Shoebox Apartment in Singapore: Is it still worth buying in today’s market?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Druce is the Chief Editor at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.

Put simply, a shoebox apartment is characterised as a studio or one-bedroom apartment that has less than 500 square feet of space. For a period of time, a shoebox apartment or more commonly known as a Mickey Mouse apartment locally, was all the rage in Singapore. Ching Chiat Kwong, dubbed as Singapore’s shoebox king, was one of the pioneers of the trend here. He had realised there was a niche in the market for small affordable homes and started by selling shoebox apartments as small as 32 square metres. His first project was the 48-unit Tyrwhitt 139 in Little India which sold out in just 3 hours.

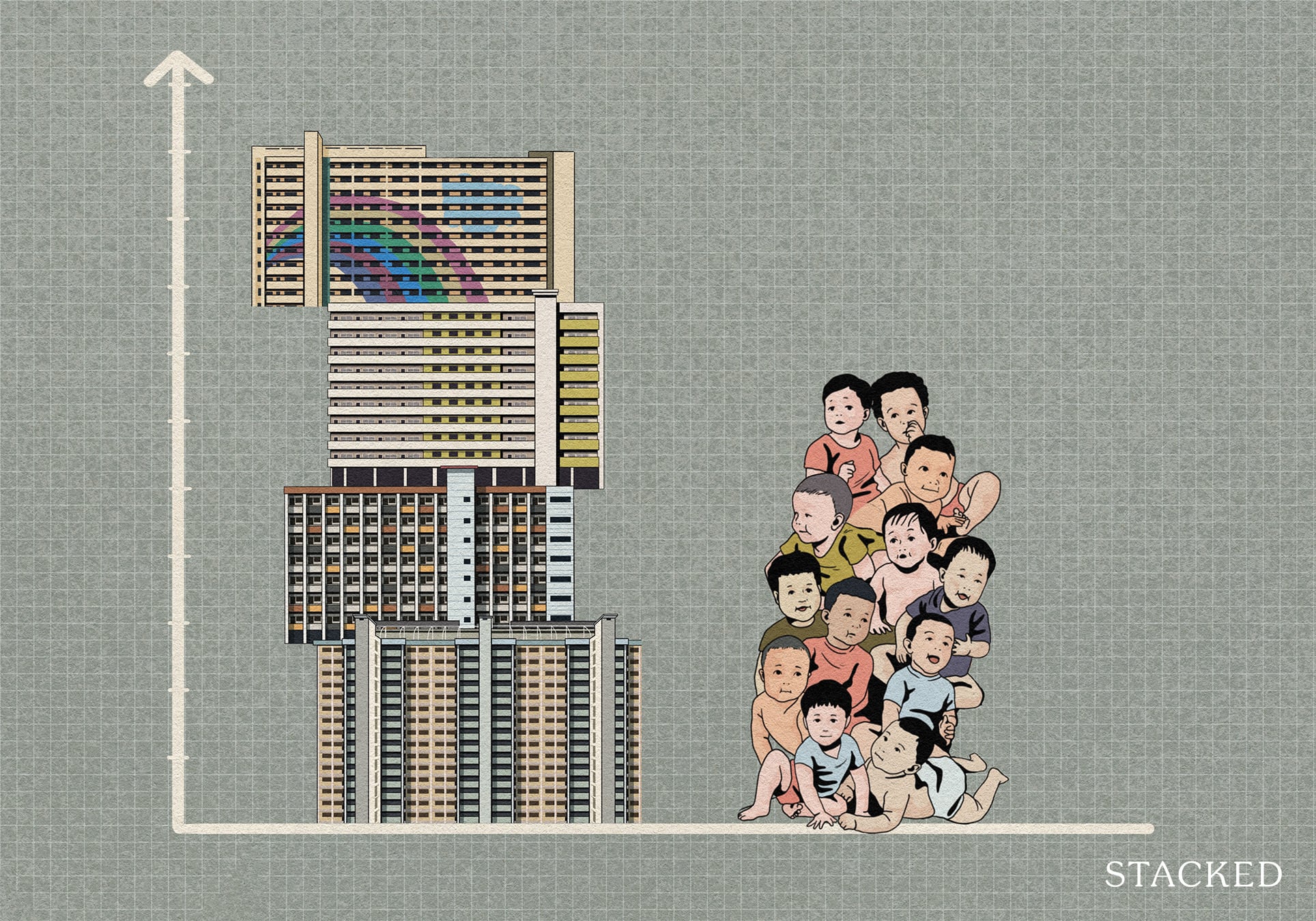

However, they were also not without their detractors as many people were exclaiming about how unliveable the sizes of these new apartments are and there were many a debate as to whether buying a shoebox apartment was a silly decision. Simply because back in that period of time, unit sizes were not as small as they are today. Nowadays, things have changed and people are getting increasingly used to small unit sizes, especially in the city centre. According to the URA, there were 28,000 completed shoebox units in total, which is an 11-fold increase in the past 6 years.

You can also see this in mainstream media like newspapers and interior magazines, as shoebox apartments were popular features. These articles showed off different ways you could utilise small spaces, or even how you can maintain a similar lifestyle despite the smaller space.

Why the restriction on a shoebox apartment now?

On Oct 17th the Urban Redevelopment Authority (URA) announced that the average size of new private flats outside the central area will have to be at least 85 square metres. This means that the number of units allowed in a project will be cut down. Not to mention, 9 areas in Singapore (from 4 presently) will be subject to an even more stringent minimum average requirement of 100 square metres. This includes Marine Parade, Joo Chiat-Mountbatten, Balestier, Telok Kurau-Jalan Eunos, Stevens-Chancery, Pasir Panjang, Kovan-How Sun, Shelford and Loyang.

So from 17th January 2019, the minimum average unit size for developments outside the central area will go up from 70 square metres to 85 square metres, which is the same starting date for the 100 square metres threshold in the 9 designated areas.

So why the sudden restriction on a shoebox apartment?

Firstly, this can be seen as a move to put a dampener on the en bloc market. Evidently, the last cooling measures were not seen as adequate enough. This move would most likely be the warning sign for anyone who expects more en bloc deals to be done, particularly in those 9 regions that were highlighted. This move hampers a developers profitability as their ability to build a shoebox apartment was a way to boost profit margins as they were able to build more smaller units. Also, the smaller units usually command a higher PSF and this in turn will increase the overall PSF of the development.

Another reason would be a concern for the general liveability and space for the future of Singapore. If this was not addressed early, there could be a glut of shoebox apartments in locations outside the Central Area. Of the 28,000 shoebox apartments that were completed, 85 percent of them were located outside the Central Area. So, a ton of apartment units but perhaps not suited for families that want to live there. A somewhat similar situation is happening right now in China’s ghost city, Tieling.

More from Stacked

How I Picked My Co-Living Apartment: My Experience Booking Hmlet, Figment, & Coliwoo

Hello again! Last week, in the first unvarnished and objective article documenting the experience of co-living/moving out in Singapore, I…

So what will happen next?

Now that we know the full details of the measures that are going to take place, here are some of the likely scenarios that could play out.

1. As said earlier, this move will probably curtail the en bloc market, especially for the 9 areas that have an even stricter control. Even if there are still deals to be made, this means lower land prices as developers will make lower bids. Less money will flow to the sellers, and less money will flow back into the market when they start buying as well.

2. In the short term, demand for shoebox apartments could go up. Those that are looking for a shoebox apartment might feel that because supply for these units will be lesser in the future, and as such, now would be a good time to buy before that happens. The restrictions also do not apply to the Central Area, which are, Outram, Newton, River Valley, Singapore River, Marina South and Marina East, Rochor, Orchard and Downtown Core. So things there should continue as per normal.

3. This move could also be good for consumers that are looking for bigger living spaces. Now, there will be a lower amount of units in a residential project as well as a general larger floor areas for the units as well. This means that there could be a move to provide more family friendly units outside the Central Area, to provide to a different crowd. So think more comfortable living and a higher quality of life, which will be better for consumers.

4. This also could lead to a downward pressure on the prices. Bigger units will likely be priced more attractively as the downward trend for prices will mean more affordable PSF pricing for them.

Conclusion

It is easy to see why shoebox apartments have been so popular the past few years. At the price point, it is attractive to HDB buyers as a way to invest in the private market. Also, it is easy to see the rental yields garnered by shoebox apartments in the Central Areas and be swayed by it, hence the demand for them in the past few years. The investment size is also small enough such that it poses less of a risk in a sense to buyers.

Now with the new ruling in place, this might even bring about more demand for shoebox apartments in those areas. Judging whether it is a worthy purchase in todays market will be determined by whether there will be continued rental demand in these areas. Will the yields be enough for you to sustain the mortgage payments? Will this constrained supply now mean a bigger future demand for these smaller units? These are some of the questions you will have to answer to determine if it makes sense for you as in investment.

If you would like to read more about the cooling measures you can do so here. As always, feel free to leave a comment below or you can always reach us at hello@stackedhomes.com!

Druce Teo

Druce is the Chief Editor at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.Read next from Property Market Commentary

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

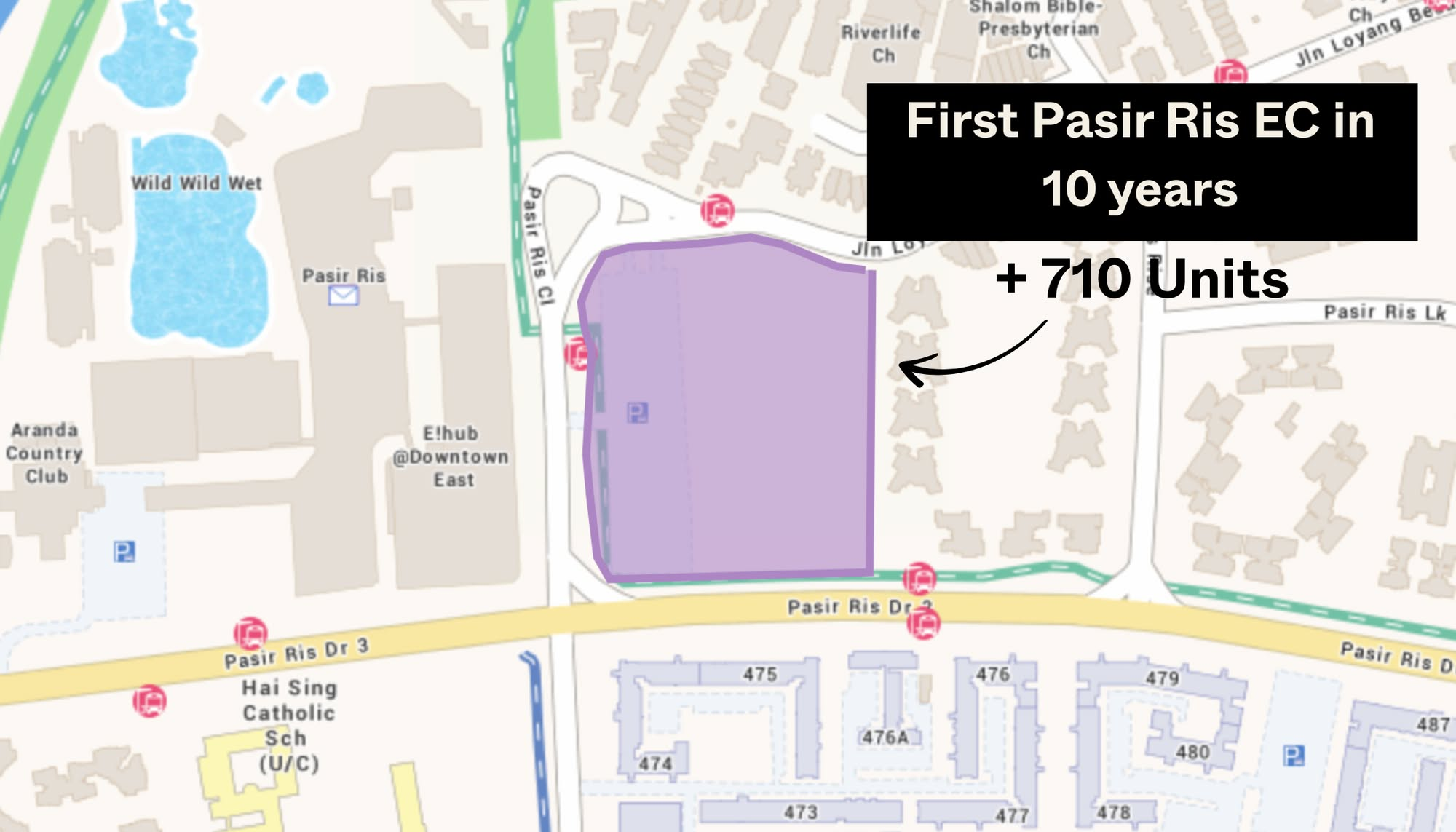

Property Market Commentary This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families

Property Market Commentary Which Central Singapore Condos Still Offer Long-Term Value? Here Are My Picks

Latest Posts

Landed Home Tours Where $4 Million Semi-Ds Sit Next To $40 Million GCBs: Touring First Avenue In Bukit Timah

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

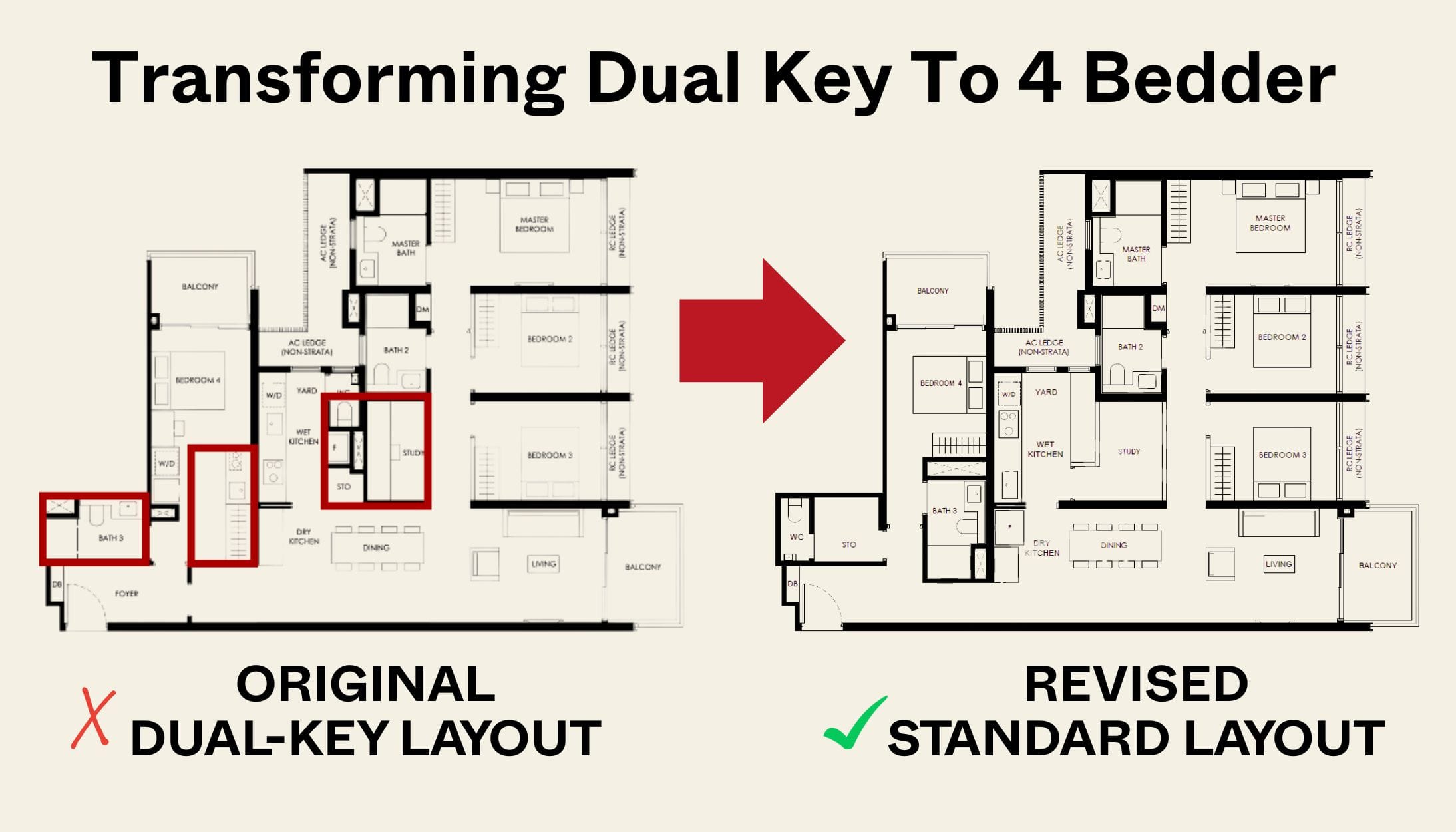

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

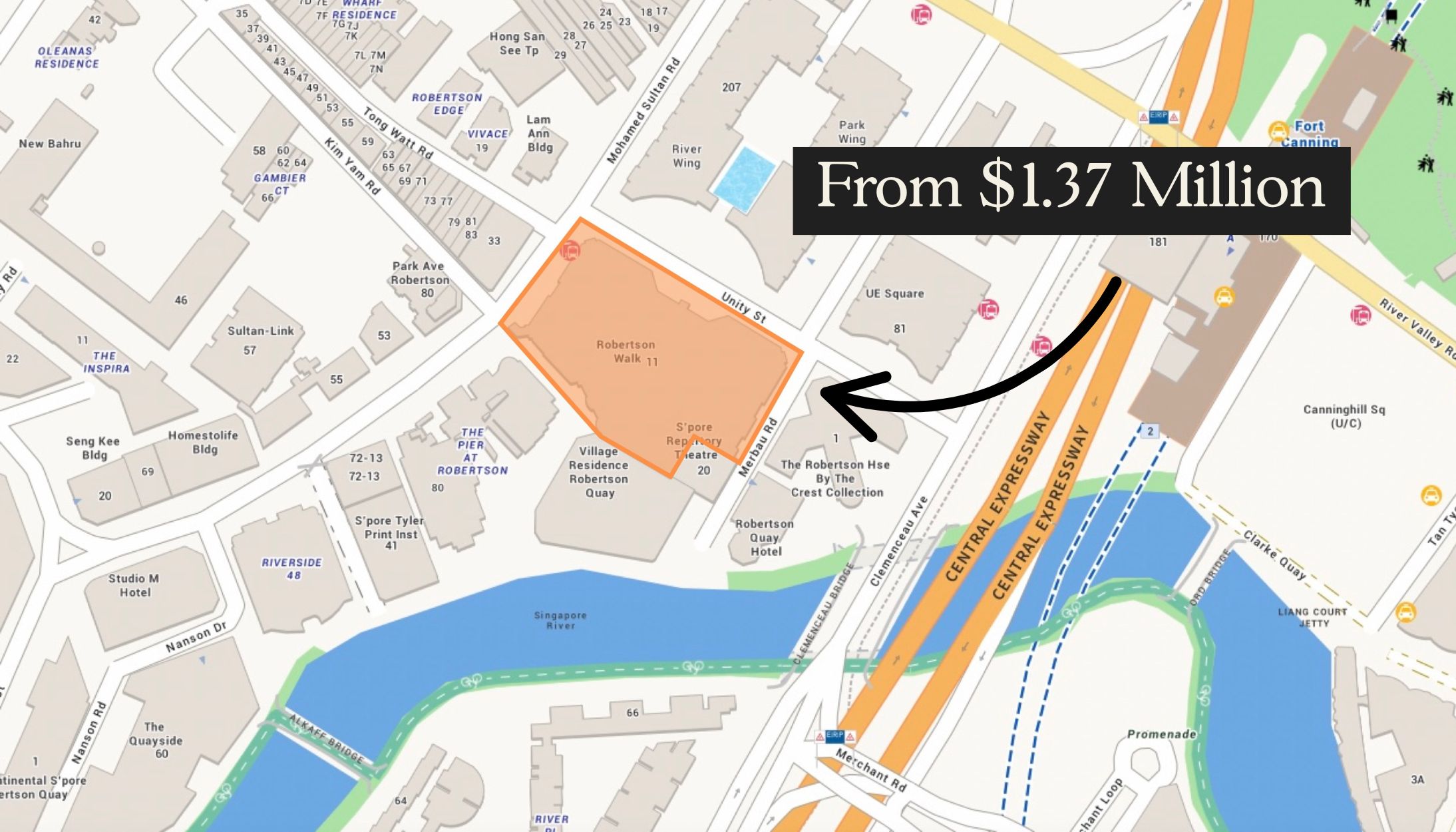

New Launch Condo Reviews The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

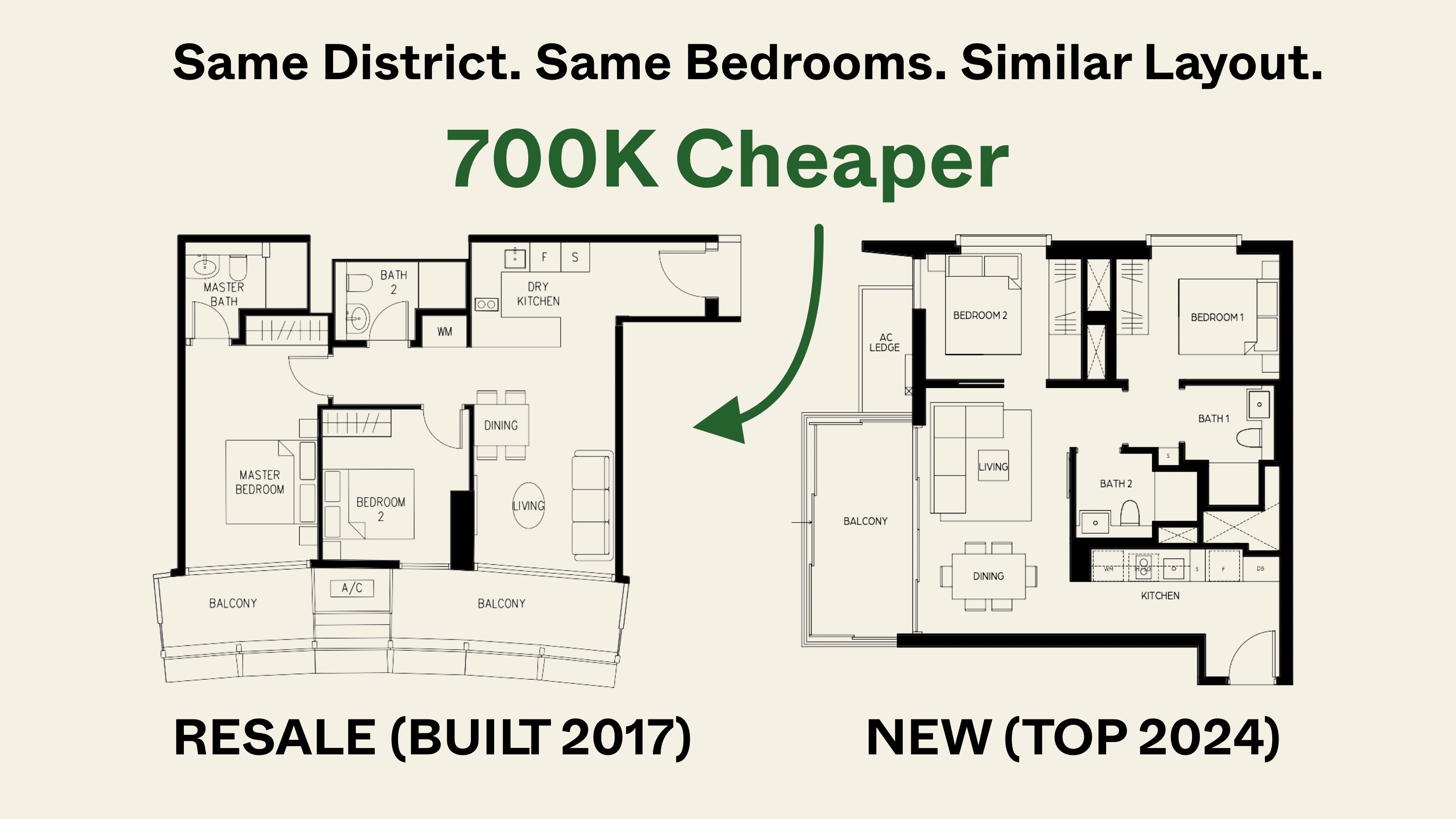

Pro Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

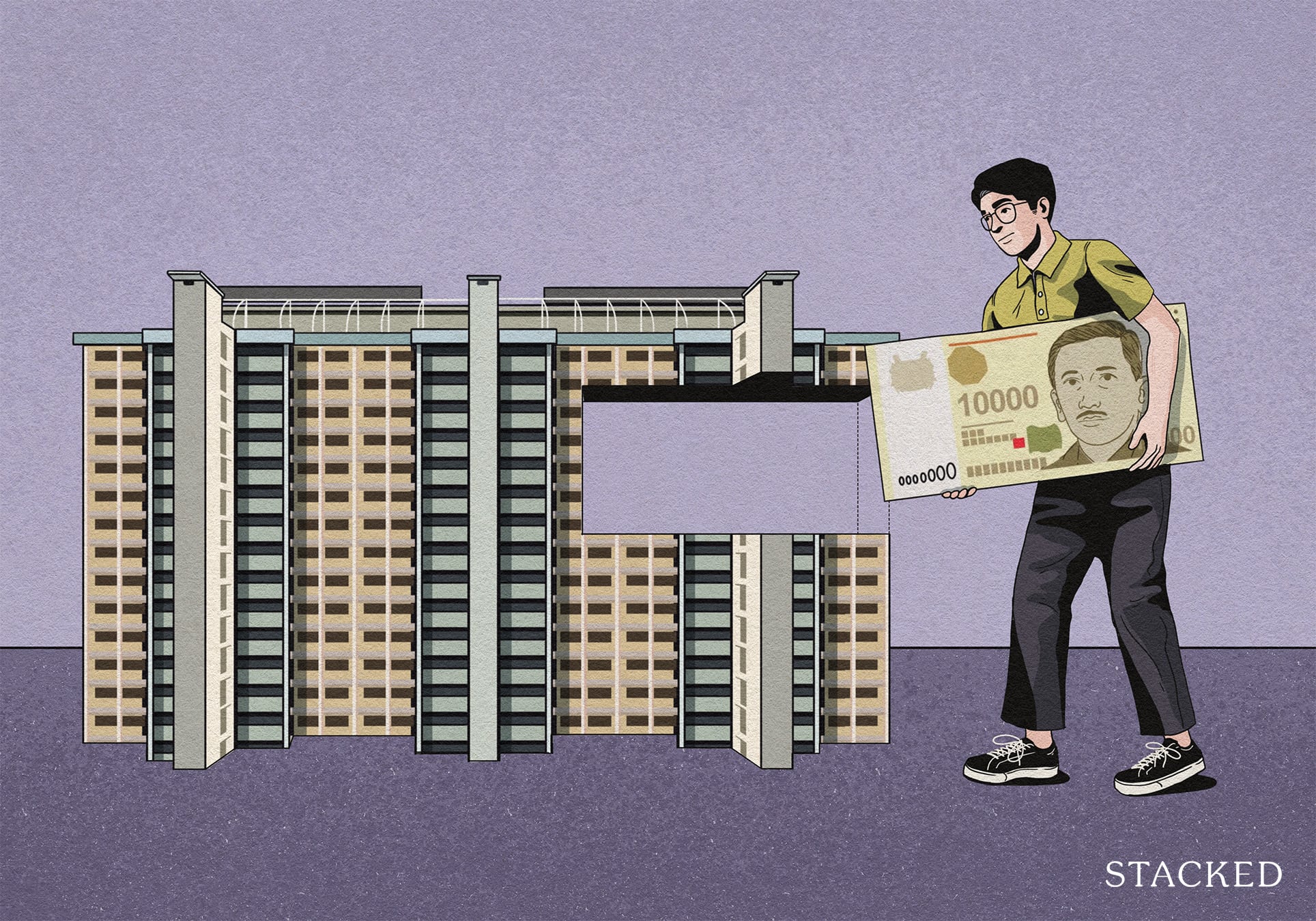

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

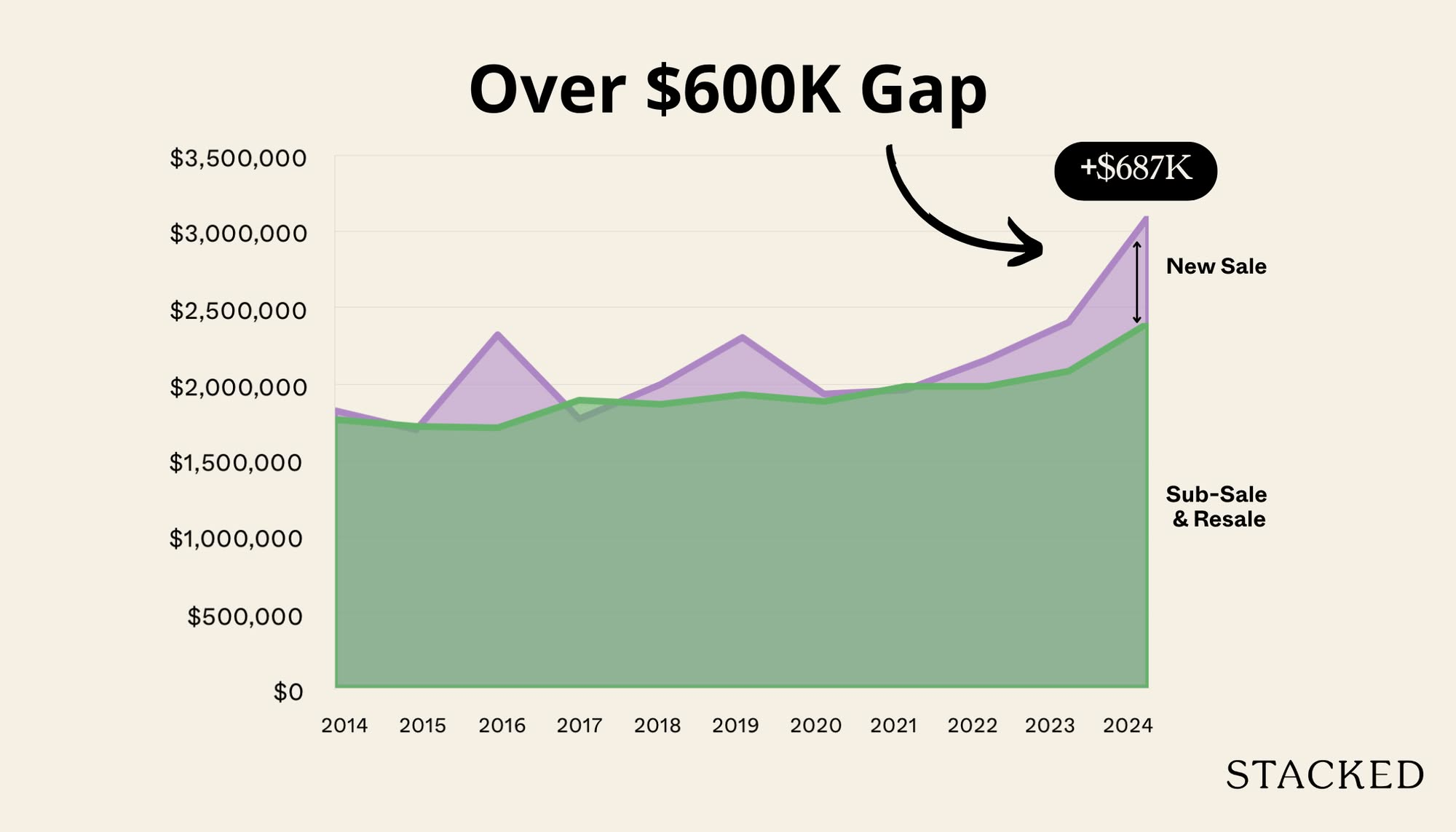

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

Shoebox unit is all I can afford for stay due to HDB limitations >.<