10 Biggest Property Losses Besides James Dyson’s $11.8m Penthouse Loss

October 21, 2020

You must have heard the news by now. British Billionaire James Dyson has sold his Wallich Residence penthouse at an eye-watering loss of $11.8 million.

While we can’t determine the actual selling date, and hence, the Seller’s Stamp Duty (SSD) incurred, we can show you an estimate instead. If sold within a year, he would have to pay an insane SSD of $7.44 million. If sold within 2 years? A frankly still jaw dropping $4.96 million – that’s enough to buy a high end apartment in the top districts in Singapore.

That said, this still doesn’t top the astounding $15.8 million loss sustained by Japanese billionaire, Mr Katsumi Tada.

To those who don’t watch the property market often, this might come as a shock. But when it comes to super lux properties, seven or eight-digit losses do happen. Here are the top 10 biggest property losses we’ve seen to date (we’ve only included those with caveats lodged with URA):

Loss #10: Orchard Scotts (-$4.776 million)

| Date Bought | 21 Oct 2013 |

| Date Sold | 15 Feb 2017 |

| Unit Size | 2,336 |

| Price Bought | $8,456,320 |

| Price Sold | $3,679,200 |

| Loss Incurred | -$4,776,653 |

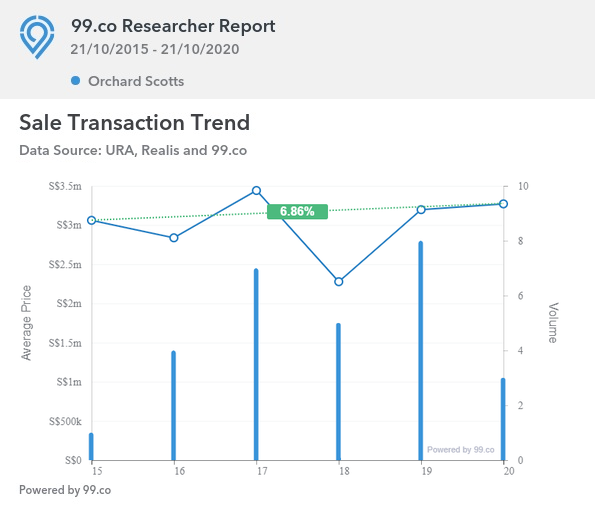

Prices at Orchard Scotts in the last five years:

The only transaction in 2015 was at $3.06 million, with the last three transactions this year averaging $3.27 million. This is a percentage gain of about 6.8 per cent.

Fact sheet:

Developer: Golden Development Pte. Ltd.

Address: Anthony Road (District 9)

Tenure: 99-years from 2001

TOP: 2008

Number of units: 387 units

What’s happening here?

Orchard Scotts was a stand-out development during its initial launch, due to its location. This development is about 300 metres from the Newton MRT station, and about 260 metres from the prestigious Anglo Chinese School. The fundamentals are solid, from an investment perspective.

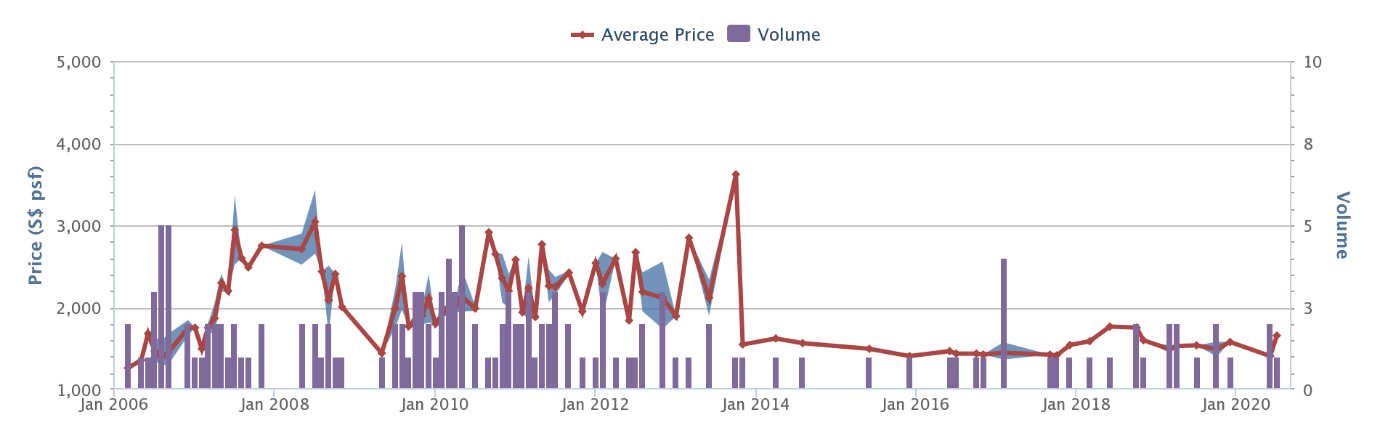

The loss is due to a timing issue. 2013 was the peak of the property market, and an expensive time to buy. Data from Square Foot Research provides a good illustration of what happened at Orchard Scotts:

In October 2013, when the unit was purchased, prices averaged $3,620 psf. But by November of the same year, prices had plunged to $1,548 psf, and have yet to recover.

Unfortunately, we’re not confident prices can see a sharp rebound to their 2013 levels soon. This is partly because Orchard Scotts is a leasehold property, which is getting on in years. The other reason is mounting competition.

Developments like The Vermont on Cairnhill, and more recently Kopar at Newton, are among condos that pose strong alternatives to Orchard Scotts. The Vermont on Cairnhill, for example, is newer (completed in 2014), and is also a freehold development.

As such, the owner may have been willing to sell at a loss, rather than keep holding on to sunk costs.

This being said, Orchard Scotts isn’t a bad investment if you look at it for a rental perspective. Square Foot Research, for instance, shows an implied rental yield of 3.5 per cent, in an environment where most condos struggle to get out of the two to three per cent bracket.

Loss #9: Reflections at Keppel Bay (-$4.82 million)

| Date Bought | 8 May 2008 |

| Date Sold | 21 Jul 2020 |

| Unit Size | 3,854 |

| Price Bought | $10,671,726 |

| Price Sold | $5,850,372 |

| Loss Incurred | -$4,820,400 |

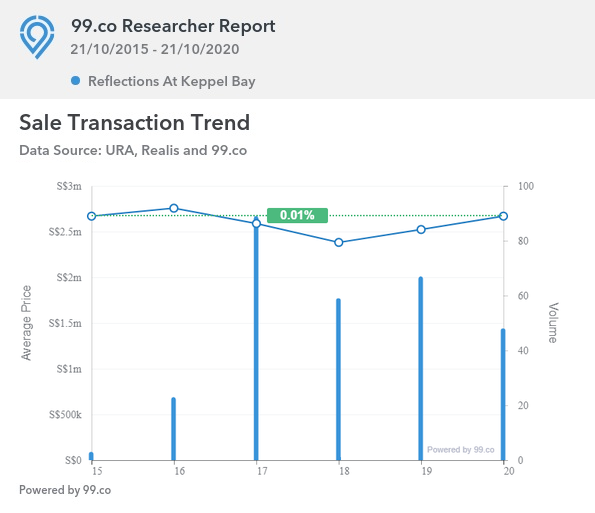

Prices at Reflections at Keppel Bay in the last five years:

The last transaction in 2015 was at $2,668,333. In 2020, there were 48 transactions, averaging $2,668,502. The price movement is flat.

Fact sheet:

Developer: Keppel Bay Pte. Ltd.

Address: Keppel Bay View (District 4)

Tenure: 99-years from 2006

TOP: 2011

Number of units: 1,129 units

Condo ReviewsReflections at Keppel Bay Review: Glitzy Living with Waterfront Views

by Reuben DhanarajWhat’s happening here?

This development has seen a difficult year. Square Foot Research shows 25 unprofitable transactions for Reflections at Keppel Bay to date in 2020, and only one profitable transaction. Some of the other losses for this year (besides the featured transaction) include:

| Date | Unit size (sq. ft.) | Total loss | Annualised return |

| 30th June 2020 | 2,260 | $2,147,900 | -4.3% |

| 2nd September 2020 | 2,174 | $1,345,150 | -2.4% |

| 22nd September 2020 | 1,518 | $1,076,960 | -3.6% |

| 26th March 2020 | 1,830 | $1,100,000 | -2.4% |

| 10th January 2020 | 1,701 | $1,091,756 | -2.6% |

The only profitable transaction so far this year was on 24th September, and the recorded profit was $10,000 (which after accounting for all the taxes and costs is basically a loss).

Reflections at Keppel Bay, like many luxury condos in its location, tends to attract a higher number of investors (i.e. they don’t occupy their units, their property is fully let out).

However, the soft rental market has not been helped by the onset of Covid-19. The resulting downturn threatens to further reduce the pool of prospective tenants – recessions tend to result in slashed housing allowances, or the replacement of expatriate workers with locals. Both events that don’t bode well for landlords.

As such, we believe recent sales reflect investors offloading their units, which they may now consider liabilities.

Loss #8: The Marq On Paterson Hill (-$4.92 million)

| Date Bought | 17 Sep 2012 |

| Date Sold | 20 Dec 2017 |

| Unit Size | 3,089 |

| Price Bought | $15,197,880 |

| Price Sold | $10,280,192 |

| Loss Incurred | -$4,920,000 |

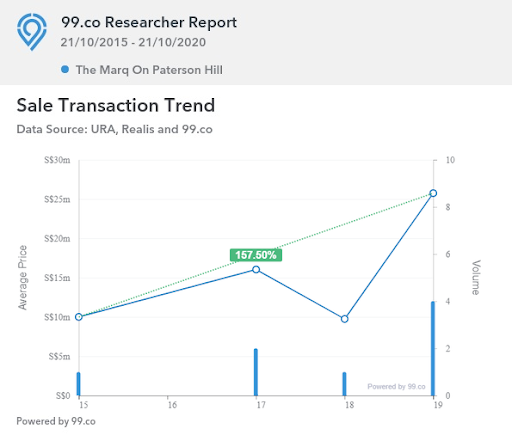

Prices at The Marq On Paterson Hill in the last five years:

*Please note that, due to this being a superlux property, transaction volumes tend to be low, and some transactions may not have been lodged at all.

Transaction volumes are too low to paint an accurate picture. However, the last transaction on 2015 was for $10 million, and the last four transactions in 2019 averaged $25.75 million. This is a percentage gain of 157.5 per cent.

Fact sheet:

Developer: Grandon Pte. Ltd.

Address: Paterson Hill (District 9)

Tenure: Freehold

TOP: 2011

Number of units: 66 units

What’s happening here?

This is a super lux boutique development with only 66 units. Only the most affluent property buyers can afford a unit here: at the time of writing, the asking prices for four-bedroom unit range from $11.9 million to $34 million.

Apart from offering a high degree of privacy, it’s only 550 metres from Orchard MRT. It’s also freehold, which makes it attractive to long term investors.

We feel the losing transaction was a bit of an outlier – freehold properties in the Orchard area do usually hold its value. However, the loss could be due to the high quantum involved: if you have a time limit, it’s a challenge to find buyers who can afford the property’s true value.

Loss #7: Turquoise (-$5.132 million)

| Date Bought | 7 Nov 2007 |

| Date Sold | 5 Sep 2018 |

| Unit Size | 3,746 |

| Price Bought | $9,533,570 |

| Price Sold | $4,401,550 |

| Loss Incurred | -$5,132,280 |

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Units Of The Week Issue #16

Singapore has officially "opened" up, and things are slowly going back to normal.

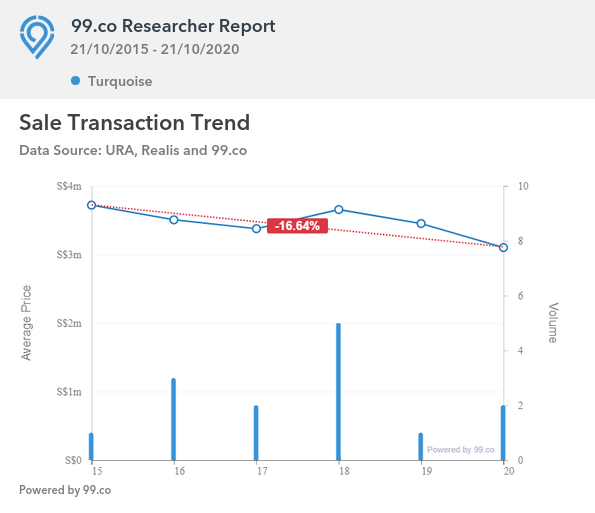

The last transaction in 2015 was at $3,718,888. The last two transactions averaged $3.1 million, an overall decline of 16.6 per cent.

Fact sheet:

Developer: Ho Bee Cove Pte. Ltd.

Address: Cove Drive (District 4 / Southern Islands)

Tenure: 99-years from 2007

TOP: 2010

Number of units: 91 units

What’s happening here?

Sentosa Cove has been in serious decline this decade. Back in 2018, it was noted that volumes and sales had reeled worse than London properties during the Brexit shock.

One of the key factors is the Additional Buyers Stamp Duty (ABSD). This imposes a tax of 20 per cent of the property price or value – whichever is higher – on foreign buyers. Unfortunately, foreign buyers are the target demographic for Sentosa Cove. In Turquoise, for example, foreigners make up 38.7 per cent of owners, with close to another five per cent being entities / companies. Only about 42 per cent of the owners are Singapore citizens.

The already high quantum, coupled with soaring ABSD rates, make Sentosa Cove properties a tough sell.

While Singaporeans could buy these properties without ABSD, consider the quantum and location involved: at over $3 million, most Singaporeans would prefer a landed property on the mainland, or an Orchard / CBD area luxury condo.

Loss #6: Seascape (-$5.2 million)

| Date Bought | 21 Dec 2011 |

| Date Sold | 29 May 2015 |

| Unit Size | 4,133 |

| Price Bought | $10,997,913 |

| Price Sold | $5,798,599 |

| Loss Incurred | -$5,200,000 |

(For condo details, see loss #3)

Loss #5: Nassim Park Residences (-$5.311 million)

| Date Bought | 5 Apr 2011 |

| Date Sold | 22 May 2019 |

| Unit Size | 6,954 |

| Price Bought | $24,116,472 |

| Price Sold | $18,803,616 |

| Loss Incurred | -$5,311,500 |

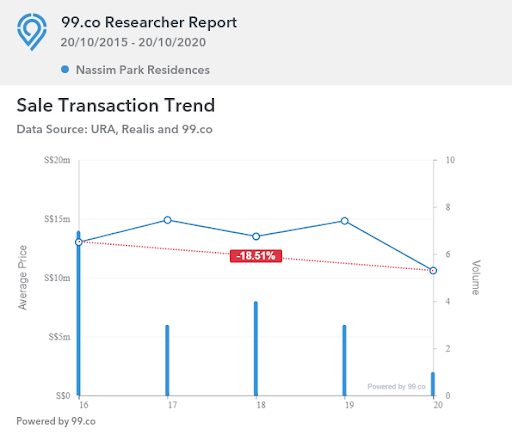

Prices at Nassim Park Residences over the past five years:

Prices at Nassim Park Residences have fallen from an average quantum of $13,007,143, to $10.6 million. This is a percentage decrease of about 18.5 per cent.

Fact sheet:

Developer: Nassim Park Developments Pte. Ltd.

Address: Nassim Road (District 10)

Tenure: Freehold

TOP: 2011

Number of units: 100 units

What’s happening here?

If you’ve been to Nassim Park Residences, you can see why it commands the prices it does. It’s always had the advantage of being close to Orchard, while being far enough to escape the noise pollution and traffic.

We suspect losing transactions may come from expatriates moving home, who don’t have a lot of time (high quantum units like these take much longer to sell). And Nassim Park Residences has always been an “expat condo”: at the time of writing, 29 per cent of the owners are foreigners, while close to 19 per cent of owners are entities / companies. ABSD may also be a contributing factor, as it would mean fewer foreign buyers. You’d usually find at the quantum prices that Nassim Park Residences is asking, most well to do Singaporeans would rather buy a landed home instead.

At any rate, this condo has much better prospects now (the losing transaction was way back in 2008). Tanglin is part of the major Orchard Road rejuvenation, and is set to become a cultural centre for the neighbourhood; most investors would consider a boon to the property.

Loss #4: Ardmore Park (-$5.5 million)

| Date Bought | 1 Dec 1999 |

| Date Sold | 1 Sep 2001 |

| Unit Size | 8,740 |

| Price Bought | $16,002,940 |

| Price Sold | $10,496,740 |

| Loss Incurred | -$5,500,000 |

(See #1 for details on this condo)

Loss #3: Seascape (-$6.6 million)

| Date Bought | 28 Jun 2010 |

| Date Sold | 7 Feb 2017 |

| Unit Size | 4,069 |

| Price Bought | $12,801,074 |

| Price Sold | $6,201,156 |

| Loss Incurred | -$6,600,000 |

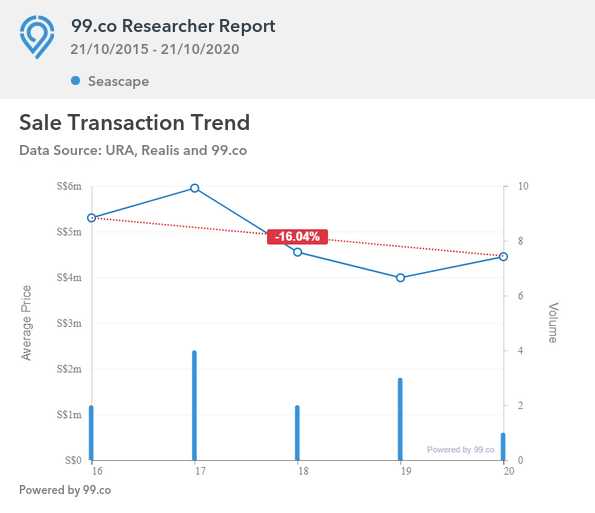

Prices at Seascape over the past five years:

There were no transactions in 2015, but two transactions in 2016 had a quantum of around $5,300,000. The last transaction in 2020 was at $4,450,000.

Fact sheet:

Developer: Seaview (Sentosa) Pte. Ltd.

Address: Cove Way (District 4 / Southern Islands)

Tenure: 99-years from 2007

TOP: 2011

Number of units: 151 units

What’s happening here?

Please see #7, as what we said about Turquoise also applies to Seascape. The key causes are also ABSD, and the preference of Singaporeans to buy on the mainland.

Loss #2: Seven Palms Sentosa Cove (-$7.12 million)

| Date Bought | 26 Feb 2010 |

| Date Sold | 12 Feb 2019 |

| Unit Size | 4,822 |

| Price Bought | $15,999,596 |

| Price Sold | $8,877,302 |

| Loss Incurred | -$7,120,000 |

There is insufficient transaction volume to see meaningful price movement. Over the past five years, the only transaction was the featured loss above.

Fact sheet:

Developer: Trollius Pte. Ltd.

Address: Cove Drive (District 4 / Southern Islands)

Tenure: 103-years from 2006

TOP: 2013

Number of units: 41 units

What’s happening here?

Please see #7, as what was discussed about Turquoise also applies to Seven Palms Sentosa Cove. The main reason continues to be ABSD, which dissuades foreign buyers, and makes selling units here difficult.

Singaporeans who could afford these units tend to prefer landed homes on the mainland.

Loss #1: Ardmore Park (-$8 million)

| Date Bought | 1 Feb 2000 |

| Date Sold | 1 Sep 2001 |

| Unit Size | 8,740 |

| Price Bought | $18,502,580 |

| Price Sold | $10,496,740 |

| Loss Incurred | $8,000,000 |

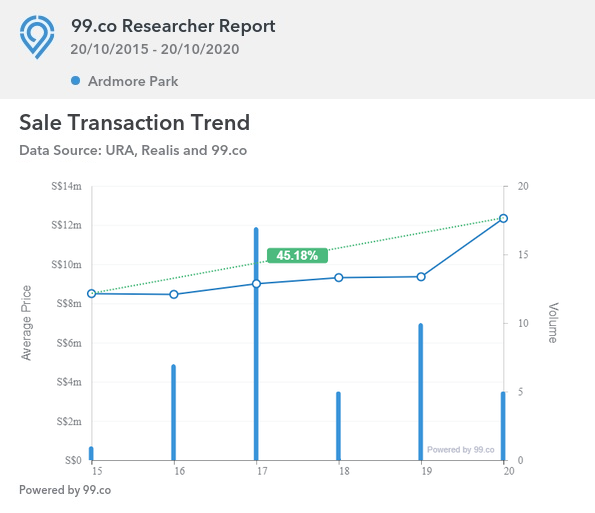

As these transactions are very old, the current prices have little relation to it; we include the following for your information only. Ardmore Park continues to appreciate well today:

Prices at Ardmore Park averaged $8.5 million in 2015, and have since risen to $12.34 million. This is a percentage gain of around 45.2 per cent.

Fact sheet:

Developer: Maro Polo Developments Pte. Ltd.

Address: Ardmore Park (District 10)

Tenure: Freehold

TOP: 2001

Number of units: 330 units

What’s happening here?

In #4, the initial purchase occurred in 1999, before Ardmore Park was complete. The unit was then sold in 2001, at around the same time Ardmore Park reached TOP. For the #1 loss, the purchase was also just a year before completion.

As such, these could have been sellers trying – and failing – to flip the unit (e.g. buying it early at a lower price, and then selling it for a profit once it’s complete). This was almost 20 years ago though, and such methods are inadvisable today due to the taxes like the Sellers Stamp Duty (SSD).

Coming back to today, Ardmore Park is one of the best performing prime region properties. In fact, one unit raked in a record $3.13 million profit in November 2018.

The condo is known for its proximity to Raffles Girls’ School (Secondary), which is about 200 metres from the development. The condo is also just a 12-minute walk to the Orchard MRT station.

The luxury property segment is a whole different market, where the rules of real estate are different.

Like James Dyson’s triplex penthouse, these properties are not conventional investments. Buyers typically have an attitude of “it’s nice if it makes money, but if it doesn’t it won’t break me”.

These properties are interesting as aspirational examples; but they’re not well -correlated to Singapore’s wider private property market. You can find reviews of more “down to earth” properties on Stacked, as well as an occasional sneak peek inside these top-end properties.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the biggest property loss recorded after James Dyson's $11.8 million penthouse loss?

Why did the owner of Orchard Scotts incur a loss of about $4.78 million?

What factors contributed to the decline in property value at Sentosa Cove's Turquoise?

How does the article explain the losses on luxury properties like The Marq on Paterson Hill?

Are luxury property losses common in Singapore, according to the article?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Picks

Property Picks Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

0 Comments