10 Cognitive Biases That Are Affecting Your Property Purchases!

April 19, 2020

Sentosa.

Everyone knows Sentosa.

Anyone remember the buzz surrounding those Sentosa waterfront developments back in the early 2010s though?

‘Billionaire Playground’.

That’s the term they used to call it.

Wanna guess what happens to the place 10 years down the road?

Demand plummets.

Value falls.

And the poor folks over at Singapore’s sunny island-home are forced to sell their units at losses of up to 40% what they initially paid for them!

And all this because they couldn’t help wanting a piece of the pie.

Or in other words,

They fell to the Bandwagon Effect.

Now the Bandwagon Effect isn’t the only thing that plagues the decision-making of investors today.

And we sure as hell don’t want you to fall into that same trap.

No.

In fact, that’s the whole reason for today’s piece.

On today’s journey, we’re going to cover some of the more pertinent sins and irrational thought processes that we’ve seen property investors resort to over the years… all this, so that you don’t have to make the same mistakes!

But first…

Cognitive Biases – What are they?

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Good question.

You see, I would like to think that we were all born ‘pure’.

That is, with completely no biases (apart from the fact that Huggies is probably better than Mamy Poko).

But as we gradually progress through life, our cognitive biases begin to increase. Cognitive biases that we obtain from:

- Family

- Friends

- Aspirations

- Past Experiences

…the list goes on.

But why do we hold on to these biases? Aren’t we all smart, rational human beings that are capable of easily seeing through these things?

You see, one big reason why we cling on to these biases day after day is because we tend to have limited attention spans.

And what happens when you have limited attention spans?

You formulate mental shortcuts (or biases) that you then apply to seemingly ‘familiar’ scenarios.

They aren’t necessarily bad for split-second decisions per se (ie. someone throwing a banana at you).

But if you’re going to invest substantial time, effort or money into a decision, then wouldn’t it be better to do so without any of these ‘shortcuts’ hampering your potential success?

Ok, enough chit chat. Grab your coffee and let’s get started!

Types of Cognitive Biases

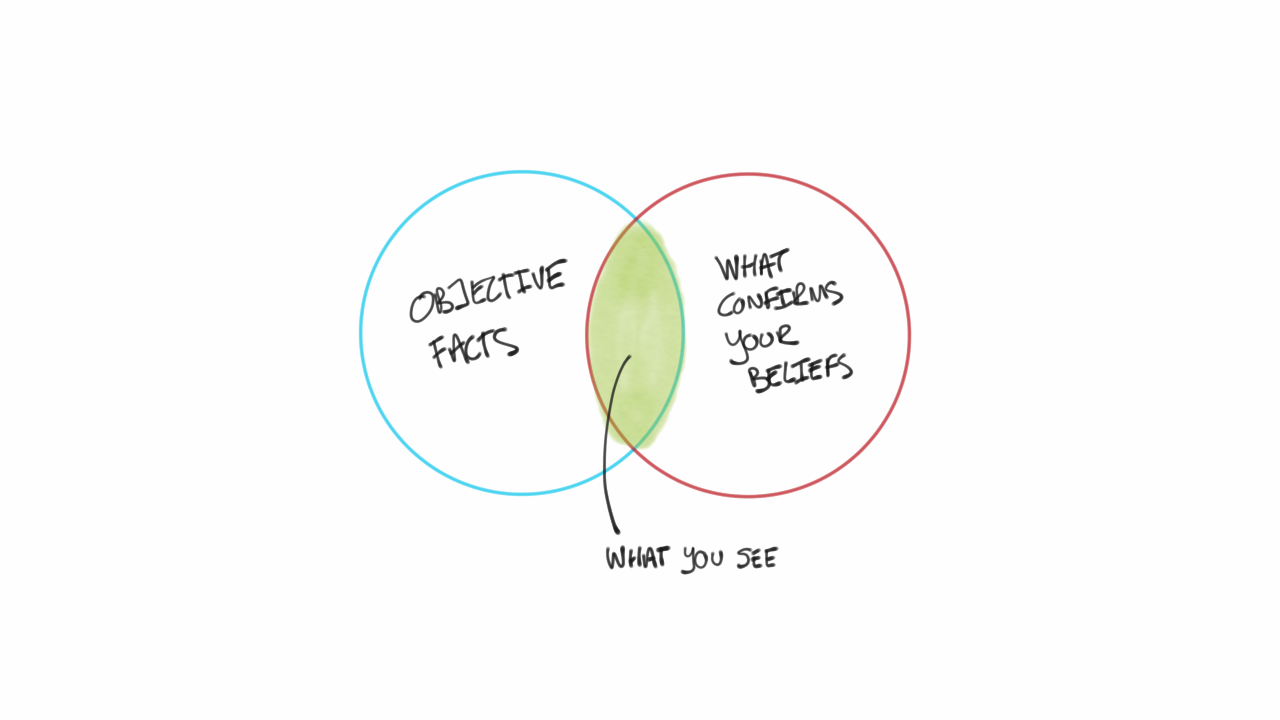

# 10 – Confirmation Bias

The confirmation bias appears when receiving, or giving information. You tend to prioritise information that confirms your beliefs, while discounting those that do not.

Example: In one of Sean’s recent articles, he challenged our readers to prove which residential tenure-type was better. Leasehold, or Freehold?

Naturally, we got a mix of very interesting responses.

The best part about them? They were all valid!

Some argued that freehold was something that you kept forever, while others believed that leasehold properties were more ‘affordable’ and therefore sold better in the resale market.

Both sides weren’t wrong!

But I’m sure that on many an occasion, parties on either end of the debate might not even have considered the benefits posed by the opposing half’s arguments!

See how the bias fits here?

Why it’s Detrimental: In many cases, discounting information that does not resonate with you could lead to narrower conversations, a lower knowledge grasp than others, and ‘fool’s confidence’ in key investment/life decisions.

How to Avoid/Correct it: In essence, never ‘care-off’ methods/alternatives that might not resonate with your or the people around you. Observe these alternate pathways (logically of course) and act them out every now and then.

# 9 – Halo Effect

Halo effects often occur based on an initial perception of an object/person based of their overall appearance. The more attractive/wholesome the subject, the better/more receiving your generalised perception – and vice versa.

Example: Visiting showflats.

We’ve been through countless showflats on our condo reviews, and it’s one of those things that can really vary in quality.

Boulevard 88‘s showflat for example, featured luxurious designs, wonderful hospitality and a certain opulence that we were extremely impressed by.

Naturally, that good ‘first impression’ gave us high expectations of the place across a number of (unrelated) sectors!

The opposite scenario could also have played out if we had walked into a showflat on the other end of the quality spectrum.

Why it’s Detrimental: By forming impressions based on an initial feel/look, we then expect certain expectations to be met. When these (sometimes unfair) expectations are not met, the object/person’s value drastically decreases in our eyes.

Worse still, we might even close our eyes to the positives/negatives the object/person brings till it’s too late!

What’s more, it sometimes paves the way for careless judgement-calls (ie. investments) without conducting further research on our part. Yes, it does save some time, but isn’t potential value also sacrificed?

How to Avoid/Correct it: Simple put, never be fooled by an entire appearance. Uncover the ‘less visible’ aspects before you piece together an opinion on something.

Also, here’s a tip: Why not gain from it at the same time by appearing more ‘put-together’ than you already are?

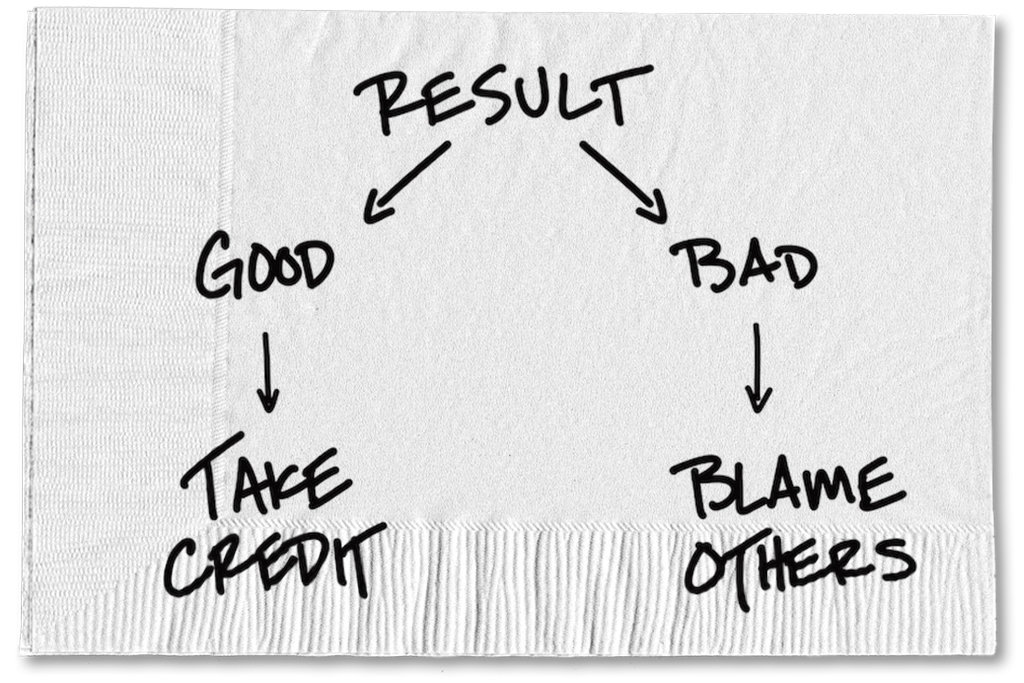

#8 – Self Serving Bias

Self-serving biases are involved in hindsight perceptions of personal situations. When something negative happens, we attribute it to uncontrollable forces. When something positive happens however, we believe it is due to our personal skills/hard work.

Example: Investments!

Say you buy a condo unit for investment purposes (please don’t get into this with little or no prior research btw!).

5 years later, it appreciates, and you sell. Wonderful! ‘Must be my investment prowess,’ you say.

OR

5 years later, it depreciates. ‘Aiya, how would I know there would be coronavirus?!’

See how it works?

Why it’s Detrimental: This applies more for the losses aspect. In following with this bias, you reward/normalise yourself for failure. In other words, you are not taking ownership of your actions, even though in more cases than one, it was the lack of effort/research on your end that caused the loss!

It could also mean that you are easily contented with your success. At the risk of sounding like a kiasu asian parent… you could achieve so much more!

How to Avoid/Correct it: Never blame external factors for your losses. Anticipate them if possible, and keep the mindset that you have the power to change everything. It might seem impossible, but it will keep you on your toes, and bring about more action than not.

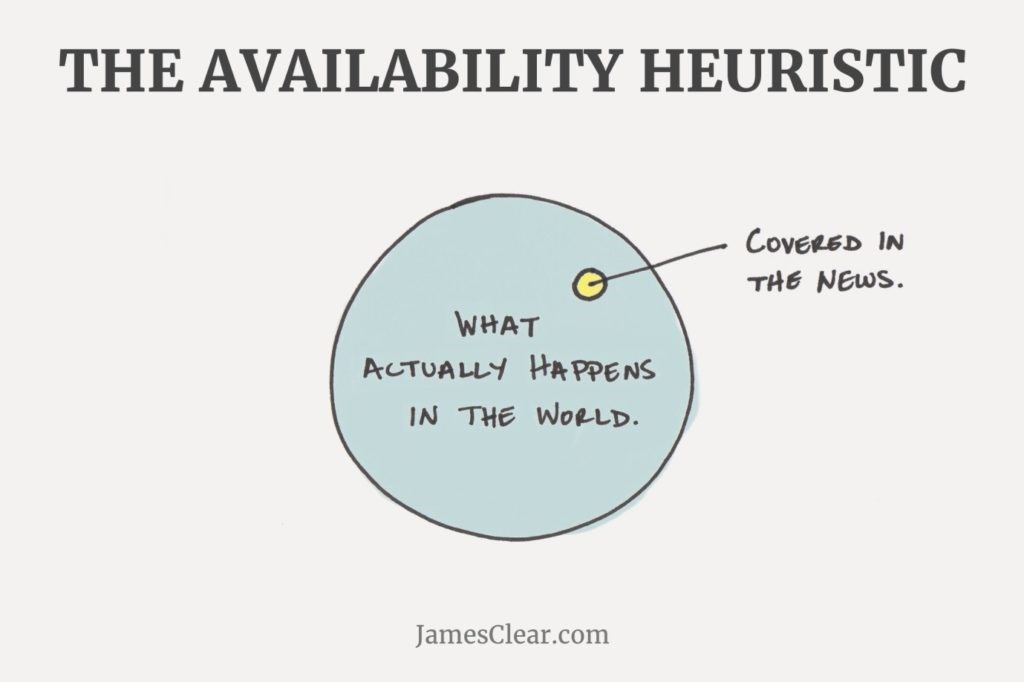

#7 – Availability Bias

Availability biases shape our beliefs/emotions/decisions based on what we remember from past experiences, social norms and the media.

Example: Dual key units.

In his most recent piece, Sean told us a little more about the history and types of dual key units available today.

In essence, dual key units were all the hype back in the early 2010s.

Someone who might have heard/had a bunch of success from investing in these units could be inclined to reinvest in these units when given a windfall.

Unfortunately, due to changing policies/circumstances, that same high yield potential might no longer apply.

Why it’s Detrimental: Four words.

Living. In. The. Past.

There has probably been no faster developing age than the one we live in today. By basing major decisions/taking risks solely on past experiences or heresay, it’s safe to say that any chance of success will be greatly reduced.

While some might like to reminiscent past golden years, few of us can afford to be permanently based in it.

How to Avoid/Correct it: Keep up to date with the latest news and be prepared to accept and adapt to sudden/new changes. In essence, do not let the past shape your future.

#6 – Attentional Bias

Attentional biases apply more significantly to consumer purchases. Certain characteristics of a product garner more interest/research as opposed to its other traits based on a buyer’s preferences/wants.

Example: In Ryan’s case study on two house-hunting couples, he famously referred to one of the couples as the ‘Goodviews’.

As the name implies, they were…well, prioritising good views above all else.

(Spoiler alert!)

After all was said and done, they eventually chose the unit with the better views, and in the process, passed up a $200k appreciation opportunity!

Ultimately, they did get the characteristics (views) they came for, so no regrets there.

That said, by passing up another arguably more important trait (ie. appreciation potential), would they come to rue their choice in the years to come?

Why it’s Detrimental: Due to attentional cognitive biases, different buyers are often attracted to varying characteristics in single, more complex products (a house for example).

As such, priorities are often warped, with buyers conducting in-depth research only on the particular aspects of the purchase that they feel are important.

Research on other key components of the product of purchase are therefore often skipped.

Any guesses as to how this could affect the integrity of your product purchase?

How to Avoid/Correct it: This one isn’t easy. In fact, the larger the object of purchase, the more factors need to be considered.

That said, it’s perfectly fine to prioritise some aspects in your purchases as the Goodviews did.

Just make sure that you look at the purchase from a birds’ eye (long-term) view, understand the importance/tangibility of your priorities, and have an idea of most, if not, all the other factors that might impact the long-term success of this purchase.

#5 – Anchoring Bias

(Oi wake up!) Anchoring bias occurs when receiving information. The first piece(s) of information/news one receives tends to garner more attention and hence, reactions. Subsequently received information (which might be just as, if not, more important) tends to generate less awareness.

Example: Choosing a condo…again!

Say you’re in the market for a new launch condo unit in the Holland area.

The first place you gravitate to on your research journey?

The unforgiving (but incredibly fun) forums.

Now supposedly the first page you stumble upon has everyone talking about how living at One Holland Village is going to be a million times more convenient than say… the Leedon Green.

New Launch Condo ReviewsOne Holland Village Residences Review: Best Located New Launch In Holland

by Reuben DhanarajWhether you’re a greenhorn in property or not, you might be inclined to agree with them to an extent.

Perhaps more impactfully, you then bring in this aspect of convenience as your biggest concern/decision-maker.

Despite there being a myriad of other important factors you should also consider!!

Why it’s Detrimental: Giving in to the anchoring bias means that you often won’t see the full picture of the issue at hand…perhaps not even half of it!

As a result, you might make flawed decisions/’accusations’ based on a complete lack of information, or worse still, someone else’s opinion!

Picture a headless chicken running around.

Not fun.

How to Avoid/Correct it: Read, watch, communicate, understand.

As with most things in life, refrain from giving your opinion/making a key decision based on the very first piece of news you receive (unless it’s an emergency…in which case, run!).

Instead, try to think rationally and observe as many sources before making an informed decision/opinion.

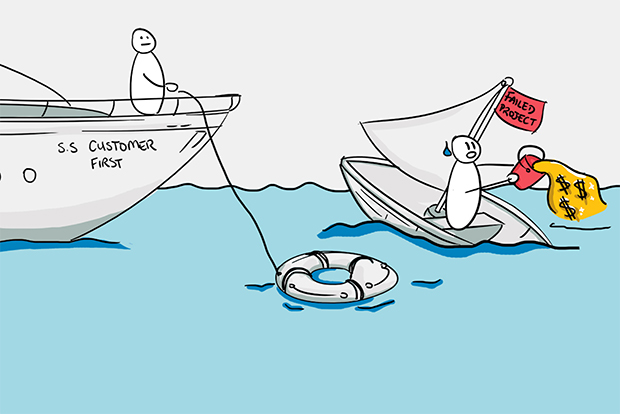

#4 – Sunk Cost Fallacy

Sunk cost fallacy occurs in habitual actions. One tends to continually invest time/money into a negatively-yielding action instead of considering an alternative.

Example: Sticking to an ‘ownstay/rental’ model.

On today’s story of a sinking ship, we’ve got another example from Ryan.

In this article, a client of his simply refused to sell his condo (for good gains might I add) despite ‘paltry’ rental fees and monthly income loss.

Now this isn’t just the endowment effect I’m talking about.

It’s the inability to accept that your (investment) actions are bringing you harm, and that when you’re presented with an alternate path, you simply refuse to move out of our comfort zones!

Why it’s Detrimental: By continually engaging in a negative-yield, sometimes self-debilitating action (*evil grin*), your negative returns are compounded over a period of time beyond the point of no-return.

What’s more, by refusing to acknowledge alternate methods (as was the case in the example), you might actually miss out on a major opportunity to get out of an unhealthy situation!

How to Avoid/Correct it: Keep your mind open to the multiple (sometimes unorthodox) ways that your purchases/assets can yield you gains (both in terms of money and wellbeing).

In crux, do not let habit overcome your assets’ potential when the time comes to make a change!

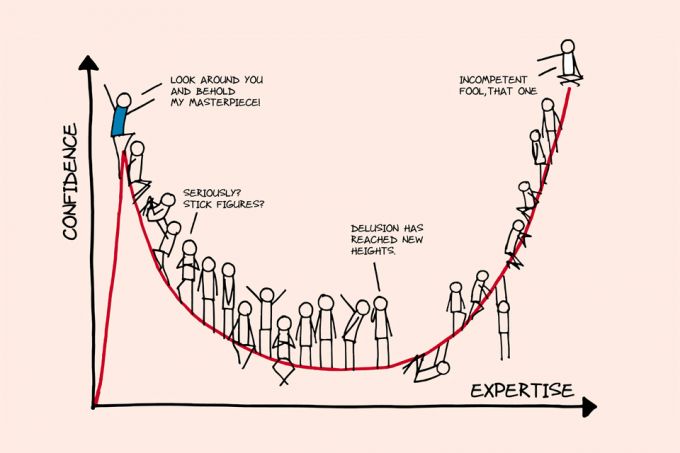

#3 – The Dunning-Kruger Effect

The Dunning-Kruger Effect is involved in a person’s confidence and (sometimes rash) decision making. Those who know less, think they know more (…classic Peter Griffin).

Example: New Investors Vs Seasoned Investors

Before you start hiring assassins from the dark web to plot my demise, I’m not saying that this scenario applies in every similar case! Once again, this is just an example!!

Say you have a greenhorn investor and a weathered investor. Both fresh on a good stock/property return.

Both are amicable, non-arrogant fellows with a relatively calm, unemotional investment strategy.

The greenhorn immediately buys into an undervalued stock/unit, while the weathered investor holds for a less riskier play.

Who would you put your money on to succeed?

Fair enough, some might go for the greenhorn because he is young and has energy to compensate for any losses in the future.

Yet for safer, more astute investment advice, wouldn’t you go to the weathered investor for help?

Why it’s Detrimental: Unexperienced persons in any particular field might make swift major decisions based on a ‘gut-feel’/confidence due to the little knowledge they have in this area of exploration.

Yes, he/she might generate new ‘unforgettable’ experiences/adventure, but those ‘rash’ moves could incapacitate financial growth for a period of time, or worse, an entire life.

How to Avoid/Correct it: If you are new to a topic, be sure to seek out experienced folk who are well-versed in the subject.

Learn first about the risks, possibility of success and overall rationality of the decision you are about to undertake (ie. is there a better way?).

#2 – Authority Bias

Authority cognitive biases occur when receiving information and during decision making. Information from figures with authority/recognition is more likely to be consumed, and likewise, acted upon by its receivers.

Example: Influence from the news/media.

Over the last two decades in Singapore, there have been a number of major property market shifts.

Following the SARs period in 2003, it was just bad news after bad news for the financial market. People began to panic-sell their developments (one seller, even losing out on $10million had he just waited for 3 more years).

There was rarely mention of an economic resurgence.

It happened.

During the en bloc sale of 17/18’, all the media was talking about was the newly minted millionaires. People began to buy en bloc units in droves.

There was rarely mention of a policy that might halt the explosion.

It happened again.

Now I’m not denying that the local news/media outlets are mere gatekeepers (mostly without strong opinion).

That said, they can still be seen as authoritative figures that do influence the authority bias onto their readers/listeners (as you are now seeing with Covid-19).

Why it’s Detrimental: Sometimes, having an authoritative/experience figure is crucial in ensuring a level of stability/success (as mentioned in #3).

That said, it is extremely important to understand the ulterior motives of these authoritative figures/opinion leaders.

If you do closely follow an authoritative figure whose ulterior motive is misaligned from your goals, you might not end up where you initially aspired to..

How to Avoid/Correct it: Follow the right sources!

More specifically, do a background check and ensure that these authoritative sources are diverse, credible and ultimately aligned with your end-interests.

It also doesn’t hurt to be constantly on your toes for inaccuracy on their end!

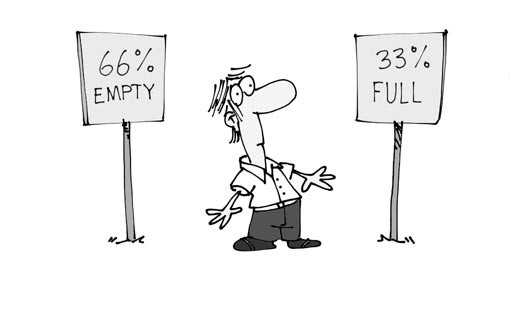

#1 – Framing Effect

The framing effect appears when receiving information (more specifically, values). Depending on how a similar piece of information is ‘framed’, perceptions from receivers can vary dramatically.

Example: Looking at property market trends.

In light of Covid-19, URA has released its Q1 flash estimates which show a drop of 1.2% in the private residential property index.

It looks bleak, yes.

Yet if you were to compare the actual number of private units sold over the 1st quarter of 2020 (2096) to that of 2019 (1838), you can see how the stats suddenly don’t look so bad!

Why it’s Detrimental: If we interpret the severity/impact of statistics based solely on the way it’s ‘framed’/presented (and we actually do from time to time), then we might misunderstand the true ‘value-range’ of the particular object/incident at hand.

What’s more dangerous is that enormous risk factors in certain ventures might then be under-prioritised/overlooked, thus resulting in catastrophic financial missteps.

How to Avoid/Correct it: Research, research, research.

Never take a value and estimate it as a ‘normal’/median.

Instead, bring in other values of similar/competing objects into the list to complete the entire picture.

Final Thoughts

At the end of the day, we do have to be realistic in managing our expectations on cognitive biases.

For those who have seen logical sense in the cognitive biases (or are learning of it for the first time), the first thing would probably be to share this with your closed ones (good call), and then to practice altering these mindsets.

Which is great!

That said, these cognitive biases are in place to reduce the energy and time that we spend on making daily decisions.

Mulling over every single decision we undertake will ultimately prove to be incredibly unproductive.

Thus, it makes sense to: address these cognitive biases over the course of key decisions (large purchases, actions that will have long-term impacts, investment ideas etc.).

Think of it as a muscle.

The more you exercise addressing and altering these cognitive biases, the easier/more useful it becomes; the sooner it feels like second nature; and the more you can undertake to change both yourself, and your investment decisions for the better.

I’ll leave you with one of my favourite quotes.

‘When you begin to understand certain key elements in life…it’s like waking up from a dream – into a whole new dream’

Here’s to improving ourselves everyday.

*Cover photo from Annika Brandow

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Reuben Dhanaraj

Reuben is a digital nomad gone rogue. An avid traveler, photographer and public speaker, he now resides in Singapore where he has since found a new passion in generating creative and enriching content for Stacked. Outside of work, you’ll find him either relaxing in nature or retreated to his cozy man-cave in quiet contemplation.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Singapore Property News You Can Now Buy Part Of A $300M Singapore Bungalow — But You Can’t Live In It

2 Comments

well said. there’re a lot of investors and homeowners out there who get burned because of these biases. if only they were more well aware , or if they had agents who advised them better!!