10 Common Misconceptions About Home Buying In 2022 (You Don’t Want To Get These Wrong)

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

If you last bought a home a decade or more ago, today’s property market might give you a headache. A lot has changed since then, so brace yourself for some major differences. On top of that, there are some age-old misconceptions about the transaction process, that have continued to linger for years. We’ve put together some of the most common ones on this list; do take note before you buy:

Table Of Contents

- 1. Thinking you can hoard your CPF to max out the leverage on your housing loan

- 2. Thinking you can use an HDB loan for an EC, as long as it’s not yet privatised

- 3. You just need to meet the MSR for ECs

- 4. You can clear your debt issues immediately before your home loan, to get in-principle approval

- 5. You can meet the TDSR because you’ve calculated the numbers based on the current interest rate

- 6. A bridging loan will solve all the problems of waiting for the sale proceeds

- 7. When you choose Tenancy In Common, the side with the bigger share controls the property

- 8. Underestimating stamp duties, when the asking price is higher than the valuation

- 9. Assuming you will pay only one home loan when upgrading

- 10. If you decide you don’t want to buy, then at most you forfeit the deposit

1. Thinking you can hoard your CPF to max out the leverage on your housing loan

The minimum down on a home is 15 per cent when using an HDB loan, or 25 per cent for bank loans (of which the first five per cent has to be in cash).

However, note that if you have more than the minimum down payment in your CPF Ordinary Account (CPF OA), you have to use all of it except for up to $20,000. For example:

Say you have $120,000 in your CPF OA, and the minimum down payment for your home is only $60,000. You cannot choose to pay only $60,000, and hoard the remaining $60,000 in your CPF. You can at most keep $20,000 in your CPF only – $100,000 has to go toward the down payment.

This is to prevent you from borrowing the largest amount you possibly can.

2. Thinking you can use an HDB loan for an EC, as long as it’s not yet privatised

It doesn’t matter whether the EC has been privatised, or is still an HDB property. You can never get an HDB loan for an EC.

This means buyers must be prepared to cover the first five per cent of the costs with hard cash. Note that this is the same whether you buy a resale EC or a new EC; even with the Progressive Payment Scheme, the initial booking fee is still five per cent.

It also means the minimum down payment is going to be 25 per cent (for resale) or 20 per cent (for the Progressive Payment Scheme). The first five per cent is always in cash, and the next part can be in cash or CPF.

This also affects the next point:

3. You just need to meet the MSR for ECs

The Mortgage Servicing Ratio (MSR) caps the monthly loan repayment at 30 per cent of your monthly income.

The Total Debt Servicing Ratio (TDSR) caps your total debt obligations – inclusive of credit cards, personal loans, and so forth – at 55 per cent of your monthly income.

For HDB properties, the MSR always applies; so if you buy an EC, you need to meet both HDB’s MSR requirement, as well as the bank’s TDSR requirement. There are some instances where buyers have high outstanding debts, and find they can meet the MSR but not the TDSR.

Review your existing debts with care, before you decide to buy.

4. You can clear your debt issues immediately before your home loan, to get in-principle approval

The banks will use your credit report from the Credit Bureau of Singapore (CBS). However, it takes time for your CBS report to reflect the changes in your debt situation. As such, buyers who try to clear their debt in a very short time before a loan application can still fail to get Approval In Principle; or they may be approved for a much smaller loan quantum.

Most mortgage brokers advise that you start paying down debts 12 months before your loan application, to ensure everything is properly reflected. Some brokers might be able to negotiate on your behalf, but it’s best not to take the risk.

Besides this, note that some issues in your credit report, such as frequent late repayments or prior defaults, are not instantly erased the moment you repay debts. It can take a few years for these to go away.

The most notable issue here is bankruptcy: even if you’ve cleared the debt and gotten your official Letter of Discharge, it typically takes around five to seven years before you can be approved for most home loans.

(Non-banking Financial Institutions may still grant you a home loan as soon as you’re discharged; but the interest rates are often higher. Consult a qualified mortgage broker for help, and don’t go to payday lenders).

One final point as this is less known, but having regular usage on your credit card (whether or not you pay on time) can also contribute towards your loan eligibility. This can come to effect if you anticipate getting a loan may be difficult, so do watch over how many credit cards that you have on hand.

5. You can meet the TDSR because you’ve calculated the numbers based on the current interest rate

To ensure you can cope with rising interest rates, the bank will use a rate of 3.5 per cent for the TDSR. So a $1 million loan, for 25 years, will be projected to cost about $5,006 per month.

This is higher than the actual rate (at the time of writing, around $4,300 per month). If you find that your loan is being rejected, this may be the issue.

Property AdviceUnable To Meet TDSR & MSR Limits? Here Are 6 Things You Can Do

by Ryan J. Ong6. A bridging loan will solve all the problems of waiting for the sale proceeds

The bridging loan is meant to temporarily cover the costs of the new home, until the sale proceeds of your previous home come in. But if you don’t have a realtor, mortgage broker, or other expert helping you, it can be a tricky tool to use.

The first thing to know is that bridging loans have a maximum loan tenure of only six months. This is significant if you’re waiting for en-bloc proceeds, which can sometimes take up to a full year. You need to double-check the timelines involved, lest you be saddled with a giant debt repayment before the cash is available.

The second thing to note is that bridging loans are not cheap (although it can be argued that it is worth it with respect to the convenience it offers). The interest rate on most bridging loans is between five to six per cent, or about 0.5 to 1.5 per cent per month. This is before adding various administrative fees, which differ between banks.

It’s generally best to plan your timeline such that a bridging loan is not necessary at all.

7. When you choose Tenancy In Common, the side with the bigger share controls the property

When you buy your property (including your flat), you’ll be asked to declare the manner of holding. This is whether you want to be joint tenants (all the borrowers count as a single entity), or tenancy in common (different borrowers can own different percentages of the property).

Some Singaporeans are under the mistaken impression that, for the latter, a higher percentage of ownership means more rights over the property; but it doesn’t work that way: even if a borrower has just one per cent of the property, they are still entitled to the same rights to enjoy it.

This means, for instance, the person with 99 per cent ownership cannot unilaterally decide to sell the property, or evict the person who only owns one per cent.

The percentage ownership does matter in other areas, such as division of sale proceeds, survivorship, stamp duties, when transferring their share, etc. But it’s not like ownership in a company, where having the bigger share means you get to call the shots.

8. Underestimating stamp duties, when the asking price is higher than the valuation

The Buyers Stamp Duty (BSD) is based on the price or valuation, whichever is higher. So if you buy a property valued at $1.5 million, but sold for $1.75 million, your BSD would be $54,600 (based on a price of $1.75 million) instead of $44,600 (based on a valuation of $1.5 million).

This means that prices above valuation don’t just cause a higher cash outlay; they also cause you to pay higher stamp duties.

9. Assuming you will pay only one home loan when upgrading

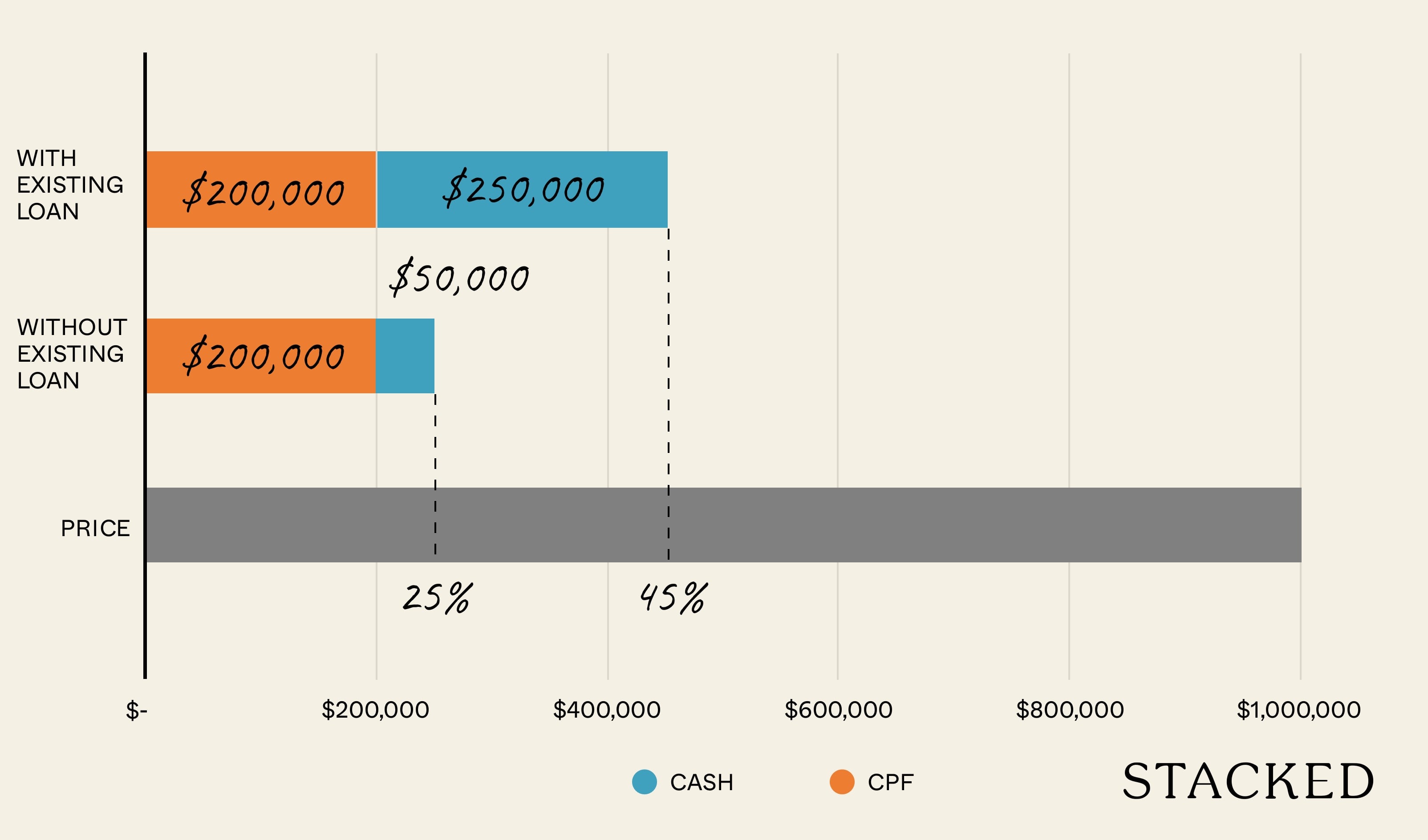

If you cannot get the sale proceeds to discharge your existing home loan, but you go ahead and buy a new property, you may be saddled with both loans for a short time.

This can cause an administrative pickle – the bank can’t give you the full 75 per cent loan quantum, if you have an outstanding home loan. You may need to prove your existing property is being sold (i.e., the OTP is signed) before you can get the loan.

We also understand from some brokers that banks may reject you anyway, even if you have a signed OTP for your previous home – they may insist you discharge the existing loan before taking the new one, as having two loans at the same time might bust your TDSR limit.

It may also strain your cashflow if you need to service two loans at once for a few months.

10. If you decide you don’t want to buy, then at most you forfeit the deposit

If you’ve exercised an Option To Purchase (OTP), and the seller takes legal action, the Court can compel you to proceed with the purchase. So even if you have the disposable income to shrug off the initial deposit, it’s inadvisable to assume you can back out of “any” deal later on.

Be absolutely certain of your purchase before signing anything.

For more information and strategies on purchasing your home, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale developments alike.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Have a real estate question, or not sure what your options are? Email us at stories@stackedhomes.com.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Advice

Property Advice Should We Buy An Old 99-Year Leasehold Condo To Live In: Will It’s Value Fall When The Lease Runs Out?

Property Advice We Own A $800K 1-Bedder And A $1.1M 3-Bedder: Is It Possible To Upgrade To A 4-Bedder Condo?

Property Advice I Own A 55-Year-Old HDB Flat, But May Have To Sell — Can I Realistically Buy A Freehold Condo With $700K?

Property Advice We Own A 2-Bedder Condo In Clementi: Should We Decouple To Buy A Resale 3 Bedder Or Sell?

Latest Posts

On The Market Here Are The Cheapest 4-Room HDB Flats in Central Singapore You Can Still Buy From $490K

Pro How A Once “Ulu” Condo Launched In 1997 Became A Top Performer

Editor's Pick I Reviewed A New Launch 4-Bedroom Penthouse At Beauty World

Property Market Commentary When Renting In Singapore Is The Smarter Move — And Buying Can Wait

Editor's Pick Why Singaporean Families Are Looking At This Landed Enclave From Around $4M

Singapore Property News Lentor’s First Condo Is Complete — The Early Profits May Surprise You

Editor's Pick A Wave Of New HDB Resale Supply Is Coming In 2026: Here’s Where To Find Them

On The Market These Are Some Of The Cheapest 5-Room HDB Flats Left In Central Singapore

Pro This 698-Unit Ang Mo Kio Condo Launched At The Wrong Time — And Still Outperformed Peers

Singapore Property News $281.2M in Singapore Shophouse Deals in 2H2025 — But That Number Doesn’t Tell the Full Story

Property Market Commentary 5 Key Features Buyers Should Expect in 2026 New Launch Condos

Editor's Pick What “Lucky” Singaporean Homebuyers Used To Get Away With — That You Can’t Today

Property Investment Insights These Resale Condos In Singapore Were The Top Performers In 2025 — And Not All Were Obvious Winners

Singapore Property News CapitaLand–UOL’s $1.5 Billion Hougang Central Bid May Put Future Prices Above $2,500 PSF

Singapore Property News Why New Condo Sales Fell 87% In November (And Why It’s Not a Red Flag)