The Impact Of High Land Prices On Singapore’s Property Prices: How Land Prices Have Moved Since 1992

February 6, 2024

One of the main reasons cited by developers, as to why new launch prices are so high, is the price of land. We have an article that covers some of the details here. However, a common criticism we’ve heard from many of you is that you seem to hear this every year; and granted, we’re hard-pressed to find a time when developers weren’t complaining about land prices. So we decided have a look back at how land prices have been rising:

How have land prices moved in Singapore?

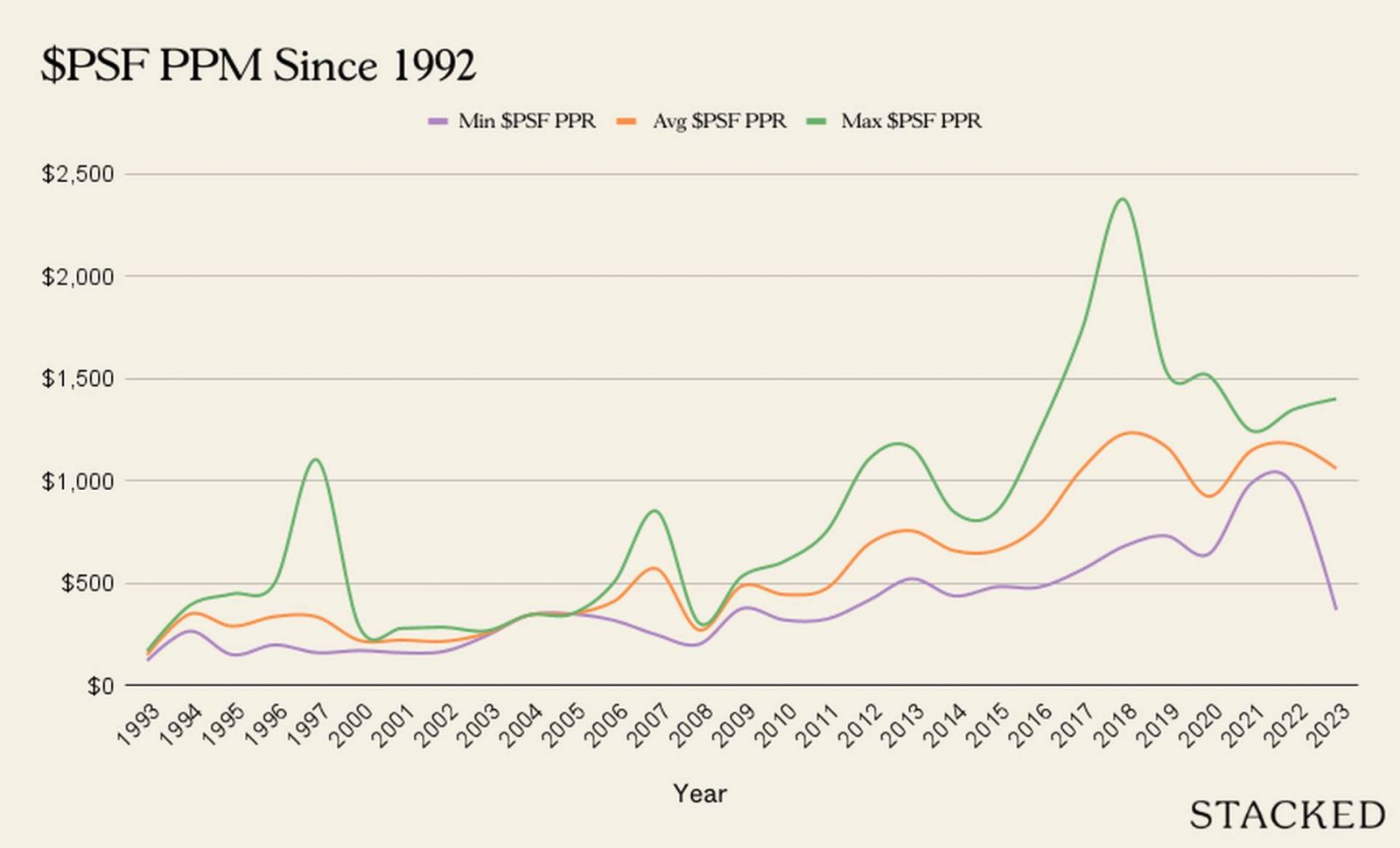

This shows the average land prices since 1992. You’ll notice three big spikes here:

The first, in around 1996, was when there were huge run-ups in prices in the years before; right up to around mid-1997. This was the prelude to the Asian Financial Crisis (AFC), when the market was exuberant before the sudden crash. When the plunge began in mid’97, it resulted in one of the worst-ever property downturns, with some home prices falling around 45 per cent from the 1996 peak (you can read about it in this old document).

The second, in around 2007, came on the back of a major property boom. Right the next year though, the Global Financial Crisis sent prices plummeting again. However, recovery was very fast-paced, thanks to a zero-interest rate policy set by the US Federal Reserve. At one point, the impact was so extreme, that borrowers using SOR loan packages (these are not used anymore today) actually had negative home loan interest rates.

The third great spike, which happened around 2017, is allegedly due to the influx of Chinese developers with deep pockets. This caused an en-bloc frenzy, with aggressive bidding that drove up land prices and depressed margins; and while Chinese developers have largely been accepted as a part of the landscape now, their impact on land prices has never quite been reversed.

2017 seemed to be the year that pushed up prices most significantly

If you look at the average land price in 2017, you’ll notice this is the first time we see the average go past $1,000 psf. This was about a spike of 34.5 per cent from the year before ($784 psf).

After 2017, we never again see land prices go below $1,000 psf, with one exception being the Covid-peak of 2020. The very next year, prices bounced right back past $1,000 psf.

At that point, the market was braced for a possible surge in prices; because by 2022 the last tranche of 2017 en-bloc redevelopments would be completed. But as we mentioned in this article, that never quite came to pass. A combination of more GLS land being released, higher ABSD, as well as Land Betterment Charges (LBC), caused developers to hesitate with any aggressive bids. Developer caution caused the price to dip to $1,061 psf last year; and if the recent bid for the Marina Gardens white site is any indication, land prices might continue to stay muted – at least in areas like the CCR, which are most impacted by cooling measures.

So in the immediate sense, land prices are a bit lower compared to the past two years.

But if that’s the case, why don’t new launch prices drop?

Well, ever since last year, it’s become established that the “norm” for a new launch is around $2,100+ psf. So even if a developer can get the land for cheaper, they will likely never go below this pricing. Why would they? If buyers are still biting at that price, and the market accepts it, then developers are eager to improve their already-thin margins.

In a related discussion with a realtor this week, she pointed out that – just because a consortium got the Marina Gardens white site for a lower bid – that doesn’t mean the resulting project is going to be much cheaper than surrounding condos. It’s expected that new launches will be priced higher than existing resale projects; and the existing projects there – such as Marina One or Marina Bay Residences – are far from cheap.

As such, land prices do impact developer pricing; but there are other “sticky” factors, like established market rates, that can keep prices high regardless of whether land is cheaper that year.

There is one other factor to consider: en-bloc sales and the cost of a replacement property

This is a bit of a wild card in the coming years, as we don’t know how the en-bloc market is now going to play out. On the one hand, it would seem that en-bloc sellers are going to push for much higher prices, given the cost of a replacement property.

If you bought a resale home in January 2014, for example, it may have cost around $1,204 psf. If that home goes en-bloc and you need a replacement property, a resale unit right now averages about $1,595 psf, whilst a new launch averages around $2,315 psf.

It’s a rather huge sum a prospective developer has to offer, to convince you to sign off on the collective sale; and this would drive up land prices again.

On the flip side, the en-bloc sellers may flinch first, and agree to come down on prices since developers are more cautious. It may seem that most people don’t have an urgent need to sell, however, as most Singaporean property owners are well-capitalised and can wait till they see the price they want.

That said, we are already seeing signs that owners will have to come down on those prices as the developers are not biting. One big example is Pine Grove, where the en-bloc sale committee is trying to get a common consensus to relaunch at a lower price of $1.78 billion, instead of the earlier $1.95 billion.

Overall, it’s likely that we won’t see another 2017 en-bloc frenzy, not with the current economic conditions, interest rates, and cooling measures; but while this means land prices aren’t likely to spike, it doesn’t guarantee lower new launch prices either.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How have land prices in Singapore changed since 1992?

Why do new property launch prices stay high even when land prices drop?

What impact did the 2017 land price spike have on property prices?

How do en-bloc sales influence land prices in Singapore?

Are current land prices likely to cause lower new property prices in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Pro This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Editor's Pick Happy Chinese New Year from Stacked

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

0 Comments