Why Lower Land Prices In Singapore Don’t Mean Cheaper New Condos

May 25, 2025

I hope I’m wrong about my predictions with lower Government Land Sales (GLS) prices.

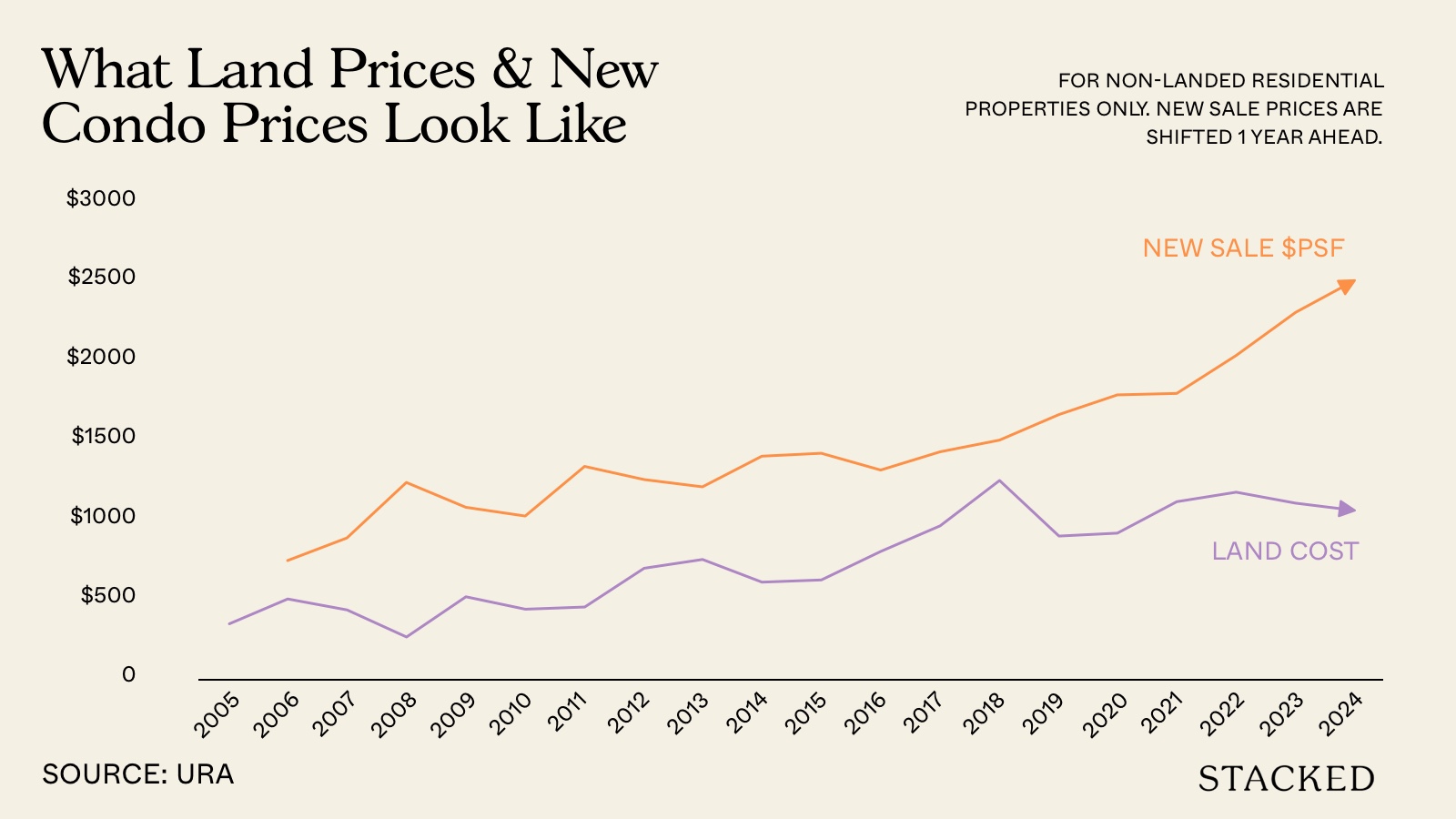

Recently, there’s been a pretty confident statement about Government Land Sales (GLS), and how it could lower some of the costs for developers. One suggestion is that, with land prices being more attractive (read: cheaper), it may help to moderate future new launch prices.

But if I’m a buyer, I wouldn’t celebrate just yet. Put it this way: Have you ever seen restaurants lowering prices because the cost of ingredients went down this year?

To be more direct: developers don’t just price their projects based on land costs. That’s one major factor, yes. But another equally significant-or I might say more significant-factor is what the market can bear. For example, if the current market rate is $2,400+ psf and there are still buyers, then that price point will likely stay. It doesn’t matter if the reserve prices for GLS sites fall.

Because even if the land price drops by 20 per cent, why would a developer now price at $1,920 psf? The developer, especially as a listed company, is more likely to pocket the difference as profit. Otherwise, a bunch of irate shareholders are going to peel strips off the senior management at the next meeting.

Now I’m not saying there’s totally no effect behind lower GLS prices

It does give developers a bit more flexibility. Perhaps one or two developers may offer bigger early-bird discounts or discounts for buying multiple units. They can do this when there’s a little more “wiggle room” if land prices dip.

However, there’s no guarantee that everyone, or even the majority of us, is going to find new launch prices falling. In fact, it’s probably only very select groups of buyers, such as those purchasing premium units or buying in bulk, who may see any real benefits.

I do think some of the more likely benefits are developers being willing to bid for land in new or less tested areas, which opens up new options and first mover advantage possibilities. If the reserve prices fall far enough, developers may now be willing to launch projects that, at earlier prices, seemed too marginal.

Perhaps developers will also channel their savings somewhere besides a direct discount, such as larger layouts or more generous facilities. But still, none of this implies lowering prices. As we saw from the aftermath of COVID and the Global Financial Crisis, real estate values are very hard to bring back down once they’ve risen.

Another piece of property news – falling new home sales in April – also has me feeling sceptical.

Yes, I’m being quite contrarian this week, but not without nuance. I accept that the uncertain economy is definitely making some buyers back off; I’ve seen two or three cases myself.

But what draws my attention are the projects currently being looked at; projects like One Marina Gardens and Bloomsbury Residences. These were April’s headliners, and while these projects are great in their own right, I think the slowdown isn’t just about macroeconomics.

Let’s not forget — fast-selling projects like Parktown Residences and Lentor Central Residences launched after the Trump re-election and during the new wave of trade war threats. And yet, they sold at a blistering pace. That tells me the slowdown is at least as site-specific as it is driven by the wider economy.

More from Stacked

Will Rich Foreigners Still Want Your Prime District Condo In 2022?

As of December 2021, there’s been an ongoing debate on whether Singapore property is still attractive to foreigners. Some believe…

Here’s the thing:

How many of you grew up in One-North? Okay, now, how many grew up in the Marina Bay area? These aren’t areas where most Singaporeans grew up as children, went to school, have long-time friends or family in the area, etc. These areas don’t have “grass roots” appeal, and that matters.

You’ll find many more Singaporeans with that sort of connection to, say, Bedok, Clementi, Jurong East, etc. than to places like Marina Bay (fancy though the latter may be.) And with the gradual pivot to more prime areas, I feel this is one of the bigger reasons we might see slower take-up rates, if they even persist.

This leads me to say: I’ve also heard the opposite on the ground. However slow April was, some agents say they’ve had more inquiries, and transactions are likely to pick up. So, besides my scepticism about the effect of trade wars, we may also see that April wasn’t a great indicator of much.

Meanwhile in other property news…

- Check out the much underrated Jalan Baiduri, a landed enclave where freehold semi-detached units can go for $4.4 million.

- There’s seven new upcoming residential plots near MRT stations; but are they all worth waiting for? We took a closer look.

- Six prime HDB shophouses are up for a cool $73 million. Check out this rare appearance in the market.

- Do integrated developments justify their higher cost? We examined 17 of them to track their performance.

Weekly Sales Roundup (12 May – 18 May)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| TERRA HILL | $5,200,000 | 2142 | $2,428 | FH |

| ONE MARINA GARDENS | $4,961,806 | 1647 | $3,013 | 99 yrs (2023) |

| NAVA GROVE | $3,931,700 | 1550 | $2,537 | 99 yrs (2024) |

| THE ORIE | $3,818,000 | 1453 | $2,627 | 99 yrs (2024) |

| BAGNALL HAUS | $3,807,000 | 1528 | $2,491 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ONE MARINA GARDENS | $1,236,876 | 420 | $2,946 | 99 yrs (2023) |

| PARKTOWN RESIDENCE | $1,268,000 | 506 | $2,506 | 99 yrs (2023) |

| NOVO PLACE | $1,357,000 | 872 | $1,556 | 99 yrs (2023) |

| HILL HOUSE | $1,368,000 | 431 | $3,177 | 999 yrs (1841) |

| BLOOMSBURY RESIDENCES | $1,376,000 | 570 | $2,412 | 99 yrs (2024) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| N.A. | $23,500,000 | 11468 | $2,049 | FH |

| N.A. | $14,688,000 | 6554 | $2,241 | FH |

| CORONATION VILLE | $13,888,000 | 4923 | $2,821 | 999 yrs (1875) |

| ADELPHI PARK ESTATE | $9,330,000 | 7010 | $1,331 | FH |

| THE HYDE | $4,100,000 | 1249 | $3,284 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CARDIFF RESIDENCE | $720,000 | 420 | $1,715 | 99 yrs (2011) |

| THE TAPESTRY | $730,000 | 441 | $1,654 | 99 yrs (2017) |

| SKYSUITES17 | $730,888 | 355 | $2,058 | FH |

| NOMA | $760,000 | 431 | $1,765 | FH |

| KINGSFORD HILLVIEW PEAK | $760,000 | 527 | $1,441 | 99 yrs (2012) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| CORONATION VILLE | $13,888,000 | 4923 | $2,821 | $2,788,000 | 4 Years |

| PARKSHORE | $3,200,000 | 1668 | $1,918 | $2,050,000 | 26 Years |

| FLAME TREE PARK | $2,980,000 | 1593 | $1,871 | $1,920,000 | 29 Years |

| ONE AMBER | $3,280,000 | 1453 | $2,257 | $1,710,000 | 14 Years |

| HAZEL PARK CONDOMINIUM | $2,193,000 | 1335 | $1,643 | $1,394,348 | 26 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| CAIRNHILL NINE | $2,530,000 | 1033 | $2,448 | -$204,000 | 9 Years |

| FARRER PARK SUITES | $1,070,000 | 829 | $1,291 | -$132,050 | 13 Years |

| NORMANTON PARK | $948,000 | 527 | $1,797 | -$62,000 | 3 Years |

| NEWTON EDGE | $918,000 | 441 | $2,080 | -$42,000 | 12 Years |

| NOMA | $760,000 | 431 | $1,765 | $5,750 | 5 Years |

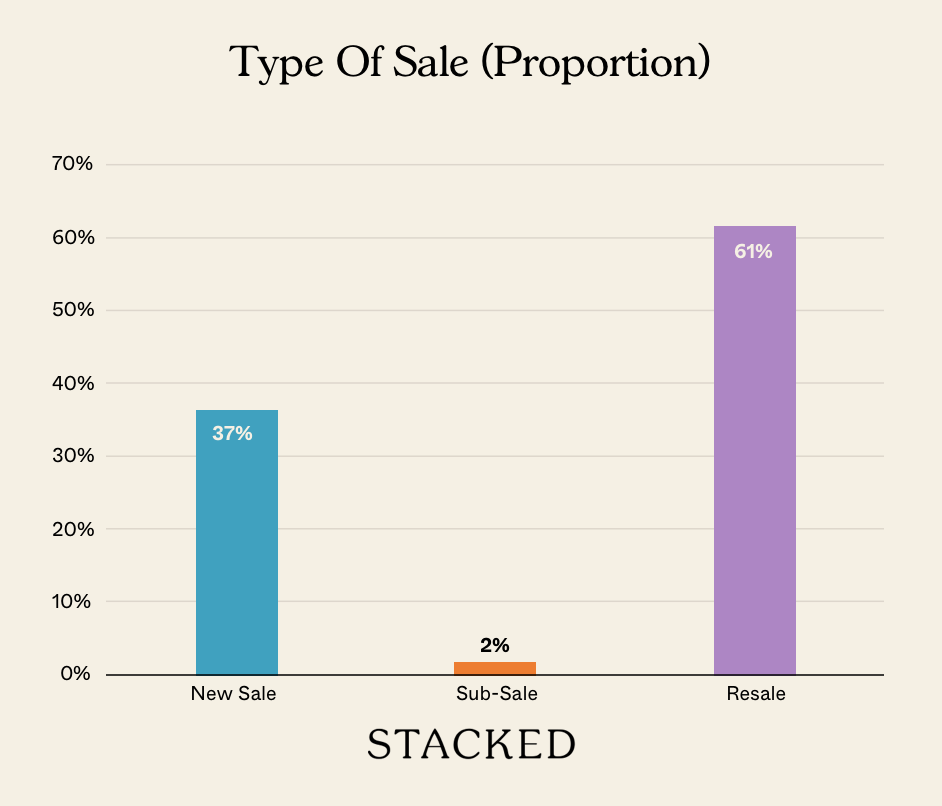

Transaction Breakdown

Follow us on Stacked for more updates and changes in the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Do lower land prices in Singapore mean cheaper new condos?

Will developers offer bigger discounts on new condos if land prices drop?

Why aren’t new condo prices in Singapore dropping despite lower land costs?

How does the market demand affect new condo prices in Singapore?

Are there specific areas where property slowdown is more noticeable in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

0 Comments