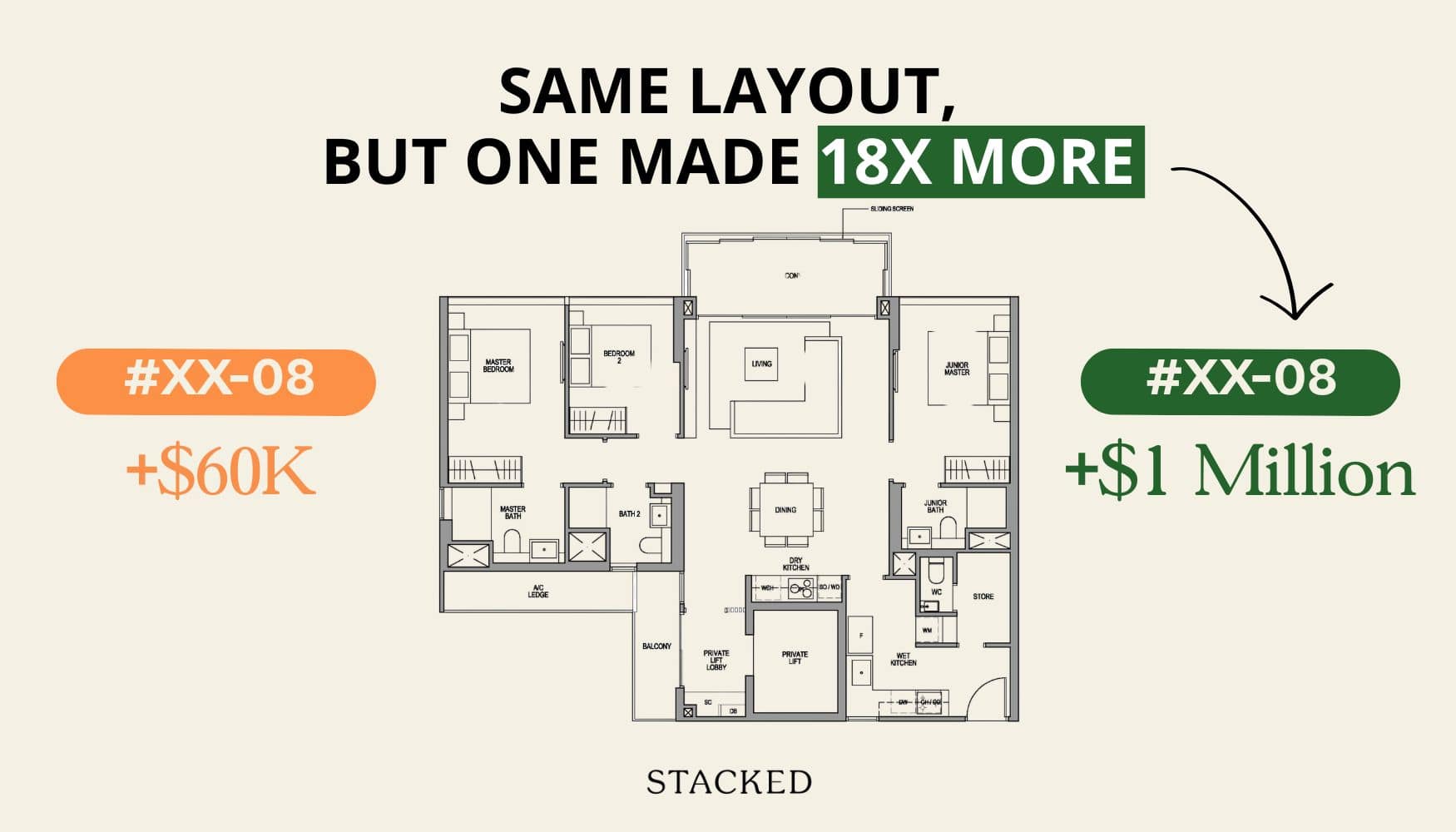

Same Condo, Same Layout — But A $1M Profit Gap: A Data-Driven Study On Martin Modern

April 30, 2025

In this Stacked Pro breakdown:

- We analysed sales data across 2- to 4-bedder units at Martin Modern to reveal how purchase timing impacted profits

- See why some early buyers walked away with $1 million more than later buyers — even when units had similar holding periods

- Understand how floor level, market cycle, and launch phase strategy all play a role in resale outcomes

Already a subscriber? Log in here.

Watertown condo is an interesting case study, as buyers weren’t sure what to expect when it launched in 2012. At the time, many still considered Punggol to be too “ulu” to see good resale gains, and some were sceptical about the impact of Waterway Point as a major recreational/family hub. Still, some buyers were bold and jumped in early, perhaps because of the integrated status and access to Punggol MRT. Let’s see if their decision paid off, compared to those who took longer to decide:

Join our Telegram group for instant notifications

Join Now

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Popular Posts

On The Market

Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

New Launch Condo Reviews

River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

Singapore Property News

The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

February 26, 2026

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

February 24, 2026

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

February 24, 2026

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

February 21, 2026

Latest Posts

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

February 26, 2026

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

February 26, 2026

Singapore Property News You Can Now Buy Part Of A $300M Singapore Bungalow — But You Can’t Live In It

February 26, 2026

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

February 25, 2026

0 Comments