En bloc seems to be coming back in fashion in Singapore, with the latest news of three collective deals that were wrapped up within a week. The three sales, coupled with another earlier during the year brings the total to slight over $1.5 billion for 2017.

In the trend of talking about all things en bloc, here are the 5 biggest en bloc deals in Singapore to date.

1. Farrer Court $1,338,800,000

Back in the day the Farrer Court en bloc deal was seen as a staggering amount as it was the first development to surge past the billion-dollar mark. Ten years on and it is still unbeaten, although that remains to be seen this year. Currently D’leedon sits on the massive plot of land and with its towering façade, looks to be an iconic part of Farrer for years to come.

2. Leedon Heights $835,000,000

Just next door from Farrer Court, Leedon Heights managed to close the deal for $835 million only to be beaten by its neighbour just a couple months later. It was comfortably the largest collective sale in Singapore’s history at that point. As it is located in prime district 10 and holds the much-coveted freehold status, the tender for the estate was hotly contested. Most owners were able to walk away with profits of about $2.35 million each.

Property Market CommentaryWe analysed 87 en bloc condos. Here’s what we learnt.

by Druce Teo3. Shunfu Ville $638,000,000

Just last year, the en bloc deal came as a surprise because of the implementation of the Additional Buyer’s Stamp Duty on developers. This meant that developers were unwilling to risk larger investment deals of above $500 million. However last July, there seemed to be a major setback when some owners objected to the sale and subsequently filed an appeal to the High Court. This was ruled in favour of the sale, and results in each owner receiving an average of $1.782 million. From the 358 units, Qingjian Realty plans to create more than 1000 homes, featuring high-rise units of up to 25 storeys.

More from Stacked

One Way To Find Undervalued Property

One of the most common lead up questions I usually get asked at a consultation meeting is this:

4. The Grangeford $625,000,000

Despite its relatively small number of units (192), the Grangeford was sold to Overseas Union Enterprise (OUE) at an astonishing $1,810 per square foot which is by far the highest price paid for a leasehold development. This works out to over $3 million for each of its owners. Currently marketed as OUE Twin Peaks, when first launched prices were going for more than $3,000 PSF. Jackie Chan reportedly owns a couple of units here, as does local born singer JJ Lin!

5. Rio Casa $575,000,000

Rio Casa, a privatized HUDC estate is the latest entry to this list. The final price of $575 million is more than a hundred million higher than the price that the owners were reportedly asking for. It is estimated that each owner will receive around $2 million from the sale.

Property market bouncing back?

With 2 of the top 5 biggest en bloc deals coming from the past two years and a couple more being transacted in the first half of 2017, it is safe to say that developers are bullish about the next few years in the Singapore property market.

Druce Teo

Druce is the Chief Editor at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.Read next from Property Market Commentary

Property Market Commentary Why More Families Are Choosing Two-Bedders Over Bigger Properties in 2025

Property Market Commentary What The URA Master Plan Reveals About Marina Bay’s Future (And How It Could Impact Property Values)

Property Market Commentary The 5 Most Common Property Questions Everyone Asks In Singapore – But No One Can Answer

Property Market Commentary 6 Upcoming New Condo Launches To Keep On Your Radar For The Rest Of 2025

Latest Posts

Singapore Property News How A Waterfront Development With 4,000 Homes Is Going To Reshape Singapore’s Property Market

On The Market 5 Rare HDB Flats Above 1,700 Sq Ft You Can Buy Right Now – From $850K

Pro District 15 Resale vs New Launch Condos – Analysing Price Gaps for Larger Family Units

Property Investment Insights Are Singapore’s Suburban Condos Still Affordable? The Surprising Truth

On The Market Rare 16,000 Sq ft Freehold Plot In D15 Hits The Market For $39M

Editor's Pick I Transformed My Two-Bedroom Unit Into A Dual-Key Layout – Here’s Why I Would Not Do It Again

Pro New Launch vs Resale One and Two Bedders in D15: Here’s Where The Price Gaps Are The Biggest

Editor's Pick We Toured An ‘Exclusive’ Freehold Landed Enclave In Singapore That Feels Close To Nature – And Even Has A Canal Running Through It

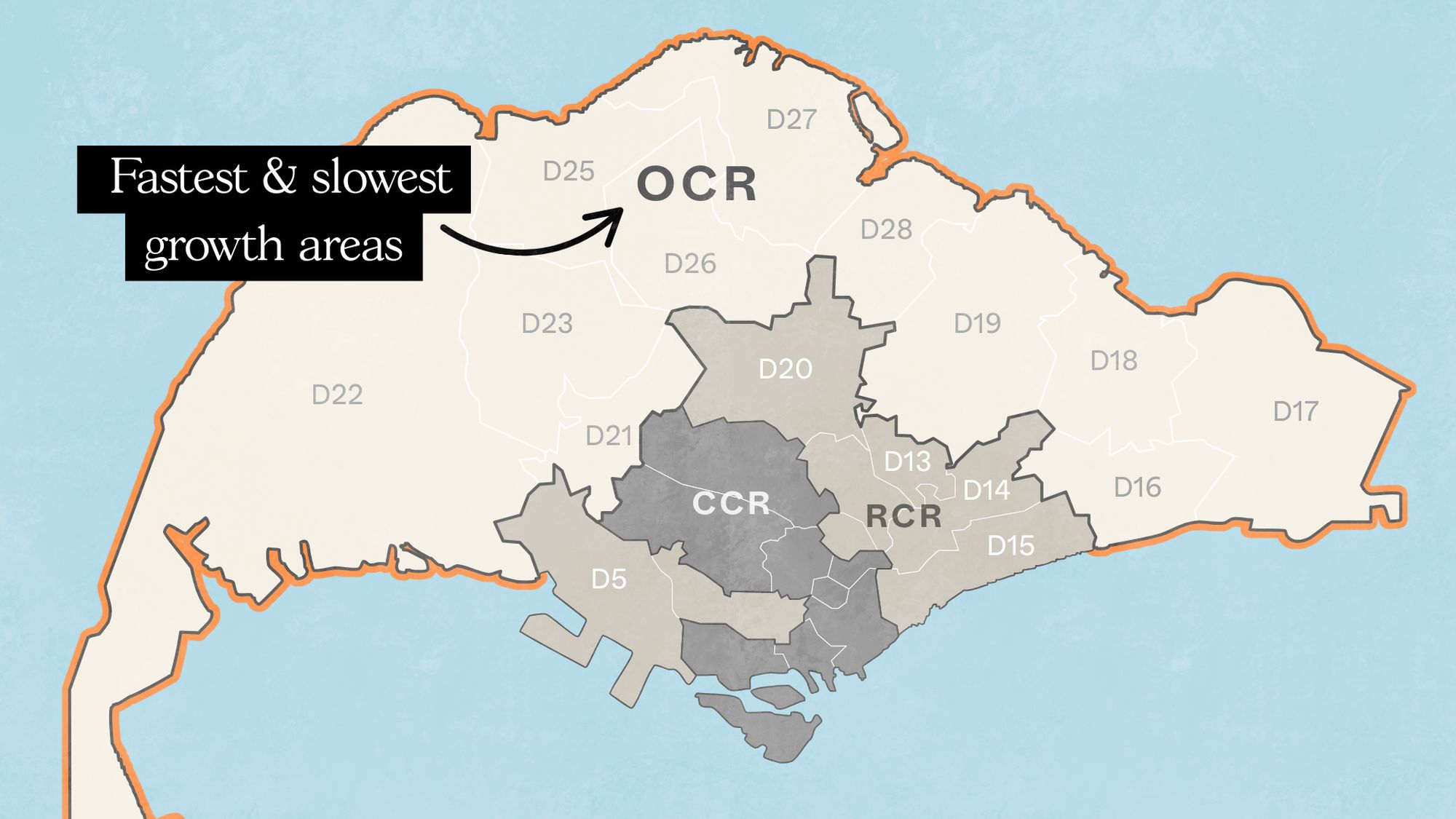

Singapore Property News Where Condo Prices Rose Fastest (and Slowest) in Singapore’s Outside Central Regions

Editor's Pick I Left Singapore for New York and Ended Up Launching a $450M Manhattan Project. Here’s What I Learned About Buying Property Here

On The Market 5 Cheapest Freehold 3-Bedroom Condo Units In Singapore You Can Buy This Week – Including Quiet Spot in Floraville

Pro Analysing 10 Years of District 12 Boutique Condo Transactions: Insights Into What Drives Profitability

Editor's Pick Rare Detached Freehold Home On Singapore’s ‘Millionaire’s Row’ Up For Sale At $14m

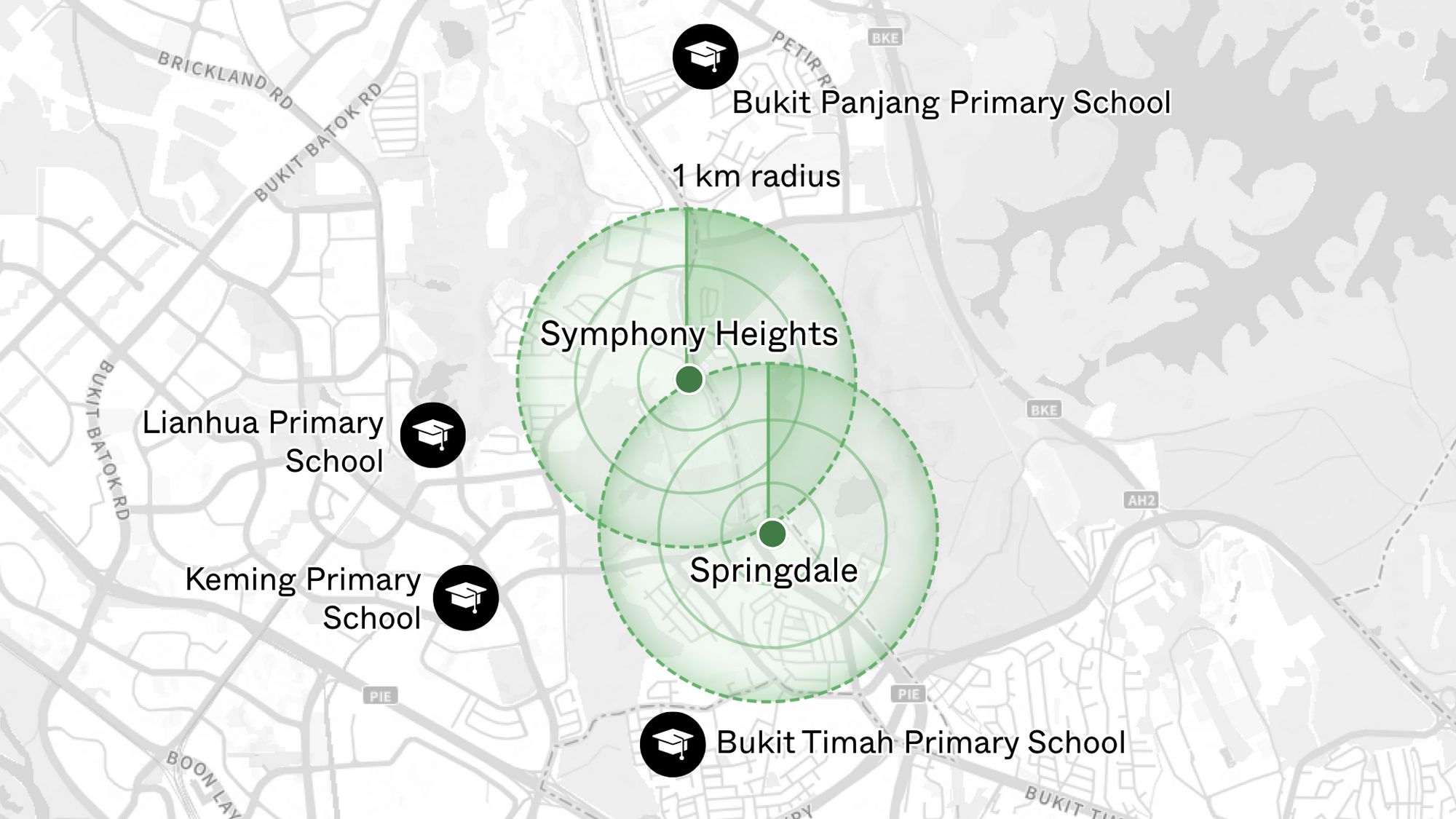

Property Investment Insights Do Primary Schools Really Matter For Property Prices In Singapore? These 6 Condos Suggest Otherwise

Editor's Pick A 5-Room HDB In Boon Keng Just Sold For A Record $1.5m – Here’s How Much The Owners Could Have Made