Is A New Launch Condo Really Better Than A Resale? We Debunk 5 Common Agent Sales Pitches

August 1, 2024

Perhaps it’s the higher commissions from new launch condos, or perhaps it’s a lack of availability. Still, some property agents are dead set on convincing you to stay away from resale condos. We’ve seen a lot more of this of late, so we’re not sure if it’s some kind of trend/training process. Regardless, we’re taking a look at some of the reasons they give, and examining how true some of them are. Here’s what to know when you’re given these reasons why a resale condo is not as good as a new launch:

Many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

First, a quick note on the performance of resale condos versus new launches

Back in late 2022, we did a deep dive comparing the performance of resale to new launches, over a five-year span. Our conclusion was that resale won by a very slim margin: 91 per cent of resale buyers saw gains, versus 89.8 per cent of those who bought new. As the margin is so slim, we’d be skeptical of any claims that suggest a major difference in gains/losses just on the basis that a project is new or resale.

In any case, just note that it is never a conclusive one between a resale or a new launch and it is project-dependent.

1. You are already buying higher than the earlier owners, so you have a higher risk buying later

The logic works something like this: the original owners of a resale condo purchased it at about $900 psf a decade ago. But if you buy today, you’re buying at around $1,500 psf. Therefore, you need to wait for prices to appreciate more, before you see a good return.

This isn’t so much a problem when the property market is doing well, as who wouldn’t want to sell for as high as they can? The issue arises more if the market isn’t doing well. The original buyers might be willing to sell at a lower price, as they would already see returns – but this can pull down the project’s average price, which would be bad for you. As such, it’s better to be an original buyer yourself (i.e., buy a new launch at floor prices).

In general, this makes sense, especially when you are buying an older development that hasn’t had a transaction in a while. Your neighbours would certainly be happy that someone else has bought in at a new high for the project.

However, in other cases, this is difficult to verify. First off, some older resale condos see predominantly resale-to-resale transactions, and not new-to-resale transactions (i.e., the majority of current owners weren’t the original buyers either, and may have purchased more recently and at higher prices).

Second, there’s no guarantee that buying a new launch means your specific unit, in that specific new project, is going to see better returns than a resale unit. There are buyers who have bought older units who have profited from an en-bloc, or found motivated buyers because of unique traits (e.g., older condos tend to be much bigger). And this is especially so if you aren’t even one of the early buyers of the new launch – and buying at a later phase or higher floor – where prices are typically higher.

2. The savings on a resale unit get “eaten up” by the higher renovation costs

It is true that in most cases, resale condos cost more in terms of renovation. With new launches, it’s sometimes possible to move in right after buying the furnishings, with zero renovation work (other than installing some lights) and no need to purchase white goods like the fridge or oven. However, all of this is contingent on a few factors:

First, some resale units were renovated quite recently, If the previous owners just renovated two years ago, for example, you could plausibly move in and be comfortable right away; and you could consider renovating further down the road. This also gives you time to save up to avoid needing loans, build a bigger reno fund, etc.

Second, if you’re saving $150,000 by picking a resale unit instead of a new launch, we doubt that your renovation costs will “eat up” those savings unless you have some truly expensive reno plans.

We’d also add that, even though resale flats need more renovations, they do save you time. It may take a few months to finish renovations and move in, but that’s still faster than waiting a few years for construction, and then waiting a few more months for renovation of your new launch.

Paying for storage and accommodations, when you’re between homes, eats into your funds too.

3. It doesn’t matter if the new launch prices are high, because you can sell it for more anyway once it’s completed

This suggests profits from new launches are higher and more “certain,” because of the way developers tend to price them. The standard approach in Singapore is to use loss leaders: the first few units sold in the earliest phases of a launch (often called the VIP or VVIP preview) are sold at a lower price. The developer then “normalises” the prices in later sales phases, with the priciest units being sold after completion (if there are any leftovers.)

Because of this, it’s sometimes argued that you don’t need to care too much about new launches being priced higher than resale – regardless of the price, you’ll be able to sell it higher later on; perhaps even before completion if it’s a sub-sale.

The risk here is that developers don’t always raise the prices later on. In fact, in some cases, the prices fall in later sales phases – either because they’re rushing to meet ABSD deadlines, or because the last few high-quantum units prove tough to move. This has happened enough that we’ve compiled lists of such projects.

Also, the usual other tactic here is to back up these claims showing evidence that newer GLS plots for sale have gone for higher prices. (As such, this contributes to the narrative that property prices would only go up). While this has proven to be true, it isn’t a guaranteed thing either. We’ve seen recently land bids at places like River Valley play out to be lower than expected. For example, CDL and Mitsui Fudosan were the sole bidders for a land parcel along Zion Road for $1.1 billion. That works out to roughly $1,202 psf, also below the projected $1,300 to $1,700 psf.

4. You will spend more on mortgage interest if you buy a resale condo

This is true if the new launch is not yet completed. This is due to the payment structure for condos still under development: you’ll pay with the Progressive Payment Scheme (PPS), where the monthly loan amount increases as the developer reaches different milestones. This means that you save on some of the interest repayments, as it’s not applied to the full repayment until the condo receives its Temporary Occupancy Permit (TOP).

You may also be told that resale projects tend to require bigger cash outlays, because most sellers will go above valuation. This might also be true: the maximum loan amount (75 per cent from banks) is based on the property price or valuation, whichever is lower. But for new launches, there’s no discrepancy between price and value: the developer’s price is considered the same as the value. This isn’t really a savings though, but more an issue of having a lower initial cash outlay.

That said, the savings on the monthly loan probably don’t match the savings from just outright buying a cheaper resale condo. This is especially true if you’re using a smaller loan amount, where the interest costs may not be too significant.

Crunching the exact numbers is important here, and we’d suggest talking to a mortgage broker, instead of the realtor. The mortgage broker is more specialised in this area, and is usually a better authority on the financing aspects.

But there’s another point to consider: the time it takes to build and pay for a new launch condo. Imagine you bought a resale condo instead and rented it out during that same period. The rental income from the resale condo could balance out the interest savings you get from paying for the new launch condo in stages. So, this advantage might not be as significant as it seems.

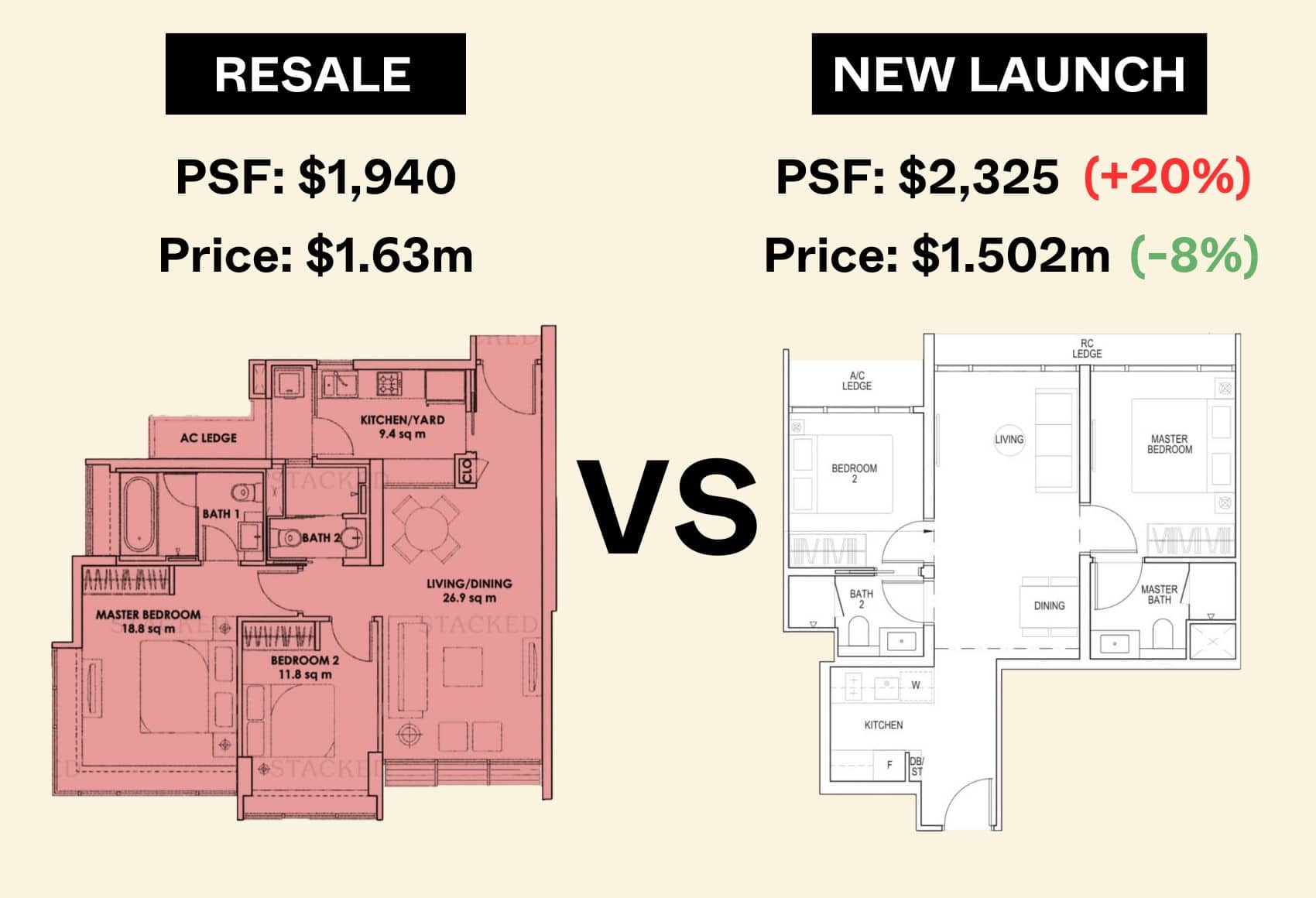

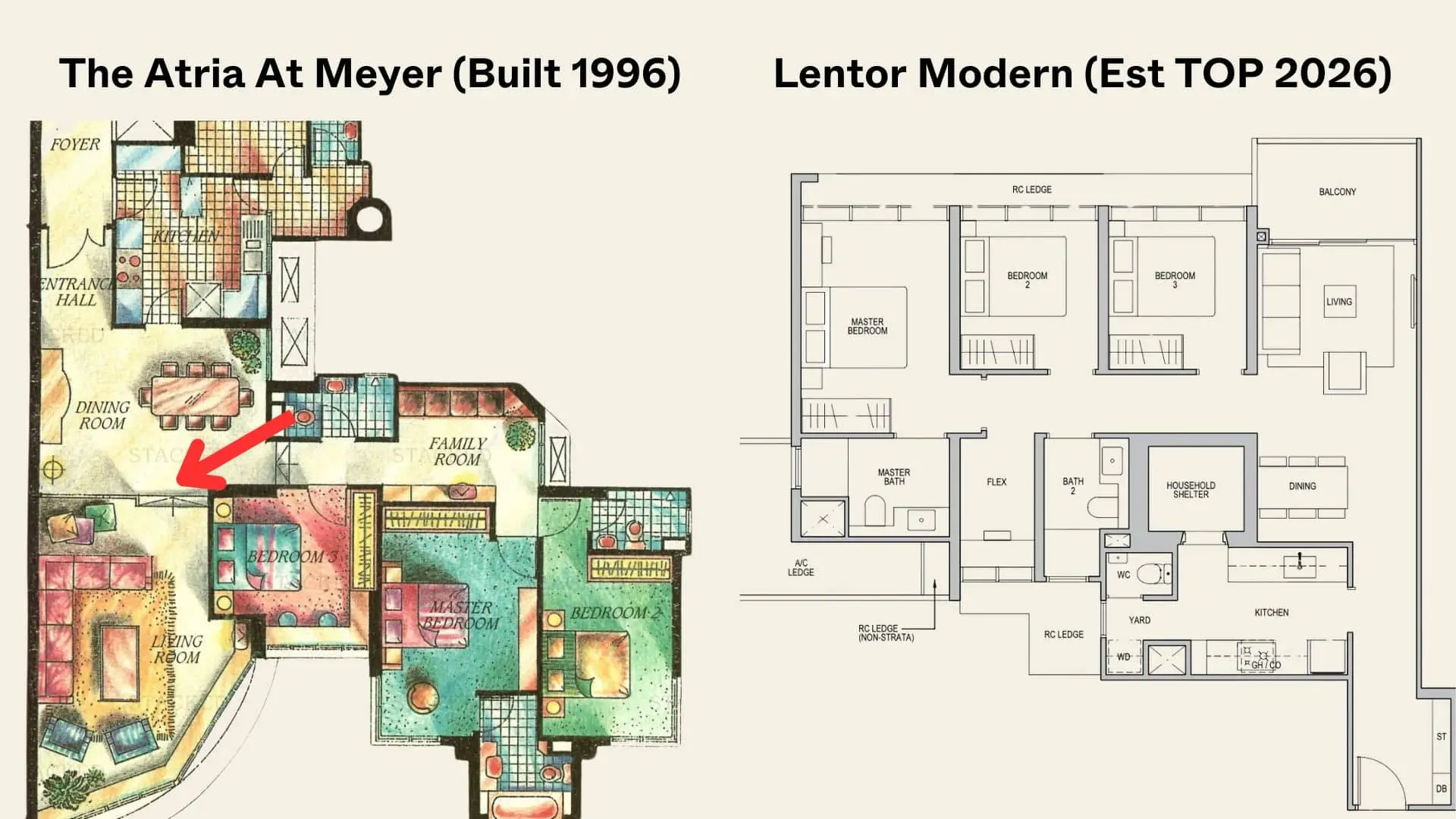

5. Resale condos are bigger on paper but are not efficient space-wise, so you’re actually wasting money

This is the counterargument if you say you want the bigger resale condo, because of the square footage. This isn’t an untruth, as some (not all) older condos have less efficient layouts. You may find older units have more corridors, separate dining rooms and kitchens, bigger balconies, etc.

Some condos from the 2010s are also plagued by developers “min-maxing,” and building bigger air-con ledges, big planter boxes, etc. to stretch the chargeable areas; this was true until the latest GFA harmonisation rules. So while the floor size may be bigger on paper, the actual living conditions may be similar given the wasted space. As a result, in some cases, the new launch could actually be cheaper even though the psf is higher.

However, do note that sometimes it’s about much more than just square footage. Some resale condos may have unique layouts and features, which you can’t find in newer ones. The terrace-style condos from the 1980s, for example, have gigantic balcony spaces that allow for more open-air activities (not to mention living without a dryer).Some buyers still like enclosed kitchens or dining spaces, or dislike new dumbbell-style layouts where the front door opens directly into the living room.

We wouldn’t consider that a “waste of money,” if it’s what you find comfortable in a home.

None of the above arguments are false truths per se, and they are valid considerations for preferring a new launch. But sales pitches tend to oversimplify the issues, and they’re not always as black and white as they seem. If you need help comparing between options, reach out to us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Property Advice We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

0 Comments