Analysing 10 Years of District 12 Boutique Condo Transactions: Insights Into What Drives Profitability

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

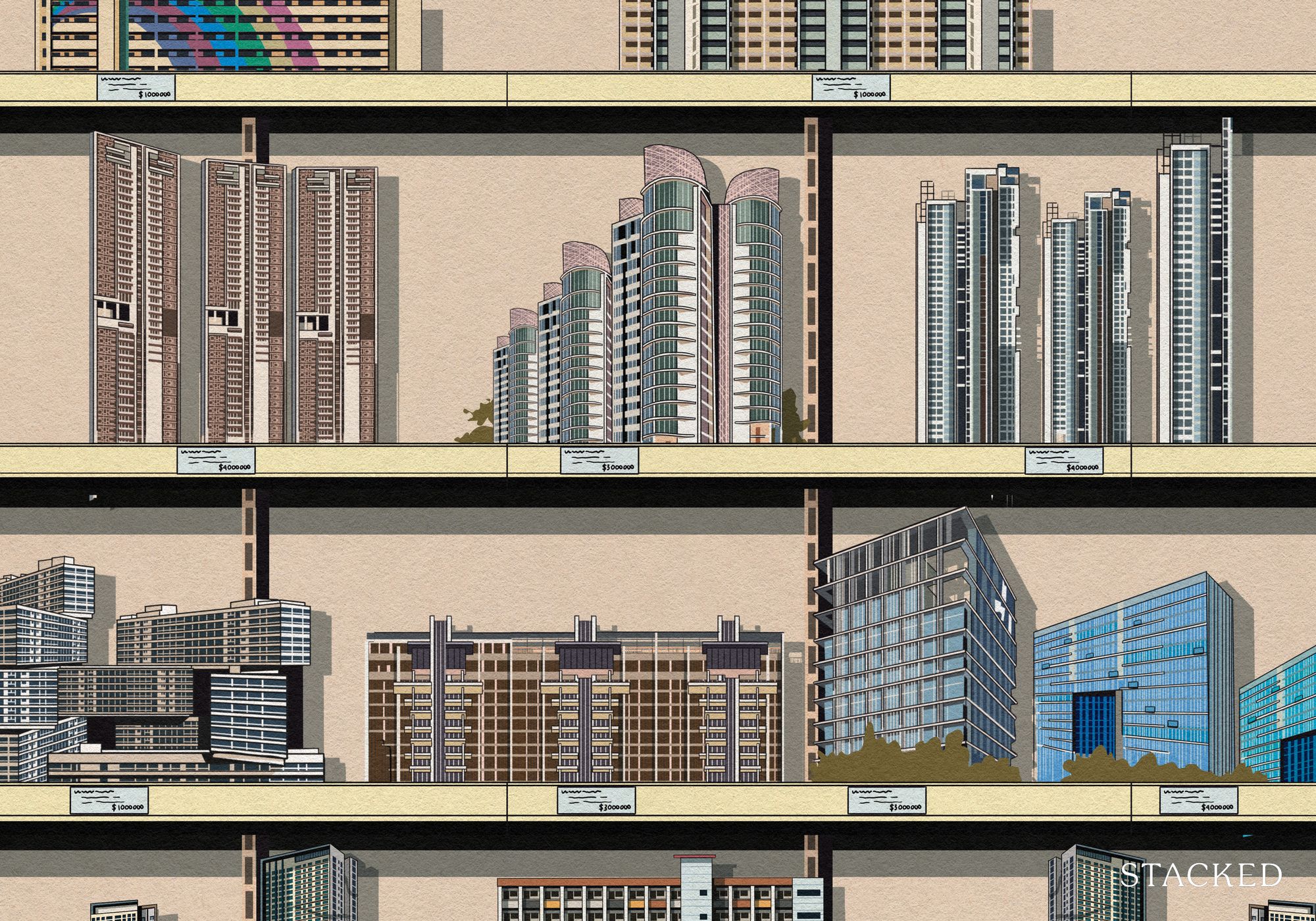

District 12 isn’t usually the first place you’d expect to find outperformers. Mention Balestier or Novena, and most buyers think of supper spots and old apartments before they think of condos. And to be frank, it is true that D12 is rather heavily built-up, and available land parcels are small; but there are boutique condos here that have punched above their weight, given the tight surroundings.

So, have boutique condos here managed to hold their own as investments? We analysed 10 years of resale transactions (2014–2024) to find out.

What do we mean by a boutique condo?

In general, these are condos with 150 units or fewer, though many in District 12 fall well below that threshold; some have fewer than 50 units. Because of their small scale, units are few and transactions may be rare. In such cases (e.g., only one transaction over more than a year), we’ve left those developments out of the analysis.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Investment Insights

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

New Launch Condo Analysis This New Freehold CBD Condo Starts From $1.29M — Here’s How the Pricing Compares

Property Investment Insights How a 1,715-Unit Mega Development Outperformed Its Freehold Neighbours

Property Investment Insights Why This Old 99-Year Leasehold Condo Outperformed Newer Projects in Bukit Timah

Latest Posts

Singapore Property News One Segment of the Singapore Property Market Is Still Climbing — Even as the Rest Slowed in 2025

Singapore Property News Why The Rising Number Of Property Agents In 2026 Doesn’t Tell The Full Story

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

On The Market Here Are The Cheapest Newer 3-Bedroom Condos You Can Still Buy Under $1.7M

Singapore Property News Why Buying Or Refinancing Your Home Makes More Sense In 2026

New Launch Condo Reviews Narra Residences Review: A New Condo in Dairy Farm Priced Close To An EC From $1,930 PSF

Property Market Commentary Why Looking at Average HDB Prices No Longer Tells the Full Story: A New Series

Singapore Property News This Latest $962 PSF Land Bid May Push Dairy Farm Homes Past $2,300 PSF — Here’s Why

On The Market Orchard Road’s Most Unlikely $250 Million Property Is Finally Up for Sale — After 20 Years

Editor's Pick We Analyse “Safer” Resale Condos in Singapore to See If They’re Actually Worth Buying: A New Series

Editor's Pick Why 2026 May Be a Good Year to Buy an EC — With an Important Caveat

Overseas Property Investing What $940,000 Buys You in Penang Today — Inside a New Freehold Landed Estate

Singapore Property News One of Singapore’s Biggest Property Agencies Just Got Censured

Singapore Property News Over 3,500 People Visit Narra Residences During First Preview Weekend

Editor's Pick 66% of Units at Coastal Cabana Sold at End of First Sales Day, Prices Average $1,734 psf