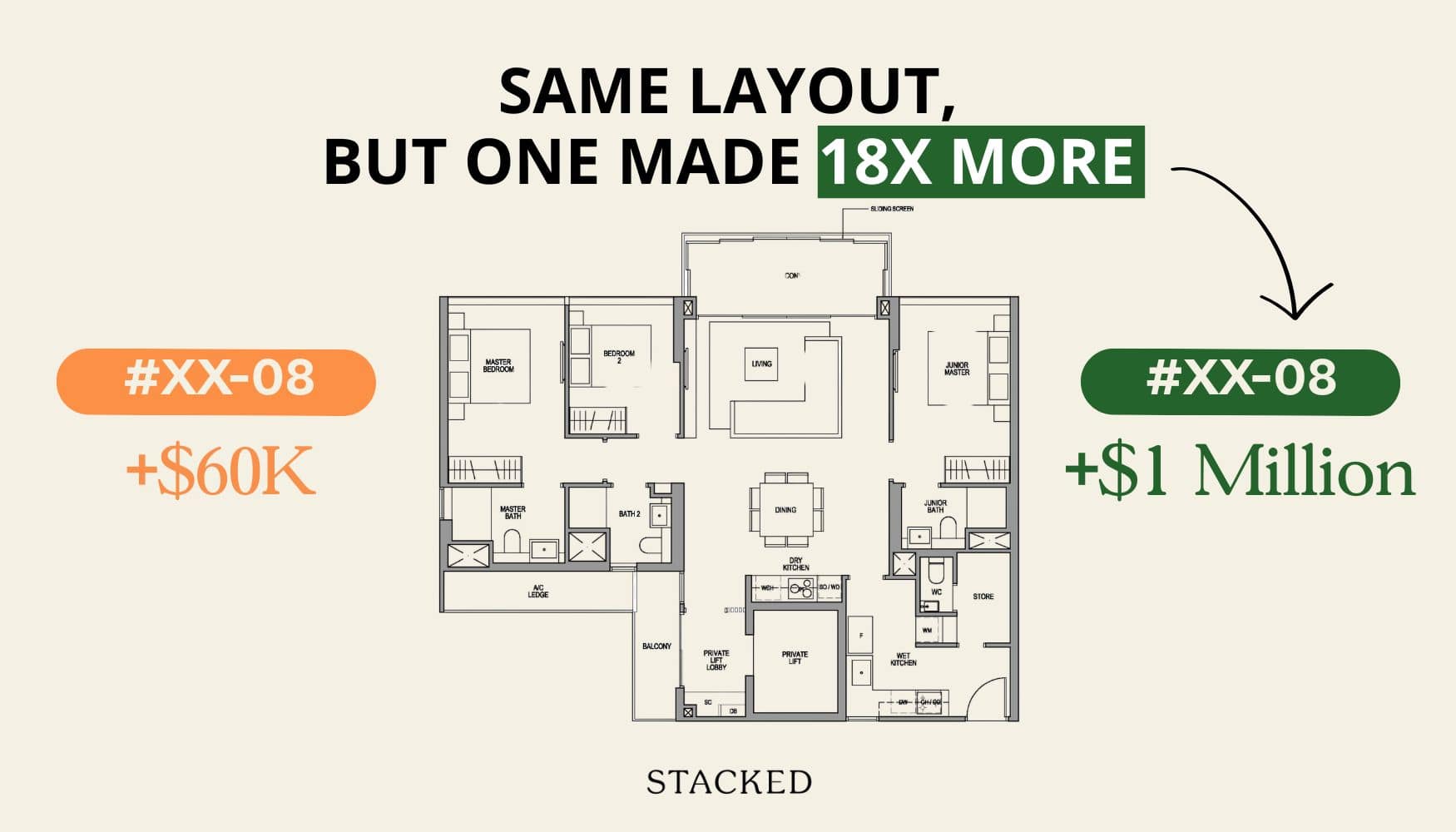

Same Condo, Same Layout — But A $1M Profit Gap: A Data-Driven Study On Martin Modern

April 30, 2025

In this Stacked Pro breakdown:

- We analysed sales data across 2- to 4-bedder units at Martin Modern to reveal how purchase timing impacted profits

- See why some early buyers walked away with $1 million more than later buyers — even when units had similar holding periods

- Understand how floor level, market cycle, and launch phase strategy all play a role in resale outcomes

Already a subscriber? Log in here.

Watertown condo is an interesting case study, as buyers weren’t sure what to expect when it launched in 2012. At the time, many still considered Punggol to be too “ulu” to see good resale gains, and some were sceptical about the impact of Waterway Point as a major recreational/family hub. Still, some buyers were bold and jumped in early, perhaps because of the integrated status and access to Punggol MRT. Let’s see if their decision paid off, compared to those who took longer to decide:

Join our Telegram group for instant notifications

Join Now

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Popular Posts

Singapore Property News

A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

On The Market

Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Singapore Property News

River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

March 10, 2026

Property Investment Insights Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

March 5, 2026

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

March 3, 2026

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

March 2, 2026

Latest Posts

Property Advice Should I Pay $500K More For A New Launch — Or Buy A Resale Condo Instead?

March 11, 2026

Singapore Property News A Rare Freehold CBD Office Unit Is Up For Sale At $20.5M — And Foreigners Can Buy It

March 11, 2026

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

March 9, 2026

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

March 9, 2026

0 Comments