Are “Normal” HDB Flats Still Affordable? Here Are The Price Trends Without Million-Dollar HDB Types

January 25, 2025

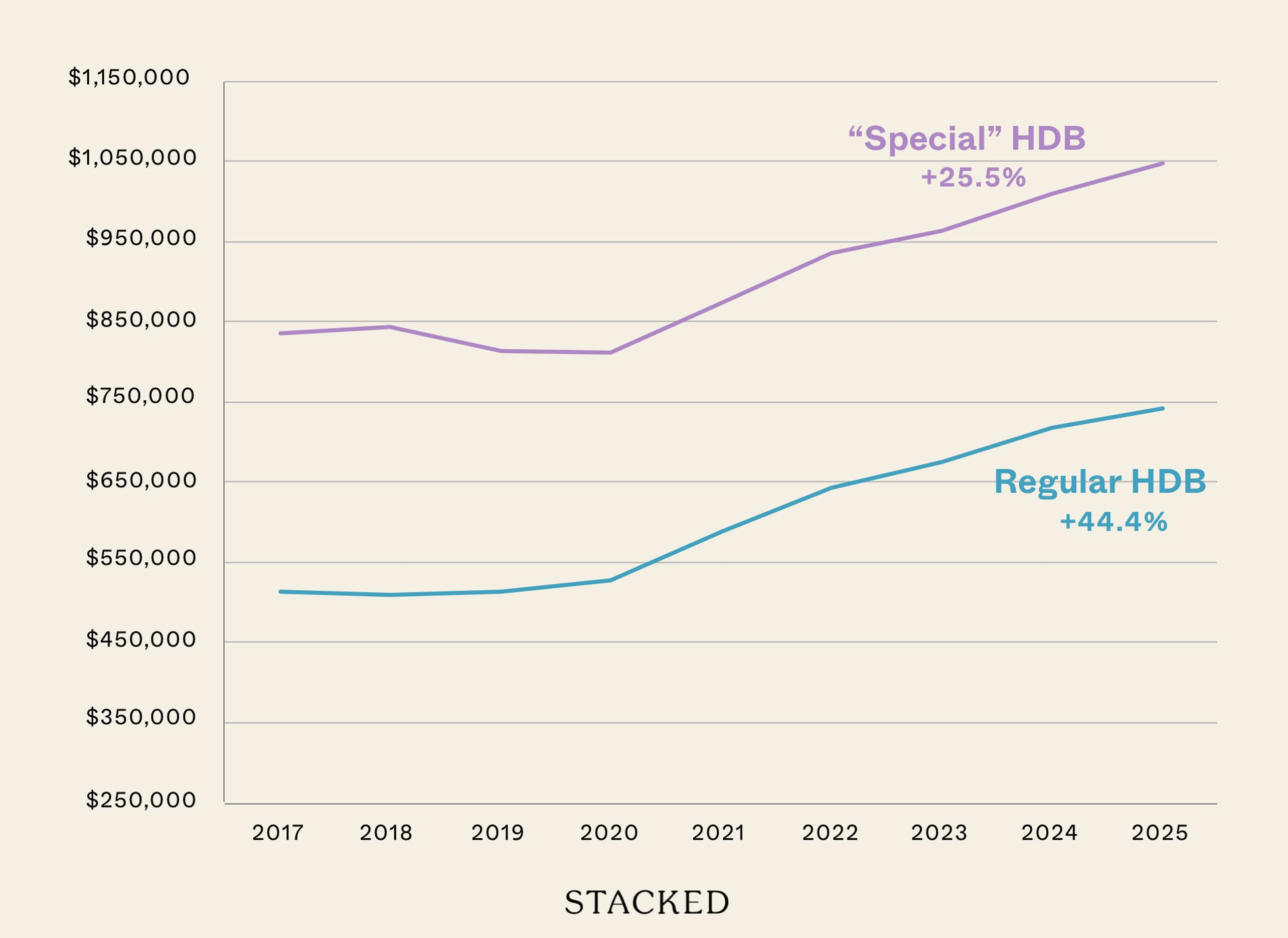

From a new record of $1.73 million for a 5-room flat to a 3-room flat hitting $900,000, the affordability of our resale HDB flats has come into question yet again. As part of the argument, we hear claims that most million-dollar (or $1.5 million+) flats are not “normal” flats. Some readers have also suggested that, if we leave out special flats like DBSS, jumbo flats, maisonettes, etc., the real price growth wouldn’t be as high as it seems. For this reason, we decided to take a look at the price growth of HDB flats, both with and without the rare special units:

A quick note on what we mean by “normal” flats:

Our definition of “normal” is flats that do not mean the following criteria:

- 3Gen and Multigenerational

- Adjoined/Jumbo flats

- DBSS

- Any maisonette

- Flats at Pinnacle@Duxton

In addition, we’ve removed HDB terraced houses from consideration entirely, as these are not typical HDB flats but landed homes. Including them would also distort results, because HDB classifies them as 3-room.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Let’s start with an overall picture of price increases in the resale flat market

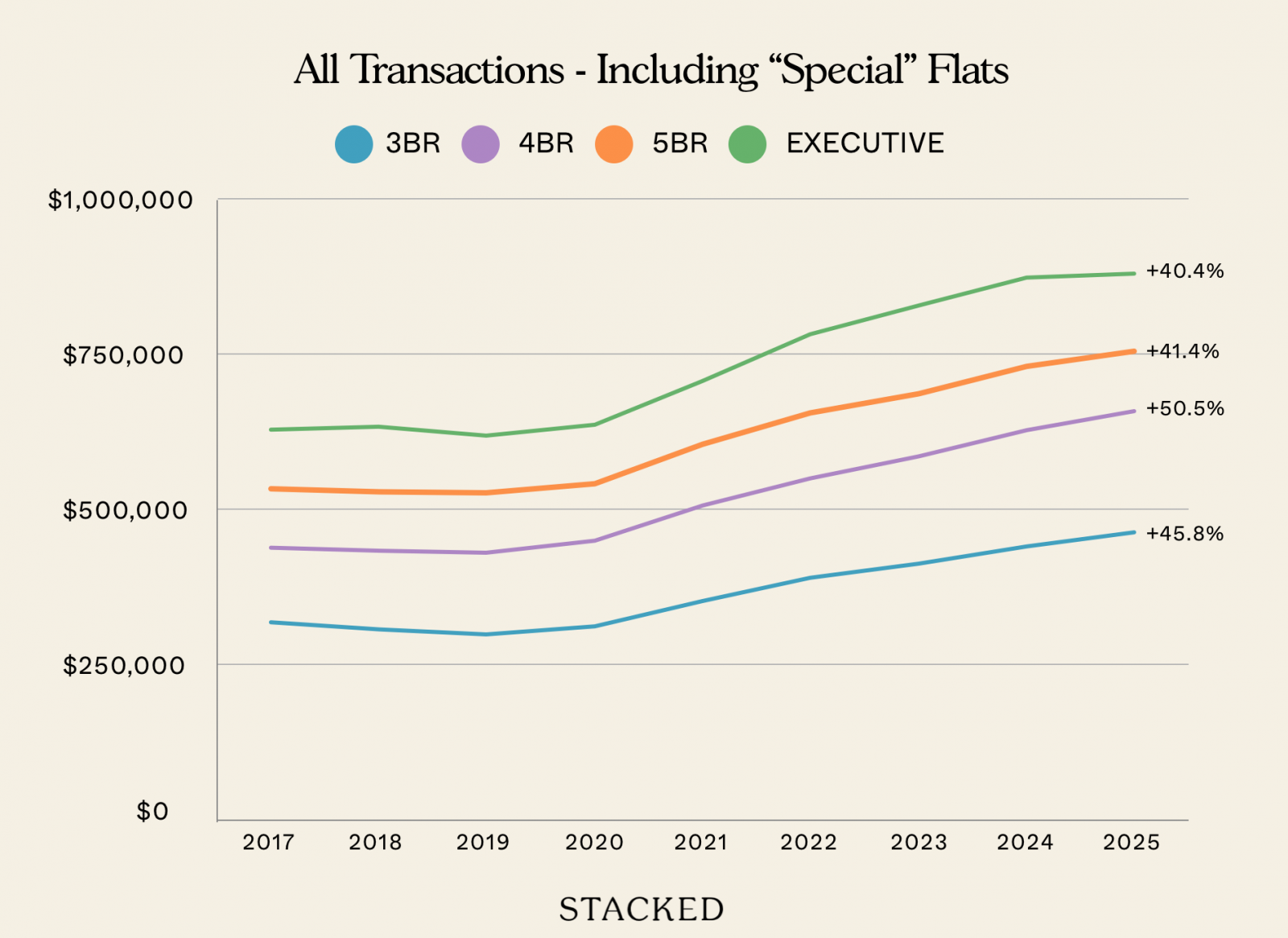

The following shows how much HDB flat prices have risen as a whole, inclusive of all flat types:

| Year | 3 ROOM | 4 ROOM | 5 ROOM | EXECUTIVE |

| 2017 | $316,668 | $437,120 | $532,277 | $627,211 |

| 2018 | $305,331 | $431,753 | $527,635 | $630,780 |

| 2019 | $298,230 | $429,749 | $526,812 | $617,561 |

| 2020 | $311,381 | $448,608 | $541,457 | $635,395 |

| 2021 | $351,378 | $505,095 | $603,990 | $705,559 |

| 2022 | $388,116 | $549,088 | $654,253 | $782,007 |

| 2023 | $411,263 | $584,050 | $685,310 | $829,310 |

| 2024 | $438,732 | $627,383 | $728,632 | $874,651 |

| 2025 | $461,844 | $658,042 | $752,641 | $880,793 |

| Change | 45.8% | 50.5% | 41.4% | 40.4% |

If we make no distinction between the types of resale flats, we can see prices are generally up by 40 to 50 per cent over nine years.

An interesting point of note: prices fell between 2017 and 2019, with the sharpest drop in 3-room flats (down about 5.8 per cent during that period.) This was a continued decline from way back in 2013, when the introduction of the Mortgage Servicing Ratio (MSR), and HDB ceasing to publish Cash Over Valuation (COV) data, caused flat prices to fall.

Prices started to see a sharp rebound after Covid. Between 2020 and 2021, we can see flat prices rising again. Ignoring the distinction between flat types, we can see that 4-room HDB flats had the most growth (50.5 per cent), while Executive flats saw the highest absolute price increase (an increase of $253,582 from 2017 to 2025). While it may not be the highest percentage-wise, an increase of over a quarter-million dollars will certainly hurt, for buyers eyeing an Executive flat.

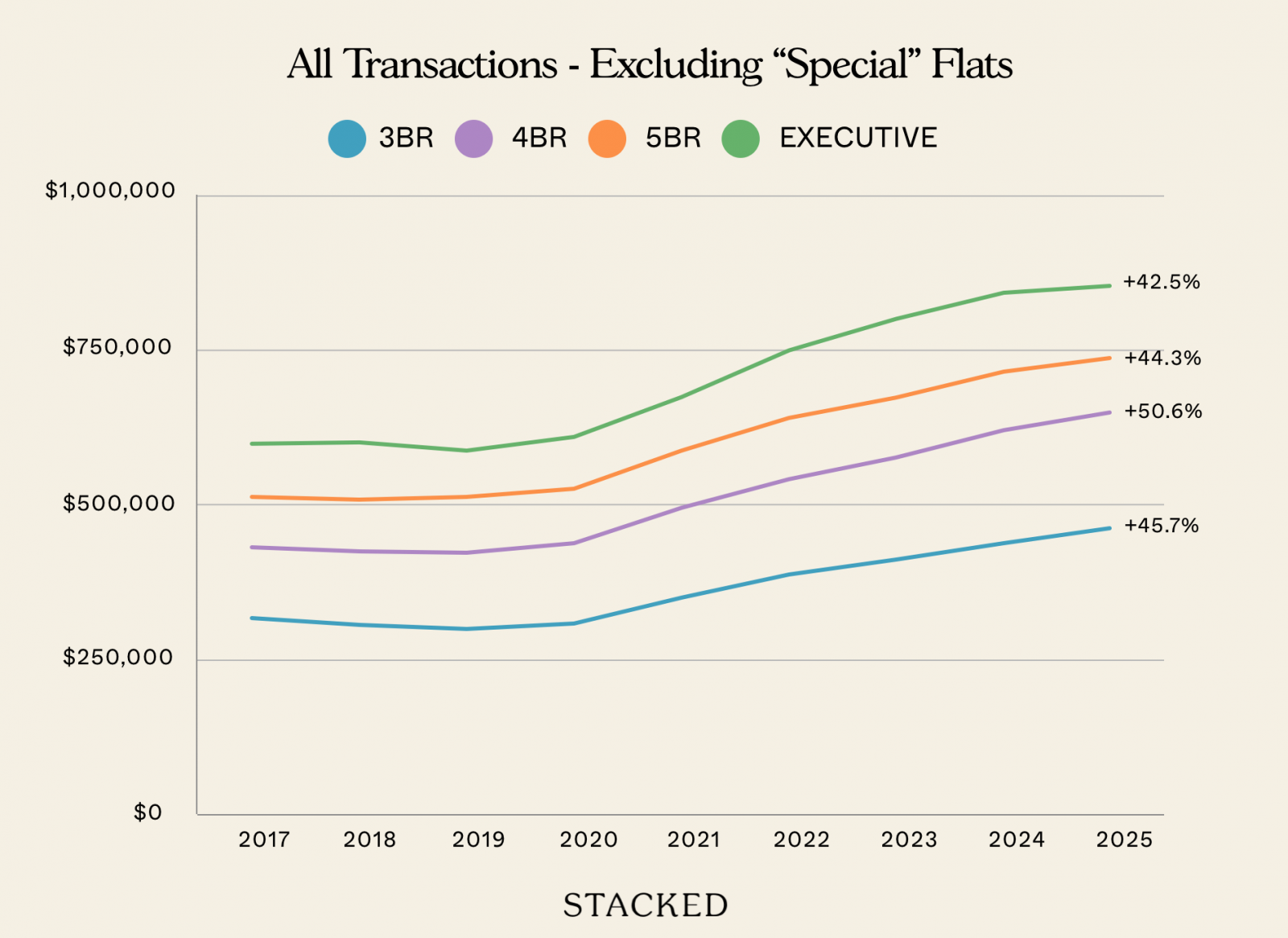

Now let’s see the difference if we exclude “special” flats:

| Year | 3 ROOM | 4 ROOM | 5 ROOM | EXECUTIVE |

| 2017 | $315,856 | $432,209 | $513,228 | $598,065 |

| 2018 | $304,678 | $425,844 | $509,639 | $600,946 |

| 2019 | $297,227 | $423,807 | $514,426 | $586,445 |

| 2020 | $307,631 | $439,859 | $527,229 | $608,669 |

| 2021 | $348,576 | $495,715 | $588,479 | $674,012 |

| 2022 | $386,466 | $543,809 | $642,771 | $747,853 |

| 2023 | $409,849 | $578,922 | $674,729 | $798,608 |

| 2024 | $437,925 | $622,741 | $717,010 | $841,328 |

| 2025 | $460,289 | $650,784 | $740,574 | $851,988 |

| Change | 45.7% | 50.6% | 44.3% | 42.5% |

Honestly, the difference is not great; and this throws into question the theory that special flats are responsible for the price growth.

When we remove all the special flats, the rate of appreciation actually increases by a small amount.

3-room and 4-room HDB flats showed almost no difference in price growth, when special flats were removed (an irrelevant 0.1 percentage point). For 3-room flats, the small difference can be chalked up to fewer special flats affecting this category. There are 3-room DBSS flats, but no maisonettes, 3Gen flats, etc.

(Interestingly, we’ve seen a tiny number of adjoined flats that get shuffled into the 3-room category, but these are rare.)

Conversely, for 5-room and executive flats, the disparity is likely due to more special flats falling into these size categories.

4-room flats though, are the most ubiquitous form of housing; and if the price growth hasn’t budged even after removing the special flats, it becomes harder to blame rising prices on DBSS or other special units.

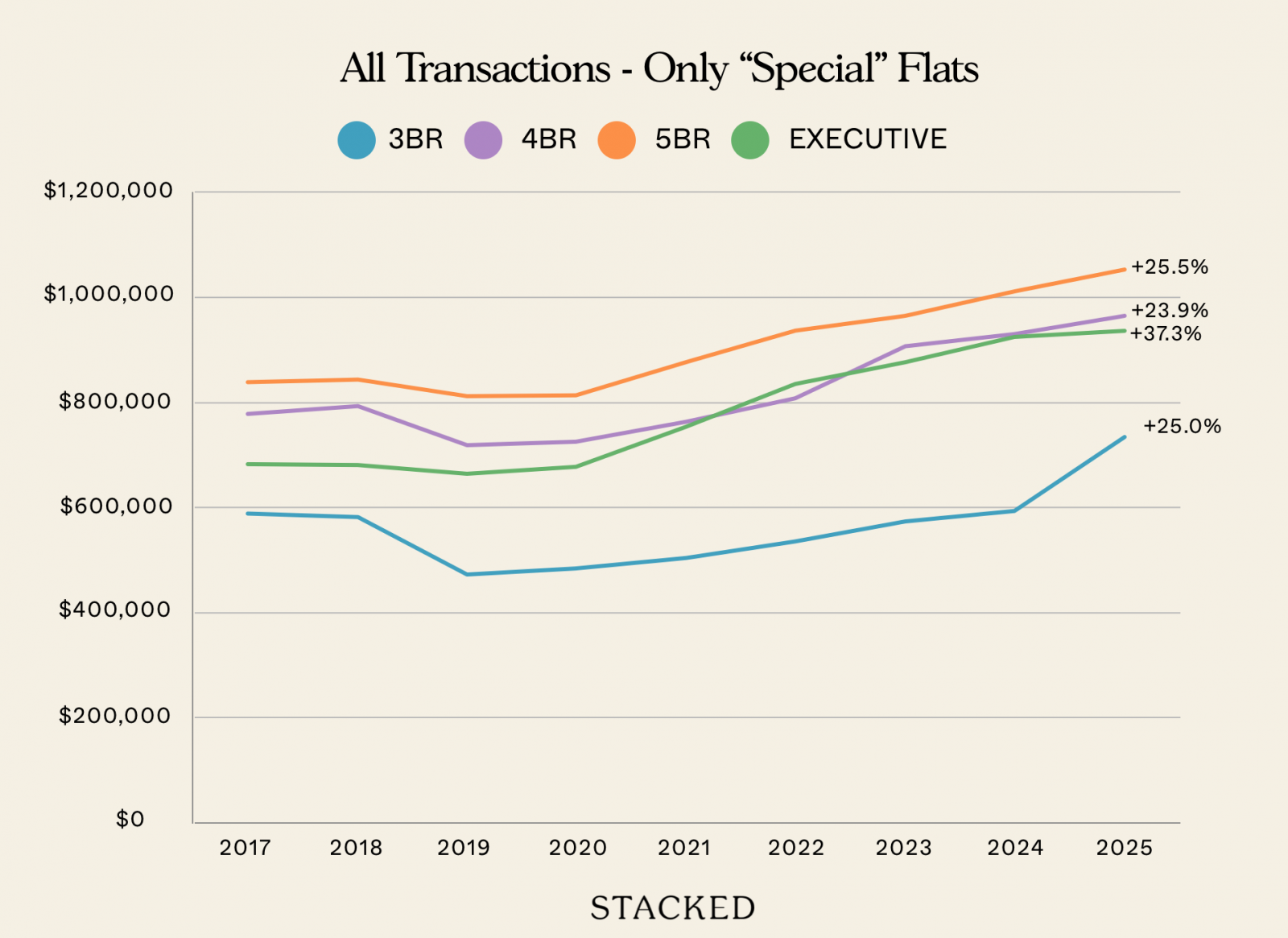

What about the appreciation of only special flats?

| Year | 3 ROOM | 4 ROOM | 5 ROOM | EXECUTIVE |

| 2017 | $588,318 | $778,563 | $837,318 | $680,961 |

| 2018 | $582,333 | $793,358 | $843,225 | $680,448 |

| 2019 | $472,222 | $718,603 | $810,529 | $662,593 |

| 2020 | $484,295 | $725,018 | $811,985 | $676,365 |

| 2021 | $503,523 | $762,536 | $875,322 | $752,498 |

| 2022 | $535,533 | $807,970 | $934,740 | $833,809 |

| 2023 | $573,065 | $907,920 | $963,625 | $876,294 |

| 2024 | $594,336 | $930,391 | $1,009,693 | $924,376 |

| 2025 | $735,444 | $964,421 | $1,050,607 | $934,947 |

| Change | 25.0% | 23.9% | 25.5% | 37.3% |

Across the board, special flats show slower price growth than their regular counterparts.

They all have higher average prices than regular flats, particularly the 3-room flats; this would be on account of their unique traits like larger sizes, unique layouts, etc. The high base price of the special 3-room flats in particular surprised us: in the year 2017, a special 3-room flat ($588,318) could have bought you a regular 5-room flat ($513,228).

This higher base price may account for the much slower pace of growth: normal 4-room flats, for instance, appreciate at more than twice the pace of their standard counterparts.

This may be worth thinking about, for buyers with an eye toward upgrading.

In conclusion, special flats may have an impressive quantum; but it’s hard to blame them for rising prices in the wider market

Normal flats didn’t need any help from special counterparts, to see significant price gains since 2017. Special flats have made for more attention-grabbing headlines due to higher absolute prices; but they actually appreciate slower than regular HDB flats.

We also wouldn’t be surprised if the slower appreciation of special flats becomes more visible over time. This is due to the advanced lease decay for some of these flat types. Maisonettes, for example, were no longer built after 1995. Likewise, jumbo flats were mainly the result of numerous vacancies in the ’90s, which led to some flats being merged to form bigger units. This is unlikely today*, when we need more flats than ever.

*Well, you can ask HDB for permission to merge two flats, but we wouldn’t get our hopes up.

Also, buyers of these older flats tend to be those less concerned with lease length. They are, for instance, retirees right-sizing from a private property. As the pool of such buyers is limited, it can further constrain price growth.

The other implication here is that we need to pay more attention to normal flats. We should worry less about a DBSS flat reaching $1.6 million, and a lot more about normal 4-room flats creeping to an average of over $960,000. The latter has a much bigger impact on the majority of Singaporeans, even if the quantum seems less impressive.

We can only hope that increased supply in the resale market (which is a bit tight right now) slows the momentum going forward.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are 'normal' HDB flats still affordable compared to special flats?

How do the price trends of regular HDB flats compare to special flats?

Does excluding special flats from price analysis change the overall trend of HDB flat prices?

What is the impact of special flats on the overall HDB resale market prices?

Why might the appreciation of special flats slow down in the future?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

2 Comments

There’s an error near the end of the article. “…normal 4-room flats creeping to an average of over $960,000.”

I think you mean over $650,000, right?

Thanks so much for this. I have been saying same thing. Dont look at Milliom dollor flats. Rather see Even in Punggol 3rm Reaching to 500K. Which is major concern.