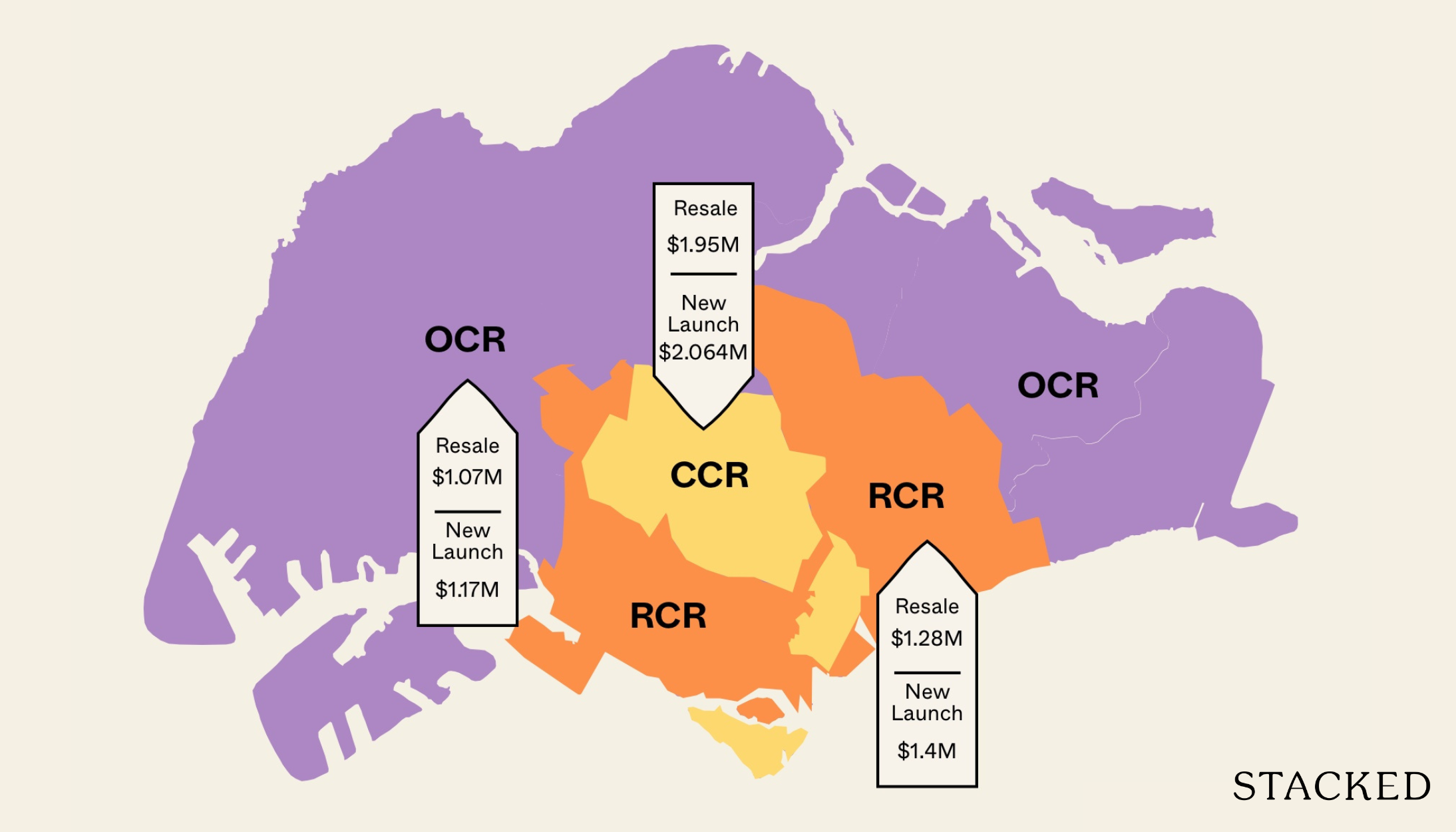

Which Singapore Regions Offer The Best Value For Two-Bedder Condos Today? (Resale vs New Launch)

April 22, 2025

In this Stacked Pro breakdown:

- We reveal which regions saw the highest growth in $PSF and quantum

- Show how resale units are catching up — and in some cases, offer better value than new launches

- Plus: A case study of Martin Modern vs Jadescape

Already a subscriber? Log in here.

Perhaps due to issues of affordability, the demand for two-bedder condos has been on the rise in Singapore. Increasingly, we’re seeing homeowners, such as small families, opt for two-bedders (or 2+1 layouts) in place of higher-quantum three-bedders.

Join our Telegram group for instant notifications

Join Now

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Popular Posts

On The Market

Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

New Launch Condo Reviews

River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

Singapore Property News

The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

February 26, 2026

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

February 24, 2026

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

February 24, 2026

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

February 21, 2026

Latest Posts

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

February 26, 2026

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

February 26, 2026

Singapore Property News You Can Now Buy Part Of A $300M Singapore Bungalow — But You Can’t Live In It

February 26, 2026

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

February 25, 2026

0 Comments