5 Key Highlights That Will Impact The Property Market From The National Day Rally 2022

August 23, 2022

The National Day Rally Speech for 2022, like the past two years, has kept a cautionary tone. There’s not much in the way of optimism right now, not with geopolitical tensions at an all-time high, and the world having barely recovered from Covid-19. Nonetheless, plans are in place; and along with it, there are some potential implications for the property market:

Note: We’ve covered the details in order of direct relevance to the property market, rather than in the sequence of the speech itself.

Table Of Contents

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

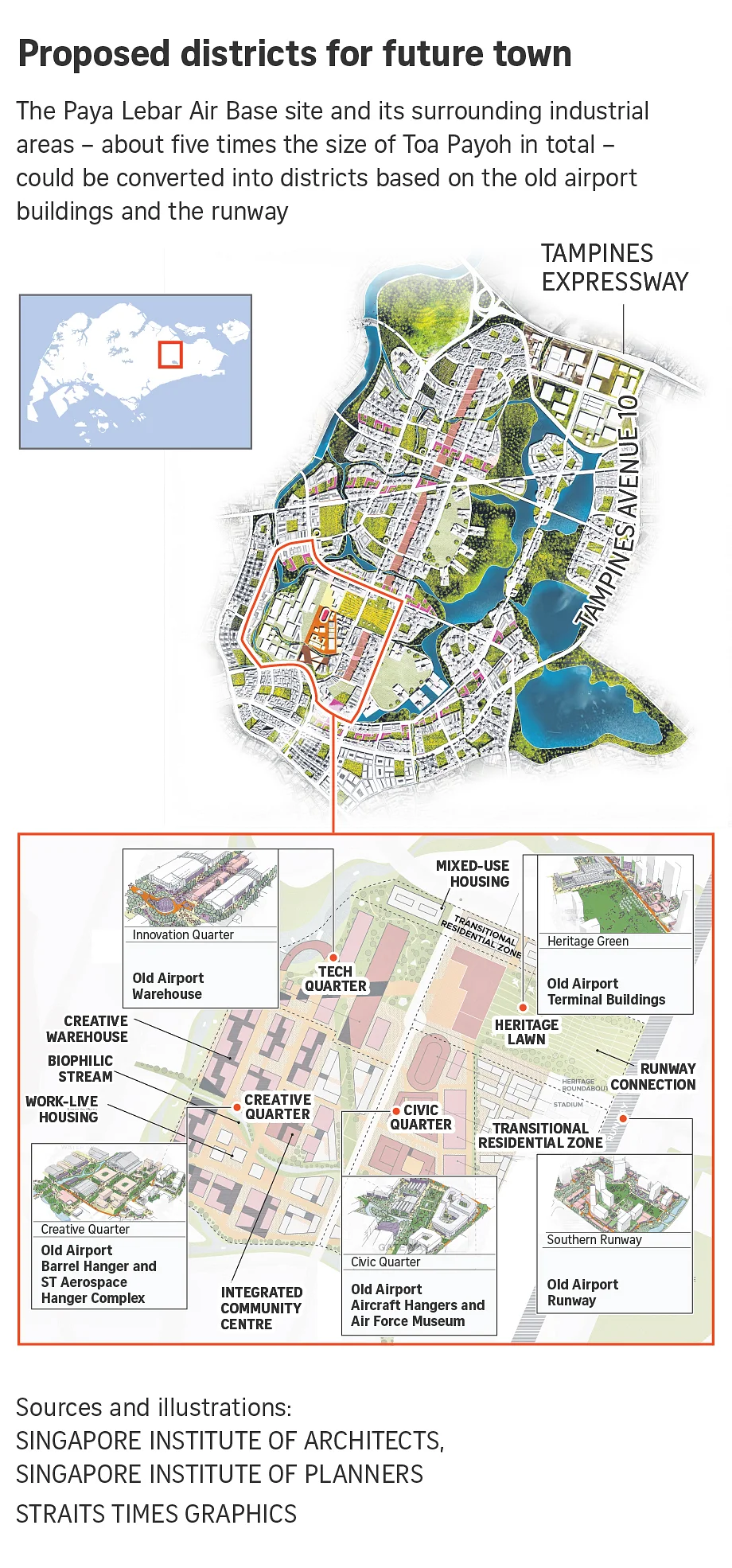

1. Relocation of Paya Lebar Airbase

The Prime Minister’s speech mentioned that 150,000 public and private new homes will be built, on the location of the current Paya Lebar Airbase. The size of the plot itself is around 800 hectares, more than sufficient for a whole new town. Just to give you some perspective on the scale, analysts predict between 100 to 130 BTO launches offering 700 to 1,500 units for each project. As for private, this could be between 40 to 70 EC and condo launches, assuming they fall between 500 to 1,000 units.

This relocation is expected to take place in around 2030.

This isn’t new information, as URA has put up the plans for quite some time; but we can take this National Day speech as a final confirmation. Besides the creation of a new HDB neighbourhood, a significant factor will be the changes to Gross Plot Ratio (GPR) in surrounding areas.

At present, some homes near the Paya Lebar Airbase (this includes parts of Hougang, Marine Parade, and Punggol) have tight height restrictions. Once the airbase moves, however, it will be possible to build higher. This may spark further redevelopment in the affected areas, and it could also raise en-bloc prospects for some private developments.

In addition, the relocation will provide space for more amenities like shops, eateries, parks, etc. This can mean a substantial upgrade to the surrounding estates as well. In particular, there are plans to repurpose the existing air base runway (3.8 kilometres long) as a “green spine”, or a communal area. The illustration from URA does show a “Runway Boulevard”, which is likely a reference to this stretch.

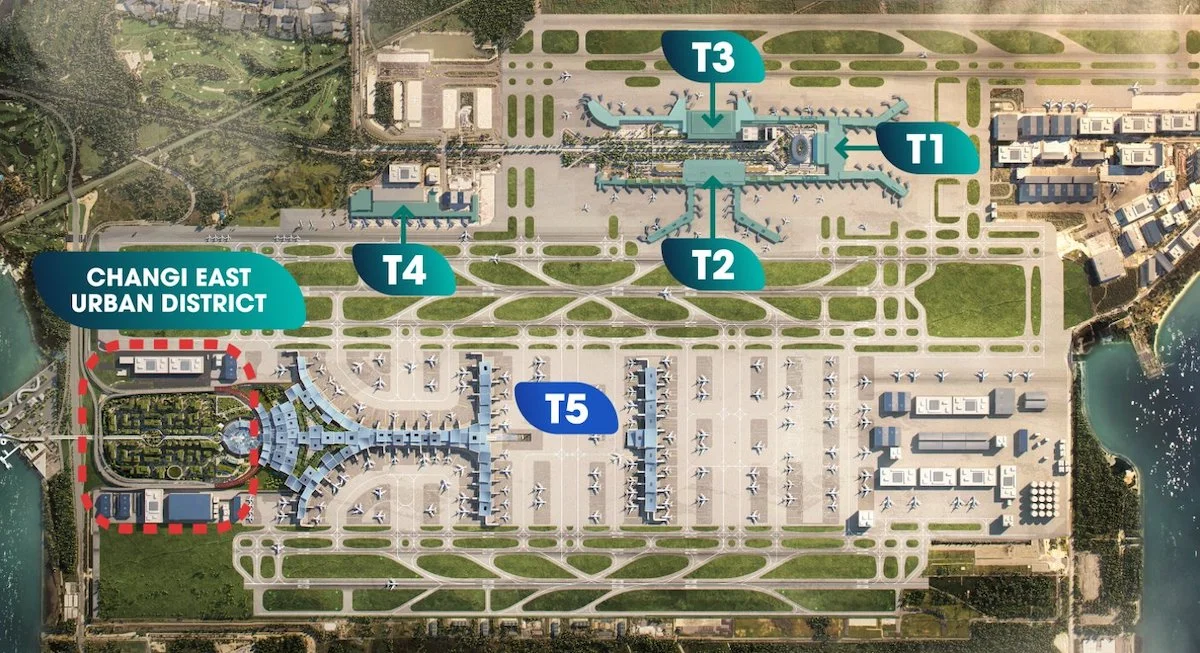

2. Changi East Urban District and Tuas Mega Port

The work on Changi Airport’s Terminal 5 is going ahead, with the pandemic now winding down. This will be accompanied by the adjoining Changi East Urban District – this is a business hub that will include hotels, serviced apartments, offices, and conference halls. Also, Changi East Urban District will have a wide waterfront, unlike the current Changi Business Park.

This could improve rental prospects for nearby homes. There are many condos surrounding the Tanah Merah MRT station (including the upcoming Seneca Residence) that may attract workers from this growing Changi hub; likewise for condos along the Upper Changi Road stretch.

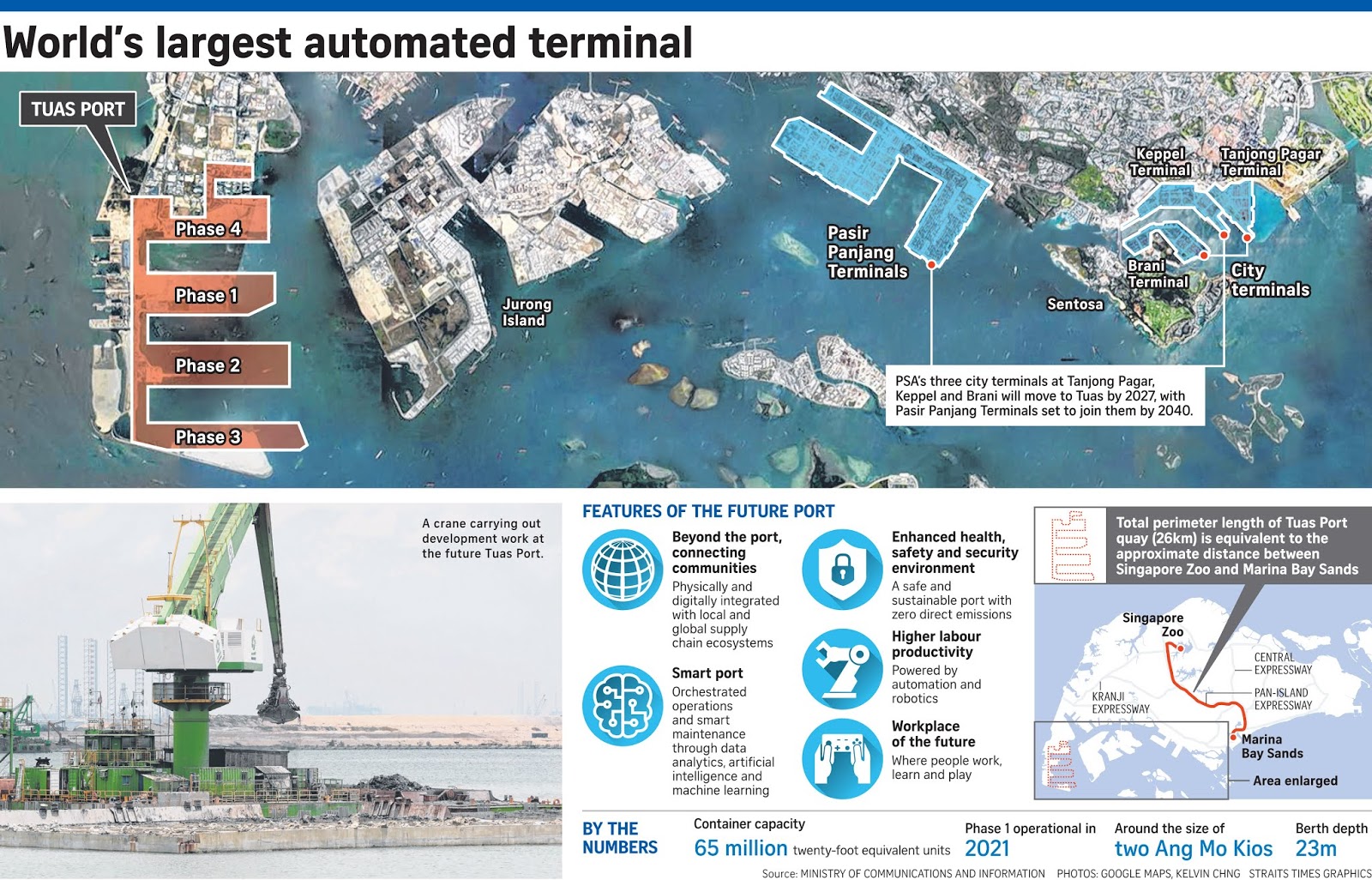

Work has also resumed on the Tuas Mega Port, with three more berths opening by the end of this year. This is a project to consolidate the existing ports at Tanjong Pagar, Brani, Keppel, and Pasir Panjang into a single area at Tuas. A large part of the vacated space will go toward the Greater Southern Waterfront, which we cover in this article.

Much has already been said about the GSW, but to see the size of what has been left behind as the port moves is quite something else – you really get the sense of how much this place will transform over the next few years.

3. Heightened geopolitical tensions

The PM’s speech warned of potential instability from the Russia-Ukraine war, and the tension in Sino-US ties.

We’ve covered the possible impaThe Impact Of War On The Singapore Property Market: Here’s What History Teaches Usct of the war before, and so far the property market has been mostly unscathed by these events (in fact sometimes prices go up, as foreign buyers look for a safe haven in our property market.

Property Market CommentaryThe Impact Of War On The Singapore Property Market: Here’s What History Teaches Us

by Ian TanHowever, there are some tangential issues that might affect home prices. One of these is the response of the US Federal Reserve, to changing energy prices. To date, the Fed has raised interest rates aggressively to combat inflation; and that has driven up home loan rates in Singapore.

More from Stacked

Do We Really Need 35,251 Property Agents In Singapore?

As of this year, we have around 35,251 property agents, up from 34,427 last year; which when we consider how…

Nonetheless, if oil prices climb too high due to the sanctions on Russia, the Fed may rethink their stance, and lose some enthusiasm for rate hikes. This remains to be seen, as we’re less than a year into the conflict.

Another factor could involve the raising of trade barriers between China and the US, as we saw in the Trump era. Retaliatory tariffs tend to raise costs for businesses on both sides; and this is also a factor that the Fed may be forced to consider, if US businesses start to feel the pinch.

In any case, the broad concern among developers is construction costs. In general, more expensive fuel means higher construction costs. At the simplest level, it means higher costs for transporting prefabricated materials, transporting workers to and from sites, etc.

Regardless, we do feel that other issues – such as higher ABSD rates and the need for aggressive land bids – will be a much bigger impact on the property market than the war.

4. Drive to attract more foreign talent

The PM’s speech said that the Ministries of Manpower and Trade and Industry will have new initiatives; these will be aimed at attracting and retaining top talent from overseas.

We don’t have the full details yet, but the Ministry of Manpower has already said there will be steps to clarify the work pass framework.

Landlords will typically benefit from such initiatives. Singapore property prices are high for foreigners, especially with the December 2021 ABSD hike – as such, we may see improved rentability for condos. This is likely to help sustain the momentum of the rental market, which managed to touch a six-year high in 2022.

Interest in retaining such talents can translate to longer-term leases, or perhaps property purchases for those who stay for the long haul.

5. Cost-of-living challenges for middle and lower-income families

Apart from inflation, we note that interest rates for property loans have been climbing; rates above two per cent are becoming the norm, whereas 1.65 per cent was common for bank loans just in 2020 (although HDB loan rates are still at 2.6 per cent).

The government is giving out the usual assortment of vouchers, conservancy fee reductions, etc. However, one unaddressed issue here is the likelihood of higher CPF usage.

When Singaporeans feel the pinch of day-to-day expenses, it becomes tempting to stop servicing home loans in cash. As such, we do think more Singaporeans will switch to CPF to service their home loans, or a larger portion of their home loans.

This has to be watched closely, to avoid a spate of incidents where older Singaporeans hit their withdrawal limits, or where CPF refunds make it hard to move to new housing.

Rising costs to these demographics may also encourage cooling measures, directed at the rising Cash Over Valuation (COV) of resale flats. Resale flat prices are at their highest in around eight years; and this is a serious challenge for lower and middle-income Singaporeans, at a time when cost-of-living is also on the rise (not all Singaporeans can wait for a BTO flat to be built).

The overall message of this National Day seems guarded, but fair and realistic under the circumstances. The irony is that the ongoing uncertainty may end up making homes cost more; we’ve seen time and again that, when the economy turns south, Singaporeans (and Asians in general) prefer tangible assets like property and gold.

For more on the situation as it unfolds, follow us on Stacked. We’ll also provide you with the latest news and reviews of the best developments.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the plans for the Paya Lebar Airbase relocation and its impact on property development?

How will the Changi East Urban District and Tuas Mega Port projects affect nearby property markets?

What are the potential effects of geopolitical tensions on Singapore's property market?

In what ways is Singapore trying to attract more foreign talent, and how might this influence the property market?

What challenges do middle and lower-income families face due to rising living costs and interest rates?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

1 Comments

Should we invest in landed or condo housing?