How Do The Additional Relief Measures For Developers Affect Home Buyers?

October 14, 2020

As of last week (9th October), property developers were granted another six-month extension to complete their projects. This is a second round of extension, with the last one being in May – altogether, property developers now have a full additional year.

This is fair given the unavoidable difficulties. Covid-19 has disrupted supplies and manpower, and construction had to be halted during the Circuit Breaker period. But what does the overall one-year extension mean for home buyers? Here are some of the side-effects:

- The delays may be fuelling interest in resale HDB properties

- A greater incentive to buy the condo before selling the flat

- QC and ABSD extensions mean lower likelihood of discounts

- It could affect upgrading plans due to the MOP

1. The delays may be fuelling interest in resale HDB properties

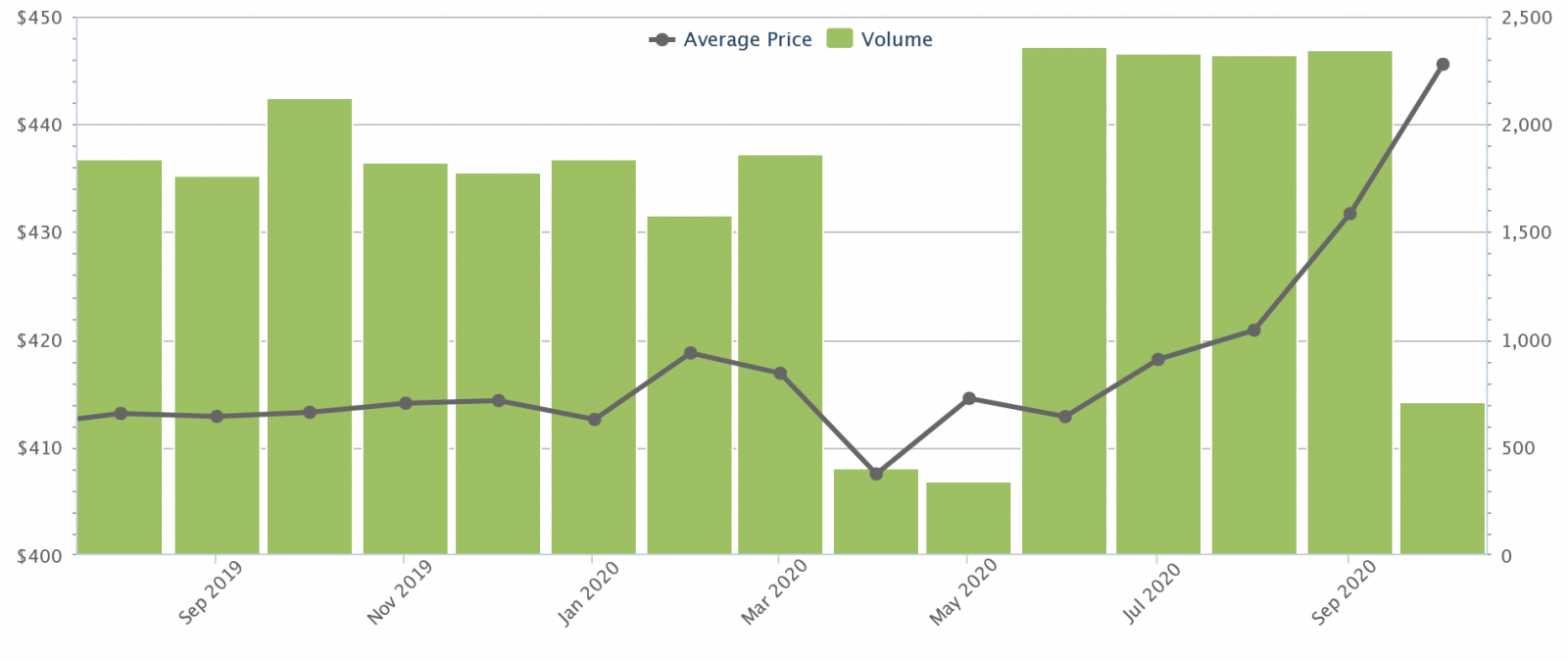

An interesting phenomenon in the past few months is the increase in HDB resale prices. Here’s what it looks like:

In January of this year, average HDB resale prices stood at $413 psf. By September, prices had risen by around 4.6 per cent, to $432 psf.

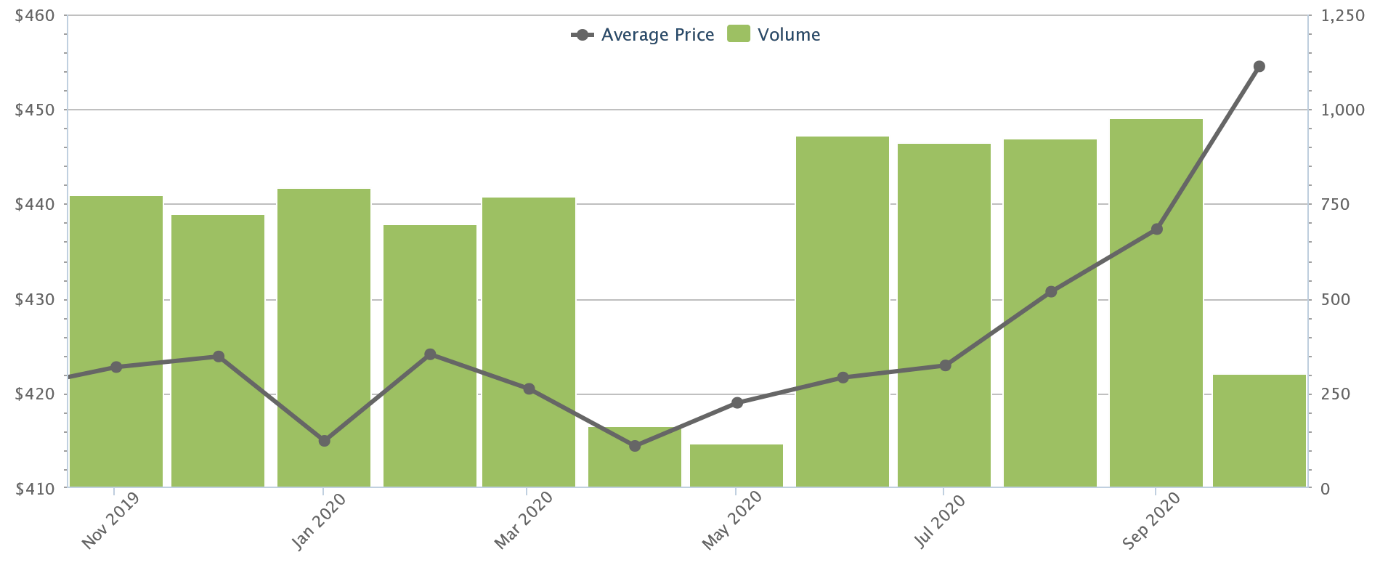

5-room flats had the strongest showing from January, up 5.9 per cent from $404 psf to $428 psf:

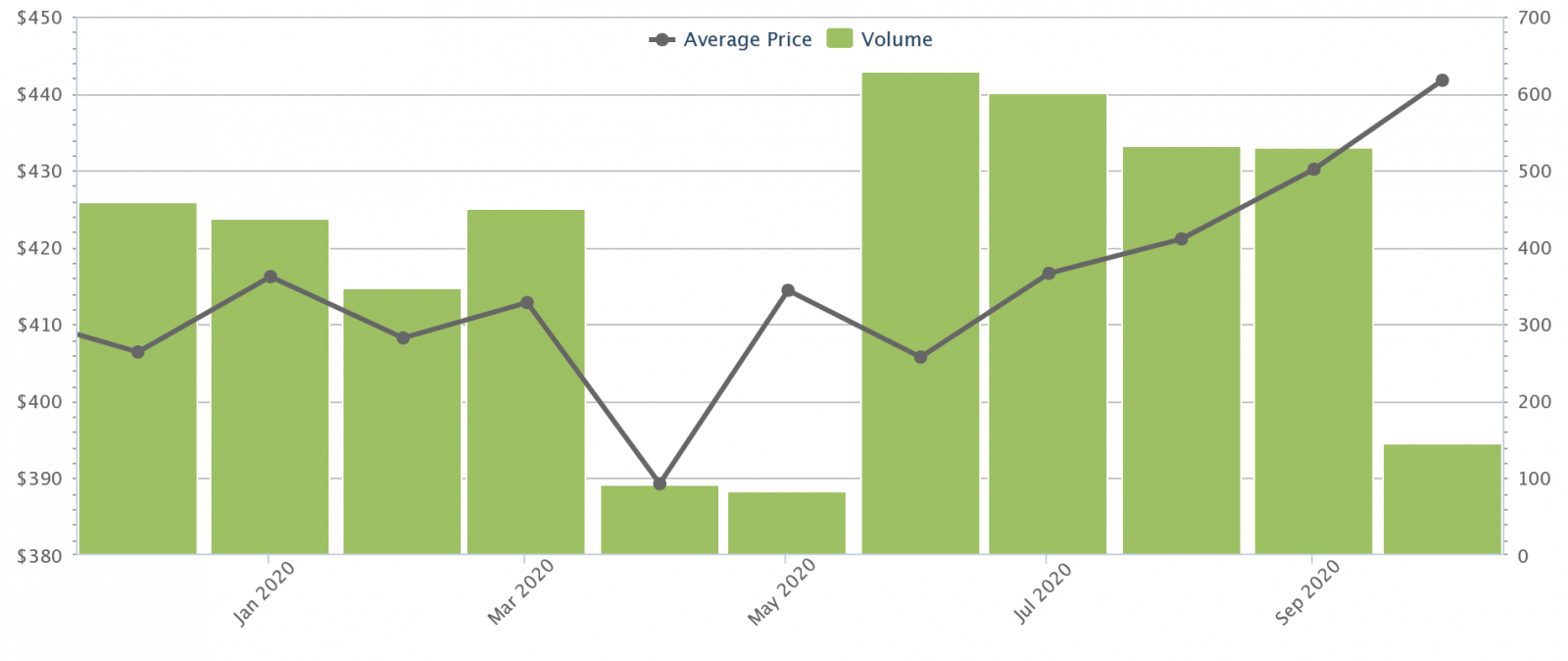

Meanwhile 4-room flats rose around 5.3 per cent, from of $415 psf in January to $437 psf in September:

3-room flats came in with smaller gains, up from $416 psf in January to $430 psf last month (up 3.3 per cent):

In terms of volume, resale flat transactions also continued to climb; last month they rose a further 2.2 per cent from August.

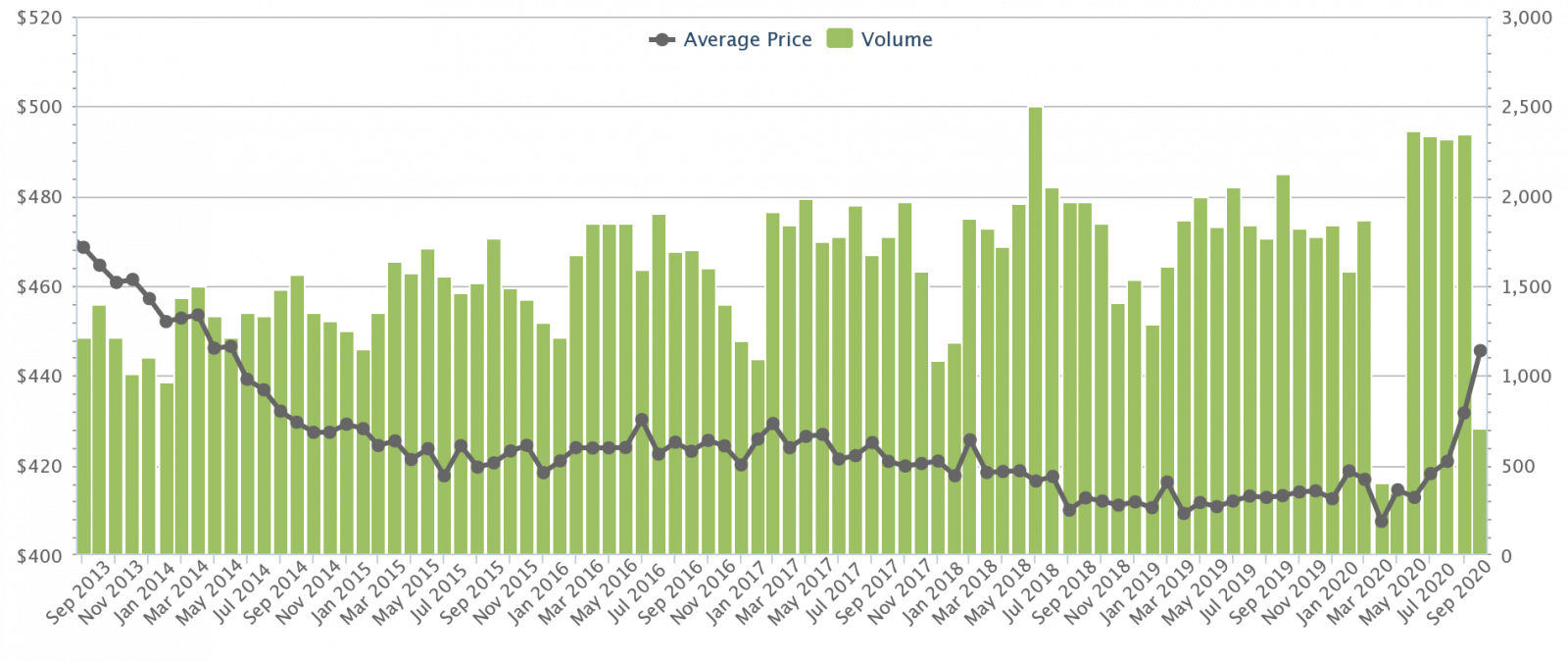

This is coming on the back of seven years of near-consecutive decline in resale flat prices. Resale prices have now recovered to the same level as 2014, although they are still down around 4.9 per cent from the last property peak in 2013.

Year on year, resale flat volumes are up by almost a third (32.7 per cent). In September 2019, resale transactions stood at just 1,875, but the number stood at 2,489 last month.

On the private property side, we haven’t seen a similar uptick in price, but we have seen higher volumes also.

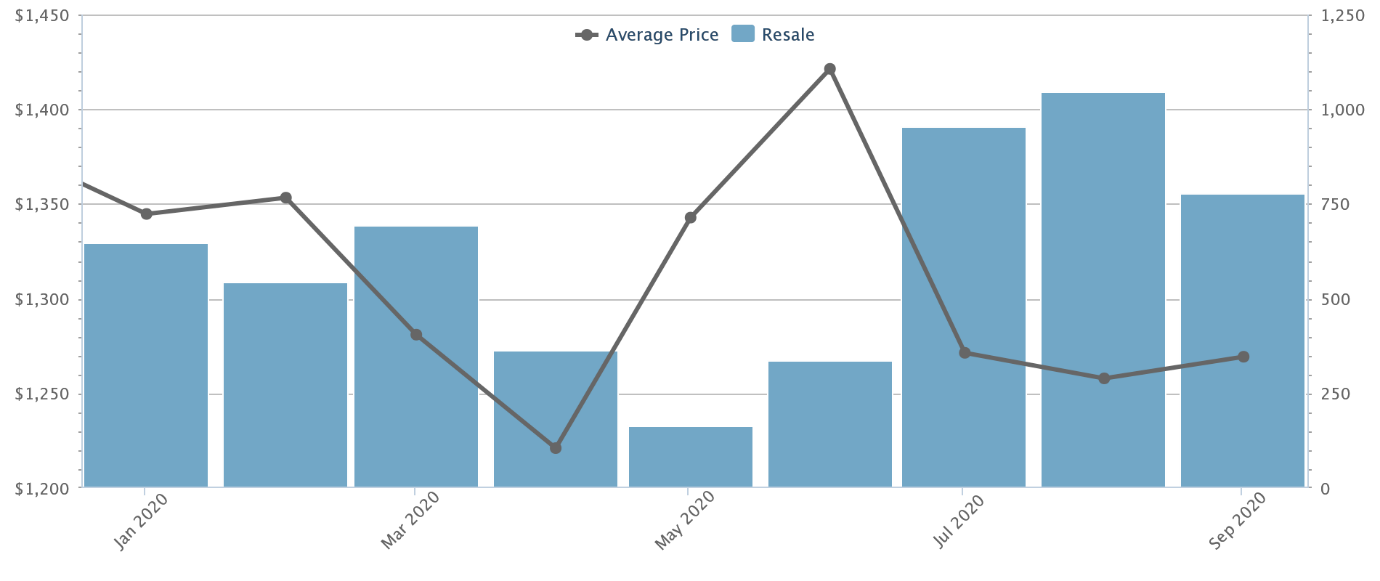

Resale condo prices are still down from January; they’ve moved from $1,345 psf, to $1,269 psf; a decrease of about 5.6 per cent:

However, take note of the rising transaction volume on this chart. Resale volumes reached 1,052 transactions in August, the highest since the same time in 2018.

What’s also notable is that the bulk of transactions came from HDB upgraders, who accounted for 60 per cent of the volume.

The renewed interest in resale properties could be partially fuelled by the prospect of construction delays.

To be sure, it’s almost never a single factor that prompts large moves in the market. However, the surge in demand for resale flats – in tandem with the telling increase in upgraders going for resale condos – shows the worry of pushed-back TOP dates and renovation delays may be putting off some home buyers.

At this point, the extension has increased the grace period from six months to a full year. Buyers of Waterway Sunrise II, for example (a BTO development in Punggol) are currently facing a full year’s delay.

This represents a significant expense for owner-occupiers, who need temporary accommodation in that time.

For investors, landlords need to factor in any lost rental income.

Under normal circumstances, investors can claim damages from developers for delayed TOP dates (we have a detailed explanation of this in our earlier article).

With the new extensions however, landlords will just have to swallow the lost rental income. As such, they may be more inclined to look at available resale units, despite the wide offering of new launches.

2. A greater incentive to buy the condo before selling the flat

In most cases, home buyers prefer the reverse: they would rather sell their flat first, and then hunt for a new condo. This spares them from having to pay ABSD upfront, the stress of possibly servicing two home loans, and so forth.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The Unexpected Side Effect Of Singapore’s Property Cooling Measures

That’s what comes to mind with this latest report on inequality in Singapore. Now most of that article covers familiar…

However, this may change as a result of delayed construction.

We may now see more upgraders willing to buy their condo, before their flat is sold. This is because they have the convenience of continuing to stay in their flat, and selling it closer to the time of their condo’s completion.

This is not always ideal for every buyer though; if you now intend to do this, drop us a message and we can familiarise you with the process.

3. QC and ABSD extensions mean lower likelihood of discounts

The ABSD deadline is five years – during this time, developers must complete and sell all units in a project, or risk a tax of 30 per cent of the land price. The Qualifying Certificate (QC) applies to foreign developers, and is in addition to the ABSD deadline – it requires that the project be completed within five years, and all units sold within two years.

A lot of home buyers were looking forward to developer discounts, as a result of the delay.

Some even got their wish. Case in point: 38 Jervois had fire sales of up to 24 per cent, to clear out its 16 remaining units in time for the ABSD deadline. 8 St. Thomas was more discreet, but still had discounts ranging from $200,000 to a whopping $500,000.

Given the deadline extensions however, it seems improbable that developers will need to resort to such measures; whether or not Covid-19 has disrupted operations.

We’ll see as we come closer to the deadline for each project, but home buyers shouldn’t have their hopes up like before (a lot of sales and construction can happen in 12 months).

Property Market CommentaryHow ABSD Deadlines Can Negate Your New Launch Discounts

by Ryan J. Ong4. It could affect upgrading plans due to the MOP

A five-year Minimum Occupation Period (MOP) applies for HDB flats, and for the first batch of buyers for an Executive Condominium (EC).

This is the minimum length of time buyers must stay in their flat, before it can be fully rented out or put on the open market.

However, the MOP date is calculated from the moment you collect the keys to your flat or EC, not just from the date of purchase. So if your flat takes another year to build, that effectively means you need to wait another year before you can sell it. This has to be factored into your upgrading plans, if you had intended to sell the flat as soon as you reached the five-year mark.

This could also further contribute to the growing interest in resale flats, which we mentioned in point 1.

However, resale home buyers should know that renovations are being stalled as well, so even they could face some delays.

Home owners have been facing renovation delays even after Covid-19. A contractor we spoke to, who asked not to be named, told us that:

“There are restrictions on how many workers can be in the same unit at once, so it’s very slow. It’s not like last time, we could settle many things at once.

Also, for those clients who want imported material, delays can be quite long. Sometimes the factory-or-whatever overseas is closed, the distributor cannot get it. So either you are okay to accept alternatives, or you just have to wait.”

Renovation delays aren’t as bad as a pushed-back TOP date though, and we expect it won’t discourage the rising interest in resale properties.

Ultimately, there’s nothing much we can do about these pandemic conditions; the best solution is to review your upgrading plans, and consider any financial cost from construction delays. You can reach out to us on Stacked for direct help…or maybe look up some reviews of resale properties instead!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How do the recent extensions for property developers impact home buyers?

Are resale HDB flat prices increasing due to construction delays?

How might the extension of project completion deadlines affect discounts offered by developers?

Can the delays influence home buyers to purchase condos before selling their flats?

What effect do the extensions have on renovation plans for homeowners and buyers?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments