9 Key Details About Condo Sub-Sale Units Most People Are Unaware Of

July 22, 2022

There’s gonna be a bumper crop of new launches being completed in 2022 and 2023 (we’ve covered 10 of those here), and as such, more sub-sale units will likely be coming onto the market.

A sub-sale can be a little more complicated, as it’s a three-way deal procedure involving the buyer, seller, and the developer. For these reasons, it’s not too common, and the transaction process is a bit obscure. In case you’re interested in selling or buying sub-sale units, here are some of the issues to be aware of:

Table Of Contents

- 1. Be aware of the SSD period

- 2. The CSC, not the TOP, is the official date for determining sub-sales

- 3. A new Sale & Purchase (S&P) Agreement is needed

- 4. There may be a prepayment penalty for selling a sub-sale unit

- 5. You may have a team of realtors, rather than just one

- 6. If you’re in the first wave, you can consider holding out for a better price

- 7. Sub-sales can provide a good exit when the market is at a standstill

- 8. If you own a bigger unit, you could end up finding sub-sale buyers even within the same project

- 9. When looking at new development prices, be aware that some listings may be sub-sales

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Be aware of the SSD period

The SSD is payable if you sell your property within the first three years of buying it. The SSD is 12 per cent in the first year, eight per cent in the second year, and four per cent in the third year. But it is possible that SSD may not apply, if the original buyer purchased the unit early in the launch.

For example: if the condo takes five years to complete, but you purchase a unit in the first year and sell on the fourth, you would be outside the three-year SSD period.

When SSD does apply, the seller will almost always mark-up the price to cover the stamp duty. Just like the stunning Boulevard 88 sub-sale unit that was bought at $9.38 million and sold for $12.5 million – making a gain of $3.12 million (aside from the 4% SSD). As such, the best sub-sale deals are usually units near completion, but also outside the SSD period.

So do calculate your timelines correctly, to avoid paying any unnecessary fees.

2. The CSC, not the TOP, is the official date for determining sub-sales

URA considers a transaction to be a sub-sale if it occurs before a development receives the Certificate of Statutory Completion (CSC). Note that the CSC is not the same as the Temporary Occupancy Permit (TOP).

It’s possible to purchase a unit after TOP and still be counted as making a sub-sale transaction, if the CSC is not yet granted.

3. A new Sale & Purchase (S&P) Agreement is needed

For a sub-sale to take place, the new buyer must enter into a new S&P Agreement with the developer. The developer just needs to be informed of the sub-sale for it to take place. You still have all the same rights as the first buyer, so there’s no need to worry about the defects during the Defect Liability Period.

Drafting the new agreement requires the services of a law firm, with prices being roughly around $640+. The fee aside, it can take a minimum of 12 weeks for all the paperwork to be settled.

It’s advisable to use the same law firm that handled the first S&P Agreement (i.e., the one the original buyers used). This can sometimes shave time off the process, as they’ve already worked with the original buyer and the developer.

4. There may be a prepayment penalty for selling a sub-sale unit

If you used a bank loan to purchase a unit, and subsequently sell it as a sub-sale, you’ll have to pay off the outstanding loan with the sale proceeds. For some banks, this might mean incurring a prepayment penalty.

Prepayment penalties tend to be 1.5 per cent of the undisbursed loan amount; but this would get quite messy for sub-sales.

This is because new developments often use a Progressive Payment Scheme, in which the bank disburses payments based on completion milestones. Under this scheme, only 85 per cent of the loan would be disbursed by the time the property receives its TOP. The last 15 per cent is usually only disbursed upon CSC.

Property AdviceCondo Progressive Payment in Singapore – All you need to know

by Druce TeoAs such, the bank often considers the last 15 per cent to be the undisbursed loan amount; and the prepayment penalty is based on this sum.

For example: for a loan of $1.25 million, the undisbursed loan amount (15 per cent) would be $187,500. At a penalty of 1.5 per cent, this is a fee of $2,812.50 for prepayment.

If you want to avoid prepayment penalties, you can consider loan packages that waive such fees in the event of a sale. Speak to a mortgage broker to review such terms and conditions.

5. You may have a team of realtors, rather than just one

Agents tell us that multiple listings may sometimes be helpful to move a specific sub-sale property, rather than just one.

This is partly to do with competition for visibility: before a project is complete, the developers’ sales teams are also blasting one listing after another to promote the new project. It’s quite hard for your one specific listing to stand out. Some agents may add on services such as rendering to help the unit stand out given it’s not a completed project yet, this can be useful to attract more buyers too.

Specialised teams, who are also more familiar with marketing sub-sale units, can also be helpful – they may have a wider range of prospects, willing to purchase under such conditions.

Your property agent(s) can lay out the specific details here, along with any differences in service fees.

6. If you’re in the first wave, you can consider holding out for a better price

If you were one of the earlier buyers (i.e., way before TOP), there’s a good chance you have one of the better units. This is on the assumption that, as an earlier buyer, you would have picked a favourable stack, or a unit with better facing, unique features, etc.

The second wave of buyers, such as those who come just after TOP, are often left with a more limited selection of units. In theory, it should be the least desirable units that are left to them.

In this scenario, you might consider sticking to your higher asking prices, for a longer period (but do remain realistic, and aware of wider market conditions).

7. Sub-sales can provide a good exit when the market is at a standstill

From a strict investment perspective, a property market that’s at a standstill can be bad news. You would have a significant amount of capital locked up in the property, which isn’t seeing good appreciation. In situations like this, it might be worth trying to offload the unit at minimal cost, and re-investing elsewhere.

Even with higher costs tacked on (e.g., due to SSD), there’s a good chance you’ll see interest because the unit is near completion.

8. If you own a bigger unit, you could end up finding sub-sale buyers even within the same project

One problem with new developments is that nothing exists yet – while floor plans exist, a lot is left to the imagination. Agents tell us that sometimes, buyers end up disappointed with the actual size of their unit; this may happen after TOP, but before CSC.

However, those buyers still like the specific project. As such, this can result in attempts to upgrade within the development itself. If you own a larger unit in the project, you may find surprisingly strong demand from this batch of buyers; and offers may be good enough to justify a sub-sale to them.

Do consider this size factor, when picking your unit.

9. When looking at new development prices, be aware that some listings may be sub-sales

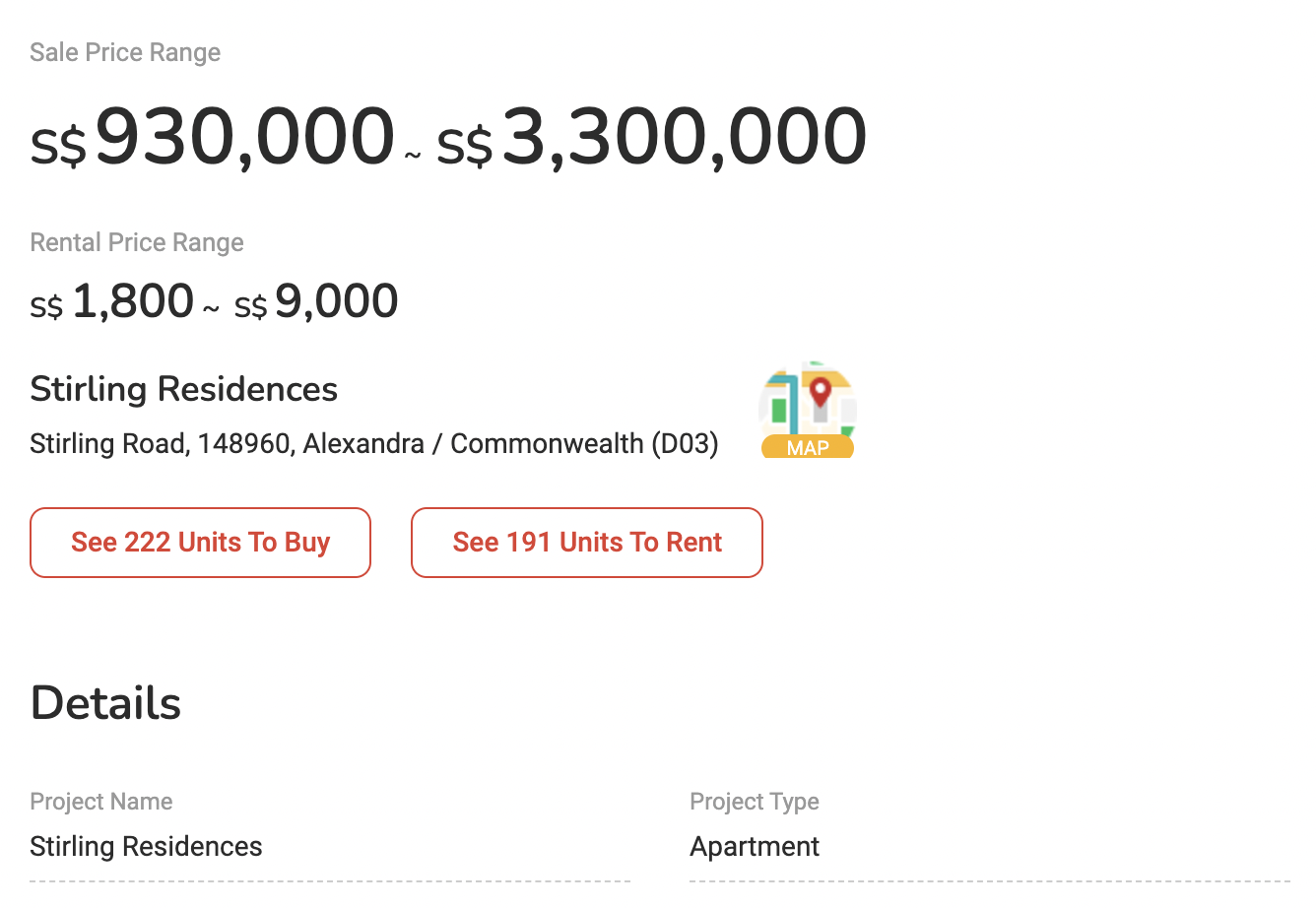

When you search for a new property on a portal, listings for the same project may not specify whether it’s just another developer listing, or a private seller (sub-sale). It can be helpful to differentiate between the two.

A seller trying to offload a sub-sale unit can be more open to negotiation, whereas developers are more fixed about the pricing. A private seller facing a change in financial situation, for instance, may have a more urgent need to offload the property – and that could translate to a lower price.

For more on the Singapore private property market, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale properties alike, so you can make a better-informed decision.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

0 Comments