4 Potential Residential En Bloc Sites That Could Be Worth Watching In 2025

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Despite the tough global trade war, developers seem to be confident in 2025. This is perhaps spurred by the strong responses to launches like Parktown Residence, Aurelle, Emerald of Katong, Lentor Central Residences, etc. Despite high new launch prices, Singaporeans seem eager to buy. We can see this in the following successful and potential en-bloc sales:

1. River Valley Apartments

This is a freehold, four-storey walk-up at 400 River Valley Road. The project was sold for $56 million in February this year, to a Singapore-based family office. (A family office is a private entity that manages the portfolio of wealthy individuals or families.) River Valley Apartments was built in 1970, but the land is freehold.

The site is around 12,408 sq. ft., coming to a price of around $1,622 psf. There were only 24 units, so each owner is expected to receive between $2 million to $2.6 million. The buyer has mentioned plans to redevelop the site, which has a Gross Plot Ratio (GPR) of 2.8, into luxury serviced apartments.

The River Valley Apartments site is interesting for two reasons: first, it represents a potential break in the en-bloc lull, which has been ongoing since the end of COVID. Developers previously lacked the confidence to go ahead with general bids, so this project might signify a turning point.

The other interesting element is the Core Central Region (CCR) location. This land plot is within walking distance of Great World City, and the Great World MRT station (TEL). While many homeowners don’t value the TEL as much as the other lines, take note that Great World is one stop away from Orchard, where you can take the NSL, and three stops from Outram Park, where you can access the NEL and EWL. So it’s more or less access to all the major lines.

Besides Great World, it’s also close to Valley Point – not a huge amenity by any stretch, but it does provide a closer supermarket. Overall, this is a very convenient location close to the Orchard area, but far enough to avoid the more serious traffic issues.

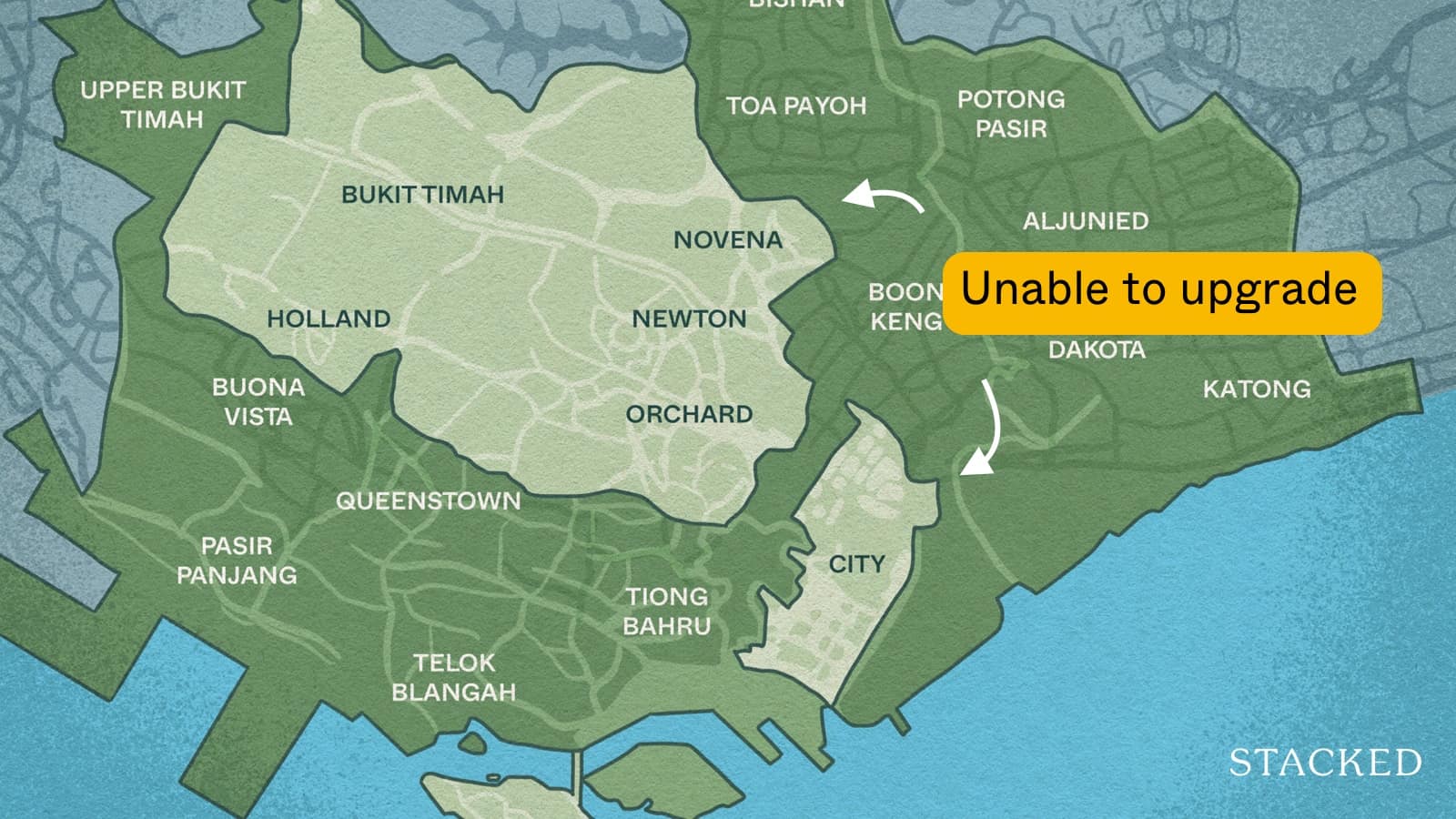

As we’ve mentioned in previous articles, we’re expecting a strong pivot to the CCR in the near term. Sources tell us a redevelopment into serviced apartments could happen as early as 2026, which may still be in time to ride the wave of CCR interest.

2. Thomson View Condominium

Note: This en-bloc transaction is on hold due to legal proceedings, with a High Court hearing due on 22nd May 2025.

If this en bloc happens, it will be one of the most watched sites for redevelopment. Thomson View is located on Bright Hill Drive, in the Upper Thomson area. This project, known for its distinctive (and unpopular) circular layout, was built in 1987. The land was on a 99-year lease dating back to 1975.

In November 2024, a joint venture between UOL and CapitaLand purchased the site for $810 million. This was after multiple unsuccessful attempts since 2007, and the price is lower than the previous reserve price of $918 million.

At present, the gigantic 504,000+ sq. ft. site is very under-utilised, comprising 255 units in a mix of condo units, landed units, and a commercial unit. Due to the mix of unit types and old record-keeping, do note that some other sites may show a lower unit count; but we have it from agents that the correct number is 255.

If Thomson View is redeveloped, the sheer size would turn it into a mega-development, with a potential 1,240 residential units. The location will appeal to those who like greenery (proximity to MacRitchie Reservoir Park) and the convenience of being near Thomson Plaza and Upper Thomson MRT station (TEL). For those who haven’t checked out Thomson Plaza in a while, by the way, the mall was heavily revamped around the 2020s, and is no longer an old or fading amenity.

We do expect a lot of interest if it works out, as mega-developments tend to perform well. In particular, we note the large landed enclaves at Brighthill and the area surrounding Thomson Plaza. This could provide a strong pool of buyers who want to live near their parents’ landed homes, or simply for right-sizers.

More from Stacked

We Own 2 Condos & Live In An HDB: Should We Sell It All To Invest In REITs, Or Buy A Landed?

Hi Stacked Homes team

The current stop-order on the en-bloc is due to objections from six unit owners, over “fairness and transparency.” We’re not privy to other specific details, and we’ll have to see in a few days whether the en bloc works out.

3. Hillcrest Arcadia (Tender closing on 22nd May)

Update: Tender closed with no bids, and now in 10-week private treaty period

This is another en bloc site to watch if it goes through. Hillcrest Arcadia is a leasehold project sitting on the edge of MacRitchie Reservoir. Unfortunately, the PIE does cut across the nearby greenery, but the condo is well shielded from noise by the foliage. This is also in a low-density area surrounded by mainly low-rise or landed homes, so it will appeal to those who want a high-privacy enclave.

This project was built in 1980 (lease commencing 1975) with just 272 units. This is Hillcrest’s second en-bloc attempt, with the previous being in 2018. This time, the reserve price is $920 million.

At over 442,600+ sq. ft. of land, but a Gross Plot Ratio (GPR) of just 1.6, this plot could hold around 773 new units. This land parcel is close to popular schools like Raffles Girls’ Primary and Hwa Chong Institution; and while there’s no MRT nearby (a trait common to most landed enclaves), Holland Village is just a few minutes’ drive from here.

Any redevelopment here will draw buyers who like the solitude and spaciousness of landed-style living, and who don’t mind having to drive.

Update: The tender closed on 22nd May with no bids, but Hillcrest Arcadia is now in a 10-week private treaty period. Expressions of interest were received by a number of developers, although all were below the $920 million asking prices. A deal may be secured, or groundwork laid for future attempts, during this 10-week period.

4. Upper Serangoon Shopping Centre (Tender closes on 10th June)

You may be surprised to learn that this ageing mall is actually mixed-use, and has a residential component. This freehold project was completed in 1982 and is around 176,792 sq. ft. At a guide price of $260 million, this would come to about $1,471 psf.

The front half of the plot is zoned for commercial and residential use, with a GPR of 3.0. The rear plot is for residential use only, with a GPR of 2.8 (there are eight residential units there right now, although they’re often unnoticed).

According to the marketing agent (CBRE), though, a redevelopment could include 154 residential units, 56 serviced apartments, and 12,000 sq. ft. of retail space. This would be a significant transformation, not only for the land parcel but for the surrounding neighbourhood.

Upper Serangoon Shopping Centre is an ageing landmark in the area, today best known for a famous vegetarian restaurant and not much else. But its location is excellent, being very close to Serangoon MRT station (CCL, NEL). This also means proximity to Serangoon NEX, and the direct bus there is right in front of the mall. The land plot is also near Methodist Girls’ Primary, and there’s bound to be interested buyers from the many older, surrounding properties (the nearby Hougang HDB cluster).

These developments also bear watching because they’re a good indicator of developer confidence. En-bloc sales were moribund in the past few years; but if the ball starts rolling, we may once again see a wider range of non-CCR alternatives. For buyers looking to upgrade in the next few years, follow us on Stacked so we can keep you updated on the rapidly changing market.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Editor's Pick

New Launch Condo Reviews Arina East Residences Review: First Condo Launch in Tanjong Rhu in 13 Years, Near MRT Station

Property Market Commentary Can Singapore’s Housing Market Handle A Rapidly Ageing Population?

Landed Home Tours We Tour Freehold Landed Homes Within 1km Of Tao Nan & CHIJ Katong (From $3.88M In 2021)

Property Investment Insights Why I Bought A $1.45 Million 2-Bedder At ELTA: A Buyer’s Case Study

Latest Posts

Homeowner Stories Why These Buyers Chose Older Leasehold Condos—And Have No Regrets

Singapore Property News $1.16M For A 4-Room HDB In Clementi? Why This Integrated Development Commands Premium Prices

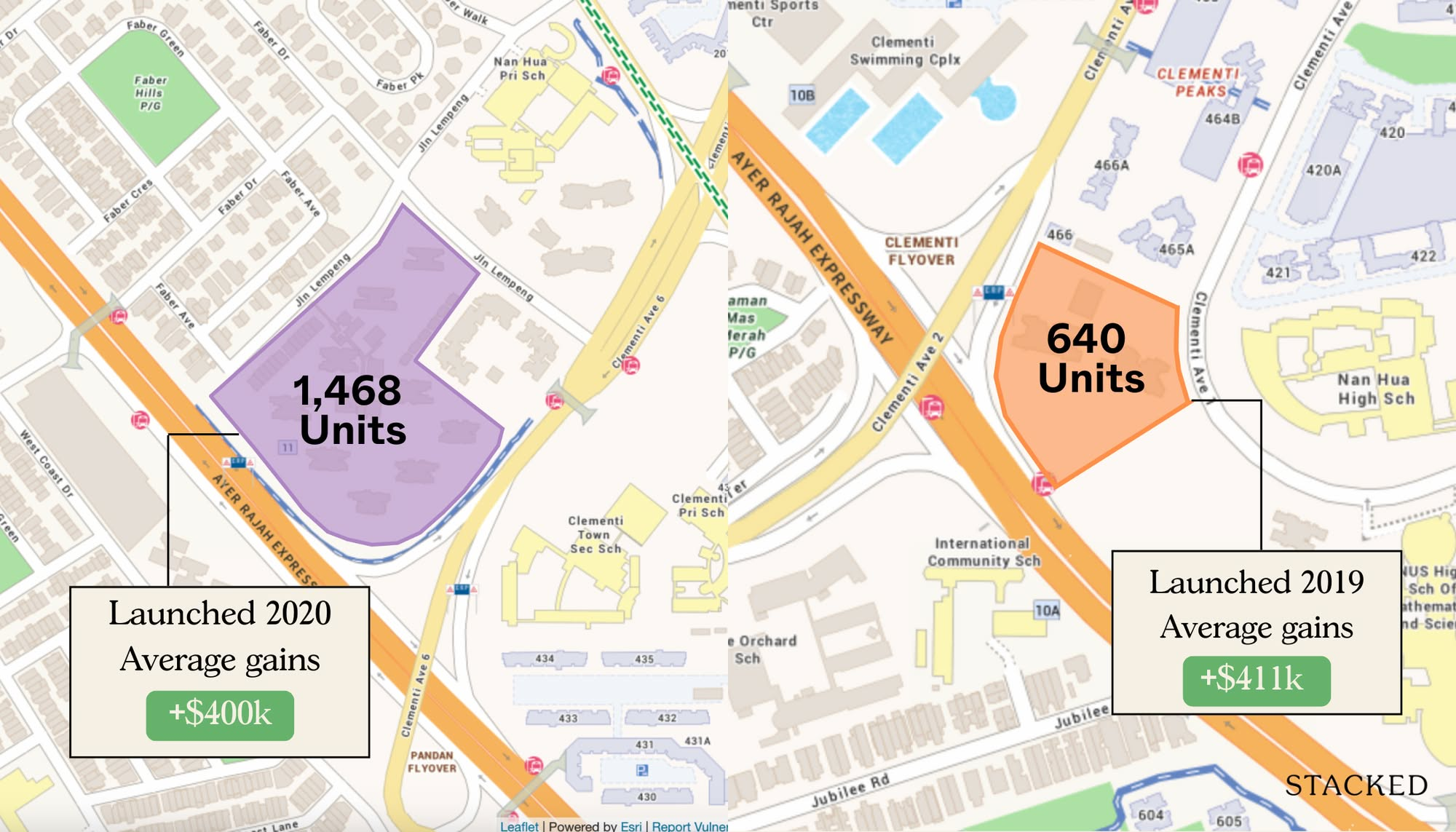

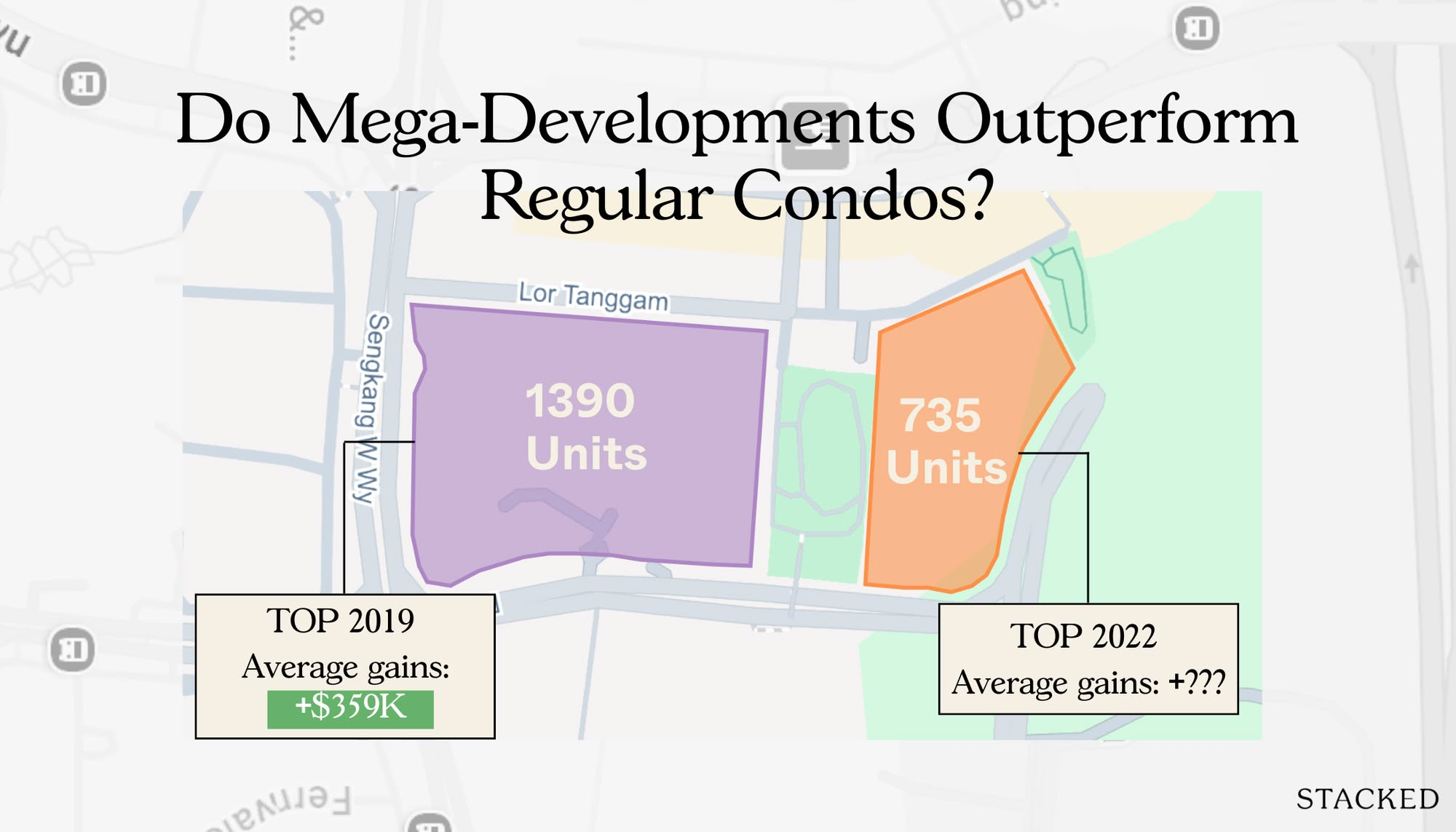

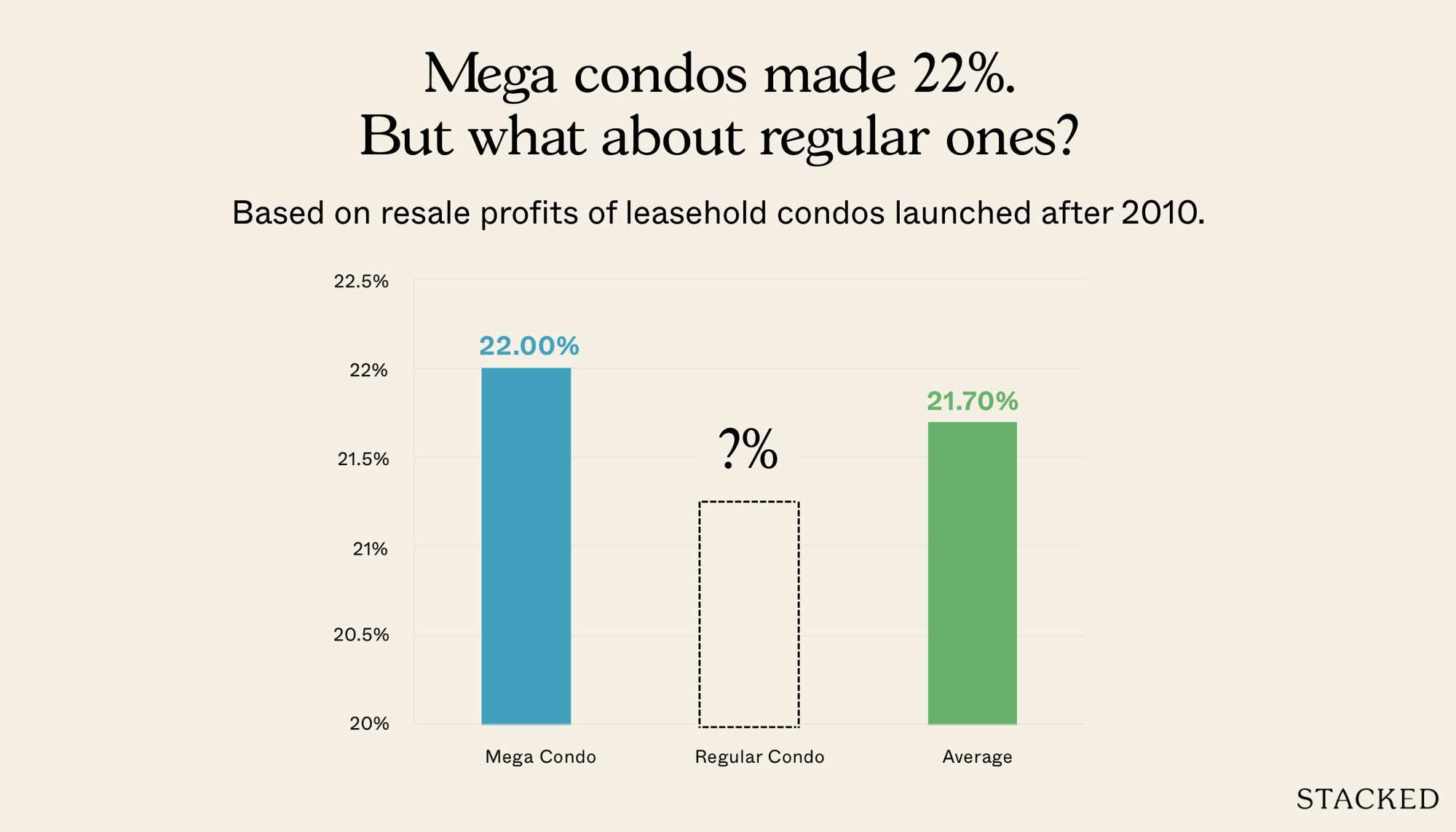

Pro Do Mega-Developments Really Outperform Regular Condos? A Parc Clematis Vs Clavon Case Study

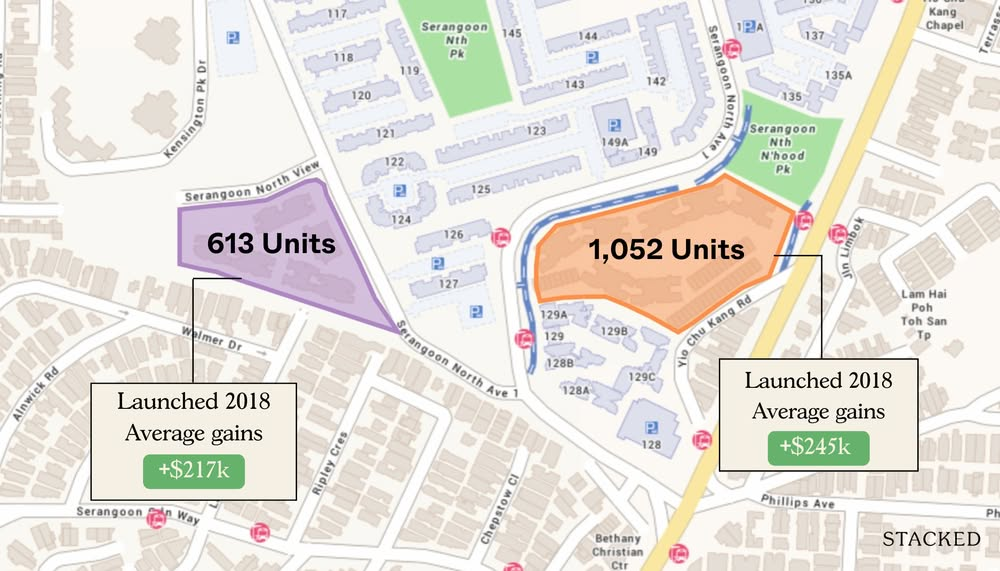

Pro Affinity at Serangoon vs The Garden Residences: Same Launch Year, Same Location — But Which Gave Better Capital Gains?

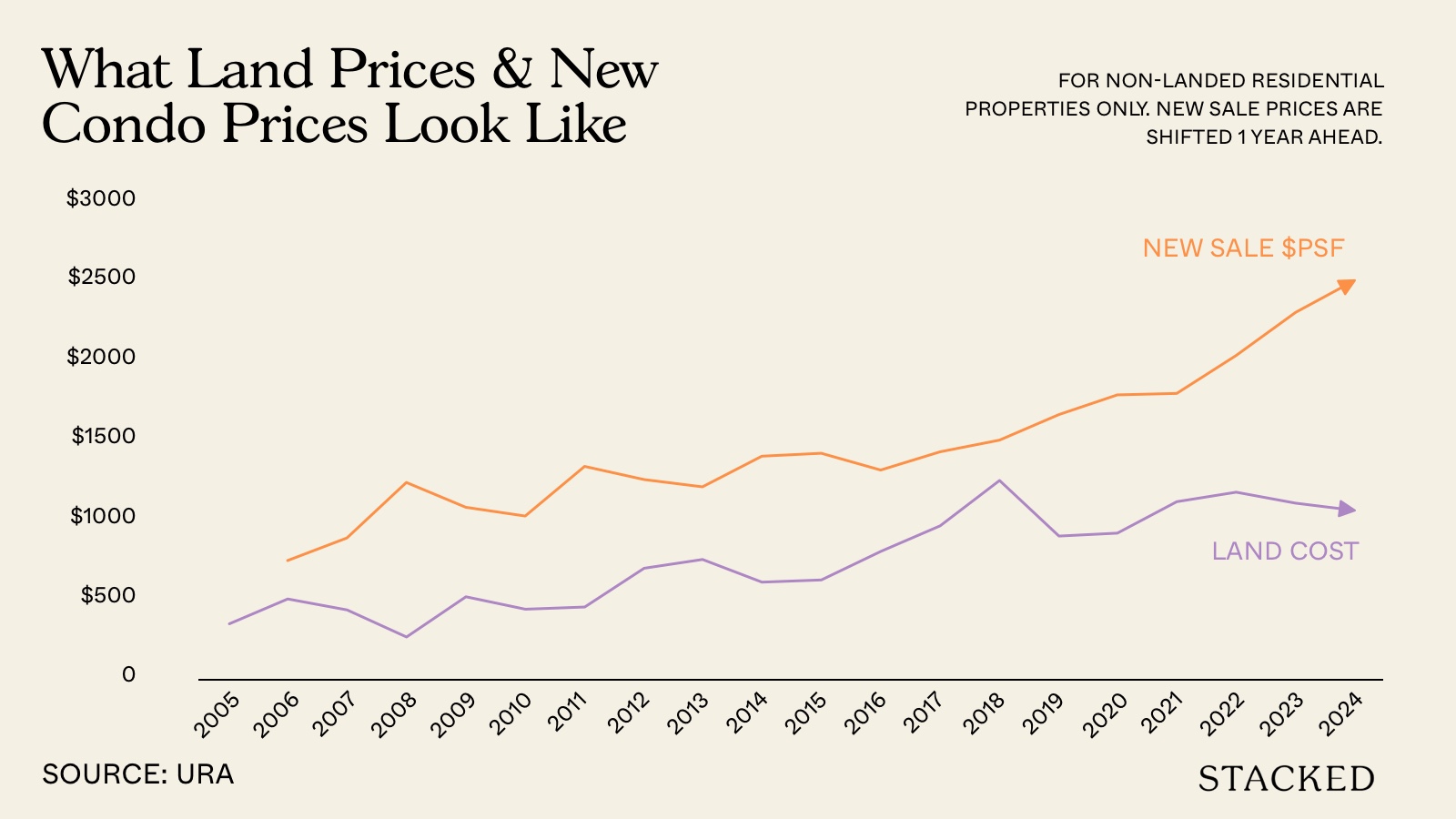

Singapore Property News Why Lower Land Prices In Singapore Don’t Mean Cheaper New Condos

Property Investment Insights Can You Upgrade From An HDB To A $1.8M Condo In 2025? Here’s What It Takes

Pro High Park Residences vs Parc Botannia: A Data-Driven Look At Mega vs Mid-Sized Condo Performance

Property Investment Insights Are Mega Developments In Singapore More Profitable Than Regular Condos? Here’s What The Data Shows

Singapore Property News Ang Mo Kio’s Most Expensive 5-Room HDB Flat Sold For $1.5 Million: Here’s Why

On The Market 5 Cheapest 5-Room HDB Flats In Central Singapore (Under $750,000)

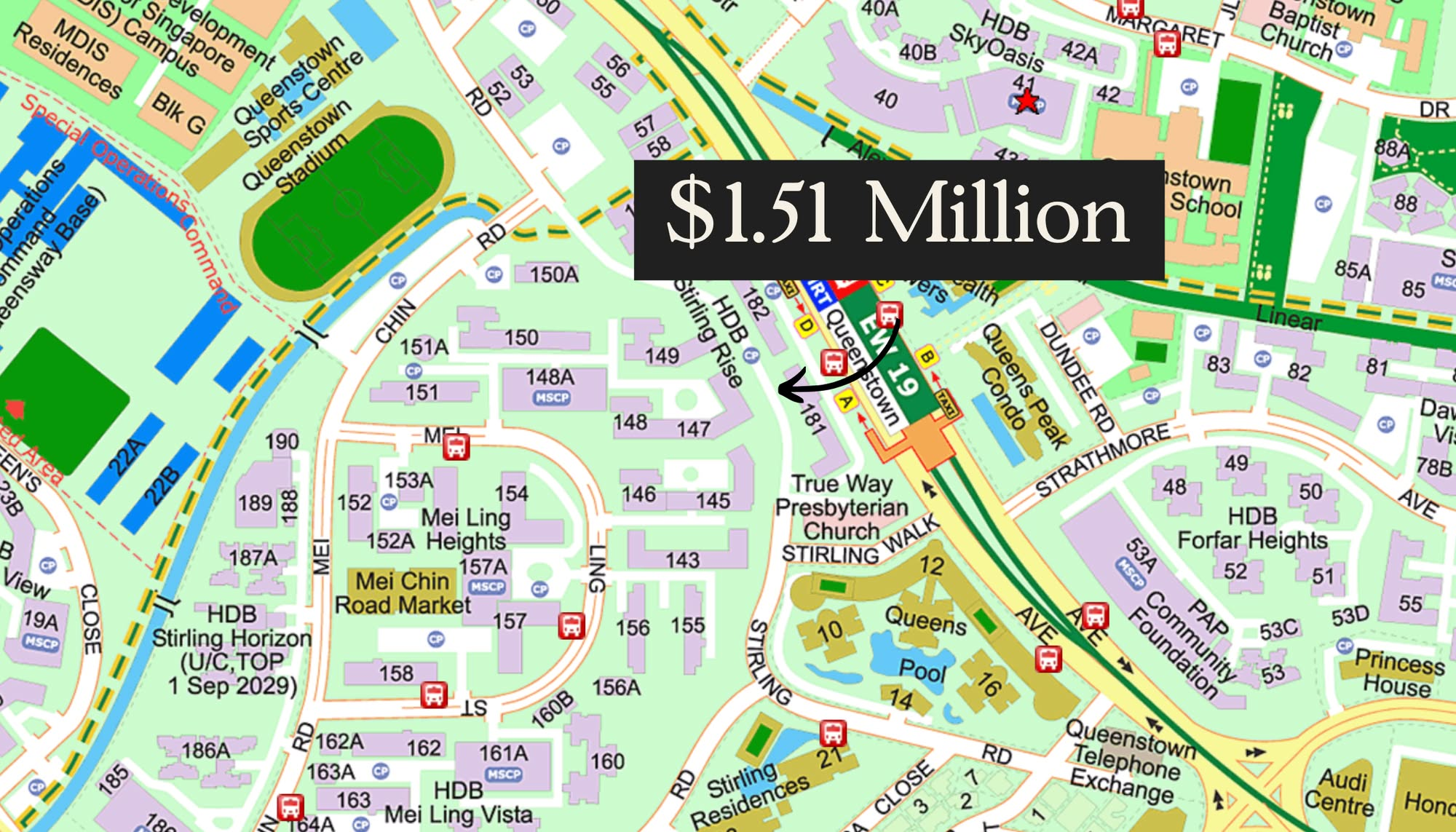

Singapore Property News This Rare HDB Maisonette In Queenstown Just Set A $1.51M Record: Here’s Why

Pro How Much Do Industrial Areas Really Impact Condo Prices? A Case Study Of Bishan And Yishun

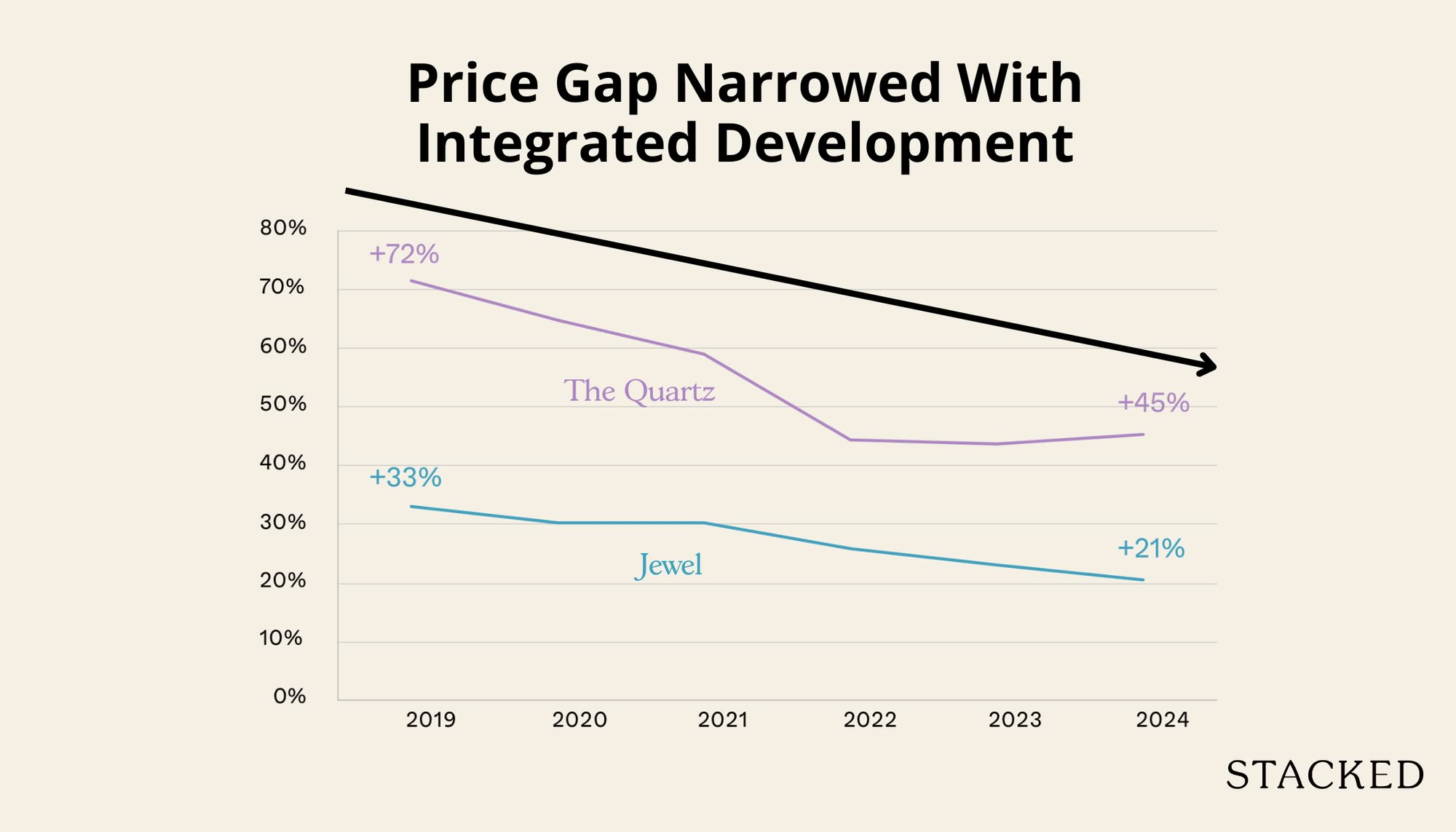

Pro Can A New Integrated Project Raise The Value Of Your Condo? The Surprising Results Near Sengkang Grand Residences

Property Investment Insights Can You Still Own Multiple Properties In Singapore? Here’s What You Need To Know In 2025

Property Advice Selling Your Home For The First Time? Here’s a Step-by-Step Timeline To Follow In Singapore