26 HDB Estates With The Biggest Price Increase Since COVID-19: Here’s What The Data Shows

July 29, 2023

While housing prices may seem to be moderating at this point, it’s still quite shocking to look back at prices in 2020 and now. Some HDB estates have increased significantly across the board (whether it be 3, 4, or 5-room flats), while others can deviate quite a lot depending on the size of the flat.

So whether you’re looking for an affordable HDB town (or you’re thinking about maybe selling), here are the prices of HDB flats across different estates from 2020:

3-Room Flats

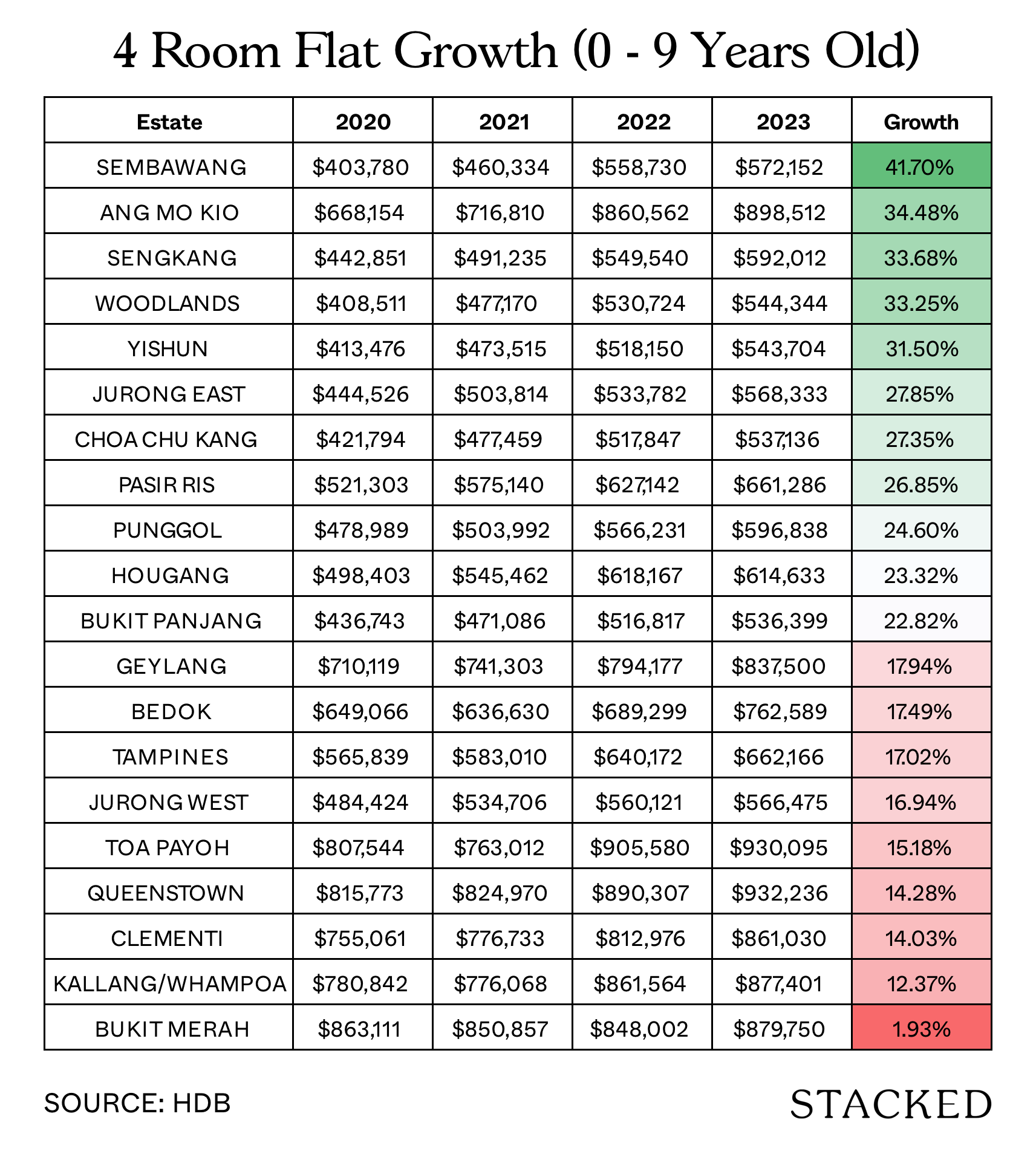

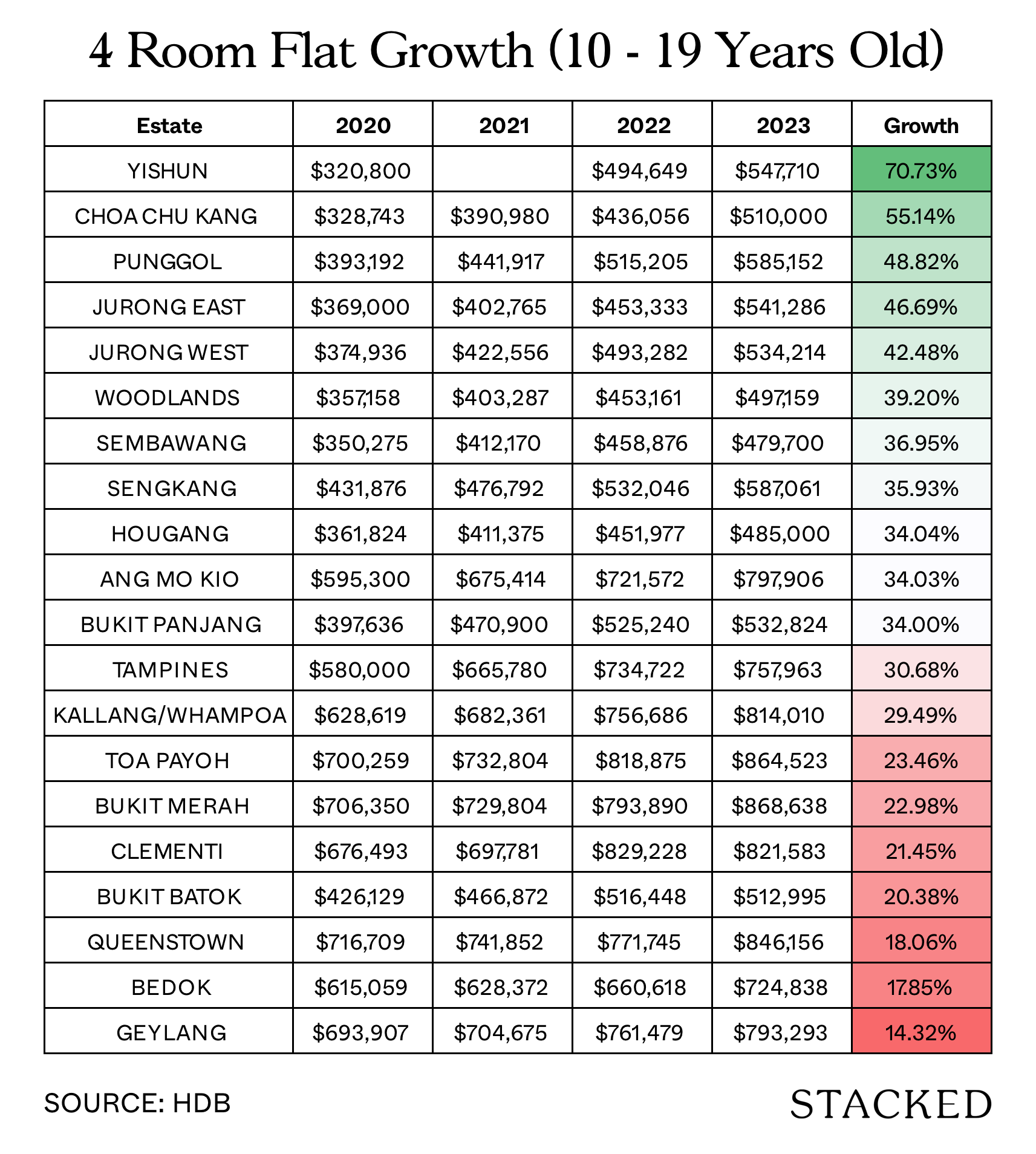

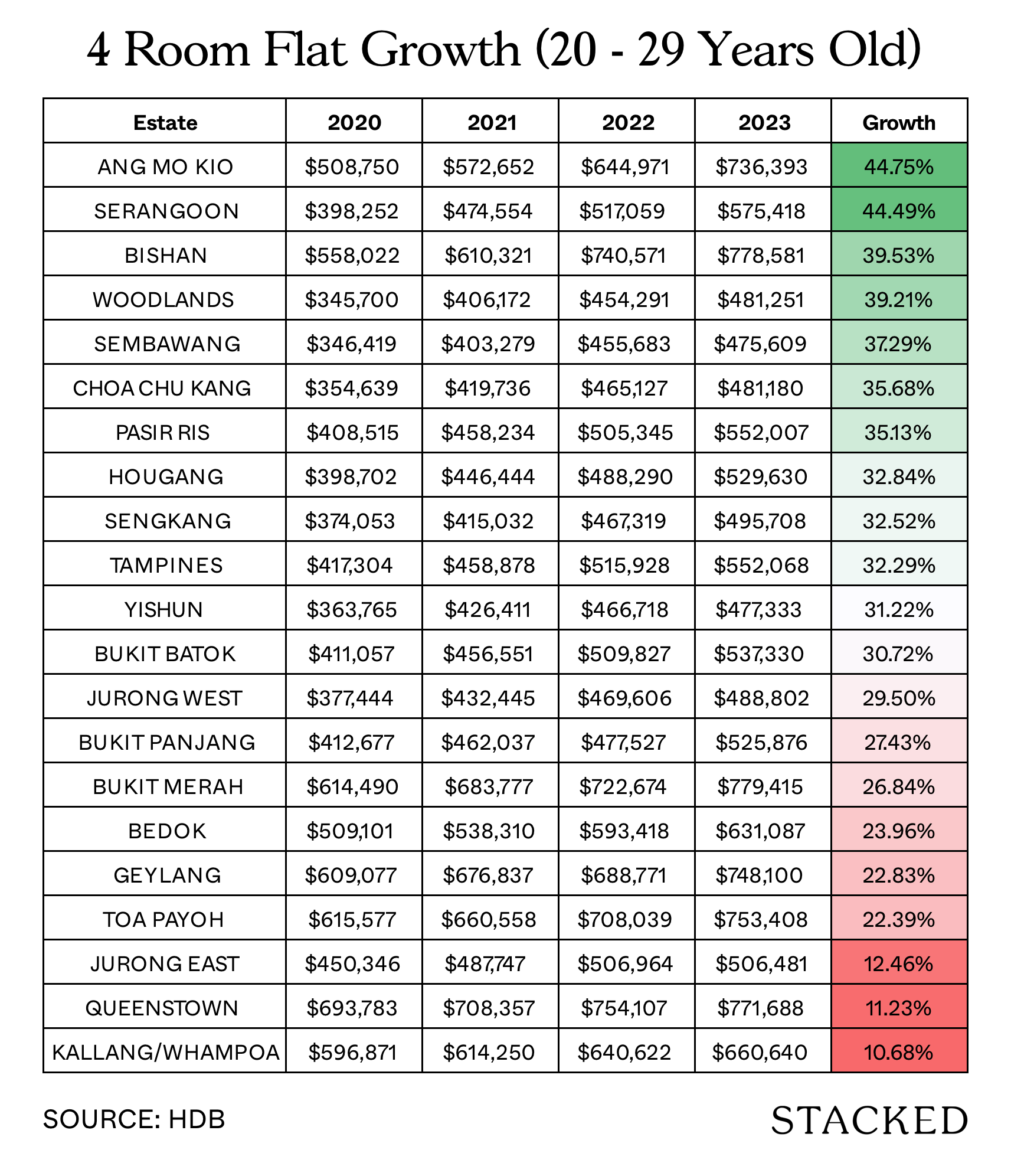

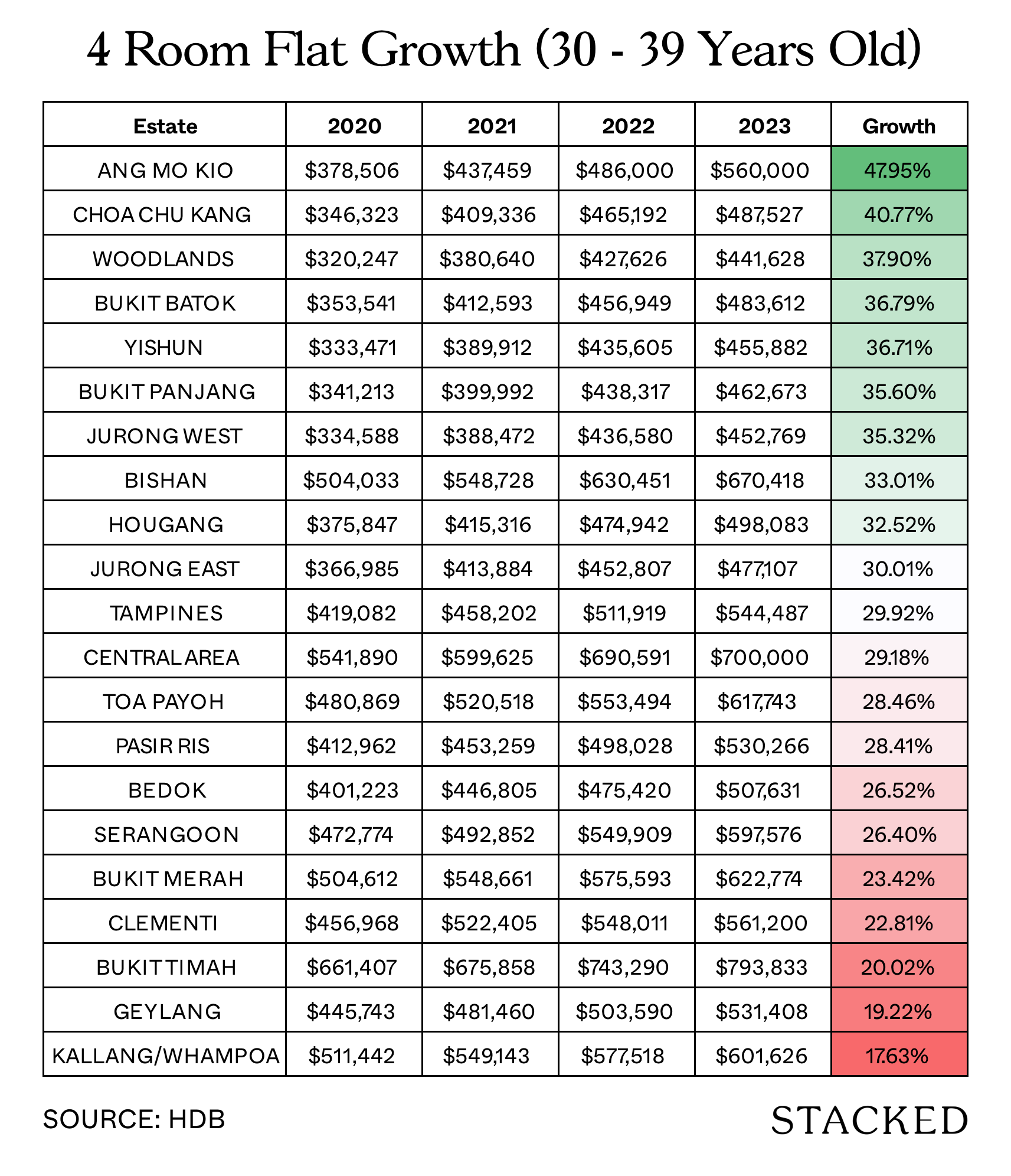

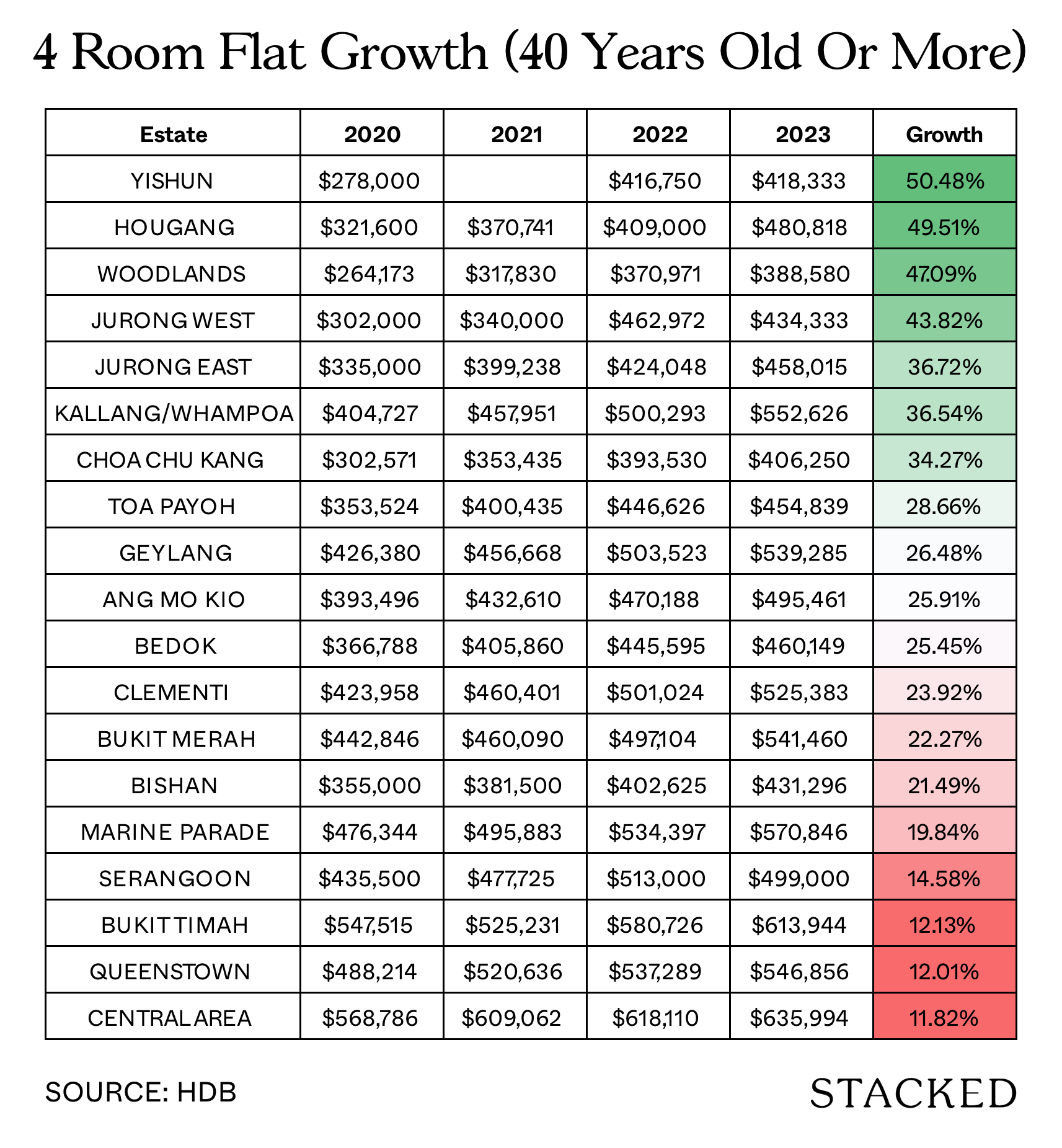

4-Room Flats

5-Room Flats

*Note, we’ve taken prices only from 4-room HDB flats as that is the most common flat type, with the most number of transactions.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

HDB Prices from 2020 to 2023

As the age of the flat matters a great deal, we’ve divided up the following based on age as well. These are broken down from 0 – 9 years, 10 – 19 years, 20 – 29 years, 30 – 39 years, and 40 years and more:

Some observations from the above

- 40+ year-old flats can still appreciate in a hot market like 2023

- Bukit Merah is a bit skewed because of one big transaction

- Newer, centrally located flats can still struggle to see higher growth

- Yishun may be next to break from the “club of five”

1. 40+ year-old flats can still appreciate in a hot market like 2023

Despite warnings about lease decay, 2023 proves that the oldest flats can still see substantial gains. Some of the highest growths were seen in 40+ year old flats in Kallang/Whampoa, Queenstown, and even Yishun, which is not even considered a mature estate.

Bear in mind these gains come after September last year, when the 15-month wait-out period was imposed (i.e., if you have just sold a private property, you must wait 15 months before you can buy a subsidised resale flat). So the high growth in older flats may come from more than just rightsizing retirees.

(Typically when a very old flat sells for a high price, it’s assumed the buyer is probably a retiree who just sold a condo to buy it).

That said, we should keep in mind that 2020 to 2023 have been unusual years. These rising prices should be viewed in the context of a housing supply crunch. It’s not certain if 40+ year old flats would perform as well under normal conditions, when buyers are pickier.

2. Bukit Merah is a bit skewed because of one big transaction

Bukit Merah’s near 60 per cent gain (for 40+ year old flats) is probably skewed by the transaction of a $1.5 million unit here; one of the largest to date for a resale flat.

This isn’t something to do with Bukit Merah itself. In fact, if you look at the 30 to 39-year old flats, Bukit Merah becomes one of the worst performers this year.

3. Newer, centrally located flats can still struggle to see higher growth

You would expect that the youngest flats in towns like Kallang/Whampoa and Toa Payoh would be the most desirable; but the numbers suggest that’s not always the case. Even younger flats in Queenstown are rather mediocre in terms of gains.

The realtors we spoke to weren’t very surprised, with most saying the longer holding periods are a consistent way to see gains. Older flats were bought for much cheaper in prior decades, and have had more room to appreciate.

That said, we still wouldn’t expect a very new (around five years old) resale flat to go for cheap; these would still be among the priciest offerings on the market.

4. Yishun may be next to break from the “club of five”

As of 2023, most HDB towns have seen at least one flat transaction at $1 million or higher. Only five HDB towns have yet to see this happen:

- Bukit Panjang

- Choa Chu Kang

- Jurong West

- Sembawang

- Sengkang

BTO ReviewsWe Review The May 2022 BTO Launch Sites (Bukit Merah, Queenstown, Jurong West, Toa Payoh, Yishun)

by Ryan J. OngYou can see from the numbers, however, that Yishun has positive gains across all age ranges. Except for 30- to 39-year-old flats, it’s also managed to beat the other four on the list.

Also, if you ask on the ground, many Singaporeans don’t really think of Yishun as non-mature (as in they consider it a rung above places like Tengah or Sembawang, in terms of built-up amenities). We’ve even heard claims that Yishun is non-mature in name only, and that the town’s been on par with areas like Bedok or Hougang for around a decade now.

The August 2023 launch may sap some of the resale demand in the Kallang/Whampoa area

The August BTO launch (note this has been pushed back to end-September, or early October) is quite substantial, consisting of three different sites that total 1,807 units. While some of these will fall under the Prime Location Housing (PLH) scheme, we suspect the currently high resale prices mean some buyers won’t mind.

When affordability and not profitability is your main concern, even a 10-year MOP seems immaterial. So among those who can qualify for BTO flats, some may switch over to balloting for these.

From word on the ground, some realtors have also opined that – as prices for the Kallang/Whampoa area creep closer to other mature areas, such as Geylang, a ceiling is likely to be reached.

Between Kallang and Geylang, for example, if prices start to come close, most buyers will opt the latter. While Kallang has seen big improvements over the years (e.g., Sports Hub, Kallang Wave Mall), it still doesn’t match powerhouses like Bishan and Queenstown.

For more information on the Singapore property market, private or public, follow us on Stacked. Also join us for the follow-up article, where we’ll look at resale price movements over a much longer period.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Which HDB estates have seen the biggest price increases since COVID-19?

Are older flats still appreciating in value in Singapore?

Why is Bukit Merah's reported price increase considered skewed?

Do newer flats in central locations tend to have higher growth in value?

Is Yishun expected to join the top HDB estates with high price gains?

How might upcoming BTO launches affect resale flat prices in areas like Kallang/Whampoa?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments