Decoupling Is No Longer a Property Hack: What the Courts and IRAS Have Made Clear

August 31, 2025

Now we have more clarification on decoupling, and it’s no longer the simple hack many of us were told to think.

For most of the ‘00s to ‘10s, decoupling was positioned as a property hack to avoid paying Additional Buyers Stamp Duty (ABSD). The concept is simple: One spouse transfers their share of the home to the other, and thus no longer owns property. This then allows them to go off and buy a property under their own name, with no ABSD, and the family effectively ends up with two properties.

This even used to be possible for HDB flat owners, right up till 2016 (from that point on, decoupling for HDB flats has only been allowed for exceptional cases, such as divorce).

But with recent cases and commentary from the courts and IRAS, the picture has become much sharper; and decoupling is no longer a neat workaround. Authorities are making clear that it’s only for a genuine transfer of ownership; and if you try to use it to avoid ABSD, you might lose more than just the monetary penalties.

What the rulings really mean

This week, I checked in with some industry professionals, and here are some clarifications:

If you decouple and give up your share, you are giving it up completely. That means the rental income, the sale proceeds, and any future claim to the property. You cannot say one thing on paper and act another way in practice.

This has already caught people out. In one case, a “former” owner kept collecting rental income and later pocketed part of the sale proceeds. IRAS saw through it and imposed penalties on top of the unpaid ABSD. In another dispute, a one per cent owner who admitted the split was for tax purposes still managed to claim over half the property in court, because the arrangement was never really genuine to begin with.

The courts have made it plain: if your transfer is a sham, it will not protect you. In fact, it may strip you of certain rights altogether.

Here are some of the other clarifications to make note of:

1. Intent is judged by actions

You can say “I’ve given up my share” all day long, but if you so much as pocket part of the sale proceeds, the law will read your intent from what you did, not what agreement you signed. As mentioned above, this has already caught people out, with IRAS disregarding the arrangement and imposing penalties on top of unpaid ABSD.

2. An ABSD saving doesn’t make it illegal

If your intention is genuinely to gift or transfer ownership, the fact that you save on ABSD as a side effect doesn’t make it unlawful. The authorities are not saying that any move which results in lower tax is automatically tax avoidance. They are saying that if your real purpose is to change who owns the property, then not paying ABSD is a resulting benefit that doesn’t “taint” your deal.

For example, suppose one spouse decides they no longer want any share in the home and transfers it completely to the other. Perhaps the marriage has failed and they’re estranged, even if there’s no official divorce. One spouse is happy to walk away with no claim to the rent, no say in the management of the property, and no entitlement to the sales proceeds. In other words, it’s a genuine transfer.

If, after this, the leaving spouse happens to buy a second property without paying ABSD (as their own separate home), saving on ABSD is just a side effect. There’s no legal wrongdoing there.

Contrast this with a sham transfer: that’s where someone supposedly “gives up” their share, but secretly continues to collect part of the rental income, or has an understanding that the sales proceeds will be shared later.

In such a case, authorities might decide the transaction was never truly about giving up ownership; it was just to keep benefits while avoiding ABSD, and that’s illegal.

So the test isn’t whether you saved on ABSD or not. It’s whether you gave up the benefit of ownership entirely. If you did, the saving is incidental and legitimate. If you didn’t, the saving is contrived and unlawful.

3. Trusts are not off-limits

The Stamp Duties Act doesn’t prohibit the creation of a trust. What matters is that the trust reflects reality: during the trust, the beneficiary enjoys the rental income, and upon sale, the beneficiary receives the proceeds.

In other words, if you set up a trust where your spouse or child is the beneficiary, the law expects them to actually enjoy the benefits of ownership. That means that, while the property is being rented out, the rental income must flow to them, not you. And when the property is eventually sold, the sales proceeds must also go to them.

More from Stacked

When My Gong Gong With Dementia Went Missing: Are Singapore’s Neighbourhoods Prepared For An Ageing Crisis?

Just the other day, I received a distressing call from my panic-stricken auntie asking for help.

This is what separates a genuine trust from a sham arrangement.

If you claim the property is for your child on paper, but you’re actually pocketing the rental income – or you keep the sale proceeds when it’s sold – then it will be seen as tax avoidance.

And in case it needs to be said, yes, such an under-the-table arrangement gives the beneficiary a very sharp knife with which to backstab you.

4. IRAS has sweeping powers

Section 33A of the Stamp Duties Act gives IRAS the power to disregard or vary any arrangement it deems avoidance.

In other words, even if you had a lawyer set up a trust or go through all the expensive paperwork ages ago, IRAS can still say: “Too bad, doesn’t count.” They can treat the deal as though it never happened, and then back-charge you for the ABSD you were trying to avoid.

On a related note, Section 46(1)(c) takes it further by allowing penalties of up to four times the duty that should have been paid. So unpaid ABSD of $200,000 can end up being $800,000; and the subsequent Section 62 also raises the possibility of criminal liability – jail for up to three years can happen (although jail is quite rare for property tax cases).

As news of this sinks in, we might see a shift in market behaviour

These clarifications could cool some speculative demand. For much of the 2010s, couples structured their first home in a 99-to-1 split, with the idea of a future decouple baked in. It was marketed as a “smart move” for anyone who could afford to hold two properties.

But now, families who once saw a second condo as a tidy investment may now decide it’s safer to skip out on multiple property ownership, and simply upgrade into a bigger joint home. This could push more demand into larger three- and four-bedroom units among upgraders, while sapping demand for more compact units.

(The old “sell one, buy two” strategy often involved purchasing one family unit, and then one more smaller compact unit, often a one or two-bedder.)

That said, some realtors have opined that – rule clarifications or no – “sell one, buy two” has become uncommon today anyway, as higher costs make it harder to take on two separate mortgages.

Meanwhile, in other property news…

- A family explains why they sold their unit at Hundred Palms EC, a project that’s arguably the most successful EC to date (performance-wise)

- We tested AI to see if it can optimise unit layouts or replace Interior Designers; here’s what we found.

- Can a two-bedder condo unit be profitable in Singapore today? Here are some that will surprise you with their performance.

- Join our Stacked Pro readers, as we uncover the price gaps between resale flats and equivalent-sized condo units in different estates.

Weekly Sales Roundup (18 – 24 August)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PROMENADE PEAK | $4,747,600 | 1421 | $3,341 | 99 yrs (2024) |

| NAVA GROVE | $4,040,600 | 1550 | $2,607 | 99 yrs (2024) |

| PARKTOWN RESIDENCE | $3,841,000 | 1679 | $2,287 | 99 yrs (2023) |

| BLOOMSBURY RESIDENCES | $3,804,000 | 1421 | $2,677 | 99 yrs (2024) |

| THE ROBERTSON OPUS | $3,720,000 | 1152 | $3,230 | 999 yrs (1841) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SPRINGLEAF RESIDENCE | $907,000 | 388 | $2,341 | 99 yrs (2024) |

| ARTISAN 8 | $998,000 | 398 | $2,506 | FH |

| CANBERRA CRESCENT RESIDENCES | $1,090,000 | 570 | $1,911 | 99 yrs (2024) |

| THE ROBERTSON OPUS | $1,380,000 | 431 | $3,205 | 999 yrs (1841) |

| PROMENADE PEAK | $1,413,067 | 527 | $2,679 | 99 yrs (2024) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| GRANGE RESIDENCES | $8,500,000 | 2583 | $3,290 | FH |

| BOULEVARD 88 | $7,800,000 | 1776 | $4,392 | FH |

| RIVIERE | $6,050,000 | 2002 | $3,022 | 99 yrs (2018) |

| ST REGIS RESIDENCES SINGAPORE | $5,382,500 | 2153 | $2,500 | 999 yrs (1995) |

| THE SEAFRONT ON MEYER | $5,280,000 | 2110 | $2,503 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE HILLFORD | $601,000 | 398 | $1,509 | 60 yrs (2013) |

| HEDGES PARK CONDOMINIUM | $697,000 | 484 | $1,439 | 99 yrs (2010) |

| URBAN VISTA | $730,000 | 441 | $1,654 | 99 yrs (2012) |

| Q BAY RESIDENCES | $740,000 | 527 | $1,403 | 99 yrs (2012) |

| RIVERFRONT RESIDENCES | $780,000 | 463 | $1,685 | 99 yrs (2018) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| GRANGE RESIDENCES | $8,500,000 | 2583 | $3,290 | $4,662,000 | 19 Years |

| ELLIOT AT THE EAST COAST | $5,025,000 | 2831 | $1,775 | $2,802,000 | 16 Years |

| THE SEAFRONT ON MEYER | $5,280,000 | 2110 | $2,503 | $1,680,000 | 12 Years |

| VARSITY PARK CONDOMINIUM | $2,300,000 | 1399 | $1,644 | $1,617,899 | 19 Years |

| FLORIDIAN | $4,068,000 | 1679 | $2,423 | $1,582,810 | 15 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| V ON SHENTON | $1,065,000 | 484 | $2,199 | -$222,000 | 13 Years |

| MARINA BAY RESIDENCES | $1,730,000 | 732 | $2,364 | -$219,300 | 15 Years |

| ECO | $950,000 | 689 | $1,379 | -$95,930 | 12 Years |

| 8 SAINT THOMAS | $2,480,000 | 807 | $3,072 | -$92,000 | 7 Years |

| SEAHILL | $1,368,000 | 861 | $1,589 | -$80,500 | 12 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| VARSITY PARK CONDOMINIUM | $2,300,000 | 1399 | $1,644 | 237.2% | 19 Years |

| THE SEA VIEW | $1,358,000 | 560 | $2,426 | 232.2% | 20 Years |

| THE RAINTREE | $2,060,000 | 1302 | $1,582 | 224.1% | 20 Years |

| BAYWATER | $2,188,888 | 1518 | $1,442 | 193.8% | 22 Years |

| PARC OASIS | $1,520,000 | 1227 | $1,239 | 192.3% | 24 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| V ON SHENTON | $1,065,000 | 484 | $2,199 | -17.2% | 13 Years |

| MARINA BAY RESIDENCES | $1,730,000 | 732 | $2,364 | -11.3% | 15 Years |

| ECO | $950,000 | 689 | $1,379 | -9.2% | 12 Years |

| SEAHILL | $1,368,000 | 861 | $1,589 | -5.6% | 12 Years |

| 8 SAINT THOMAS | $2,480,000 | 807 | $3,072 | -3.6% | 7 Years |

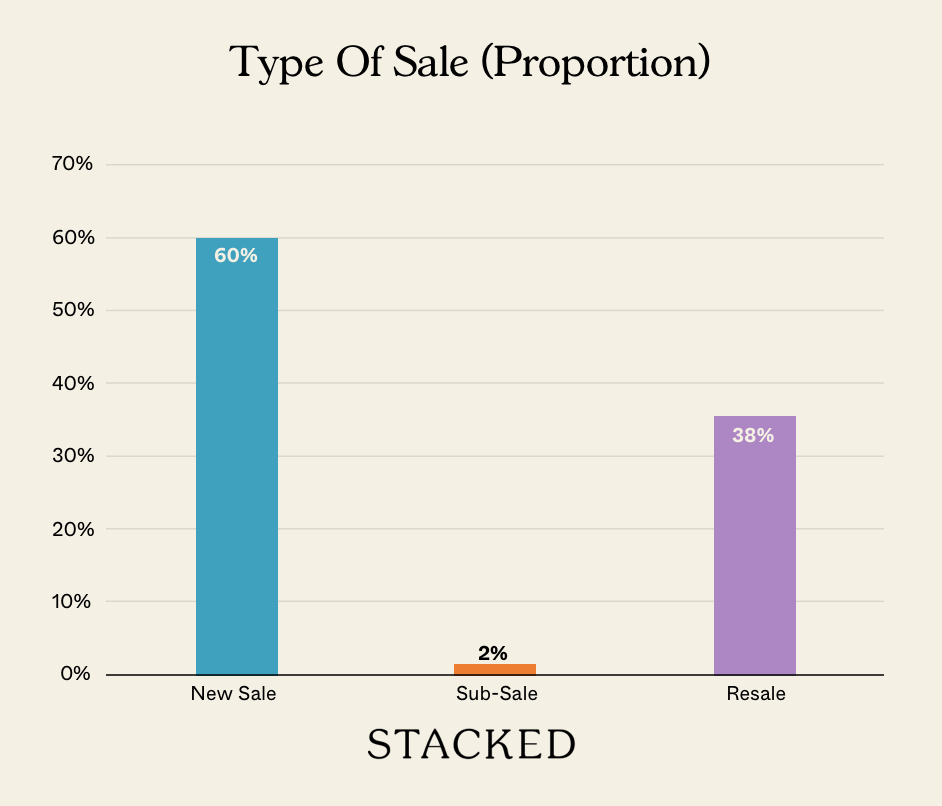

Transaction Breakdown

Follow us on Stacked for more on the Singapore housing market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What does recent legal clarification say about using decoupling to avoid property taxes in Singapore?

Can I still set up a trust to transfer property ownership without facing penalties?

How do authorities determine if a property transfer is genuine or a sham?

What are the risks of trying to use decoupling to avoid property taxes in Singapore?

How might these clarifications affect property market behavior in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Singapore Property News Why Housing Took A Back Seat In Budget 2026

Latest Posts

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

1 Comments

the concept of marriage and sharing everything comes into question.. and what about women’s charter for assets?