Is Housing In Singapore Still Affordable To The Average Singaporean In 2022?

March 29, 2022

Home prices are at record highs in 2022, and now we face the threat of higher interest rates; we’re not surprised that home buyers are starting to get anxious. This leads us to that old battleground of divisive opinions: how affordable is housing to Singaporeans, especially in light of recent events? Here’s a quick take on what we’ve seen lately:

How well are Singaporeans doing financially?

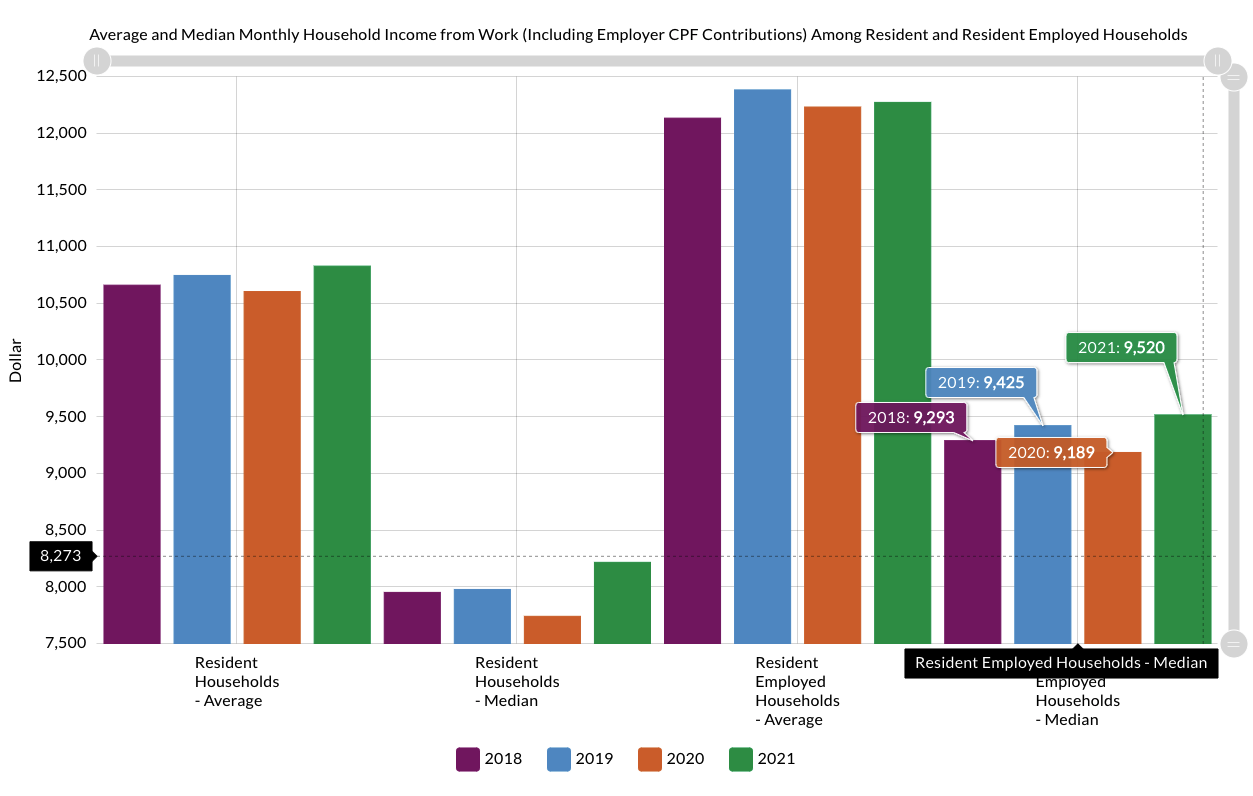

According to SingStat, the median monthly household income stood at $9,520 (inclusive of CPF contributions) in 2021.

With the exception of 2020 – when Covid-19 was at its peak – the median monthly household has risen every year since 2010.

In terms of savings, there was a recent answer to a parliamentary question that provides some information. Between 2017 to 2020, personal savings grew from $67 billion to $106 billion, while the savings rate rose from 28.6 per cent to 40.6 per cent.

For the total amount of savings in 2021, this was recorded in a recent piece in the Straits Times at $96 billion – a lower figure compared to 2020

So median income is growing, and Singaporean are saving more. The question is whether it has kept pace with property values.

Our biggest assets and liabilities are both our residential property

We can see here that residential property makes up a large chunk of our household assets; about 42 per cent.

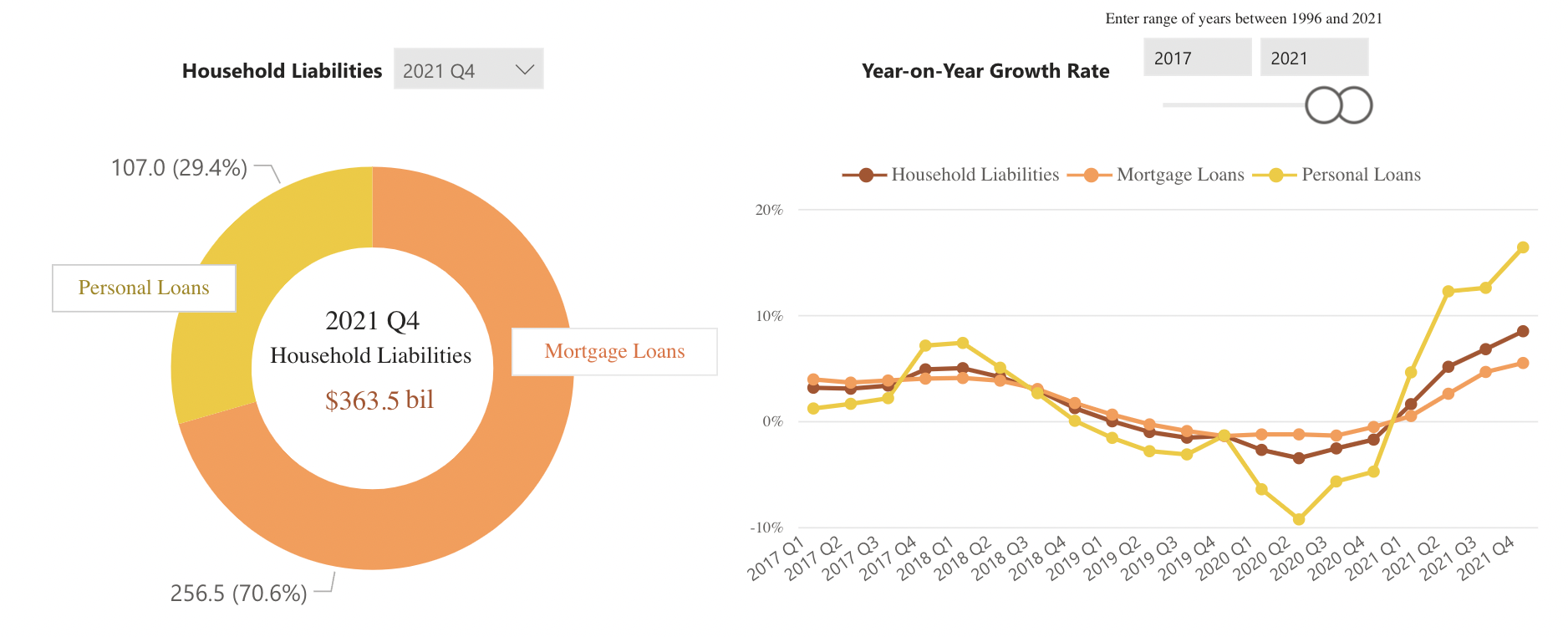

At the same time, however, our biggest liabilities are our mortgages: we owe about $363.5 billion in home loans, accounting for over 70 per cent of our liabilities. As befits our growing savings rate (above), less than a third of our liabilities are in other personal loans.

Now it’s not uncommon that mortgages make up the bulk of our liabilities – this will be true in most countries, as a home is usually the most expensive thing someone buys in their lifetime.

However, there could be some correlation between our rising property asset values and rising mortgage debt. It’s possible that, because property values have risen so much, we also need to take on larger loans to purchase homes.

Unfortunately, we have no breakdown by age, as that would give us a more accurate picture.

Can Singaporeans afford their homes?

There are many different ways to measure housing affordability, none of them perfect. However, to keep things simple, let’s look at what the CPF board often recommends: the 3-3-5 rule. Yes, it’s very conservative (and most people can’t keep to it), but sometimes it’s just good sense to err on the side of caution.

The measure of prudence here (initial capital aside) is that monthly loan repayments don’t exceed 30 per cent of the borrowers’ income*, and the total cost of the property does not exceed five times their annual income.

If we use the median household income above ($9,520 per month, or $114,240 per annum), this would mean the typical Singaporean home should not cost more than $571,200 (five years of annual income).

In addition, at $9,520 per month, the monthly loan repayments should not exceed $2,856 per month. How well do our homes fall within these amounts?

*For HDB properties you don’t really have a choice, as the Mortgage Servicing Ratio (MSR) enforces this 30 per cent limit. Private property buyers can elect to take on higher debt, so long as their monthly loan repayments plus other debt obligations don’t exceed 55 per cent of monthly income; this is the Total Debt Servicing Ratio (TDSR).

Affordability Example 1: Resale, 4-room HDB flat

Note: We are making some admittedly large generalisations, by taking the average quantum of a property across Singapore. In reality, location, age, and other such factors will result in significant divergences – the average price of a home “in Singapore” can seem misleadingly high if you compare it to prices in Sengkang, and misleadingly low if you compare it to prices in Tanjong Pagar.

In addition, note that many Singaporeans do not take the maximum possible loan quantum for HDB flats (you can only reserve up to $20,000 in your CPF, the rest must be used for your home; this will generally exceed the minimum down payment). In practice, Singaporeans will borrow less than these examples suggest, for HDB properties.

The following provides a quick snapshot, without too many specifics.

As of February 2022, the average price of a resale 4-room flat (excluding subsidies) was about $528,221.

Assume we borrow 85 per cent of this price (the maximum for HDB loans), or $448,988. This is on a 25-year loan tenure, at 2.6 per cent. This would require a monthly payment of around $2,037, still well below the 30 per cent MSR.

Going by median income, the monthly repayments are well within parameters; and the overall cost of the home is also still manageable (going by the unsubsidised price).

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

An Introvert Buys Property In Singapore: Going It Alone (Part 1)

Buying property can be daunting, and more so if you’re single. And even more so if you’re an introvert.

Affordability Example 2: BTO 4-room flat

Let’s take a look at a non-mature area, like Jurong West, where the last BTO launch (at the time of writing) was in November 2021. We can see that 4-room prices were between $264,000 to $321,000 (before any subsidies).

BTO ReviewsNovember 2021 BTO Launch: Ultimate Guide To Choosing The Best Unit (New PLH Model)

by Sean GohThis would be within five years of income for the typical Singaporean family, so there’s a pass already.

If we take the maximum HDB loan amount for a $321,000 flat, over 25 years, monthly loan repayments are just around $1,237. So even without subsidies, these flats are well within the price range of middle-class Singaporeans.

Affordability Example 3: Private non-landed property

As above, we’ve had to make some generalisations here. This average is based on 99-year leasehold condos in the Outside of Central Region (OCR). We have also kept to three-room units (roughly 900 to 1,000 sq. ft.), as these are usually the smallest sizes that a family would consider buying.

As of end-February 2022, the average price was $1,432,639; well above the five-year-income limit for the typical Singaporean family.

We have to use bank loans for private properties, so the maximum loan amount is 75 per cent of the price (this may cause some difficulties with the down payment, which will amount to around $358,160, of which around $71,632 must be paid in cash).

This is a loan of around $1,074,479. Over 25 years at two per cent per annum, this is a monthly repayment of $4,554, past the 30 per cent income limit of most families (we’d also add that most typical mass-market condos can come with monthly maintenance fees of $300 to $400, which should be taken into consideration).

As such, even a mass-market, fringe region condo is probably unaffordable as a first-home choice. The average Singaporean will have to get one via asset progression (e.g., sell an appreciated flat), or after a significant length of time-saving and investing.

So, are homes affordable to Singaporeans?

It ultimately depends on your situation. For example:

Say you and your spouse are both Permanent Residents, or you’re a lifelong single. This may restrict you to resale properties, where you might find the price is past your five-year income level; and if you’re on a single income, you may even bust the 30 per cent MSR limit.

But if you’re a Singaporean family who can wait out the four-to-five-year build time and qualify for a BTO flat, owning a 4-room, or possibly even a 5-room, is much less challenging.

There’s also the issue of what you consider to be an acceptable quality of housing. If your absolute minimum requirement is a 1,500 sq. ft. unit, for example, or HDB is simply too densely packed for you to handle, then you’re in a tight spot.

If you don’t lower your standards as a median-wage earner, your desired homes are all likely to be unaffordable. The fact is, you’re probably priced out of even the cheapest condos (which is not to say that you can’t get there eventually, just that it probably won’t be your first, or possibly even second, home).

As far as providing a roof over your head goes, HDB meets this requirement quite well; and with the plus point that most flats are a stepping stone to something greater. If that’s sufficient, then yes, homes in Singapore are no doubt affordable.

If you’re confined to the resale market, things may be a bit tougher on you; but it’s improbable that you’re truly priced out of everything. You may just need to accept smaller or less convenient locations.

For those who absolutely can’t buy an HDB flat (e.g., you’re a foreigner and would pay ABSD to boot), we hope you’re wealthy or highly paid; because you’re in one of the most expensive housing markets in the world.

Then again, with strong household savings growth due to the pandemic (and even with a whole lot of cooling measures), it’s perhaps not surprising that the property market in Singapore is as resilient as it is.

For more on the Singapore property market, follow us on Stacked. We’ll keep you up to date on the recent discussions, and on new and resale developments alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is housing in Singapore affordable for the average family in 2022?

What does the 3-3-5 rule say about housing affordability in Singapore?

Are HDB flats considered affordable in Singapore?

How does the cost of private condos compare to income levels in Singapore?

What factors influence whether homes are affordable for Singaporeans?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

0 Comments