$900k Sale Of 3-Room HDB Flat In Bidadari Sets A New Record In 2024: Here’s Why

January 2, 2025

Usually, when a resale flat comes close to $1 million, the expectation is that it’s a big older flat; hence the higher square footage and quantum. Or perhaps we’d expect a rare DBSS unit, or other such “special” flats. But as of December 2024, a “mere” standard 3-room flat managed to hit the record-breaking (for its size) price of $900,000. To be fair, this isn’t exactly surprising given that several 3-room HDB flats have already surpassed the $800,000 mark last year in 2024.

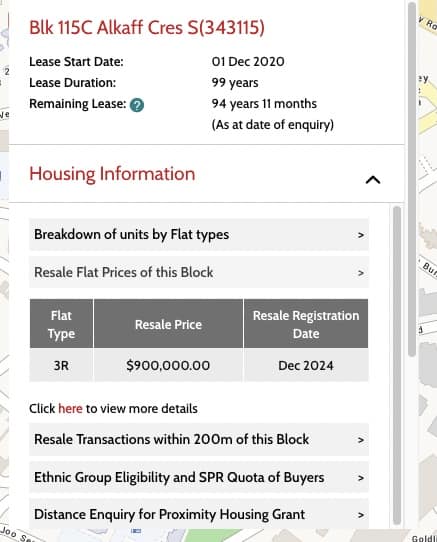

The most expensive 3-room flat took place at block 115C Alkaff Crescent

The 3-room flat is in Alkaff Lakeview, somewhere between the 13th to 15th floor, with a size of about 764 sq. ft (71 sqm). This would come to about $1,178 psf, as opposed to the average of about $560 to $580 psf for resale 3-room flats.

This is a highly desirable location, and it was one of the most oversubscribed areas during its BTO launch. It’s within walking distance of Woodleigh MRT station (NEL). This also means being close to the recently built Woodleigh Mall, and just one stop from Serangoon, where residents have access to NEX Megamall. Also in terms of immediate convenience, there’s a commercial block at 115B nearby, which includes a food centre.

School access is also excellent, with Maris Stella High, Cedar Primary, and Cedar Girls’ Secondary all being within a close distance.

Given the price point, the unit likely faces the greenery view of Bidadari Park and Alkaff Lake:

A corner unit with a dumbbell layout

The unit’s layout may have a role to play here:

This 3-room flat is a corner unit, with a very efficient dumbbell layout. Note how there’s no need for a long corridor space, as the living/dining area acts as the connecting point between the different rooms. This is a trait common to newer projects.

Being a corner unit is also seen as an advantage, as it provides greater privacy.

One other notable highlight is how new the flat is

This 3-room flat had its lease begin in 2020, so it has just barely reached its Minimum Occupancy Period (MOP). Flats sold right after MOP tend to be at a premium, as they’re ready to move in, and yet the lease decay is almost negligible. The demand is compounded by the accessibility and convenience of the location.

Million-dollar resale flats are often associated with higher square footage, or ageing designs like double-storey maisonettes, but this transaction proves that even 3-room HDB flats have the potential to reach this price point.

More from Stacked

So When Was The Actual Best Time To Buy A Property In Singapore? Here’s A Look At What History Tells Us

"When is the best time to buy a property?" echoes as one of the most perennial questions in the world…

In the immediate surroundings, only Alkaff Vista has recorded transactions so far; and Alkaff Vista has no 3-room units. As such, this is one of the first 3-room transactions in this location; and it’s definitely setting a high bar.

If we were to look for the closest other location with 3-room transactions, this would be Joo Seng Green. The highest 3-room flat transaction here is just $673,000, for a 16th to 18th floor unit. This was for a 731 sq. ft. unit, with a lease beginning back in 2017. That’s older but still less than a decade old though; and we’d say that’s a rather large price disparity.

The next highest 3-room flat transaction, islandwide, was $860,000.

This was at 10A Boon Tiong Road, in August 2024. This particular flat had its lease beginning in 2016. It’s also in a highly desirable location, close to Tiong Bahru MRT station. So if we consider the locations to be equal, the distinguishing factor here is the lease, and $900,000 is quite the leap, as we’d expect smaller premium differences for just a four-year lease difference.

We don’t know the circumstances behind the buyer though

This can make sense under certain niche conditions. For example, a couple who don’t expect to have children, and who prize the newness and location over spaciousness. It may also appeal to those who want the most convenient location, and have no interest in issues like resale gains (they’re never intending to move) or rental.

It is, however, unusual for buyers to agree to such a high quantum, when it could buy them a 4-room or 5-room flat. Hopefully, for resale buyers, this is a quirk in the market, and not a sign of things to come.

For more on the situation as it unfolds, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did a 3-room HDB flat in Bidadari sell for $900,000 in 2024?

What makes the 3-room flat at Alkaff Lakeview so valuable?

How does the price of this 3-room flat compare to other similar flats nearby?

Could this high sale price indicate a trend for 3-room HDB flats?

Who might be interested in buying a high-priced 3-room HDB flat like this one?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Latest Posts

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

1 Comments

Look at all the justification in this story. The real reason is the sudden surge in population to 6million due to foreign imports. The 2nd reason is fomo, prices are going up because people are afraid it’s..going up even more in the future.