The Only 999-Year CCR New Launch Condo In 2025: Our Preview Of Robertson Opus

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Cheryl has been writing about international property investments for the past two years since she has graduated from NUS with a bachelors in Real Estate. As an avid investor herself, she mainly invests in cryptocurrency and stocks, with goals to include real estate, virtual and physical, into her portfolio in the future. Her aim as a writer at Stacked is to guide readers when it comes to real estate investments through her insights.

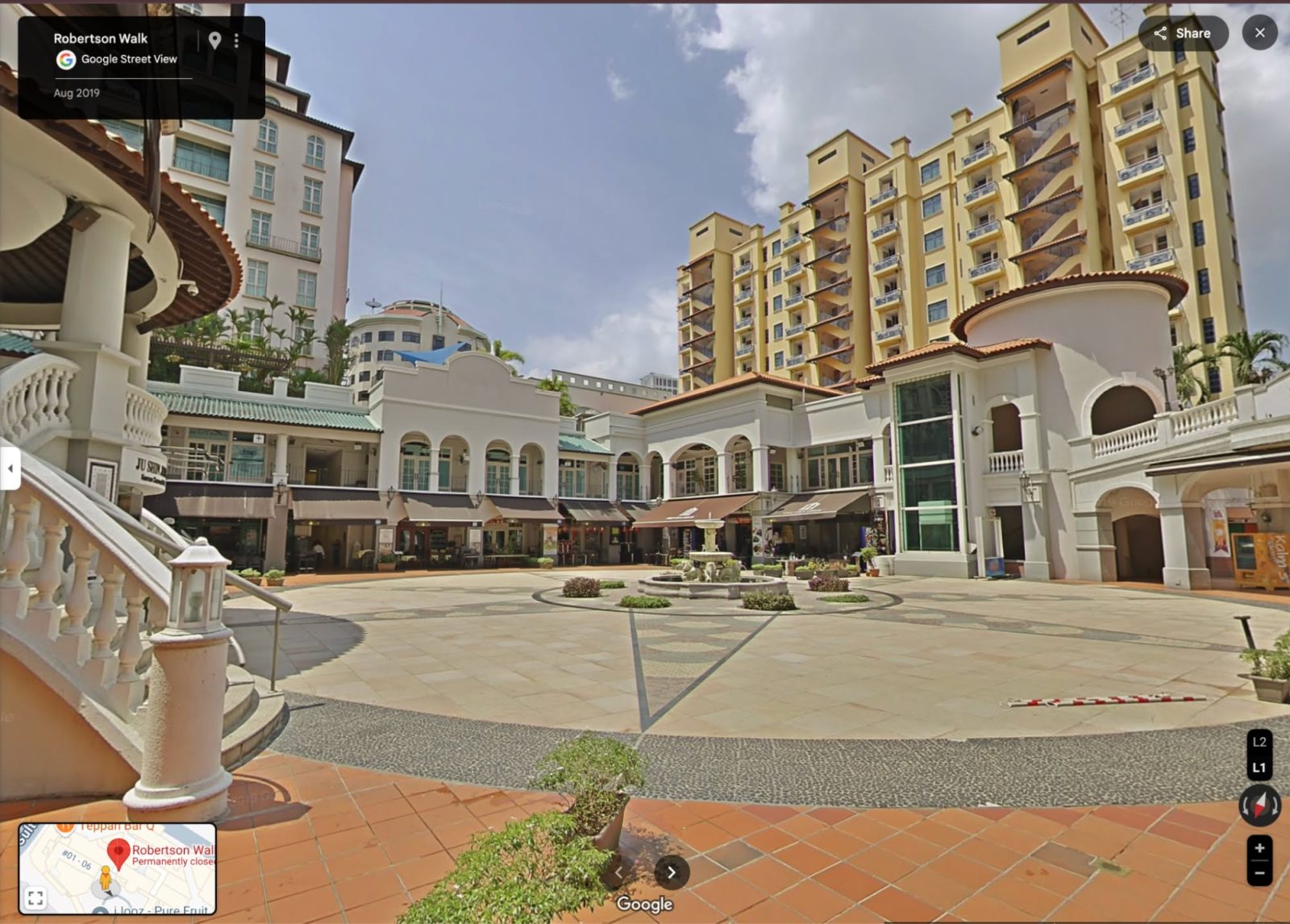

For long-time patrons, the redevelopment of Robertson Walk (once a staple in the neighbourhood) may feel bittersweet. Frasers Property, which previously owned and managed Robertson Walk, will be redeveloping it into Robertson Opus: a 348-unit mixed-use development with 26 commercial units. And perhaps more importantly, it stands as the only 999-year leasehold new launch in this current Central Core Region (CCR) cycle.

Timing-wise, Robertson Opus also arrives as the market moves towards a fresh wave of CCR launches. The last few projects that touched the area, such as Riviere, CanningHill Piers, Irwell Hill Residences, and Union Square Residences, have paved the way. However, 2025’s upcoming supply (including Zion Road Parcels A & B and River Valley Green) will reshape the landscape further.

While many new GLS sites nearby are 99-year leasehold and harmonised under newer planning rules, Robertson Opus stands apart, offering a rare long-tenure alternative at a time when land scarcity and tenure differentiation have started to come back into focus for certain buyer segments.

Let’s take a closer look.

Overview of The Robertson Opus

| Project Name | The Robertson Opus |

| Location | Unity Street |

| Developer | JV Between Frasers Property and Sekisui House (Riverside Property Pte Ltd) |

| Tenure | 999-year Leasehold |

| Site area | 30,663.64 sqm |

| GFA Harmonised? | No |

| No. of Units | 348 Residential Units 26 Shop units |

| Est. TOP | Est. Q2 2030 |

Robertson Opus enters the market as a 348-unit mixed-use development, with a 26-unit retail podium. Its 999-year leasehold gives it an edge in a launch year dominated by 99-year offerings, though within this particular pocket of District 9, such tenure isn’t entirely unique. UE Square and The Pier at Robertson, both nearby, share similar tenure and mixed-use zoning.

Some may also draw comparisons to Union Square Residences (launched just last year), located close by, which carries a similar lifestyle to Robertson Quay, with its commercial-residential mix.

In any case, Robertson Quay is helmed by Frasers Property and Sekisui House, two names that have grown increasingly familiar to local buyers. This marks their ninth collaboration — past projects include Seaside Residences and, more recently, The Orie, both of which saw strong interest.

The Robertson Opus will feature five residential blocks, each nine to 10 storeys high, sitting above a podium level that houses the commercial units. Details for these retail spaces have yet to be announced, though given the abundance of existing amenities in the area, their eventual tenant mix may feel more like a nice-to-have than a core selling point for residents. For now, the nearest option for groceries is UE Square, which houses a CS Fresh.

The site spans roughly 330,060 square feet, with a GPR of 2.8 — a plot ratio that carries particular significance in this part of town (more on that in a bit). Some may also notice that, despite the sizeable land area, the facilities here aren’t as extensive as one might expect. Much of the footprint has been allocated to the courtyard-style layout and commercial podium, with residential facilities tucked beneath the blocks themselves. Visually, the facade may even draw some parallels to Parktown Residence, which adopts a somewhat similar treatment.

As such, the common landscaped areas won’t be the headline attraction here. And given the surrounding developments, unblocked views will be limited as well.

Parking-wise, the development offers around an 80% carpark-to-unit ratio — a fairly healthy figure, especially when you consider its tenant-heavy catchment and proximity to Fort Canning MRT station on the Downtown Line (DTL), but more on the location later.

Unit Mix & Configurations

At The Robertson Opus, the unit mix spans from compact suites to 4-bedroom premium units. Here’s a quick breakdown:

| Unit Type | Typical Size (sq ft) | Total Units | Unit Breakdown |

| Suite | 431 | 40 | 11% |

| 1 Bedroom | 495 | 40 | 11% |

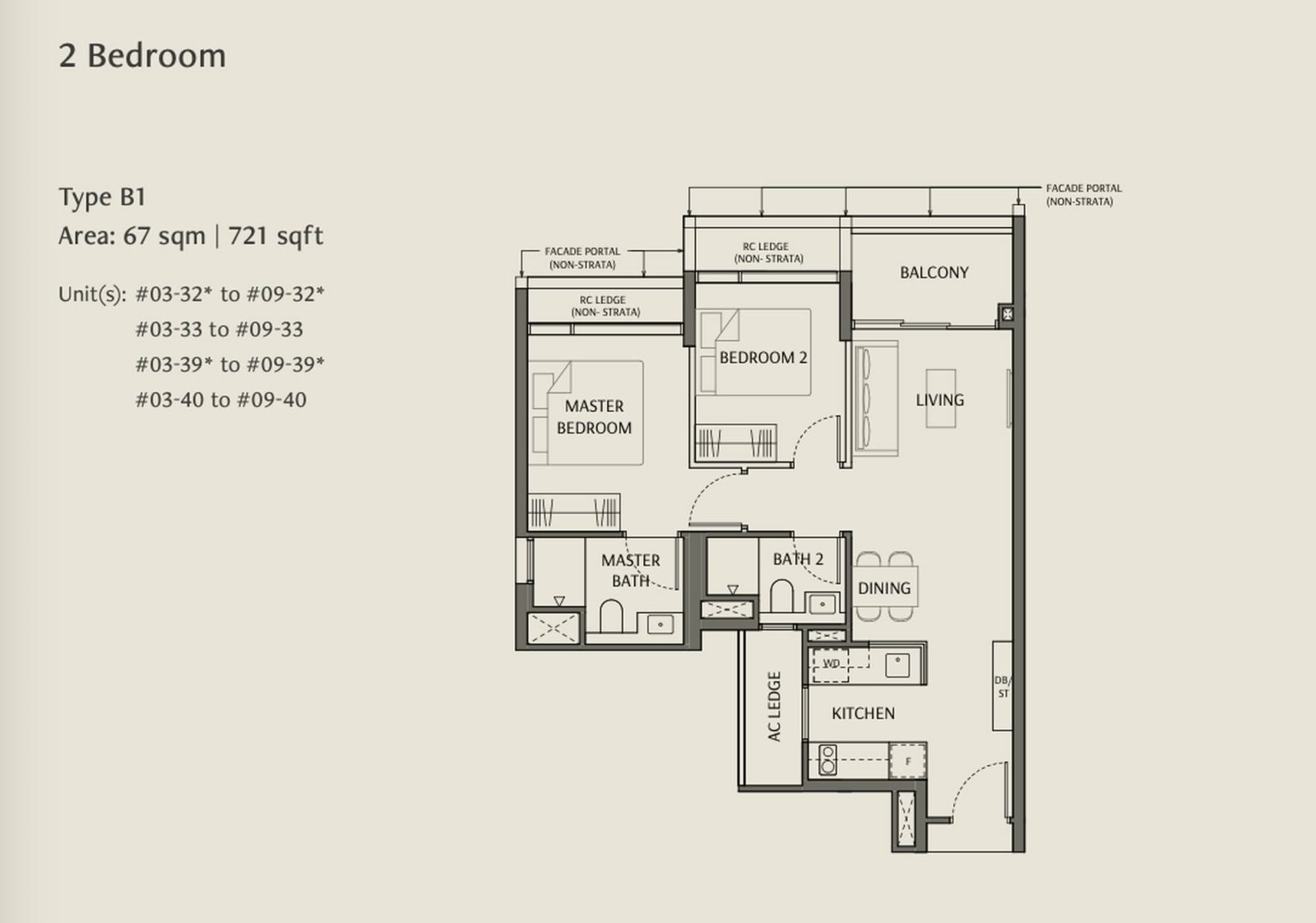

| 2 Bedroom | 689 / 710 / 721 | 118 | 43% |

| 2 Bedroom + Study | 743 | 32 | |

| 3 Bedroom + Flexi | 926 / 980 / 1,012 / 1,023 / 1,044 | 45 | 32% |

| 3 Bedroom DuoFlex | 990 / 1,023 | 37 | |

| 3 Bedroom Premium | 1,152 | 27 | |

| 4 Bedroom Premium | 1,539 | 9 | 3% |

| 348 | |||

At first glance, the configuration here leans quite heavily towards smaller units, with nearly two-thirds of the project made up of suites, one- and two-bedders. This sits somewhat at odds with past buyer trends in the Robertson Quay area, though much of that depends on which period of the market you’re looking at.

Take The Avenir, for instance. Its larger 4-bedders were among the most popular configurations, supported in part by favourable buying conditions at the time. Back then, ABSD rates for foreigners stood at 30 per cent, attracting a good mix of both Singaporean and foreign buyers seeking spacious, owner-occupier homes.

CanningHill Piers, on the other hand, saw broad-based demand across unit types, with 77 per cent sold on launch day in November 2021, including its penthouse. Launched at a point when new supply was limited during the COVID period, the project drew strong interest, with Singaporeans making up 71% of its buyer profile.

More recently, Union Square Residences saw a more muted reception, with around 33 per cent of units sold to date. Take-up here has leaned heavily towards the smaller 2-bedders, which offered a more palatable quantum starting from around $1.9M.

The rising prices at projects like Chuan Park and The Orie may have made the pricing at Union Square Residences feel comparatively more palatable, nudging some buyers to give this project a closer look. Notably, no 3-bedroom units at Union Square Residences have transacted to date, reflecting softer demand for larger layouts at higher absolute price points.

Against this backdrop, Robertson Opus’ unit mix seems to be positioning itself for today’s more price-sensitive environment, where smaller formats may resonate better with younger families or singles who still want to live in the Robertson Quay precinct, but remain conscious of overall budget.

The inclusion of 431 sq. ft. suites (effectively studios) is particularly interesting. It’s been some time since a new launch (aside from The Collective at One Sophia) has offered a suite-type format in today’s market. From what we gather on the ground, these were likely introduced to provide a lower entry quantum for buyers priced out of larger unit types but still keen to live in the neighbourhood.

At the same time, there appears to be a growing acceptance among smaller families towards making two-bedders work as long-term homes. In that sense, having four different permutations for the 2-bedroom layouts feels like a calculated move to tap into this shifting demographic.

Layout-wise, several of these 2-bedders are fairly efficient, with enclosable, naturally ventilated kitchens. It’s also worth noting that the project isn’t GFA harmonised, which means that AC ledges are included in the total unit size. As a basis of comparison, the other upcoming launches close by are under the new harmonisation guidelines, so buyers should keep this in mind.

Another interesting inclusion here is the 3-Bedroom DuoFlex units, which effectively function as compact dual-key layouts. While such configurations haven’t seen particularly strong uptake in past projects (Nava Grove, for instance, recently reconfigured its dual-key units into 4-bedders), the developers may be positioning these for Robertson Quay’s more tenant-driven demand, where flexibility can be attractive for owner-investors.

Overall, the unit mix here introduces several niche configurations, which may appeal to a narrower segment of buyers.

A Lifestyle-Led Neighbourhood, with Fewer Traditional Condo Frills

For a project situated in a lifestyle-centric enclave, the relatively pared-back condo amenities at Robertson Opus may be something for buyers to weigh. Here, the design leans more towards polished landscaping rather than expansive common spaces for residents to gather or unwind. The courtyard-style layout also naturally limits the amount of open communal space available.

That said, there are still thoughtfully landscaped pockets throughout the development, along with the usual staples: a gym, a 45-metre lap pool, a wellness pool, and sky gardens atop each residential block. However, buyers shouldn’t expect a full suite of lifestyle amenities. There’s no tennis court, nor the more expansive facilities seen in larger developments.

The integrated retail component remains a potential plus, though as mentioned earlier, the tenant mix has yet to be confirmed. That said, given the surrounding neighbourhood, with amenities like yoga studios, wellness centres, and several commercial gyms already within close proximity, many residents may prefer to rely on external lifestyle options instead.

At present, Robertson Opus is scheduled for completion in 2030.

The Location of The Robertson Opus

The main ingress to Robertson Opus is located along Unity Street, an area historically known for its bars and nightlife. To access the development by car, drivers will need to turn in via Mohamed Sultan Road, while nearby Merbau Road serves as a small roundabout for local traffic.

More from Stacked

Bullion Park Review: ‘Ulu’ With Unblocked Views And Feature Packed

‘It’s in the middle of nowhere!’

For context, here’s a look at Robertson Walk prior to its closure – once a popular destination for casual drinks, anchored by crowd favourites like Wine Connection. The area remains fairly dense, so buyers hoping for unblocked views of the Singapore River may find this particular site slightly less appealing in that regard.

That said, the development still enjoys proximity to the Singapore River lifestyle zone, a highly sought-after stretch filled with cafes, alfresco dining options, and fitness studios along the promenade. For daily groceries, CS Fresh at UE Square would likely serve most residents’ needs, though those open to a slightly longer walk can also head to the FairPrice outlet at Clarke Quay.

Connectivity remains one of Robertson Opus’ stronger suits. Fort Canning MRT Station (Downtown Line) is just a short walk away, with much of the pathway sheltered, offering convenient access to the CBD and surrounding city fringe areas.

Given its location and lifestyle offering, Robertson Quay has long been popular with expatriates working in Singapore, contributing to its reputation as one of the more foreigner-friendly residential zones in the city.

For families, the project is also within the coveted 1-kilometre radius of River Valley Primary School, while SMU is located nearby, adding to its appeal for households prioritising school accessibility.

Upcoming Supply in the Neighbourhood

Robertson Opus won’t be the only new addition to the area. Several nearby sites are in the pipeline, many of which are expected to launch in the second half of 2025, contributing to what’s shaping up to be a fairly busy year for CCR launches.

Here’s a quick snapshot of the upcoming sites nearby:

| Land Parcel | Tenure | Number of Bids | Winning Tenderer | Winning Bid ($PSF PPR) |

| River Valley Green (Parcel B) | 99-year | 5 | GuocoLand | $1,420 |

| River Valley Green (Parcel A) | 99-year | 2 | Wing Tai Holdings | $1,325 |

| Zion Road (Parcel A) | 99-year | 1 | CDL & Mitsui Fudosan | $1,202 |

| Zion Road (Parcel B) | 99-year | 2 | Allgreen Properties | $1,304 |

For additional context, nearby launches in recent years include Union Square Residences, Irwell Hill Residences, and CanningHill Piers.

Irwell Hill Residences was acquired at $1,515 psf ppr back in January 2020, drawing a stronger field of seven bids. CanningHill Piers, just across the river, sits on a prime riverfront site purchased at $1,400 psf ppr. Many of the newer sites are transacting below, or on par with, earlier land bids, which is surprising given they fall under the new harmonisation rules that typically lower buildable GFA and, in theory, should reduce land costs.

Robertson Opus, being a pre-harmonisation site, sits slightly apart from this discussion. The land was already held by Frasers Property, and hence, no data is available for direct comparison. This is also the case for Union Square Residences.

What’s also worth noting is the plot ratio difference: both Zion Road parcels carry a plot ratio of 5.6, compared to Robertson Opus’ 2.8.

In simple terms, the Zion sites will be able to accommodate significantly higher towers and denser unit counts. This usually translates into wider $PSF price bands between lower and higher floor units, much like what we’ve seen at projects such as The Orie or ELTA, and could result in a steeper pricing gradient across floor levels. By contrast, the lower-density configuration at Robertson Opus may lend itself to a more moderate $PSF gap across its stacks.

Even so, the $PSF PPR benchmarks for these upcoming sites offer some early clues as to how Robertson Opus might eventually position itself on pricing, particularly as it navigates what will soon become a more crowded market segment.

In that sense, while the influx of supply may intensify competition, Robertson Opus occupies a slightly differentiated position. Its 999-year tenure naturally sets it apart from the new 99-year projects around it.

For now, indicative pricing is still unreleased

As of now, indicative pricing for Robertson Opus has yet to be officially released, though this is a number that many CCR buyers will be watching closely, particularly given its potential to anchor pricing expectations for upcoming launches in the area.

From what we’re hearing on the ground, initial indications suggest a potential launch range starting from around $2,900 psf, possibly trending towards the $3,200 psf mark. Where it eventually lands will likely influence how buyers weigh its value proposition against both recent launches and the upcoming supply pipeline.

With that in mind, let’s have a look at the take-up of the recent Union Square Residences:

| Contractdate | Address | Type ofsale | Unit area(sqft) | Price(S$ psf) | Price(S$) |

| 3 Jun 2025 | 28 Havelock Road #37-XX | New Sale | 1,518 | 3,458 | 5,249,000 |

| 4 May 2025 | 28 Havelock Road #22-XX | New Sale | 721 | 3,188 | 2,299,000 |

| 7 Apr 2025 | 28 Havelock Road #31-XX | New Sale | 1,066 | 3,375 | 3,596,000 |

| 28 Mar 2025 | 28 Havelock Road #30-XX | New Sale | 1,066 | 3,363 | 3,584,000 |

| 16 Mar 2025 | 28 Havelock Road #37-XX | New Sale | 732 | 3,457 | 2,530,000 |

| 15 Mar 2025 | 28 Havelock Road #07-XX | New Sale | 721 | 2,980 | 2,149,000 |

| 9 Mar 2025 | 28 Havelock Road #05-XX | New Sale | 700 | 2,903 | 2,031,000 |

| 3 Mar 2025 | 28 Havelock Road #07-XX | New Sale | 700 | 2,926 | 2,047,000 |

| 28 Feb 2025 | 28 Havelock Road #14-XX | New Sale | 1,066 | 3,111 | 3,315,000 |

| 19 Feb 2025 | 28 Havelock Road #19-XX | New Sale | 721 | 3,155 | 2,275,000 |

| 8 Feb 2025 | 28 Havelock Road #17-XX | New Sale | 743 | 3,120 | 2,317,000 |

| 6 Feb 2025 | 28 Havelock Road #39-XX | New Sale | 732 | 3,478 | 2,546,000 |

| 28 Jan 2025 | 28 Havelock Road #16-XX | New Sale | 506 | 3,224 | 1,631,000 |

| 27 Jan 2025 | 28 Havelock Road #15-XX | New Sale | 743 | 3,095 | 2,299,000 |

| 27 Jan 2025 | 28 Havelock Road #34-XX | New Sale | 732 | 3,388 | 2,480,000 |

As previously mentioned, Union Square Residences, a pre-harmonisation project, has seen relatively muted take-up so far, with roughly 33 per cent sold to date. Most demand has clustered around the smaller 2-bedders, where absolute quantum pricing remains more accessible (some units transacting at around $1.9M to $2.3M). Larger 3-bedders have yet to see meaningful uptake. Some of the price momentum here was likely driven by rising prices at projects like Chuan Park and The Orie, which have edged buyers into the smaller units. On a psf basis, Union Square Residences units have been transacting between $2,900 and $3,400 psf.

On the other hand, here’s a look at how Irwell Hill Residences have performed in the resale market. This project was completed in 2024, so some of the units have already undergone a sub-sale transaction:

| Contractdate | Address | Type ofsale | Unit area(sqft) | Price(S$ psf) | Price(S$) |

| 4 Jun 2025 | 6 Irwell Hill #36-XX | New Sale | 2,228 | 2,491 | 5,550,000 |

| 16 May 2025 | 2 Irwell Hill #18-XX | Sub Sale | 667 | 3,072 | 2,050,000 |

| 14 May 2025 | 2 Irwell Hill #33-XX | Sub Sale | 667 | 3,341 | 2,230,000 |

| 28 Apr 2025 | 6 Irwell Hill #06-XX | Sub Sale | 614 | 2,510 | 1,540,000 |

| 11 Apr 2025 | 6 Irwell Hill #07-XX | Sub Sale | 667 | 2,896 | 1,933,000 |

| 28 Mar 2025 | 6 Irwell Hill #18-XX | Sub Sale | 678 | 3,023 | 2,050,000 |

| 26 Mar 2025 | 2 Irwell Hill #04-XX | Sub Sale | 452 | 2,787 | 1,260,000 |

| 14 Mar 2025 | 2 Irwell Hill #19-XX | Sub Sale | 495 | 2,989 | 1,480,000 |

| 11 Mar 2025 | 6 Irwell Hill #02-XX | Sub Sale | 603 | 2,804 | 1,690,000 |

| 10 Mar 2025 | 6 Irwell Hill #03-XX | Sub Sale | 657 | 2,833 | 1,860,000 |

| 5 Mar 2025 | 2 Irwell Hill #20-XX | Sub Sale | 624 | 2,953 | 1,843,888 |

| 21 Jan 2025 | 6 Irwell Hill #15-XX | Sub Sale | 678 | 2,802 | 1,900,000 |

| 20 Jan 2025 | 2 Irwell Hill #13-XX | Sub Sale | 667 | 3,027 | 2,020,000 |

Now entering the resale and subsale market, Irwell Hill Residences has seen recent subsale transactions for its smaller units hovering between $2,800 and $3,300 psf, with a handful of higher-floor units pushing above $3,400 psf. Larger units have changed hands at around $2,400–$2,500 psf.

As for the condos in the area, here’s how UE Square has been transacting this year.

| Contractdate | Address | Unit area(sqft) | Price(S$ psf) | Price(S$) |

| 4 Jun 2025 | 205 River Valley Road #03-XX | 1,722 | 2,206 | 3,800,000 |

| 29 May 2025 | 205 River Valley Road #12-XX | 1,561 | 2,217 | 3,460,000 |

| 16 Apr 2025 | 205 River Valley Road #12-XX | 797 | 2,157 | 1,718,000 |

| 20 Mar 2025 | 207 River Valley Road #06-XX | 1,152 | 2,108 | 2,428,000 |

| 17 Jan 2025 | 207 River Valley Road #04-XX | 1,292 | 2,090 | 2,700,000 |

| 15 Jan 2025 | 207 River Valley Road #04-XX | 1,163 | 1,966 | 2,285,000 |

| 9 Jan 2025 | 207 River Valley Road #02-XX | 1,227 | 1,964 | 2,410,000 |

| 2 Jan 2025 | 207 River Valley Road #12-XX | 797 | 2,071 | 1,650,000 |

As one of the few direct tenure comparables for Robertson Opus, recent transactions at UE Square have ranged from $1,960 to $2,200 psf, depending on unit size and floor level, reflecting its older age but strong location fundamentals.

With these benchmarks in mind, Robertson Opus (as a new launch with a 999-year tenure) will likely be positioned at a premium relative to the predominantly 99-year leasehold competition. The question, as always, is how much premium the market is willing to pay for tenure in today’s climate. While $2,900 psf could still be seen as relatively attractive for a new 999-year project in this location, anything north of $3,200 psf may start to feel more in line with current CCR new launch pricing.

Adding to this complexity is the ongoing harmonisation transition. Robertson Opus is a pre-harmonisation site, while most of the upcoming GLS sites in the area (including the River Valley Green and Zion Road parcels) will be developed under the newer harmonised rules. Theoretically, harmonisation should have reduced buildable area (and land cost), but as we’ve seen, many of the recent GLS tenders have still closed at relatively strong land bids.

In this context, Robertson Opus will likely appeal to a very specific buyer profile: one who values tenure and location, but who also recognises that this isn’t a pure investment play. With fewer facilities and limited views, its value proposition leans more toward long-term ownership within the Robertson Quay lifestyle enclave.

The finishes appear promising, the layouts are practical, and the colour palette is kept deliberately understated. Much will ultimately depend on how sensitively pricing is pitched at launch.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Cheryl

Cheryl has been writing about international property investments for the past two years since she has graduated from NUS with a bachelors in Real Estate. As an avid investor herself, she mainly invests in cryptocurrency and stocks, with goals to include real estate, virtual and physical, into her portfolio in the future. Her aim as a writer at Stacked is to guide readers when it comes to real estate investments through her insights.Read next from New Launch Condo Reviews

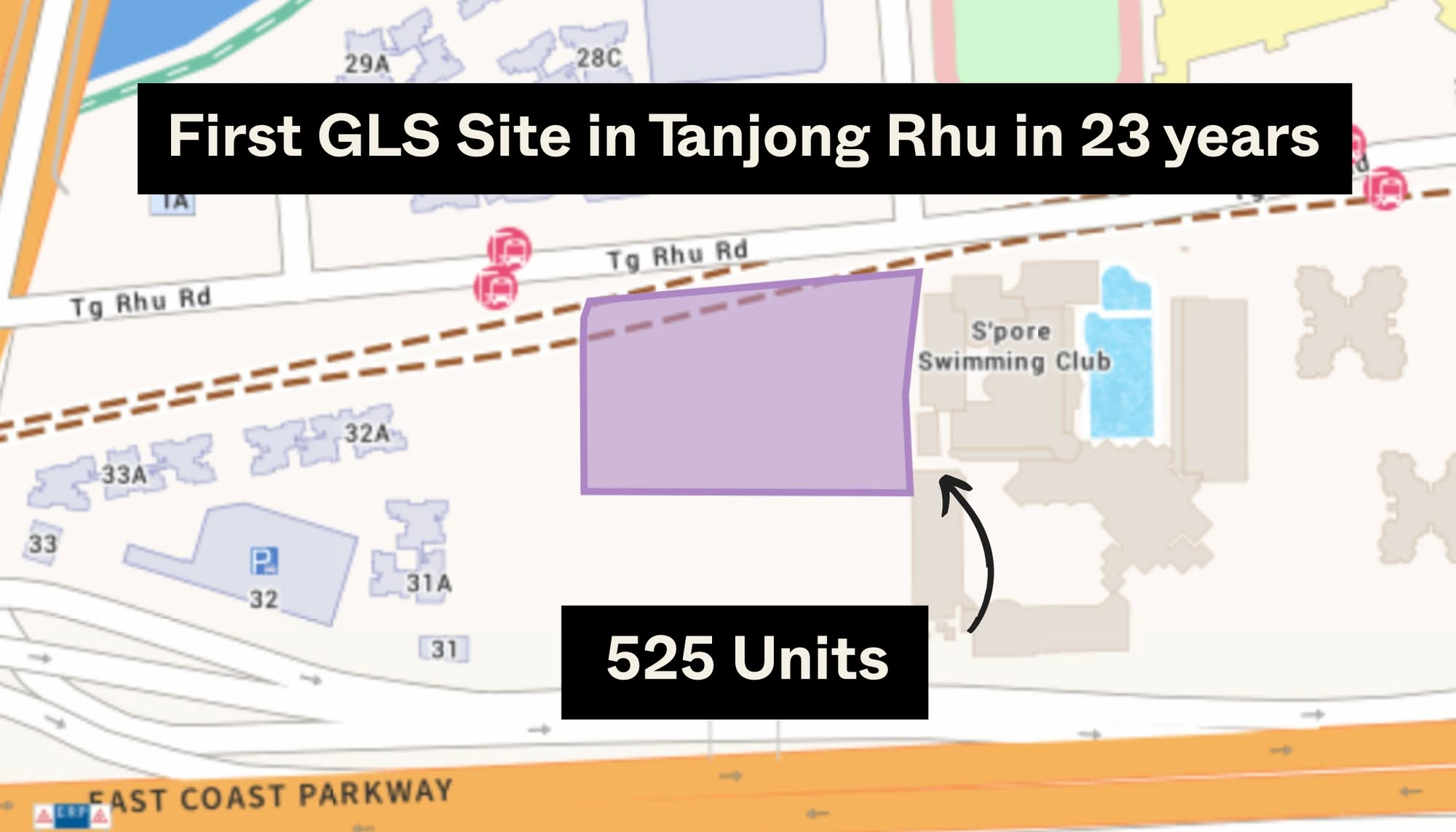

New Launch Condo Reviews Arina East Residences Review: First Condo Launch in Tanjong Rhu in 13 Years, Near MRT Station

New Launch Condo Reviews Bloomsbury Residences Review: Unblocked Views With 2-Bedders From $1.366m In One-North

Editor's Pick Aurea Condo Review: A Luxury Redevelopment Of Golden Mile Complex Priced From $1.92m

Editor's Pick ELTA Condo Review: First New Launch In 4 Years In Clementi Priced From $1.16m

Latest Posts

On The Market 5 Cheapest Newly MOP 5 Room HDB Flats From $700k

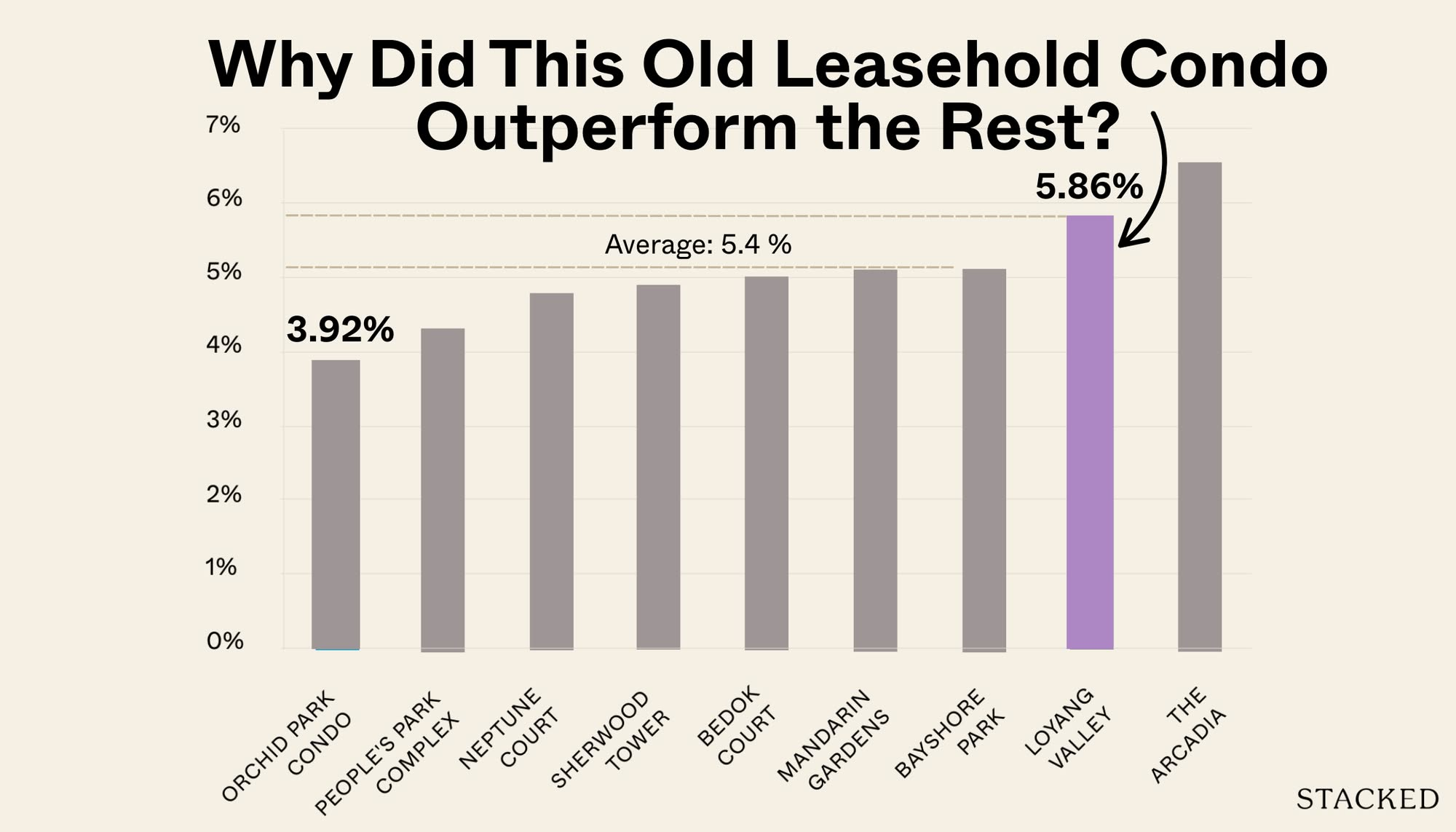

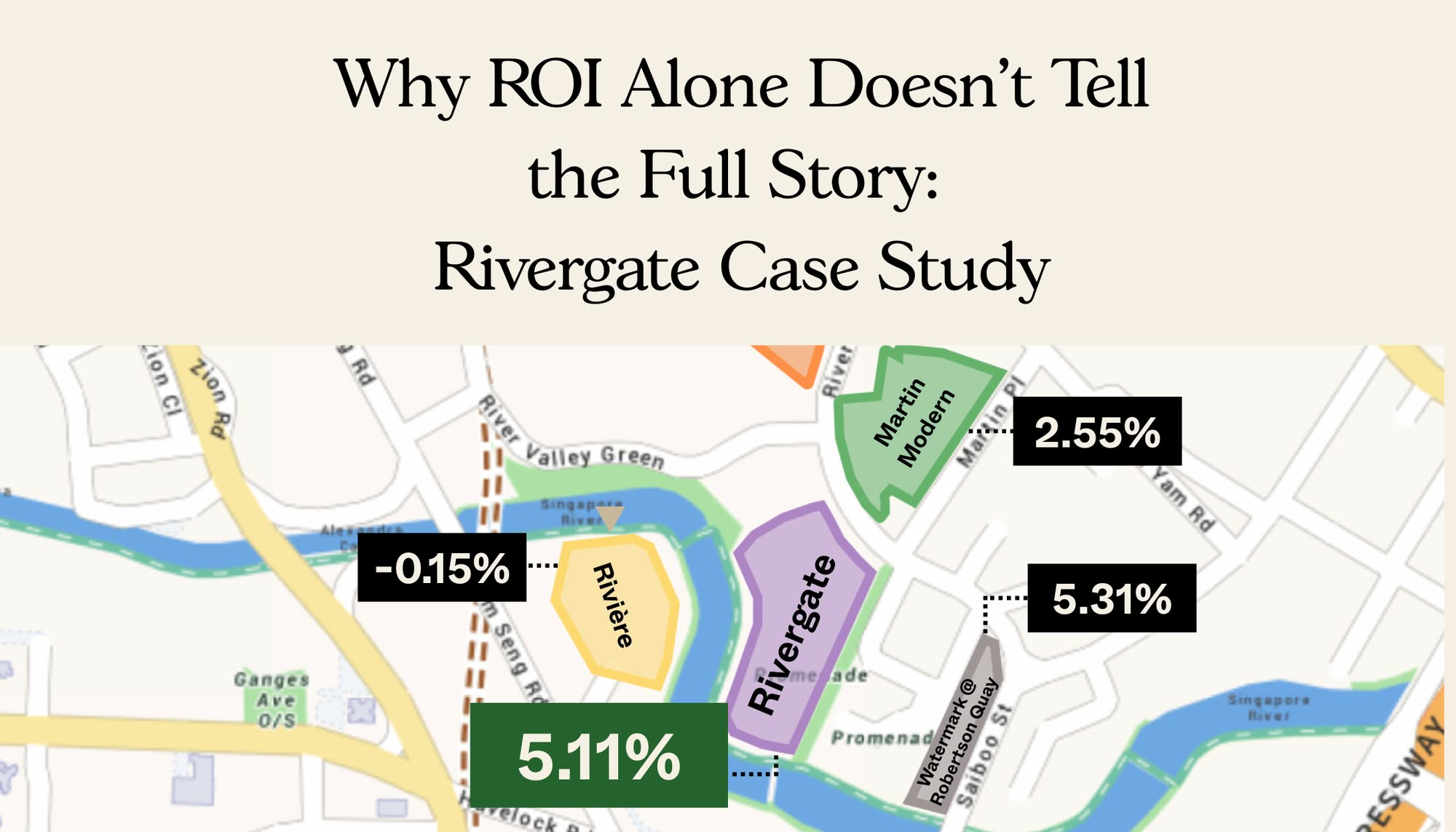

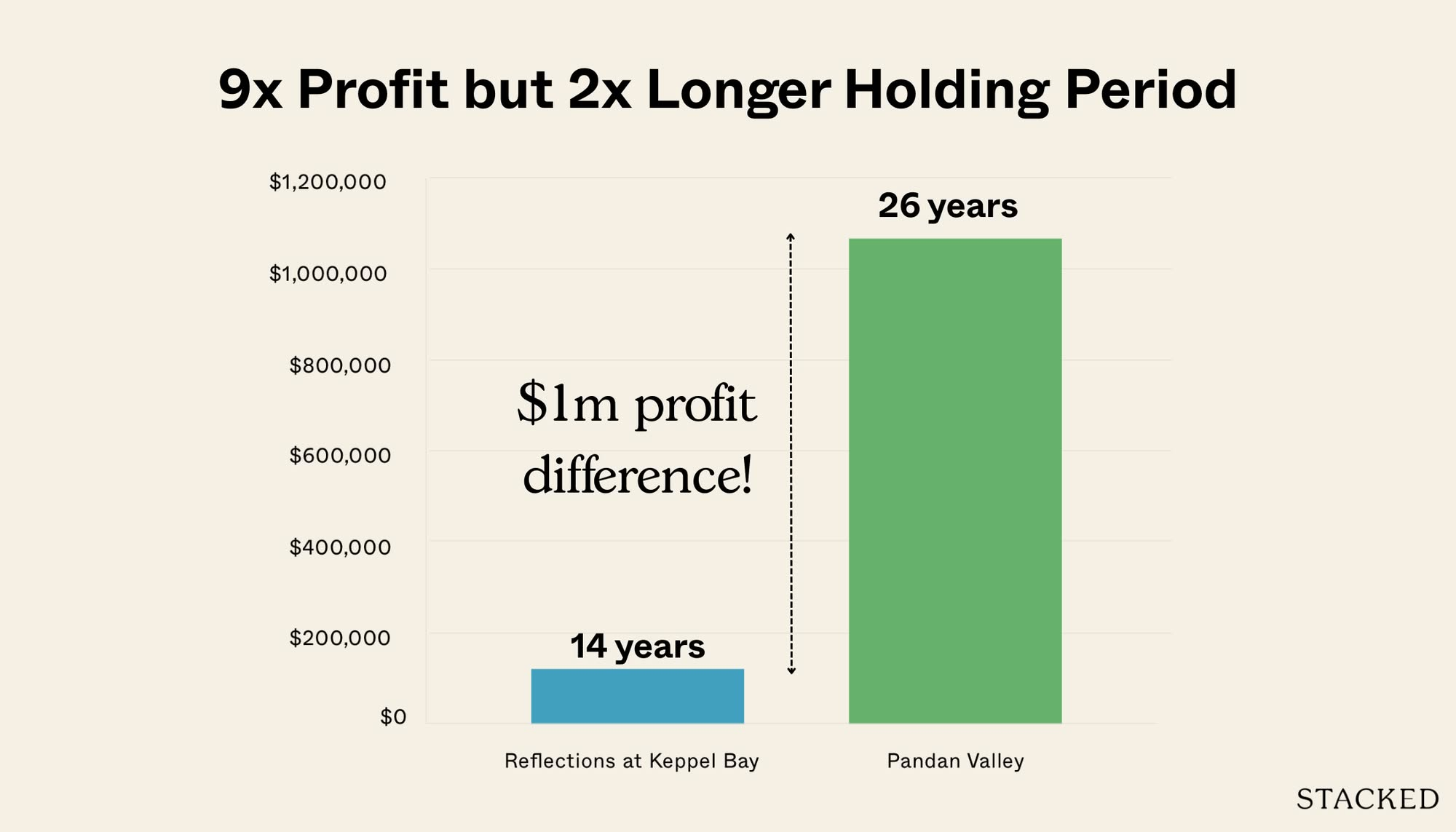

Pro Why Rivergate Outperformed Its District 9 Rivals—Despite Being Nearly 20 Years Old

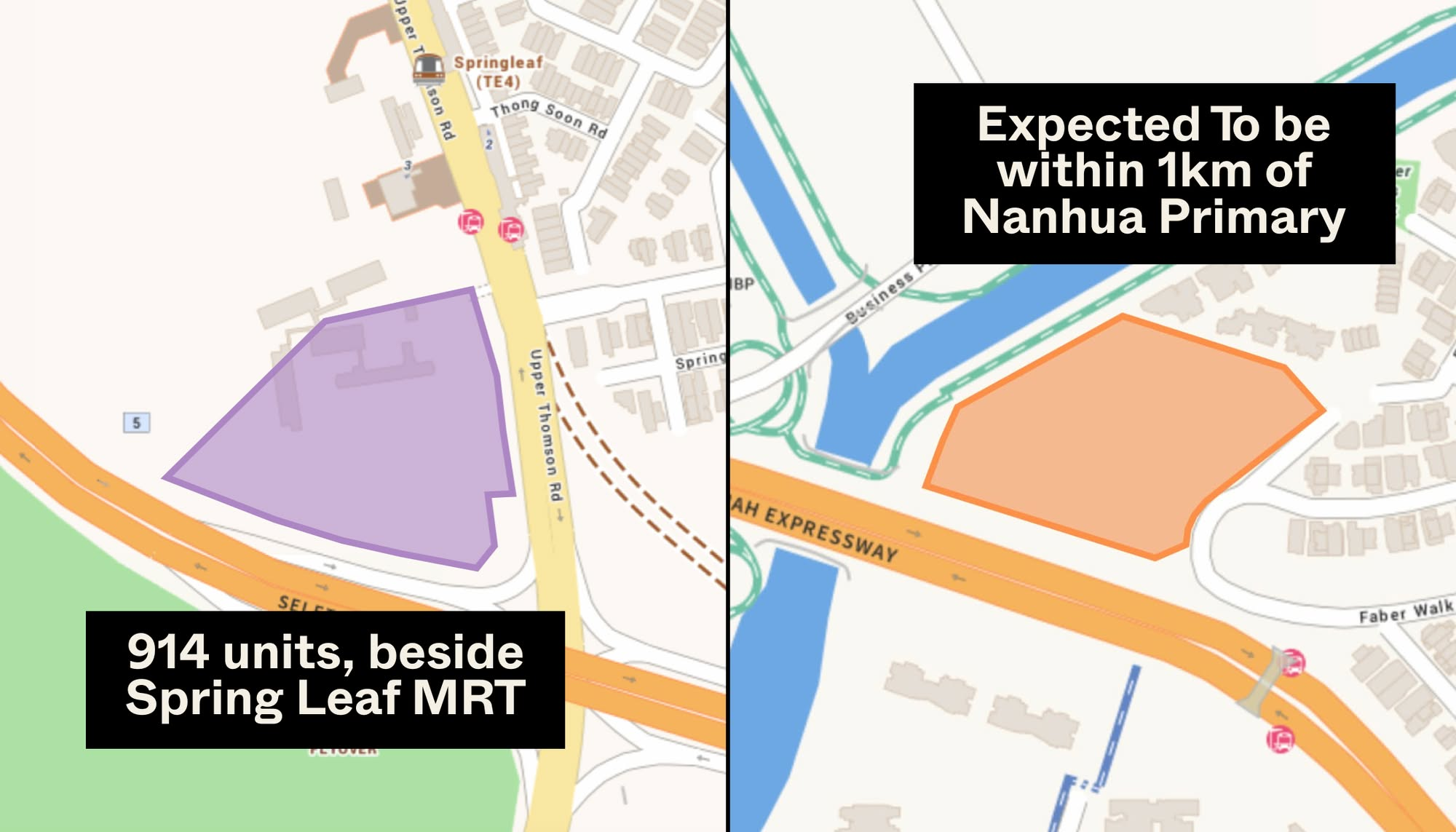

On The Market Springleaf Vs Faber Walk: Which Future GLS Residential Site Has More Potential?

Property Market Commentary I Reviewed HDB’s 2 And 3-Room Show Flats: Ideal For First-Time Buyers Or Too Small To Live In?

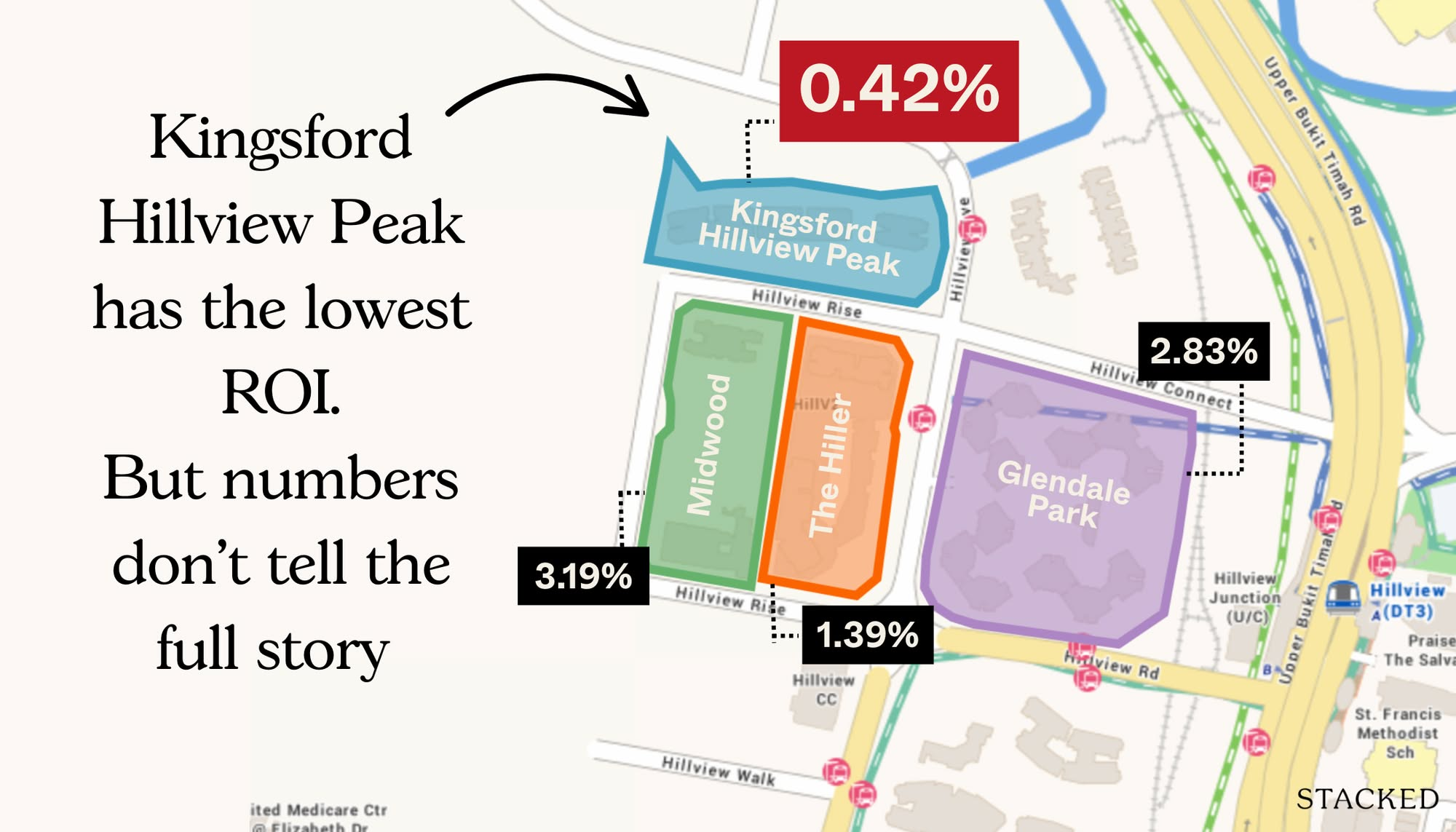

Editor's Pick Why Kingsford Hillview Peak Underperformed—Despite Its MRT Location And “Good” Entry Price

Editor's Pick Buying Property In Malaysia As A Singaporean: 6 Key Restrictions To Be Aware Of

Editor's Pick Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Singapore Property News 9,800 New Homes Across 11 GLS Sites In 2H 2025: What To Know About Tanjong Rhu, Dover, And Bedok

Singapore Property News Why HDB Needs To Build More 4 Bedroom Flats

Homeowner Stories “If We Sell, We’ll Never Have A Home This Big Again”: What Singaporean Parents Do After The Kids Move Out

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Investment Insights Singapore Property Data Is Transparent: But Here’s Why It Can Still Mislead You

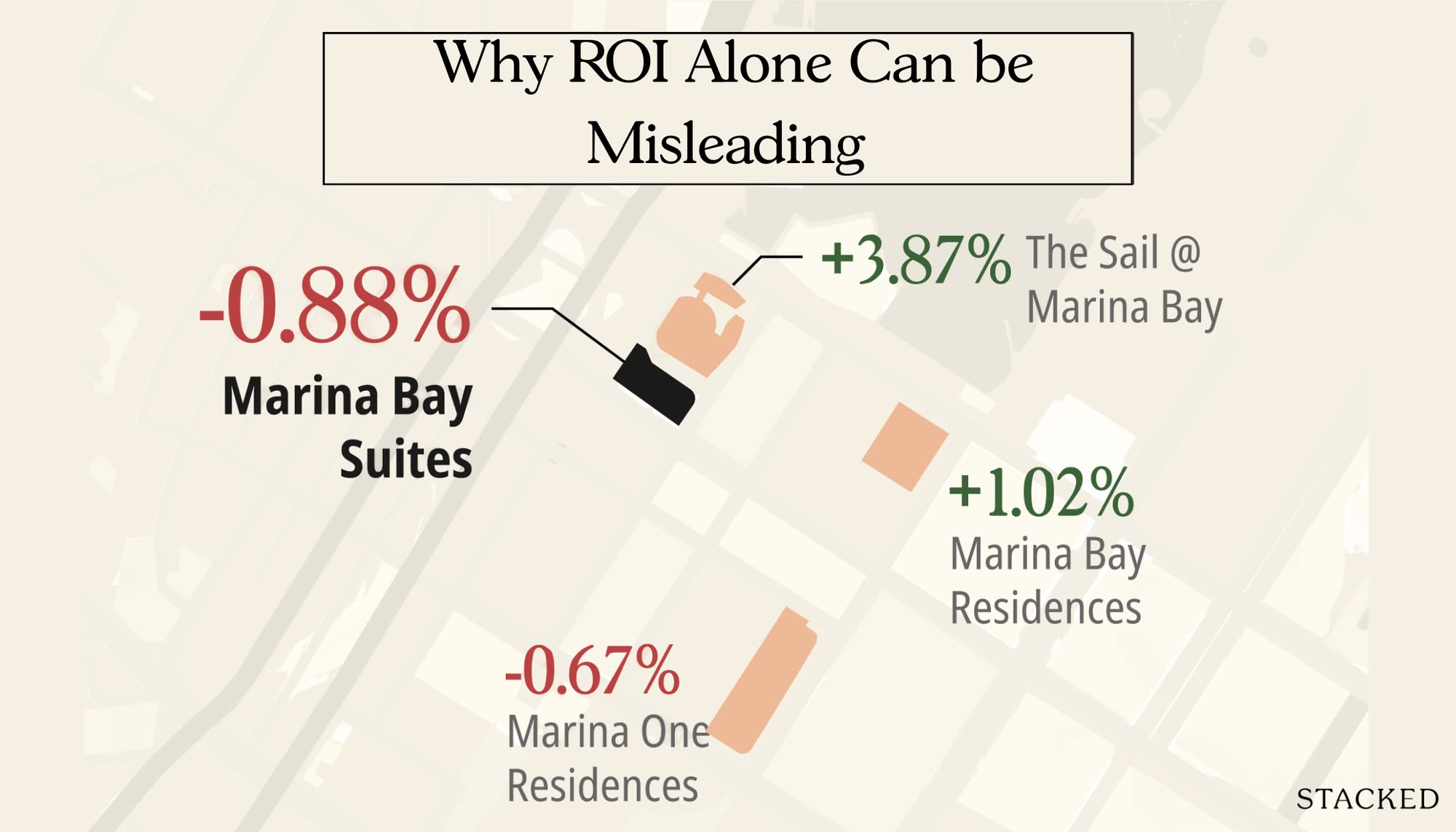

Editor's Pick Why Marina Bay Suites May Look Like a Poor Performer—But Its 4-Bedroom Units Tell a Different Story

On The Market 5 Cheapest Convenient 1-Bedders Near Integrated Developments From $800k

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore