Will Singapore’s Rental Market Maintain Its Resilience In 2021?

December 22, 2020

If you’re like most landlords this year, you’d have felt a deep sense of relief the moment the Tenancy Agreement was signed; even if it’s less than you expected. Rental rates, like property prices, have so far shown some resilience toward the Covid-19 situation – but what about next year, if the Resilience budget runs out, or the world economy sees a dearth of expatriates?

Here’s a rundown of things are looking so far in Singapore’s rental market:

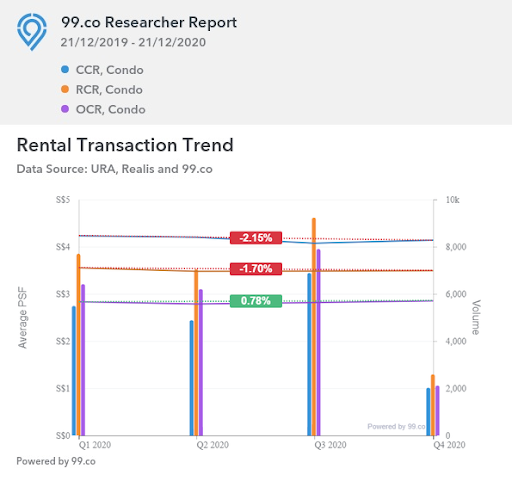

Singapore’s rental market looks surprisingly resilient, going into the end of 2020. In fact, they even appeared to be edging up slightly:

Note: This is to give you a quick snapshot of the situation only. The time of writing is close to the end of Q4, on 21st December 2020. As such, the data shows likely prices as we head into the end of Q4. We will post another rental update once the Q4 numbers are finalised.

Average rental rates started at $3.46 psf in Q1, and currently (21st December) average $3.48 psf.

OCR developments, in particular, seem likely to end the year on a good note. We notice that rental rates here haven’t changed much since Covid-19:

The CCR average has fallen from $4.23 to $4.14 psf to date, while the RCR average dipped from $3.55 to $3.49 psf. OCR condos however, have edged up from $2.83 to $2.85 psf.

While rental rates have mostly been flat, this is still better than the pessimistic expectations after the Circuit Breaker. Recall that in April this year, leasing volumes for both private and HDB units had fallen by around 40 per cent from 2019; and analysts had predicted a further decline of two to four per cent in the rental index.

But while we’re not at the end of 2020 yet, it seems the outcome isn’t likely to be as negative as predicted.

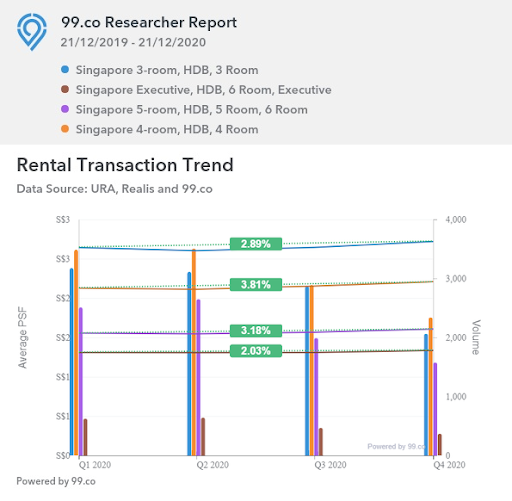

In case you’re wondering, resale flat rental rates also don’t seem to be plunging:

Island-wide, resale flats averaged rental rates of $2.11 psf in Q1. To date, the average is $2.19 psf.

Looking at HDB rental rates since Q1, it seems likely that 4-room flats will end the year ahead:

3-room flats averaged $2.64 psf at the start of the year, and now average $2.72 psf.

4-room flats rose from $2.13 psf to $2.21 psf, while 5-room flats rose from $1.56 to $1.61 psf.

Executive flats started the year at around $1.31 psf, with the average now being about $1.34 psf.

This is also surprising given the record number of HDB flats reaching their Minimum Occupation Period (MOP) in 2020. A large supply of resale flats becoming available for rental will usually provide competition, and put downward pressure on rental rates. Perhaps it takes more time before we see the full impact of this, but HDB rental rates don’t seem to be dropping yet.

Will the rental market continue to be resilient going into 2021?

Our general inclination is to say yes, with some conditional factors:

- For resale flats, the apparent uptick may not last

- CCR properties may bear the brunt of the downturn

- Tech@SG manages to draw expatriates despite Covid-19

- A lot rides on how well the Covid-19 vaccine turns out

1. For resale flats, the apparent uptick may not last

The first reason is the Malaysia Control Order (MCO) on 18th March 2020. This left some Malaysian workers unable to go back across the causeway, and resulted in them having to rent in Singapore.

This pushed up leasing volumes and prices for HDB rentals; and prices rose 1.4 per cent between June to July. It’s also possible that the sudden surge in demand prompted landlords to raise their flat rental prices; and the prospective tenants had few other choices but to accept.

However, we need to acknowledge the eventual departure of these unwilling tenants. We also don’t know that their employers here will be able to keep them on, if the economic climate worsens.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Why Did Some Condos Fail To Appreciate During Singapore’s Pandemic Property Boom? Here’s What We Found

As a collective whole, most properties in Singapore tend to appreciate. This may be a result of many different factors,…

Besides this, we would again point out the large potential supply of resale flats entering the rental market (see above). While demand may have been enough to absorb the supply in 2020, we are going to see another record number of flats reaching MOP this coming year.

As such, there’s a possibility that the rental numbers for resale flats – for now – look a lot rosier than the actual situation.

2. CCR properties may bear the brunt of the downturn

In Q3 of 2020, office rentals in the central region had fallen 4.5 per cent quarter-on-quarter. This was due to many companies downsizing, relocating, or simply restructuring to handle Work From Home (WFH) operations (which can mean foreigners don’t have to move to Singapore to work with teams here).

Landlords who own CCR properties often keep an eye on central region office rentals; this is because CCR condos derive much of their advantage from being close to the CBD. Fewer workers in central region offices could mean lower demand.

In a broader sense, companies may respond to downturns by shrinking expatriate packages. A smaller housing allowance, for instance, could cause expatriates to seek cheaper options in the RCR or OCR. This would explain the rates we’ve shown above.

3. Tech@SG manages to draw expatriates despite Covid-19

Even in 2019, Tech@SG was already hailed as the potential turning point for a soft rental market. This is an initiative that speeds up work pass approvals in the tech sector. This includes tech workers in lucrative sectors like finance, who make up a pool of prospective tenants.

We don’t know, however, if Tech@SG can continue to be a draw despite Covid-19. Barring the immediate logistical issues (e.g. travel bans in their home country if not in Singapore), it’s uncertain how entrepreneurial the world is feeling in light of the downturn.

Companies shelving their more expensive projects, or start-ups putting on the brakes, can see even Tech@SG failing to draw numbers. At least for the time being.

4. A lot rides on how well the Covid-19 vaccine turns out

We probably don’t have to say that, if the vaccine doesn’t work out, subsequent “second waves” and lockdowns will continue to dim rental prospects. This is beyond anyone’s control; but landlords would do well to brace for potential vacancies or loss of rental income, just in case.

Overall however, Singapore’s rental market seems likely to stay its course

An improvement to Singapore’s rental market in 2013 is probably too far-fetched at this point.

However, Singapore does continue to be a draw to foreigners, especially as it’s – at present – one of the least-worst Covid-19 affected countries in the region. In addition, unfortunate political upheavals in the next closest finance hub – Hong Kong – may see some companies divert to Singapore instead.

So while we don’t see many opportunities for landlords to raise their rental rates in 2021, we would say most of them can at least maintain the rental income they’re seeing this year.

Now would be a good time to try out some low-cost methods to retain those tenants, as you don’t want to go looking for new ones amid the pandemic.

If you’re currently having trouble keeping your property tenanted, drop us a message and we may be able to help. If you’re looking for a property asset that can weather these storms, check out our in-depth reviews on Stacked, with the latest news and updates on the Singapore private property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is Singapore's rental market expected to stay stable in 2021?

Will rental rates for resale flats in Singapore increase or decrease in 2021?

How might the Covid-19 pandemic affect Singapore’s office rental market in 2021?

Are expatriates still renting properties in Singapore despite Covid-19?

What factors could impact Singapore’s rental market in 2021?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Rental Market

Rental Market Is Singapore’s Rental Market Really Softening? We Break Down The 2024 Numbers By Unit Size

Editor's Pick The Cheapest Condos For Rent In 2024: Where To Find 1/2 Bedders For Rent From $1,700 Per Month

Rental Market Where To Find The Cheapest Landed Homes To Rent In 2024 (From $3,000 Per Month)

Rental Market Where To Find High Rental Yield Condos From 5.3% (In Actual Condos And Not Apartments)

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

2 Comments

Good to compare private completion to rent.

Many Malaysians stuck here are renting bedroom only, usually furnished, and on average short term (3 months with monthly extension). Therefore $psf per month figures will be pushed up.