New Launch Vs Resale: Which Districts Have The Biggest Price Gaps In 2025?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

With new launches regularly crossing $2,200 psf in 2025, many buyers are asking: “Why not go for resale instead?” It’s a fair question: after all, resale condos often come with more space, may have a lower quantum, and established locations. But the resale-versus-new decision isn’t always so clear-cut.

Depending on the district, the price gap between new and resale units can vary wildly. In some areas, it might be just a few hundred thousand dollars; an amount many buyers might stretch for. In others, the gap exceeds $800,000, making resale the only viable option unless you’ve got a huge budget.

We also found major differences when moving between bedroom types: one- to two-bedders, or three- to four-bedders. In some new launches, upgrading by just one room means paying 40 to 100 per cent more, sometimes more than a whole resale unit elsewhere!

We’ll also be looking at some of the districts with the biggest new launch and resale price gaps, like Districts 5, 10, and 7, in the follow-up Stacked Pro case studies.

Comparing across districts

We looked at 10 years of transaction data (2014–2024) across all 28 districts, comparing average prices for one- to four-bedroom new launches and resale condos. We then tracked price jumps between new and resale properties by number of bedrooms. This allows us to see whether some districts are more punishing than others, if you want to get a new launch.

Comparing two-bedders across the districts

Let’s start by comparing new launch versus resale prices for two-bedder units, across each district:

Standouts and observations for two-bedder new launch/resale gaps

Let’s start with the most recent year. In 2024, the top three districts with the largest price gaps between new launch and resale two-bedders were:

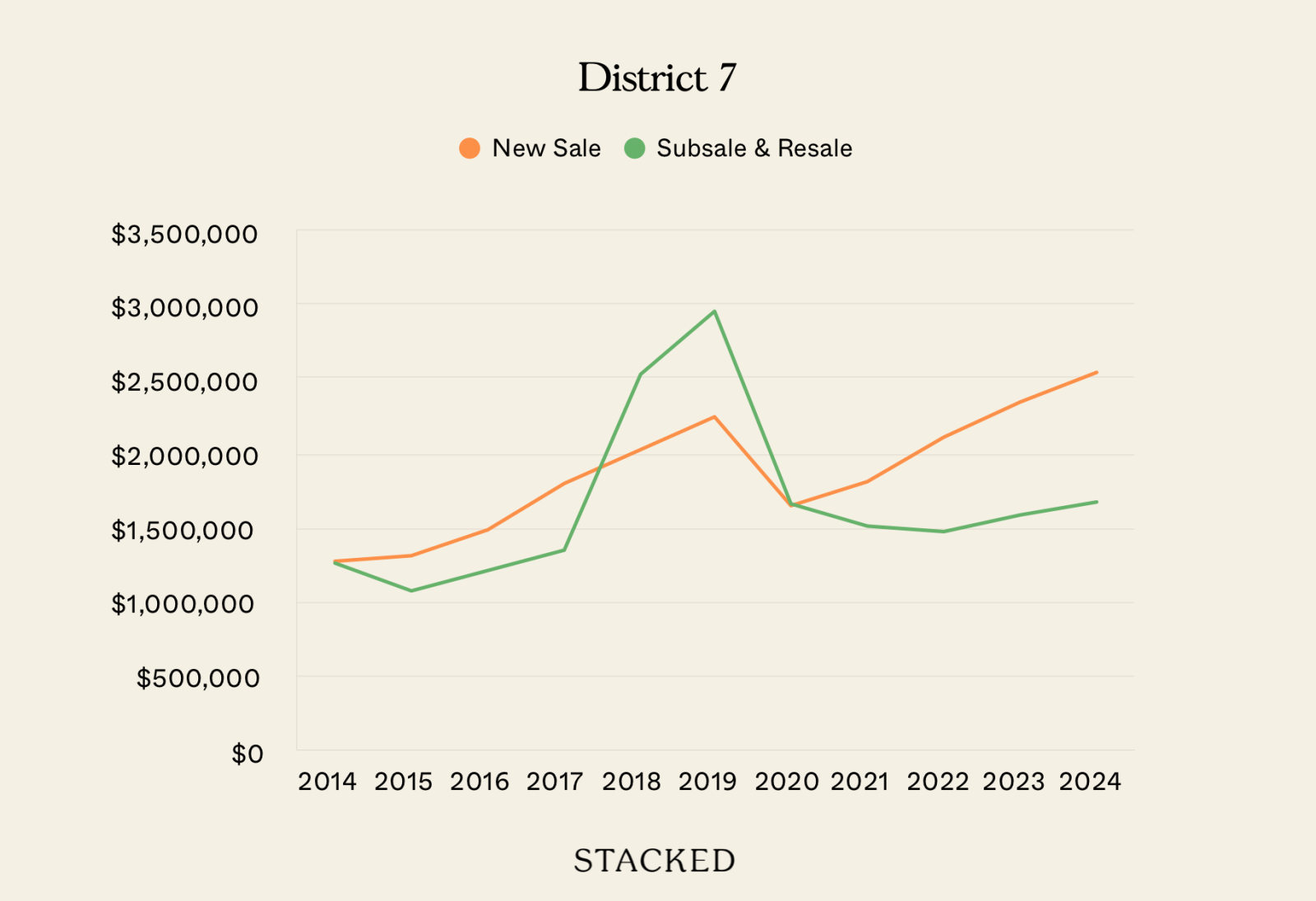

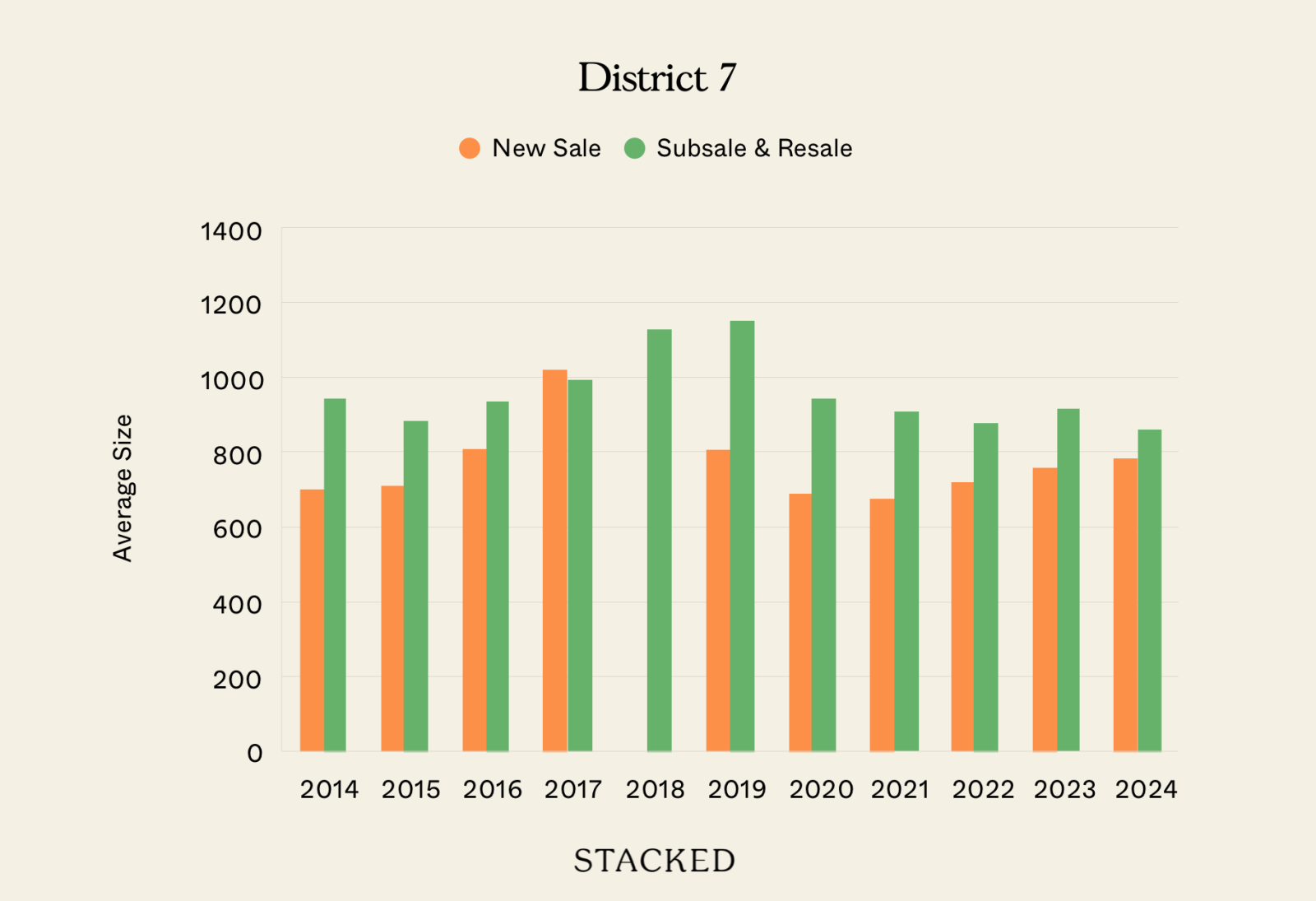

- District 07 (Bugis/Beach Road) – $878,394 gap

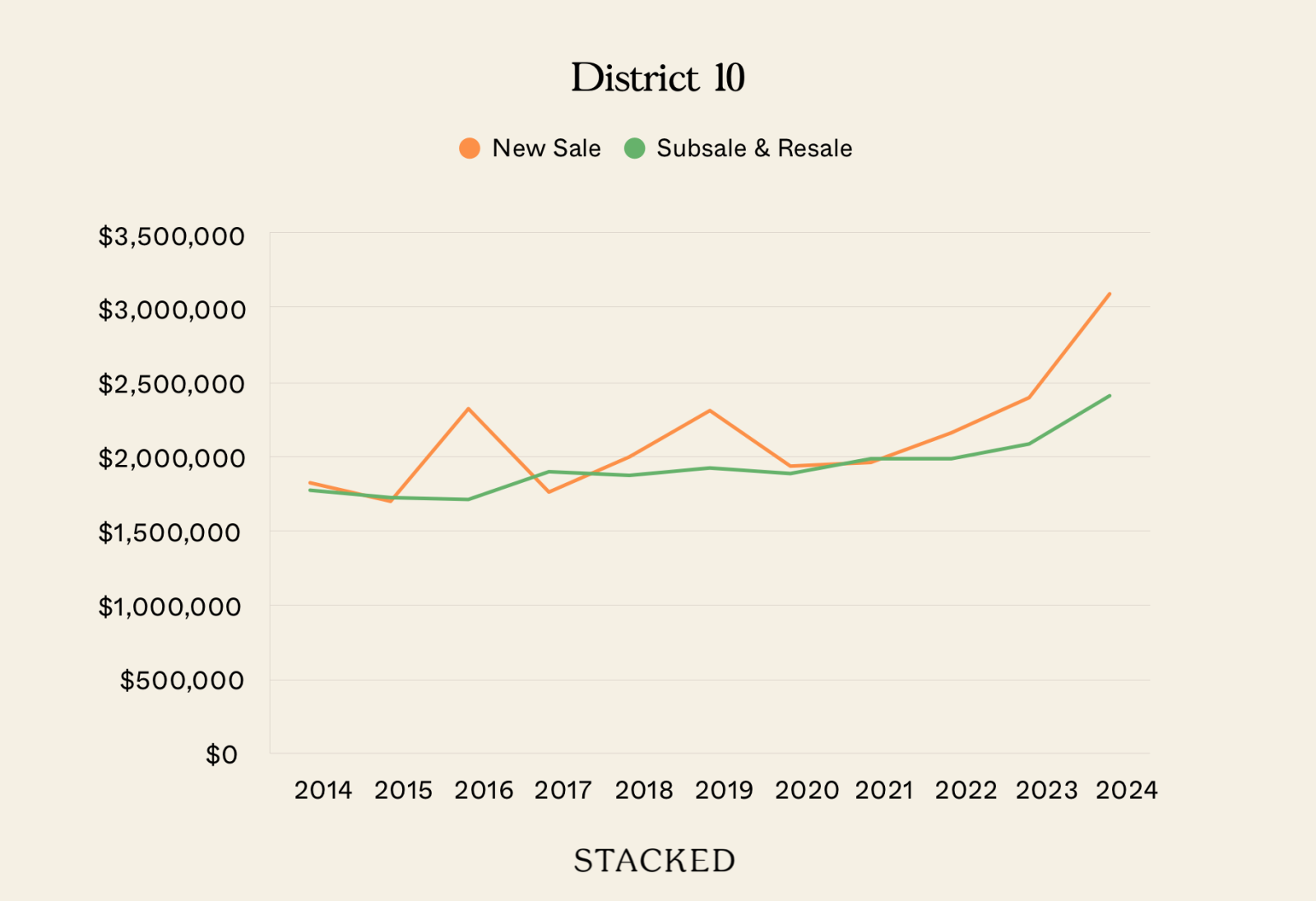

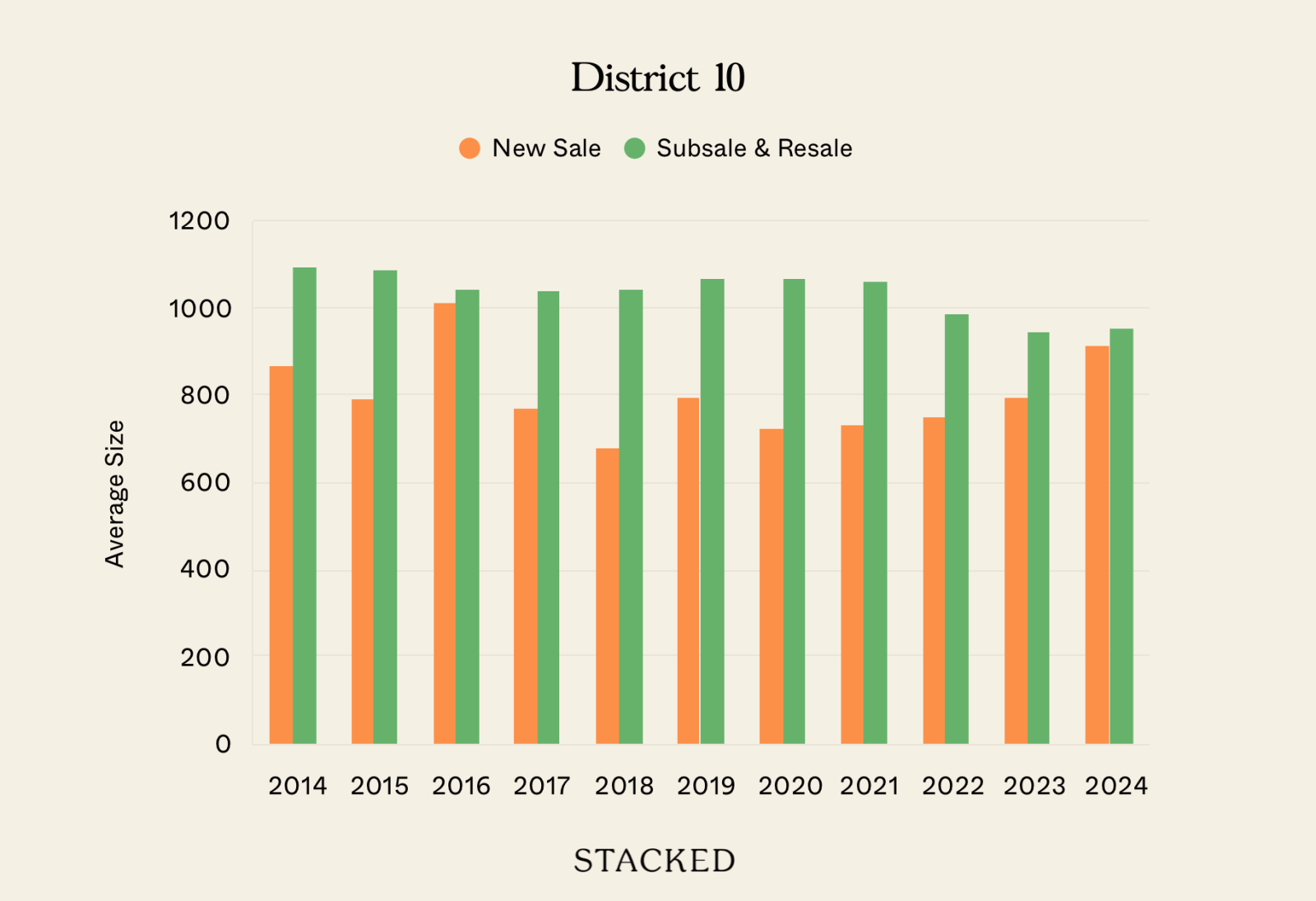

- District 10 (Tanglin/Holland) – $687,151 gap

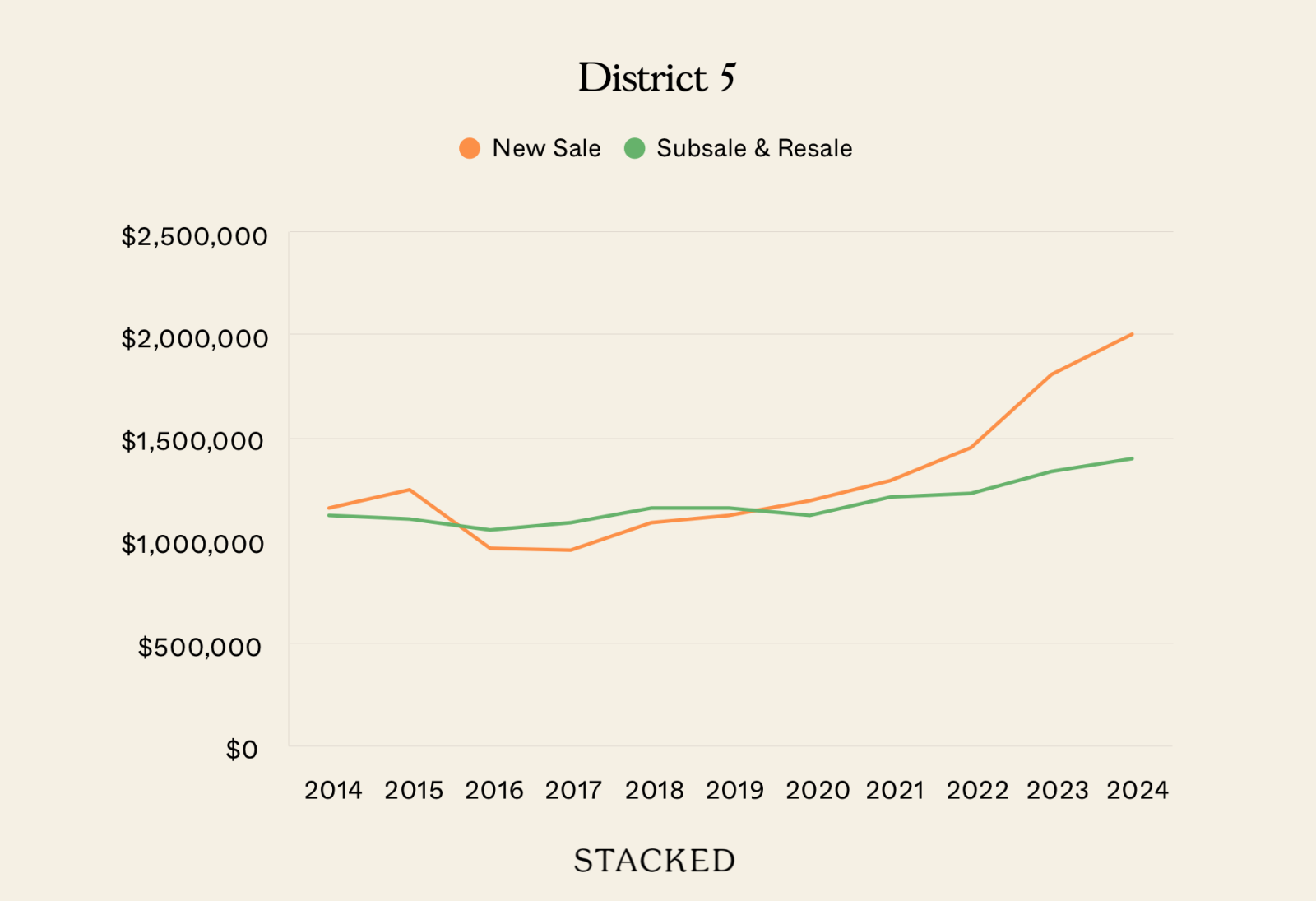

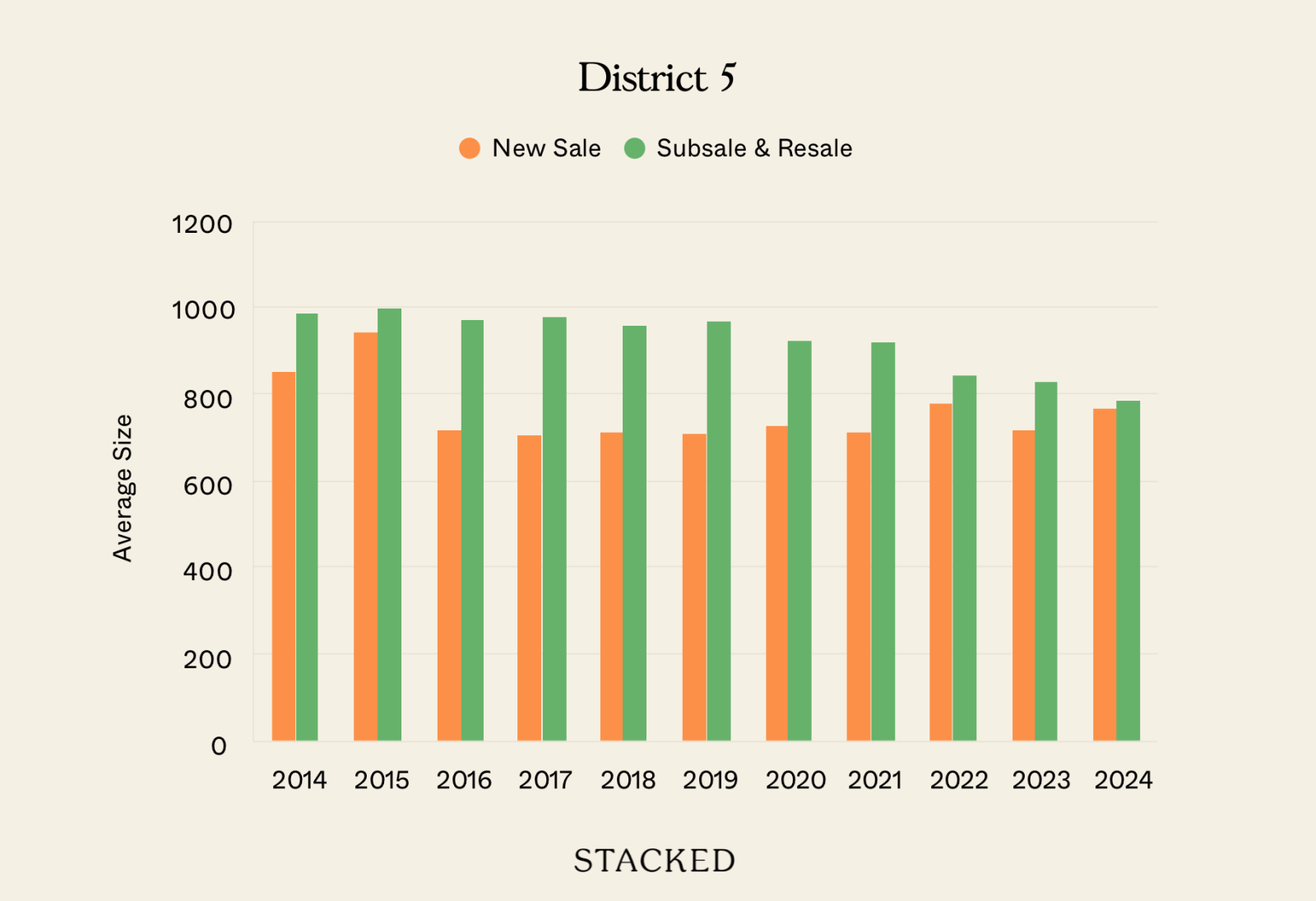

- District 05 (Buona Vista/West Coast) – $607,154 gap

These districts saw the largest absolute dollar gaps in 2024. In District 7, some realtors pointed to Midtown Bay and Midtown Modern, which sometimes reached prices well above $3,000 psf. In District 10, some identified One Holland Village Residences as a key driver, with 2-bedroom units transacting at up to $2.98 million. For District 5, we saw launches like Blossoms by the Park and The Hill @ One-North, where 2-bedders routinely crossed $2,600 psf, pushing the new sale averages far ahead of resale counterparts.

Next, we’re going to look at the price jump from one to two-bedders

At first glance, comparing one-bedroom to two-bedroom prices within the same district might seem like a tangent, especially in an article focused on new launch vs resale pricing. But there’s a good reason to bring it in.

The first reason is that, if upgrading from a new launch one-bedder to a two-bedder requires a massive jump in price, the resale market starts to look like a much better deal, especially if the resale two-bedder is more spacious and only marginally more expensive.

Second, it gives us insight into how developers price bedroom types. In some districts, the jump from one- to two-bedroom in a new launch can be more than 40 to 50 per cent, suggesting a steep premium placed on additional rooms. Meanwhile, the resale market, based on older layouts and more organic supply, often shows a more modest increase. That pricing gap may nudge some buyers toward resale two-bedders even if they were initially considering a new one-bedder.

So by comparing how much more you need to pay for that second bedroom – within both new and resale segments – we get a clearer picture of where the value lies, and how different buyer types might make their trade-offs:

Notable observations from the above:

When we look at how much more a buyer would have to pay to move from a one to two-bedder within the same district, we start to see some big discrepancies, especially between new launches and resale units.

In the new launch segment, the jump from a one- to a two-bedder can be dramatic. For example:

- In District 2 (Tanjong Pagar/Chinatown), the average new two-bedder costs $1.04 million more than the one-bedder. This is a 106 per cent increase.

- In District 3 (Queenstown), the jump was even more extreme at 161.4 per cent, with an average price difference of over $1.55 million.

In many high-demand districts, developers like to anchor entry prices with one-bedders, such as shoeboxes at or below 500 sq ft, while pushing up quantum and psf on two-bedroom types. This strategy magnifies the cost of upgrading, even if the square footage difference is modest.

Resale markets tell a different story.

In many districts, the jump from a one- to a two-bedder is more manageable, thanks to larger base unit sizes and older pricing patterns.

Take District 12 (Balestier/Toa Payoh) for example: the average price for a resale one-bedder was $1.13 million, and for a two-bedder, it was $1.35 million; a difference of just $216,000, or 19.1 per cent.

More from Stacked

The Myst, A New Launch Condo With Prices Under $1 Million: A 5-Minute Overview Of Upper Bukit Timah’s Latest Launch

The new condo launches are coming in thick and fast, with City Developments Limited (CDL) launching The Myst (yes, I…

In some districts, resale two-bedders are priced only 10 to 20 per cent higher than one-bedders. That smaller gap could make resale two-bedders an attractive option for upgraders, especially if the layout and location remain desirable.

There are anomalies too. In District 3, we notice resale two-bedders were on average $106,000 cheaper than one-bedders. Realtors we asked had a few theories, the common one pointing to newer, higher-psf one-bedders from projects like Queens Peak or Commonwealth Towers, which drove up the one-bedder average.

What This Means for Buyers

The price jump data reveals two important considerations for buyers:

- If you’re stretching your budget for a new launch one-bedder, it may not be much more expensive to buy a larger resale two-bedder in the same district.

- In some areas, two-bedroom resale units cost less than the price jump you’d pay upgrading within the new launch segment.

- Developers are often compressing unit sizes and pushing psf, so you’re paying more per sq ft and getting less space, especially for two-bedroom units.

Also, if you’re planning to upgrade from a one to a two-bedroom unit in the same district, certain areas are far more punishing than others.

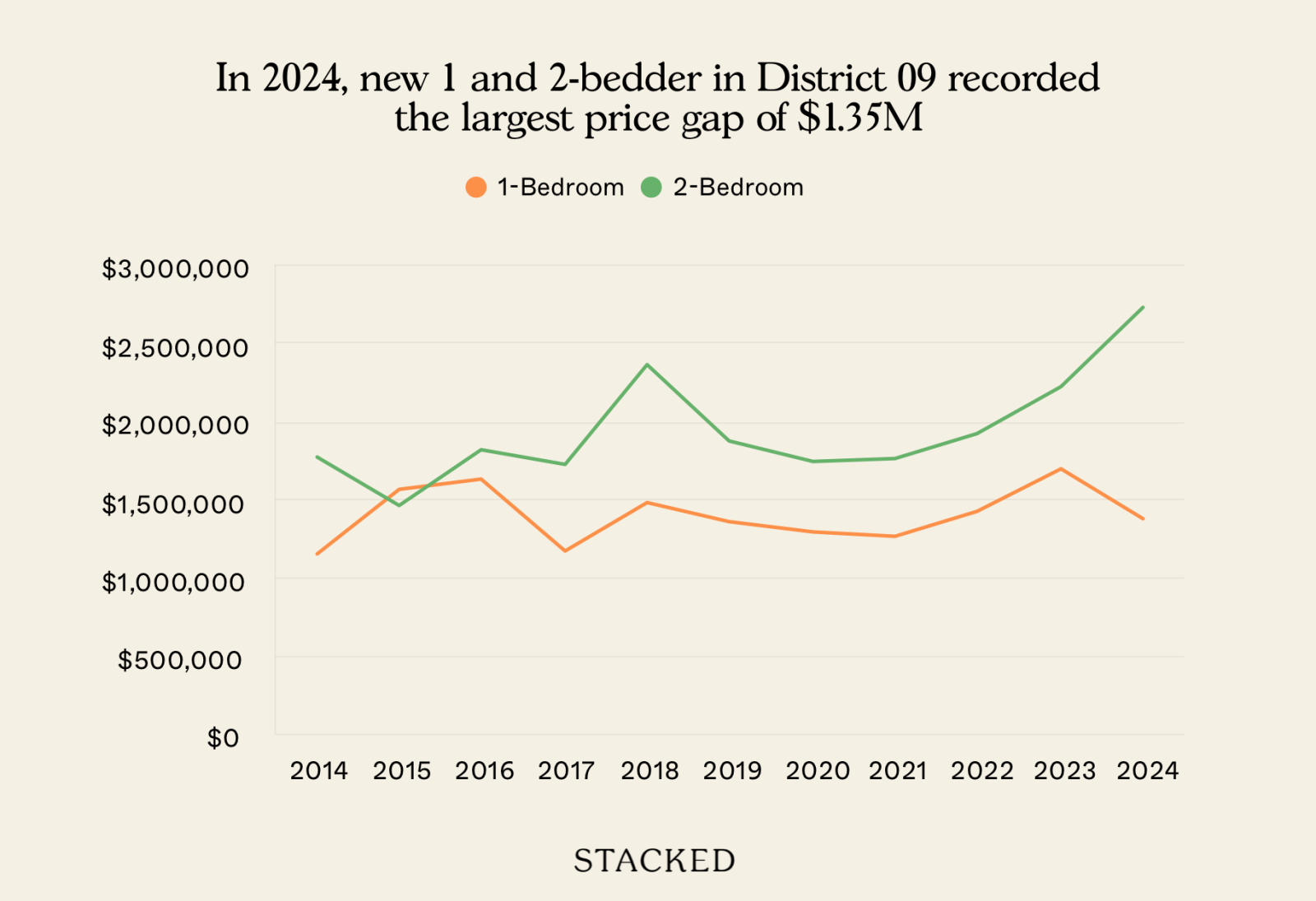

In 2024, District 9 (Orchard/River Valley) recorded the largest price jump between a new launch one-bedder and two-bedder: a massive $1.35 million difference. That’s more than the full price of a two-bedroom unit in many OCR districts.

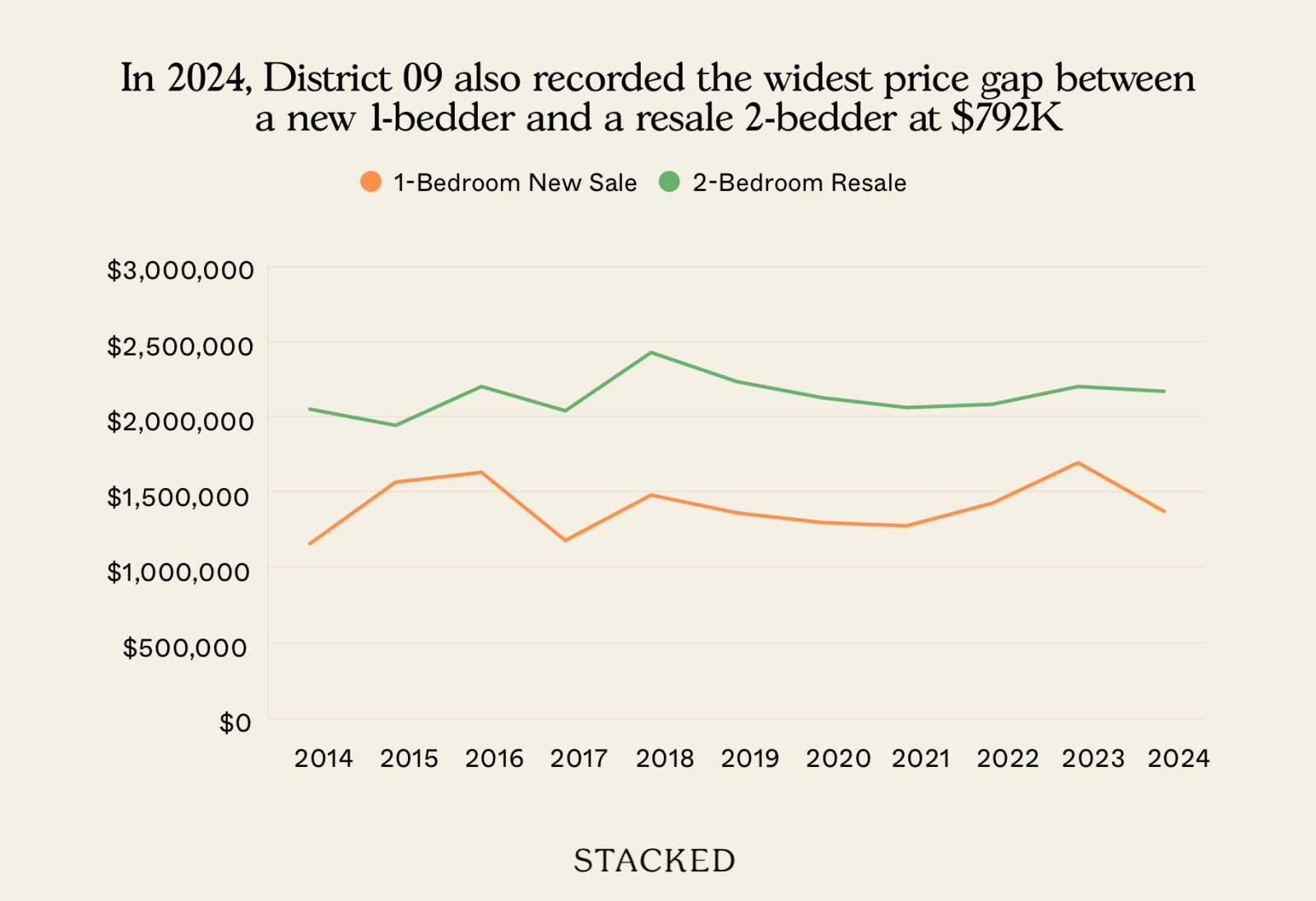

District 9 also posted the widest gap between a new one-bedder and a resale two-bedder, at $792,147. In other words, even if you switch to the resale market, you’d still need to fork out nearly $800,000 more for that one extra bedroom in this district.

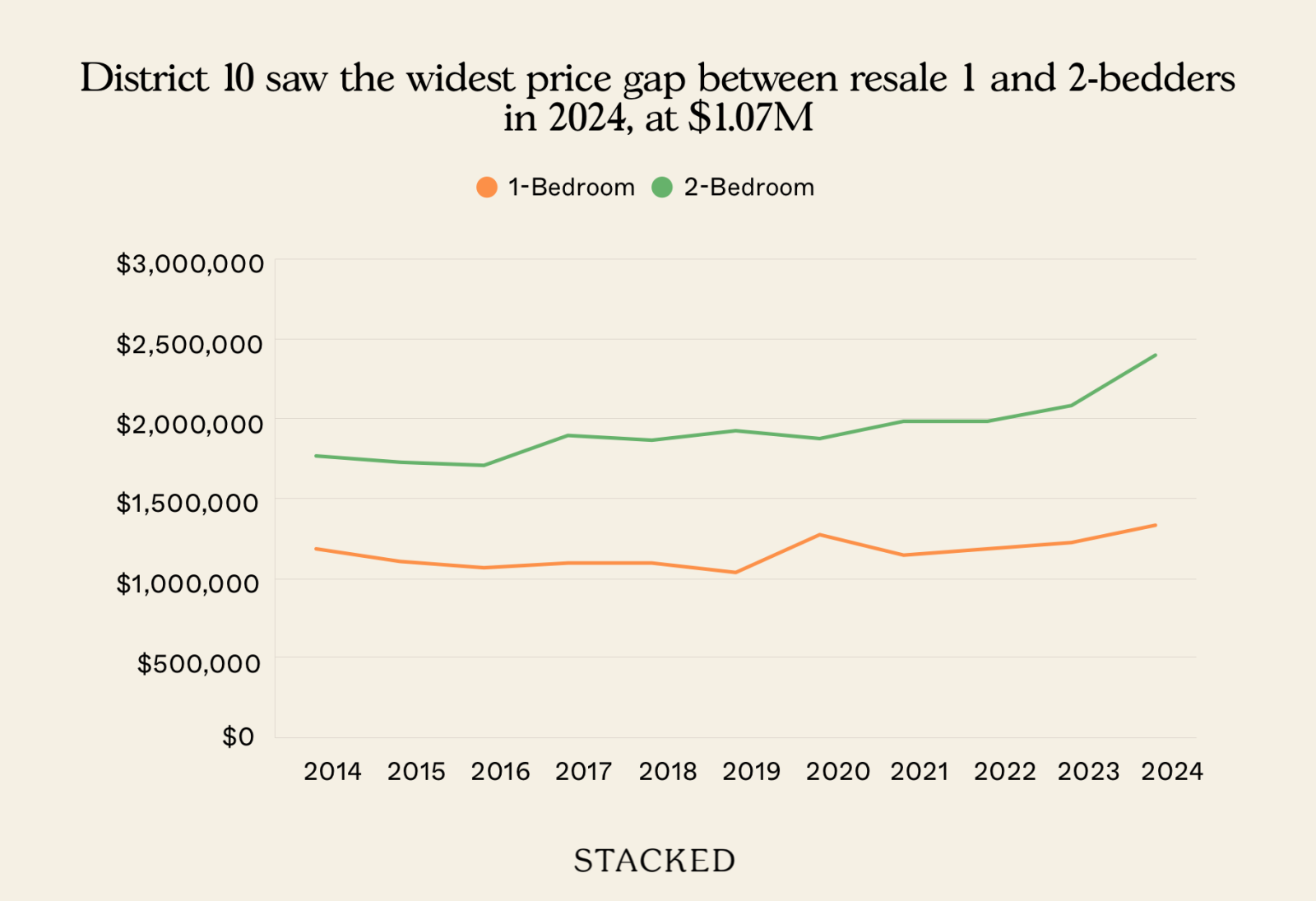

In the resale segment, District 10 (Tanglin/Holland) was the worst offender, with a $1.07 million price gap between resale one and two-bedroom units. That’s despite both segments being on the secondary market.

Next, let’s take a look at three to four-bedder price jumps

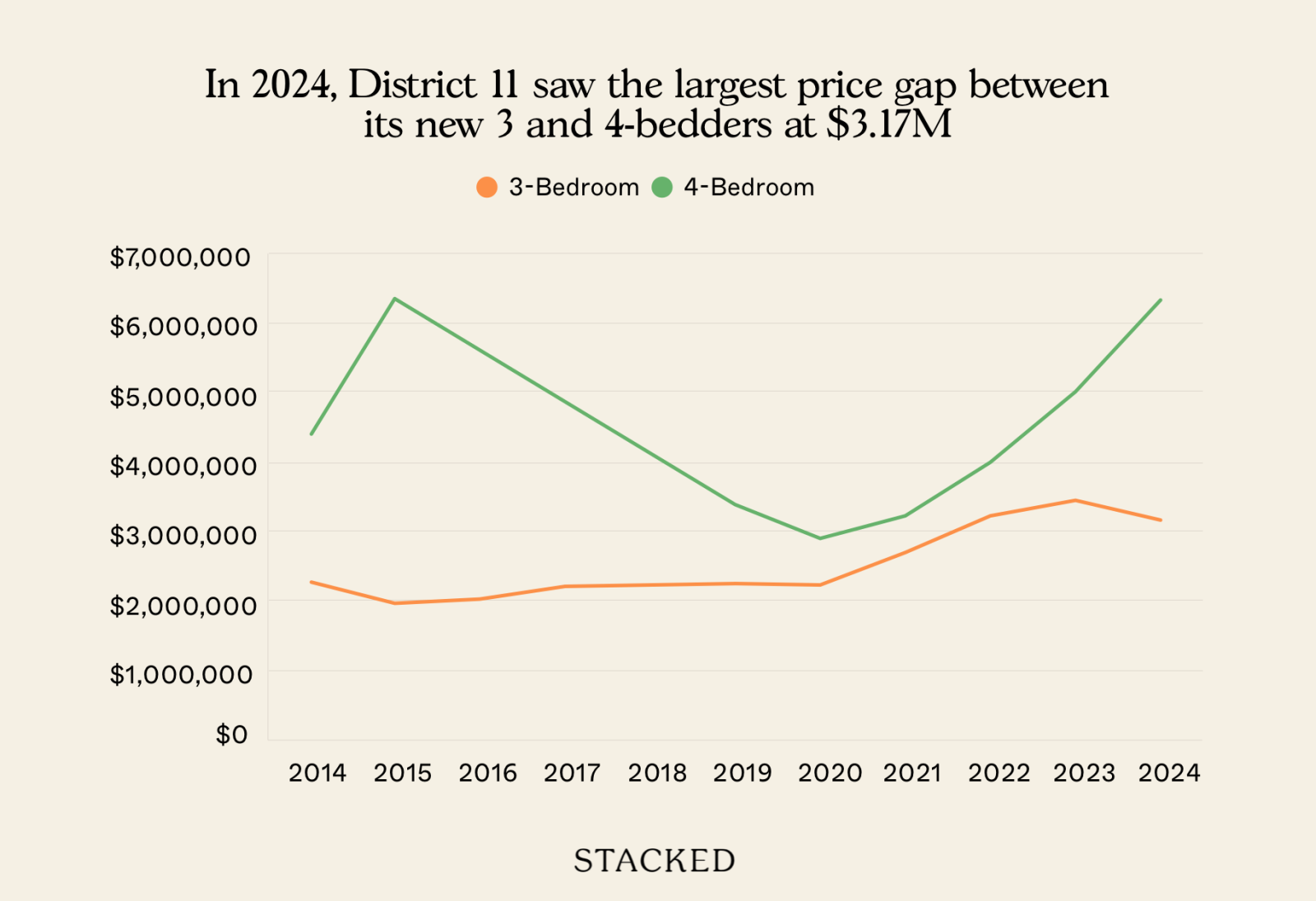

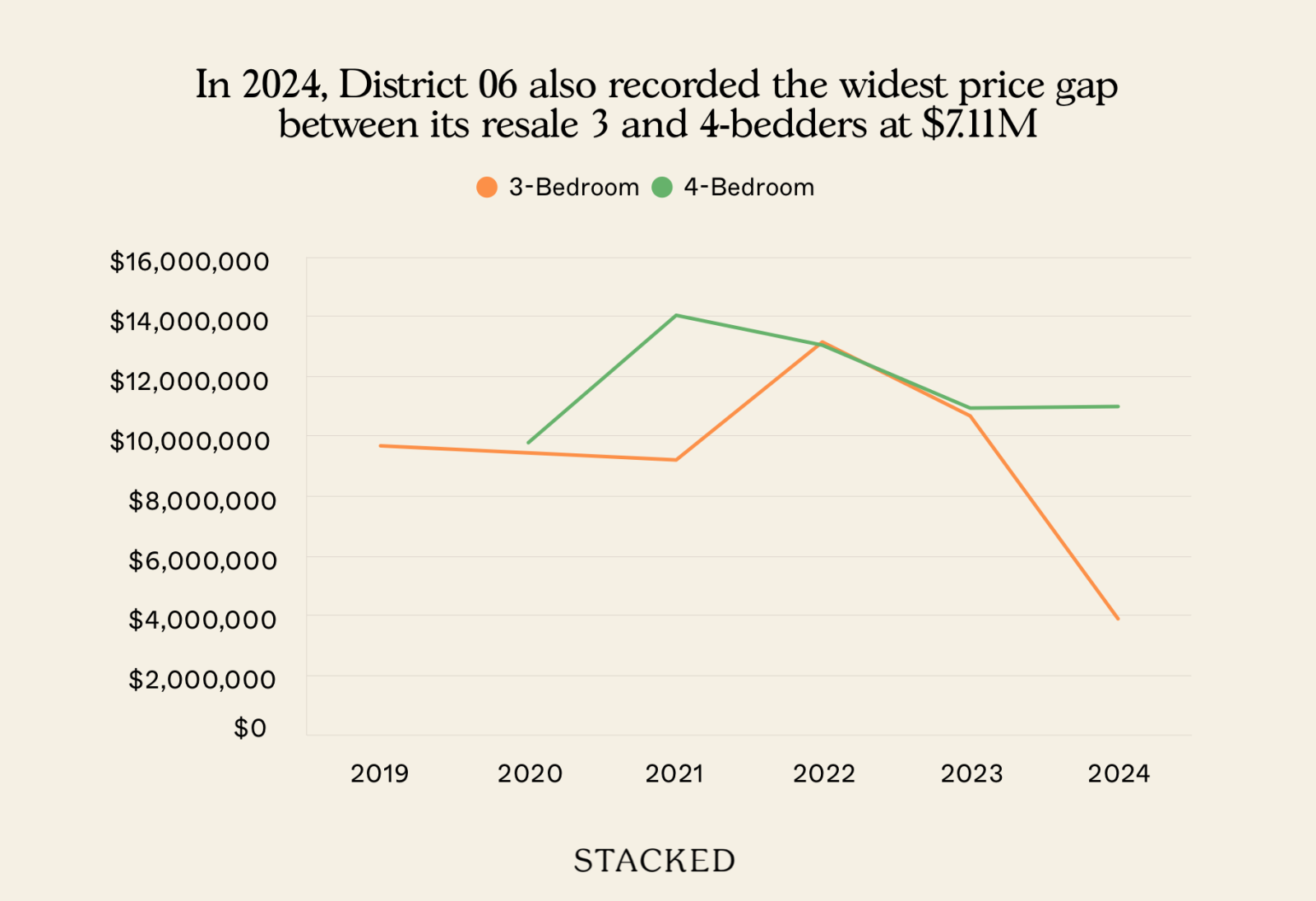

Moving from a three-bedder to a four-bedder is a very tough stretch in prime districts. In 2024, the most dramatic gap in the new launch market was found in District 11 (Newton/Novena), where the average four-bedder cost $3.173 million more than a three-bedder.

District 6, of course, has a tiny sample size and a skewed market: think ultra-luxury developments like Eden Residences Capitol or conserved mixed-use buildings near The Capitol.

In contrast, some districts saw much more modest jumps – under $500,000 – between three- and four-bedder resale units, making the leap more manageable in select OCR or fringe RCR areas. But those are the exceptions, not the norm.

Some notable points in the new launch market for this segment are:

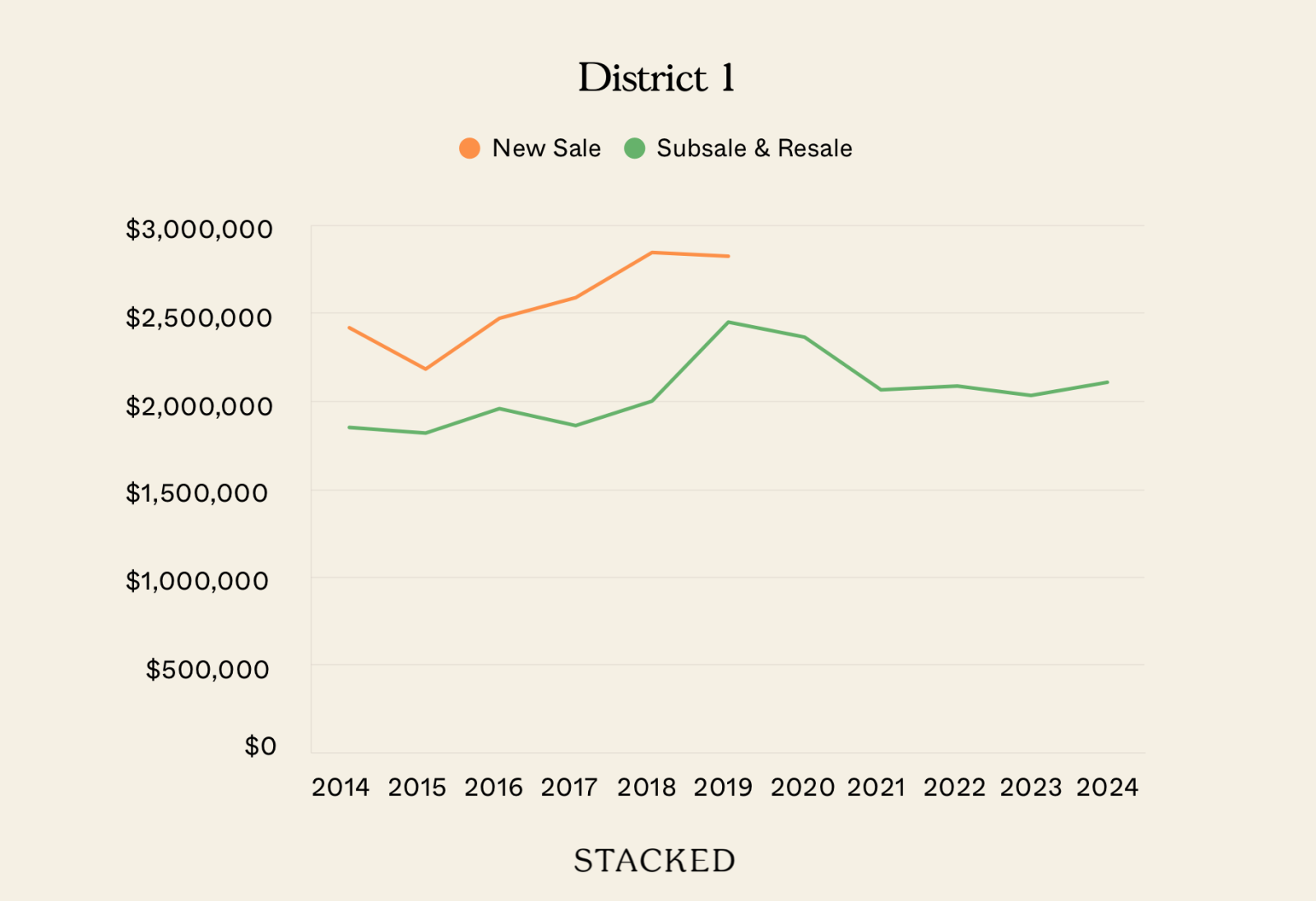

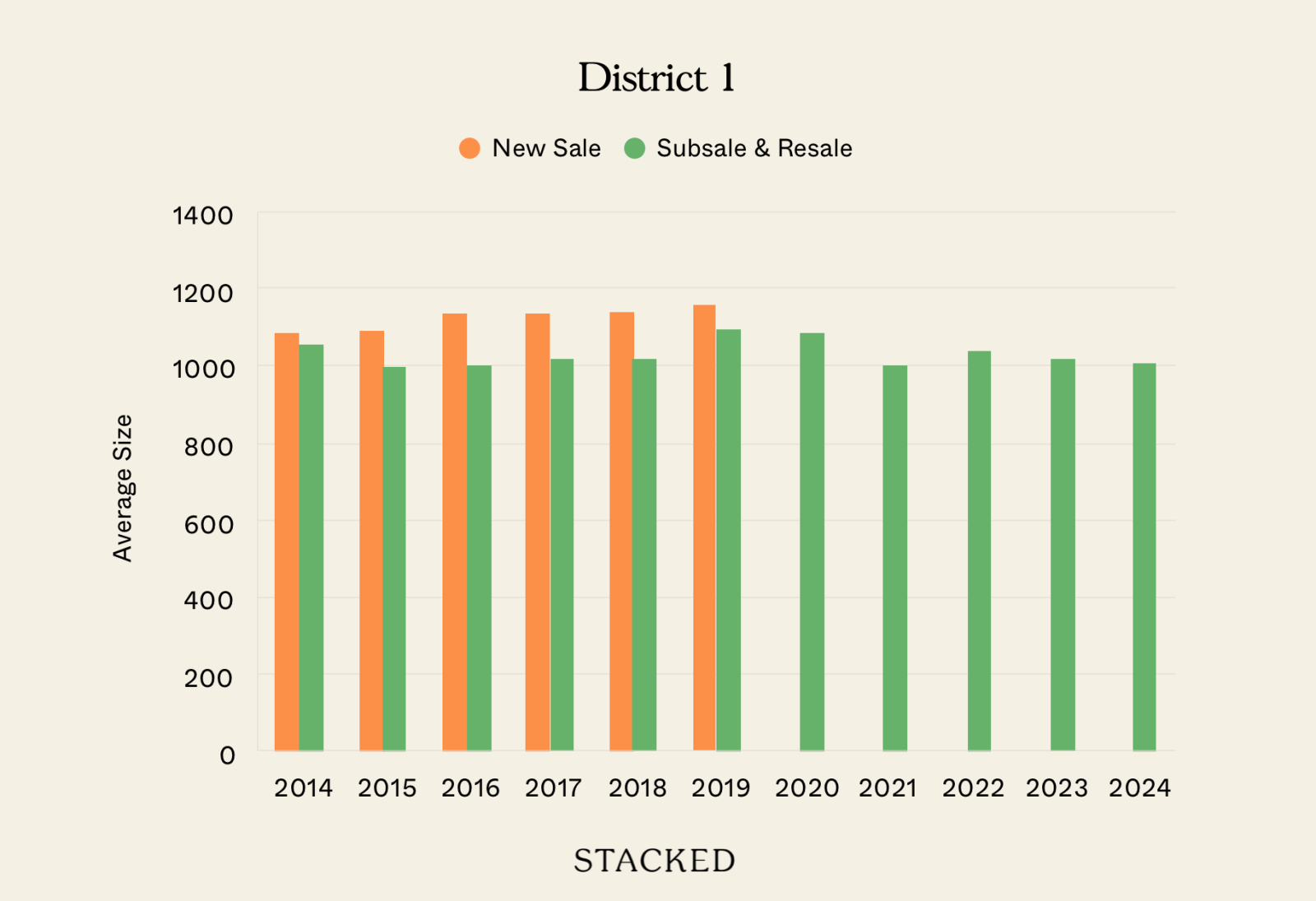

- District 1: The average price difference between new three and four-bedders was $1.34 million, a 68.9 per cent increase.

- District 5: The gap hit $1.14 million, or 48.4 per cent more for a four-bedder.

- District 4 (Harbourfront/Sentosa): New four-bedders cost $922,278 more on average, about 29.2 per cent higher.

In contrast, some districts like District 2 saw very minimal differences (only 2.2 per cent more), suggesting four-bedders are priced more reasonably; though this may also reflect limited availability or transaction data.

For District 3, the average new four-bedder actually costs less than a three-bedder. We don’t believe this reflects a genuine “average”, though, and is likely due to factors such as luxury three-bedder penthouses in boutique launches, which distort the overall picture.

In the Resale Market, District 5 again stands out, with a resale jump of $1.75 million, or 95.9 per cent, one of the steepest increases across all districts. District 1 and District 2 both saw resale four-bedders priced 27 to 45 per cent higher than their three-bedroom counterparts.

Overall Conclusion: How Much Should You Pay for That Extra Room?

Whether you’re considering a new launch or a resale unit, your desired bedroom count can drastically shift what’s within reach, within a given district.

In the new launch market, developers are often compressing sizes and pushing up psf, especially in larger layouts. This leads to sharper pricing cliffs: two-bedders that cost 50 per cent more than one-bedders, for example.

Resale units often offer more generous layouts and less dramatic price jumps; but not always. In some cases, resale four-bedders have surged ahead, especially in districts with a low supply of large condos. And in fringe RCR/OCR districts, the gaps remain relatively manageable, but those may require buyers to sacrifice location, tenure, or newer amenities.

In the coming weeks, we’ll be doing a district-level deep dive exclusively for Stacked Pro readers. We’ll highlight the districts with the biggest new launch and resale price gaps, like Districts 5, 10, and 7, in subsequent case studies.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Investment Insights

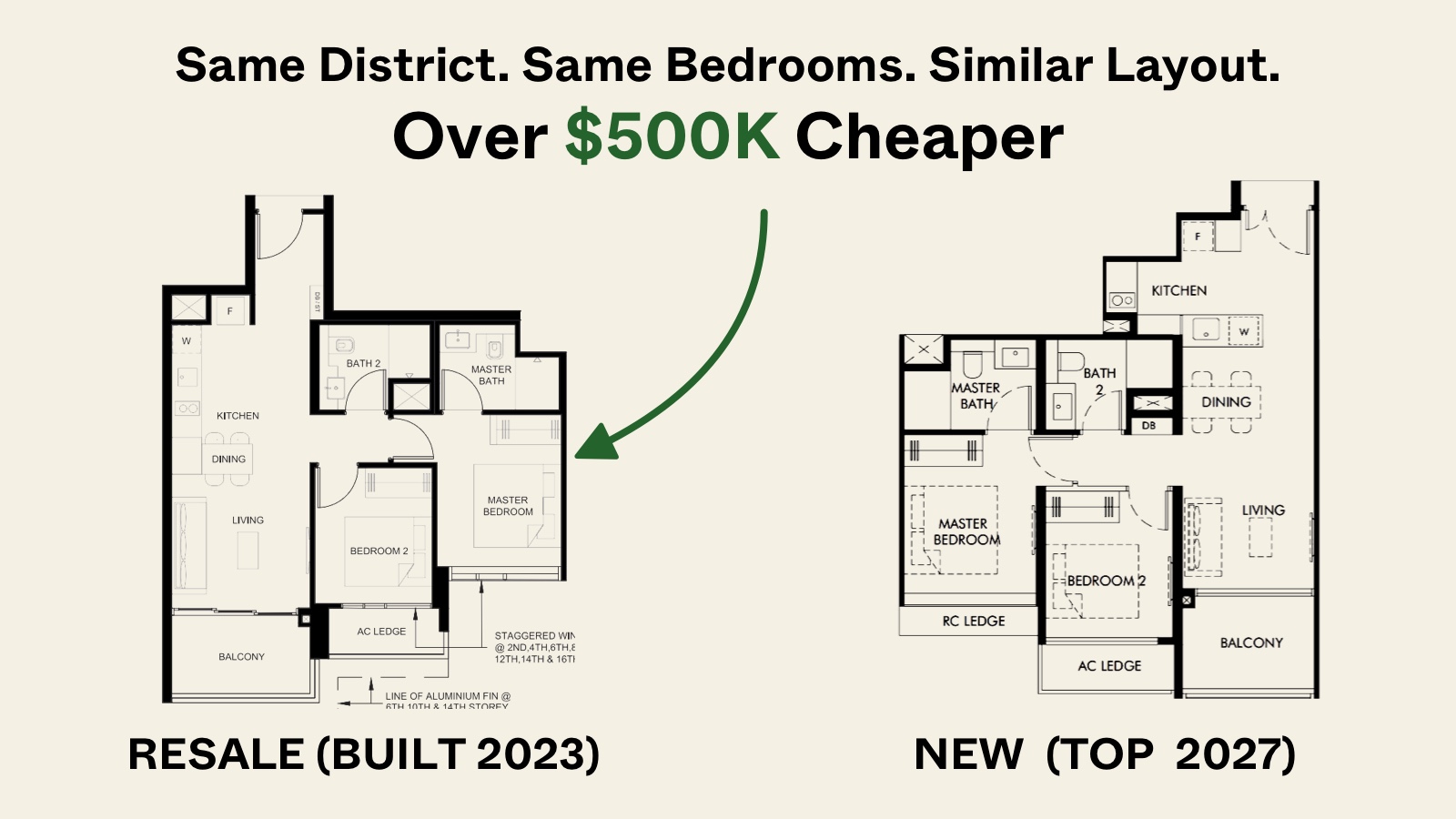

Property Investment Insights Similar Layout, Same District—But Over $500K Cheaper? We Compare New Launch Vs Resale Condos In District 5

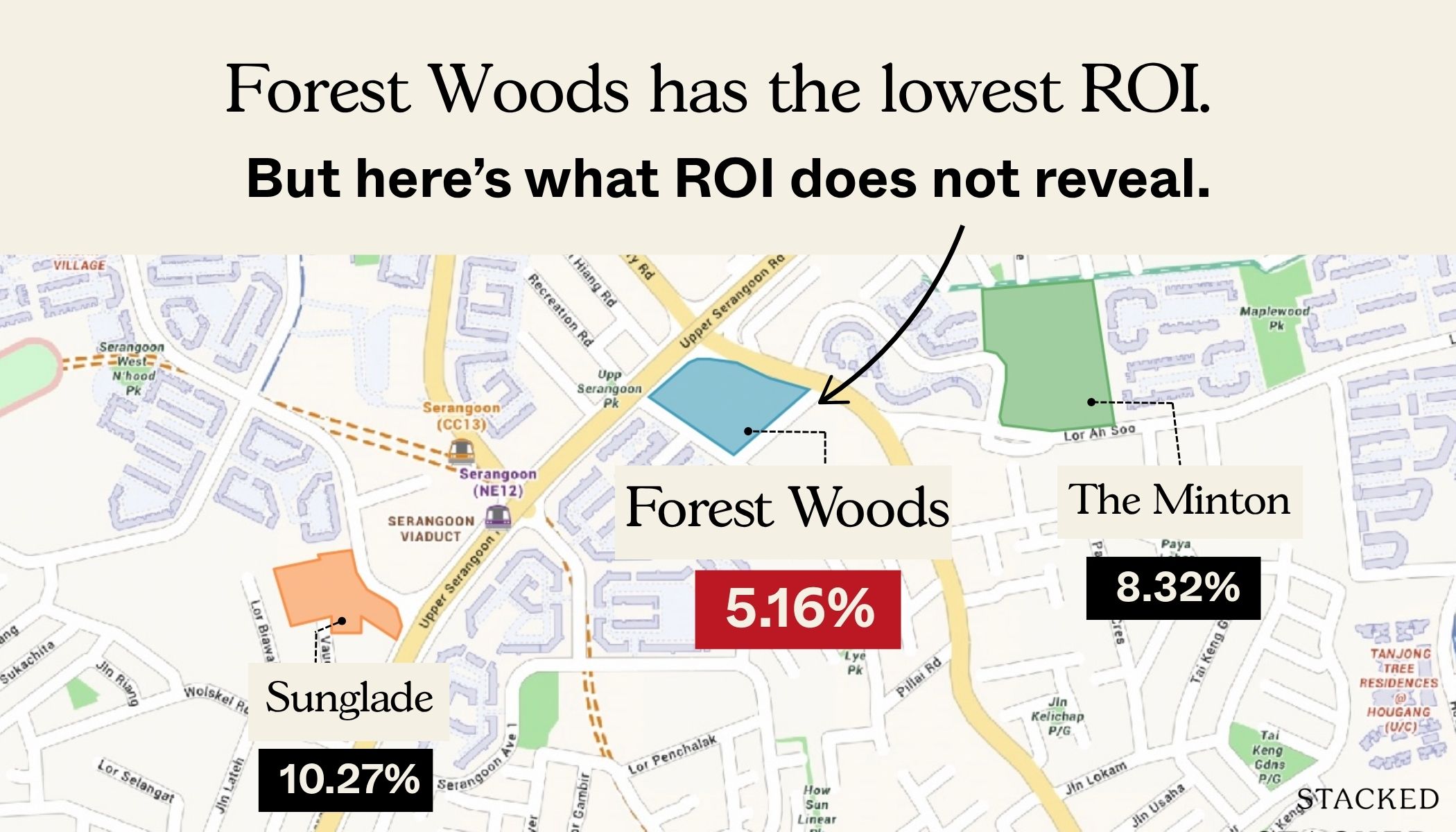

Property Investment Insights Analysing Forest Woods Condo at Serangoon: Did This 2016 Project Hold Up Over Time?

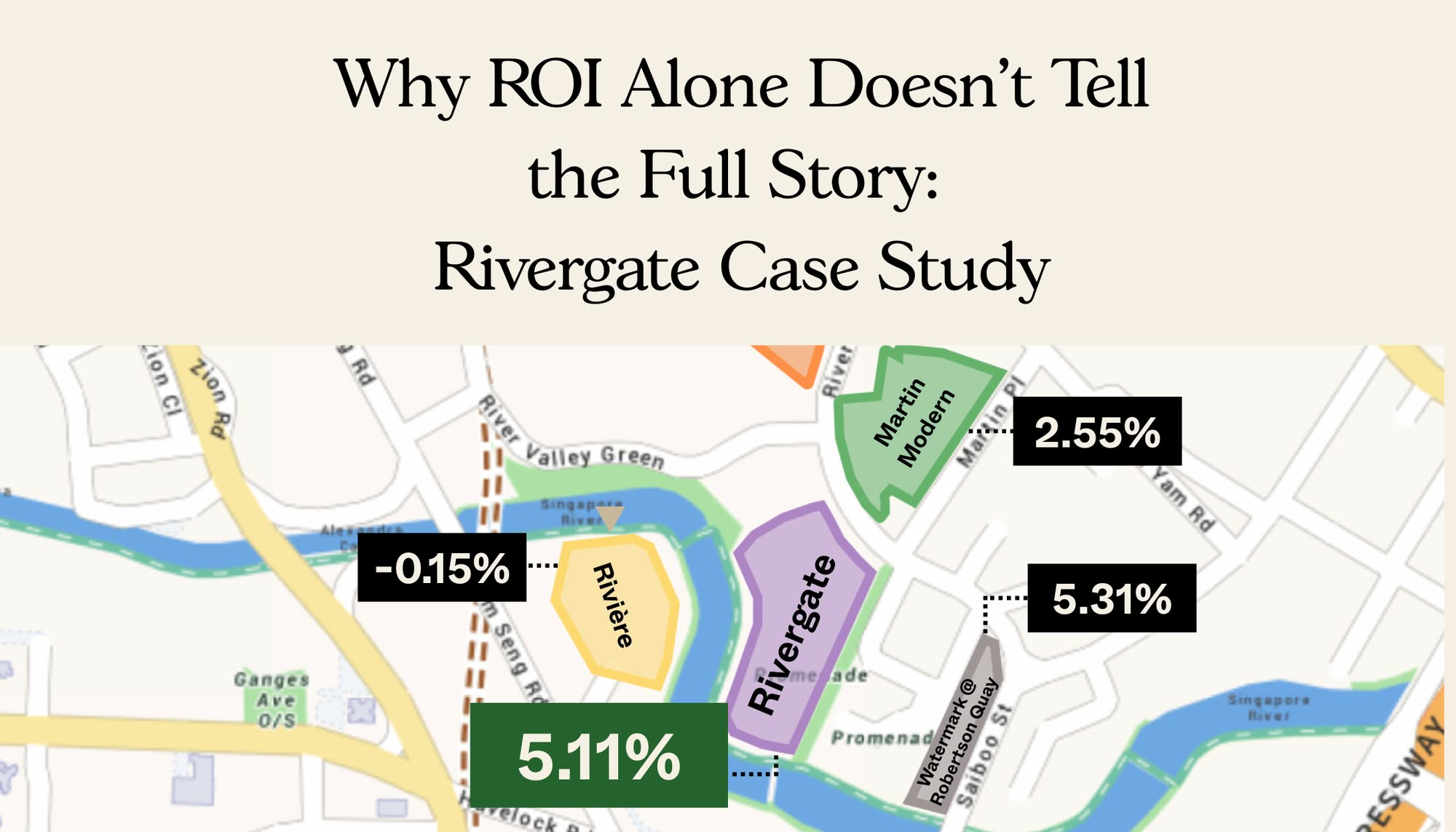

Property Investment Insights Why Rivergate Outperformed Its District 9 Rivals—Despite Being Nearly 20 Years Old

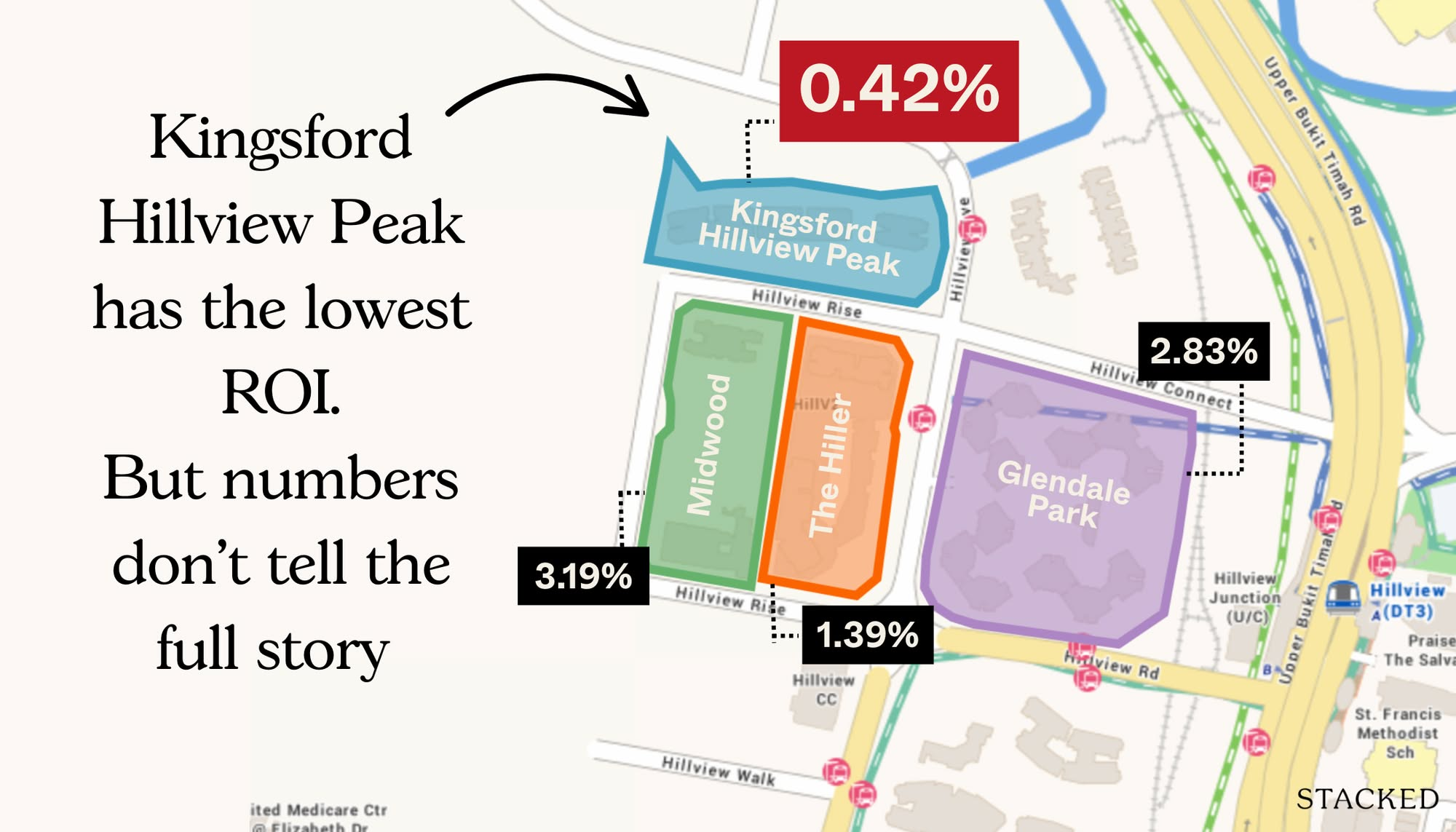

Property Investment Insights Why Kingsford Hillview Peak Underperformed—Despite Its MRT Location And “Good” Entry Price

Latest Posts

New Launch Condo Reviews The First New Condo In Science Park After 40 Years: Is LyndenWoods Worth A Look? (Priced From $2,173 Psf)

Editor's Pick Why The Johor-Singapore Economic Zone Isn’t Just “Iskandar 2.0”

Editor's Pick URA’s 2025 Draft Master Plan: 80,000 New Homes Across 10 Estates — Here’s What To Look Out For

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

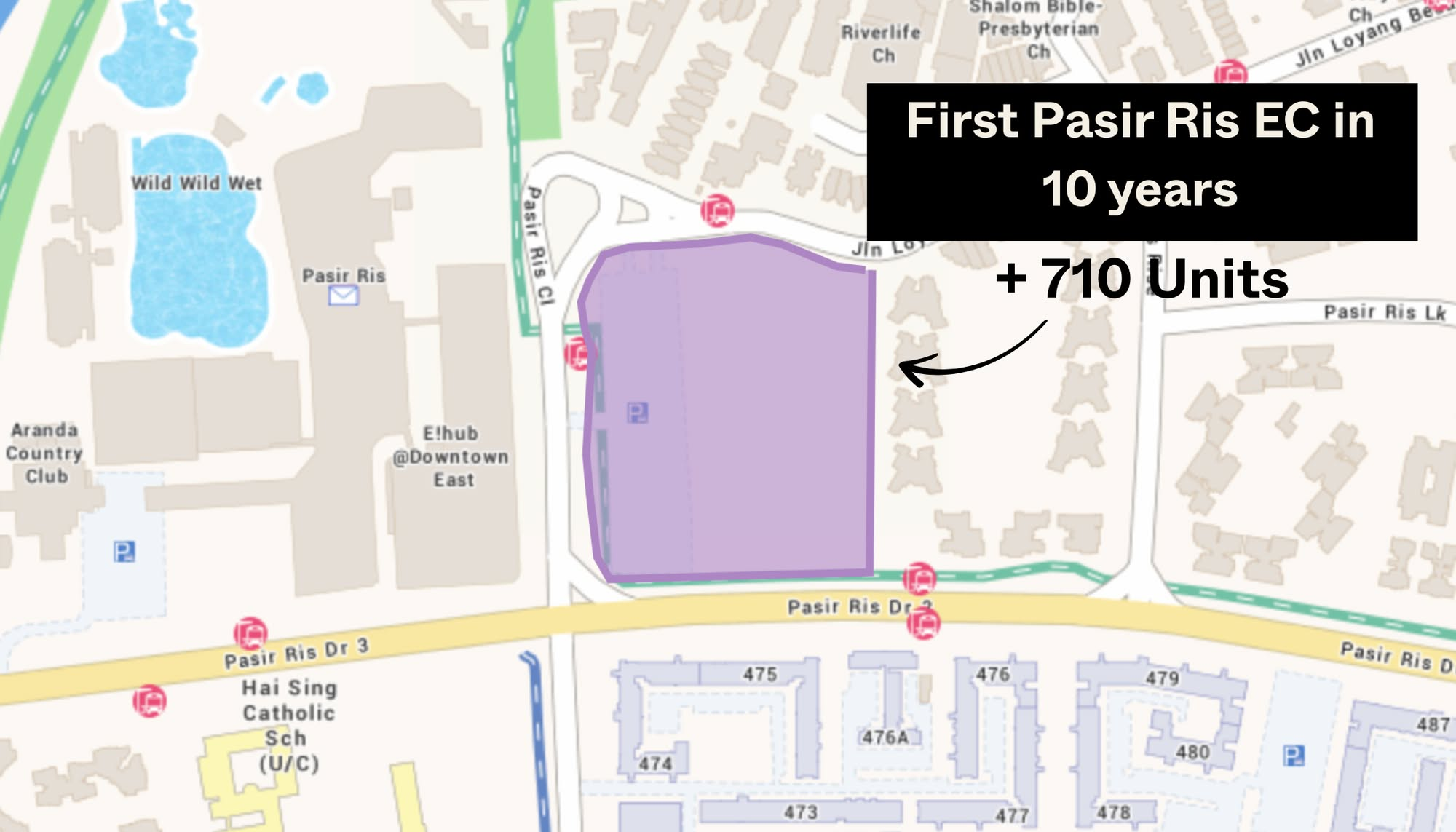

On The Market This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families

Editor's Pick Where To Find Freehold Terrace & Semi-D Landed Homes From $4.85 million In The East

Singapore Property News She Lost $590,000 On A Shop Space That Didn’t Exist: The Problem With Floor Plans In Singapore

Editor's Pick Which Central Singapore Condos Still Offer Long-Term Value? Here Are My Picks

On The Market 5 Cheapest Newly MOP 5 Room HDB Flats From $700k

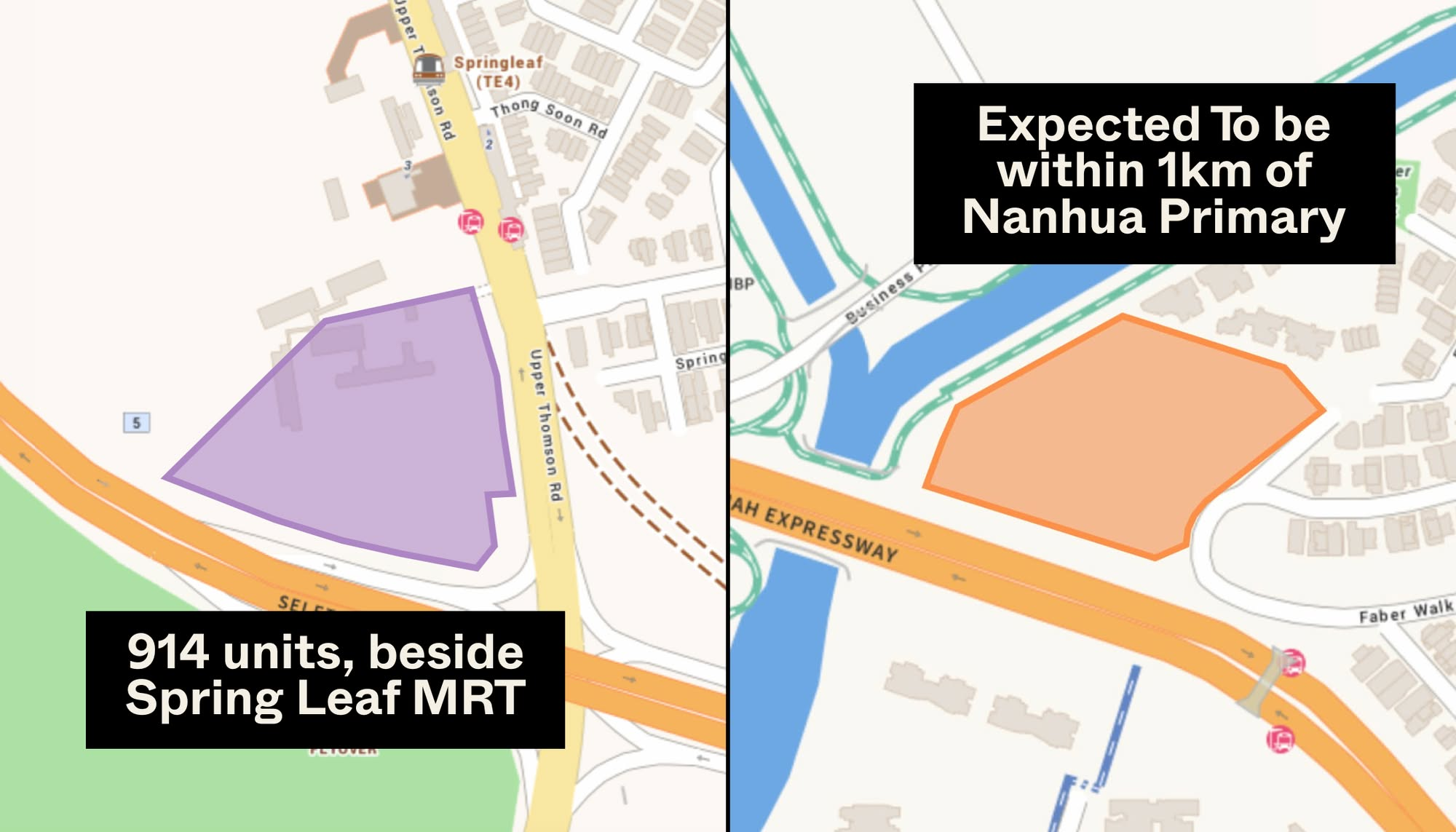

On The Market Springleaf Vs Faber Walk: Which Future GLS Residential Site Has More Potential?

Property Market Commentary I Reviewed HDB’s 2 And 3-Room Show Flats: Ideal For First-Time Buyers Or Too Small To Live In?

Editor's Pick Buying Property In Malaysia As A Singaporean: 6 Key Restrictions To Be Aware Of

Editor's Pick Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

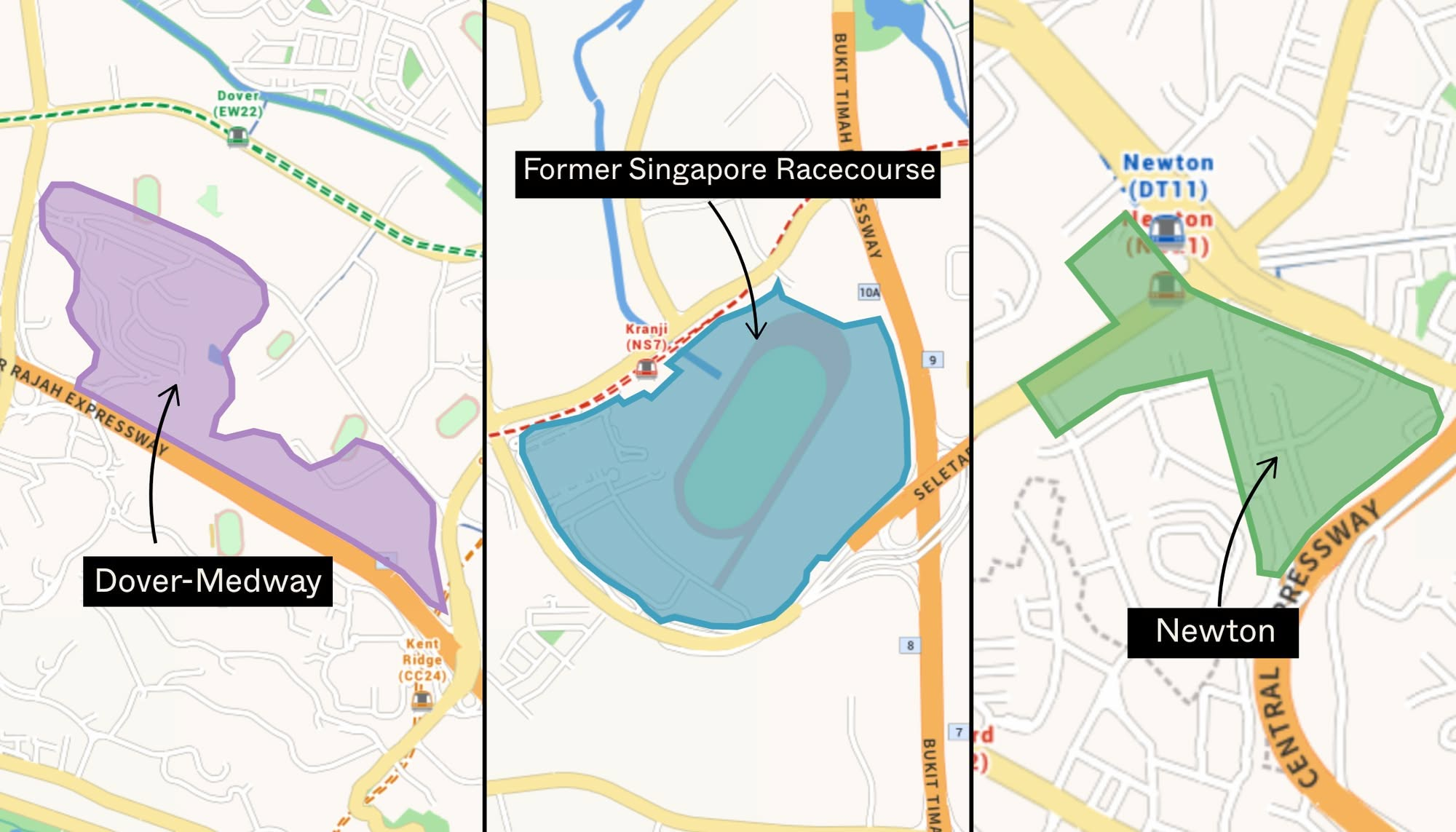

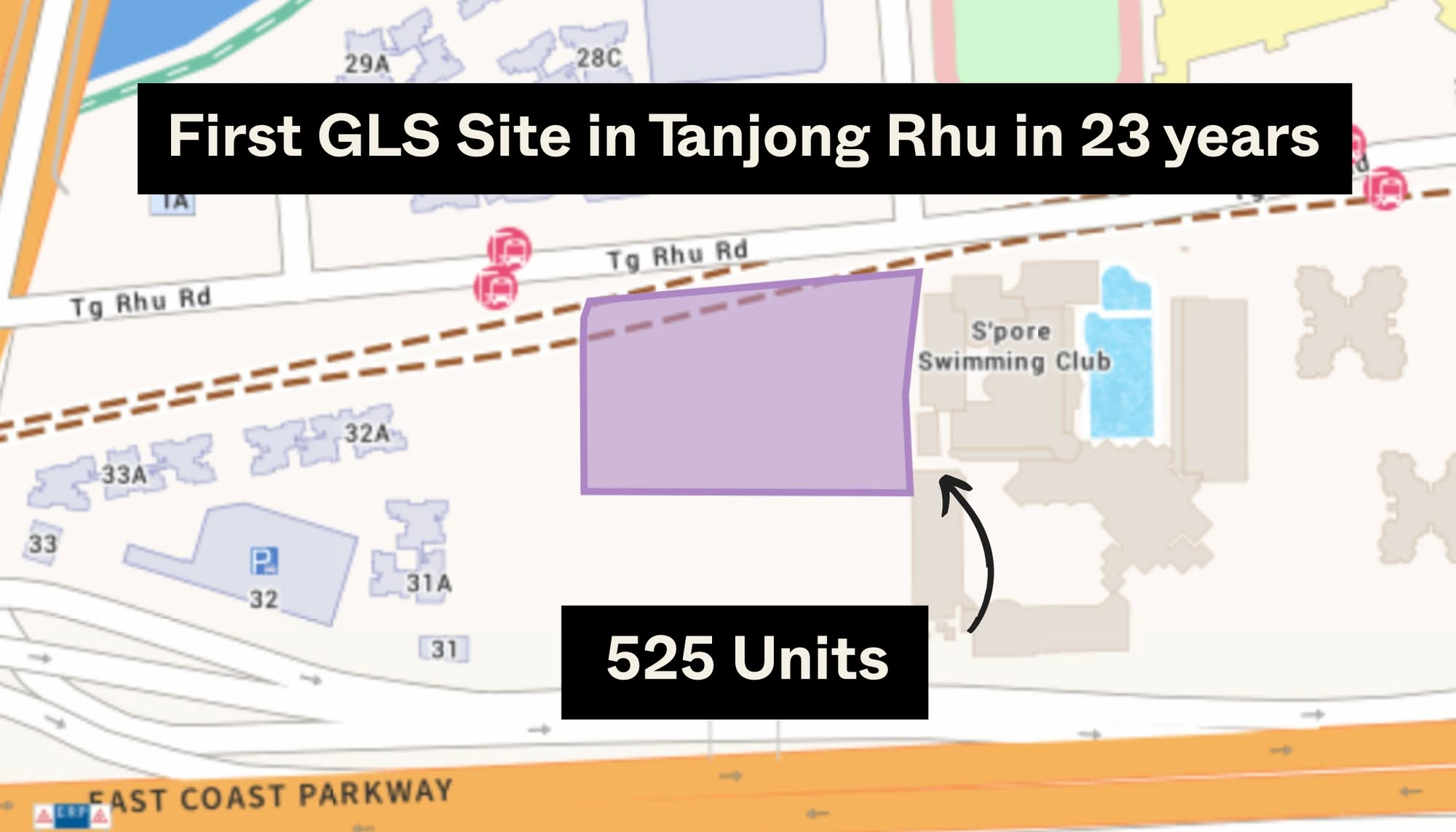

Singapore Property News 9,800 New Homes Across 11 GLS Sites In 2H 2025: What To Know About Tanjong Rhu, Dover, And Bedok

Singapore Property News Why HDB Needs To Build More 4 Bedroom Flats

Could you do 2-3 bedroom jumps? Not sure why that was missed