23,000 BTO Flats Launched In 2022: What Does This Mean For Home Buyers?

December 24, 2021

HDB has decided to ramp up the supply of BTO flats in the coming years. This will ostensibly avoid situations like the present, where some first-time home buyers feel squeezed out: they keep losing at the BTO flat ballots, but can’t afford the rising resale flat prices. Now, in theory, increasing supply should fix all of these issues; but the devil is in the details:

What’s happening with the BTO flat supply?

Over the next two years (2022 and 2023), HDB will increase the number of BTO flats built by 35 per cent. This comes to about 23,000 new flats per year, across both mature and non-mature estates.

This is a marked increase from just 17,100 new flats, for all of 2021. It’s a response to the growing tendency of flats to be oversubscribed; from an average of 4.1 times oversubscribed for 4-room flats in 2020, to 4.7 times by 2021.

For mature estates, note that one of the targets is one Prime Location Housing (PLH) development per year; so we’ll still probably just see two of these.

Some of the HDB towns mentioned for 2022 are:

- Bukit Merah

- Jurong West

- Kallang

- Whampoa

- Queenstown

- Tengah

- Toa Payoh

- Yishun

How will this affect buyers? Based on opinions from realtors and market watchers, here are some of the most common conclusions:

- A more accommodating market for singles

- Possible, but uncertain, impact on resale prices

- We could see greater numbers of smaller flats

- A future supply glut due to the ageing population

1. A more accommodating market for singles

Some realtors noted there’s a greater tendency of singles wanting to move out, even if they’re not married. One of the signs they pointed out was HDB’s recent change to rental flats, allowing singles to apply without also needing to have a flatmate.

We also note that, in our recent poll on whether PLH measures were fair, a leading protest was the inability of singles to buy prime region flats.

One realtor we spoke to mentioned there are strong social forces behind this. One of these is recognition of the challenges faced by the LGBTQ+ community, who cannot be married in Singapore, and hence face greater challenges in securing a flat.

Another realtor noted that rising affluence, coupled with a rise to a $14,000 income ceiling, placed BTO flats at the “sweet spot” of many singles. She said that at that income range, some singles might find it tough to single-handedly afford a private property; but they could buy themselves a spacious flat.

As such, the general consensus was that a bigger supply of flats would be a big win to this particular demographic (regardless of whether it’s BTO or resale, as all new flats become resale flats eventually, and singles are happy to snap those up as well when they can).

2. Possible, but uncertain, impact on resale prices

There were split opinions on whether a higher BTO supply would impact resale flat prices.

According to one realtor, for example, the relationship between the two is not as direct as many assume:

“Raising the supply of BTO flats doesn’t directly mean resale flats will get cheaper, because the supply and demand does not work like the private market.

If the buyers are all Permanent Residents, they need to buy a resale flat. If they bust the income ceiling, they need to buy a resale flat. If they need to move in urgently, they also need to buy a resale flat.

So you have these buyers who can only buy resale, and it doesn’t matter to them how many BTO flats you build – they cannot buy. So the new flats cannot absorb the demand from this group of buyers, and its resale prices may not fall even with more BTO flats.”

Another realtor, however, said:

“After MOP, BTO flats become resale flats. If you add construction, they join the pool in nine to 10 years. So we are facing a supply glut not too far down the road if we keep building, and it will affect resale prices negatively.”

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Is There Room For Conservation In Land-Hungry Singapore?

It’s from our late, and much venerated, Minister Mentor Lee Kuan Yew. Granted, he said it a long time ago…

Other realtors who took this view reminded us of a time in 2013, when HDB reined in the supply of BTO flats. They also noted that the whole reason for the Built To Order scheme was originally to prevent future oversupply; so we have had situations where we had too many flats before.

3. We could see greater numbers of smaller flats

While 4-room flats will remain the norm, the new demographic (more single buyers) might prompt HDB to use different size mixes.

It’s possible, for instance, that we’ll see more in the way of 2-room or 3-room offerings, as HDB adopts to more singles moving out and buying their own homes.

5-room flats and executive flats can be beyond the means of a single buyer; especially given the tighter debt ratios on HDB properties. The Mortgage Servicing Ratio (MSR) for flats caps a buyer’s loan repayments to 30 per cent of their income, making it much tougher for a median-wage single to buy bigger homes.

We have also seen that family units – in the form of HDB upgraders – tend to view their flat as more of a stepping stone. This is one of the reasons for the surge of private housing sales in 2020 and 2021 (alongside other factors like growing affluence).

If we have a lot of younger Singaporeans who are getting a flat as a young couple, but then upgrading once they have a family, perhaps we don’t need as many 5-room or executive flats.

4. A future supply glut due to the ageing population

The main worry behind building so many flats, should lie in the question: Who is going to inherit them?

Due to our high homeownership rate, most Singaporeans already have a home, by the time their parents pass on and leave the flat behind. Foreigners cannot buy these flats, leaving only Singaporeans and PRs (and inheriting a flat is complicated).

Property AdviceInheriting An HDB or Condo? Here Are 5 Simple Guidelines To Help You Decide Whether To Sell Or Keep

by Ryan J. Ong

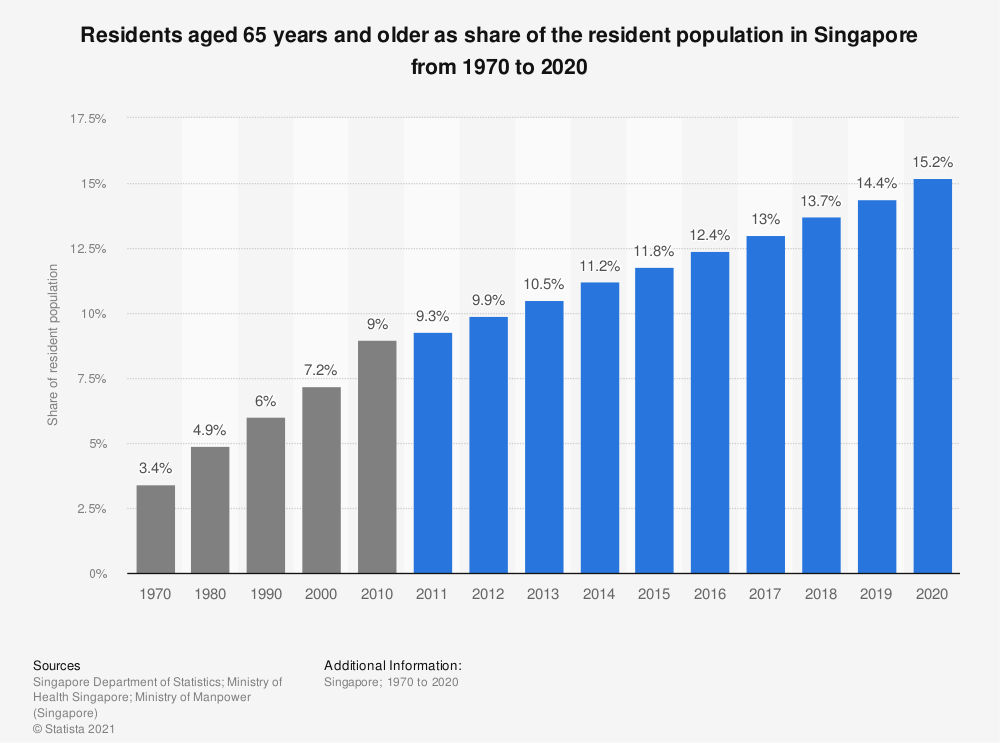

By around 2030, a quarter of our population is expected to be 65 or older, up from just around 14.4 per cent in 2019. There are, increasingly, more old Singaporeans than young ones; and it leaves us to wonder what’s going to happen to all the flats they leave behind.

While the government probably has plans to absorb these, it doesn’t change the fact that – at some point down the road – we could be awash in vacant HDB flats, for just a handful of eligible buyers.

That could effectively kill resale values; and every time we raise the BTO supply, we increase the likelihood of that scenario.

For the time being, however, ramped up BTO supply will provide relief to struggling first-time homebuyers

There’s no overcoming the pain of having to wait out construction; and Covid-19 will (with luck) be well and over by the time the new slew of flats are built. However, it will at least bring relief to first-timers, who can’t win the ballot, and who have found themselves priced out of every segment.

We don’t think this will stop the rush for resale flats, as there’s still an urgent need to move due to Work From Home; so those hoping for lower resale prices right away may be disappointed.

For more on this issue as it develops, follow us on Stacked so we can update you. We also provide in-depth reviews of new and resale homes alike, in the Singapore private property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What does the increase in BTO flats mean for first-time home buyers in Singapore?

How will the new supply of BTO flats affect resale flat prices?

Are we likely to see more smaller flats like 2-room or 3-room units in the future?

What are the concerns about building so many flats given Singapore's aging population?

Will the increased BTO supply help struggling first-time buyers immediately?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments