7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

In this Stacked Pro breakdown:

Overview

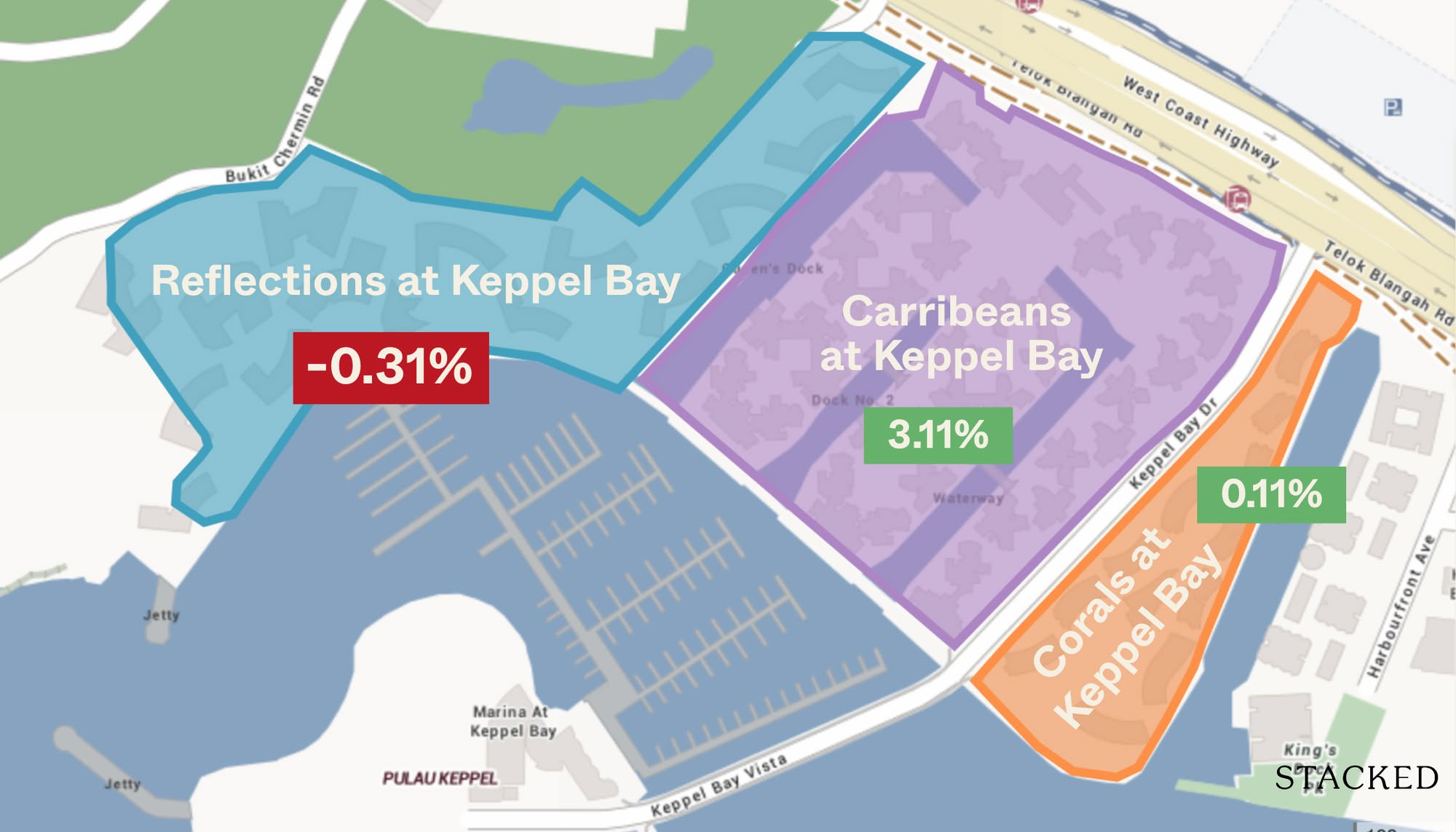

We tracked the price movements of Reflections at Keppel Bay from its completion in 2011 to 2024, and compared its performance to other 99-year leasehold condos in the Keppel Bay area, including Caribbean at Keppel Bay and Corals at Keppel Bay. Despite its iconic design and waterfront location, Reflections has seen uneven resale results, with many units showing muted returns. We broke down its transaction data and average quantum to understand why this high-profile project hasn’t performed as expected.

Key Insight

With larger-than-average unit sizes and high entry prices, Reflections has struggled to attract a broad resale audience. While some units have made strong gains, many others haven’t, leading to a volatile and often underwhelming return profile, especially for investors expecting consistency.

Why This Matters

Reflections at Keppel Bay highlights the risk of relying on design prestige or branding alone. Even a visually striking project can underperform if its pricing and layout don’t align with buyer demand. For investors, it’s a reminder that aesthetics don’t always translate into returns.

🔓 Unlock the full analysis — including floor plan breakdowns, resale trends, and how Reflections at Keppel Bay has performed, only on Stacked Pro.

Already a subscriber? Log in here.

Reflections at Keppel Bay is a unique project, in more ways than one. It’s an architectural icon to be sure – but whenever buyers ask to see the performance, the result is often…well, unexpected. The truth is, this is a rather volatile project, with an ROI that’s less spectacular than its facade. But why, and what is the simple ROI not revealing about Reflections? Let’s take a closer look at this simultaneously enigmatic and iconic condo:

A quick profile of Reflections at Keppel Bay

Reflections at Keppel Bay is a 99-year leasehold condominium developed by Keppel Land. Completed in 2011, the project has 1,129 units across six high-rise towers and 11 villa blocks. It’s located along Keppel Bay View in District 4.

Reflections is an architectural landmark: it was designed by Daniel Libeskind, and was his first residential work in Asia. This project has won the FIABCI Prix d’Excellence Gold, and the Chicago Athenaeum International Architecture Award for its design.

In this context, its ROI numbers may be quite surprising:

How has Reflections at Keppel Bay performed from launch till 2024?

| Year | Average $PSF |

| 2007 | $1,858 |

| 2008 | $2,037 |

| 2009 | $1,830 |

| 2010 | $1,924 |

| 2011 | $1,933 |

| 2012 | $1,926 |

| 2013 | $2,037 |

| 2014 | $2,088 |

| 2015 | $1,860 |

| 2016 | $1,682 |

| 2017 | $1,658 |

| 2018 | $1,680 |

| 2019 | $1,638 |

| 2020 | $1,596 |

| 2021 | $1,640 |

| 2022 | $1,757 |

| 2023 | $1,827 |

| 2024 | $1,763 |

| Annualised | -0.31% |

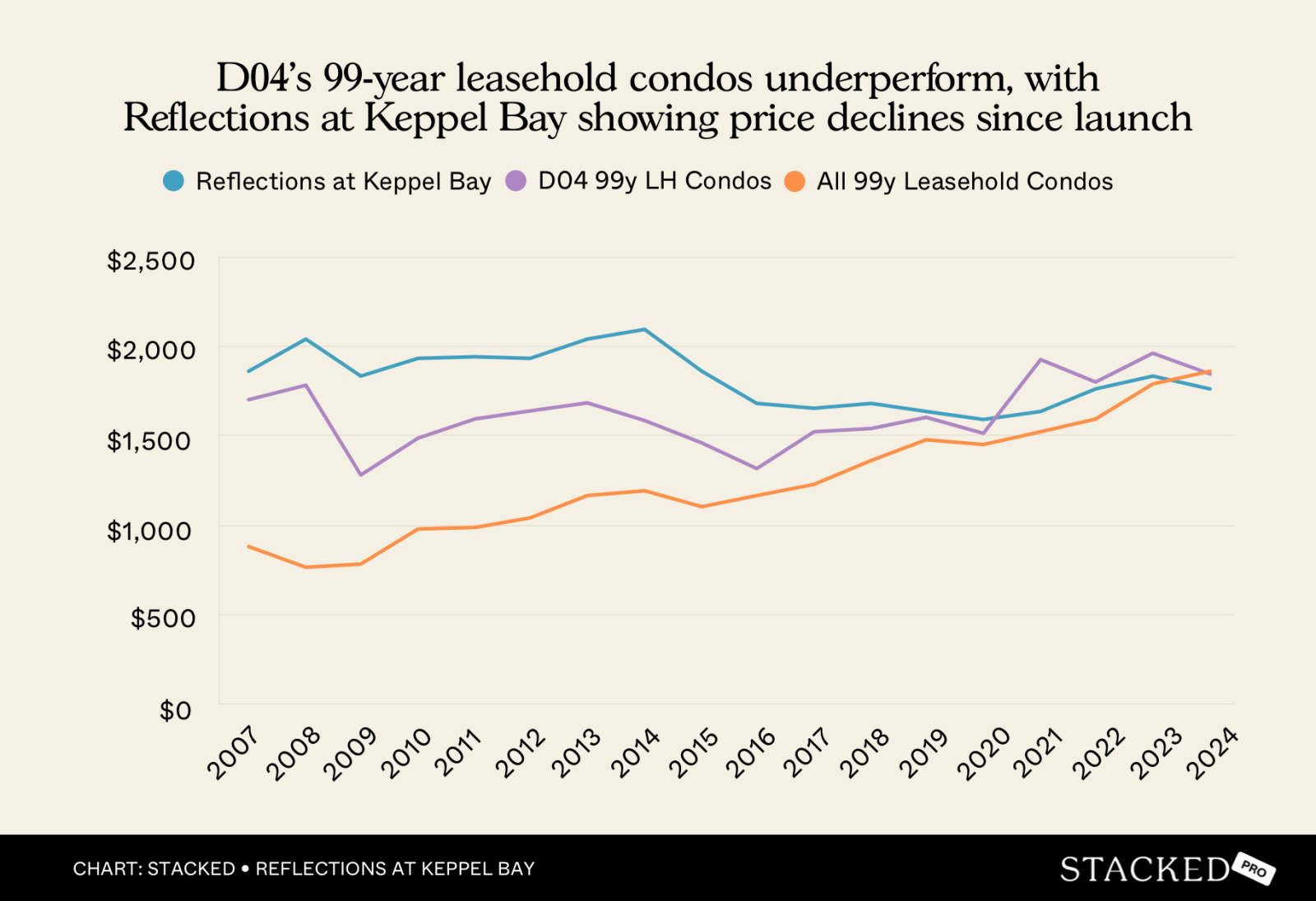

Reflections at Keppel Bay initially saw strong appreciation, from $1,858 psf in 2007 to a peak of $2,088 psf in 2014. However, from 2015 onward, prices entered a gradual decline, bottoming out at $1,596 psf in 2020, before recovering slightly in subsequent years.

As of 2024, the average price stands at $1,763 psf, which is still below the 2014 peak. Overall, this is an annualised decline of around -0.31 per cent over 17 years.

But ROI alone doesn’t give the full picture of what’s happening and why. So next, let’s look at how Reflections at Keppel Bay compares to the wider leasehold condo market in Singapore, and also alongside other District 4 projects.

| Year | Reflections at Keppel Bay | 99y LH condos in D04 | All 99y LH condos |

| 2007 | $1,858 | $1,695 | $885 |

| 2008 | $2,037 | $1,774 | $765 |

| 2009 | $1,830 | $1,278 | $788 |

| 2010 | $1,924 | $1,484 | $977 |

| 2011 | $1,933 | $1,596 | $985 |

| 2012 | $1,926 | $1,640 | $1,039 |

| 2013 | $2,037 | $1,678 | $1,163 |

| 2014 | $2,088 | $1,584 | $1,195 |

| 2015 | $1,860 | $1,462 | $1,104 |

| 2016 | $1,682 | $1,317 | $1,166 |

| 2017 | $1,658 | $1,522 | $1,230 |

| 2018 | $1,680 | $1,538 | $1,359 |

| 2019 | $1,638 | $1,599 | $1,474 |

| 2020 | $1,596 | $1,508 | $1,453 |

| 2021 | $1,640 | $1,922 | $1,517 |

| 2022 | $1,757 | $1,799 | $1,595 |

| 2023 | $1,827 | $1,955 | $1,783 |

| 2024 | $1,763 | $1,842 | $1,854 |

| Annualised | -0.31% | 0.49% | 4.45% |

How does Reflections stack up against its peers?

When compared to the other District 4 leasehold condos, we can see some of the issues stem from the district itself.

From 2007 to 2024, District 4’s 99-year leasehold condos saw almost no appreciation, climbing by a negligible 0.4 per cent. In contrast, the islandwide average was 4.45 per cent. Reflections suffered broadly the same fate as its District 4 counterparts, with an annualised decline of -0.31 per cent over the same period.

This changed somewhat in the post-COVID period of 2021 to 2023: Reflections’ rebound was stronger than other District 4 counterparts, rising by about 11.4 per cent, versus just 1.7 per cent in the overall district.

But even so, note that this performance still lagged behind the Singapore-wide leasehold market, which climbed by around 17.5 per cent.

Let’s look deeper by focusing on just resale transactions.

When we look at the secondary market only, we can see Reflections’ gains without the impact of developer pricing:

| Year | Reflections at Keppel Bay | 99y LH condos in D04 | All 99y LH condos |

| 2012 | $2,001 | $1,655 | $989 |

| 2013 | $2,037 | $1,765 | $1,059 |

| 2014 | $2,088 | $1,625 | $1,029 |

| 2015 | $1,860 | $1,380 | $1,032 |

| 2016 | $1,682 | $1,266 | $1,145 |

| 2017 | $1,660 | $1,477 | $1,115 |

| 2018 | $1,680 | $1,538 | $1,151 |

| 2019 | $1,638 | $1,599 | $1,177 |

| 2020 | $1,596 | $1,508 | $1,148 |

| 2021 | $1,640 | $1,570 | $1,207 |

| 2022 | $1,757 | $1,764 | $1,337 |

| 2023 | $1,827 | $1,882 | $1,465 |

| 2024 | $1,763 | $1,790 | $1,574 |

| Annualised | -1.05% | 0.66% | 3.95% |

The results aren’t much different.

From 2012 to 2024, resale prices at Reflections at Keppel Bay fell from $2,001 psf to $1,763 psf, or about -1.05 per cent. This actually underperforms the leasehold market in District 4, which saw prices grow by 0.66 per cent in the same time.

This suggests that even within the constraints of District 4’s slower growth, Reflections at Keppel Bay underperformed on the resale front. This challenges our initial assumption that the underperformance was primarily a District 4 issue. While location remains a factor, it seems there may be project-specific reasons why Reflections is faring worse than its peers.

To get to the specifics, we’ll compare Reflections at Keppel Bay to its immediate neighbours

| Project | Caribbean at Keppel Bay | Reflections at Keppel Bay | Corals at Keppel Bay |

| Tenure | 99-year | 99-year | 99-year |

| Launch year | 2000 | 2007 | 2013 |

| Completion year | 2004 | 2011 | 2016 |

| No. of units | 969 | 1,129 | 366 |

Here’s how they performed from launch:

| Year | Caribbean at Keppel Bay | Reflections at Keppel Bay | Corals at Keppel Bay |

| 2000 | $884 | ||

| 2001 | $879 | ||

| 2002 | – | ||

| 2003 | $721 | ||

| 2004 | $770 | ||

| 2005 | $774 | ||

| 2006 | $805 | ||

| 2007 | $1,230 | $1,858 | |

| 2008 | $1,350 | $2,037 | |

| 2009 | $1,303 | $1,830 | |

| 2010 | $1,431 | $1,924 | |

| 2011 | $1,557 | $1,933 | |

| 2012 | $1,548 | $1,926 | |

| 2013 | $1,627 | $2,037 | $2,171 |

| 2014 | $1,556 | $2,088 | $2,278 |

| 2015 | $1,495 | $1,860 | $2,147 |

| 2016 | $1,448 | $1,682 | $1,881 |

| 2017 | $1,485 | $1,658 | $1,938 |

| 2018 | $1,569 | $1,680 | $2,091 |

| 2019 | $1,536 | $1,638 | $2,266 |

| 2020 | $1,436 | $1,596 | $2,095 |

| 2021 | $1,565 | $1,640 | $2,204 |

| 2022 | $1,714 | $1,757 | $2,367 |

| 2023 | $1,811 | $1,827 | $2,398 |

| 2024 | $1,846 | $1,763 | $2,198 |

| Annualised | 3.11% | -0.31% | 0.11% |

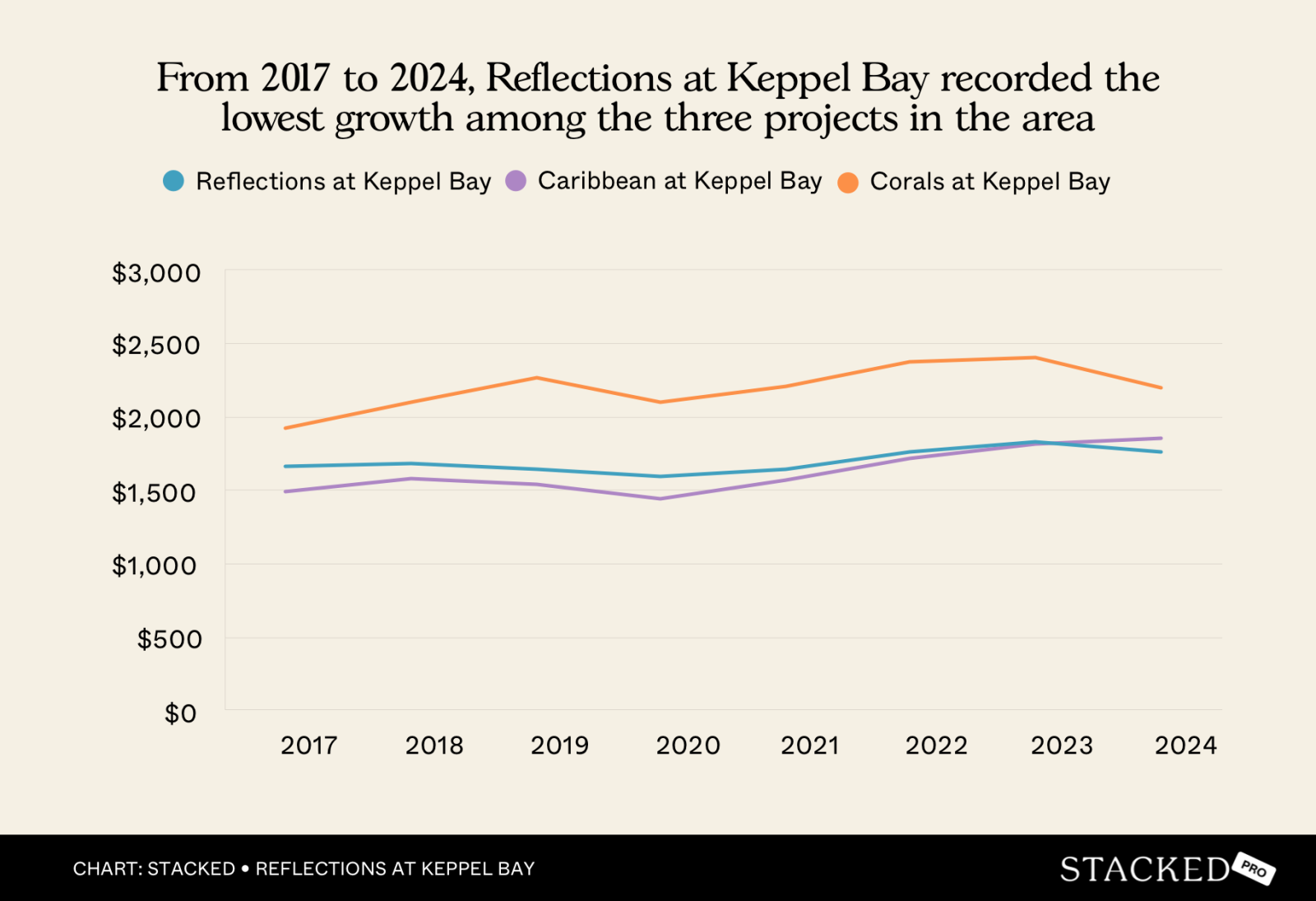

The first thing we notice is that Caribbean at Keppel Bay, launched in 2000 and completed in 2004, has performed markedly better than Reflections.

From $884 psf at launch, Caribbean climbed to $1,846 psf by 2024, achieving an annualised growth of about 3.11 per cent. Corals at Keppel Bay stayed mostly flat at 0.11 per cent.

By contrast, Reflections at Keppel Bay, despite being newer than Caribbean and arguably more architecturally ambitious, posted an annualised decline of -0.31 per cent. We don’t consider that much worse than Corals at Keppel Bay, but Caribbean has outperformed Reflections by a significant margin.

Let’s see if there’s any difference if we just look at resale transactions:

| Year | Caribbean at Keppel Bay | Reflections at Keppel Bay | Corals at Keppel Bay |

| 2017 | $1,485 | $1,660 | $1,915 |

| 2018 | $1,569 | $1,680 | $2,091 |

| 2019 | $1,536 | $1,638 | $2,266 |

| 2020 | $1,436 | $1,596 | $2,095 |

| 2021 | $1,565 | $1,640 | $2,204 |

| 2022 | $1,714 | $1,757 | $2,367 |

| 2023 | $1,811 | $1,827 | $2,398 |

| 2024 | $1,846 | $1,763 | $2,198 |

| Annualised | 3.16% | 0.86% | 1.99% |

Note: We’re starting from 2017 as Corals at Keppel Bay doesn’t have any transactions before then

There’s not much difference. Caribbean at Keppel Bay still stands out as the strongest performer, rising about 3.16 per cent. Corals at Keppel Bay comes next, falling just under two per cent.

Reflections at Keppel Bay still holds third place, seeing resale prices inch up from $1,660 psf in 2017 to $1,763 psf in 2024: an annualised gain of below one per cent.

To look deeper, we’ll compare the performance between unit layouts:

1-bedroom units

| Year | Reflections at Keppel Bay | Corals at Keppel Bay |

| 2018 | – | $2,689 |

| 2019 | – | $2,359 |

| 2020 | $2,039 | $2,599 |

| 2021 | $1,723 | $2,468 |

| 2022 | – | – |

| 2023 | – | – |

| 2024 | – | $2,172 |

| Annualised | -3.50% |

2-bedroom units

| Year | Caribbean at Keppel Bay | Reflections at Keppel Bay | Corals at Keppel Bay |

| 2017 | $1,577 | $1,587 | $1,944 |

| 2018 | $1,652 | $1,636 | $2,217 |

| 2019 | $1,653 | $1,594 | $2,198 |

| 2020 | $1,588 | $1,545 | $1,857 |

| 2021 | $1,672 | $1,626 | $2,117 |

| 2022 | $1,773 | $1,735 | $1,913 |

| 2023 | $1,886 | $1,768 | $1,929 |

| 2024 | $1,905 | $1,775 | $2,054 |

| Annualised | 2.74% | 1.61% | 0.79% |

3-bedroom units

| Year | Caribbean at Keppel Bay | Reflections at Keppel Bay | Corals at Keppel Bay |

| 2017 | $1,450 | $1,712 | $1,875 |

| 2018 | $1,528 | $1,749 | $1,989 |

| 2019 | $1,488 | $1,667 | $1,977 |

| 2020 | $1,407 | $1,607 | $1,984 |

| 2021 | $1,543 | $1,645 | $1,956 |

| 2022 | $1,730 | $1,682 | $1,994 |

| 2023 | $1,751 | $1,771 | $2,020 |

| 2024 | $1,836 | $1,721 | $2,025 |

| Annualised | 3.43% | 0.08% | 1.10% |

4-bedroom units

| Year | Caribbean at Keppel Bay | Reflections at Keppel Bay | Corals at Keppel Bay |

| 2017 | $1,437 | $1,940 | – |

| 2018 | $1,612 | $1,746 | – |

| 2019 | $1,470 | $1,542 | $2,807 |

| 2020 | $1,281 | $1,577 | $2,595 |

| 2021 | $1,419 | $1,646 | $2,593 |

| 2022 | $1,553 | $2,031 | $2,698 |

| 2023 | – | $2,052 | $2,620 |

| 2024 | $1,686 | $2,097 | $2,572 |

| Annualised | 2.30% | 1.12% | – |

Looking at the performance of each unit type, here’s what we can see:

- One-bedroom units: Unfortunately, there are only two transactions, so there’s nothing we can really determine here. Although the one-bedders declined at an annualised rate of about -3.50 per cent; we’d avoid reading too much into this.

- Two-bedroom units: Caribbean achieved the strongest growth at 2.74 per cent annualised, followed by Reflections at 1.61 per cent, and Corals at just 0.79 per cent.

- Three-bedroom units: Caribbean once again came out ahead with 3.43 per cent growth, while Reflections barely broke even at 0.08 per cent, and Corals grew modestly at 1.10 per cent. Notably, Reflections’ three-bedders were the poorest performing segment among all three projects.

- Four-bedroom units: Caribbean held its lead at 2.30 per cent, with Reflections trailing at 1.12 per cent. Transactions for Corals were limited, but it doesn’t change the fact that Reflections failed to stand out.

Overall, Reflections at Keppel Bay underperformed across almost all configurations, despite its iconic architecture and premium positioning. Its two- and four-bedroom layouts have fared relatively better than its three-bedders, but not enough to close the gap with Caribbean.

However, we may be getting close to an explanation, once we factor in the actual quantum:

Average 1-bedroom prices

| Year | Reflections at Keppel Bay | Corals at Keppel Bay |

| 2017 | – | – |

| 2018 | – | $1,563,000 |

| 2019 | – | $1,531,500 |

| 2020 | $1,580,000 | $1,632,000 |

| 2021 | $1,335,000 | $1,427,500 |

| 2022 | – | – |

| 2023 | – | – |

| 2024 | – | $1,250,000 |

Average 1-bedroom sizes (for units sold between 2017 and 2024)

| Project | Reflections at Keppel Bay | Corals at Keppel Bay |

| Average size (sqft) | 775 | 603 |

Average 2-bedroom prices

| Year | Caribbean at Keppel Bay | Reflections at Keppel Bay | Corals at Keppel Bay |

| 2017 | $1,384,453 | $1,730,260 | $1,775,900 |

| 2018 | $1,456,462 | $1,713,552 | $2,067,340 |

| 2019 | $1,464,833 | $1,828,087 | $1,968,800 |

| 2020 | $1,448,750 | $1,658,994 | $1,670,000 |

| 2021 | $1,473,625 | $1,749,902 | $2,045,455 |

| 2022 | $1,611,444 | $1,812,948 | $1,750,000 |

| 2023 | $1,671,750 | $1,850,241 | $1,795,000 |

| 2024 | $1,786,157 | $1,929,871 | $1,905,750 |

More from Stacked

Can 30+ Year-Old Leasehold Condos Still Perform? The Arcadia’s Surprising Case Study

In this Stacked Pro breakdown:

Average 2-bedroom sizes (for units sold between 2017 and 2024)

| Project | Caribbean at Keppel Bay | Reflections at Keppel Bay | Corals at Keppel Bay |

| Average size (sqft) | 899 | 1079 | 922 |

Average 3-bedroom prices

| Year | Caribbean at Keppel Bay | Reflections at Keppel Bay | Corals at Keppel Bay |

|---|---|---|---|

| 2017 | $1,894,703 | $2,860,197 | $2,585,143 |

| 2018 | $2,085,660 | $2,904,596 | $2,678,000 |

| 2019 | $1,966,450 | $2,693,425 | $2,643,414 |

| 2020 | $1,973,885 | $2,918,703 | $2,719,000 |

| 2021 | $2,207,727 | $2,885,344 | $2,992,500 |

| 2022 | $2,403,333 | $2,747,928 | $2,744,400 |

| 2023 | $2,533,433 | $2,853,586 | $2,915,000 |

| 2024 | $2,563,199 | $2,608,730 | $2,805,714 |

Average 3-bedroom sizes (for units sold between 2017 and 2024)

| Project | Caribbean at Keppel Bay | Reflections at Keppel Bay | Corals at Keppel Bay |

|---|---|---|---|

| Average size (sq ft) | 1,412 | 1,655 | 1,395 |

Average 4-bedroom prices

| Year | Caribbean at Keppel Bay | Reflections at Keppel Bay | Corals at Keppel Bay |

| 2017 | $3,183,600 | $6,467,778 | – |

| 2018 | $2,877,929 | $4,818,926 | – |

| 2019 | $3,787,000 | $4,886,000 | $11,012,500 |

| 2020 | $3,767,000 | $4,468,333 | $6,900,000 |

| 2021 | $3,709,714 | $5,525,067 | $7,200,000 |

| 2022 | $3,764,000 | $8,587,000 | $7,552,857 |

| 2023 | – | $5,974,143 | $8,230,109 |

| 2024 | $4,216,667 | $9,500,000 | $7,032,500 |

Average 4-bedroom sizes (for units sold between 2017 and 2024)

| Project | Caribbean at Keppel Bay | Reflections at Keppel Bay | Corals at Keppel Bay |

| Average size (sqft) | 2,587 | 3,345 | 3,025 |

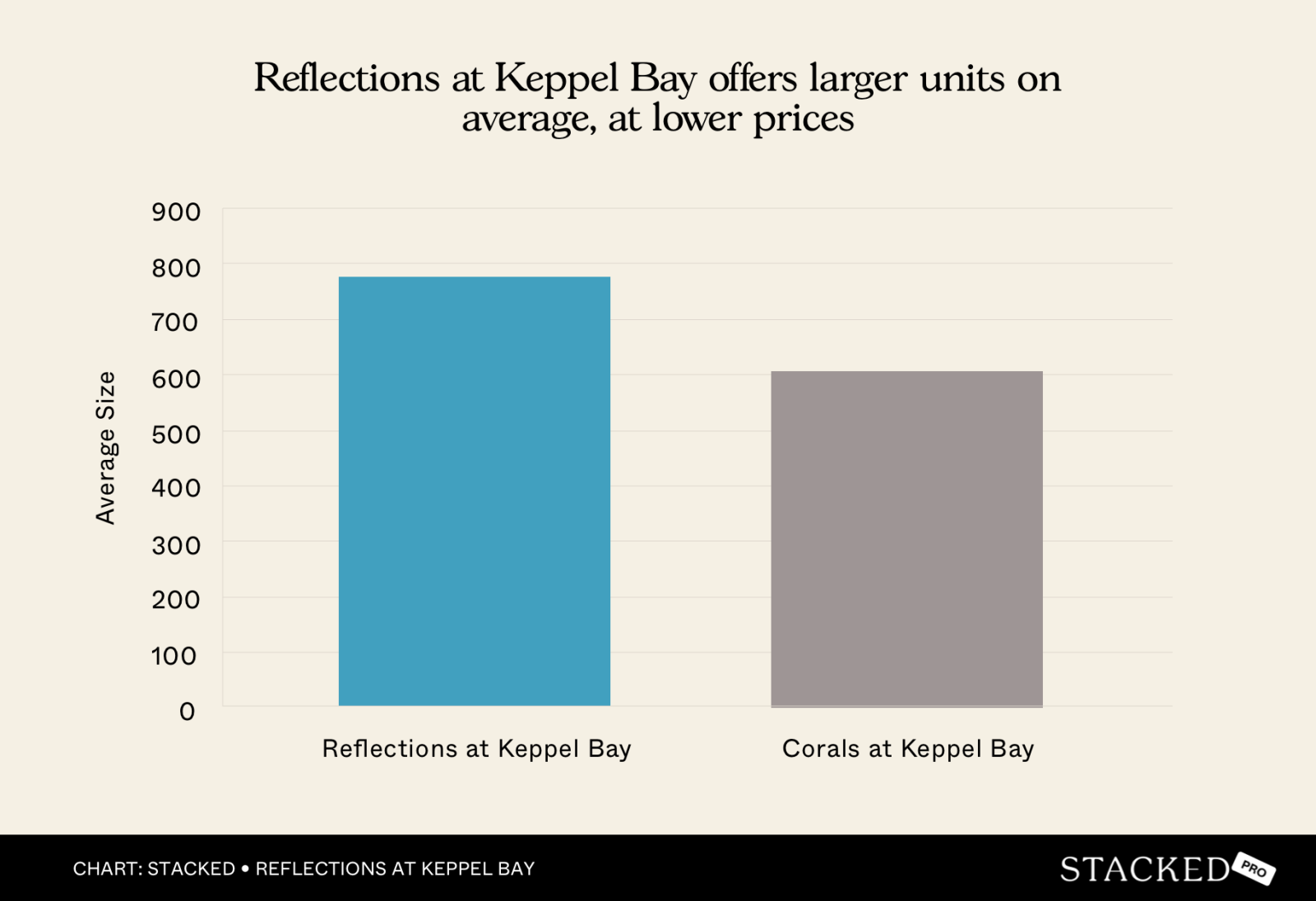

At this point, we suspect Reflections at Keppel Bay’s issue isn’t so much its architecture, but a case of having built units that are too large.

Now we know that two one-bedder transactions isn’t much to go on, but here’s a quirk that is worth noticing: in the two years where transactions occurred – 2020 and 2021 – the average prices at Reflections were lower than those at Corals at Keppel Bay, despite being much larger on average (about 775 sq ft compared to Corals’ 603 sq ft). This suggests that buyers preferred the smaller, more affordable quantum at Corals, despite the higher price per square foot.

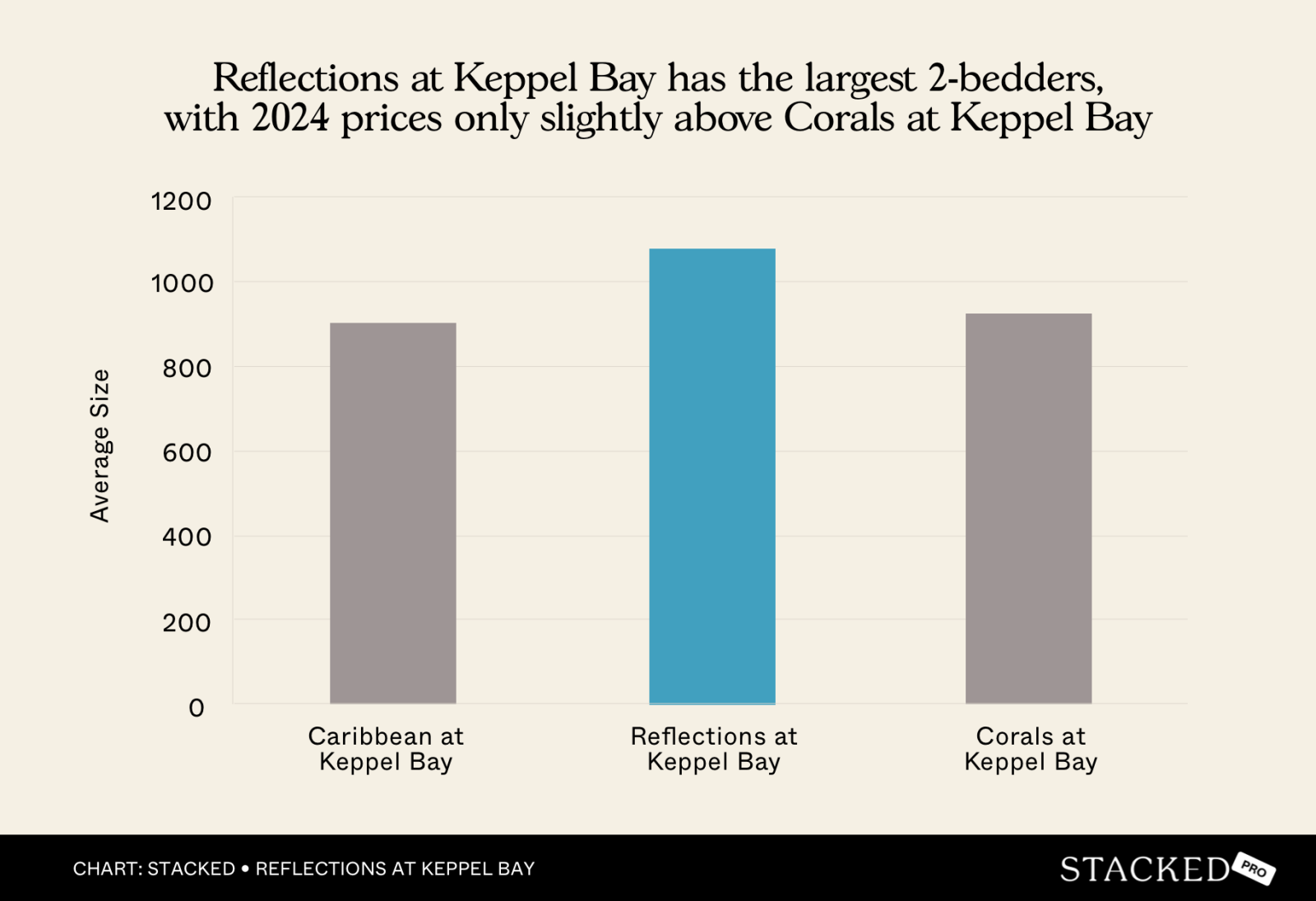

Then we see the trend continue with two-bedroom units. Reflections at Keppel Bay has the largest two-bedders on average, at 1,079 sq ft, compared to Caribbean’s 899 sq ft and Corals’ 922 sq ft. In 2024, Reflections also had the highest average prices among the three projects at around $1.93 million (though only slightly higher than Corals’ $1.91 million, despite being substantially larger!)

Again, the higher quanta from the bigger size may have capped further price upside.

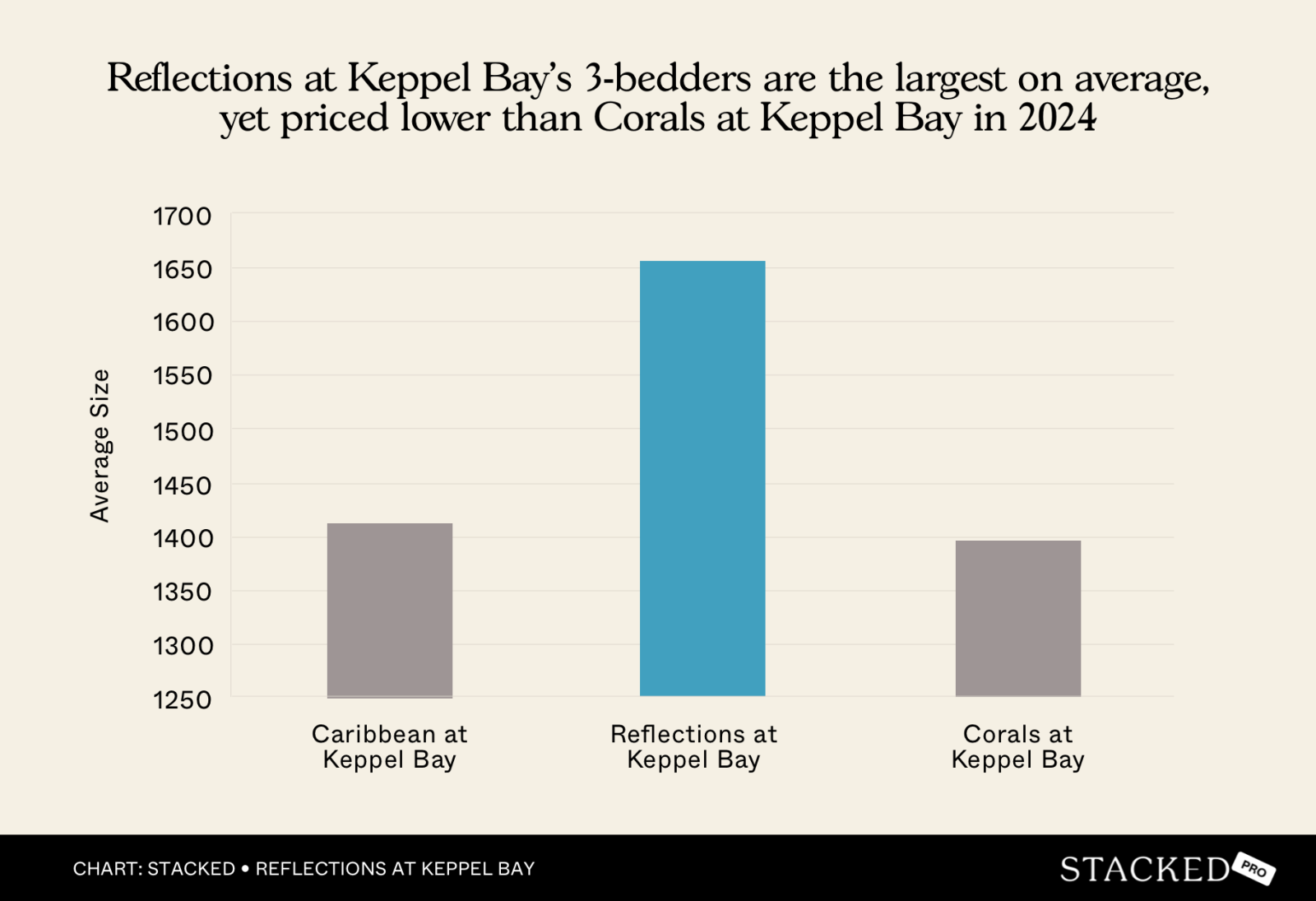

For three-bedroom units, Reflections again roared into the area with the largest layouts, averaging 1,655 sq ft. And here too, the story is the same: average prices have been notably lower than those at Corals, despite the additional space. Buyers seem more willing to pay for Corals’ manageable quantum than for the oversized offerings at Reflections.

In terms of sizing Corals did enough, while Reflections did too much.

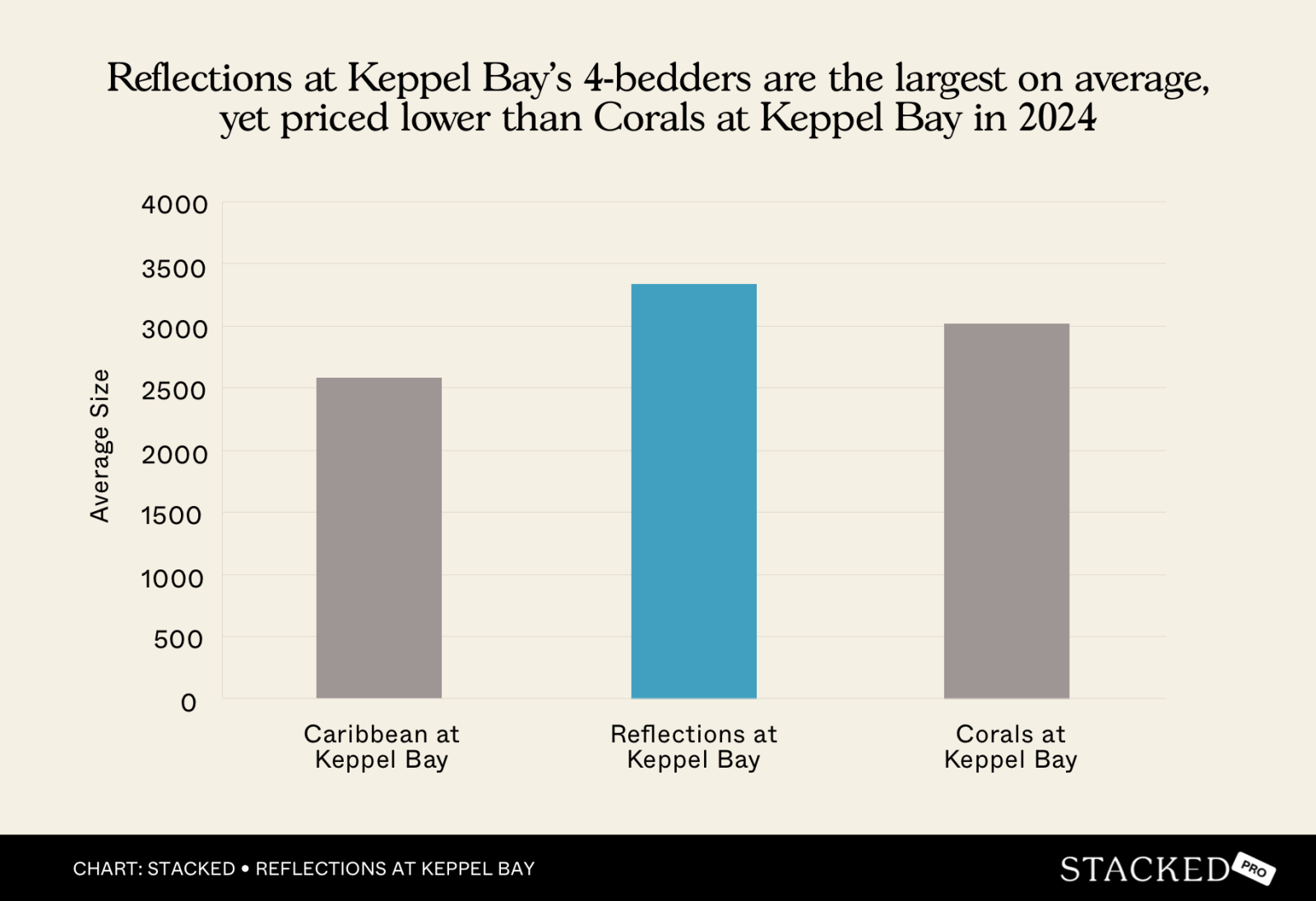

For four-bedroom units in 2024, there are a lot of unusual things going on. For starters, Reflections had just two four-bedroom transactions, but one of these was an absolutely monstrous 5,576 sq ft unit sold for $13.6 million, which skewed the average upwards.

Another more typical unit – still huge at 3,079 sq ft sold for $5.4 million. At Corals, a similar pattern emerged, but we once again see that prices are more manageable — one larger unit sold for $8.7 million, while the rest averaged closer to $6.48 million.

This shows that, while larger units may appear attractive on paper, they narrow the buyer pool by pushing up the absolute price. Plausibly, the developer figured that being in a luxury area, the buyers would be less price sensitive than they really are.

Let’s look at absolute profit next, which is less abstract than ROI

| Project | Profitable transactions | Unprofitable transactions | ||||||||

| Average gains | Average purchase price | Average ROI | Average holding period (years) | No. of tnx | Average losses | Average purchase price | Average ROI | Average holding period (years) | No. of tnx | |

| Caribbean at Keppel Bay | $534,730 | $1,653,285 | 32.34% | 11.7 | 268 | -$147,667 | $2,362,188 | -6.25% | 7.7 | 64 |

| Reflections at Keppel Bay | $211,126 | $2,051,355 | 10.29% | 9.8 | 127 | -$543,875 | $3,030,831 | -17.94% | 11.1 | 248 |

| Corals at Keppel Bay | $123,063 | $2,537,057 | 4.85% | 7.4 | 18 | -$165,727 | $2,517,724 | -6.58% | 8.4 | 19 |

On average, profitable sellers at Caribbean walked away with over half a million dollars ($534,730), but we can really see how volatile this area can be; it’s loss-making sellers there still saw a rather painful average loss of -$147,667 (-6.25 per cent).

At Reflections, the volatility is much more extreme. New reports can already show that there was a unit that saw a $6.6 million profit in one year, and one that managed a $2.15 million loss after a holding period of almost a decade.

If we look at averages, we see some sellers managed gains averaging $211,126 (10.29 per cent ROI), but there are far more sellers with losses: 248 loss-making transactions versus 127 profitable ones. The average loss is -$543,875.

It appears that concentrated risk – oversized units with sky-high quantum and niche buyer demand – makes Reflections more prone to wild swings than its peers.

The Caribbean at Keppel Bay, by contrast, has shown more consistent and predictable outcomes: higher average gains, fewer losses, and lower downside.

Corals fared worse in terms of average profitability by the way: though its losses were less extreme than Reflections, its gains were modest, with sellers averaging just $123,063 (4.85 per cent ROI).

Let’s also look at how Reflections fares compared to other condos that launched in the same year:

| Project | Clementiwoods Condominium | One Shenton | One-North Residences | Reflections at Keppel Bay | Soleil @ Sinaran |

| Tenure | 99-year | 99-year | 99-year | 99-year | 99-year |

| District | 5 | 1 | 5 | 4 | 11 |

| No. of units | 240 | 341 | 405 | 1,129 | 417 |

| Completion year | 2010 | 2011 | 2009 | 2011 | 2011 |

| Year | Clementiwoods Condominium | One Shenton | One-North Residences | Reflections at Keppel Bay | Soleil @ Sinaran | All 99y LH condos |

| 2007 | $586 | $1,915 | $922 | $1,858 | $1,427 | $885 |

| 2008 | $671 | $1,855 | $950 | $2,037 | $1,434 | $765 |

| 2009 | $731 | $1,787 | $1,011 | $1,830 | $1,264 | $788 |

| 2010 | $912 | $1,998 | $1,231 | $1,924 | $1,532 | $977 |

| 2011 | $1,066 | $2,128 | $1,414 | $1,933 | $1,699 | $985 |

| 2012 | $1,120 | $2,031 | $1,466 | $1,926 | $1,860 | $1,039 |

| 2013 | $1,242 | $2,077 | $1,495 | $2,037 | $1,932 | $1,163 |

| 2014 | $1,056 | $1,975 | $1,368 | $2,088 | $2,064 | $1,195 |

| 2015 | $1,063 | $1,714 | $1,398 | $1,860 | $1,825 | $1,104 |

| 2016 | $1,072 | $1,723 | $1,370 | $1,682 | $1,683 | $1,166 |

| 2017 | $1,018 | $1,647 | $1,428 | $1,660 | $1,753 | $1,230 |

| 2018 | $1,118 | $1,780 | $1,502 | $1,680 | $1,797 | $1,359 |

| 2019 | $1,116 | $1,641 | $1,463 | $1,638 | $1,800 | $1,474 |

| 2020 | $1,094 | $1,643 | $1,422 | $1,595 | $1,765 | $1,453 |

| 2021 | $1,147 | $1,656 | $1,456 | $1,640 | $1,820 | $1,517 |

| 2022 | $1,317 | $1,758 | $1,505 | $1,757 | $1,916 | $1,595 |

| 2023 | $1,367 | $1,782 | $1,583 | $1,827 | $2,018 | $1,783 |

| 2024 | $1,434 | $1,796 | $1,574 | $1,763 | $1,977 | $1,854 |

| Annualised | 5.41% | -0.38% | 3.19% | -0.31% | 1.94% | 4.45% |

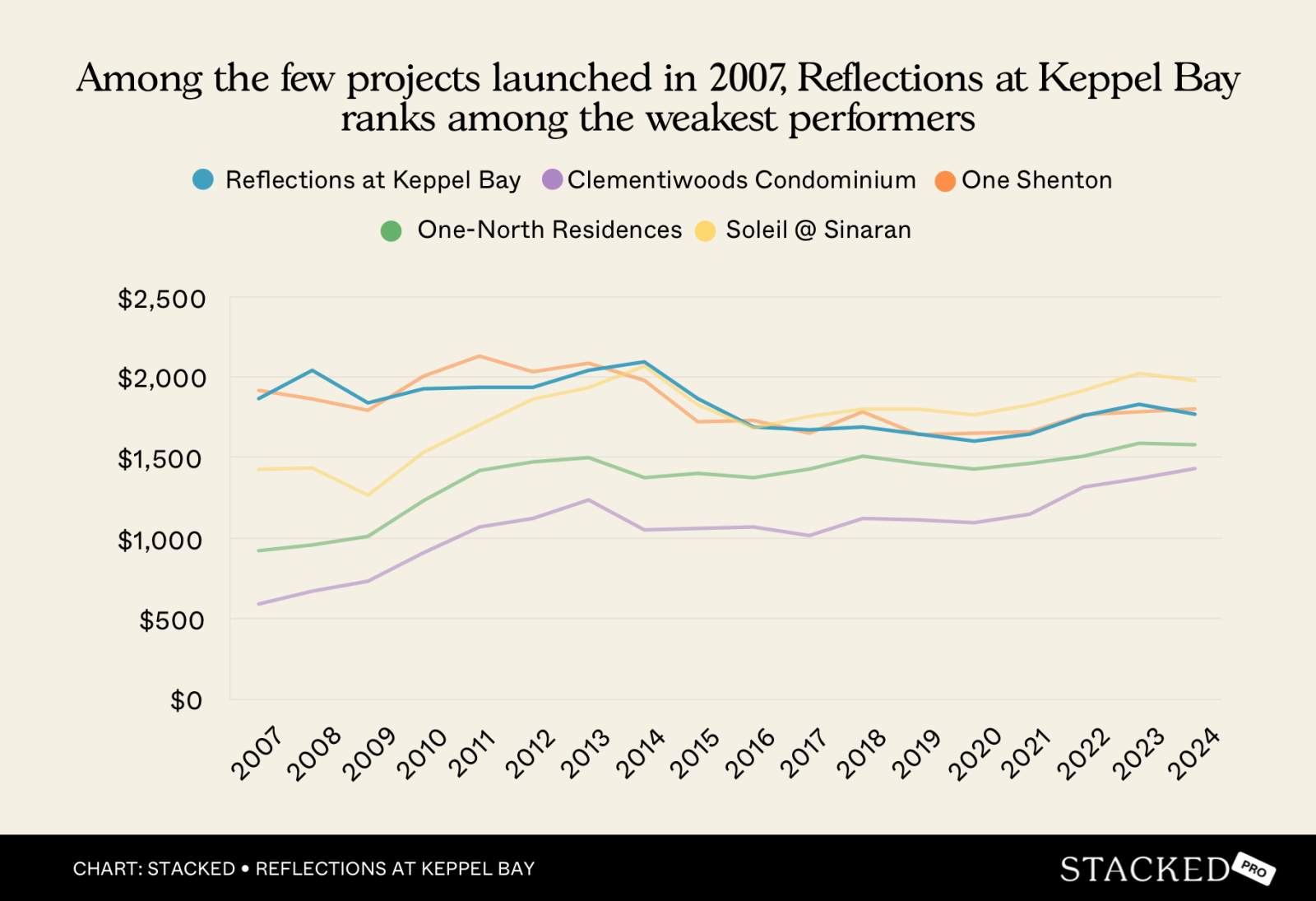

When measured against other 99-year leasehold condos launched around 2007–2011, Reflections at Keppel Bay is one of the weakest performers. Over 17 years, Reflections saw an annualised price decline of -0.31 per cent, making it one of the poorest performers in its cohort. This was slightly better than One Shenton (-0.38 per cent) but a far cry from the positive growth seen in projects like Clementiwoods, One-North Residences, or even the islandwide average of +4.45 per cent.

Reflections outclasses many of its peers in terms of quality and design. But its ambition, from the iconic architecture to the premium pricing, may have overshot the mark, leading to more risk than reward for buyers.

Now, let’s look at floor plan comparisons to see if the layout was an issue

Before we get into this, we do have word from agents on the ground regarding unit facings. This won’t be apparent from floor plan comparisons, but it has a real impact on pricing:

Within Reflections, there’s an unusually wide range of unit facings. There are units that have a sea view, units that face a former golf course (which will now be replaced by future housing, which might have a negative impact on value), units that face the marina, units with a pool facing, and units with internal courtyard facings.

All of these facings see differing levels of demand, and makes it difficult to establish a clear pricing benchmark. This is due to a lot of the preferences being subjective. For example, some buyers would consider a marina facing to be less desirable than a sea view and pay less, whereas others may consider the two to be functionally similar. This has created a wide disparity in resale outcomes, as seen from our numbers above.

What is visible from some (not all) floor plans are the presence of columns and support structures within some units. Some buyers may consider these architectural quirks, along with the rounded features of some units, to be visually striking and desirable. Others may simply consider them inefficient. This, aslo, results in muddled value perception and more unpredictable resale outcomes.

Nontheless, let’s take a look and assess the layouts as best we can.

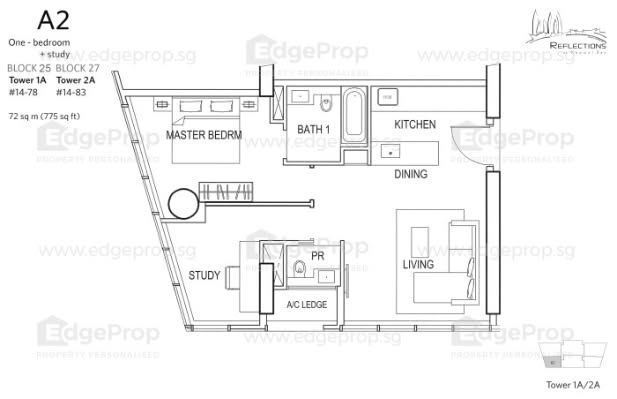

For the one-bedroom units, we will compare them against Corals at Keppel Bay, since there were no one-bedder transactions in Caribbean at Keppel Bay in recent years.

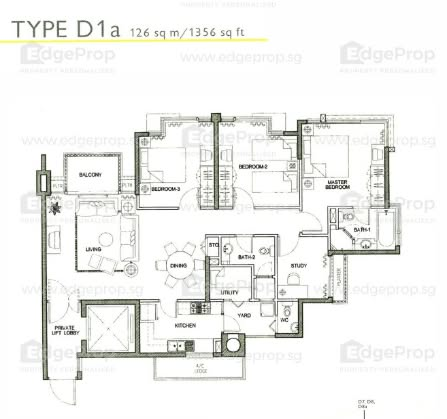

Reflections at Keppel Bay – 775 sq ft

Corals at Keppel Bay – 700 sq ft

Both Reflections at Keppel Bay and Corals at Keppel Bay offer one-bedroom units in a range of sizes. But as you’d expect by now, the ones at Reflections are generally larger on average (often configured as one-bedroom plus study units).

This extra space makes them more versatile, with the study room able to double as a small second bedroom if needed.

There are also some notable differences in layout. While both projects have open kitchens, the one at Reflections is tucked into a corner and can potentially be enclosed, which works to its advantage. In contrast, the kitchen counter at Corals runs along the side of the living space and cannot be enclosed. Given that these are one-bedders, though, kitchen use may be light anyway, so buyers may not care as much.

The unit at Reflections also comes with an additional powder room, which is lavish to say the least for a one-bedder; and has the advantage of not wasting space on a balcony.

Overall, the Reflections one-bedder is more attractive from a pure lifestyle/comfort perspective; but a landlord or other investor may consider it a bit much.

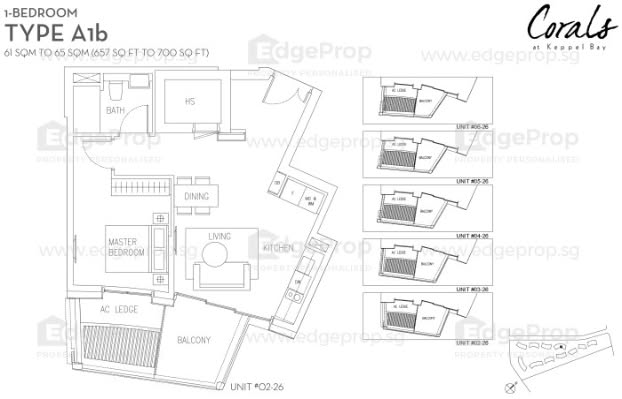

2-bedroom units

Reflections at Keppel Bay – 1,076 sq ft

Caribbean at Keppel Bay – 904 sq ft

Both projects offer two-bedroom, two-bathroom units in various sizes and layouts. As usual, units at Reflections at Keppel Bay are the larger ones.

The most glaring and immediate issue is that the unit at Reflections is irregularly shaped, while the Caribbean unit has a more regular, efficient layout. This makes it a bigger interior design challenge and runs up the risk of wasted space.

Caribbean’s two-bedders have private lifts, which offer added privacy and are more typical of a luxury project. At Reflections, the unit comes with two balconies; while inefficient, it’s still an edge over Caribbean, which only offers three planter boxes – an even worse use of space.

Reflections has an open kitchen integrated with the dining area, while Caribbean has an enclosed kitchen that is fully separated from the dining room, along with a dedicated service yard. This gives a clear edge to Caribbean at Keppel Bay as far as kitchen layouts go.

Finally, the master bathroom at Caribbean is noticeably more spacious, featuring a separate shower and bathtub; which surprises us since Reflections is more inclined toward having all the bells and whistles.

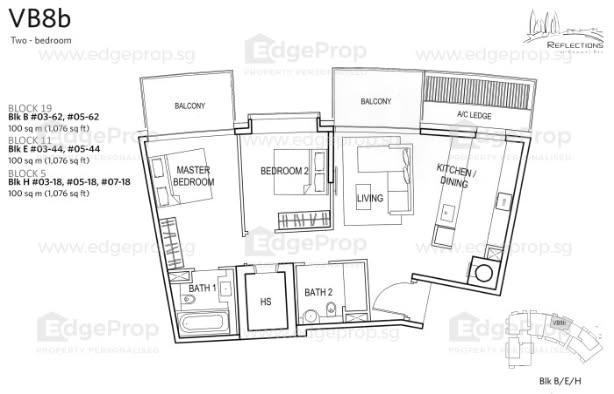

3-bedroom units

Reflections at Keppel Bay – 1,625 sq ft

Caribbean at Keppel Bay – 1,365 sq ft

Both projects offer three-bedroom units in a variety of sizes and layouts, but on average, the units at Reflections at Keppel Bay are larger than those at Caribbean at Keppel Bay.

The Reflections unit is a three-bedroom, three-bathroom configuration, while the Caribbean unit is a three-bedroom plus study; and the study space in Caribbean is spacious enough to function as a small bedroom if needed.

Both have balconies, but Reflections is a little more inefficient with two. Reflections also uses an open kitchen, albeit complete with a home shelter and WC; this time it can be enclosed, which places it above the previous configurations. Caribbean provides a fully enclosed kitchen as well though, with a separate yard, utility room, and WC.

The living and dining areas at Reflections are nicely segregated into distinct spaces, while Caribbean’s are less clearly defined; this is mainly an advantage of the Reflections’ unit having more space to do so.

Again, due to the unique building design, the unit at Reflections has an irregularly shaped layout, whereas the Caribbean unit maintains a more regular, efficient shape. But we do think these two are closely tied.

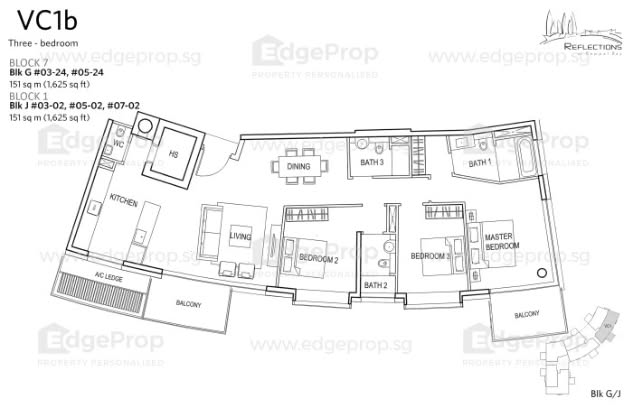

4-bedroom units

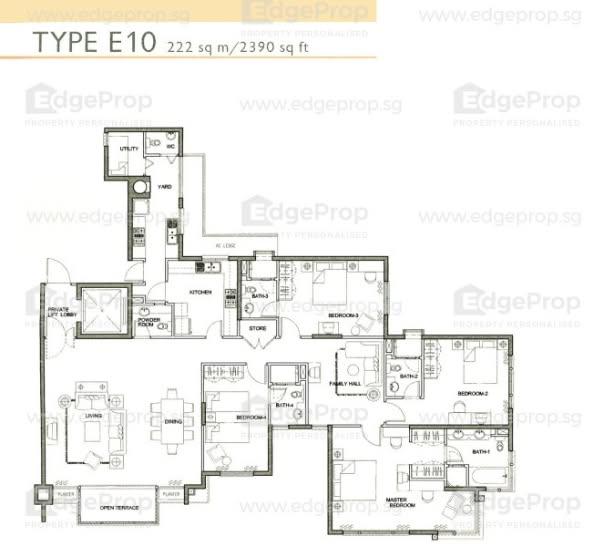

Reflections at Keppel Bay – 3,186 sq ft

Caribbean at Keppel Bay – 2,390 sq ft

As with the other unit types, both projects offer four-bedroom units in a range of sizes and layouts, with Reflections generally being larger. As always.

Both four-bedders provide spacious layouts, but there are some notable differences between the two. In the layouts above, the Reflections unit is a four-bedroom, three-bathroom unit with a study, while the Caribbean unit is a four-bedroom, four-bathroom unit with an additional family room.

Both layouts include powder rooms and open terraces attached to the living room. In terms of kitchen functionality, both units also provide a separate yard, utility room, and WC.

Reflections offers two ensuite bedrooms, whereas Caribbean has all four bedrooms ensuite. Despite being smaller overall, the Caribbean unit manages to maintain generous proportions for all four bedrooms, while in Reflections, two of the bedrooms are noticeably smaller; so we give the edge to Caribbean here.

Overall, while Reflections does have some slightly more irregular nooks due to the shape, we don’t think there’s a marked quality difference compared to its neighbours. The issue, as you see, appears repeatedly is the tendency for Reflections to build big and go all the way. This drives up the quantum and limits the upside potential.

Conclusion:

Reflections at Keppel Bay is a major architectural landmark. The design, amenities, and overall lifestyle proposition are undeniably premium.

Rather, the issue is the outsized units with a very high quantum, which dampen its investment appeal. The market seems to want more manageable, efficient layouts, as seen in the stronger performance of its peers (not small, mind you, but just smaller). A related issue are the widely mixed unit facings and layouts that – whilst unique and enticing to some – may be less palatable for others; they create pricing complexity across the layouts, and makes Reflections a tough project to value with any uniformity.

In this case study, ROI may give a misleading picture: on the numbers alone, Reflections look like a money sink. But that’s because the ROI doesn’t factor in Reflections’ concept, which is to be a lifestyle or home-owner indulgence; a role it fulfils quite well.

Also, the ROI can be misleading because of the higher volatility. As we’ve seen in the linked news articles though, there are owners who have made astounding gains, but this is drowned out by the average.

For homeowners who value the lifestyle and can overlook market swings, Reflections still offers an excellent living experience. But as an investment, we’d take care that your risk capacity matches your risk appetite.

Most property commentary on Reflections at Keppel Bay falls into two extremes: it’s either written off as a poor investment due to low ROI, or hyped up purely for its design and waterfront views.

What we’ve shared today is neither. It’s a data-backed look at Reflections’ performance and a clear-eyed understanding of its lifestyle value, two things often missing in typical investment narratives.

We can’t cover every nuance in one article, but this is exactly where our team adds value: helping buyers distinguish between lifestyle indulgence and long-term upside, especially in volatile, high-quantum developments like Reflections.

If you’re serious about planning your next move (whether it’s upgrading to a waterfront home or diversifying your portfolio) let’s talk about how Reflections, or projects like it, specifically fit into your situation.

Join us in our next case study, as we look past the ROI of larger projects like Costa Del Sol and The Interlace on Stacked Pro.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Investment Insights

Property Investment Insights Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

New Launch Condo Analysis LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden

Property Investment Insights Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Property Investment Insights We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Latest Posts

New Launch Condo Analysis This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Landed Home Tours Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Overseas Property Investing Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Property Market Commentary 2-Bedder vs 2+Study Units: Which Condo Layout Has Better Returns Over The Last Decade?

Homeowner Stories Does The “Sell One, Buy Two” Strategy Still Work In 2025? 3 Real Stories From Singapore Homeowners

Editor's Pick Where $4 Million Semi-Ds Sit Next To $40 Million GCBs: Touring First Avenue In Bukit Timah

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

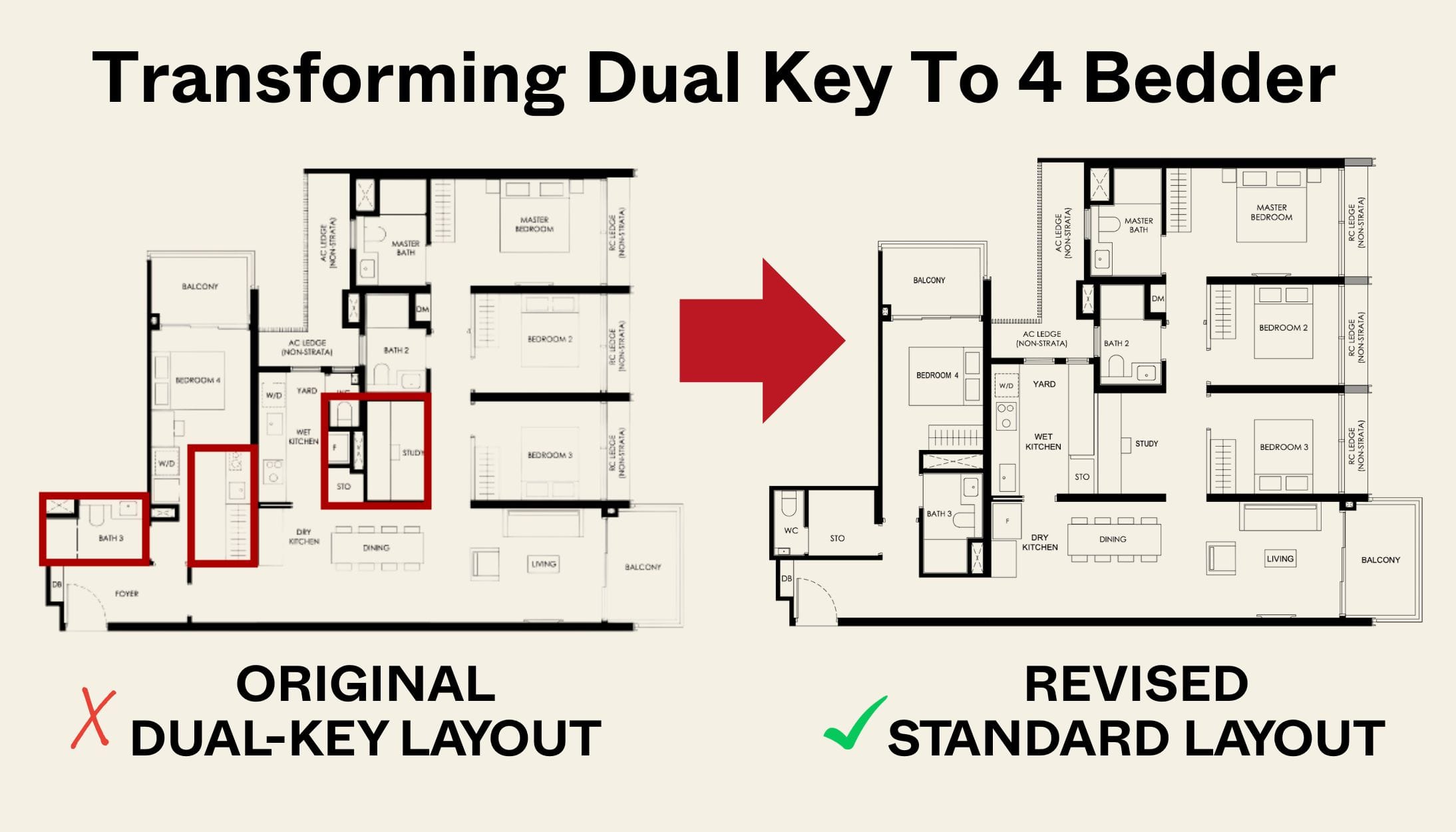

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000