Why You Will Never Buy When There Is A Market Crash

May 13, 2022

The stock market is the only market where people run away when things are on sale.

A seemingly innocent sentence, but perhaps none truer than what is happening in the markets right now.

Stocks, crypto, the shocking implosion of Luna and Terra – everything is a dismal sea of red at the moment.

It reminds you of popular sayings back when the market was hot.

“I’m waiting on the sidelines to buy the dip”

“I’m going all in when the market drops”

These are what you typically might hear on various forums or even during gatherings with friends and family.

And probably what countless people have repeated during each recession.

It may seem obvious in hindsight now, but when we last wrote about the possible effects of the pandemic on the property market in February 2020, we received some backlash on our views.

So much so that we felt like we had to change our tact, for fear of further negative comments.

But since then (if you had bought) prices have already risen considerably.

I’m sure many people look back at that point with feelings of regret, as we know of many who had a need to buy were holding out at that point for fear of the market dropping further.

So why don’t people just buy when prices drop?

After all, you should know the very popular mantra said by Warren Buffet by now:

“Be fearful when others are greedy and be greedy when others are fearful.”

Let’s look at some of the reasons why this is easier said than done.

The market doesn’t exist in a vacuum

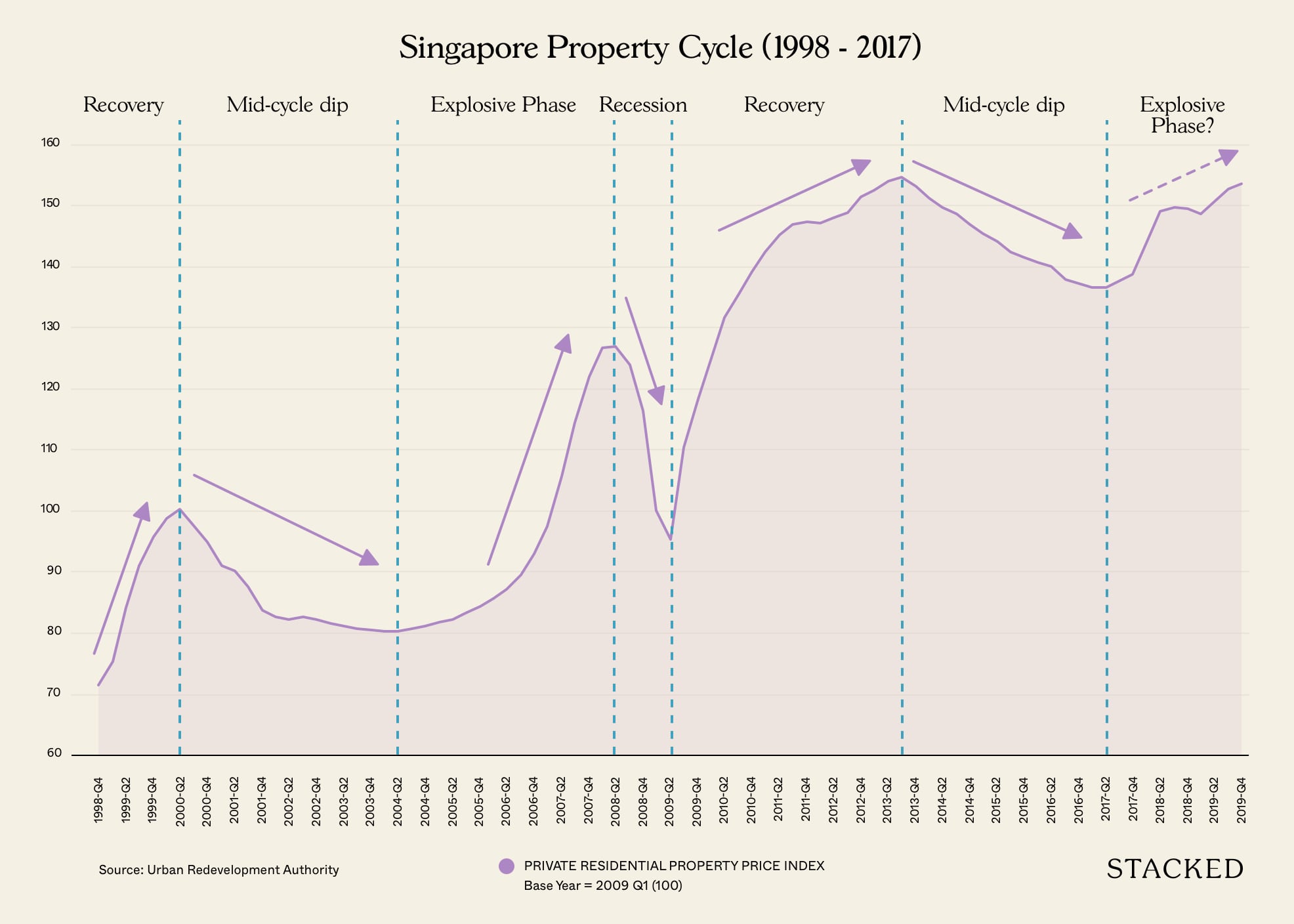

As you can see from the property cycle, every time it dips, it ALWAYS goes back up.

You’d think people would have learnt by now after a few cycles, but why is it that most people are usually too fearful to pull the trigger?

Property Market CommentaryCoronavirus and SARS: How It Might Affect The Singapore Property Market

by Reuben DhanarajOne reason why it’s not easy to buy during the dip is that the market doesn’t exist in a vacuum.

If you notice, every time someone says they are waiting for the dip to buy, it’s always easy to say that because they are thinking about the market dropping but with everything else staying constant (all other factors are going well).

To give you an example, let’s go back to March 2017.

Martin Modern along River Valley was launched at around $2,000 psf.

It seems like an incredible price right now, especially with OCR new launches looking to breach the $2,000 mark in 2022.

Today, it’s selling at an average of $2,700 psf. Multiple people have made 6 digits in profits, the highest being $700k so far.

So why were most people fearful then?

Here were the headlines at that point in time.

In late 2016, multiple news reports were talking about Singapore entering into a technical recession.

In the property market, there was impending talk about an increase in interest rates (sounds familiar?)

Property prices had been slowly declining.

The rental market was weak.

Like it or not, consumer sentiment plays a huge role in buying decisions.

You might feel confident about your job, but reading newspaper headlines talking about the impending doom of recession, listening to friends scaremonger – even the most positive person can shrink away in fear.

Most people don’t do it because of loss aversion.

Loss aversion refers to a phenomenon where people care more about losing than gaining.

For instance, the pain of losing $1,000 is often far greater than finding that same amount.

The reason for this seemingly irrational behaviour is that we feel the pain of a loss about twice that of the pleasure from a gain of the same amount.

As such, the fear of losing money is much harder to overcome, which is why during a property slowdown it is much harder for people to commit to buying a property for investment.

Despite the fact that everyone was waiting for the market to bottom when the market was hot, the pain of possibly “losing” money is much stronger than thinking about any gain – even if you are aware that the market will always eventually bounce back up.

There is also the part about negative bias.

While somewhat similar, loss aversion can also lead to something called negative bias.

As humans tend to weigh negative more than positive, it means that you will tend to dwell on a negative comment more than a positive one.

A criticism will affect you more than compliments, and there’s a reason bad news is a lot juicier than reading about good news.

Here’s a more relatable situation.

Ever read a review of a hotel online? There may be hundreds of positive reviews.

But find one particularly descriptive negative review on how the glass cup was not clean, and our perception of the hotel can immediately change.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

10 Key Things You Can’t Overlook In Your Condo Floor Plan Before Buying

What makes a good condo layout? Well, the answer is, truthfully, quite subjective - but there are some common features…

This can have an unintended effect on when we read the news.

There could be different reports about the stability of the property market in Singapore, but read one on how the market may crash soon – and all rationality goes out of the window.

Some people don’t do it because they can’t make the distinction between price and value.

“Buy low/Sell high” is a mentality of a speculator, because it focuses on the price, when you should really be thinking about value.

In general, when the price of stocks goes down, the value doesn’t actually go anywhere.

The value of it exists only as people agree that it exists.

Let’s say that one day you inherit a house, and it has been valued by the bank for a million dollars.

That makes you a millionaire.

However, a day later, you get a call and the bank tells you they made a mistake and it is now $500,000 instead.

You feel like you’ve just been deflated as you’ve just “lost” $500k, but where did the money actually go?

Was the previous value really just an illusion?

Basically, price is what you pay for something, or what the market thinks something is worth; value is what you think it is worth.

If the property is worth $1 million today, but suddenly during a downturn it drops to $200,000, does it mean that the value of the property is really $200,000?

What has really changed?

It’s still near an MRT, it is still freehold, and it is still in a very convenient location.

And so when the price drops, people don’t think about the value enough, and are afraid to buy when in reality – the merits of the property have not changed at all.

The fear is real

If everyone that you know has just lost their jobs, and companies are closing left right and centre, it takes courage to go against the flow.

While history has shown that it is never a good idea to sell after a huge crash, emotions always get the better of us, and the prospect of sustaining even more losses can make us make poor decisions.

Here’s an example of how even the best of the business has shown how emotions can get the better of a person.

In early May 2020, airline stocks were crashing from the impact of Covid-19.

Warren Buffet sold off all of Berkshire’s airline holdings at a loss, selling Delta Airlines, American Airlines, Southwest Airlines, and United Airlines.

At that point, these stocks were down between 45% and 70% from the start of the year.

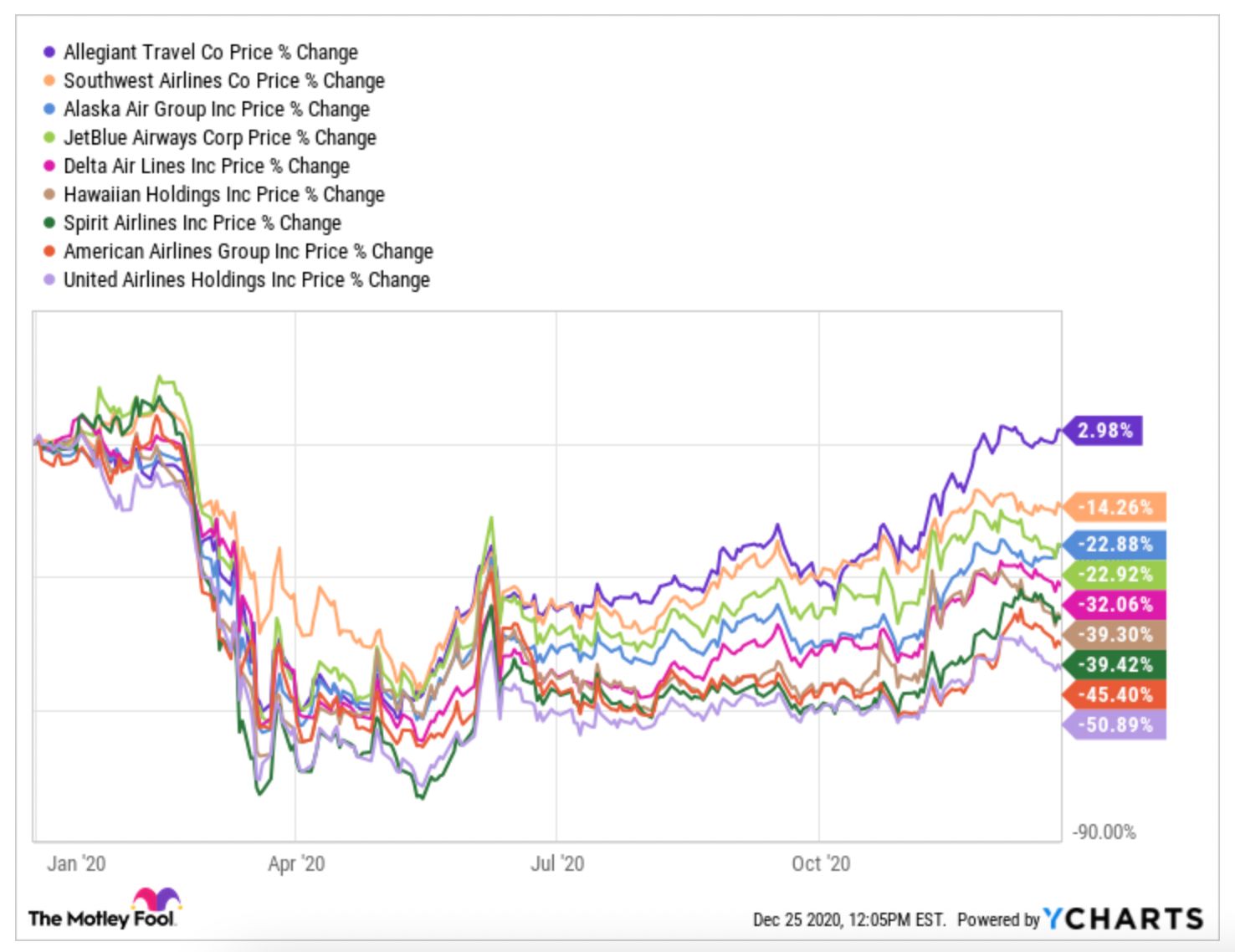

Since then, however, the stocks have made a comeback. They’re all still below their levels at the end of 2019, but just a year later in May 2021 – Delta is up 168%, American is up 163% and United is up 199%.

While Buffet still denies that he regrets selling off all of the airline stocks, there’s still no question that had he waited it out, he would not have suffered the same amount of losses.

In his defence though, he did state that it was his belief that Congress might not have stepped in to aid the airlines if a prominent investor like him still maintained a major position in the airlines.

Final Words

Look, at the end of the day, this isn’t about trying to encourage people on the sidelines to jump in during a dip (whether it be property or stocks).

It’s about having a long term view. Like what we wrote in April 2020 during the start of the pandemic, if you always have a long term view, you would know how to act in situations such as this.

The “good” part is that you are forced to hold a property in Singapore because of the SSD – unlike stocks where you can just sell it off.

I’d like to leave you with this fantastic quote by Fred Ehrsam (Co-Founder for Paradigm and Coinbase, courtesy of the Milk Road)

“Cycles are neither good nor bad, they are natural. Peak euphoria provides the opportunity for the world to dream about the future. Rock-bottom despair forces practicality and clarity. When things are good, they’re never as good as they seem. When things are bad, they’re never as bad as they seem.”

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why do people tend to avoid buying during a market crash?

How does loss aversion influence investment decisions during a market decline?

What is the difference between price and value in investing, and why is it important?

Why does the market tend to recover after a dip, despite people's fears?

How can emotions affect decisions during a market crash, as seen in examples like Warren Buffett's airline stock sale?

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments