Buying A New Launch Condo Early Vs Late: Here’s How It Compares

March 21, 2022

You’ve done all your homework, and have finally found the right home after months of searching. It’s a popular new launch condo, and you submit your cheque to be part of the balloting process.

There have been more than 1,000 cheques collected, and there are just 300 units for sale.

On balloting day, you wait for the results with bated breath, hoping to get a favourable ballot number to give you a chance to select one of your choice units.

Your phone pings.

You open the message with bated breath, and your trembling fingers hover over the button to tap the message.

The number 1043 flashes up, accompanied by a message from your agent telling you to focus on the next launch. Your heart sinks, all hopes have been dashed, and it’s left you feeling like a pricked balloon.

Sounds familiar? While this was my exaggerated attempt at setting the scene, I think it’s fair to say this was a feeling that most of us could resonate with, especially from the run-up in late 2020 till last year, when the supply of new launches were dearth (~ 14,000 unsold units as of Q4 2021), and demand for new homes was surprisingly resilient (and partially driven by the FOMO sentiment).

Having an ideal ballot number not only puts us in a position to secure our choice units. It also allows us to reap potential paper/capital gains as the developers stage up the prices of their unsold inventory. However, this is not something that we have control over unless you are buying multiple units yourself/with one or more family members or as a real estate agent, where you will have priority to buy new launch units over the general public.

Should you resign to your fate when you obtained an undesirable ballot number or are there opportunities to be found by buying leftover units? Let us unveil our findings for you!

2. Notes on this Study

Before we present our findings, here are the following points that we wish to highlight –

- The dataset in our study comprises close to 60,000 transactions from URA spanning from 2003 to present day. The year 2003 was chosen since there was only data from 1995 that we could rely on. We also needed assurance that new sales didn’t occur before 1995 or it would not have been captured. As such, the year 2003 was chosen to safely account for this as it’s far enough away from 1995, yet captures a large enough dataset for analysis (almost 20 years!).

- The transactions were collated based on the Register of Booking (i.e. Form 1 in the First Schedule to the Housing Developers Rules) submitted by the developers to URA. While the dates of the transactions are accurate, the sequence of units sold within the day is not reported (e.g. Units A and B transacted sequentially on the same day may end up being reported differently with Unit B preceding Unit A). However, we are of the view that this is not a major issue, as most developers defer staging up of their units’ prices towards the end, when the price difference between early and later buyers are more distinct. Moreover, price staging within the day happens if units are flying off the shelves and are not so relevant when comparing the profitability between the first and last batch of buyers.

- Two categories of transactions were used for this study as shown below –

- First 30% – refers to transacted units that fell within the first 30% (i.e. 1st to 30th percentiles) of the total units sold and recorded; and

- Last 30% – refers to transacted units that fell within the last 30% (i.e. 71st to 100th percentiles) of the total units sold and recorded.

3. Key findings

The key findings of our study are summarised as follows –

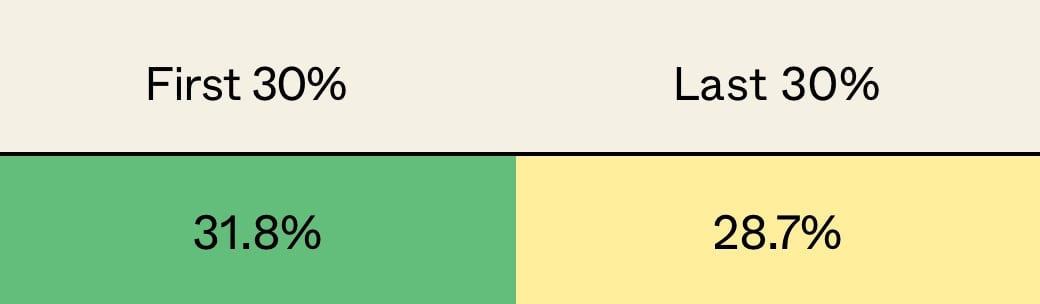

1. Based on the profitability of actual transactions since 2003, new units sold during the first 30% recorded better gains on average than those that fell in the last 30%.

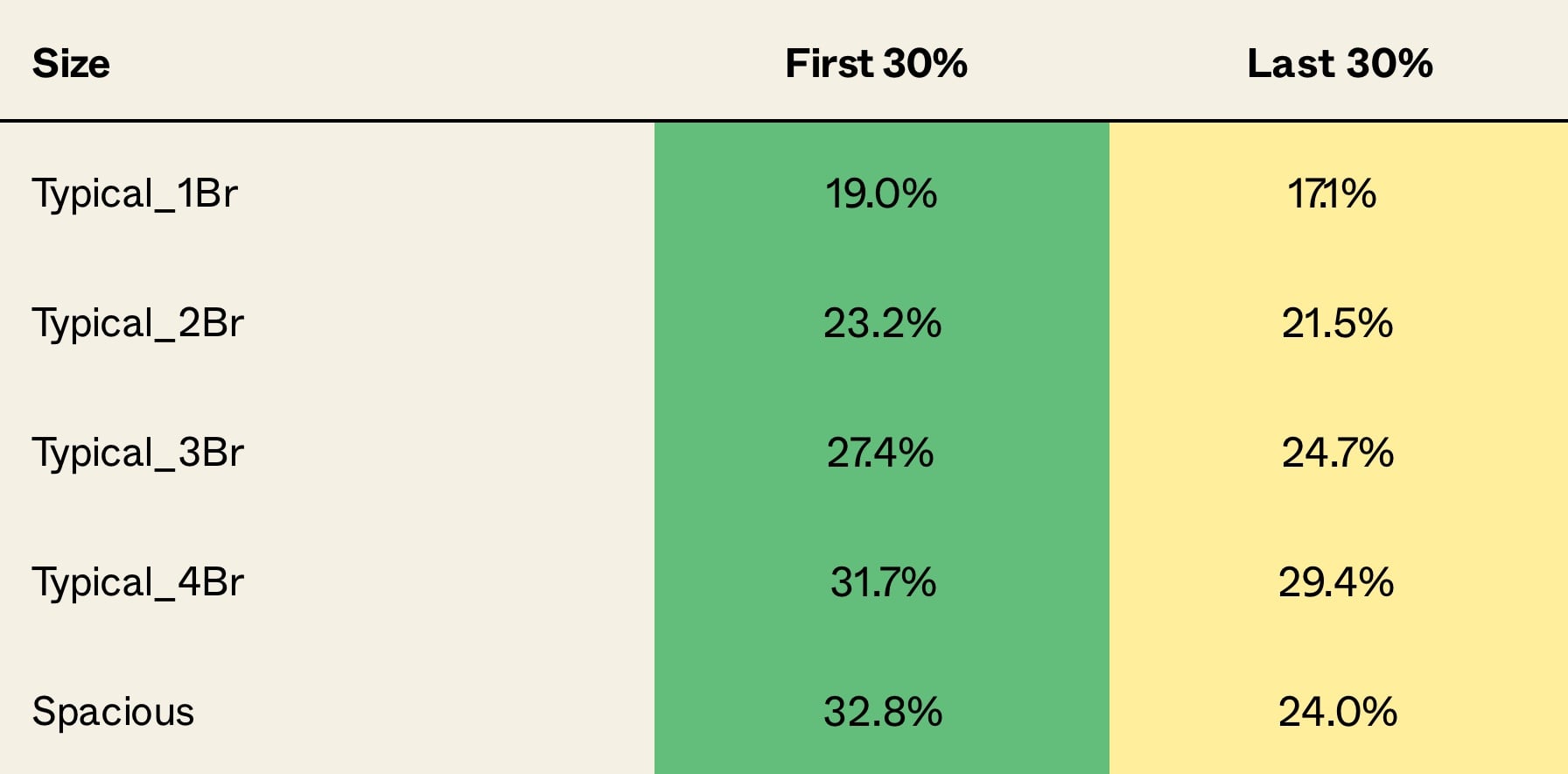

2. Similar trend was observed where the first 30% of new sales outperformed their counterparts sold in the later phases across unit sizes.

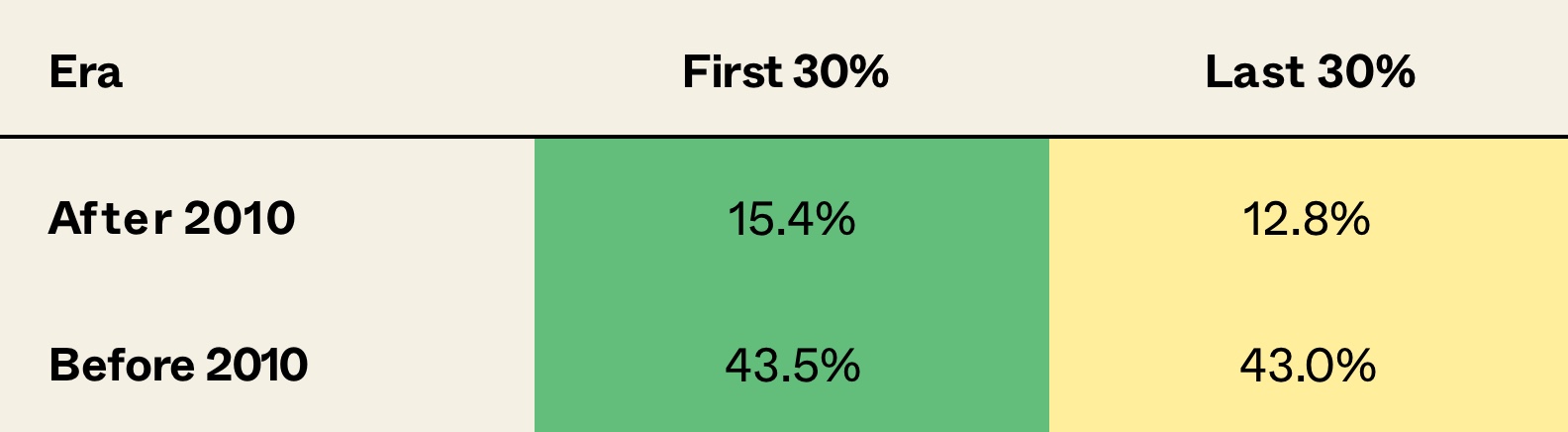

3. When comparing between new units sold in the 2010s and 2000s, it was noted that while new units sold in the first 30% edged those sold in the last 30%, the gains in the 2000s were significantly higher than those sold during the 2010s. Naturally, this underscores the value of holding power (i.e. the longer you hold your unit, the better the gains), as well as the market sentiment at the point of purchase

4. A hedonic regression analysis, however, reveals that if we account for factors such as holding period, there is no statistical significance that buying in the first 30% would result in better gains. However, we have observed a slightly negative effect when buying the last 30% of units in a new sale, though it is also not statistically significant. This means that we cannot generalise the fact that buying early results in better gains while being the last few buyers will result in losses.

3A) New units sold during the first 30% recorded better gains on average

In line with conventional belief, we saw that early buyers in a new launch benefitted from being the first movers, as the gains they reaped surpassed that of later buyers by about $40K on average (pls see Table 1 below).

This is no surprise, as developers tend to price their new units sensitively on launch day to test the market’s receptivity to their products, while also attempting to move a certain percentage of their units before they qualify for loan facilities from their banks.

3B) Early buyers outperformed their counterparts across unit sizes

On average, early buyers also registered higher gains than their later counterparts across all unit sizes as shown in Table 2 below.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Signature Park Review: All About Family Living

The dawn of the 21st century brought many positive changes to Singapore - and perhaps one of the most influential…

However, we wish to emphasise that the difference has been averaged out. There are pockets of opportunities in some of today’s new launches that saw some units holding steady prices since launch day (e.g. 4-bedders at Treasure at Tampines, 5-bedders at Florence Residences) or even lower prices (e.g. 2 to 4-bedders at One Pearl Bank).

3C) Houses sold before 2010 clocked much higher gains regardless of entry point

We did expect the same trend where early buyers have higher profits than later buyers to repeat itself for this finding. However, what was unexpected was the significant difference in the gains, which was more than 3 times for transactions recorded before 2010 than those that took place after 2010 (pls see Table 3 below).

One reason for this observation could be attributed to the slew of cooling measures that were implemented after 2010 (e.g. buyer/additional buyer stamp duties, seller stamp duties, Total Debt Servicing Ratio) which required higher upfront costs that eroded potential capital gains for sellers. Against this backdrop, increasing land cost also heralded more pricey homes.

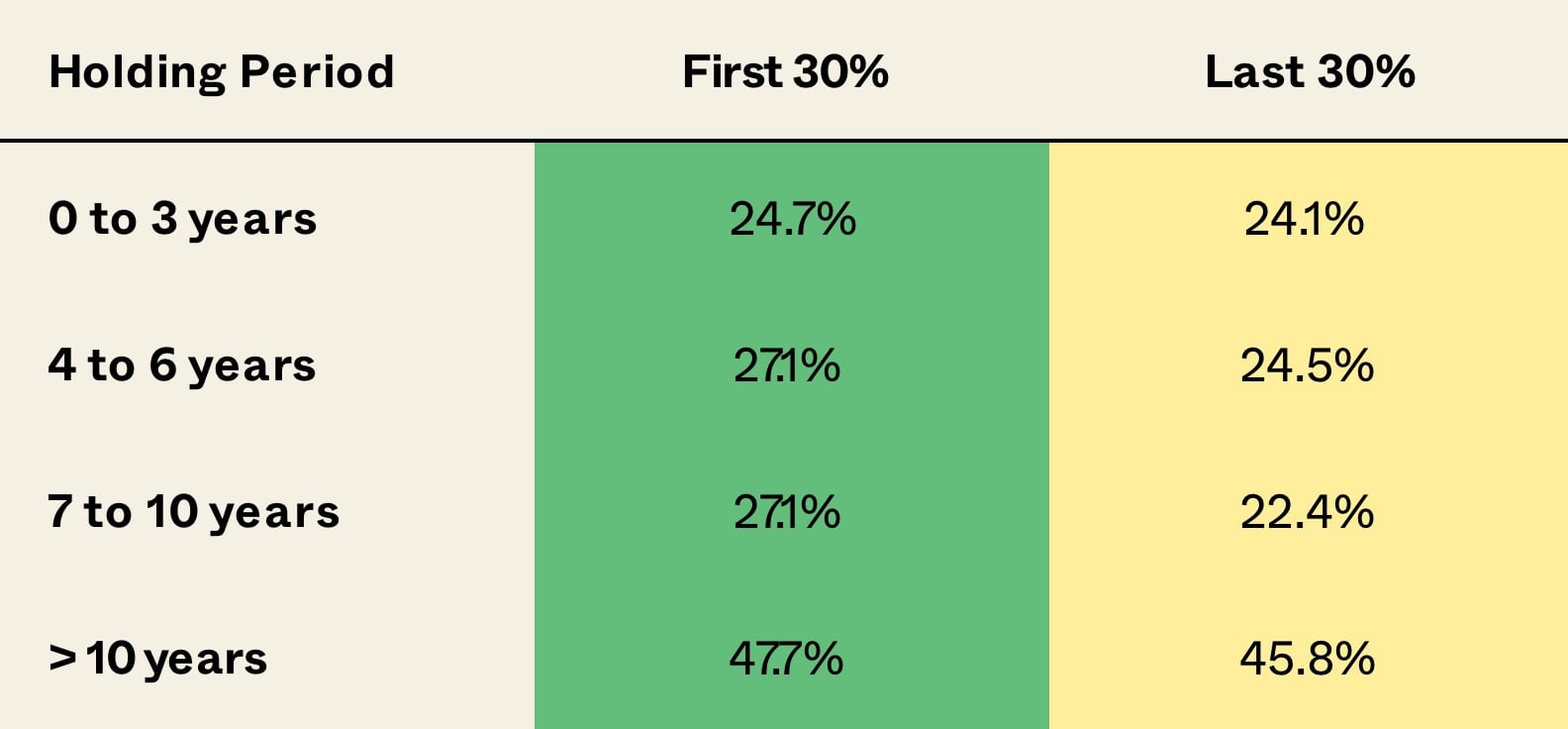

Another possible explanation is the longer holding period for houses bought before 2010, which would have provided more runway for capital appreciation as indicated in Table 5 below.

3D) While empirical evidence shows gains are likely in the first 30%, it cannot be a generalised rule.

It’s important to highlight that the above results were based on actual transactions since 2003. To examine whether buying early can be generalised though, we ran a hedonic regression to account for other factors that could affect the profitability such as the holding period. Once these factors were normalised, we found that there is no statistical significance on the effect of profitability whether one purchased within the first 30% or the last 30% of units available.

As such, despite actual transactions being more profitable for those who bought in the first 30% over the last 30% of buyers, this rule cannot be generalised for all cases (otherwise, buying a property would be a black and white affair).

This may seem counter-intuitive as you will always hear about developer staging their prices upwards through the sales cycle. We have observed from past research that bigger developments tend to do this quite systematically, however, this becomes less true for projects of a boutique nature, or for those luxury-focused ones.

Just take a look at the 2-bedroom $PSF changes of various new launches that were dug up in January this year:

It’s clear that the larger developments saw their $PSF rising gradually (Treasure At Tampines saw $PSF rising consecutively each month perfectly).

This could be due to the fact that boutique developers have less exposure when it comes to marketing, so lowering their prices in the later stages of the cycle might be important to attract sales.

For luxury-focused ones, the various cooling measures, smaller target audience along with the 5-year ABSD deadline would likely deter developers from raising prices. On the contrary, they may even lower it to avoid having unsold units by the time the deadline is up.

To dig deeper into this thought process, we will be looking at a further study to compare the effects of buying within the first 30% and last 30% of units within developments segmented by whether they’re mass-market or boutique ones.

4) Closing Thoughts

While actual transactions point to bigger profits if you buy early on compared to later, it’s easy to see why this rule cannot be the norm given the lack of statistical significance once other factors are taken into consideration.

It may be true for mass-market condominiums versus boutique/luxury ones, but as that wasn’t the focus of our study, it’s not something that can be concluded at this point.

In general, if the condo is well-priced, popular, and is priced staged well throughout its sales period, it’s definitely easy to conclude that buying early would be an advantage as compared to those that buy late at the highest prices.

The problem is that not every condo will enjoy such a smooth sales process. There are a lot of nuances to manoeuvre during those few years: competitors launching at more competitive prices, cooling measures, external economic factors, and black swan events like the pandemic – just to name a few.

As such, developers will be pricing accordingly to reflect market changes and demand – so the situations may vary.

If you are a home buyer right now, you are probably facing the reality that buying a home is not as straightforward as it seems on the surface. With a moderated Government Land Sales Programme due to the uncertain economic outlook brought by the ongoing pandemic, we expect the insatiable demand of homebuyers to persist in the short term, which translates to a more competitive balloting process.

Besides balloting for a new unit, do consider private homes in the resale market that are fairly new, which could offer decent upside. One simple example would be resale units with no new private homes supply in the pipeline in the area.

If you are exhausted from balloting for one new launch after the other and would like to explore other options, do drop us a note and we will be happy to assist you.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is it better to buy a new launch condo early or late to maximize profits?

Do unit sizes affect the profitability of buying early in a new condo launch?

Has the era when the property was bought influenced the gains from early or late purchases?

Can I assume buying in the first 30% of units always results in better profits?

How do market conditions and cooling measures impact the advantage of buying early in a new launch?

What should I consider if I want to buy a condo now given the current market situation?

Ian Tan

Ian is a property enthusiast who finds himself constantly learning about this art and uses data to educate himself on property investment. When not analysing property data, Ian can be found shooting hoops, eating healthily and reflecting on himself, so that he can continue pursuing his aspirations for as long as his mind and body allow.Need help with a property decision?

Speak to our team →Read next from New Launch Condo Analysis

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

New Launch Condo Analysis This New Freehold CBD Condo Starts From $1.29M — Here’s How the Pricing Compares

New Launch Condo Analysis This Freehold New Launch Condo In The CBD Is Launching From Just $1.29M

New Launch Condo Analysis I Reviewed A New Launch 4-Bedroom Penthouse At Beauty World

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

10 Comments

Normanton park not included…

Hi could you send the same to me too? Thanks

Very insightful condo pricing heatmap! Is it possible to share a refresh version of the heatmap with 2022 Q1 and Q2 data?