Why Some 30-Year-Old Leasehold Condos Are Still Outperforming New Ones

May 30, 2025

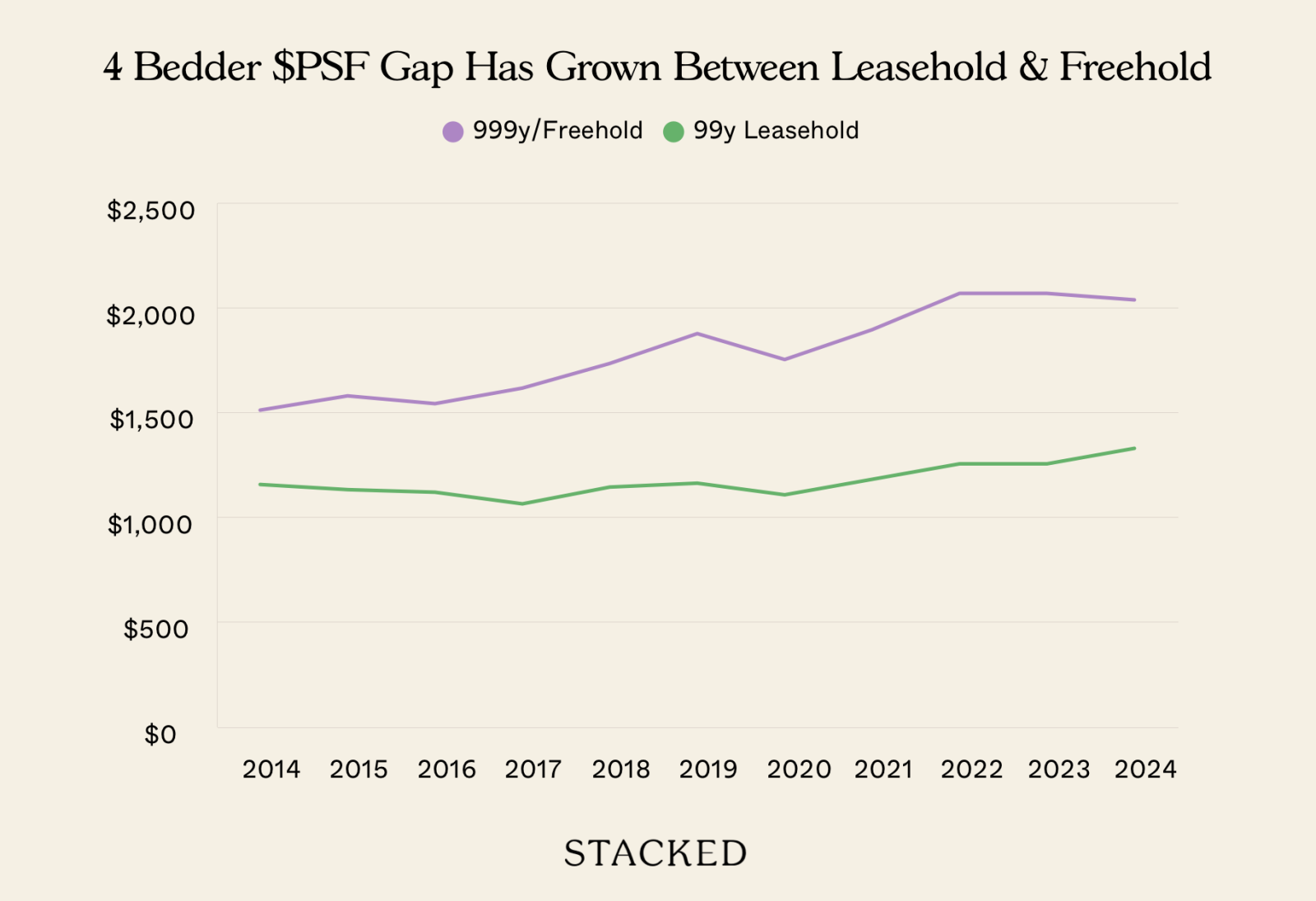

One of the most common worries about leasehold condos (which are the majority of projects in Singapore) is lease decay. At some point, as the lease runs down, appreciation has to flatline and eventually become depreciation. But when exactly does this happen? Is it in the first 30 years? Is it at the mid-point of a 99-year lease? Or does it come much later? This question has become more complex in the aftermath of COVID, when we’ve seen older condos show unexpected price spikes, and with more investors showing an interest in these ageing properties. Here are the numbers we’re seeing today:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

In this analysis of older leasehold condos, we find that:

1. Older leasehold condos (built in the 1980s–1990s) matched or outperformed newer ones in annualised price growth, over 3% per annum.

2. COVID-driven demand and WFH trends helped boost prices, especially for affordable, larger units in good locations.

3. While lease decay is real, short- to mid-term upside remains strong, and some of these ageing condos may still hold en-bloc potential.

👉 Follow our case studies on Orchid Park, The Tanamera, Loyang Valley, and the Arcadia, as we find out how they held up (or didn’t) under lease decay.

Get the numbers behind the insights — read the full report with Stacked Pro

A quick note on what we mean by “pitfalls and advantages”

Within the context of this article, the pitfalls we refer to are stagnant growth or price depreciation. Buyers, however, should be aware that there are qualitative factors outside of the price alone, such as ageing facilities or poor maintenance.

In terms of advantages, a lower price can mean a chance to buy a certain unit size or location that we usually can’t afford. For landlords, the lower price of an ageing leasehold unit translates to a higher rental yield.

Some of these qualitative factors are outside the purview of this data alone and may instead be covered by our many condo reviews.

Annualised growth rates of leasehold condos

This is a general snapshot of price growth for older leasehold condos (over 30 years old), compared to some newer counterparts.

Note that for the older condos, we have filtered for condos that have had at least one transaction per year since 1995, for a more complete picture of their price appreciation.

99-year leasehold condos

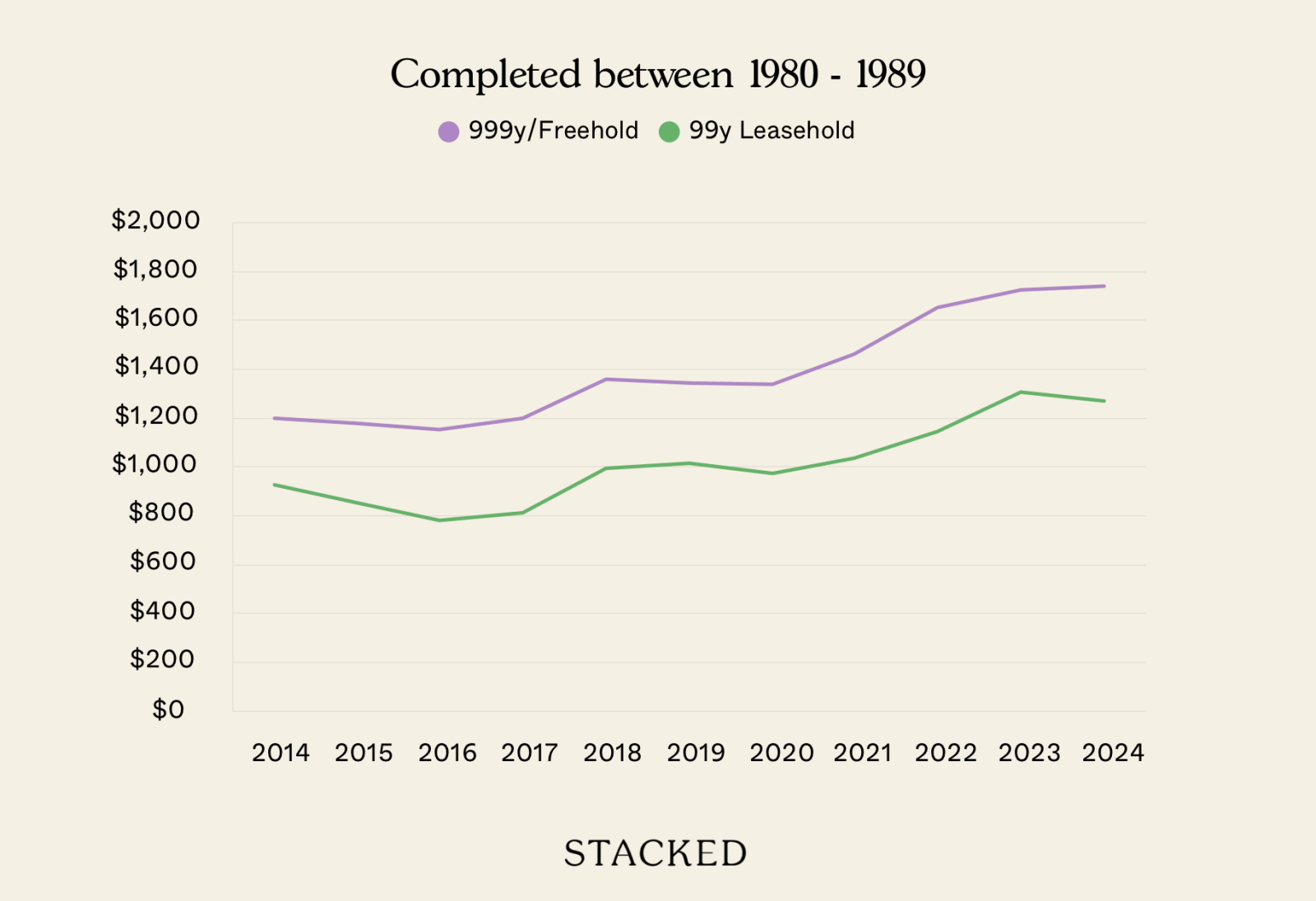

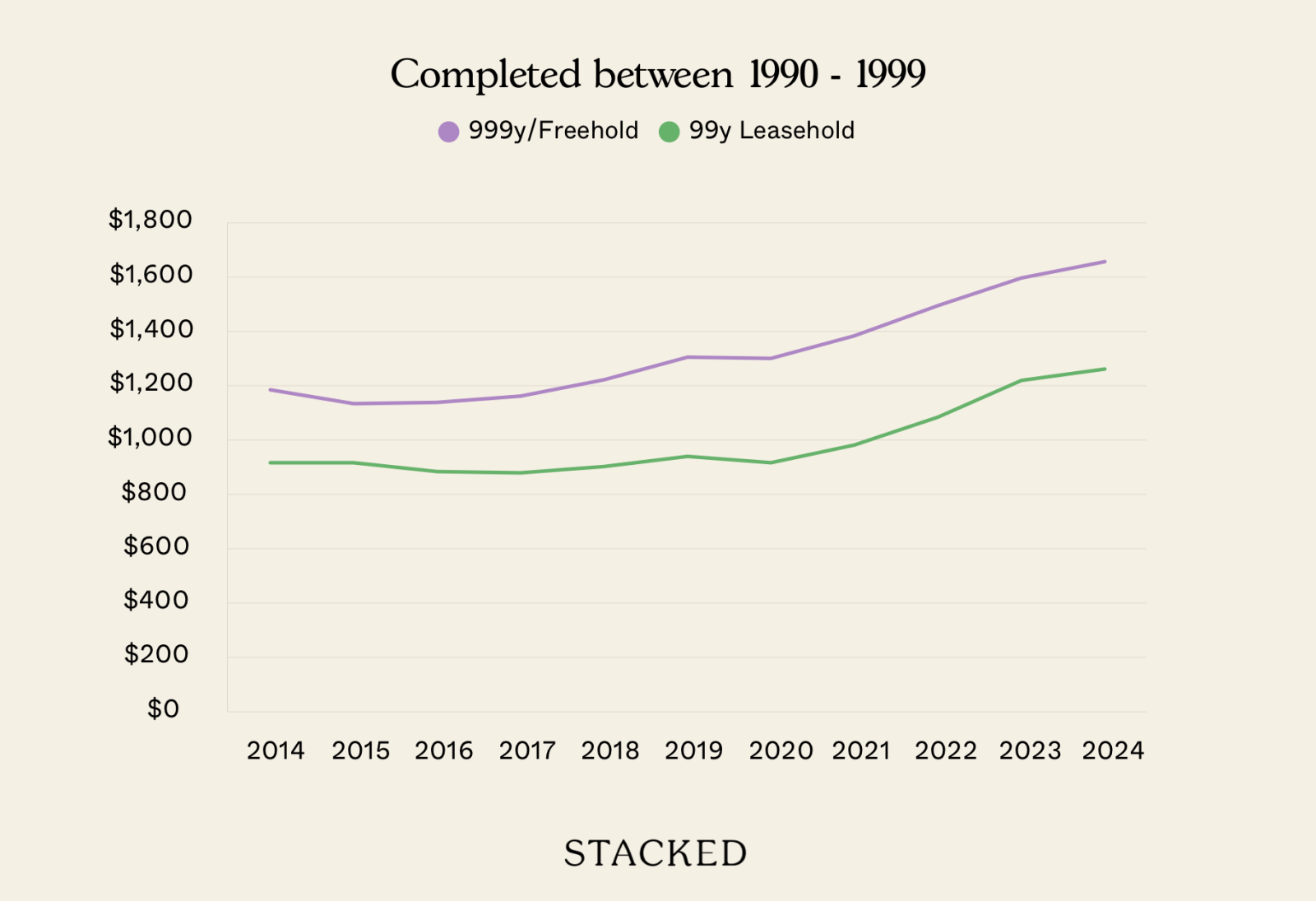

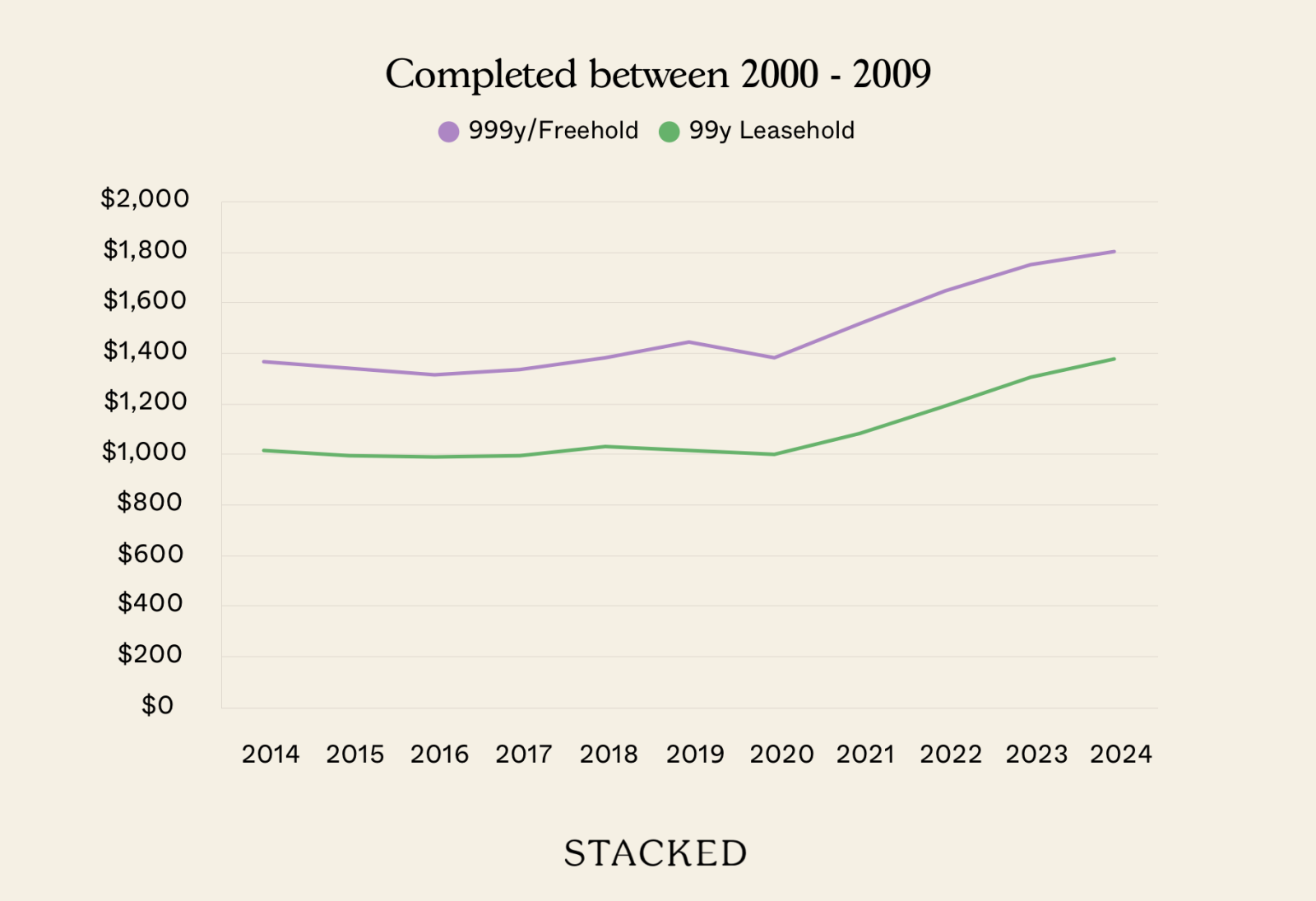

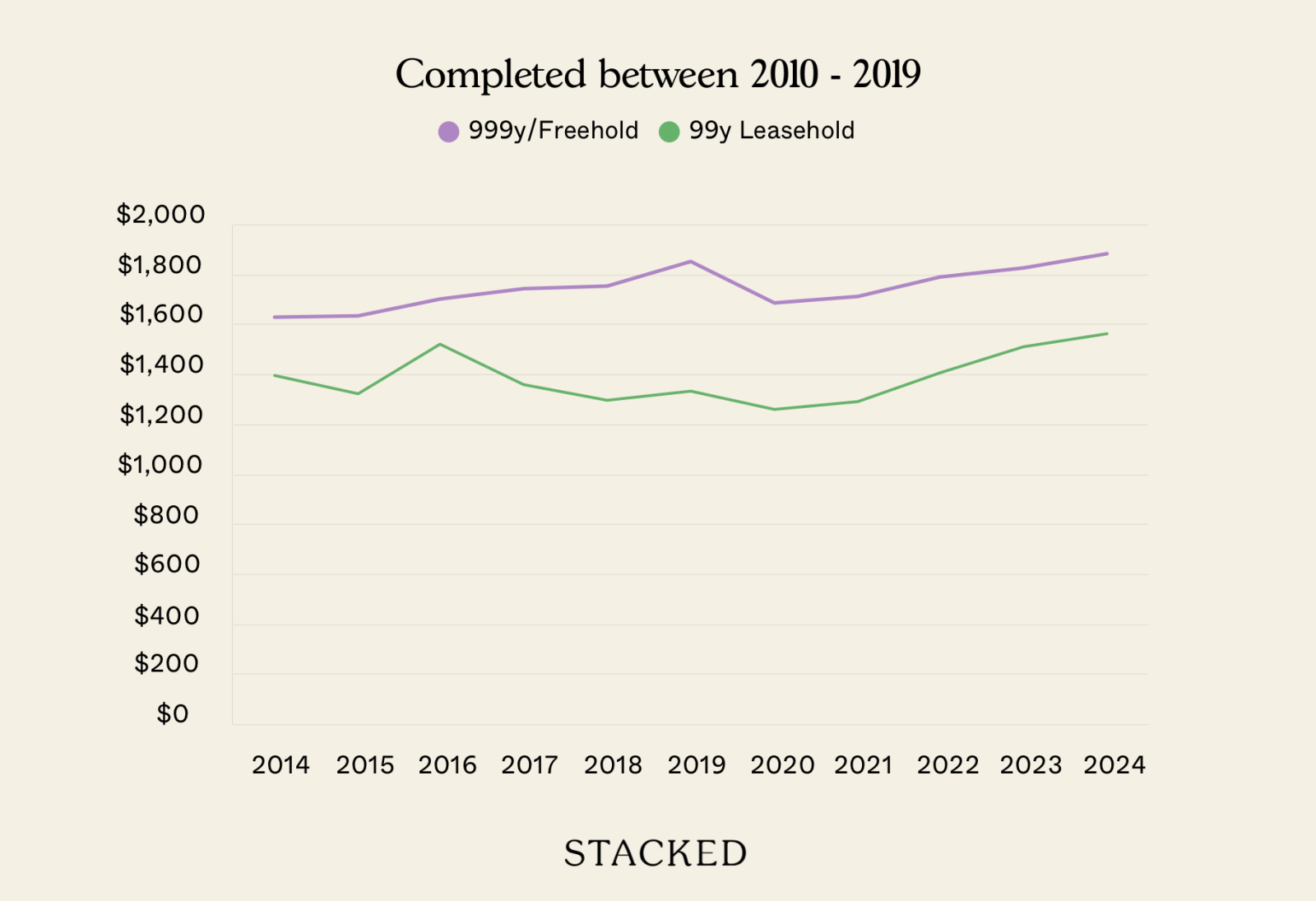

| Year | Completed between 1980 – 1989 | Completed between 1990 – 1999 | Completed between 2000 – 2009 | Completed between 2010 – 2019 |

| 2014 | $931 | $918 | $1,018 | $1,394 |

| 2015 | $855 | $915 | $998 | $1,325 |

| 2016 | $787 | $881 | $993 | $1,519 |

| 2017 | $818 | $879 | $995 | $1,357 |

| 2018 | $996 | $904 | $1,034 | $1,298 |

| 2019 | $1,018 | $941 | $1,019 | $1,333 |

| 2020 | $974 | $916 | $1,004 | $1,263 |

| 2021 | $1,040 | $981 | $1,084 | $1,291 |

| 2022 | $1,147 | $1,083 | $1,193 | $1,404 |

| 2023 | $1,307 | $1,219 | $1,304 | $1,511 |

| 2024 | $1,273 | $1,260 | $1,378 | $1,563 |

| Annualised growth | 3.19% | 3.22% | 3.08% | 1.15% |

More from Stacked

Are Older Three- and Four-Bedders in District 10 Holding Up Against the New Launches? We Break It Down

In our previous piece, we saw how one/two-bedders in District 10 fared. This time, we’ll turn to the larger three-…

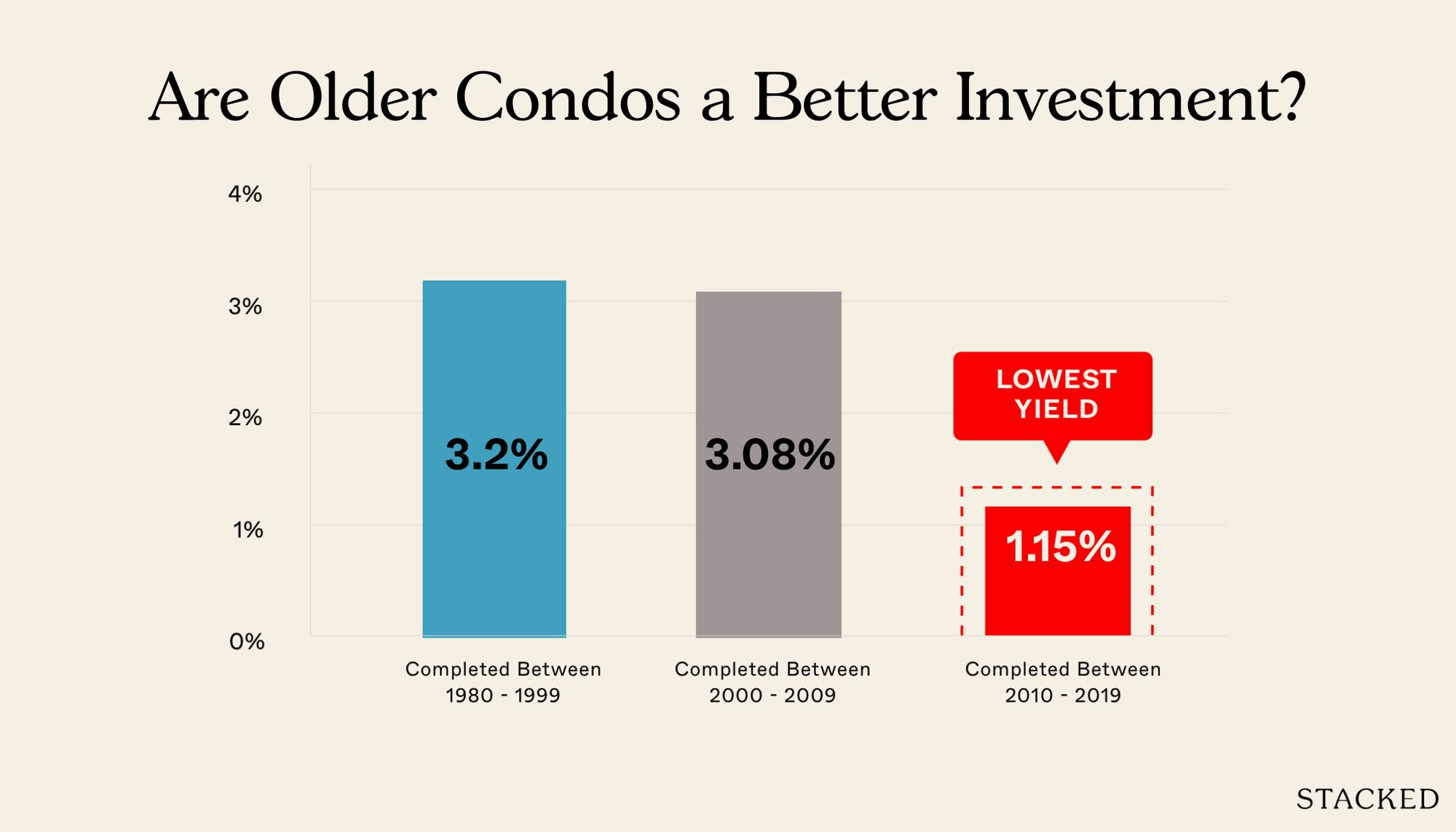

The older condos (1980-1989 and 1990-1999) still show consistent annualised growth rates of around 3.19 and 3.22 per cent, respectively. Condos built between 2000-2009 have slightly lower annual growth (3.08 per cent), while condos built between 2010-2019 have the lowest growth rate of 1.15 per cent.

This is the phenomenon we mentioned earlier: Due to the pandemic, even older condos have seen a surge in prices, which now makes it tough to determine their point of stagnation.

During COVID and its aftermath, Work From Home (WFH) became more widespread. Coupled with a lower supply of new housing, some people were willing to accept even older properties. Combine this with the fact that older condos, particularly those built in the 1980s and 1990s, already had lower price points than their newer counterparts.

As the market started to heat up, these older properties had more room for appreciation, simply because they were coming from a lower baseline. This explains the higher percentage increase in price compared to newer properties, which started at higher prices.

This analysis challenges the assumption that older leasehold condos always perform worse.

In fact, units from the 1980s and 1990s grew just as well, or better, than newer ones over the last decade. While lease decay remains a long-term risk, the short to medium-term performance suggests factors like location, size, and affordability can outweigh age concerns, especially when newer launches come with premium pricing.

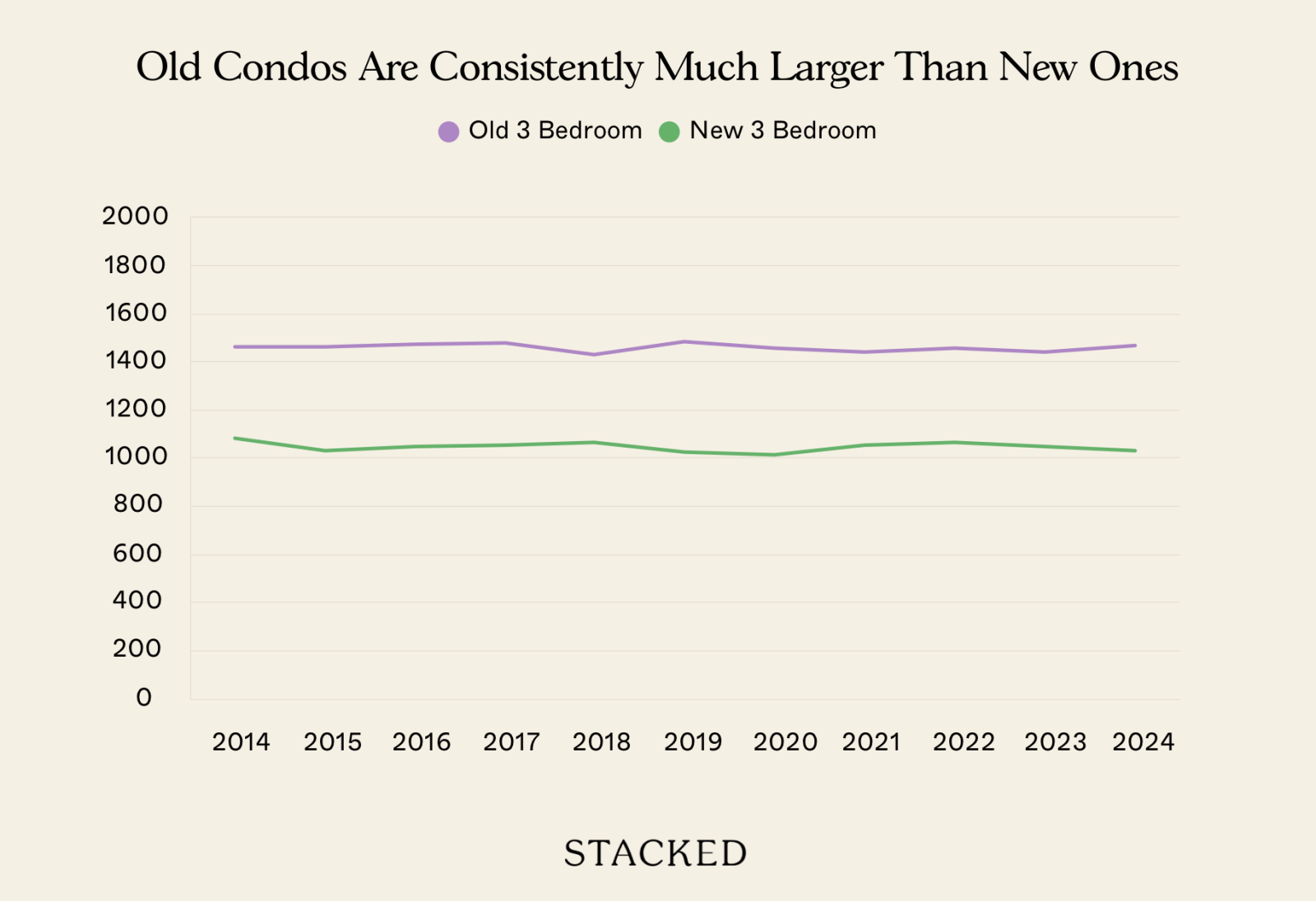

It’s also worth considering factors that aren’t reflected in the data. For example, an older leasehold condo in an area that has seen significant improvement might have better en-bloc potential, and factors like size (the oldest projects tend to be larger) can draw higher demand.

As always, though, it’s good to look at specific examples.

To do that, we’ll look at case studies of Orchid Park, The Tanamera, Loyang Valley, and The Arcadia. These are all older condos aged 25 or more, which are leasehold. If you’re purchasing or selling a 99-year lease condo, you’ll definitely want to see the findings to inform your future decisions, so follow us on Stacked and subscribe for the upcoming results.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Do older leasehold condos in Singapore still appreciate in value?

How has COVID-19 affected the value of older leasehold condos?

Are older leasehold condos a good investment despite lease decay concerns?

What factors influence the performance of older leasehold condos in Singapore?

Is it true that newer condos always perform better than older ones in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments