New launch condos have a lot of psychological appeal, until you hear the horror stories – like Laurel Tree and Sycamore Tree condos going unfinished, or the $32 million lawsuit over defects at The Seaview.

Or maybe you’d love to have a new launch condo, but for some reason you have to move in immediately; and a 30+ year old development is the only viable location.

While on the other hand, older condos usually have more spacious living areas and regular layouts. Plus you can customise the space to exactly how you’d like it (not that you can’t do it for a new launch, but some might feel that it is such a waste).

Whether it’s by choice or otherwise, picking an older condo development is a complex process. From lease decay to the state of facilities, there are thousands of variables that can lead to inconvenience, poor rent, or capital losses upon resale. Here’s how to research an older development and avoid pitfalls:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Research the transaction history, and look for patterns

One big advantage of buying an older development is the long transaction history. Make full use of this to identify if you’re getting a fair price. But beyond that, you should also take note of price patterns.

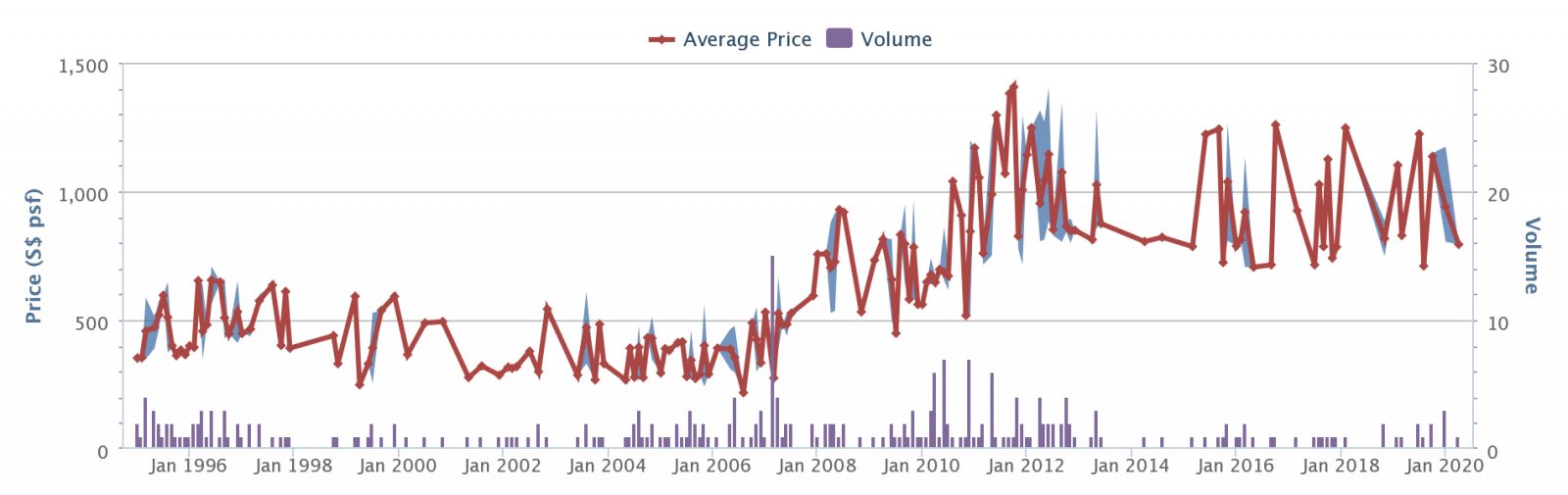

Here’s an unusual pattern from People’s Park Complex:

Notice how volatile the prices are: transactions in June and September 2015 were around $1,242 psf, but similar sized units plunged to around $925 psf in March 2017. By October of the same year, prices were back up to $1,125 psf).

You could say that it is because of low transactions, but have a look at a similar old development in the area (Pearl Bank before it had gone en bloc) and you’ll find it isn’t anywhere near as volatile.

As to why, that’s a question to put to the seller’s agent; volatile prices can reflect situations like en-bloc struggles, new developments in the neighbourhood that affect the condo, or even problems with units in a specific stack (i.e. the sharp dives may reflect the sale of units in a “problem” block, where there are maintenance issues due to age).

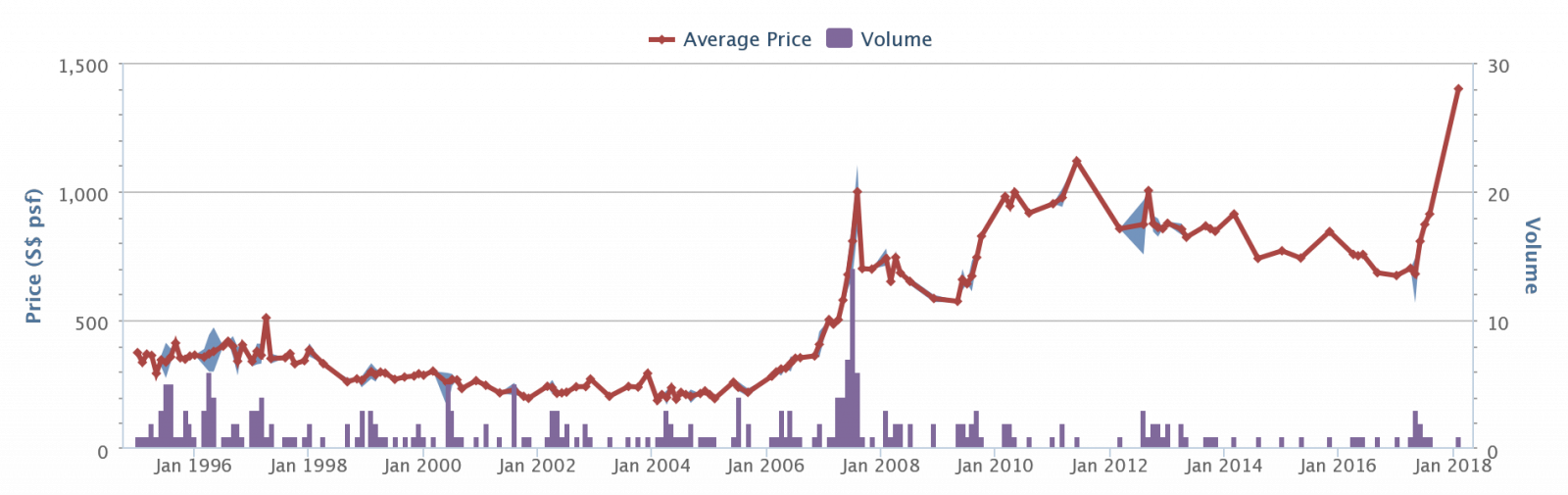

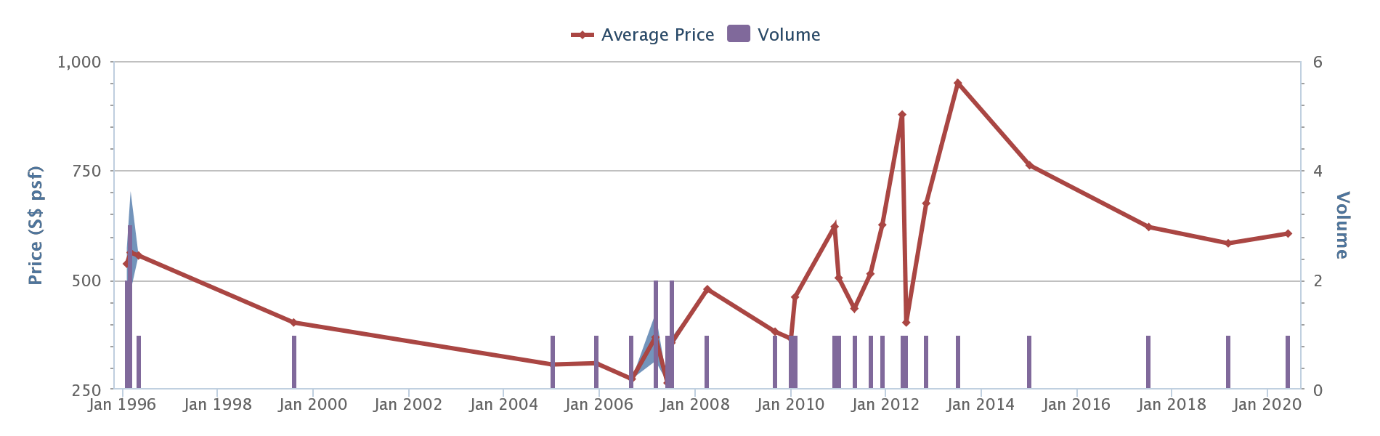

Another thing to note is consecutive declines in price. For example, this is the price movement at Sembawang Cottage:

Note that these alone may not indicate a bad buy; they may be due to certain episodic issues that are soon corrected (e.g. a recently failed en-bloc attempt). But do present such questions to sellers, and look for a satisfactory answer.

If you have doubts about their explanation, drop us a message on Facebook; we may have information that can help to verify it.

2. Pay close attention to the financing issues involved

Some banks don’t like to give out full financing (75 per cent of the property price or value, whichever is lower), for properties dating back to 1980 or earlier. You may have to fork out a much bigger down payment (e.g. the financing may fall to 55 per cent).

Property AdviceAll You Need To Know: The Income Requirements For Getting A Home Loan

by Ryan J. OngWhile some banks may still offer full financing, those banks may not have the lowest home loan interest rates. As such, you could end up paying more than you initially expected.

As for future resale value, note that banks will not finance properties with 30 years or less on the lease. So while you may still be able to get financing, subsequent buyers of your property may not. This can decimate resale value, as your future buyers will have to pay in cash.

3. Find out when the last en-bloc occurred, and what the results were

This isn’t so that you can plan for an en-bloc windfall, although it does help to estimate the chances (but never count on an en-bloc in your financial planning).

The main issue here is the Sellers Stamp Duty (SSD). This is:

- 12 per cent of the sale price, if you sell a unit within a year of buying it

- Eight per cent if you sell within the second year of buying

- Four per cent if you sell within the third year of buying

The SSD still applies in the event of an en-bloc sale.

Also remember the en-bloc sale proceeds may not take into account the full value of your renovations; and they certainly don’t account for the inconvenience of moving again so soon, the lost opportunity cost of not buying somewhere else, etc.

Coupled with having to pay the SSD, it can add up to a frustrating waste of time and money.

Now there is a waiting time of 24 months between each en-bloc attempt. So if the last en-bloc was three years ago and nearly succeeded*, there’s a risk that a successful en-bloc may happen too soon after you buy.

Unfortunately, there’s no requirement for en-bloc attempts to be lodged anywhere; so you have to take the seller’s word on this. You can also drop us a message, and we’ll try to ascertain the details if possible.

*80 per cent of the development’s ownership must agree to the en-bloc for it to proceed.

4. Inspect the facilities to see if the management is competent

Some of the things to do here are:

- Get a list of which facilities work, and which are closed down (if they’re closed, how long have they been closed?)

- Check the gym and look for tell tale signs of shoddy management, such as rusted equipment, missing free weights, unusable treadmills, etc.

- The pool shouldn’t have missing tiles, dirty poolside furniture, etc. Also do a quick inspection of the showers, and see if all of them are working.

- The children’s playground should be safe; that means no broken and jagged plastic, rusted metal parts, or swings sagging to one side.

- Walk around the landscaped areas and make sure they’re well-tended (badly tended gardens also breed mosquitoes and other vermin, by the way).

- Visit the condo’s website, and check for updates. Good management remains active. For more laid-back management, the last updates may be non-existent (e.g. the condo was around before the internet was a thing, and they never kept up).

- Keep an eye out for mounds of trash, anywhere other than the dumping ground. Some older developments have turned entire portions of the car park into dumping grounds. This sort of eyesore reflects on the management.

5. If it’s a 99-year lease, who is the land going back to (don’t assume it’s SLA)?

It’s possible for a 99-year leasehold development to be sitting on freehold land. In this instance, the owner of the freehold land – be it an individual or entity – has simply leased out their land for 99-years. At the end of the lease, the land will revert back to them. An example of this would be Spring Grove Condominium, which is a 99-year leasehold condo, sitting on freehold land owned by the United States government.

Take note that this sort of arrangement affects en-bloc potential. You can’t know for sure what the ultimate owner wants to do with the land. If they decide to use the land for their own developments, then any en-bloc deal may be impossible, as they won’t offer another 99-year lease.

Finally, if your intention is to rent it out, do look at rentability and not just rental yield

Old developments do have a higher rental yield, for no reason other than the lower initial price tag. However, you should also take into account rentability. This is how easy or quickly you can find a tenant.

Remember that tenants can be put off by poorly maintained facilities, or dated and run-down appearances. If you wouldn’t rent such a unit, then neither will they – whatever the potential rental yield may be.

Meanwhile, you can compare the development against other alternatives on Stacked Homes. We bring you reviews of old and new properties alike, as well as news on the Singapore private property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

14 Comments

Hi Ryan,

Looking to buy a <10 year old condo in district 11 with good layout. Do you have a review on properties in the Derbyshire Road area? How do I go about getting the construction plan around the area like the north-south corridor tunnel and construction to the empty plot of land behind SJI school. Thank you.

Hi there, what do you think about Clementi Park? Will you be doing a review of this project anytime soon?

Hi Ryan,

do you have a review on the Tessarina in D10?

Hi, any opinions on Double Bay Residences in Simei? Looking at own stay but concerned about stagnant prices and lease decay thanks

Hi Ryan,

Looking to buy on Sunrise Gardens. Do you have a review about this project or opinions about this area?

thank you!

Hi Ryan,

I learn a lot from your analysis. What do you think about The Lanai in Hillview Area ? Thank you.

Hi Ryan,

Is pebble bay a good investment for own stay? Appreciate your views on the resale or En-bloc potential in the future. PSF is higher than the peers in the vicinity… your knowledge is really helpful. Thank you.

Hi Ryan, was researching about purchasing old condos and saw your great post. Would you be able to share your views on The Gardens at Bishan? Would like to purchase for stay for 10 years but worried about lease decay..