The Previous Owner Made A Loss On The Unit. Does This Mean There’s A Better Chance To Earn Next Time? (And More)

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

We get a ton of questions each day, whether it is through Instagram, Facebook, YouTube, or email. And unlike a normal Q&A, real estate is something that is really nuanced, and sometimes it really needs a lot of research (and background) before something can be answered to a satisfactory level. Still, we try our best to answer each and every enquiry (sorry to those who’ve been kept waiting!) and we hope that this has gone some way to help everyone to make a more informed decision.

And well, since time has been spent to craft an answer – we figured it would be good to put all these up in a permanent spot! So if you do happen to face the same dilemma, or have a similar question, you could get some reference points from these questions. We hope to make this into a weekly series, let us know what you think or what can be improved!

Have a question to ask? Shoot us an email at hello@stackedhomes.com – and don’t worry, we will keep your details anonymous.

Question 1

Hi Stacked Homes,

Always love your post. Can I ask which makes a better option, The Cape or Roxy Sq in District 15 for my own stay in the next few years? But also taking into consideration that I will eventually be renting it out as I will be posted overseas. Or should consider Lumiere in District 2.

Also, since there’s an unprofitable transaction, does it mean if I purchase at a lower price (since the owner made a loss), I will be able to stand a better chance to earn when I sell in the future? Or do you see if this condo has so many unprofitable sales while the condo is still young, it means in the future when the condo becomes much older, the price may continue to be stagnant or even go down since there are newer condos coming to market?

Hey there,

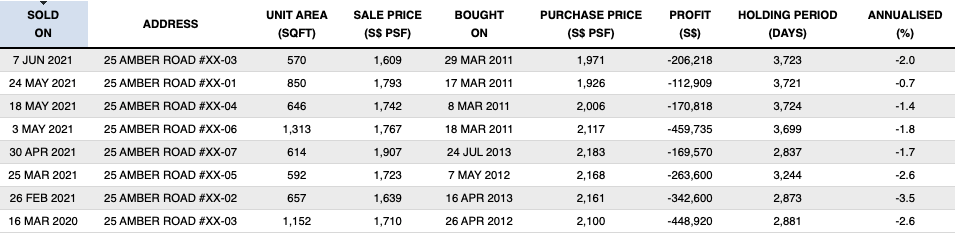

Thank you for your question. The Cape & Roxy Square are both small exclusive developments and Roxy Square is quite dated with a lack of facilities. Despite being freehold, The Cape is seeing negative transactions in the resale market since TOP (13 transactions) which is a red flag.

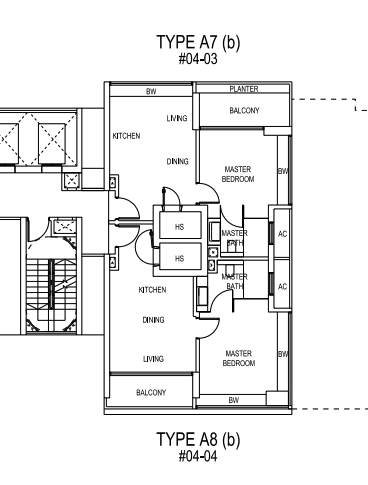

One reason we can think of is the inefficient layout – the kitchen cabinet is too huge which takes up a lot of space even for the 1 bedders and hence the living area becomes rather narrow. The bay windows take up space too and the loft in the bedroom which is frankly catered to a niche market.

Undeniably both Roxy and The Cape are located within walking distance to amenities and the upcoming TEL MRT line which is a plus. As for the Lumiere, it is more for rental play as the development has lots of small units with commendable rental yield. Lumiere being a leasehold development is currently seeing prices on a downward trend hence for appreciation wise it may not be visible unless there is rejuvenation in the area or it will follow the overall market sentiments. However, if it is for rental it is fairly great!

Yes, you may think that buying it at a loss of the current owner may put you on the upper hand if you are looking to exit in the future however even in today’s market the layout is not preferable and the rental yield isn’t that fantastic. We don’t foresee the perception changing in the future. Plus over the years as the building gets older, more maintenance is needed which may eat up your rental yield.

Furthermore, there aren’t many facilities for The Cape since it is a boutique development and there are lots of condos in the area. That said, we aren’t putting down The Cape entirely, the design of the facade is nice. However, you have to be aware that the layout isn’t something that many will like. This just means that you have a niche group of buyers that will be okay with the layout – thus you could face a longer wait to sell when you are looking to exit in the future. Hence, if this is a development you are looking to explore, just note that it may be tough to exit and price may be stagnant as well.

Question 2

Hi,

Thanks for publishing content on your website. It has been informative and helpful. I’m interested to get your thoughts on the enbloc potential of the Claremont on 161 Killiney Road & River Place at Havelock. With a plot ratio of 2.8, it seems there’s huge potential GFA. But there’s has been no talks.

Hey there,

About Claremont on 161, we have 2 main concerns.

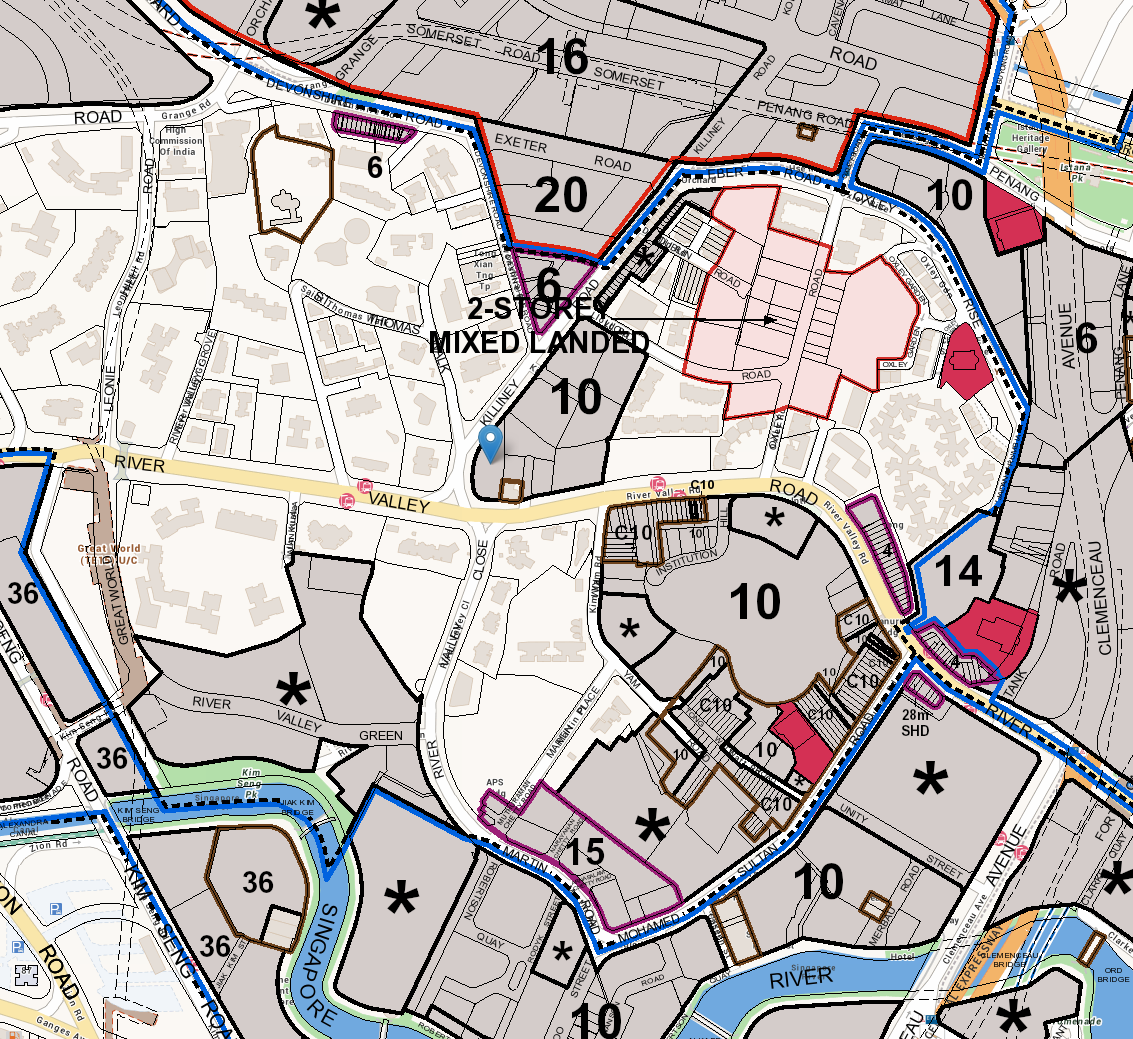

1) There are other resale condos in the area that developers could go for.

2) There is a building height restriction of 10 storeys here (this could be due to the 2-storey mixed landed housing estate nearby, so URA wants to preserve the overall characteristic of the estate).

I believe that these 2 considerations would make it less straightforward when it comes to redevelopment. The good news is that the plot is small, so it would be easier for the developer to sell out all the units within the 5-year ABSD deadline.

As usual with all en bloc, nothing is ever guaranteed. Most important is also whether the owners are willing to sell in the first place. Next is just whether developers would feel it’s profitable and worth the risk!

So to be honest, we can’t say whether or not it has a good chance, but the height restrictions are a cause for concern.

For more news and information on the Singapore private property market, or an in-depth look at new and resale properties, follow us on Stacked.

We hope that our analysis will help you in your decision-making. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Read next from Property Advice

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Advice Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

Editor's Pick The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

Editor's Pick This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Editor's Pick Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Editor's Pick Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?