2,000 New Units For GLS Sites In 2021: We Review The 4 New Additions

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Some eyebrows were raised last week, when the supply of Government Land Sales (GLS) sites was hiked. In the first half of the year, the government had been quite conservative with supply, on the back of Covid-19. Yet for 2H 2021, we’ve seen the potential supply ramp up by around 25 per cent; one of the steepest increases since 2016. It must be said though, that it is still some distance from the 7-8,000 units that was released in the second half of 2010 and 2012. Here’s what’s going on:

An increase in supply may help to prevent an en-bloc rush

The government moderated supply in 1H 2021, with 1,605 potential new homes. Following strong demand however, this has been raised to 2,000 potential new homes for the second half of the year. This could help to precent an en-bloc rush from land-starved developers, who have burned through the last of the collective sale purchases from 2017.

We also note that most of the sites below are located in fringe regions, where the overall quantum of new launch condos is affordable to HDB upgraders. This makes sense, given that they’re the dominant group of buyers – but it does indicate a reversal from the 2019 trend, which was to have small (read: low quantum, high price per square foot) units in pricier central regions.

There are four confirmed GLS sites, including nine reserve* sites:

Confirmed sites are:

| Location | Area | Units | Est Launch Date |

| Jalan Tembusu | 1.96 | 645 | Sept 2021 |

| Lentor Hills (Parcel A) | 1.71 | 595 | Sept 2021 |

| Dairy Farm Walk | 1.56 | 385 | Oct 2021 |

| Bukit Batok West Avenue 8 (EC) | 1.25 | 375 | Dec 2021 |

Reserve sites are:

| Location | Area | Units | Est Launch Date |

| Dunman Road | 2.52 | 1,035 | Available |

| Hillview Rise | 1.03 | 335 | Available |

| Tampines Street 62 (Parcel B, EC)* | 2.8 | 700 | Available |

| Lentor Hills Road (Parcel B) | 1.09 | 265 | Sept 2021 |

| Pine Grove (Parcel A) | 2.25 | 520 | Nov 2021 |

| Pine Grove (Parcel B) | 2.48 | 565 | Nov 2021 |

| Kampong Bugis (White site) | 8.29 | 1,000 | Available |

| Woodlands Ave. 2 (White site) | 2.75 | 440 | Available |

| River Valley Road (Hotel site) | 1.02 | 530 | Available |

*We’ve covered this in a previous article.

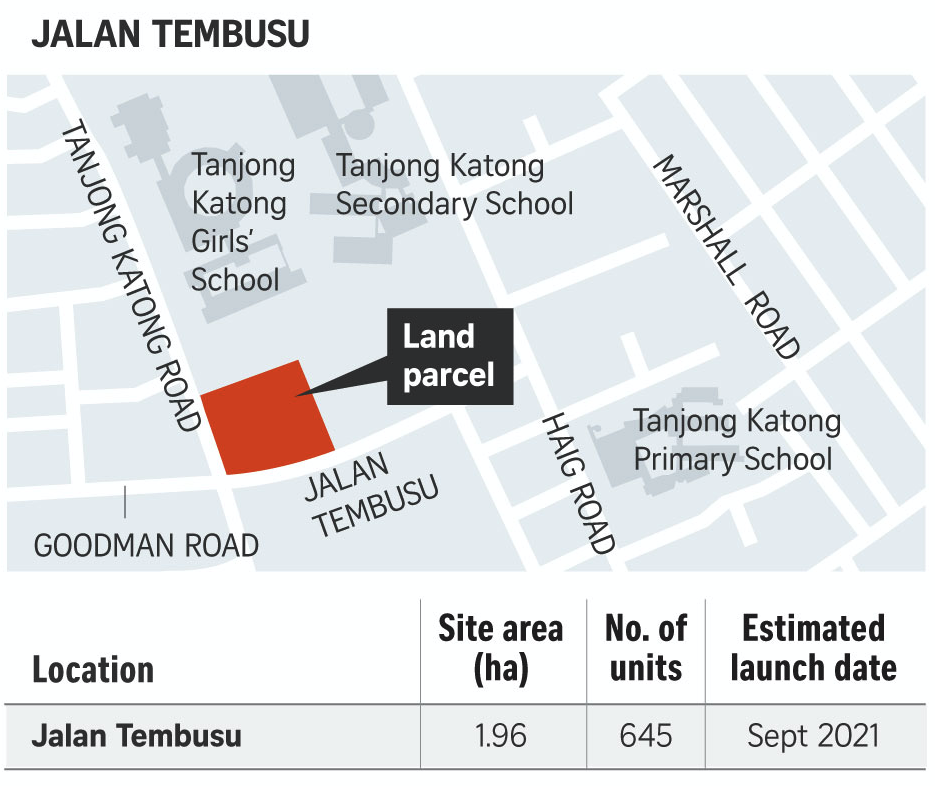

1. Jalan Tembusu

We’ve already discussed this site in-depth in a previous article, so this is just a quick summary. This is a 1.96 ha. site, which could yield a possible 645 homes.

We continue to think the Jalan Tembusu site will be one of the hotter ones, given its location in Katong. This is one of the lifestyle hubs of the east, as well as being a known expatriate enclave. The site is, in fact, next to the Canadian International School. Add that it’s surrounded by family amenities like enrichment centres, and is surrounded by significantly older condos, and you’ll see it checks the boxes for both home owners and landlords.

It’s also just a 1.5 km drive to East Coast Beach, and will be close to Tanjong Katong MRT station (operational in 2024). East siders looking to upgrade in a few years, and who don’t want to move from the east, would do well to watch this site.

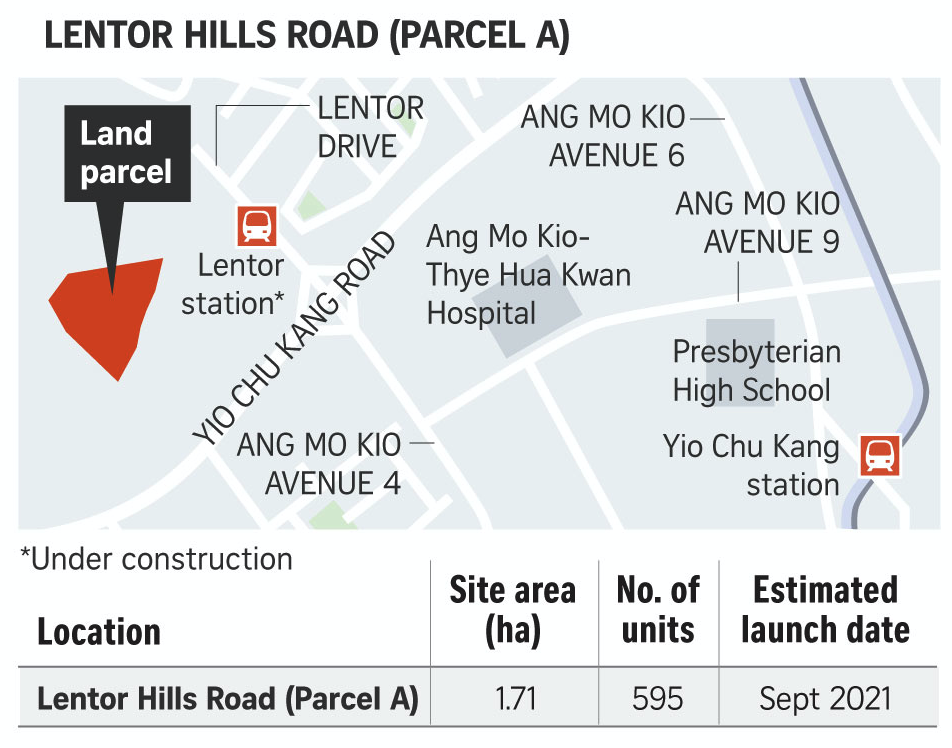

2. Lentor Hills (Parcel A)

This land site spans 1.71 ha., and can yield 595 homes. Its main highlight is being adjacent to Lentor MRT station, which provides access to the Thomson-East Coast Line (TEL). The station is expected to become operational this year.

The site is surrounded by residential developments, mostly with a GPR of 3.0 (or 3.5 for Lentor Central). This is not the most eye-catching site, being low on amenities and close to a major road; but the MRT access could make up for it.

The proximity of Ang Mo Kio Thye Hua Kuan Hospital (across Yio Chu Kang road) might be an issue for future buyers. If you believe living near hospitals is noisy, or have a taboo about it, this might be too close for comfort.

That said, it’s worth considering this will be the first new condo in the area for a long time. The closest condos within a kilometre are quite dated – they include Castle Green (1997), Seasons Park (1997), and Far Horizon Garden (1987). These condos are all leasehold. Even if they were to go en-bloc and be redeveloped, they would not be as close to Lentor MRT.

More from Stacked

How Bad Are Singapore’s 5 Worst Google-Rated Condos? We Take A Closer Look At The Reviews (Part 2)

Before making any purchase today, anyone's first instinct would be to turn to Google for online reviews, and condos are…

The site is also roughly two kilometres from Nanyang Polytechnic, which makes for a short (around six minutes) drive.

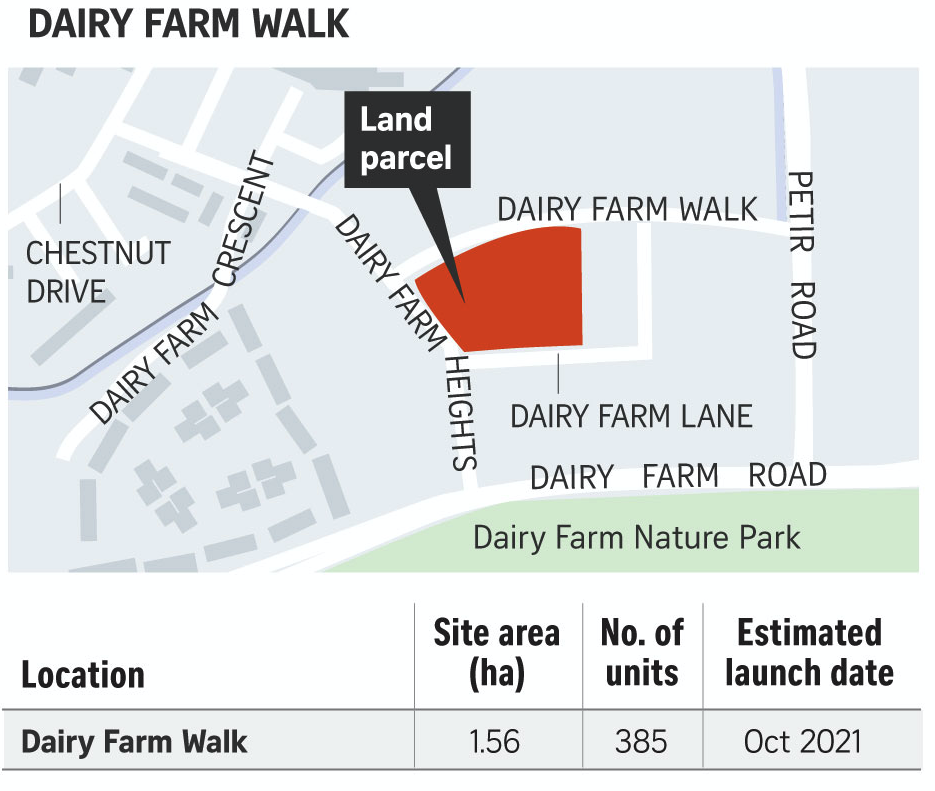

3. Dairy Farm Walk

This site is small at 1.56 ha., and is expected to yield just 385 homes. This is a low to mid-density housing area, with surrounding plots ranging from a GPR of 1.4 to 2.1. It could also provide a good view of the Dairy Farm Nature Park nearby.

The German European School Singapore (GESS) is less than a five-minute walk, and traffic here is low despite the number of intersecting roads. There’s no MRT station nearby, but it’s only three-minutes’ drive to connect to Upper Bukit Timah Road; and around a 10-minute drive to get on the BKE.

Any condo here will be a neighbour to Skywoods, and will also be close to the upcoming Dairy Farm Residences. Some may point out that new launches in the area such as Dairy Farm Residences and Midwood have hardly set the world alight – and so it would be curious to see the response to this plot.

Overall, any development here will be typical of a District 23 condo: it’s mainly for nature lovers who don’t want to be close to noisy malls and MRT tracks. That means the usual trade-off of convenience for peace and quiet.

New Launch Condo ReviewsMidwood Review: Small But Efficient Units Amidst Nature

by Matt K

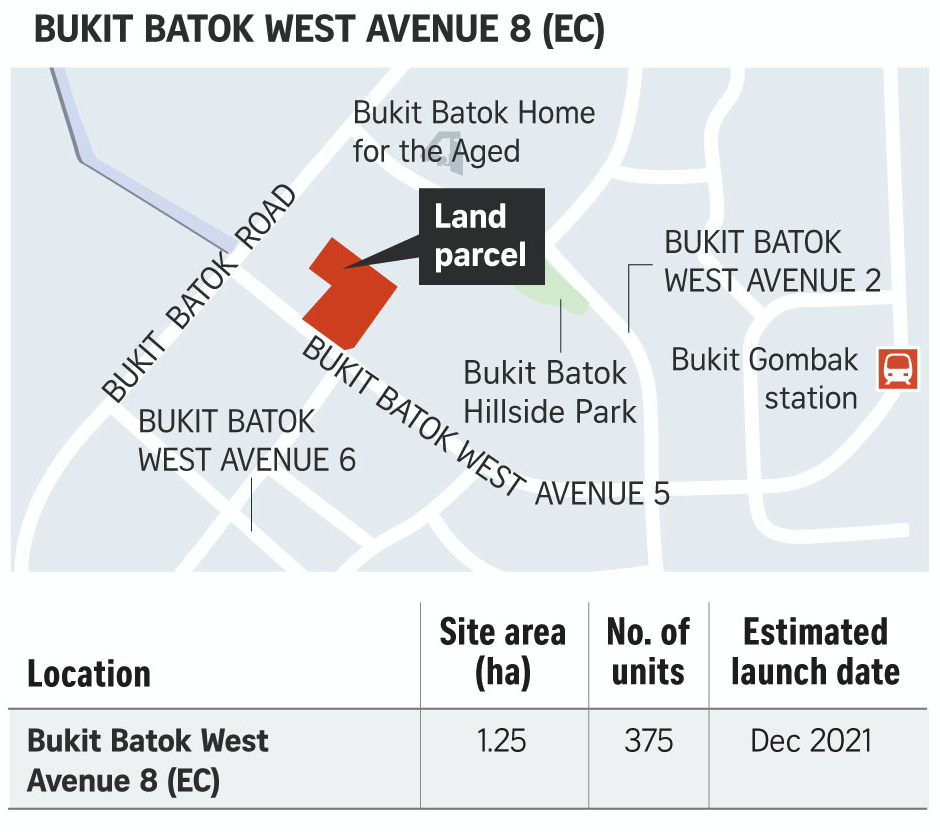

4. Bukit Batok West Ave. 8 (EC)

This will be a pretty small EC, based on the land size. It’s 1.25 ha., and could yield 375 homes. The site is nestled in a high-density area, bordered by residential plots with a GPR of 3.0.

It overlooks the Bukit Batok Hillside Nature Park, so we do think developers will use that for a good view. It’s also near Le Quest, a mixed-use development which has some commercial shops and eateries (this includes an NTUC Fair Price). You should also be able to drive to West Mall in under 10 minutes, and get to Little Guilin in about the same time.

As is common with most ECs, this site is not near an MRT station. But some buyers will appreciate that, apart from Le Quest itself (TOP in 2020), there are no competing condos in the area.

(Then again, buyers who don’t like seeing a lot of HDB blocks in the area may still be unhappy with the density).

Of the four sites, Jalan Tembusu and Bukit Batok West Ave. 8 are probably the ones to watch

The Jalan Tembusu site isn’t just in an expat enclave and family area, it’s also surrounded by ageing boutique developments. It won’t be hard for new launches there to catch the eye of potential tenants; and it’s not often that an opportunity to build a condo at Katong comes along.

As for Bukit Batok West Ave. 8, this is an EC site as Piermont Grand proved, distance to the MRT is no deterrence when it comes to ECs (Sumang Walk is far from any MRT, but it was still a quick sell out). Bukit Batok Ave. 8 has the added benefit of being a known “green zone”; so it will appeal to those who want a nature enclave, minus the crazy Bukit Timah prices.

With regard to the reserve sites, Tampines Street 62 (Parcel B) is worth watching, if it comes around.

The site is less than a 10-minute drive from Tampines Hub and Downtown East, making it close to two lifestyle destinations. Coupled with being an EC, any condo on this plot is likely to be an easy sell. It’s also far enough from condos like Treasure at Tampines, to avoid the worst of the competition for landlords.

(Although it’s a different matter for those looking at gains, as future buyers might prefer the many options closer to Tampines Hub).

For more news and updates as they become available, follow us on Stacked. We’ll also provide you with the most in-depth reviews of new and resale properties alike.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

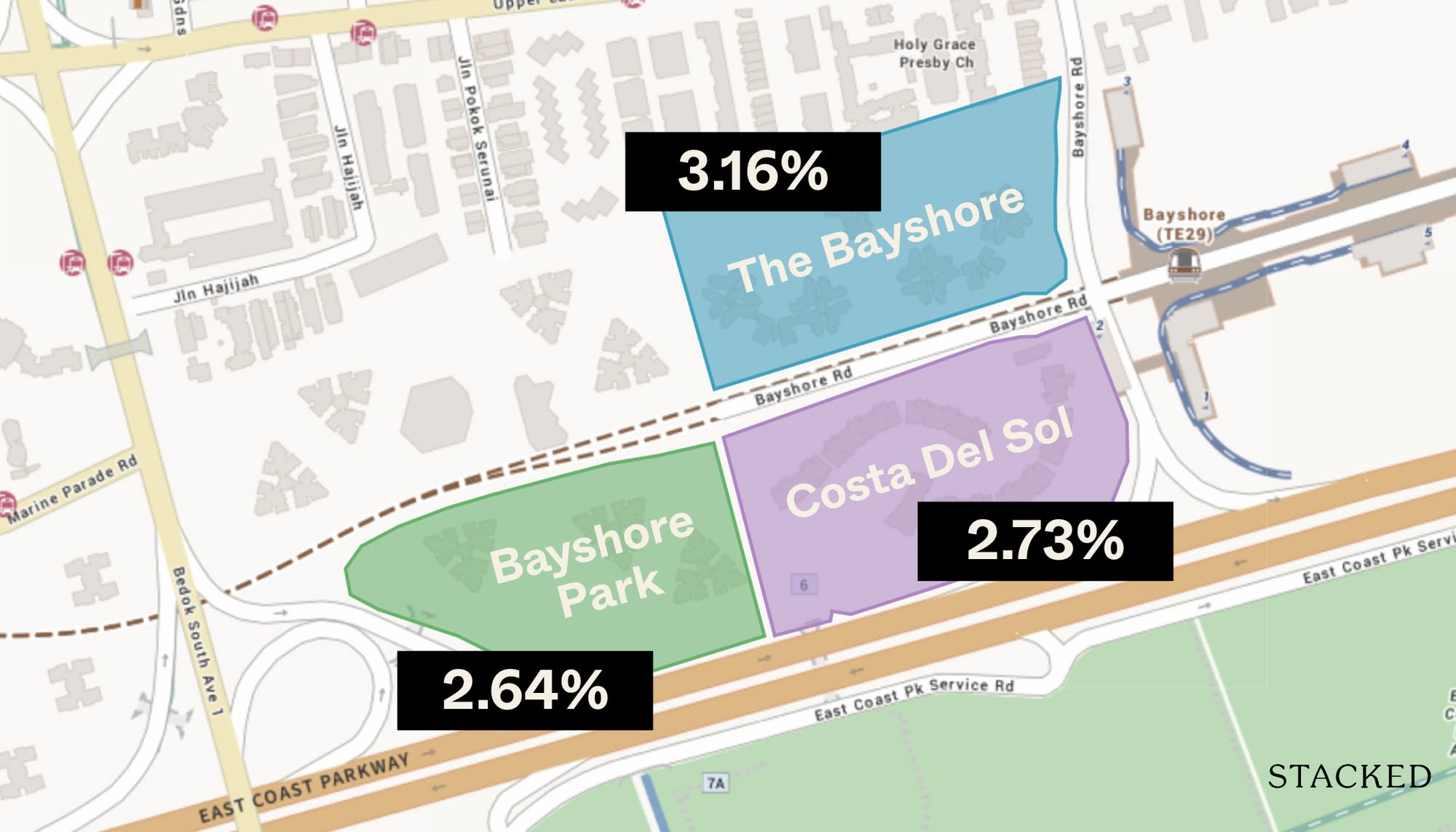

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

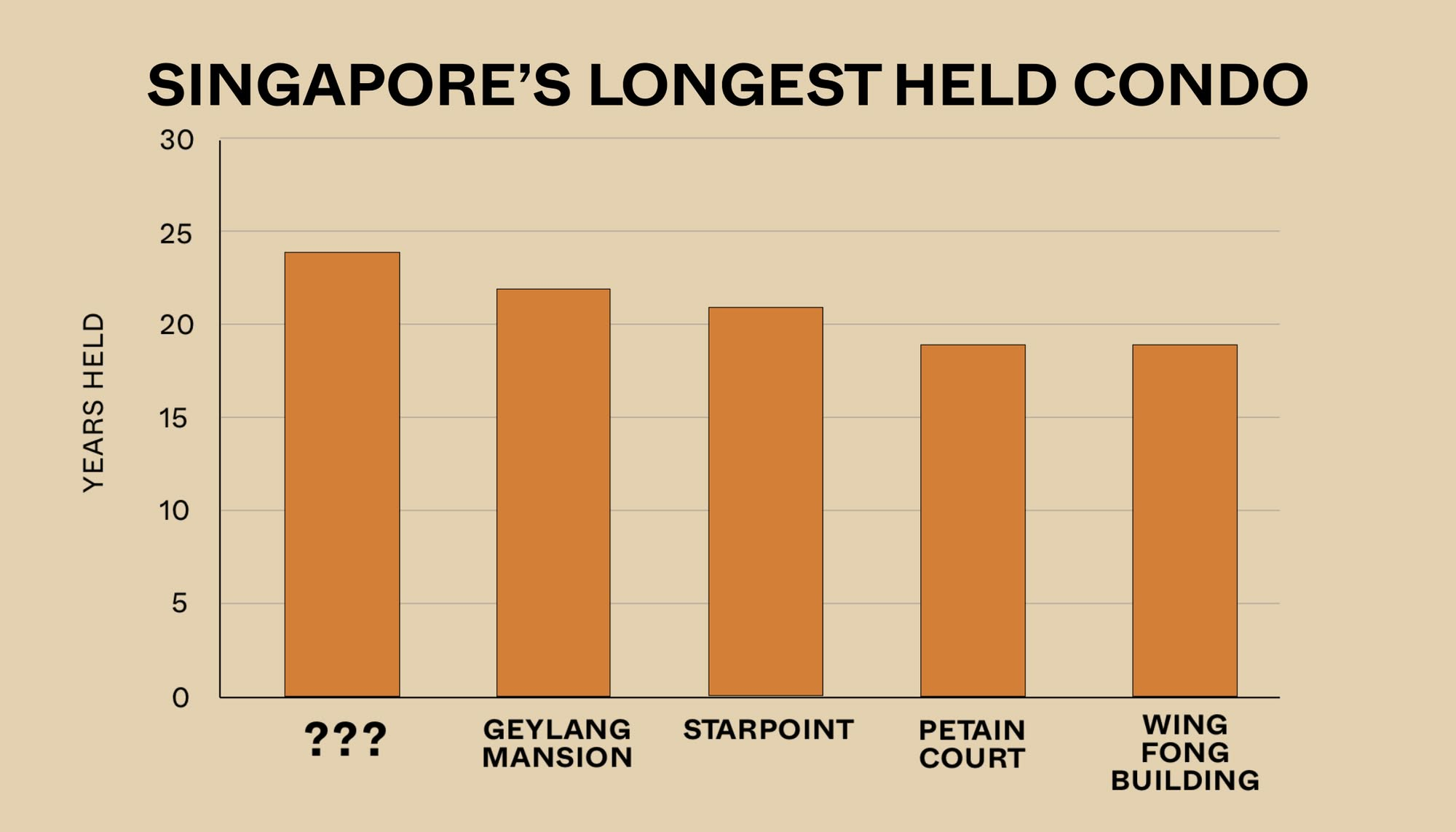

Editor's Pick The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Editor's Pick This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Editor's Pick Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Editor's Pick Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

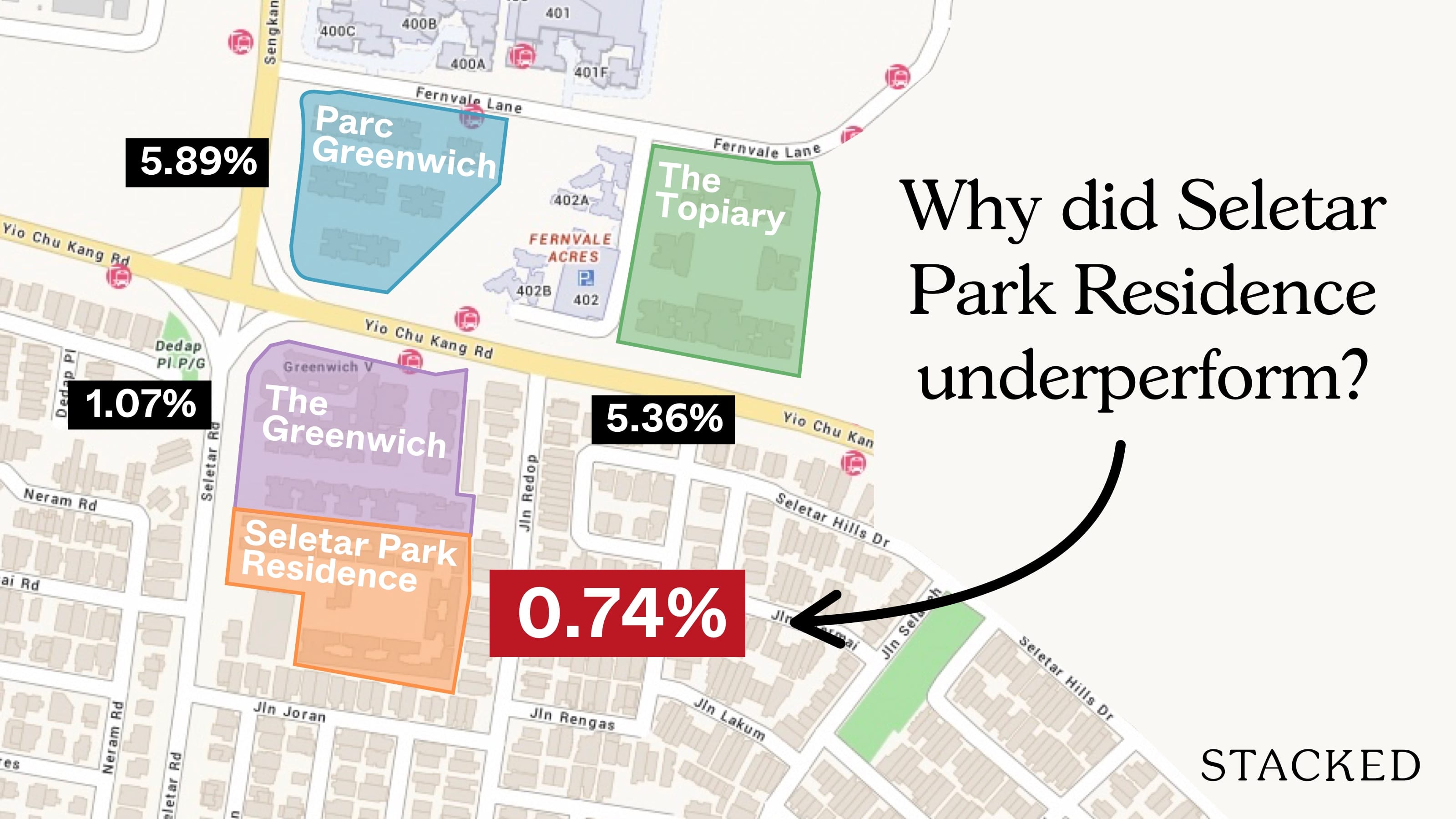

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

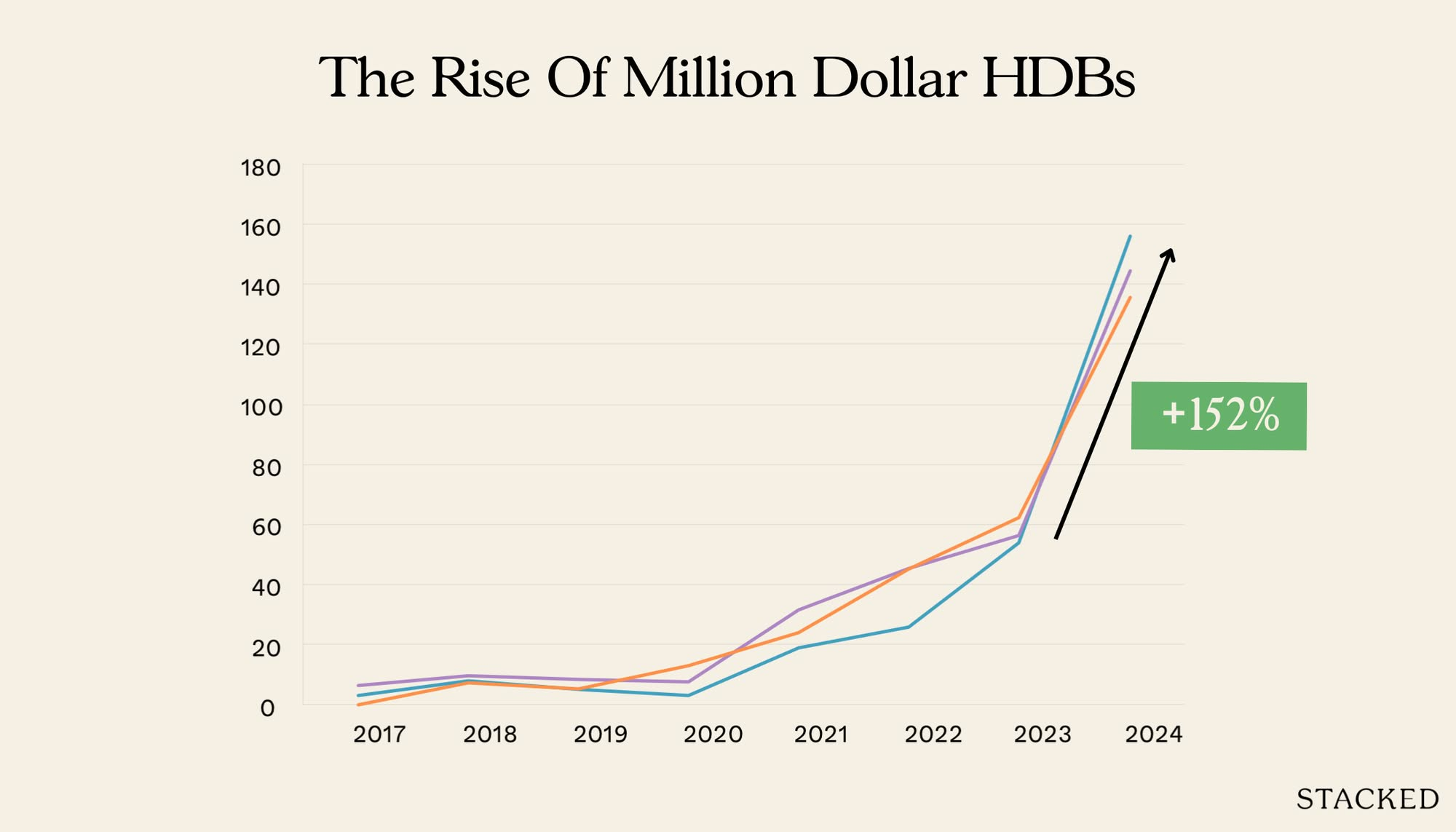

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Editor's Pick LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden

The Katong site is good. The rest are , mehh.

It’s exciting to see the addition of 2,000 new units from the 2021 GLS sites! These new developments offer great potential for buyers looking for prime properties in Singapore. The diversity in locations and project types is especially appealing. It will be interesting to see how these developments influence the local market and whether they cater to the growing demand for modern, convenient homes. Looking forward to more updates!