Can You ACTUALLY Lose Money With Landed Property In Singapore? We Look At Data From 26 Years

July 9, 2021

Today, the purchase of a $40 million Bin Tong Park Good Class Bungalow by Grab CEO Anthony Tan hit the headlines. This follows the purchase of a $36 million Good Class Bungalow (GCB) last week. It’s clear that larger properties – and in particular landed property – are in vogue this season. However, these high quantum properties are a small sliver of the Singapore private property market; and their performance is not well tracked (there really aren’t a lot of transactions to go by). Still, in this article, we’ll try to determine what sort of gains or losses you might expect from a landed property:

A look at landed property prices in Q2 2021

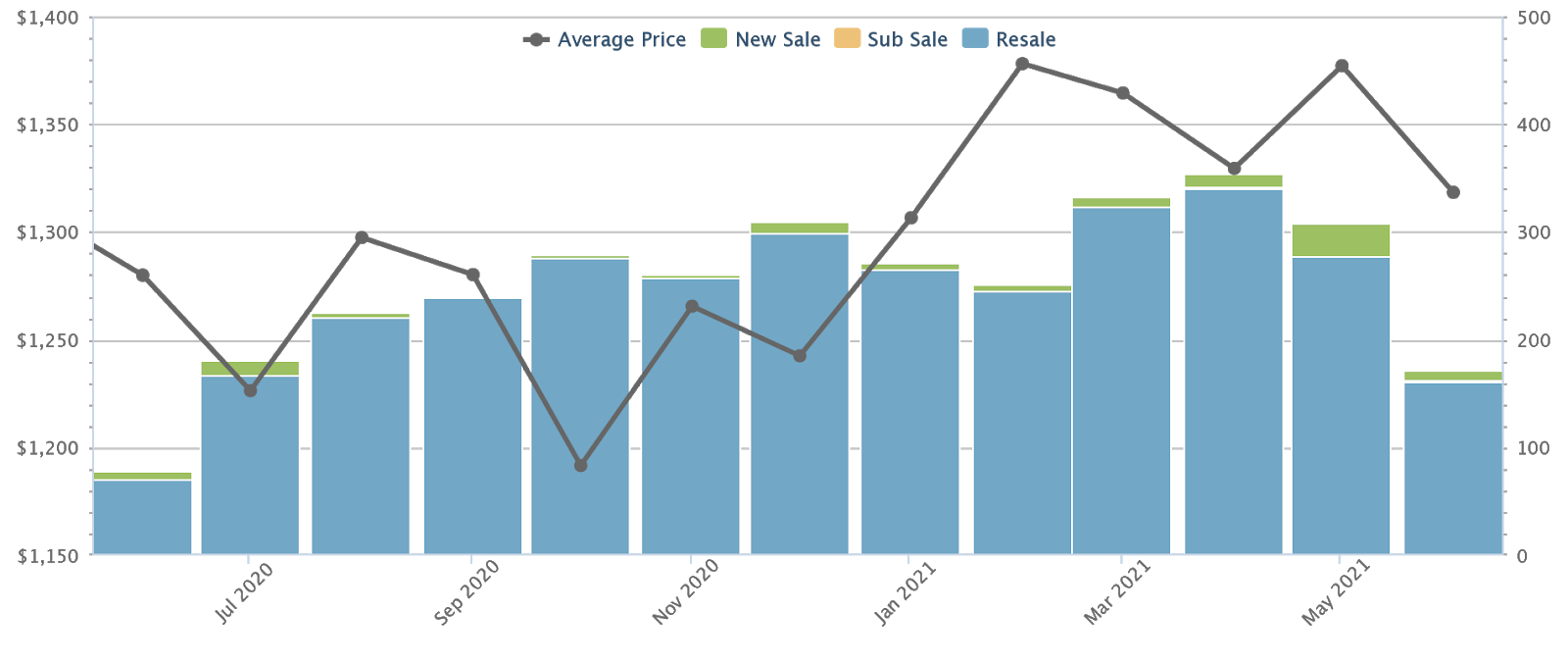

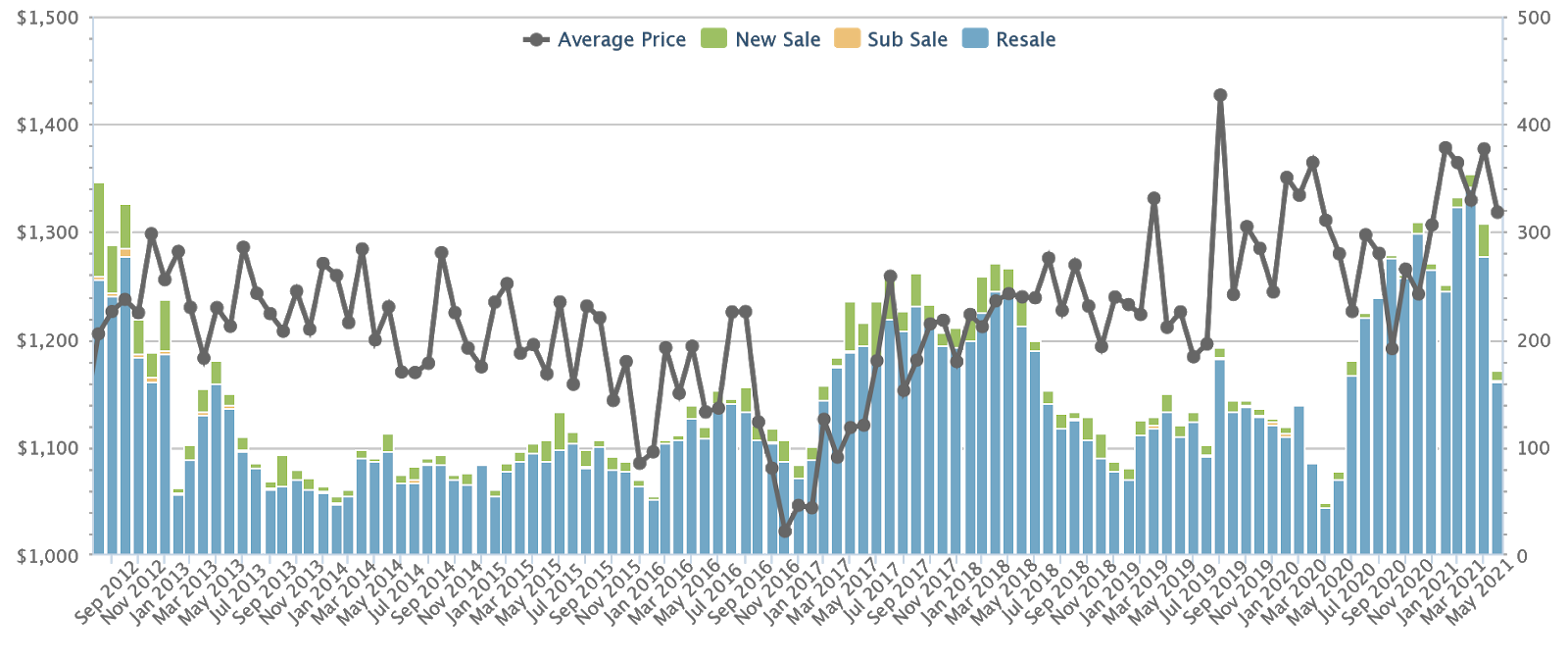

Average landed property prices, across Singapore, now stand at $1,318 psf. The average for new sales is $1,431 psf, while resale units average $1,315 psf.

Overall transaction volumes are among the highest we’ve seen in around eight years. The most recent peak in April 2021 saw 354 landed home transactions, a number that was only beaten way back in August 2012 (346 units):

Between August to May this year, landed home transactions never fell below 225 in any given month. Realtors also told us transaction numbers fell in May simply because of a return to Phase Two (Heightened Alert); this restricted viewings and slowed sales, or else we’d likely have topped 225 units that month as well (there were 171 transactions even in spite of restrictions).

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

We Compared Old vs New Condos in One of Singapore’s Fastest-Growing Districts — Here’s What We Found for Small Units

District 5 (D5) is often considered the “education belt” of Singapore, thanks to the presence of NUS, SIT, UniSIM, etc.…

Realtors we spoke to gave three likely reasons for the current demand:

- Landed homes are a safe haven investment, in times of economic uncertainty.

- Fear of potential new cooling measures has incentivised higher-quantum purchases; this is due to some home buyers being afraid that they’ll be priced out, if new stamp duties or loan curbs kick in.

- Growing permanence of Work From Home arrangements, as well as the memory of cramped spaces during the last Circuit Breaker, have prompted a desire for larger homes.

This desire runs contrary to many new launch condo designs, which cater to an earlier trend of low quantum, high price per square foot (i.e., small) units in central locations.

Gains and losses of landed properties

The following shows the average gains and losses from landed property transactions, across multiple districts. As is often the case, transaction volumes are low for these scarce, high-quantum properties; but some trends are visible from the limited data.

Key points to note

- District 9 seems to show the best potential for gains

- Barring some outliers, District 17 has the worst average losses to date

- Sentosa Cove still shows little signs of recovery

- Larger units tend to do better, in prime regions

- Overall, average gains significantly outweigh average losses

1. District 9 seems to show the best potential for gains

District 9 is the reigning favourite for landed properties, and this hasn’t changed in decades. It’s easy to see why – with gains averaging about 129.3 per cent, and losses averaging a mere 14.7 per cent, this is still the “safest” district to bet on.

There’s also the fact that District 9 properties (landed or otherwise) are almost all freehold. As we’ve mentioned in a previous article, demand is heavily skewed toward freehold, when it comes to landed properties.

Buyers may also be interested to note that, while Districts 9, 10, and 11 are often considered peers, District 9 comes out far ahead.

In fact, the next top district for average gains isn’t even Districts 10 and 11; it’s District 15, where we see an average of close to 119.8 per cent.

2. Barring some outliers, District 17 has the worst average losses to date

Outliers include the $1.51 million loss in District 15 (single unit), and $820,000 loss in District 17 (also a single unit).

Besides showing the highest average loss at around 23.1 per cent, District 17 only shows average gains of around 54 per cent (below the overall average of 66 per cent).

Realtors we spoke to opined that the average was probably lower mainly because of the lack of demand in the area, as much as landed property is in demand, the far off location of some of these will naturally put most buyers off.

3. Sentosa Cove still shows little signs of recovery

While it’s no longer the worst for losses, District 4 is still characterised by lacklustre gains (48.5 per cent, against the island-wide average of 66 per cent). This runs contrary to the speculation that prices have bottomed out here, and that foreign investors could bring a revival (we touched on the topic in a prior article).

The problem remains unchanged: foreign buyers have fallen in number due to a 20 per cent Additional Buyers Stamp Duty (ABSD), while local buyers overwhelmingly want freehold landed homes (Sentosa Cove landed properties are leasehold).

4. Larger units tend to do better, in prime regions

In Districts 10 and 11, units that were 15,000 sq. ft. or larger saw higher average gains. Conversely, units in non-central districts, such as District 19 and 20, tended to see higher averages for units below 15,000 sq.

A notable exception is the city fringe area of District 4, where Sentosa Cove is located. Smaller landed homes have seen a much higher volume of transactions, and average gains of around 48.5 per cent, compared to two larger units that saw gains of around 18.6 per cent.

Do note, however, that transaction volumes for units 15,000 sq. ft. or larger are small; often in the single digits. This makes potential gains more speculative.

Property Market CommentaryAre Sentosa Cove Bungalows Really Seeing A Turnaround?

by Ryan J. Ong5. Overall, average gains significantly outweigh average losses

The numbers make it hard to argue against landed homes as an investment. The overwhelming number of landed home purchases – even in non-prime areas – are profitable.

Average gains stand at a whopping $1,182,465; and even for the handful of unprofitable transactions, average losses only average around $369,420.

Ultimately, this comes down to the fact that landed homes make up barely five per cent of private properties in Singapore. Buyers also tend to be among the most affluent and well-capitalised, so mortgagee sales or discounts are much harder to come by (and tend to only be for leasehold landed).

It’s also worth noting that cheap credit is abundant right now, with home loan rates at just around 1.3 per cent per annum. This means landed home buyers would pay about half the interest rate of an HDB flat owner; an enticing prospect given the potential resale gains.

We’ll take a more specific look at Good Class Bungalows (GCBs) next, so do follow us on Stacked. You can also check out in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Can I really lose money investing in landed property in Singapore?

What are the recent trends in landed property prices in Singapore?

Are landed properties in Singapore a safe investment during uncertain economic times?

How have transaction volumes for landed homes changed recently in Singapore?

What factors are driving demand for landed properties in Singapore now?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

0 Comments