8 New GLS Sites Revealed For 2023: We Explore Each Site And How They May Impact Homebuyers

June 22, 2023

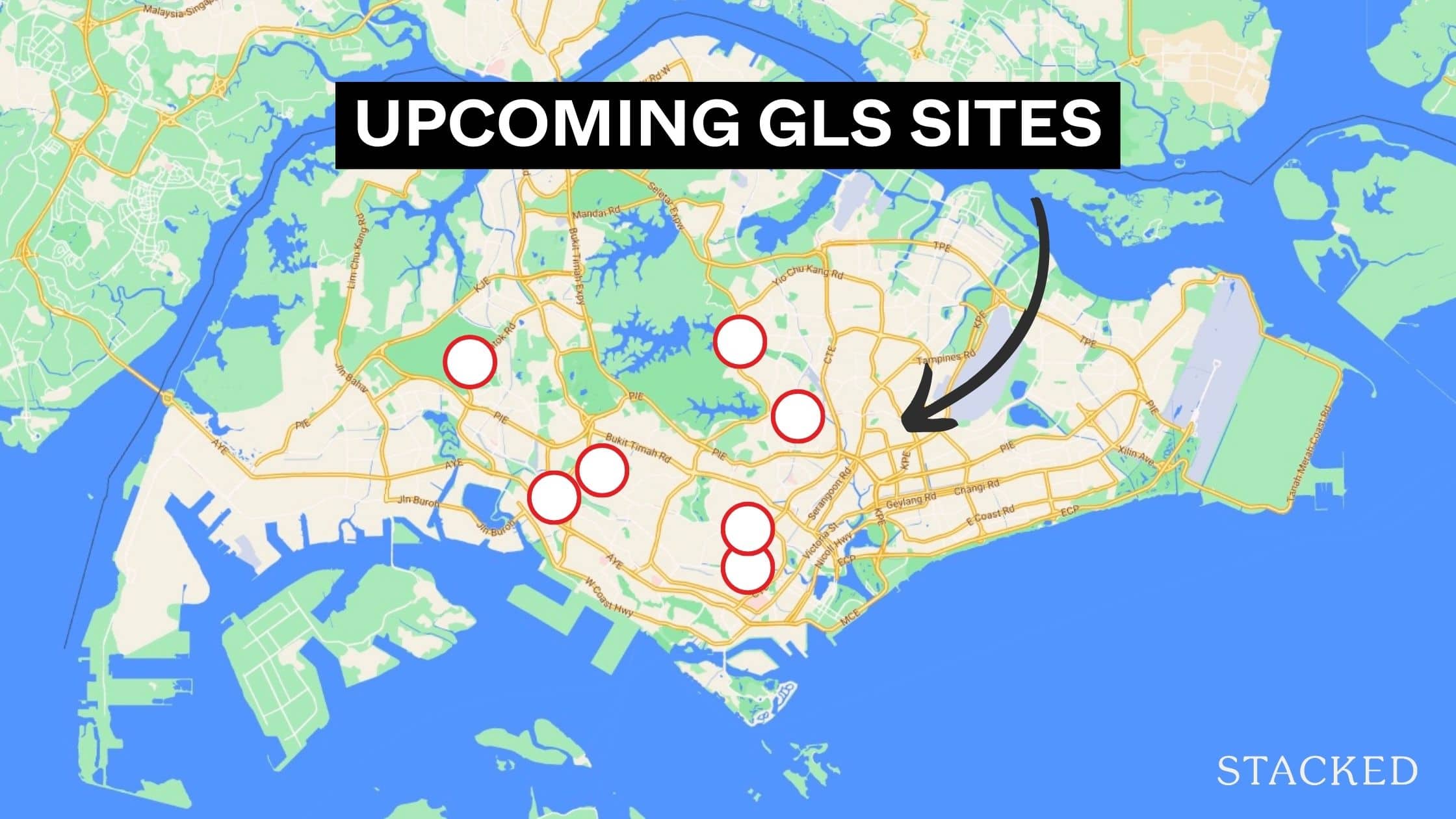

In an unexpected move, the government has announced eight new GLS sites for the second half of 2023; one of the biggest land sales events we’ve seen in around a decade. On top of that, two of the GLS sites are in the prime areas of Orchard and River Valley. This will be the first time since 2018 when land became available in these areas. Here’s what we can expect from the upcoming sites:

A sudden turnaround in supply

It’s a bit of an eye-opener to see this much land up for grabs. It’s enough to build an estimated 5,160 new homes in total, including an estimated 560 Executive Condo units.

Coupled with the GLS sites in the first half of this year (around 4,090 new homes), this makes for about 9,250 new homes for 2023 alone; a number we haven’t beaten in close to a decade.

But why now? From word on the ground, most realtors felt it was just a response to rising home prices. This has happened before too, when the Government pushed out a bumper land supply to tame the property market before 2013.

Rather than raise cooling measures further, the government is raising the supply of new homes, to moderate the pace of private home prices.

And prices are high – far back as May 2022, we pointed out that $2,000+ psf, a price point that used to be associated with luxury condos in the early 2000s, has become the norm for new launches; even those in fringe areas.

We can also see that land sales were limited during the Covid-era, from 2020 to the aftermath of the pandemic. The release of more GLS sites may be a way to compensate for the previous move (which has also been blamed by some market watchers for the current high prices).

Just like what we wrote about in what Tokyo has been doing to curb high property prices, beyond measures like loan curbs and the ABSD, opening up the supply is definitely the way to moderate prices.

A look at the eight sites

The available sites are as follows:

| Location | Size | Gross Plot Ratio | Est. number of residential units |

| Clementi Ave. 1 | 1.34 ha | 3.5 | 500 |

| Pine Grove (B) | 2.5 ha | 2.1 | 565 |

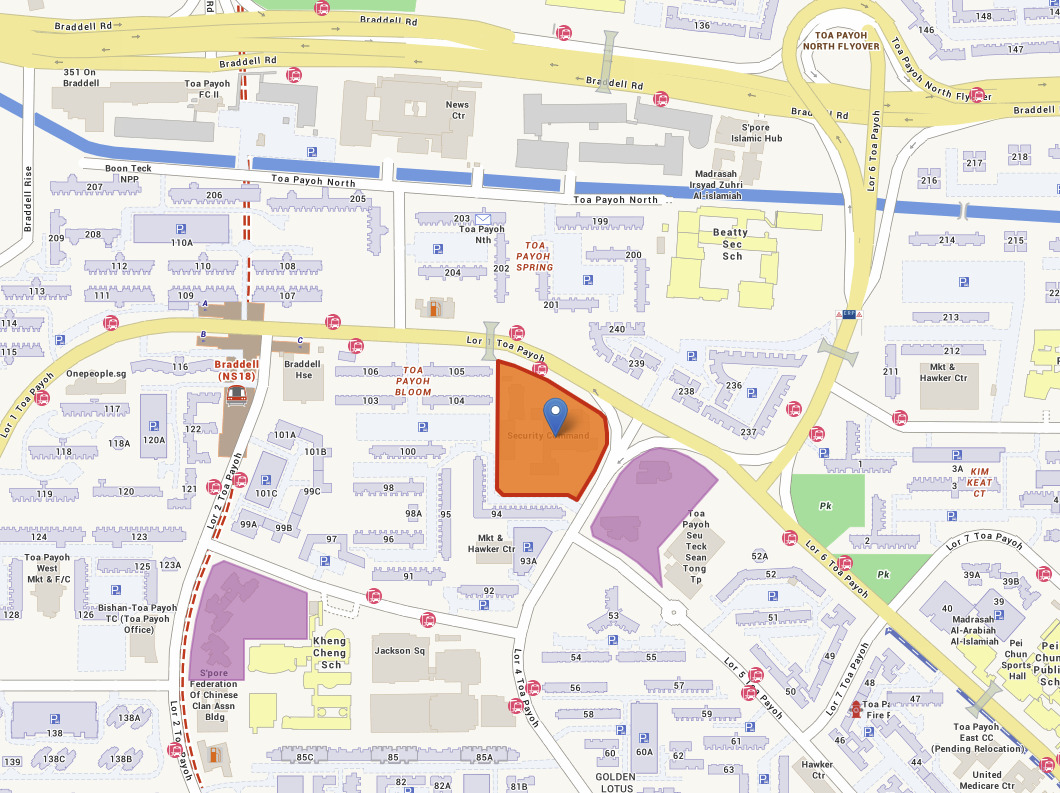

| Lor. 1 Toa Payoh | 1.57 ha | 4.2 | 775 |

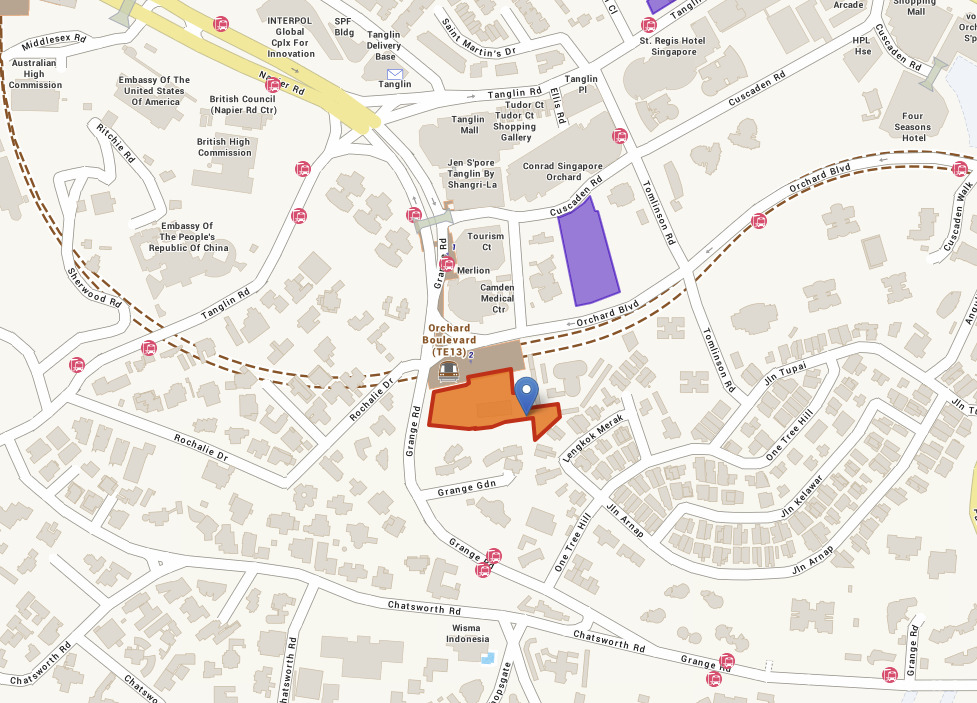

| Orchard Boulevard | 0.68 ha | 3.5 | 270 |

| Plantation Close (EC) | 2 ha | 2.8 | 560 |

| Upper Thomson Road (A) | 2.4 ha | 2.2 | 595 |

| Upper Thomson Road (B) | 3.2 ha | 2.5 | 940 |

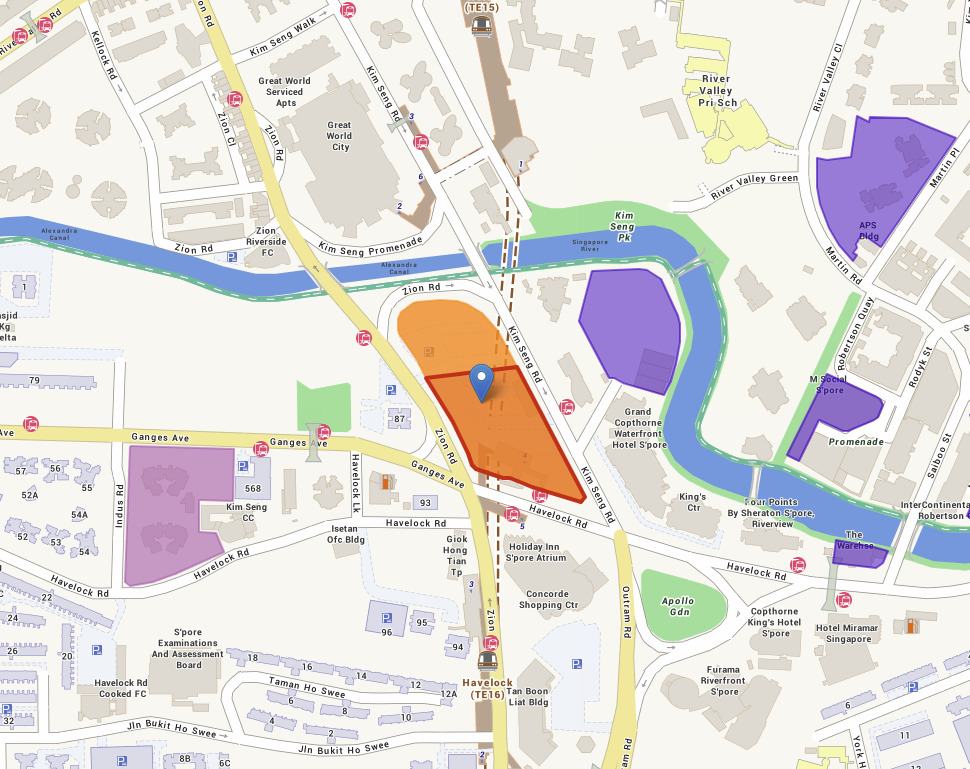

| Zion Road (A) | 1.5 ha | 5.6 | 955 |

There are also six reserve sites. Reserve sites are only triggered for sale if a certain level of demand is met, so they are not guaranteed:

| Location | Size | Gross Plot Ratio | Est. number of residential units |

| Lentor Gardens | 2 ha | 2.1 | 500 |

| Senja Close (EC) | 1 ha | 3.0 | 295 |

| Holland Drive | 1.2 ha | 4.7 | 680 |

| De Souza Avenue | 1.9 ha | 1.6 | 350 |

| Tampines Street 95 (EC) | 2.2 ha | 2.5 | 560 |

| Zion Road (B) | 0.9 ha | 5.6 | 605 |

We’ll take a closer look at each site as more details become available, and in subsequent articles. But for now, the ones that stand out the most would be the ones at Orchard Boulevard, Zion Road, and Lorong 1 Toa Payoh.

The Orchard Boulevard site is going to be a well-connected one, with a link to Orchard Boulevard MRT station (TEL). This is a new station that’s expected to begin operations in November this year. The site includes a commercial component; and any development here will want to play up the location between Orchard Road and the Botanic Gardens area.

Cuscaden Reserve, which is one of the closest developments to this site and the last GLS site that was sold in the area for $2,377 psf to developers back in 2018.

While the value would certainly have gone up, there was no clear consensus on how much it could be right now. Some realtors noted that, with the new 60 per cent ABSD on foreign buyers, this site could be affected. Prime region properties tend to rely more on wealthy foreign buyers or investors, compared to mass-market condos; so developers may not be as eager as usual.

It will also be interesting to see what the eventual winner of this plot of land will opt to do, as the current sluggish sales of Cuscaden Reserve could be an indication of the type of units that are accepted in the area. Cuscaden Reserve has a unit mix of 1 to 3 bedroom units, with the 1 and 2 bedrooms a little bigger than the new launch average, while the 3 bedders can be said to be on the smaller side for a luxury unit.

Compare this to the success of Boulevard 88 and Park Nova, where the bigger more expensive units sold out first (and the resale profitability of Boulevard 88 proves the demand for big luxurious units).

That said, the new foreigner ABSD could also weigh in here, as too high a quantum would push wealthy local buyers towards landed homes instead.

Nevertheless, whatever we see here will definitely be in the luxury category, and not for the average Singaporean.

The same applies to the Zion Road site, which will be connected to the Havelock MRT station (TEL). This is much larger than its other prime region counterpart (Orchard Boulevard), and could yield as many as 955 homes. That’s almost mega-development territory. There’s also reportedly 2,300 sq. m. of commercial space, so it seems this too will be an integrated project of sorts.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

“We Calculated Our Interest Payment Alone To Be $110k In 10 Years” Why We Chose To Pay Off Our Home Loan Early

Most Singaporeans resign themselves to paying off a home loan for 25 to 30 years. In most cases, the home…

The Zion Road site is very close to Riviere (the condo famous for being on the former site of Zouk), which sold to Frasers for $1,733 psf back in 2017. Also nearby is Irwell Hill Residences at Irwell Bank Road; this sold for $1,515 psf in 2020.

Like the Orchard Boulevard site, it’s likely that some learnings will have to be taken from the sales performance of both projects. Although they were both launched at different times, Irwell Hill Residences was by far the more successful one of the two.

The Lorong 1 Toa Payoh site was actually expected. In 2022, a Singapore Police Force building here was relocated, and market watchers already knew the land would be for residential use.

It’s too good to pass up as it’s within walking distance of Braddell MRT station (NSL), and is situated near a large cluster of flats that reached MOP not long ago. Given the hot resale flat market and the time since the area has seen a new condo (the last was GEM Residences, where a recent high of $2,067 psf was achieved on March 2023), any project here will probably cater to HDB upgraders.

However, some realtors noted that the area is quite heavily built up. While convenient, a project here will have less appeal to buyers who dislike higher-density areas, or seek greenery views.

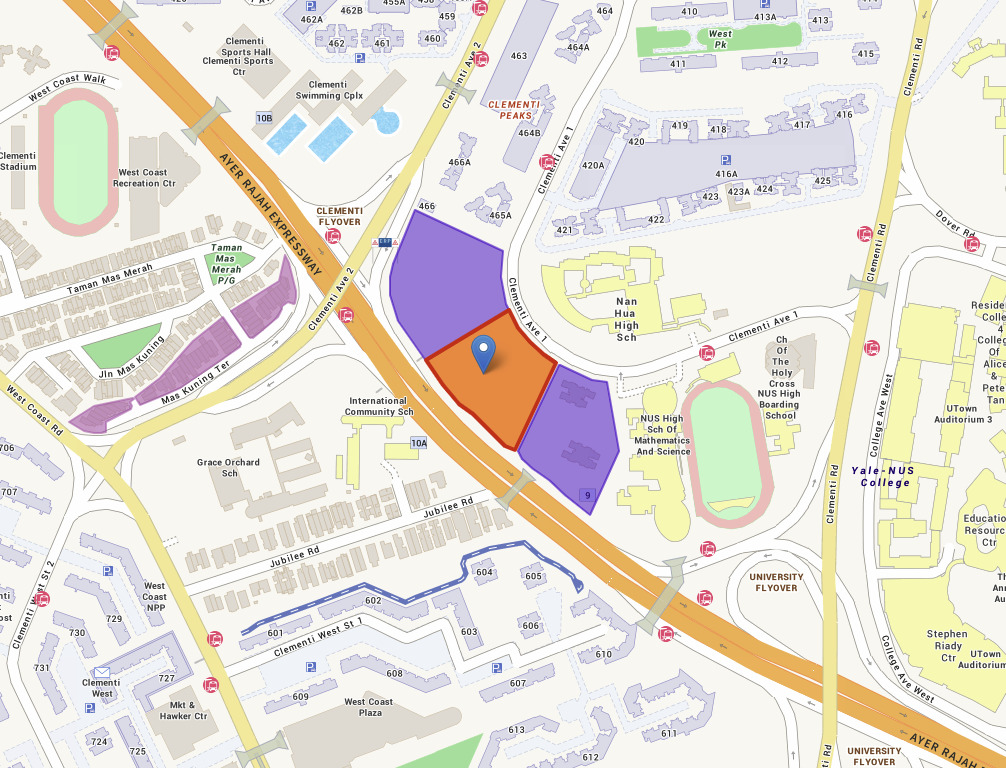

Clementi Avenue 1 is a plot that will be smack bang between Clavon and Clement Canopy, both developed by UOL. Clement Canopy has made substantial profits in the resale market, and Clavon has sold out at this point. There’s clearly still room for demand here, with price support from the Clementi HDB developments in the area.

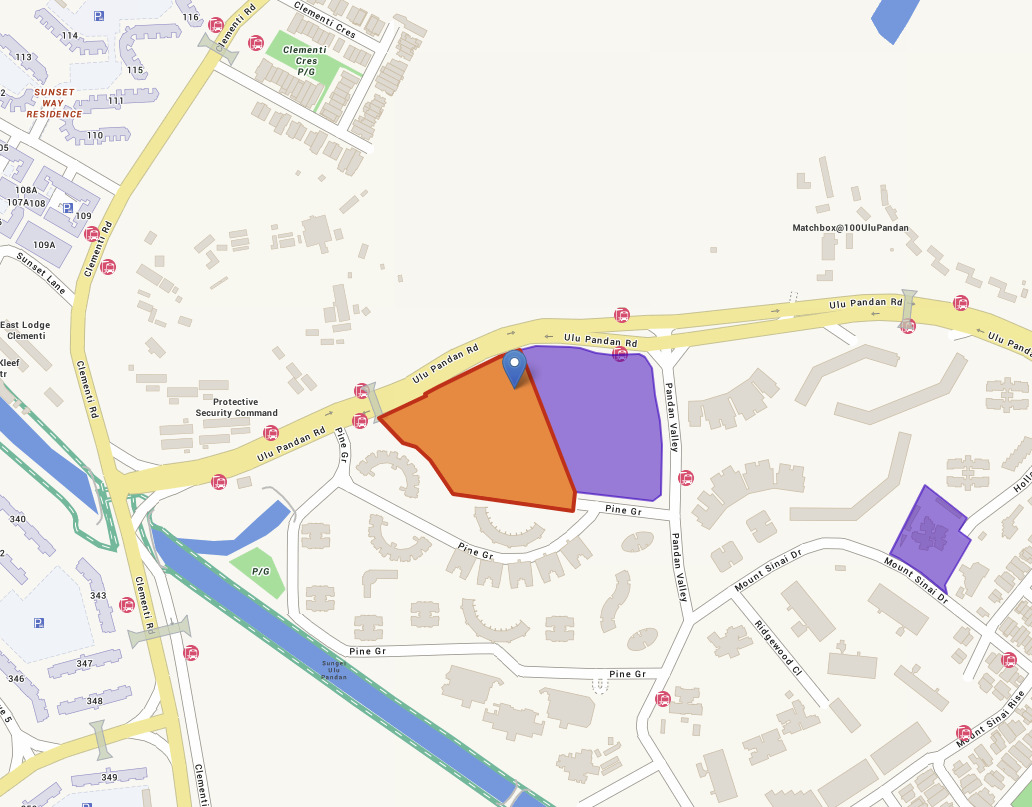

Pine Grove plot B will be another interesting one to look at, as there now will be further eyes on how Pinetree Hill performs. As we detailed in the overview of Pinetree Hill, there was keen competition for plot A, with the difference between the first and second bids just a mere $800.

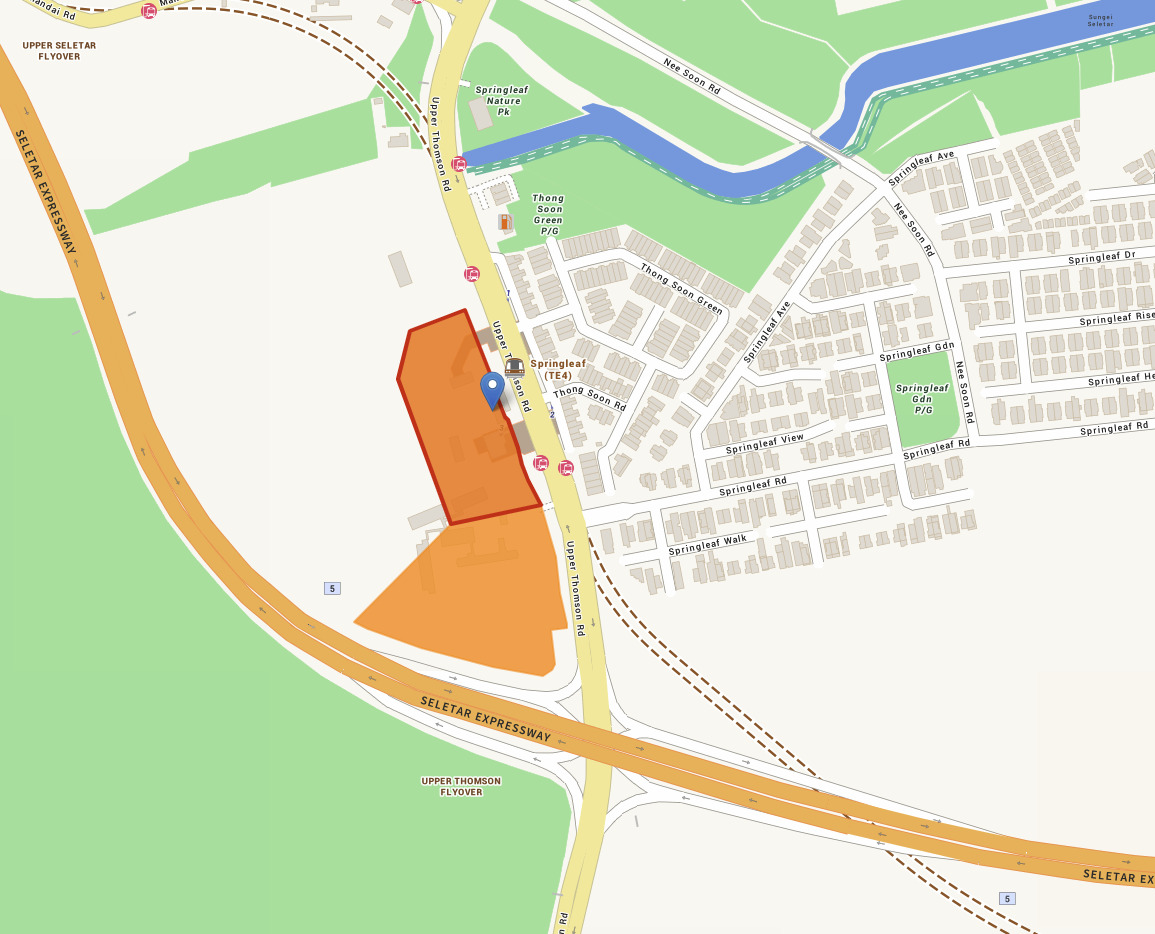

Finally, Upper Thomson Road (A) and (B) will be similar to what happened over at Lentor. Parcel A will be somewhat like Lentor Modern as the anchor of the place, with the connection to Springleaf MRT station as well as 2,000 sqm of commercial space. There’s clearly a push to see these areas of Singapore being developed, and like Lentor, there could be some support from the landed homes in the Springleaf area.

What’s the likely impact of the new GLS sites?

Ironically, the highlighted areas (see above) may have the least impact on the overall market.

Realtors pointed out that the Orchard Boulevard site is small, and that the average buyer may be priced out of sites like Orchard, Zion Road, and Toa Payoh. Most HDB upgraders are comfortable with a quantum of $1.6 million to $1.8 million, and prices for family-sized homes (three-bedders or above) in the highlighted areas are likely to push the limits of affordability.

We do feel that owners of properties near the upcoming GLS sites – especially the prime spots in Orchard and near Zion Road – may be a bit unhappy with all this.

At least some of those owners were sold on the idea that future competition, in areas as packed as Orchard or near Great World, was unlikely. But here we are, with Cuscaden Reserve and Irwell Hill Residences facing new alternatives in just a short time (both were just completed around 2020).

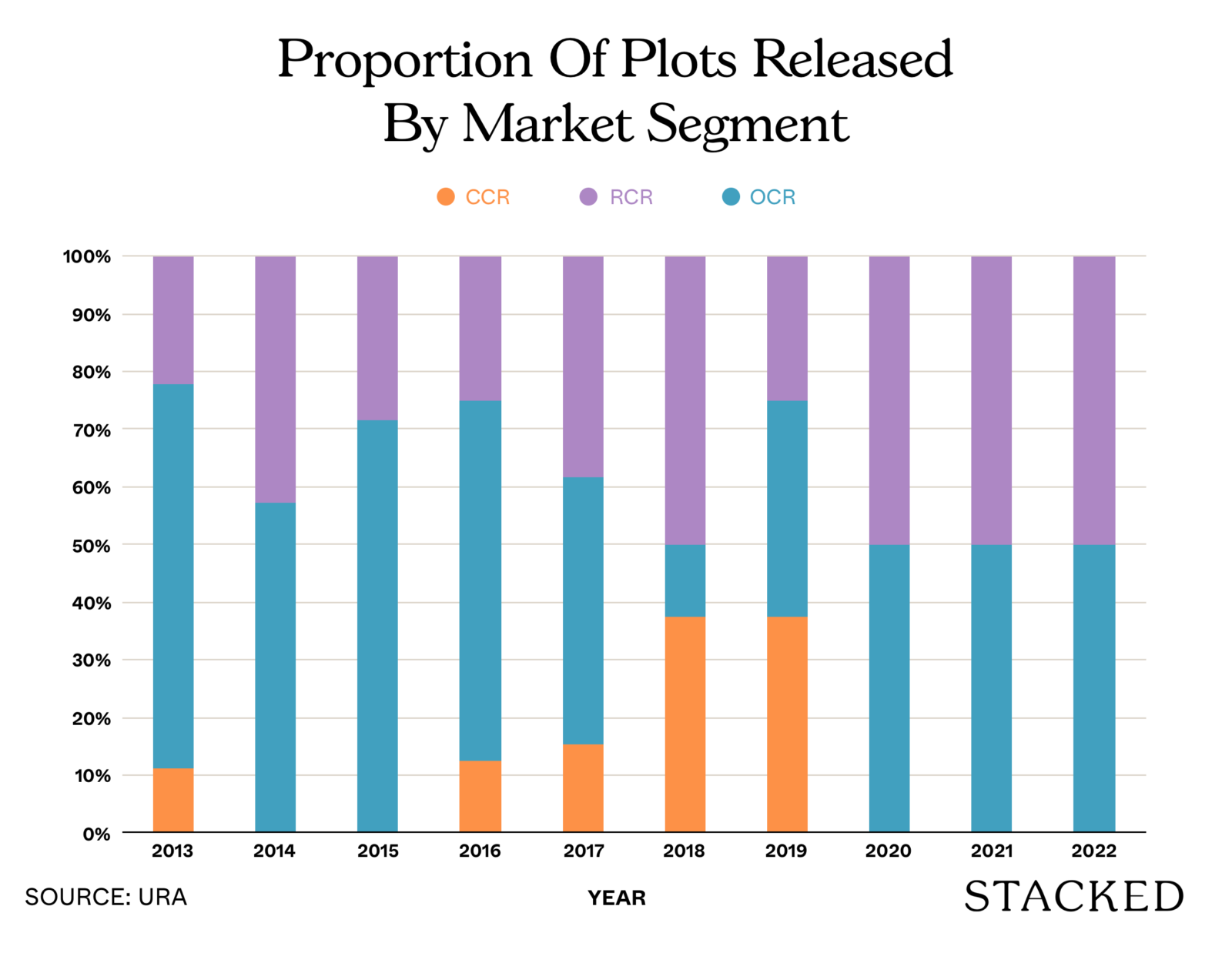

To be sure, the introduction of more CCR could close the gap between the OCR/RCR regions, as there was a focus on pushing more land supply in the outer areas over the last few years.

Much of the supply in the CCR consists of more dated products from 2006 to 2013. This includes condos in the Novena area and Somerset, where many condos have less popular characteristics from that era of bay windows and planters.

As for the EC sites, Plantation Close (In Tengah) was long expected. But realtors were also confident that the other two EC sites on the reserve list, Senja Close and Tampines, are likely to be triggered for sale.

The reason is the limited number of affordable options for many upgraders, given fully private condos are reaching a quantum of $2 million for 1,000+ sq. ft. units. One realtor opined it’s not even about “whether EC are profitable anymore” – it’s simply that ECs, or older resale condos, are the only way upgraders or first-time buyers can afford a family-sized home right now.

It’s possible that in the coming decades, a progression from HDB flat to EC, and only then to a private condo, will be more prevalent than a direct jump from flat to private condos.

Finally, there is likely to be some impact on the collective sales market, as developers are known to prefer GLS sites. As seen in cases like the Chuan Park en bloc saga, en bloc cases can be more tricky and long-drawn. There are also further costs involved to tear down the existing development, and possible hidden issues of the land that can only be found out later on.

This is compared to GLS sites, where they come ready for construction, and it’s a very straightforward deal.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the new GLS sites announced for 2023 and where are they located?

How might the new GLS sites affect home prices and the property market in Singapore?

Which GLS sites are expected to have the most impact on the luxury property market?

What is the significance of the reserve sites listed alongside the main GLS sites?

How could the new GLS sites influence property owners near these developments?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

0 Comments