Is It Still Safe To Buy A Home In 2025? Why Singapore Property Buyers Shouldn’t Panic

April 27, 2025

With recent fears of an escalating trade war, we’ve seen more buyers switch to a nervous, “wait and see” approach. This is despite the risk of rising prices, and potentially having to pay more for their home later (or worse, being priced out of a sufficiently large unit). Whilst we’d never downplay the need for caution, there are a few key considerations here, such as how difficult it is to truly be overleveraged, even if you tried. Here are some reasons to stay calm:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Due to debt servicing ratios and Loan to Value ratios, it’s hard to be overleveraged (assuming you didn’t get help for the down payment)

One rule of thumb for housing is “3-3-5.” This means you should have 30 per cent of the capital needed to buy, the monthly loan repayment should not exceed 30 per cent of your combined income, and the property should not exceed five times your combined annual income.

With regard to HDB properties, you don’t have much choice in the matter. The Mortgage Servicing Ratio (MSR) caps home loans to 30 per cent of the borrowers’ monthly income: you can’t go past this even if you wanted to.

For private bank loans, the Total Debt Servicing Ratio (TDSR) caps your total loan repayments – inclusive of debts like car loans and personal loans – to 55 per cent of borrowers’ monthly income. While this can exceed the 3-3-5 rule, it still means it’s difficult to be seriously over-leveraged. It’s also worth noting that the projected interest rate, for calculating TDSR limits, is set at four per cent per annum: this is actually higher than the market rate for private bank loans. This is specifically so that, even if the rate rises, borrowers won’t find themselves overstretched.

(For Executive Condominiums, you need to pass both the MSR and TDSR)

For example, say a young couple earns a combined monthly income of $8,000.

If they’re buying a flat with an HDB loan, the (MSR) limits their monthly repayment to 30 per cent of their income, which is $2,400 per month.

Assuming a 25-year loan tenure at three per cent interest (this is the floor rate for HDB loans), that gives them a loan amount of roughly $509,000.

With the Loan-to-Value (LTV) limit of 75 per cent, the maximum flat price they can afford is roughly $678,667. They can’t just go out and overleverage themselves to buy a million-dollar flat, even if they wanted to.

What about private property?

It’s improbable that a first-timer can take a loan to buy a private property today. Most buyers will be upgraders who need substantial sale proceeds, again due to financing restrictions. For example:

Let’s say a couple is buying a private property priced at $2 million, and they’re applying for a bank loan. The Loan-to-Value (LTV) limit is 75 per cent, so the maximum loan amount they can get is $1.5 million.

This means they need to pay $500,000(!) upfront as the down payment.

Assuming the couple has a combined monthly income of $15,000, their TDSR limit (55 per cent) is $8,250 per month.

Based on a floor rate of four per cent for private bank loans, a $1.5 million loan, over 25 years, would result in a monthly repayment of roughly $7,918 per month: well within their $8,250 TDSR cap.

These rules force a level of prudence. If you don’t need help with making a bigger down payment, and your income is at these levels, chances are you won’t be as overstretched as you might imagine.

(But we still suggest keeping monthly loan repayments at 30 per cent or below if you really want to be safe, even if you’re not subject to the MSR for private homes).

A quick note on LTV ratios

Ever since 20th August 2024, HDB loans have had the same LTV limits as private bank loans. You need a minimum down payment of 25 per cent of the property price or value, whichever is lower.

This also makes it harder to over-leverage today, unlike the less-regulated days of the ‘90s or ‘00s, when you really could get into trouble with gigantic loans.

2. Self-employed or work on commissions? That’s already accounted for

A haircut of 30 per cent is applied to your earnings, when your MSR or TDSR are calculated. This is based on your declared earnings in your annual Notice Of Assessment (NOA).

So if you try to get In Principle Approval, and you can meet TDSR or MSR limits even when self-employed, chances are you’re in a safer position than you think.

3. You no longer need to clear out your CPF OA, and can keep up to $20,000 in it

If you bought a home before 2018, you should be aware of a significant change: you no longer need to drain your CPF OA when taking the housing loan. Previously, you had to use as much as you had (this rule was to prevent people from borrowing more than they needed).

More from Stacked

5 Interesting 4-Room HDB Layout Ideas To Utilise Your Space Better

Despite all the complaints that people may have about HDBs in Singapore, there’s a lot to admire about how different…

Note that for most HDB properties, such as in the example above, $20,000 is enough to service the loan for around eight months in an emergency. For private properties, though, this might only account for around two to three months, so you may want to pad your emergency fund a bit.

As an aside, you’ll also earn the guaranteed 2.5 per cent interest on this amount, which further builds your safety buffer.

4. You have various loan options, if the economy looks volatile

For those who can qualify for HDB loans, you’re in luck: the HDB interest rate is pegged to the CPF interest rate, and not the wider market rate. It’s always 0.1 per cent above the prevailing CPF rate.

It doesn’t matter whether trade wars or pandemics cause interest rates to spike – those with HDB loans have been paying the same 2.6 per cent throughout the decades.

For private bank loans, a mortgage broker can help you with volatility concerns. You can, for instance, pick a longer interest rate period, such as a three-month SORA rate instead of a one-month rate. When interest rates climb, you’ll still be pegged at the rate from three months prior, thus slowing the increase.

Some banks also offer fixed interest rates for a certain duration; three to even five years can be found most of the time. This can also help you to plan financially and keep things predictable.

At the end of the fixed-rate period, incidentally, you might be able to find yet another fixed-rate package to refinance into. Sometimes called a semi-fixed rate, this is a tactic where you move from one fixed-rate to another to ensure your finances are on track.

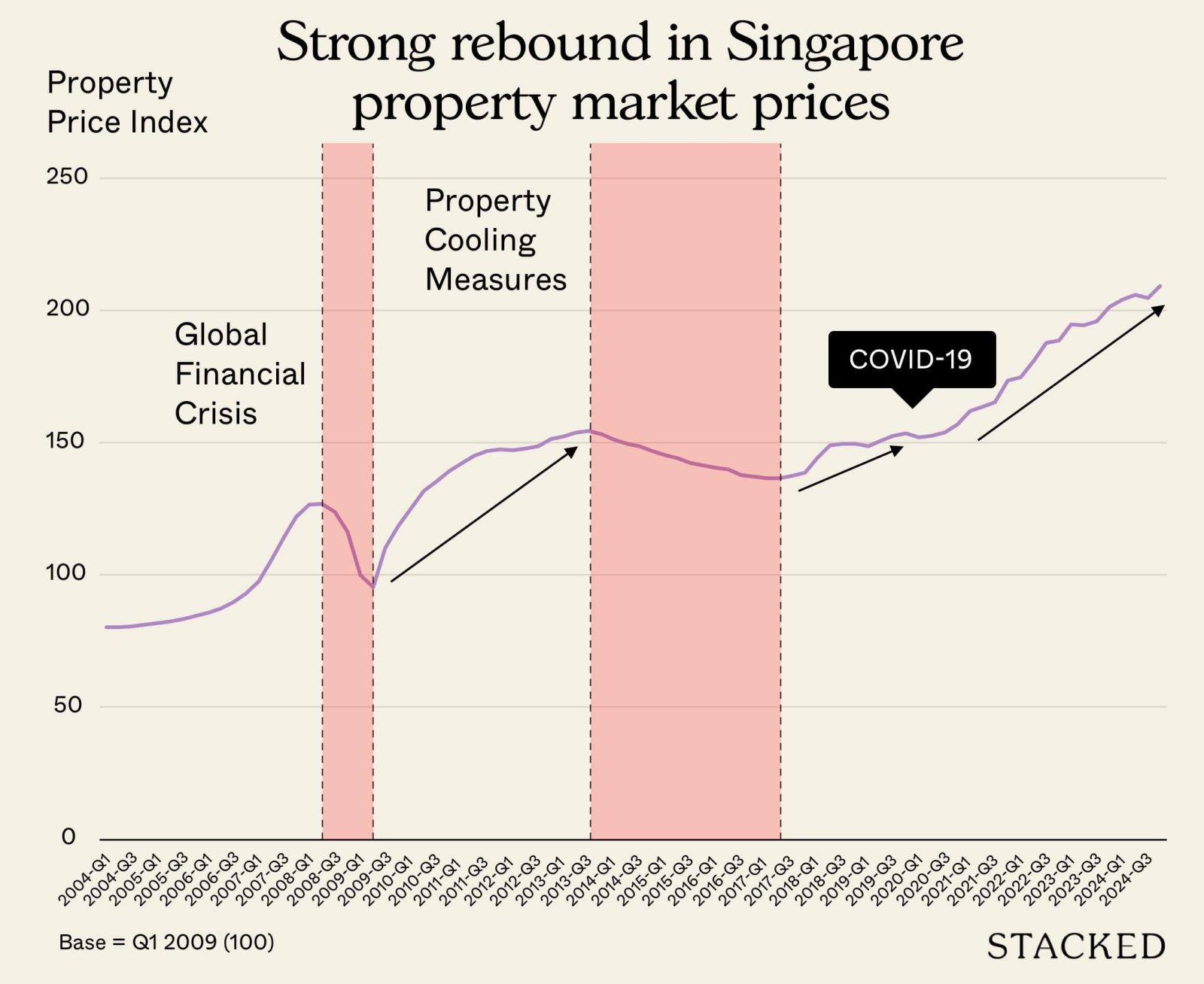

5. Don’t forget that prices are suppressed by cooling measures, which can be changed if the market goes south

In reality, the prices you’re seeing in the current property market would be even higher, were it not for cooling measures. The Additional Buyers Stamp Duty (ABSD) and Sellers Stamp Duty (SSD) work hand-in-hand with loan curbs (see above), and these help to prevent bubbles from forming.

It also means that, if property prices start to decline too fast or at inopportune moments, the government can revise the cooling measures. Lowering stamp duties, reducing the time period when SSD applies, reducing property taxes, etc. can help property prices to recover.

The fundamental demand for real estate remains strong, and it’s highly improbable that you can’t find a buyer if you ever need to sell, or that you’ll end up with a loss (although this still requires you to make smart property picks). Even if your personal financial situation declines, chances are you’ll have decent offers if you’re forced to right-size again.

6. If the private property you’re eyeing is a new launch, you’re not paying the full loan repayment from the start

To be clear, you still need to qualify under the TDSR framework (it’s calculated based on the full repayment). But while the project is under construction, your payments are based on the Progressive Payment Scheme (PPS).

The monthly loan repayments go up gradually as the developer completes different milestones in the project. This makes it easier on your cash flow and saves you some interest repayments (it’s also one of the reasons why some sub-sales are so profitable).

Unfortunately, there isn’t a way to give you specific numbers here, as the construction speed will differ for each project. Some take longer to reach certain milestones, whereas some may even complete multiple steps in one shot.

Nonetheless, the period under construction also gives you time to save up and build your buffer.

It’s a balance between preparation and waiting too long, whilst prices rise

If we look at the history of property prices in times of tumult, we can see that a sharp recovery tends to follow, and over time, it ends up even higher than the last peak. We saw this most recently during COVID, but also during the Global Financial Crisis, and other similar events:

It’s absolutely true that you should save up and meet the 3-3-5 parameters first if possible; and pay down any existing debt. But once you have a sufficient buffer, do consider moving in to get the home you need, rather than waiting too long and watching prices climb.

Next, we’ll quantify the effect of staying too long in “wait-and-see” mode, and how it can leave you priced out or stretched. We’ll also be looking at the times when Singapore property prices actually managed to fall, rather than just rise more slowly. Follow us on Stacked for updates.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is it still safe to buy a home in Singapore in 2025 despite economic concerns?

How do Singapore's mortgage rules prevent overborrowing?

Can self-employed individuals qualify for property loans in Singapore?

Do I need to use all my CPF savings when buying a home in Singapore?

What are the benefits of buying a new launch property during construction?

How do cooling measures affect property prices in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

0 Comments