Looking To Buy Singapore Property In 2025? Here’s What’s Different (And What Could Catch You Off Guard)

May 17, 2025

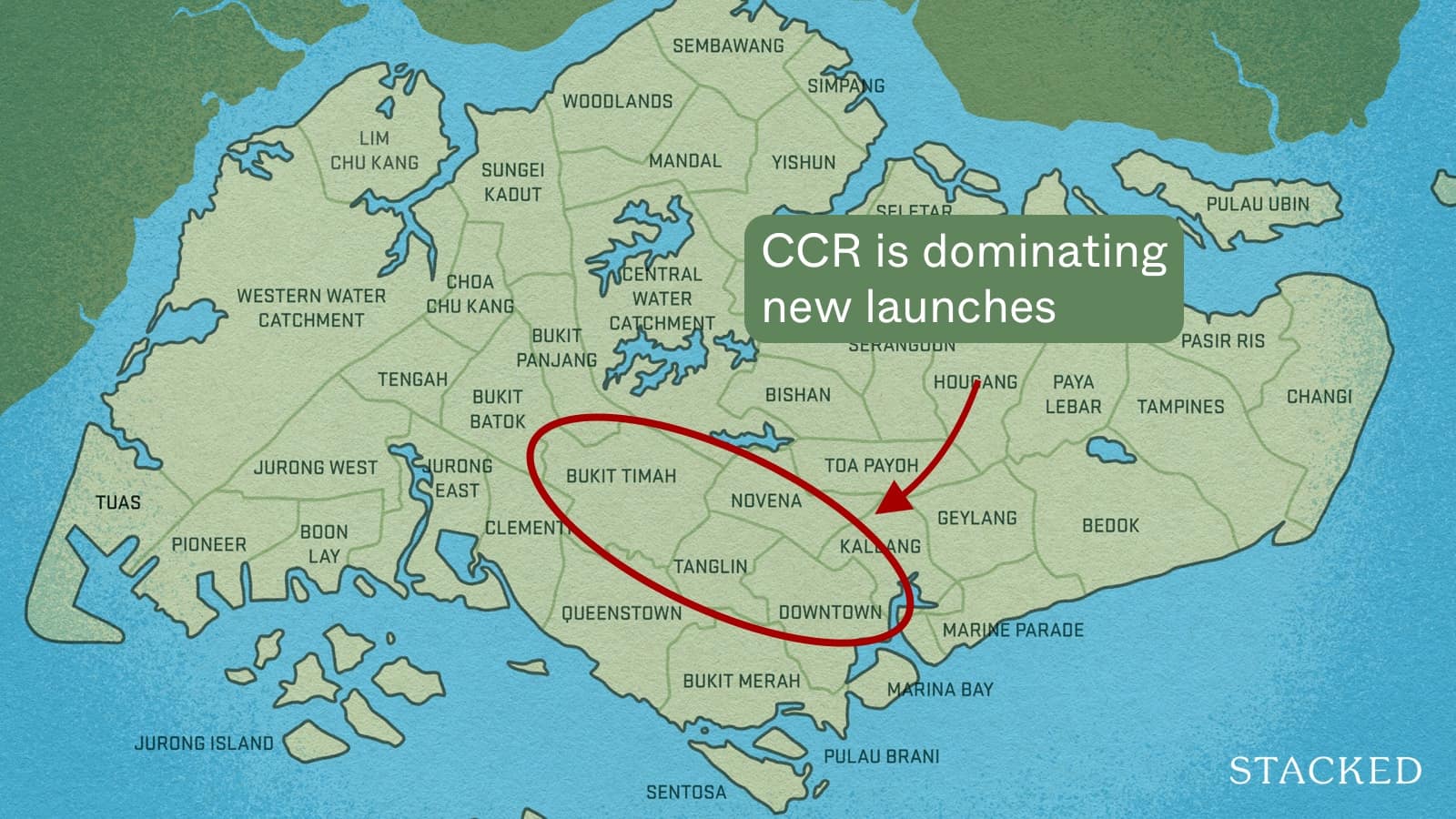

The 2025 property market is going to be unique, for several reasons: a pivot to the Core Central Region (CCR), a tight supply of resale homes, and an uncertain economy are at the top of these. Besides this, we’ll also see the outcome of cooling measures implemented over many years: will a 60 per cent Additional Buyers Stamp Duty (ABSD) prevent affluent foreigners from rushing into Singapore’s “safe haven” property market, as has occurred in the past? Whatever the outcome, one thing is clear—the average homebuyer in 2025 may see fewer options in the near term:

Three big factors limiting options for upgraders and other buyers

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Ageing and property replacement costs

This is really a combination of two factors, and it stems from the effects of age and the Total Debt Servicing Ratio (TDSR).

The TDSR restricts total monthly loan repayments to 55 per cent of the borrowers’ income, inclusive of other debt obligations. So if they have a combined income of $12,000 a month, this restricts them to a total loan repayment of $6,600 (assuming they have no other loans).

There is another element to this, though: the loan tenure. The longer the loan tenure, the lower the monthly repayments – and hence the more likely it is that a borrower will pass the TDSR. Conversely, a shorter loan tenure means higher monthly repayments, and a higher risk of failing to meet the TDSR.

Keep in mind that if the loan tenure exceeds the retirement age of 65, the maximum loan quantum falls to 55 per cent.

As a 45 per cent down payment is usually not viable, this leaves borrowers having to settle for a shorter loan tenure (e.g., an upgrader aged 50 years will probably have to settle for a 15-year loan tenure).

Let’s consider this scenario:

You and your spouse buy your first home, an HDB flat, at the age of 35. Fifteen years later, at age 50, you decide to upgrade to a private condo. Let’s say your intended new home costs $2.1 million.

At this stage, you earn a combined monthly income of $12,000. As mentioned above, this gives you a TDSR limit of $6,600.

Now here’s the issue: because you’re already 50 years old, the maximum loan tenure you can take is just 15 years (as they cannot afford a 45 per cent down payment).

At a four per cent floor rate for the mortgage (required by MAS when assessing loan eligibility), a 15-year loan with monthly repayments of $6,600 can support a maximum loan of only around $878,000.

(Note: This maximum loan amount is not exact, and may vary slightly depending on the methods of the bank you go to)

Suppose you sell their flat for $600,000, and we assume it’s fully paid off (no more outstanding flat loan or other costs).

That gives you a total budget of $1.478 million (i.e., total $878,000 loan + $600,000 from sale proceeds).

But with your dream condo costing $2.1 million, you still face a shortfall of $622,000; money they must pay in cash or from their CPF savings.

Our couple could possibly have made it when they were younger, but it’s less viable for them now.

Those who can still upgrade at a later age would likely need (1) a huge windfall, like selling their flat for $1 million or more, (2) above-average income, or (3) huge savings for bigger down payments; possibly a combination of all three.

Lacking these, our couple may decide to simply not upgrade and hold on to their existing flat. Given Singapore’s ageing demographic, this may be a factor that constrains the number of resale units entering the market.

More from Stacked

How Would Old People Affect The Future Master Plan?

As before, the Master Plan Review will be in gear over the next two to three years, and any property…

2. Most upcoming new launches are in less family-friendly areas

The next batch of new launches will mainly be in the Core Central Region (CCR). Around 14 of the roughly 22 remaining launches are in this region; and already we’ve seen some projects like Aurea, One Marina Gardens, The Collective at One Sophia, and so forth.

While these locations are prestigious, they’re typically associated with offices or sometimes high-end malls and entertainment; less so with family-friendly heartland living. One Marina Gardens, for instance, doesn’t have any primary schools within one kilometre. According to realtors we’ve spoken to, this is one of the most critical considerations among buyers.

It’s also been said, by buyers on the ground, that prime-area malls are not as superior to heartland malls these days. Barring some luxury brands (which are not everyday needs anyway), everything you can find in a CCR mall can probably also be found in Tampines Central, Waterway Point, Clementi Mall, etc.

Decentralisation has eroded the importance of the CCR, while other amenities, such as coffee shops or food and market centres, may better serve homeowners in an everyday capacity. While the government does intend to make CCR locations more balanced, it’s not as if they can build a lot of schools or markets there overnight.

But unless you go for resale, where there are few sellers, there’s not much choice in the near term. The CCR is where the new launches are going to be.

3. On the resale HDB front, time is needed for more supply to kick in

The number of flats reaching their Minimum Occupancy Period (MOP) this year is phenomenally low – about 6,974 units in 2025, as opposed to 30,920 units in 2022.

While HDB is ramping up construction (an intended 50,000 new flats released between 2025 to 2027), this doesn’t provide immediate relief. Those flats still have to be built and lived in for five more years before they join the resale market. With fewer people willing to let go of their flat right now (see point 1), it is unsurprising that buyers feel constrained.

For those who don’t have the option to just sigh and join the BTO queue, 2025 is shaping up to be a rather frustrating year.

What can buyers do about all these?

It’s time to recognise that, in the face of these constraints, an ideal property may not be possible – it’s now a matter of trade-offs. You may need to settle for a smaller two-bedder instead of a three-bedder, for example, if age prevents you from taking a bigger loan.

There may also have to be a compromise on location. We saw a good example of this way back in 2018, when Parc Esta was launched: part of the reason for brisk sales was its one-stop proximity to Paya Lebar Quarter (PLQ). In the same way, you might want to consider a project that’s much cheaper, despite being just a few minutes away by bus, MRT, etc.

For those looking at resale options, a final consideration is not to take too long. Resale buyers don’t have much of an advantage in this market; and waiting even a week or two can result in having to come back with a much higher offer.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What factors will make the Singapore property market different in 2025?

Why might homebuyers face fewer options when upgrading in Singapore in 2025?

How does age affect property financing options for buyers in Singapore?

Why are upcoming new property launches in Singapore mostly in less family-friendly areas?

What is the outlook for resale HDB flats in 2025?

What strategies can buyers consider given the constraints in the 2025 Singapore property market?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments