Can 30+ Year-Old Leasehold Condos Still Perform? The Arcadia’s Surprising Case Study

June 5, 2025

In this Stacked Pro breakdown:

Can Ultra-Large Units Like Those at The Arcadia Still Perform in Today’s Market?

Comparison

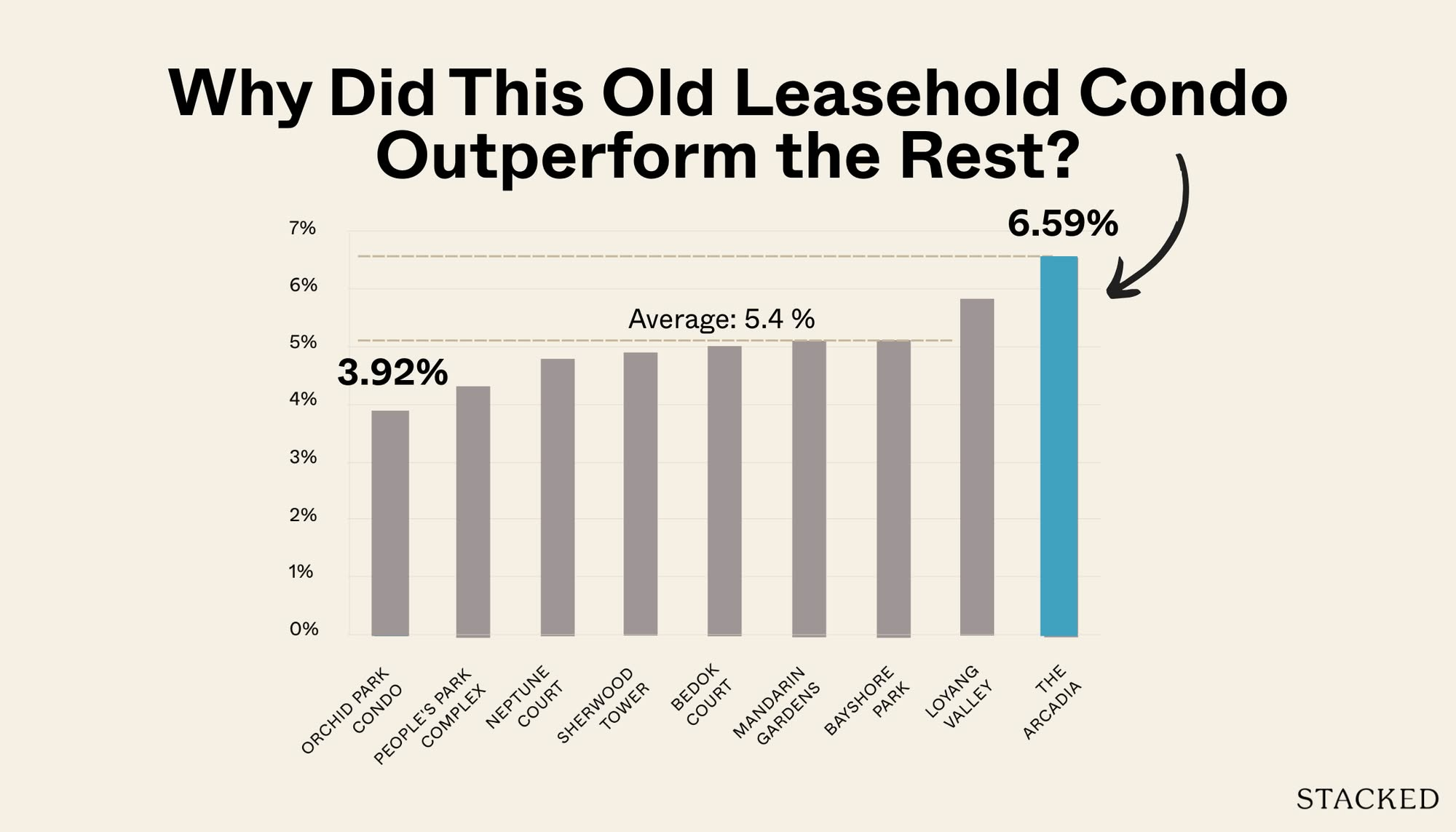

We analysed The Arcadia — a rare condo made up entirely of 4-bedroom units over 3,700 sq ft — and tracked its performance from 2016 to 2024 against nearby Hillcrest Arcadia, Bukit Timah resale condos, and the wider CCR.

Join our Telegram group for instant notifications

Join Now

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Popular Posts

On The Market

Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

New Launch Condo Reviews

River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

Singapore Property News

The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

February 26, 2026

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

February 24, 2026

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

February 24, 2026

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

February 21, 2026

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

February 27, 2026

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

February 27, 2026

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

February 27, 2026

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

February 26, 2026

0 Comments