at $1,062 psf at the start of the year; but as of this point in August, the median has risen to $1,164 psf.

This is close to a 10 per cent increase, and we’re only around eight months into the year:

*Prices above exclude ECs

By comparison, median prices in the RCR have fallen from $1,422 psf to $1,403 psf, while the CCR has seen a modest rise from $1,792 to $1,908 psf.

There was also this head-turning transaction in the OCR in July, at Breeze by the East:

| Date | Unit size | Purchase price | Sell price | Total gain |

| 19 Jul 21 | 2,856 sq. ft. | $901 psf | $1,196 psf | $850,000 |

Square Foot Research indicates a holding period of 1,337 days, which comes to an annualised return of 8 per cent per annum. Impressive for a District 16 condo, that some might even consider inaccessible (at least until Bayshore MRT station is up).

While Breeze By the East is a dramatic example, we can consider it the high watermark of a very obvious trend: private non-landed homes in the OCR are the highlight of 2021.

Even new launches in the OCR have seen a strong surge of interest

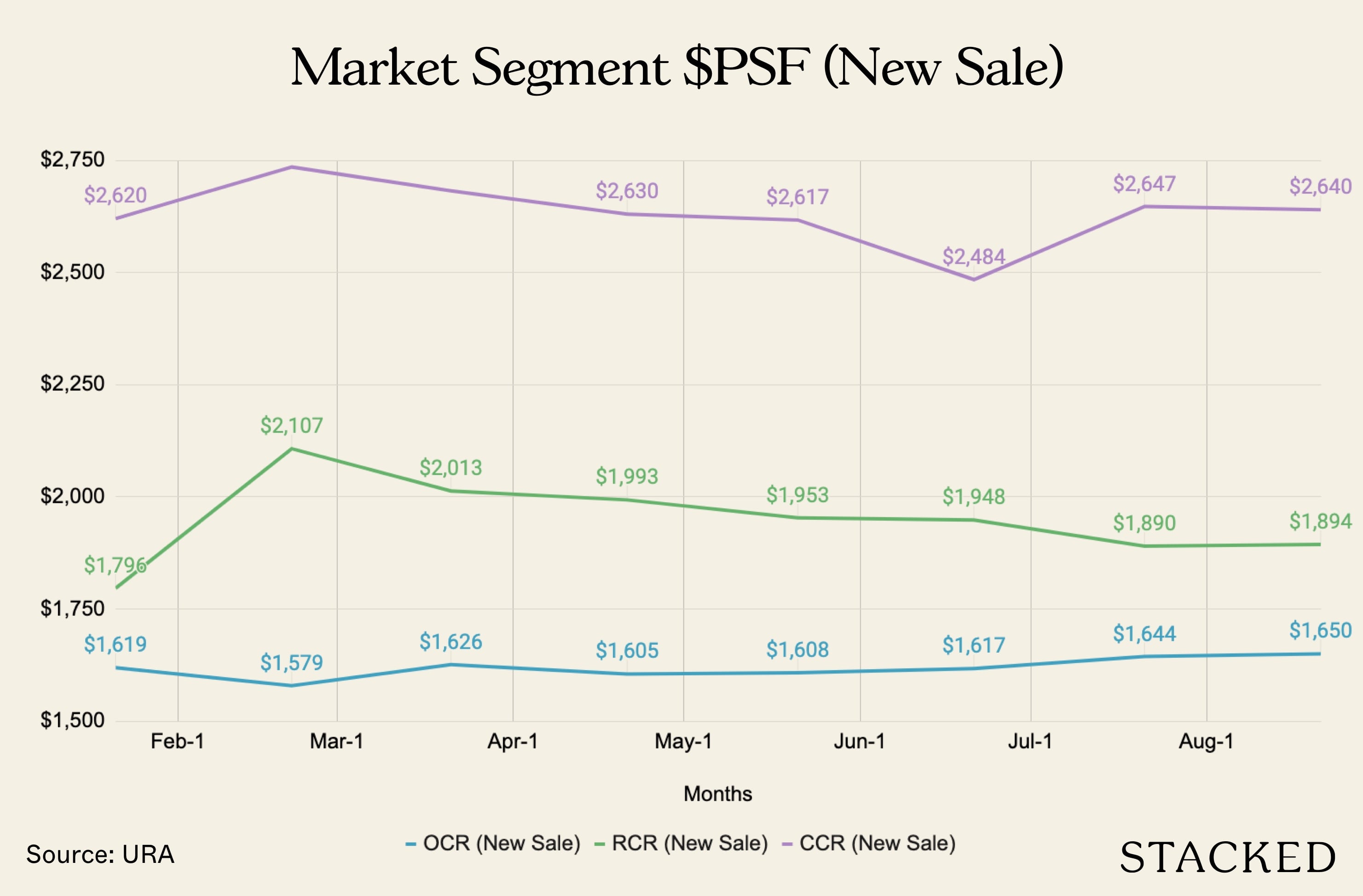

A look at new launch prices shows that the biggest pick-up has actually been in the RCR:

*Prices above exclude ECs

New condos in the RCR now average $1,894 psf, up around 5.4 per cent since the start of the year. However, new launch prices in the OCR are also up, from $1,619 to $1,650 psf; close to a two per cent increase.

On the ground, however, it still feels like the OCR is the most hotly contested for new launches. A good example of this would be the media hype around Pasir Ris 8, and how some units had gone from $1,400 to $2,000 psf over the launch weekend.

Why are OCR condos, particularly resale condos, doing so well in 2021?

- Suitable price range for HDB upgraders

- Larger condo units

- Not many new launches in the OCR lately

- Rental can be more resilient in a downturn

- Work From Home becoming an indefinite arrangement

1. Suitable price range for HDB upgraders

The biggest demographic of home buyers right now are HDB upgraders. For these buyers, the right price tends to be a quantum of between $1.2 million to $1.5 million.

In most cases, this comes down to financing. The difficulty lies in the cash portion of the down payment.

The first five per cent of the new home must be paid in hard cash; for most upgraders, this will be roughly between $60,000 to $75,000. In our experience, most upgraders can barely cover this, after selling a 4-room flat and refunding their CPF.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Is One North Singapore’s Next Real Estate Investment Hotspot? Here’s The Important Points Buyers Need To Consider

One North has always occupied an odd position in the Singapore property market. On the one hand, most people acknowledge…

Given that the average family unit in the RCR approaches $1.8 million, this restricts most upgraders – and hence the bulk of buyers in general – to OCR condos.

2. Larger condo units

It’s not just about the quantum. It’s possible to get a unit in the RCR or even OCR for $1.5 million or under. For example, a two-bedder at The M (District 7) would be in this price range; but the unit is only around 592 sq. ft.

New Launch Condo ReviewsThe M Condo Review: Incredible Location And Rental Potential

by Reuben DhanarajBy contrast, a 4-room flat is around 970 sq. ft., while most 5-room flats reach 1,100 sq. ft. This means the affordable RCR or even CCR condos tend to be way too cramped for upgraders.

In the OCR however, a resale condo that is at least the size of their previous 4-room or 5-room flat might only come to about $1.2 million.

It is, however, mainly resale condos and not new launches, that boast these larger units.

3. Not as many new launches in the OCR lately

There have been roughly 10 new launches in the OCR for 2021, including ECs like Provence Residences and Parc Central Residences.

This is opposed to a slew of new launches in the CCR and RCR, of which we count around 24 to date. This is somewhat similar to previous years, and has lowered supply where it’s most needed.

Sellers in the OCR have received no shortage of offers lately, hence the significant price spikes compared to other regions.

4. Rental can be more resilient in a downturn

We have an earlier article on why rental looks better for the OCR right now.

The most obvious reason would be lower prices and hence better yields; and among resale OCR condos, you can potentially find some that are cash-flow positive. But this aside, Covid-19 has affected the rental market.

Companies have a tendency to slash housing allowances, or bring in future expatriates, during downturns. Reduced expat packages can cause a move to cheaper alternatives in the OCR. There’s less reluctance because Singapore is small, and even a “fringe” district is not really far from the CBD anyway.

(To some foreigners, a 40-minute train ride to work is not “inaccessible”, and may even be short by the standards of their bigger home countries).

5. Work From Home becoming an indefinite arrangement

With Work From Home (WFH) becoming indefinite for many, there is less need to live near the CBD. This may incline some buyers toward cheaper OCR condos, even if they have the means to buy in pricier areas.

From a long-term perspective, Singapore is also becoming more decentralised, with separate hubs like the Punggol Digital District, Woodlands North Corridor, Changi Business Park, etc.

These new hubs are closer to the OCR districts; and as employment and amenities spread out, this will dilute the advantages of a pricey RCR or CCR condo.

Should home buyers and investors look outside the prime regions?

Singapore will not stop decentralising, and the price gap between prime regions and the OCR will get harder to justify over time. Coupled with affordability issues and a lack of new launches, OCR condos will be in the spotlight for some time to come.

For more updates as the situation progresses, follow us on Stacked. You can also check out our in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are resale condos in the outside of central region doing so well in 2021?

What makes OCR condos attractive to buyers right now?

How have condo prices in the OCR changed in 2021?

Why is the limited number of new launches in the OCR significant?

How does Work From Home influence the demand for OCR condos?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

0 Comments