Which HDB Towns Sold The Most Flats In 2024?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

2024 was quite the year for resale flats. We saw little real loss of momentum, despite many earlier claims that the rising prices couldn’t be sustained. We even saw notable transactions, such as one flat reaching over $1.7 million, and a 3-room unit that hit the $900,000 mark. But which HDB towns saw the biggest volume of transactions, and where are Singaporeans rushing to for their homes?

Update 19 Feb 2024: The information below was correct at the time of writing. As of 19 Feb 2024, more data has been added, which brings the total number of sales previously reported from 27,052 to 27,839. As such, Tampines no longer remains in the top 3 as it was replaced by Punggol, however, it ranks 5th (1,961 units) in terms of total volume transacted in 2024 – just 1 behind Jurong West (1,962 units).

Here’s a breakdown of the most active parts of the HDB market for year-end 2024:

Breakdown of resale flat transaction volumes for 2024

| Estate | 3 ROOM | 4 ROOM | 5 ROOM | EXECUTIVE | MULTI-GENERATION | Total |

| SENGKANG | 171 | 1042 | 718 | 125 | 2,056 | |

| WOODLANDS | 274 | 882 | 626 | 214 | 1,996 | |

| TAMPINES | 421 | 867 | 506 | 150 | 2 | 1,946 |

| PUNGGOL | 259 | 1,007 | 646 | 33 | 1,945 | |

| JURONG WEST | 399 | 764 | 567 | 170 | 1,900 | |

| YISHUN | 478 | 896 | 311 | 90 | 3 | 1,778 |

| BUKIT BATOK | 429 | 810 | 305 | 75 | 1,619 | |

| HOUGANG | 308 | 672 | 288 | 144 | 1,412 | |

| BEDOK | 536 | 453 | 252 | 61 | 1,302 | |

| CHOA CHU KANG | 85 | 655 | 407 | 127 | 1,274 | |

| ANG MO KIO | 571 | 308 | 144 | 15 | 1,038 | |

| BUKIT MERAH | 379 | 433 | 183 | 995 | ||

| SEMBAWANG | 111 | 485 | 256 | 71 | 923 | |

| KALLANG/WHAMPOA | 416 | 375 | 111 | 15 | 917 | |

| BUKIT PANJANG | 119 | 370 | 275 | 85 | 849 | |

| TOA PAYOH | 366 | 299 | 108 | 17 | 790 | |

| QUEENSTOWN | 339 | 273 | 69 | 4 | 685 | |

| PASIR RIS | 18 | 279 | 195 | 186 | 678 | |

| GEYLANG | 308 | 248 | 61 | 24 | 641 | |

| JURONG EAST | 230 | 171 | 118 | 39 | 558 | |

| CLEMENTI | 270 | 201 | 67 | 14 | 552 | |

| SERANGOON | 97 | 197 | 88 | 58 | 440 | |

| BISHAN | 51 | 188 | 105 | 38 | 1 | 383 |

| CENTRAL AREA | 81 | 68 | 24 | 173 | ||

| MARINE PARADE | 78 | 34 | 28 | 140 | ||

| BUKIT TIMAH | 12 | 22 | 16 | 12 | 62 | |

| Grand Total | 6,806 | 11,999 | 6,474 | 1,767 | 6 | 27,052 |

Some of the numbers are routine and expected, and not specific to 2024. Most transactions, for instance, were for 4-room flats, because these are the most ubiquitous form of housing in Singapore. Likewise, mature and central areas saw the lowest number of transactions (although usually the highest prices) due to reasons of scarcity and higher prices.

However, there are some notable trends in the above:

Some observations and upcoming changes to expect:

1. Tampines joined Sengkang and Woodlands in the top three

It’s not too surprising to see Sengkang, Woodlands, Punggol, etc. having higher transaction volumes, as these are less mature areas where prices tend to be lower. Tampines however, is a mature town and a regional centre of the east, so we wouldn’t have expected it to be in the top three.

However, a closer look shows that a high number of more affordable 3-room flats (421 units) are driving up the volume in Tampines. Besides this, Tampines Central (the area where Tampines MRT station and malls like Century Square are clustered) is quite different from Tampines North or Tampines South. These two parts of Tampines are less developed, and prices here will be lower for some time to come. There are also planned future developments for these parts of Tampines, which may spark interest for those looking at the long term.

Update 19th Feb 2025: Tampines now ranks 5th based on the updated 2024 data.

2. 3-room flats saw high demand in Yishun, Ang Mo Kio, and Tampines

Ang Mo Kio saw the biggest number of 3-room flat transactions (571 units). Ang Mo Kio is a mature estate, and flats here can command high prices; 4-room flats here can hit the million-dollar mark. The number of 3-room flat purchases may reflect buyers who are willing to compromise on space, in exchange for better amenities.

Yishun saw the next highest number of 3-room flats (478) with Tampines following up at 421 units. As stated above, some parts of Tampines are cheaper than the famed Tampines hub. The 3-room flats purchased in these Yishun, and the less-pricey parts of Tampines, may reflect buyers who are prioritising affordability right now.

3. A possible grab for the most affordable large flats in Woodlands and Pasir Ris

Resale flat prices are high right now, so those who want large executive flats may be in a bit of a bind. The solution seems to be executive flats in less mature areas: Woodlands saw the highest number of executive flats transacted (214 units), while Pasir Ris followed at 186 units. The third highest (170 transactions) was also in the lower-cost area of Jurong West, followed by Hougang.

It seems that at prevailing prices, those who need larger homes will have to settle for the fringe areas. It may also be no coincidence that Jurong West, Hougang, Woodlands and Pasir Ris are the first recipients of the latest round of HDB’s Home Improvement Scheme. This may mitigate the greater age/lease decay of some of some executive flats.

4. Plus flats may change the HDB landscape in the coming year

Plus flats were introduced at the very end of 2024, with the first Plus BTO launch site being in Bayshore (it’s still under construction). One differing factor between Plus and Prime is that a Plus flat isn’t necessarily near the city centre; Bayshore, for instance, is far out on the fringes of the East Coast. All a flat needs to have Plus status is to be close to the hub of its specific neighbourhood – the spot where the train station, mall, market & food centre, etc. are located.

This could introduce a new dynamic even in non-central parts of Singapore. In particular, it could drive demand for existing resale flats located near their neighbourhood hubs, but which are not subject to Plus housing restrictions like a 10-year MOP.

We may see some effects from this toward the end of the coming year, or perhaps a bit later.

For more on the Singapore property market, and information on private as well as public housing, follow us on Stacked.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Editor's Pick

New Launch Condo Analysis LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden

Landed Home Tours Where $4 Million Semi-Ds Sit Next To $40 Million GCBs: Touring First Avenue In Bukit Timah

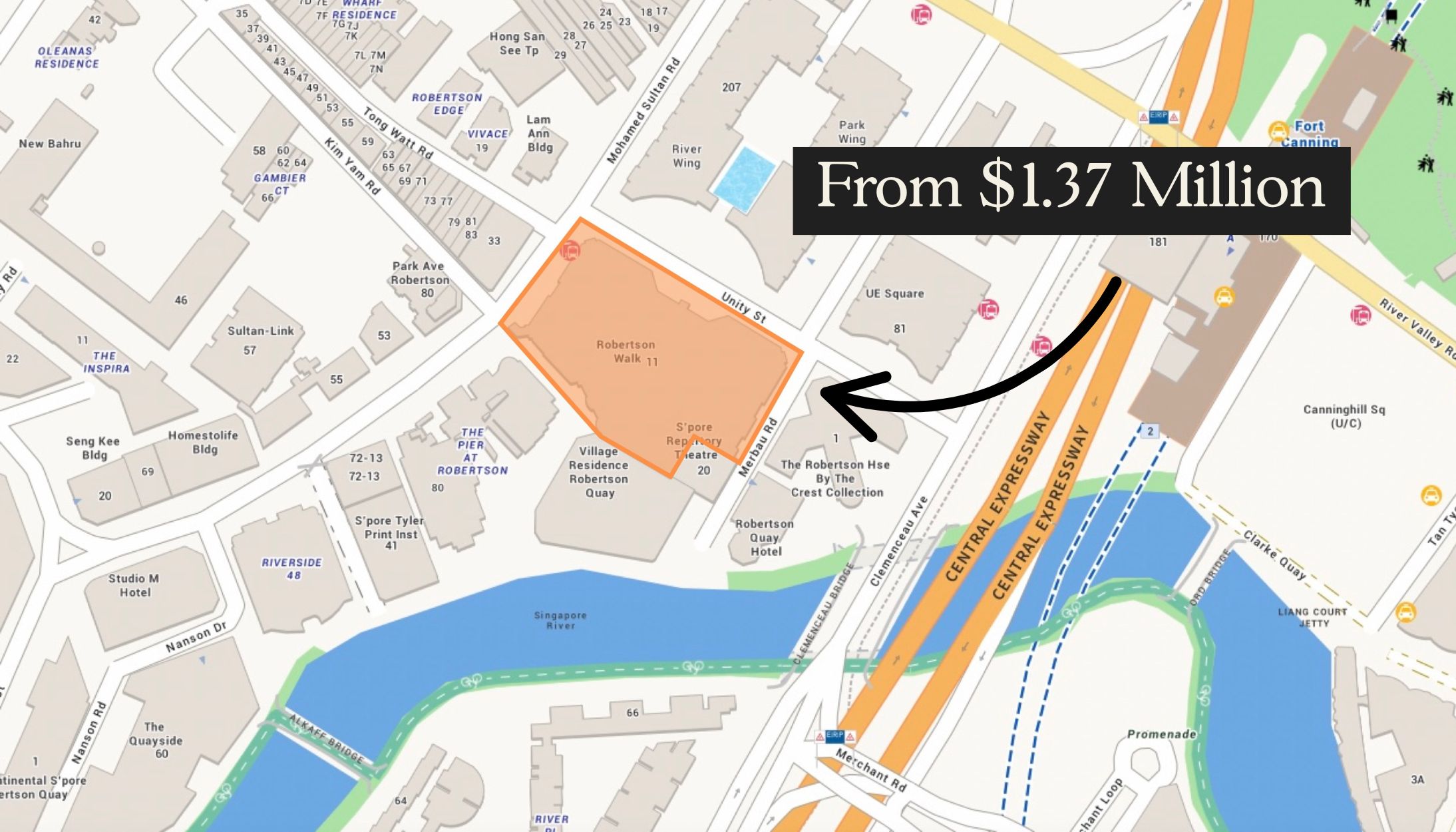

New Launch Condo Reviews The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

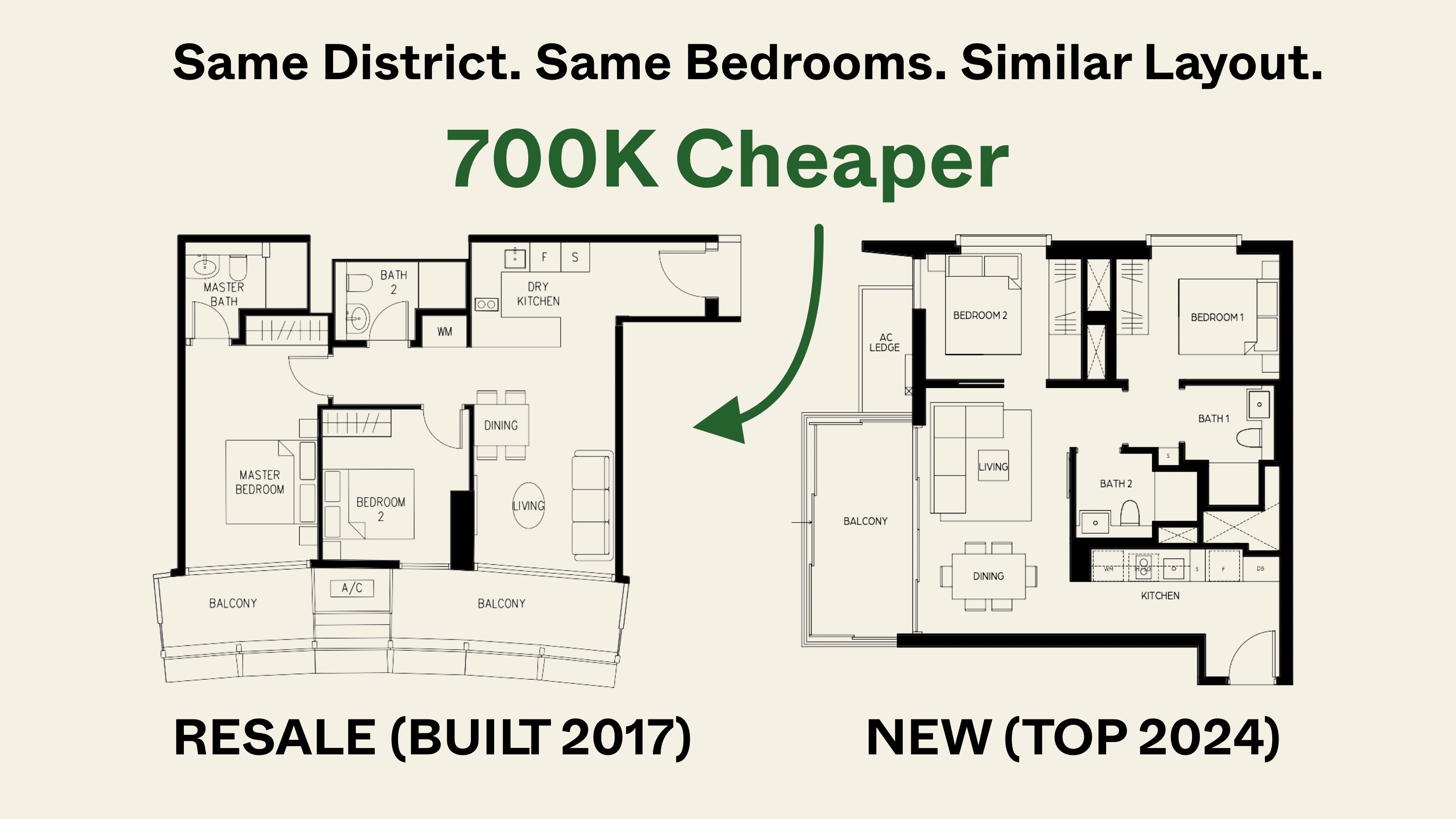

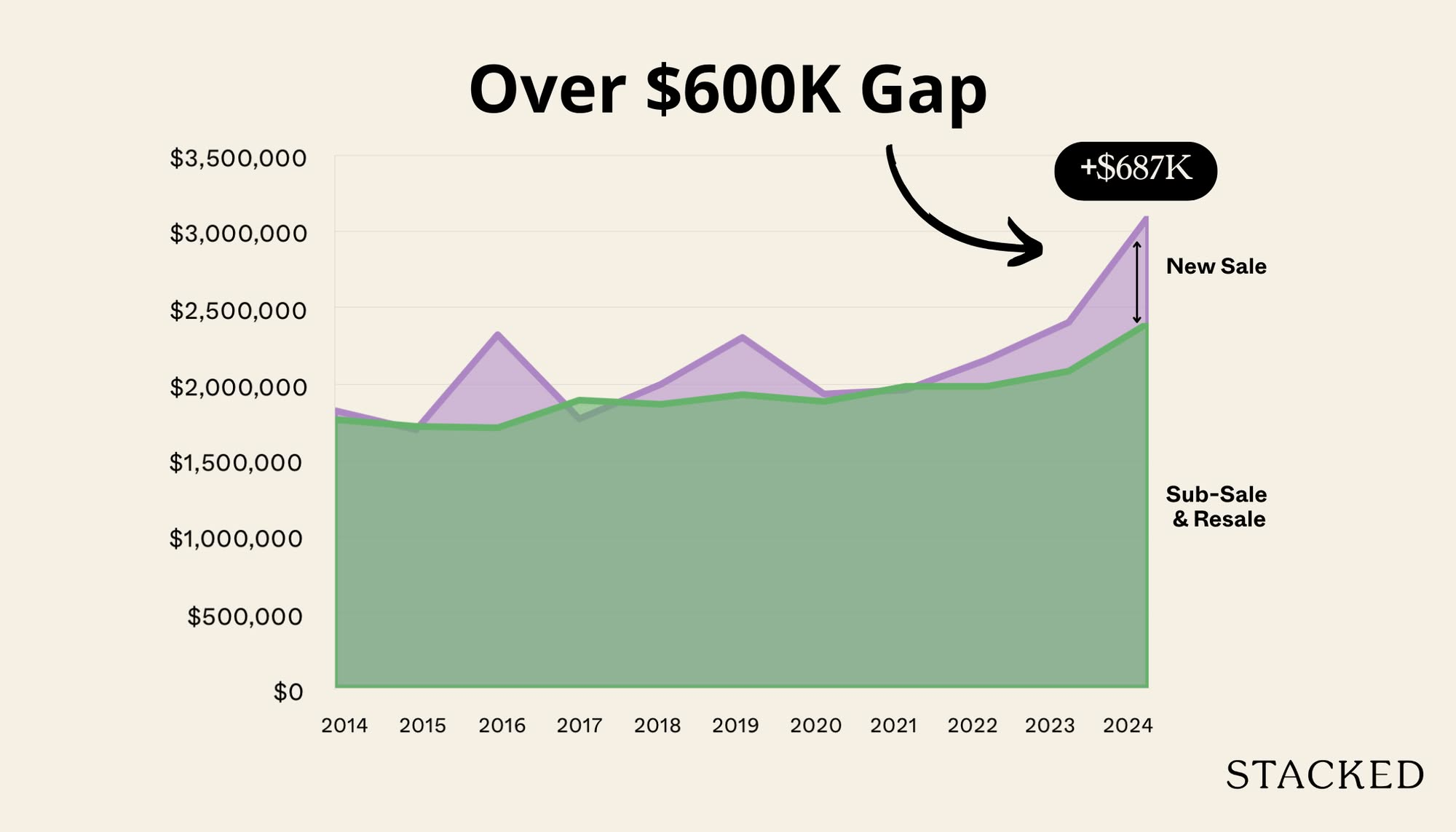

Property Investment Insights Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Latest Posts

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

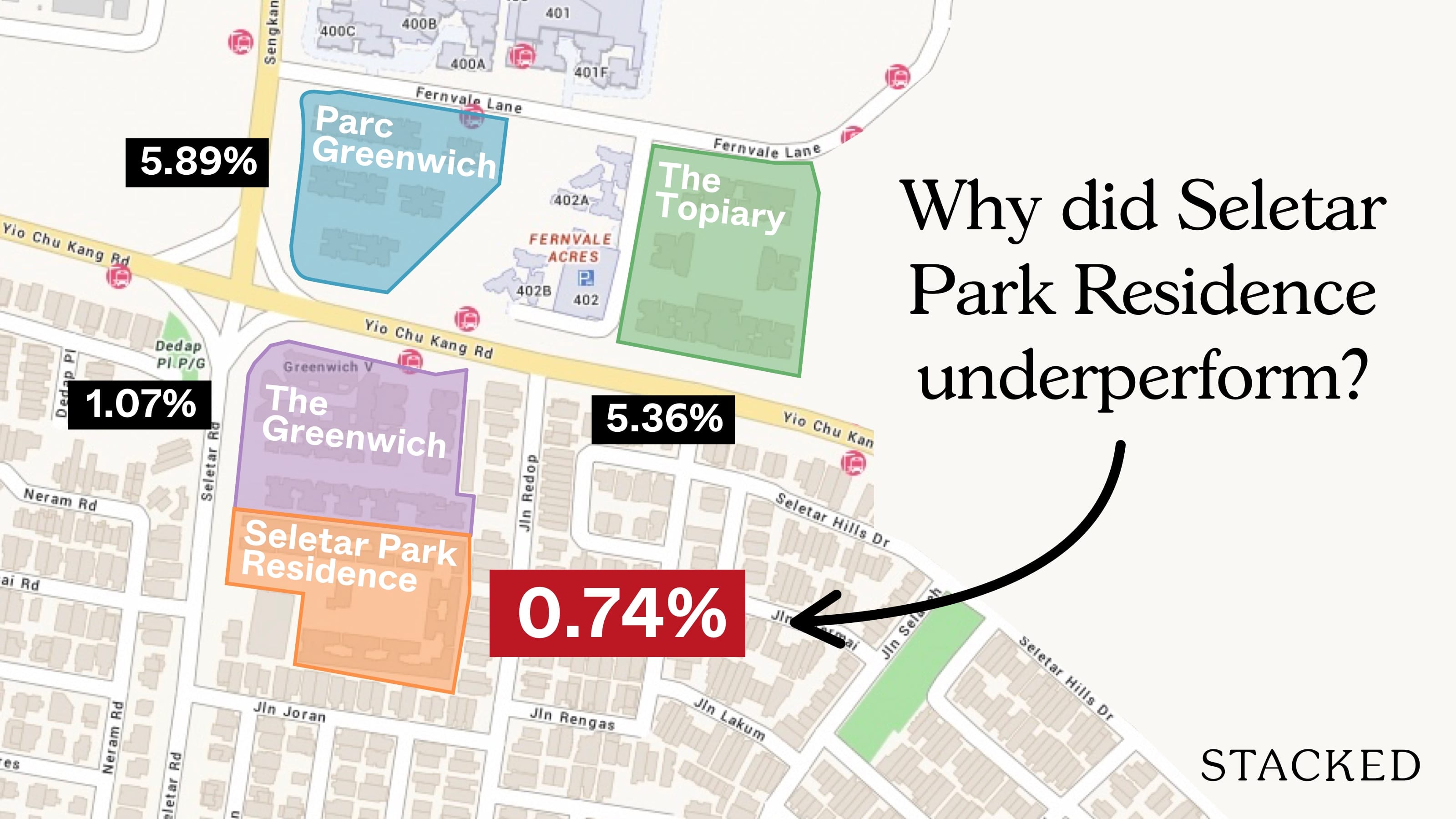

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

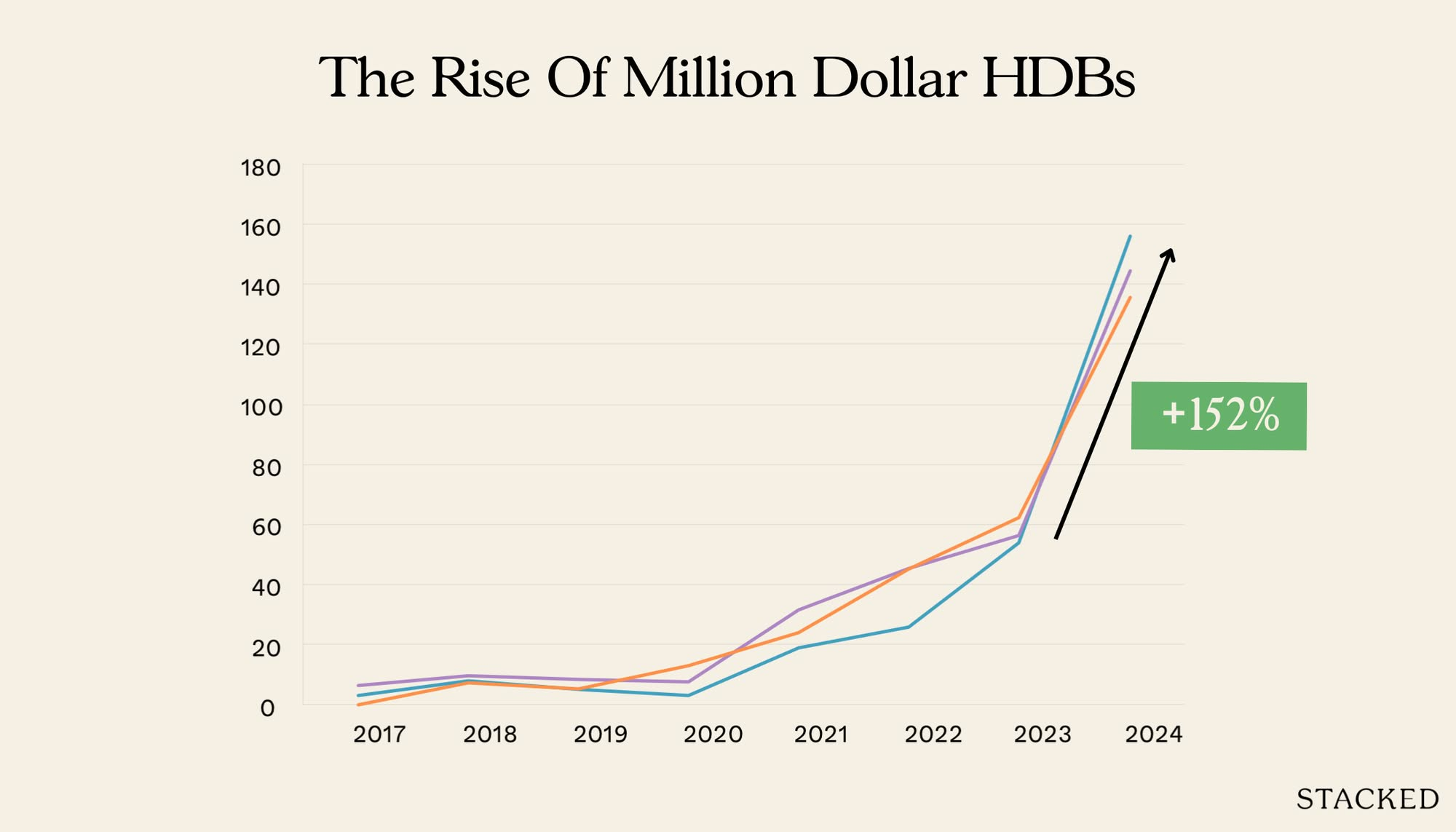

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

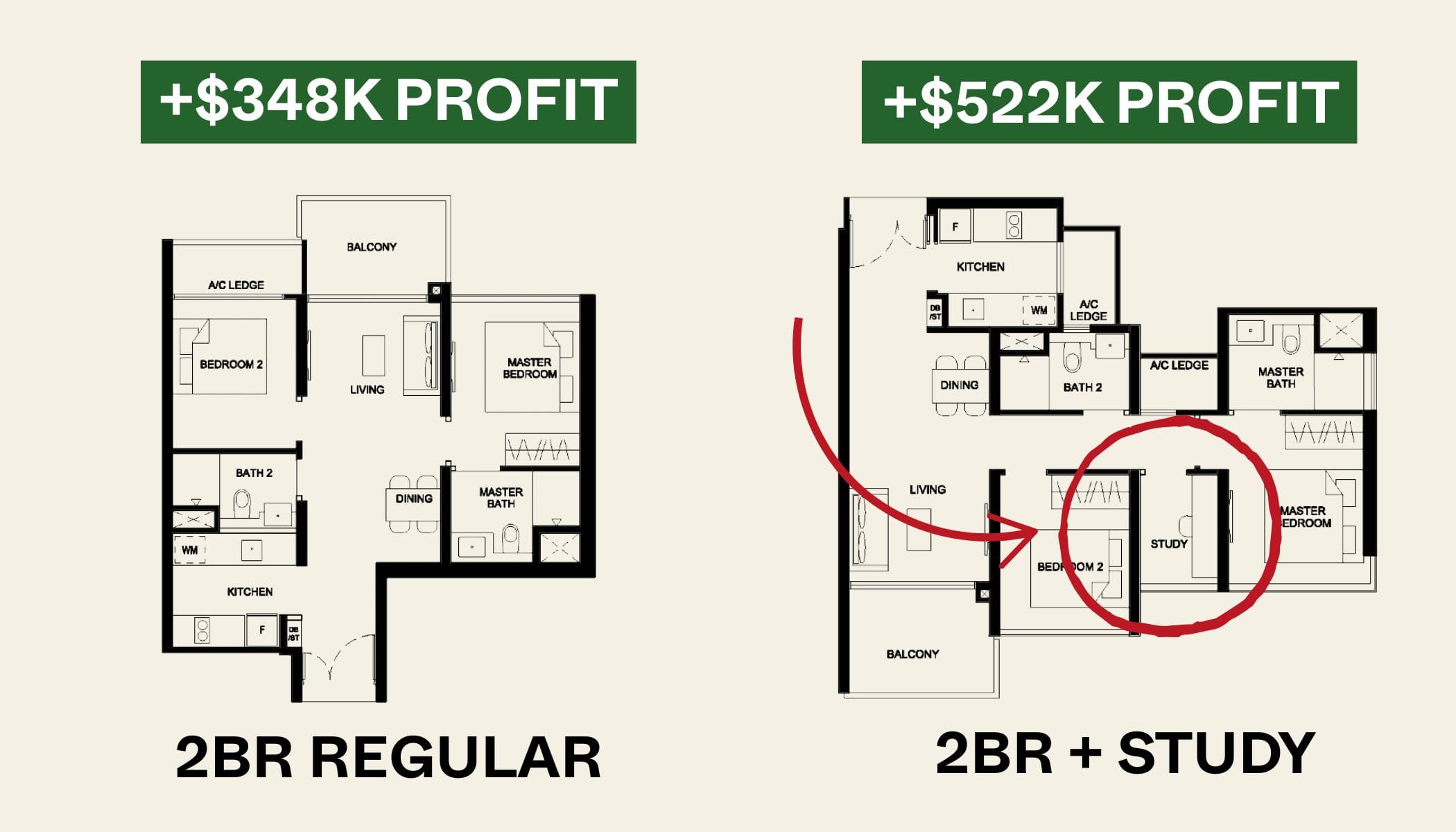

Property Market Commentary 2-Bedder vs 2+Study Units: Which Condo Layout Has Better Returns Over The Last Decade?

Homeowner Stories Does The “Sell One, Buy Two” Strategy Still Work In 2025? 3 Real Stories From Singapore Homeowners

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

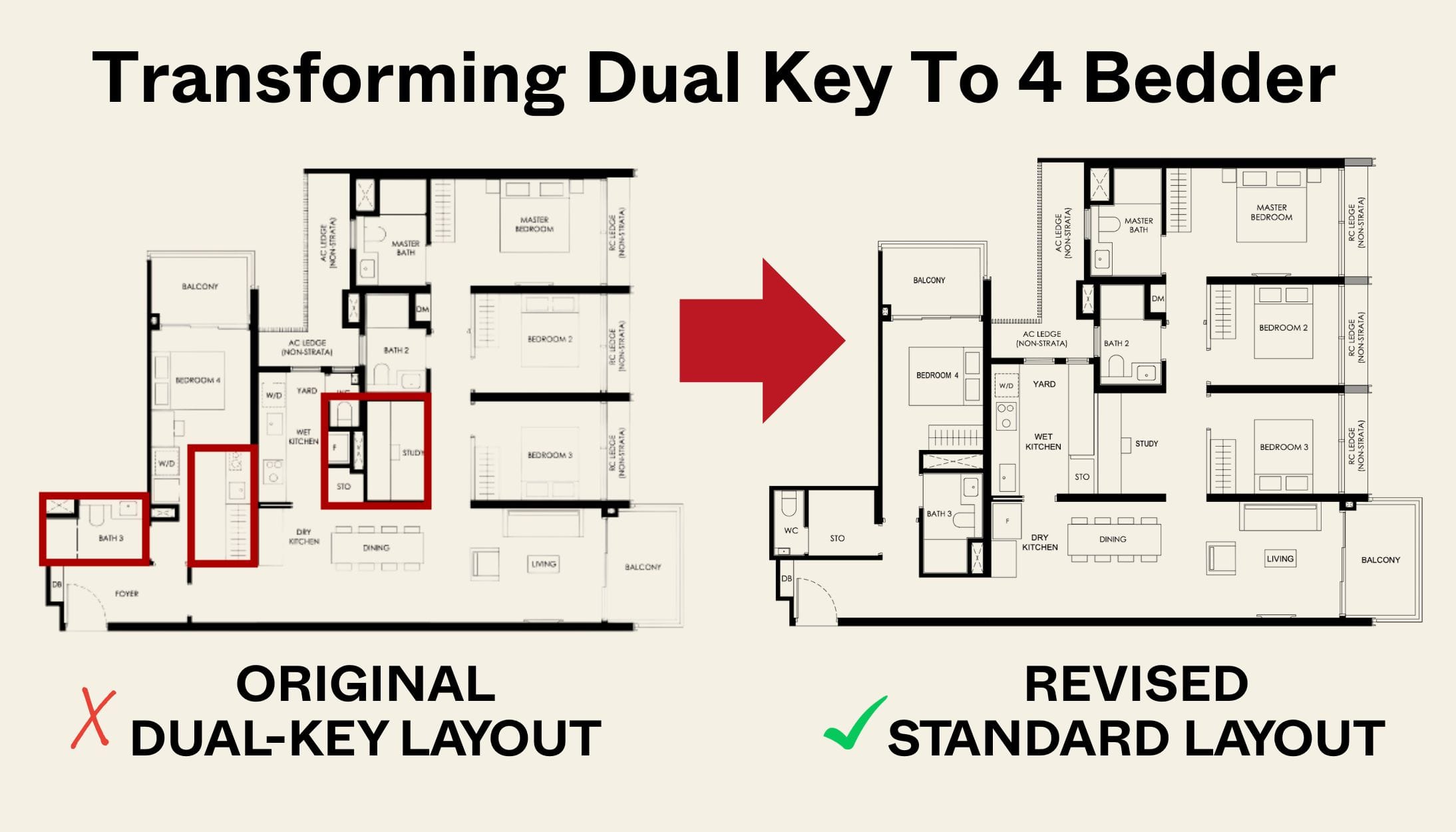

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.