We Asked: Is The New PLH Model Fair? Here’s The Collated Response From 175 People

November 4, 2021

The PLH model is one of the biggest changes we’ve seen to the housing market, since the first cooling measures.

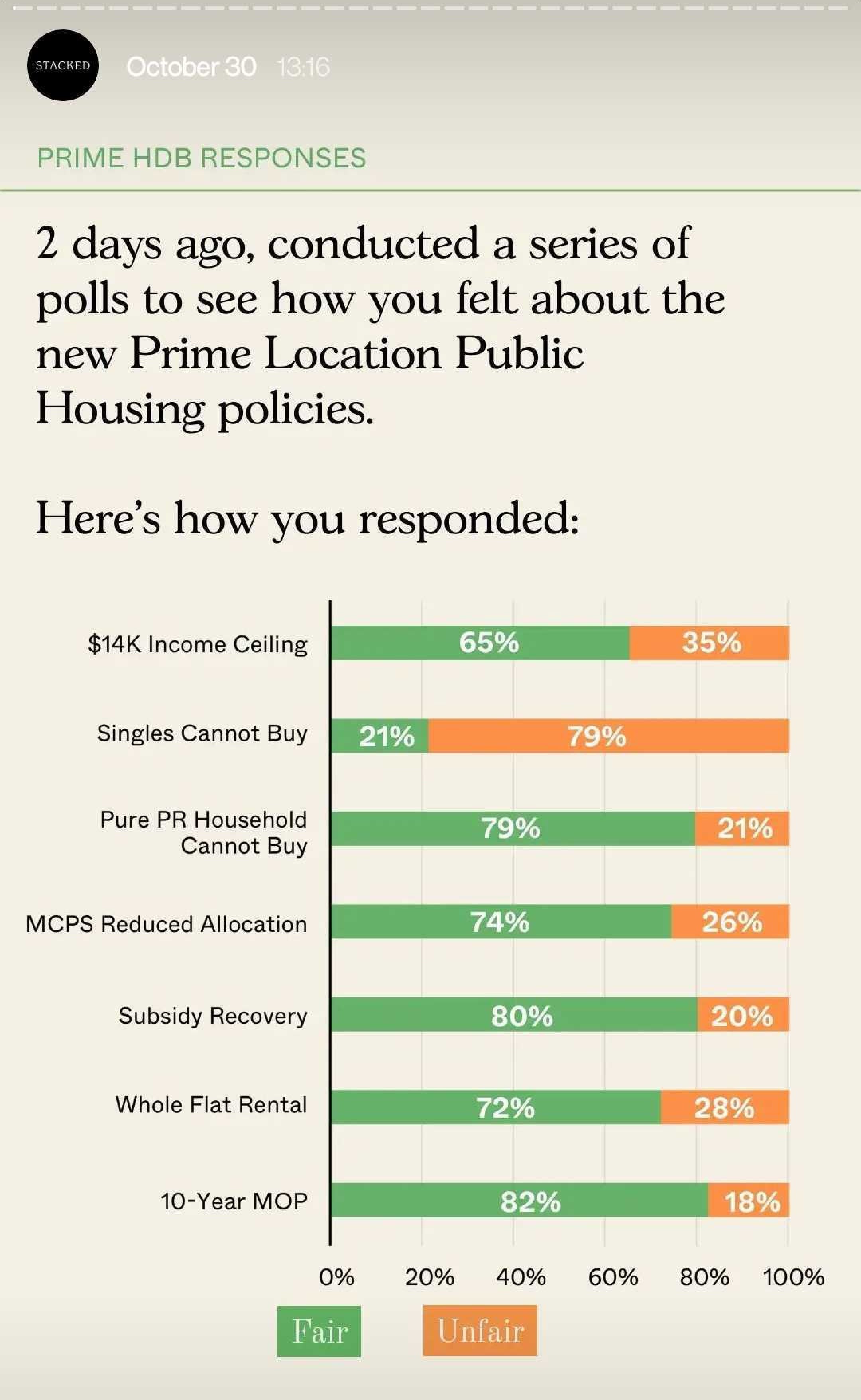

When news of the new model came out, we ran a poll on whether or not our followers felt certain policies were fair or not:

Out of curiosity, we also asked for your initial impressions. From the generally positive to the angry, the following are some of the concerns raised; and we’ll soon see if the predictions play out:

General impressions of the PLH model flats

On the whole, most readers seemed to agree it’s a good idea; in fact, a number of people pointed out that it came too late. From comments like “should have been implemented earlier”, to “should be applied to ALL BTOs”, there’s a growing sentiment that flats should be homes first, and investment assets second.

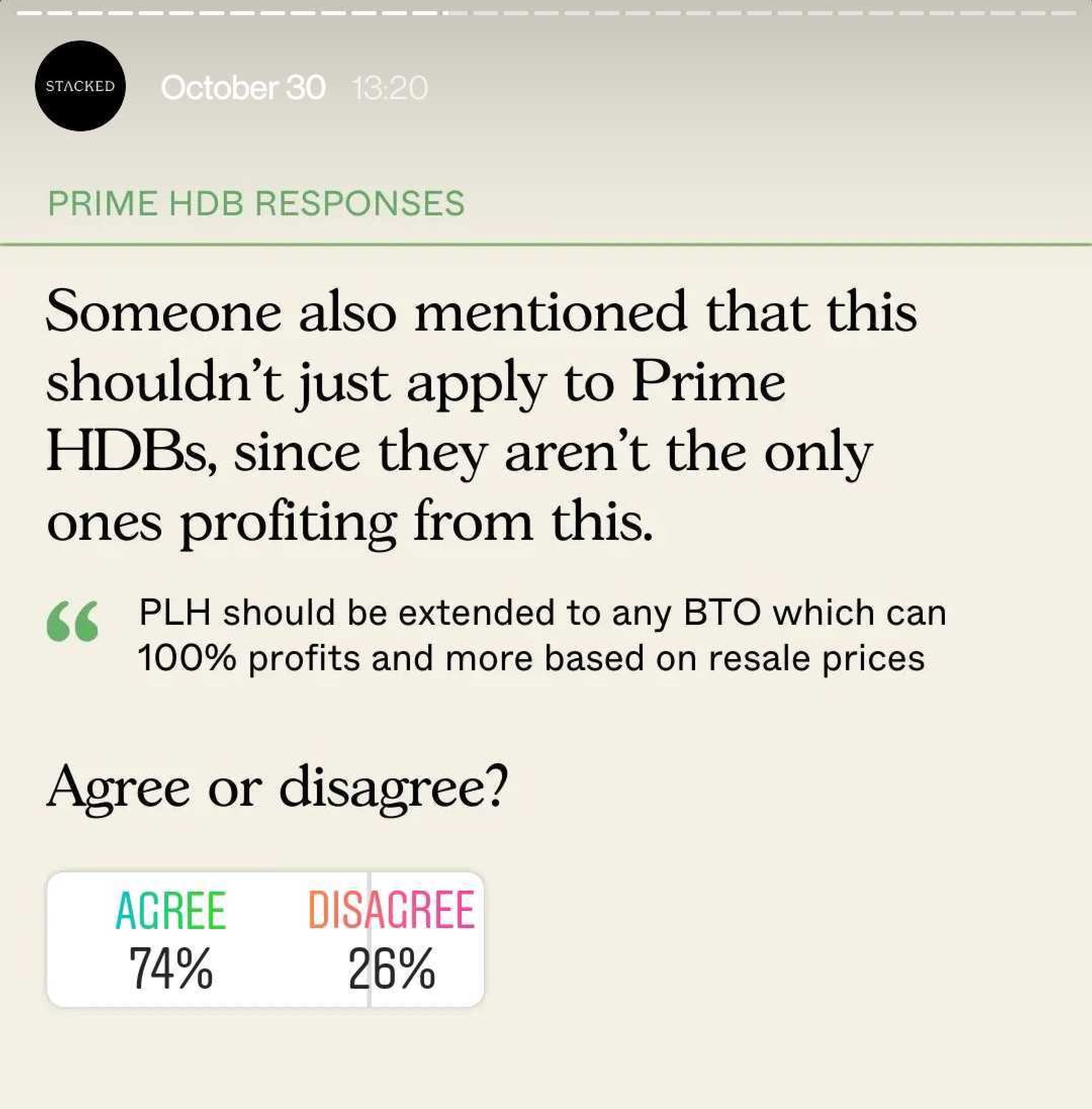

Some even suggested the model should apply to all HDB flats, as they believe resale prices are out-of-control. We asked about this, and about 3 out of 4 people agree:

A smaller group were less enthusiastic, with one reader noting a small irony: the PLH aims at handling wealth inequality but does so by removing another way to get rich.

The most common issues brought up were (in order):

- Inability of singles and PRs to buy PLH model flats

- Impact on desirable flats, outside of prime areas

- Differing views on the income ceiling

- Suspicion of stealth cooling measures

1. Inability of singles to buy PLH model flats

PLH flats cannot be purchased by singles, even if they’re 35 or older. Likewise, families that are only Permanent Residents (PRs), with no Singapore Citizen (SC), are excluded from these flats. This applies to both new and resale flats.

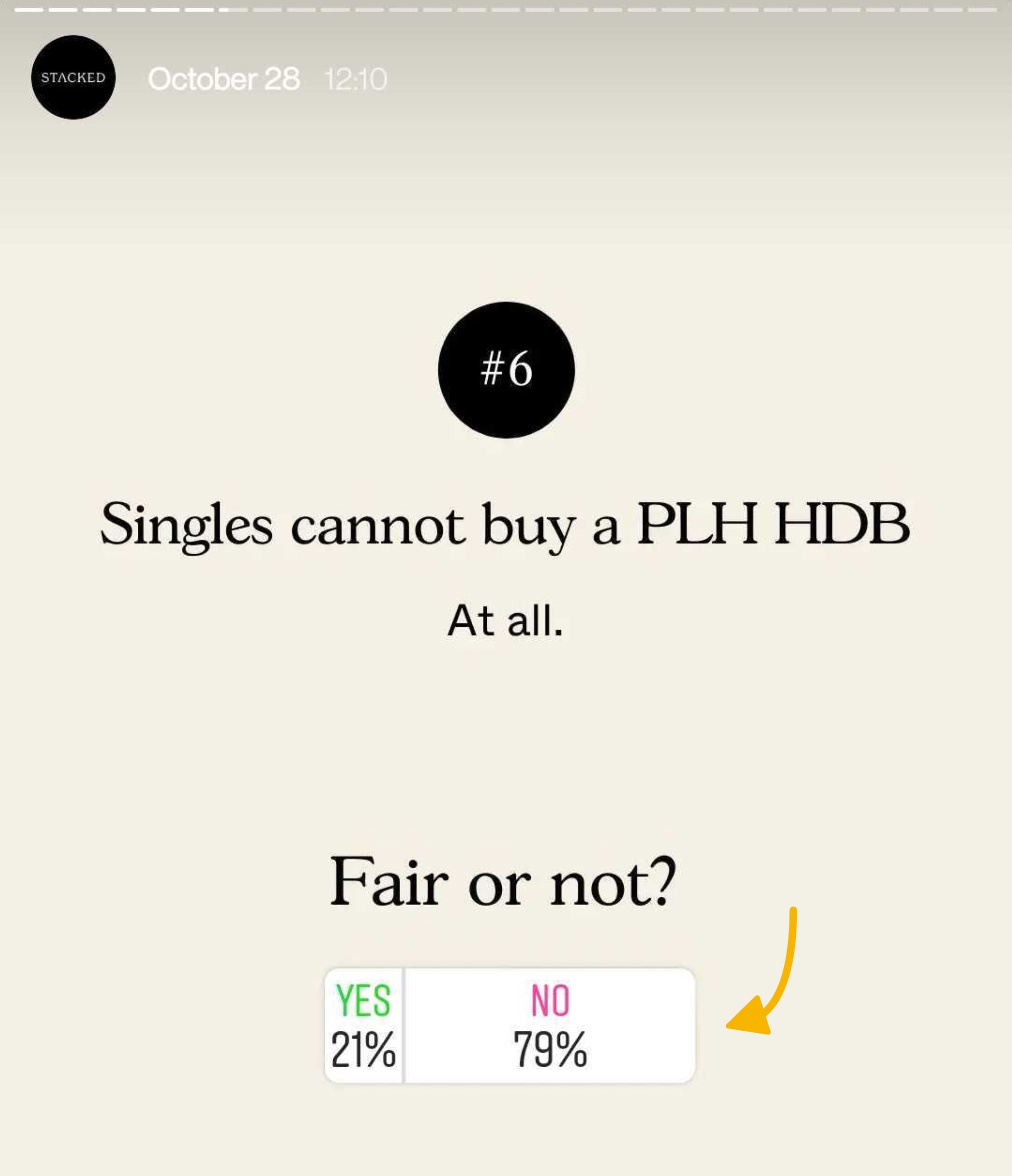

These were the most contentious issue among most readers. In fact, about 4 in 5 expressed disagreement on this policy:

Many pointed out that PLH model housing was not truly inclusive, as it leaves out lifelong singles, or those who cannot get married (e.g., LGBTQ+ couples). It also raises the question of how interested we are in truly integrating PRs.

One reader asked:

“The heteronormative expectation of the modern family is ridiculously outdated… I’ve lost count of the number of married couples that don’t intend to have children, and couples that do not intend to get married, but have remained together for years. Not to mention LGBT folks and just straight people who don’t intend to settle down. The restriction on singles is ridiculous. For BTO? Fine. But for resale?!”

Some readers felt that singles and PRs pay the same taxes and contribute just as much; but in return are treated as “second class citizens” when it comes to housing.

It was pointed out that these groups already face existing challenges. For example, singles already face the age limit of 35; and PRs must reside in Singapore for three years before they can buy a resale flat. Barring them from Central Area flats just adds to already serious obstacles.

On a more practical level, some also questioned if areas like Rochor are good for families anyway.

There are no schools in the priority enrollment range of many Central Area plots, and these are heavily built-up areas with fewer green spaces. As such, they feel the decision to prioritise families in these areas may be unnecessary.

However, some readers do feel the policies are fair

One argument is that, given the high price of PLH flats, any single able to foot the mortgage is likely of a higher-income demographic. One reader noted that:

“Any single who is able to afford a prime flat is someone who is very affluent by default. Think $14,000 single income versus $14,000 from dual income. That is an opportunity for a median income family to stay in the prime area and add diversity, taken away by an affluent individual. People forget that the whole point of this scheme is to prevent further concentration of wealth in prime locations, while leaving only the non-prime area for less affluent families, who are arguably the future of the nation.”

This spills over to a much bigger topic, on to the importance of nuclear families to Singapore’s future.

Some readers pointed it’s just a numbers game, and a larger number of people benefit if singles aren’t also balloting. A single who gets a 3-room flat, for instance, could leave a family of three or four out of a desired home.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Avoid Homebuying Regrets: 9 Commonly Overlooked Things to Consider Before Buying a Home

There are some housing issues that you can quickly research online, and there are issues which you only learn to…

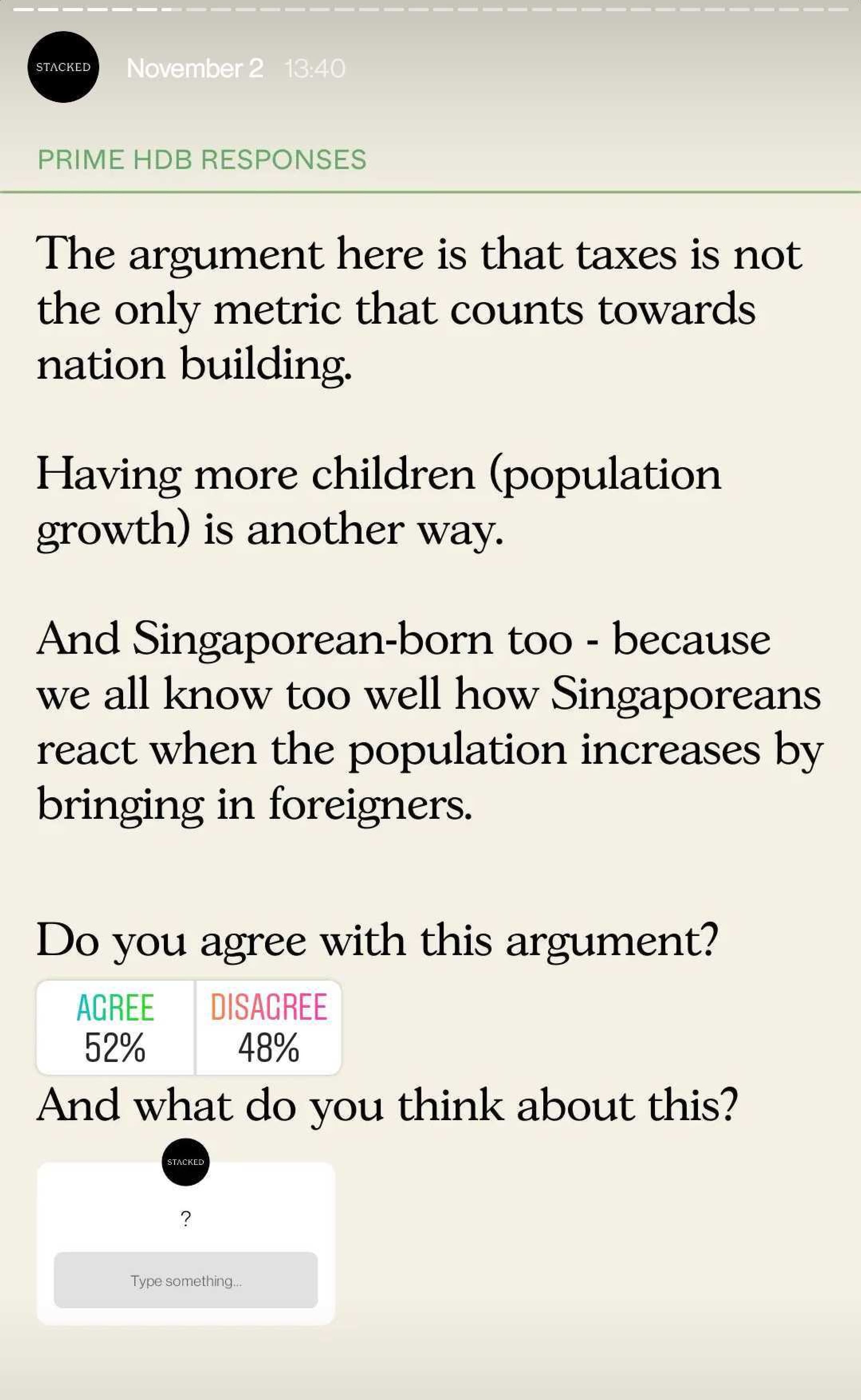

Others have also pointed out that while singles pay their taxes too and are entitled to public housing regardless of the location, married couples contribute to the country in a different way – by having children and helping with local population growth. This was seen as a long-term contribution to the country that singles cannot contribute.

We brought the point to our followers and asked if they felt this argument was fair. About 50% of respondents felt it was/wasn’t:

But others have also argued against this point, saying that married couples do not pay the same amount of tax since they are entitled to rebates. They are also given subsidies and grants which comes from taxpayers too.

2. Impact on desirable flats, outside of prime areas

Some readers felt the PLH model would jack up the prices of resale flats elsewhere. This would be true in areas on the fringe of prime locations, or in areas where resale flat prices are already at record highs (e.g., Bishan, Queenstown, Kallang, Marine Parade).

One reader also noted that “Very soon the number of Rest of Central Region (RCR) million-dollar flats will increase. Not sure what HDB trying to level.”

Another voiced that “It is going to push up current HDB resale price in prime area such as Dawson, Telok Blangah”.

This is because the PLH model will not apply retroactively, to flats already in prime areas.

Another reader predicted follow-up steps would be needed, to manage resale flat prices in surrounding areas. Some felt it could even spike private property prices nearby, such as older resale condos close to the prime areas.

These opinions are similar, almost word-for-word, to the predictions of realtors we spoke to.

3. Differing views on the income ceiling

Some readers feel the $14,000 income ceiling doesn’t really help ensure equality. That’s because income isn’t the same as wealth – those who have rich parents to help, for instance, won’t find it much of an impediment.

Likewise, another reader noted the income ceiling doesn’t necessarily prevent flats from reaching million-dollar resale prices. Among affluent families, buyers can still cope with high resale prices.

Others felt the income ceiling made no sense, given the high expected prices of these flats. One reader noted:

“It’s not fair. PLH flats will naturally will have a higher price. And income ceiling of $14,000 does not make sense, for servicing the mortgage and considering other expenses”.

4. Suspicion of stealth cooling measures

Some readers feel this is a much smarter way to cool the market, without announcing another round of cooling measures. One reader noted this seems to be a variant of a cooling measure, with a delayed effect.

Announcing cooling measures, or making their threat too evident, can create the opposite of the intended effect. It can cause buyers to rush their purchases, for fear of new stamp duties/restrictions pricing them out.

As such, some readers feel it was smart to rein in prices of prime region flats without resorting to such measures.

Some readers, however, feel this doesn’t help to cool the market at all; rather, it could drive up prices in select areas (see point 2).

With the pilot launch only happening this month, we believe the PLH model will be subject to a lot of tweaking over the years

The problem is that prime spots are quite different; but we also can’t have a model that’s so haphazard, every PLH estate ends up having its own set of rules.

There’s a need for standardisation, but for estates that are anything but standard. We do think a lot of tweaks will have to take place, but it’s hard to see what they are when so much is unprecedented.

For more on the situation as it unfolds, visit us on Stacked. We also offer the most in-depth reviews of new and resale condos in the Singapore private property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why can't singles buy PLH model flats in Singapore?

How does the PLH model affect resale flat prices outside prime areas?

What are the concerns about the income ceiling for PLH flats?

Do people think the PLH model is a fair way to address housing affordability?

Is there suspicion that the PLH model is a hidden cooling measure?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

0 Comments