How To Pick The Right-sized Rental Unit For Renting Out

May 18, 2020

When you first bought your rental unit, it was all so simple: it’s a few hundred metres from the MRT, in a central location, and working expatriates would be lining up to rent. But then reality sinks in:

You’re losing money even when there’s no vacancies. Or you’re fetching far less, after costs, than a unit 200 square feet bigger than yours. Or maybe you thought you’d get working expatriates, but all of them complain it’s cramped, and all you’re getting are transient student tenants.

Why?

Well barring other fundamentals like location and amenities, it comes down to size; a much-overlooked factor among newer landlords. In this article, Stacked gives you a more in-depth consideration of unit size when renting out:

Key considerations in picking the right size rental unit:

- Look at the lay-out, not just the square footage

- Know your tenant demographic

- Bear in mind the overall cost to the tenant

- Rental yield doesn’t mean rentability

1. Look at the lay-out, not just the square footage

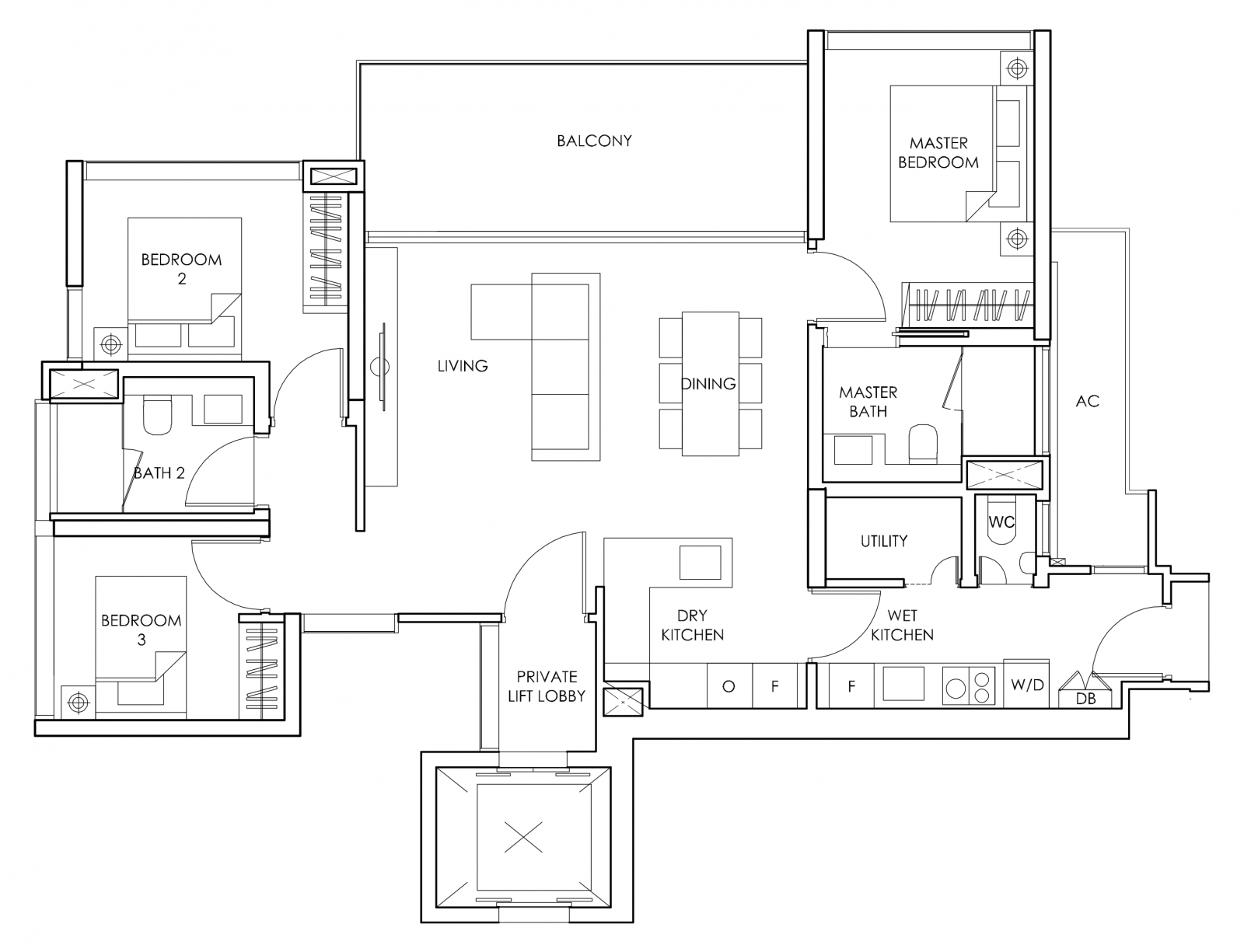

Recently, we did an in-depth review of Sloane Residences, which is a very small, boutique development in Balmoral. We mentioned that on paper, 1,249 sqft is kind of small for what’s meant to be a luxury, three-bedroom apartment.

However, it still manages to feel spacious because of a dumbbell layout; that is, the bedrooms are on two separate sides of the unit, with the living room connecting them. This is more space efficient than older designs, as it eliminates the need for long corridors (corridor space is wasted space, as it could be given to a functional room).

The same goes for Meyer Mansion; some of its three-bedroom units are just 1,109 sq.ft., but the dumbbell layout makes it feel more open, and creates more functional space.

Other aspects to watch for are good squarish shapes (odd shaped corners tend to be inefficient), and the availability of vertical space.

For example, consider Parkwood Residences (one of the smallest developments to date with only 18 units by the way). The units are designed with exceptional high floor-to-ceiling spans, which allows for modifications like a sub-level for storage. These units can be more spacious than the square footage indicates, as tenants can stash their belongings “up top”.

So when picking a unit, don’t just look at the number of square feet. It’s possible that a smaller unit, through efficient use of space, can still be a better buy than a larger, poorly laid-out unit.

With resale properties you can easily check for these qualities. With new units however, you’ll need to know a bit about reading the floor plan, and how to evaluate the space based on the show flat. We’ve covered that in this earlier article.

2. Know your tenant demographic

Different tenants have different spatial needs.

For example, student tenants tend to be harder to “upsell” when it comes to space. Between a 500 sq.ft. one-bedder, and a 550 sq.ft. counterpart, students may not be interested in paying significantly more for that extra 50 sq.ft. of space. This leads some student landlords to opt for the smallest unit, if they’re going to buy a one-bedder.

But your main demographic is families, a minimum size is needed to attract them (often something in the 1,400+ sq.ft. range). Unlike students, you’ll often find that families can be persuaded to pay more for a larger unit than they initially wanted.

Conversely, it’s much harder to persuade families to take a unit they think is too small, even if it’s much cheaper.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

PLH Model HDB Flats VS Other “Prime” Resale Flats: How Do They Stack Up?

The first PLH model flats, River Peaks I & II, are part of the November BTO launch. It’s crunch time…

So the better you understand your tenant demographic, the more accurately you can put a value on unit size. If you’re a new investor, do have a conversation with your renting agent before you buy. You can also reach out to us on Facebook if you have any questions.

3. Bear in mind the overall cost to the tenant

New landlords tend to obsess over the price per square foot when renting. In this process, they often forget that many tenants consider it less important than the overall cost.

You should also consider the advantages of a unit large enough for at least one roommate. Let’s go back again to the previous example: $3,000 for the 1,200 sq.ft. unit may be too much for one tenant; but if they rent with a roommate and split it between them, that’s $1,500 each.

That may be an even better option than renting the one-bedder for $1,750.

All of this relates to our previous point: know your tenant demographic. If you understand their budget, you can better pick a unit size that will accommodate them. How much you can charge per square foot is a follow-up concern.

Rental MarketRental Yield Singapore: Top 10 condos with the highest rental yield

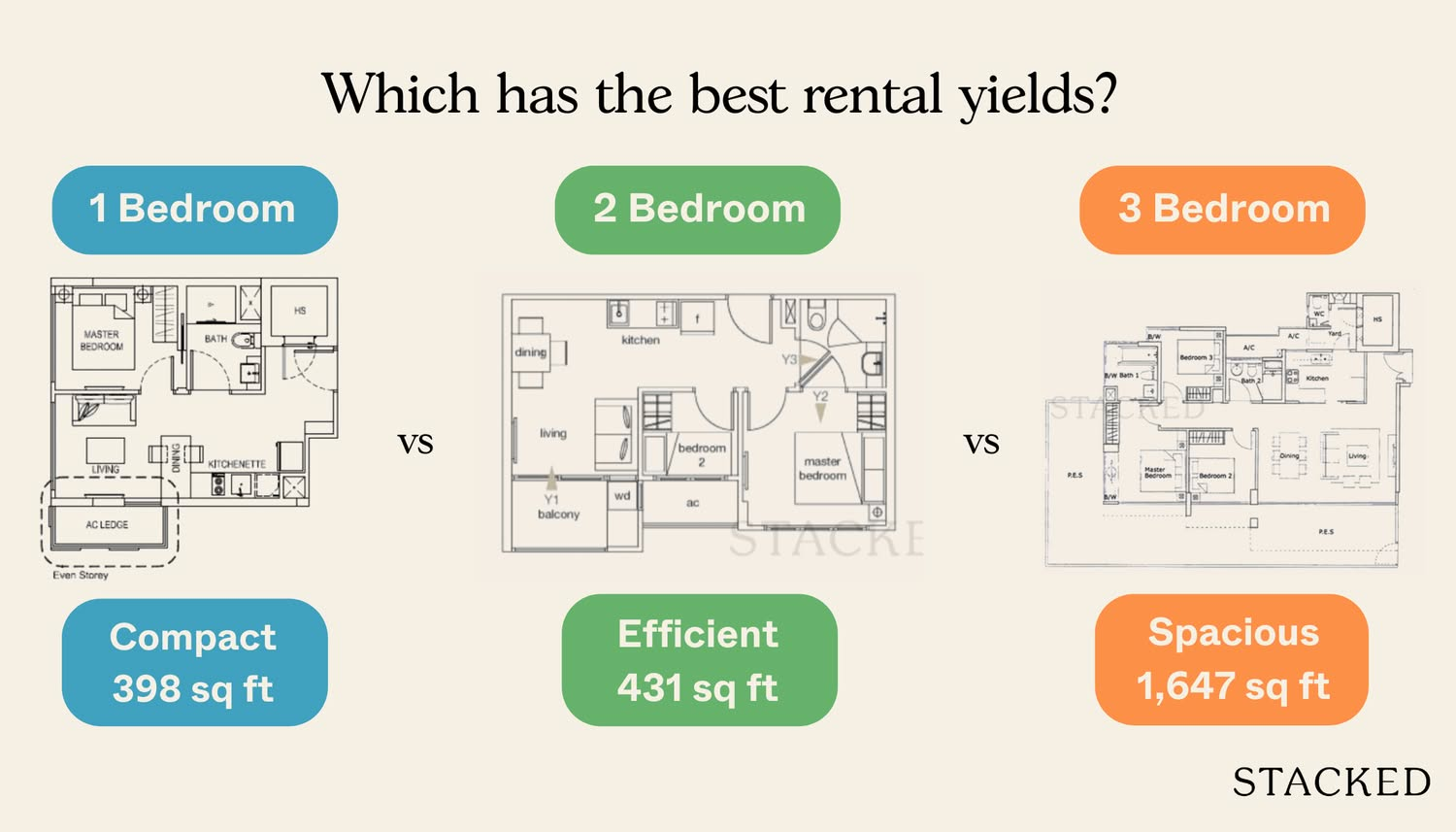

by Stanley Goh4. Rental yield doesn’t mean rentability

Rentability refers to how easily you can attract a tenant, while rental yield is the ratio of your rental income to the overall cost of the property.

There can actually be an inverse relation between the two, such as for some large luxury properties. There may be sky high demand to rent your unit at Marina One Residences – but if your unit costs over $2.5 million (typical for a two-bedder here), then even a rental income of $4,500 a month will give you a yield that’s barely two per cent.

All of this impacts the unit size you should choose, as the larger the unit, the higher the cost (and the lower your yields). Conversely, choosing a unit that’s too small – although it might give you higher yields – might affect rentability.

For example, choosing a 500 sq.ft. one-bedder means you’ve ruled out the possibility of families as tenants; and you may also be losing a large number of long-term stayers (size is more of an issue for tenants who are looking at longer stays, such as five years).

So aim for a good rental yield, but avoid buying a unit so tiny that you end up unable to rent it easily (no tenant = no rental yield either). Again, it helps to know your tenant demographic.

Most landlords, if unable to make a decision, will fall back on the two-bedder

This is because most property agents recommend two-bedders as a rental unit; it’s generic advice. These units tend to be on the lower end in terms of quantum (overall cost); but big enough to cater to the widest range of tenants: everything from young couples awaiting their condo / HDB completion, to students who can split costs with a roommate.

Beyond size, it’s a matter of location and amenities. For those other vital details, you can find the most in-depth reviews of different condos at Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What should I consider besides square footage when choosing a rental unit size?

How does tenant demographic influence the ideal rental unit size?

Why is rental yield not the only factor in choosing a rental unit size?

How can layout and design impact the perceived space in a small rental unit?

What role does overall cost to the tenant play in selecting a rental unit size?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Rental Market

Rental Market Is Singapore’s Rental Market Really Softening? We Break Down The 2024 Numbers By Unit Size

Editor's Pick The Cheapest Condos For Rent In 2024: Where To Find 1/2 Bedders For Rent From $1,700 Per Month

Rental Market Where To Find The Cheapest Landed Homes To Rent In 2024 (From $3,000 Per Month)

Rental Market Where To Find High Rental Yield Condos From 5.3% (In Actual Condos And Not Apartments)

Latest Posts

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Singapore Property News You Can Now Buy Part Of A $300M Singapore Bungalow — But You Can’t Live In It

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

0 Comments