Margin Calls: Possibly The Most Overlooked Risk In High-quantum Properties

October 30, 2020

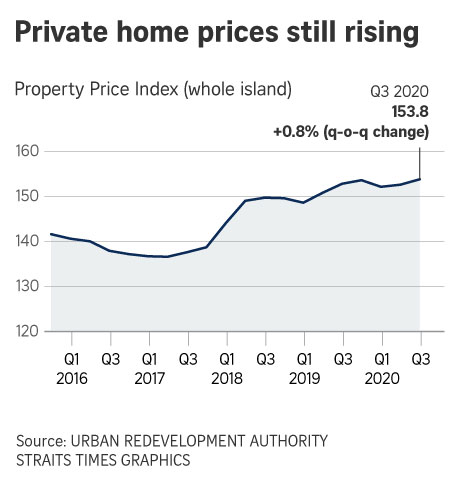

You could say that the Singapore private property market has left many people puzzled. Despite Singapore seeing its worst recession in over 55 years, home sales and prices are rising across the board.

HDB resale flats are at a 10-year high (volume wise), landed home sales are up 50 per cent, and private home prices continue a steady rise, quarter after quarter. Chalk it up to the reputation of Singapore properties as a safe-haven investment, or low interest rates (we detail it more here), but there’s no doubting the rising numbers.

However, this situation also means it’s time to sound an alarm bell: that’s the often-overlooked risk of margin calls. While these are rare for mass-market properties, the potential of facing one rises along with the quantum; and particularly at stake at the high-end luxury and landed homes (both of which are more popular in this pandemic environment).

What’s a margin call?

A margin call is when your bank requires you to top up your home loan. In effect, the bank has decided to lend you less than initially agreed, and is asking you to reduce your loan quantum.

The exact conditions in which your bank can do this are in the terms and conditions of your home loan. However, it mostly happens under two conditions:

1. Your property value is deemed to be lower than your outstanding loan amount

Say you own a luxury property, with an outstanding home loan of $1.5 million. Due to a downturn in the property market however, your home falls to a value of $1.4 million. The bank can ask you to top up the difference of $100,000.

2. Your property value is much lower than the Loan to Value (LTV) ratio allows

The maximum amount that you can borrow for your property is 75 per cent of the price or value, whichever is lower. A steep fall in property values can result in your LTV ratio being higher than 75 per cent, so a margin call is used to correct that.

For example, say you have a property that – after a real estate downturn – plunges to a value of $2 million. Your outstanding home loan is $1.6 million.

Your maximum loan quantum, however, should be $1.5 million (75 per cent of your $2 million property). This would result in a margin call, for you to top up the $100,000.

You can pay for the margin call using either cash, or your CPF (although you’ll have to contact CPF to explain your situation, and provide the supporting documents).

The terms and conditions regarding margin calls can vary significantly between banks

For example, some banks may give you 60 days to respond, others will only give you 30 days. Some banks specify when exactly a margin call will occur (e.g. when the property value falls by a specified amount), others can issue a margin call as and when they deem fit.

In all cases, failure to make the margin call can result in foreclosure. As such, it’s important to know the terms, especially if you’re taking a loan for a high quantum property (luxury or landed).

Why are high-quantum properties at greater risk?

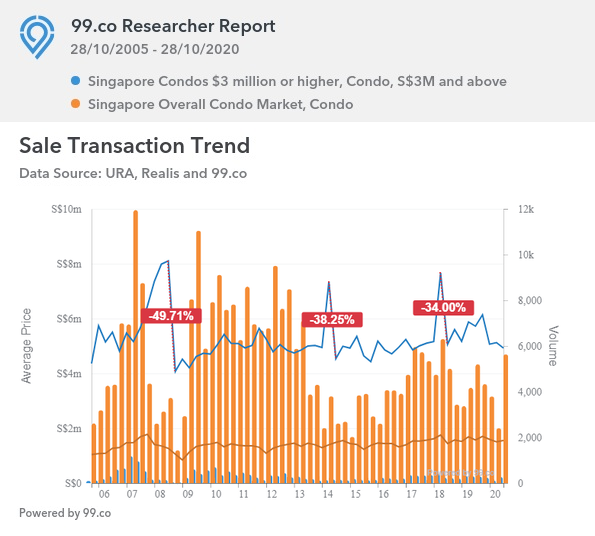

It’s due to greater volatility. Have a look at the following, where you can see the price movement of high-quantum condos ($3 million or above), versus the prices of condos in general.

This is the quarterly movement from 2005 to the present:

Between 2008 to 2009, in the wake of the Global Financial Crisis, high-end condos plunged 49.7 per cent.

After the slew of cooling measures in 2014, prices plunged 38.2 per cent.

More recently, trade war worries brewing in 2018, coupled with a fresh round of cooling measures, again sent prices down by 34 per cent.

For buyers who were unfortunate enough to purchase near the peak, the resulting price plunges could have been sufficient to trigger a margin call.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

“I Paid Down My Home Loan Early” 4 Homeowners Share How They Are Working Around Rising Interest Rates

With interest rates now sitting at over four per cent, and the potential for further hikes on the horizon, Singaporeans…

The prices of the condo market in general, however, are much less volatile. Most “regular” or mass-market properties are at little or no risk of margin calls – it’s just rare for the average property to suddenly lose over 30 per cent of its value.

How do you avoid the possibility of a margin call?

- Borrow less than the maximum allowable quantum

- Stick to less volatile properties

- Maintain a good credit report

- Don’t buy at property peaks

1. Borrow less than the maximum allowable quantum

You don’t have to use the full 75 per cent LTV, just because it’s available. The less you borrow, the less the likelihood of your property value falling below the allowable LTV.

This may be out of the question for some investors though, as for many of them a key draw is leverage (they want to use as little of their own money as necessary, especially given the low interest rate environment). As such, investors may need to take additional precautions, such as having savings to tide over such possibilities.

For homeowners, do consider taking a smaller loan if you can. Not only does it help to avoid margin calls, it means you’ll pay a bit less every month.

2. Stick to less volatile properties

We’ve mostly covered this above, where we discussed volatility.

If you choose to go for a high quantum unit, do so with the awareness of what you’re getting into. Volatility is an especially real concern due to the Covid-19 situation. In the last crisis, for instances, luxury property prices plunged sharply before recovering.

Property Market CommentaryAre Luxury Or Mass-market Condos Better Investments In Singapore?

by Ryan J. Ong3. Maintain a good credit report

There are many cases where – despite property values falling sharply – banks have decided against issuing a margin call. The bank can decide to wait a bit, and see if your property values recovers.

For the most part, this decision is based on how reliably you pay your home loan. If your mortgage is already in arrears, or the bank knows you’re heavily in debt, a margin call is more probable.

4. Don’t buy at property peaks

This is easier said than done. But if you’re buying a luxury property, it’s best to really ensure you are financially sound and that you pick the right property.

This requires you to monitor the overall market, and know the transaction history of the units you buy. If you need help with this, drop us a message on Facebook; we may have the information and the relevant experts you seek.

Just because it’s unlikely, doesn’t mean it won’t happen

Some bankers and agents may handwave the risk of margin calls. A common saying is that banks prefer not to do it, as any resulting foreclosure would be costly to them.

While true, this fact should be treated as immaterial. When a margin call does happen, you have one to two months to pay up a sizeable amount; it makes no practical difference whether or not the bank likes doing it.

As such, it’s advisable for all property buyers – but especially those purchasing high-quantum properties – to be aware of the risk. Do have additional savings, in the event that it happens.

We feel it’s an important consideration right now, just in case the Covid-19 situation causes the market to reverse course.

For more updates and tips on the Singapore property market, follow us on Stacked. You can also check out the latest condo offerings with our in-depth reviews.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is a margin call in property loans?

Why are high-quantum properties more at risk of margin calls?

How can I reduce the risk of facing a margin call on my property loan?

What should I do if I receive a margin call from my bank?

Are mass-market properties also at risk of margin calls?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

0 Comments