The Fascinating Story Of How We Ended Up With So Many Trees In Singapore

July 23, 2023

How Singapore became a garden city

I came across this excerpt that was posted from Lee Kuan Yew’s memoirs, where he talks about how the emphasis on trees came about in Singapore.

He visited both Paris and London, and was surprised to see how different they both were. Paris had their expressways lined with trees, while London had grass that was unkempt and overgrown with weeds.

He also wasn’t impressed by the size of their buildings, but the standard of their maintenance.

Cracked washbasins, leaking taps, and overgrown gardens were a telltale sign that the country wasn’t ran well.

As such, he realised the need for Singapore to promote itself as a tropical garden city (to stand out in a Third World region). By keeping the country clean and green it would create a good impression, and in turn, attract businesses to set up shop in Singapore.

So, he set up a department dedicated to the care of trees, and senior officers of the Government were involved in the creation of the “clean and green” movement.

It wasn’t easy at first. They needed to stamp out old habits of people who walked over plants, or worse yet, stole them.

The natural conditions of Singapore also didn’t help. He had to invite a plant and soil expert from overseas to find out what we could do better in our tropical environment and implemented the findings.

By the 1970s, the clean and green campaign had born fruits.

CEOs contemplating investment in Singapore would visit before they made their decision. Believing in the power of first impressions, he ensured the roads from the airport to their hotels and his office were spotless and lined with trees.

Upon entering the Istana grounds, they found a green oasis amid the city’s hustle: a 90-acre spread of well-manicured lawns, woodlands, and a golf course nestled within. This spectacle silently conveyed Singapore’s competence, discipline, and reliability, reassuring CEOs of the potential workforce’s skill adaptability.

This unique approach resulted in American manufacturing investments surpassing those from Britain, the Dutch, and Japan. Singapore’s garden city image successfully attracted global businesses.

For me, it’s a remarkable reminder of just how much foresight he had. While I’m sure that there are other reasons, this was an underrated one that laid the foundations for where Singapore is today.

Look at all our new condos, and see how much emphasis is now placed on greenery as well. Sometimes, it’s the little things and the impressions that it can play and add to the value of real estate as an asset.

Meanwhile, the battle for parking space is reaching a fever pitch in landed enclaves.

Now I understand some people will roll their eyes and complain about rich people defending their privilege, etc. But to be fair, there are some real issues faced by landed owners.

Last week I was told a story that dates back to 2004. This was when someone disrupted a church service in the Siglap area, due to frustrations over people blocking the driveway.

I was told in confidence that, within the same area, there was a case of someone passing away, because they couldn’t get to the hospital due to cars blocking the driveway and roads.

These days the Siglap area is much improved, with a traffic warden there on Sundays to control the flow of cars. But it does raise the issue of hazards posed by these narrow roads, and whether they’re going to be an ongoing issue going forward. I’m pretty sure that, for landed homeowners, what makes it tougher will be the public perception that they’re wealthy and less deserving of sympathy*.

More from Stacked

“Surprise” New Property Cooling Measures Aug 2024: How New Loan Curbs And Grants Will Affect HDB Homebuyers

Following the NDP rally speech, MND has rather quickly followed up with the numbers. In our last piece on whether…

*Incidentally, there are people who live in landed homes who are far from rich. Some of them only have that property because it was inherited, from a time when landed homes were much cheaper.

Nevertheless, this parking issue is one that not just landed homeowners are facing, but condo owners as well. I’ve heard of some new launch buyers who have been shocked that their condo doesn’t come with visitor parking lots, or that they won’t be able to own more than one car.

This issue could be solved in the near future given the high COE prices, but perhaps it won’t be surprising that we could follow what has been happening in Hong Kong. Car park lots are not a given in some developments, and you’d have to pay for the car park lot separately (so it’s also an asset that you can sell).

In other serious property news this week…

- We checked out the upcoming BTO launch sites for August, and they’re looking good.

- There are, in fact, freehold condos below $1,000 psf even in 2023. Here’s a list.

- Take a look at how condo layouts have changed over time, before deciding you’re happy with an older or newer project.

- If you think this is the peak and new condo prices may be about to drop, I hate to disappoint you; but I doubt so for now.

Weekly Sales Roundup (10 – 16 July)

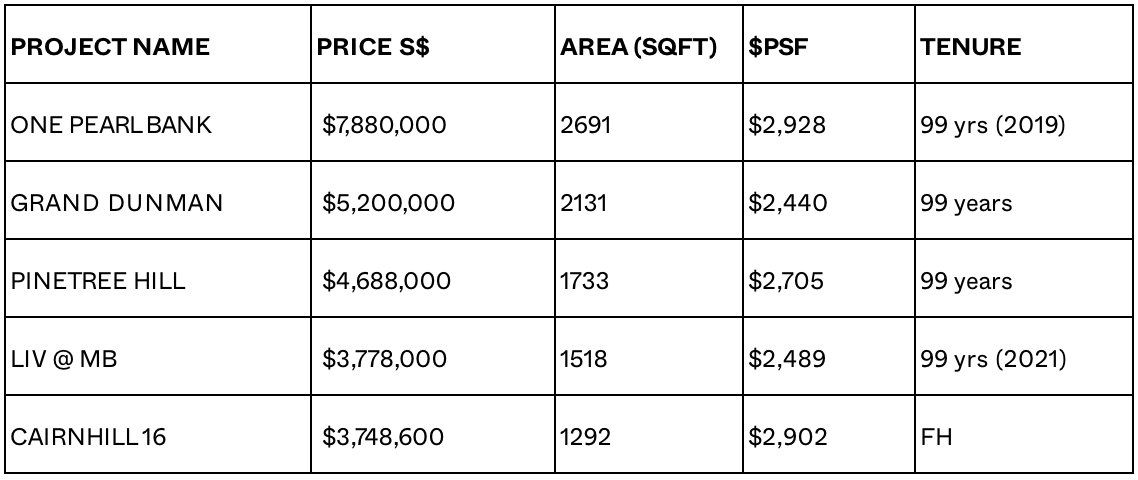

Top 5 Most Expensive New Sales (By Project)

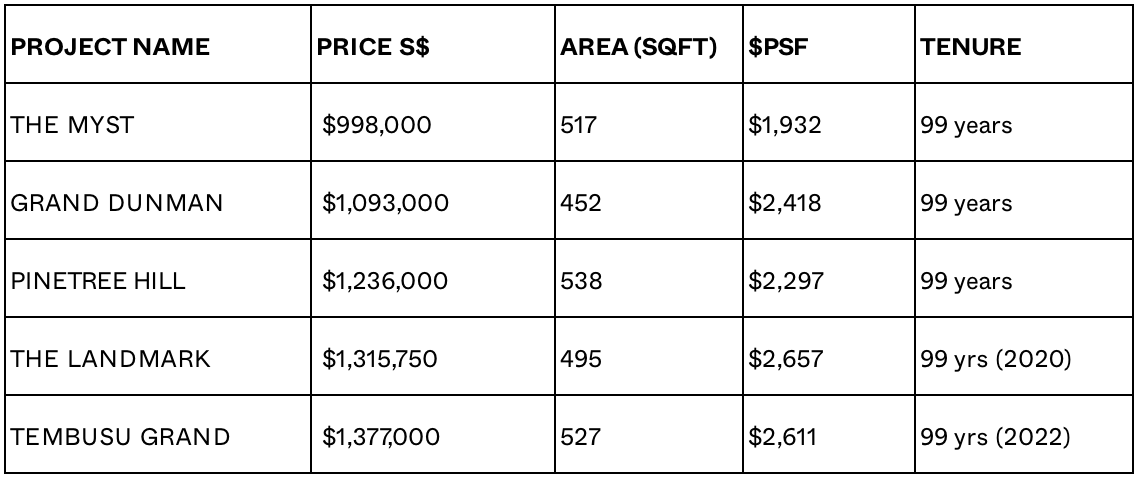

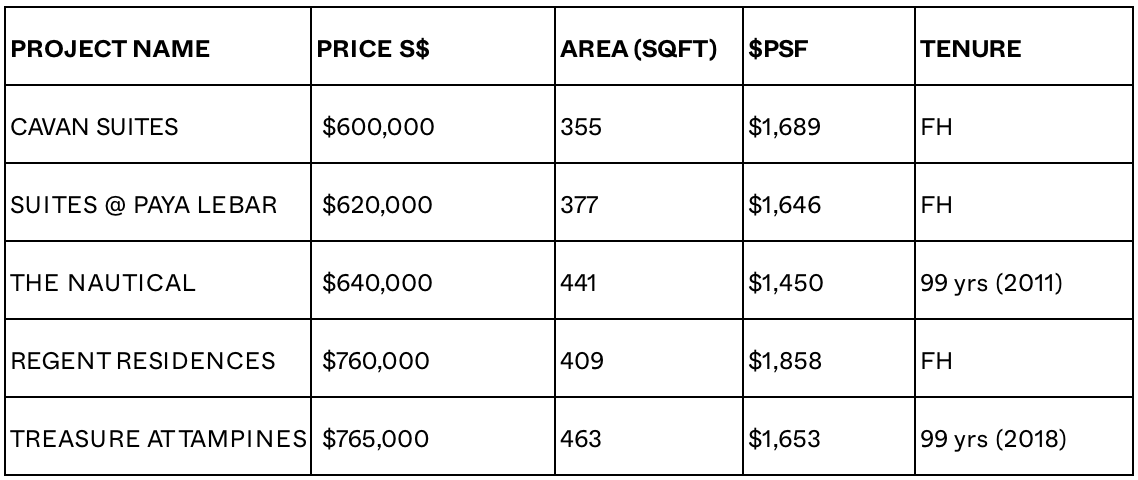

Top 5 Cheapest New Sales (By Project)

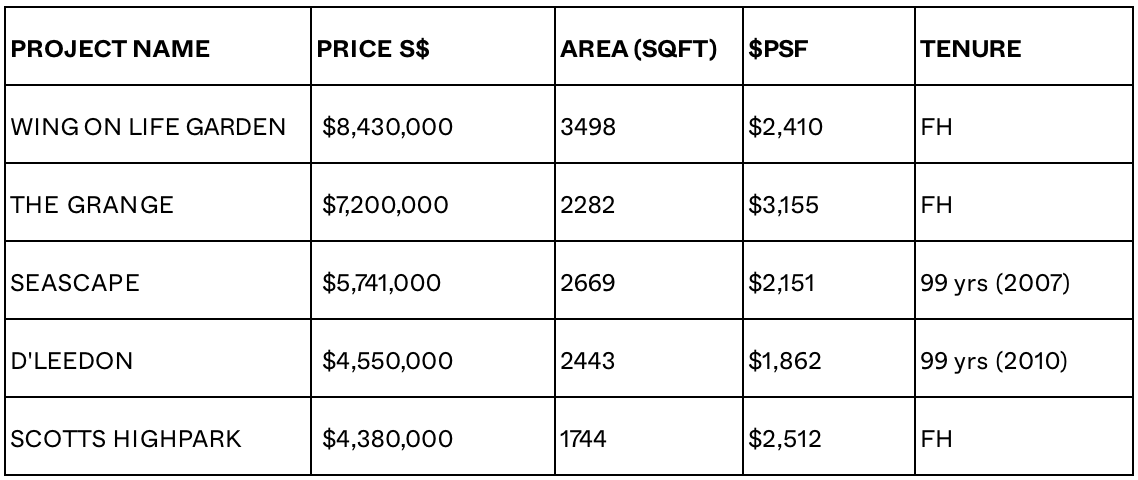

Top 5 Most Expensive Resale

Top 5 Cheapest Resale

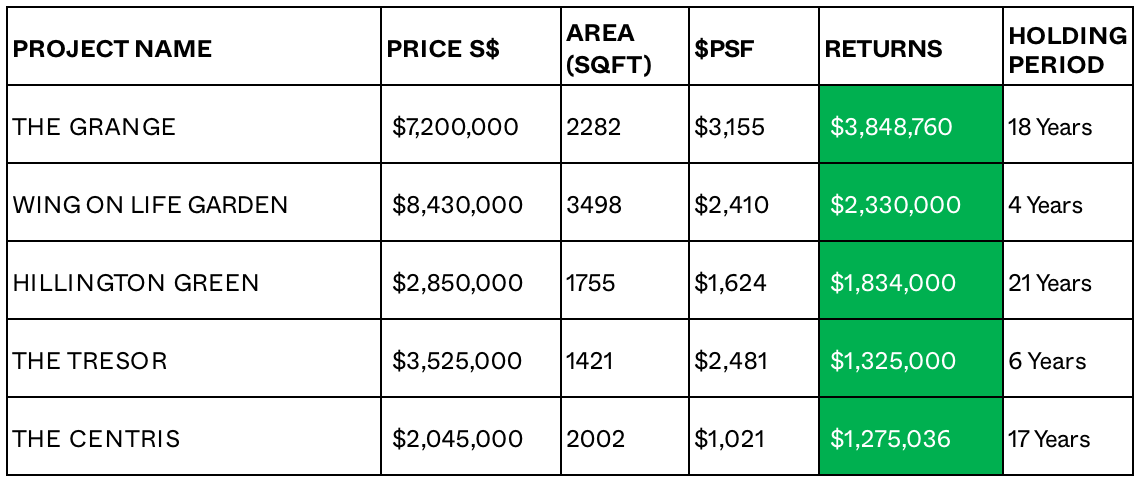

Top 5 Biggest Winners

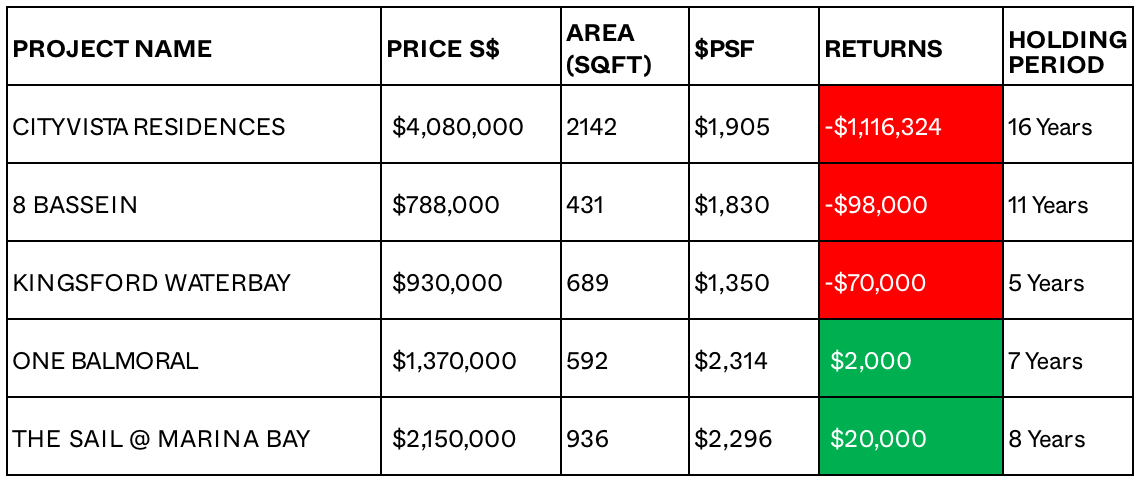

Top 5 Biggest Losers

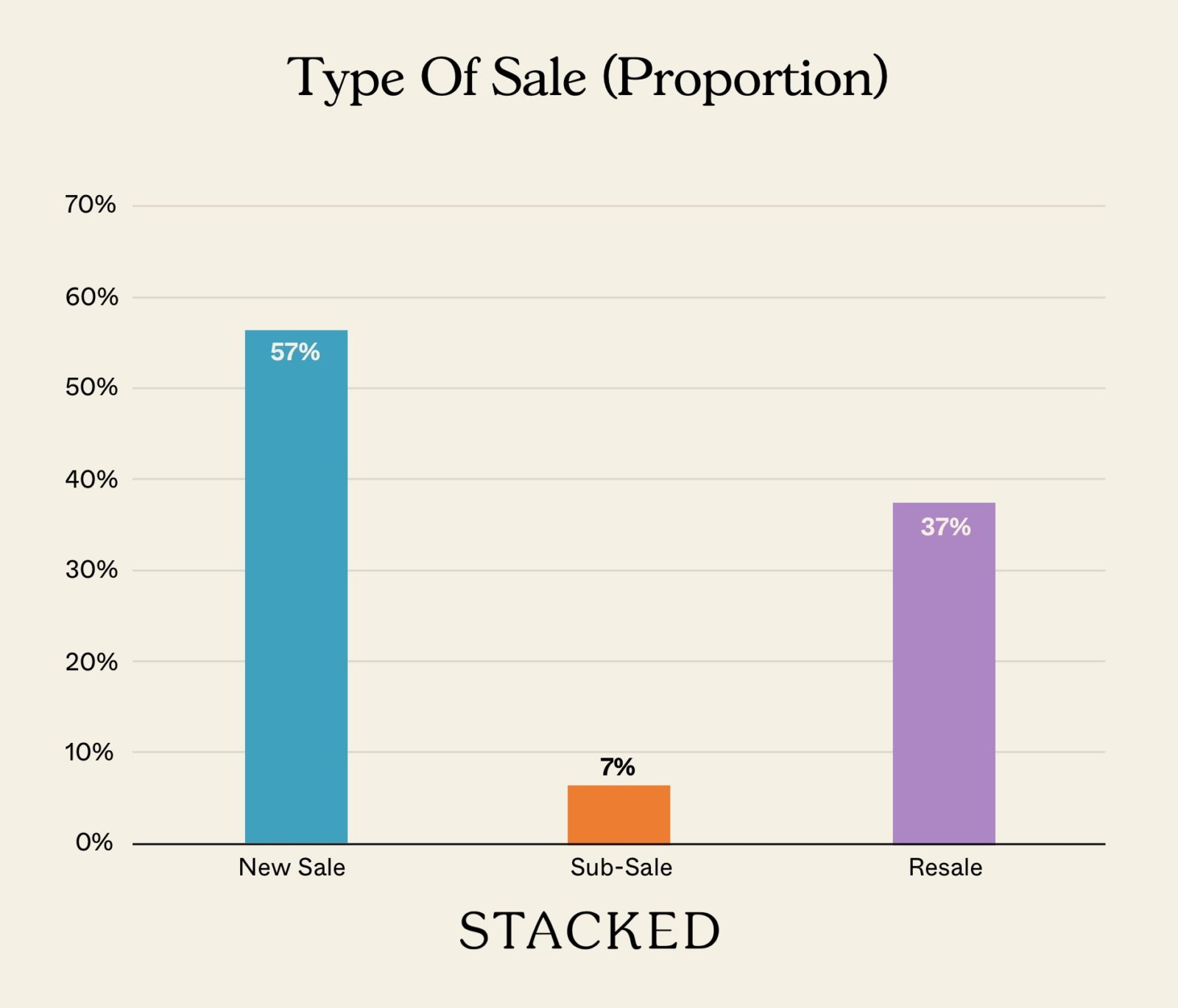

Transaction Breakdown

My Favourite Links Of The Week:

– Mixed-use properties are now residential, or for the purposes of foreign ownership.

The Ministry of Law and the Singapore Land Authority have tweaked the Residential Property Act (RPA): Developments with both a commercial and residential aspect – like some shophouses, as well as malls with apartments – are no longer designated as “non-residential” in land use zones.

That means foreigners who want to buy these now need to get approval, by applying under the RPA.

(For those who already own these properties, they only need to apply for approval if they want to redevelop and retain the property).

It’s not a big change, as this is a small number of properties, and the number of foreigners buying properties (at 60 per cent ABSD) is tiny anyways.

I suppose this is a fair move, possibly to keep Singapore property less susceptible to price fluctuation from foreign money – which in turn helps keep real estate prices and the operating costs of businesses in Singapore relevant.

But it does show how much demand there is for all types of properties in Singapore. The increased ABSD in the residential sector has moved the demand toward other assets such as shophouses. That spillover effect has really pushed the pricing for such shophouses too, with prices that are apparently pushing above the $7,000 psf mark.

This has been going on since 2022, so this move could help slow prices down.

Follow us on Stacked for news and trends in the Singapore property market, and for curated property picks.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How did Singapore develop its reputation as a garden city?

Why did Singapore focus on planting more trees and maintaining greenery?

What challenges did Singapore face in making it a green city?

How does the garden city image impact Singapore's real estate and business?

What are some parking and property issues faced by residents in Singapore?

Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

0 Comments